General Discussion

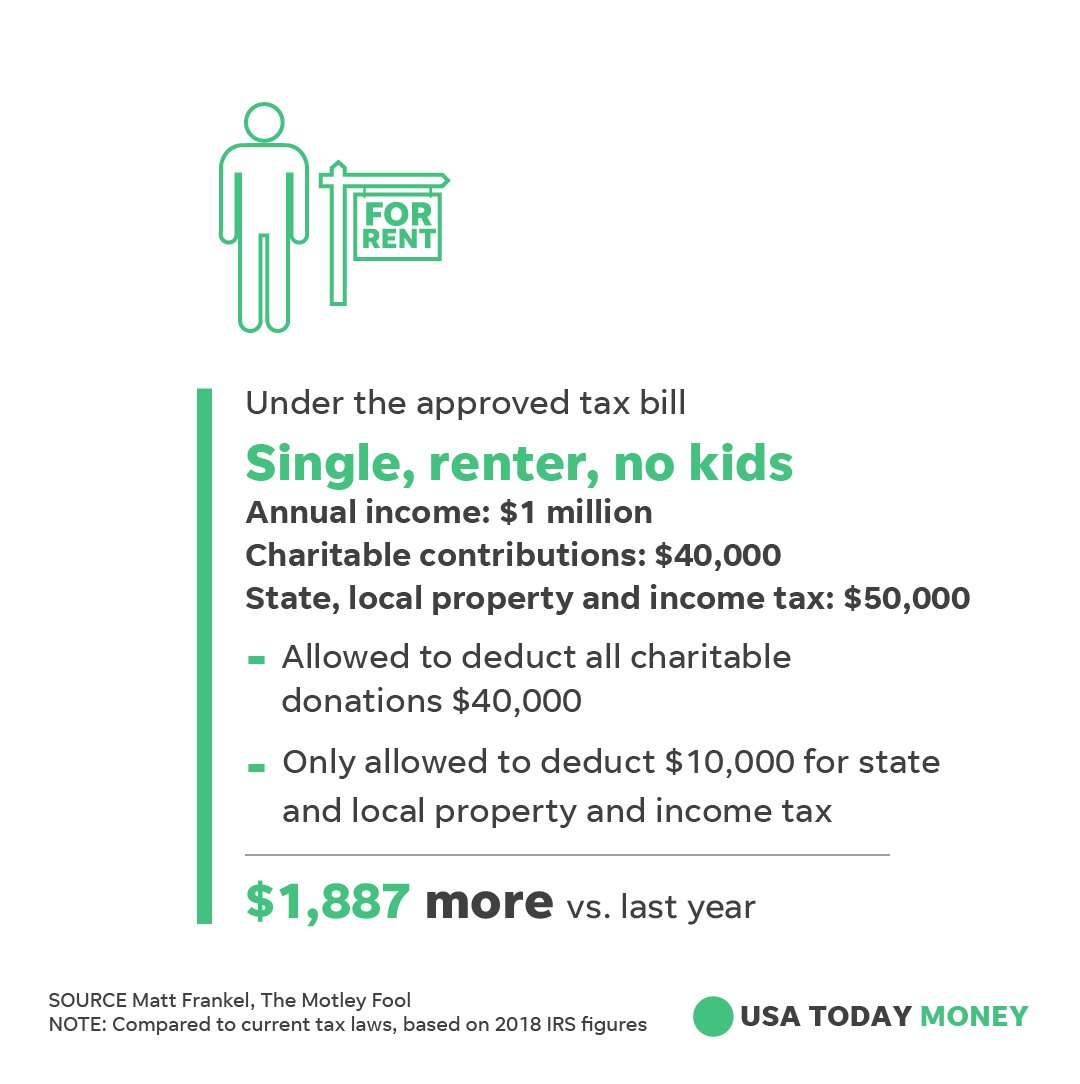

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsSINGLE RENTER - NO KIDS

Link to tweet

@USATODAY

17 hours ago

How could the GOP tax bill affect you? Here are five household situations and how the bill could have an impact on each one.

https://www.usatoday.com/story/money/taxes/2017/12/20/how-the-tax-cuts-and-jobs-act-could-affect-these-5-households/108773102/

USA TODAYVerified account

@USATODAY

A single renter with no kids:

MichMan

(11,929 posts)Just unconscionable how someone with annual income of 1 million and is renting will have to pay more in taxes. This will apply to vast numbers of people I'm sure.

Every other example listed in the link shows people,'s taxes going down a couple thousand a year. Going to be hard to convince many of them how horrible this tax plan really is.

blogslut

(38,000 posts)...who had to create that graphic.

Marengo

(3,477 posts)Response to Marengo (Reply #2)

Dr Hobbitstein This message was self-deleted by its author.

mythology

(9,527 posts)Who would owe less than $2,000 a year more is a good example of the craptastic nature of the bill.

Hoyt

(54,770 posts)Christ, you'd have to go from 25 year old Scotch to 18 year old.

LonePirate

(13,424 posts)kcr

(15,317 posts)There are reasons to rent besides not being able to afford to buy. ETA not in support of the boo hoo tax example in the story. Just wanted to point out there are logistical reasons some people rent.

crazycatlady

(4,492 posts)There's something about the peace of mind knowing that I never have to have a line item in the budget devoted to Home Depot.

NCTraveler

(30,481 posts)I'm sure a lot of that small amount are renters. That is not to say they don't own their main residence.

MrScorpio

(73,631 posts)As in someone who lives in NYC vs suburban Cleveland for example.

dembotoz

(16,804 posts)blogslut

(38,000 posts)Link to tweet

@toomuchpete

Replying to @USATODAY

Oooh! Do a renter married to five different men with an annual income of $2.6 Billion next!

rgbecker

(4,831 posts)Here's one that gives a slightly ($7100 tax savings) answer if the the guy were from Alabama, for example. This shows the unfairness in the tax code that is actually made worse by the GOP tax. It has been pointed out that many will simply find ways to reclassify income to allow a lower tax rate.

http://taxplancalculator.com/calc

procon

(15,805 posts)The average income in America across all jobs is only $51,939. A million dollar income is fantasy dream for most people.

Skittles

(153,160 posts)Kirk Lover

(3,608 posts)amount of money....it breaks down to $43 per paycheck. Is that what we are calling significant?

MichMan

(11,929 posts)I would think a couple hundred bucks a month would be helpful to a lot of families.

Kirk Lover

(3,608 posts)Lee-Lee

(6,324 posts)Kirk Lover

(3,608 posts)MichMan

(11,929 posts)Kirk Lover

(3,608 posts)significant and that amount is not...it's friggin crumbs but looks like folks are happy with anything they can get no matter what the real cost is.

Lee-Lee

(6,324 posts)There are a lot of people who have almost all the money coming in going right back out in rent/mortgage, food, debt payments, etc.

They end up with very little money after all that to do anything with.

That $86 a month can be a huge differnce- maybe more clothes for the kids, or more fresh food and less processed food, or a night at the movies for the kids they couldn’t afford before.

Kirk Lover

(3,608 posts)break it down that is $21.50 a week. You really think that's going to be HUGE difference? As someone who has had not a dollar in their bank account that 'extra' 20 bucks a week ain't getting you too far. That's not relief...that is a tease whilst the top tier gets 83% of the benefits.

haele

(12,654 posts)An significant increase in health care premium will offset that tax savings. Inflation in general can also offset that tax savings. And some of those "savings" in taxes will end up affecting the way interest rates are set by the Fed (especially since we are currently at what is considered Maximum Employment), which will drive up the costs of things like groceries and clothes as businesses will have to charge more to be able to pay for capital improvements.

Not to mention the revenue that the Federal Government is losing that will cause cuts in various Social Services and other federal subsidies that many of those not so well off median wage earners depend on to make it to the end of the month, such as the TVA (and other Rural infrastructure programs), low cost mass-transit, School Lunches and SNAP or WIC, Education, SBAs, HUD vouchers, Medicare, low cost Health Clinics, etc...

An extra $100 a month will not help a family of 4 one bit when general inflation causes the cost of utilities or their rent to go up by 2 or 3% a month and they lose access to reduced School Lunches for their kids, as well as having to pay 5% more for their health costs in general, as well as the 20% more for their health care premiums. When their local taxes go up and access to Social Services decrease, when their local policing and EMS, along with affordable housing and community projects are reduced or shut down because the Federal Government cut infrastructure and community improvement programs due to lack of revenue.

When that family of 4 now has to replace their tires every year and face hundreds of dollars in annual auto maintenance bills due to pot-holes and poor street repair because that local or state repair money had to be used maintain ambulance services for the disabled and nursing homes that lost Medicare money because Multi-Billion dollar corporations and investment firms just had to get their 40% tax cut.

I'd much rather pay all my taxes and have a healthy, affordable community and infrastructure than a hundred dollars extra in my pocket a month - that will end up getting spent on something that better Federal tax revenue and spending would have typically taken care of.

After all, Tires and the alignments that ensures good gas mileage aren't cheap. Nor is health care.

Haele

we can do it

(12,184 posts)alarimer

(16,245 posts)Boo fucking hoo. And if you rent (you're making a million bucks, why the fuck do you rent?), you are not paying property taxes, not directly, anyway, so you don't get to deduct it.

And honestly, I'm not going to cry over someone making more than 100K paying a bit more. So what? It's those on the bottom getting screwed by everyone else I worry about. I don't even worry about myself so much, even though what I may gain, I will lose in higher health care costs somewhere down the line. I don't itemize at all, usually. I DO worry about things like 401K because at one point they talked about making those contributions being taxable, instead of being pre-tax. And also the IRA deduction. But I assume those have not survived.

VMA131Marine

(4,139 posts)even if they are making $1 million per year. But somebody like that is probably paying far too little in taxes as it is.

vsrazdem

(2,177 posts)Itemize taxes and mortgage interest, which is just a few thousand more than the standard deduction. Taking away the personal exemption I will be getting no tax benefit and in fact a little increase in my taxes. How the hell does this benefit the middle class.

SoCalMusicLover

(3,194 posts)$40K in Contributions, and THEY RENT?

haele

(12,654 posts)Taxable income for Joint filers with two children $67,100

Mortgage interest payments $7200

State and local taxes: $1200

Health Care costs $9800

Charity $250

Contractor Business expenses $9500

Student Loan Interest payments $1400

Total itemized deductions: $29350

Line 41 income (itemized) $37750

Line 41 income (standard) $53500

Personal Exemptions (4) - $16000

Line 44 Income (Itemized): $21750 (at 15%)

Total Tax owed w/out credits: $ 2331

Child Credit -$2000

Child care Credit -$300

Total Tax Owed: $31

This new GOP plan on same filing

Taxable income: $67100

Standard Deduction -$24000

Allowable Deductions

Mortgage -$7200

SALT -$1200

Line 41 income $33700

12% Tax $4044

Child Credit $4000

Total Tax Owed $44

They will actually owe a whopping $13 more.

Not to mention, their health care premiums go up another 12% or so because the insurance companies know that cost sharing and Medicare is the next to go, so they're going to gouge as much as they can while other customers still have "a few more dollars" in their pocket to pay for it.

Haele