General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums"It took us 18 tries to find a GOP congressman who could tell us the individual income tax brackets.

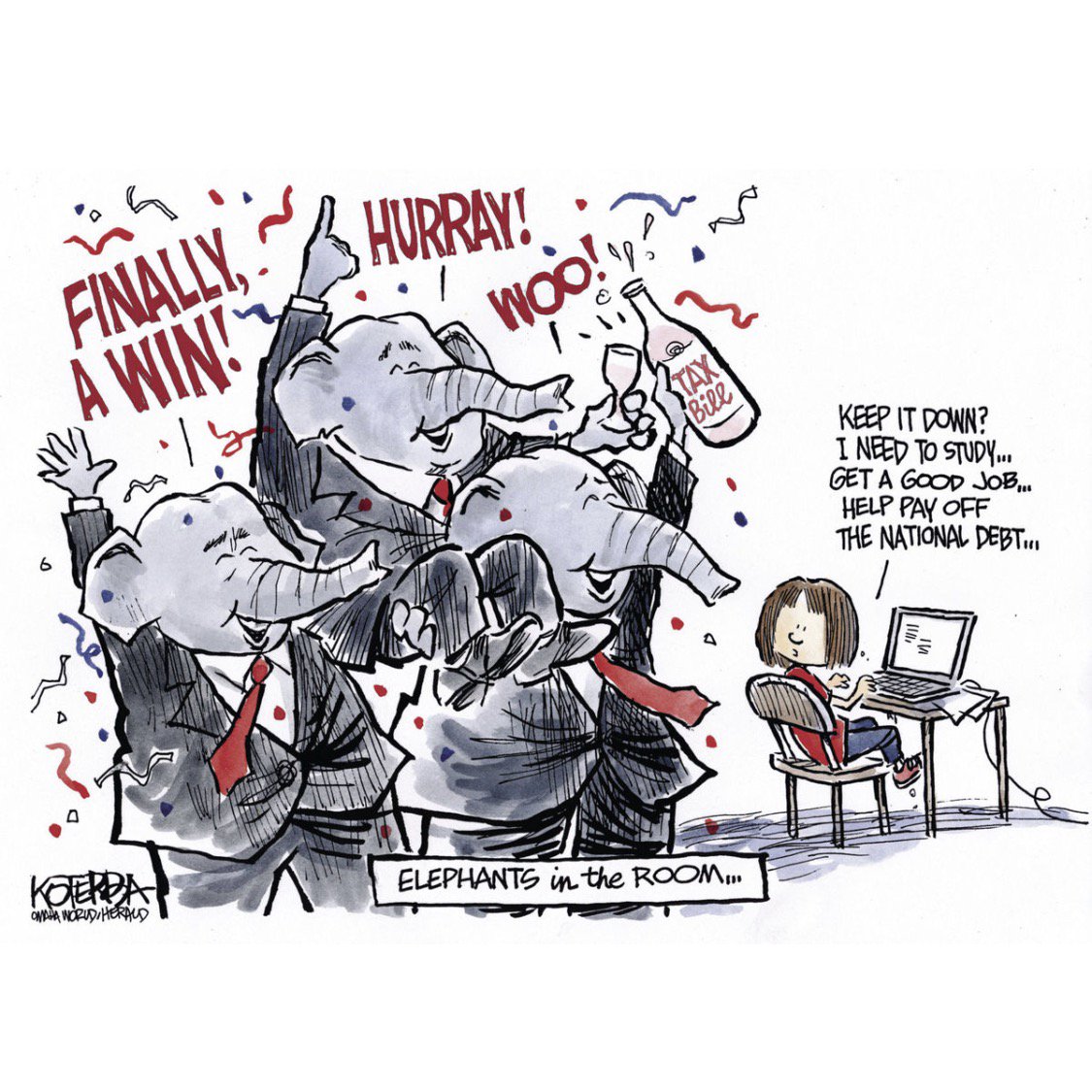

House Republicans Don’t Know Some Very Basic Facts About The Tax Bill They Wrote

It took us 18 tries to find a GOP congressman who could tell us the individual income tax brackets.

By Matt Fuller 12/20/2017

House Republicans swear they had enough time to review a 500-page conference report released last Friday night before they voted on what they thought would be the final tax bill Tuesday. (They actually had to vote on the bill again Wednesday because of a parliamentary mishap.) But when we asked GOP lawmakers supporting the legislation this week for just one basic detail of the bill ― the tax bracket percentages for individual income ― hardly anyone could list them.

HuffPost had to ask 18 House Republicans to identify the tax brackets before we finally came across one member who could: Rep. Chris Stewart of Utah. (We stopped asking after Stewart, meaning the percentage of the House GOP conference who knew this key aspect of the bill could have been much worse than our imperfect survey suggests.)

To be clear, we were just looking for seven figures: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. We were not looking for congressional representatives to display some savant-like ability and provide the income thresholds for each bracket. We just wanted to see if Republicans knew this one simple element of a bill they were rushing into law.

They didn’t.

Among the GOP lawmakers who were shaky on those specifics were members of the tax-writing House Ways and Means Committee, the chairwoman of the House Budget Committee (Rep. Diane Black of Tennessee) and the lead author of the bill in the House (Ways and Means Chairman Kevin Brady of Texas). ....................

Link to tweet

underpants

(182,803 posts)They started with the cuts for their donors and corporations then they had to figure out how to "pay for it" so they didn't need 60 votes. They had to keep the whole thing under the $1.5 Trillion they had already cut from Medicaid and Medicare. They basically had lost it notes with different revenue generators - post grad tuition assistance, plugin electric car credit, SALTs, etc. each time they had a new mixture they totaled it up. Once they found their sweet spot they typed it up and added hand written notes in the margin. They found some money at the end to sweeten it for Corker.

L. Coyote

(51,129 posts)The 600 lobbyists who wrote it were able to arrive at a final agreement because the heist is just soooo YUUUUGE.

procon

(15,805 posts)"... comfort the comfortable and afflict the afflicted." That line perfectly sums up the Republican Tax Scam.