General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsReverse Mortgages - The Final Blow Killing Middle Class Wealth (VIDEO)

Many fellow Americans that have worked their entire lives, weathered several recessions and depressions, put their children through school, helped many in need, and faithfully paid their mortgages for decades are now being taken advantage of once again with great marketing. Don't fall for it.

https://egbertowillies.com/2013/08/18/reverse-mortgages-the-final-blow-killing-middle-class-wealth-video/

NCTraveler

(30,481 posts)Reverse mortgages are a great tool for some people. It is very individual specific.

The manner in which you present this is actually harmful. It can ward off those in the group who might benefit from this tool.

It's not for everyone does not equal it's good for everyone.

egbertowillies

(4,058 posts)They forget the instrument was foremost designed for someone else to profit from the asset you built up over the years. I am all for profits but there should be better protection from sharks.

NCTraveler

(30,481 posts)Your anecdote poses no significance.

It’s about as intellectually honest as the argument that Trump delivering single payer.

Big Blue Marble

(5,091 posts)the closing costs, the interest rates, and the restrictive clauses.

You quickly come to understand that these mortgages are not a service, but an attempt to

extract the last full measure of wealth from the working and middle classes. It may seem an effective

pitch for those who find themselves in retirement desperate for money, but they would be better

off selling their home, banking the money and renting a smaller place.

Mosby

(16,317 posts)Bacause they couldn't afford palliative and hospice care.

NCTraveler

(30,481 posts)They sure as heck aren't for everyone.

" but an attempt to extract the last full measure of wealth from the working and middle classes."

They are actually a useful tool for many. Very useful. They aren't even close to being a useful tool for everyone.

Their advertising is deceptive and directed toward more people than they are good for. That's for sure. That's also extremely common across many sectors.

You have not made an argument they are bad for everyone as is being done. Reverse mortgages are a life saver for some. A true life saver.

I am clearly not claiming they are beneficial in absolute terms. I would fail just as the op has done with their fear mongering and absolutism. Education is key.

Jose Garcia

(2,598 posts)Hoyt

(54,770 posts)Personally, I'd probably sell the house first. You have to have a good bit of equity to get a reverse mortgage. I feel for people who have to consider reverse mortgages, payday loans, etc.

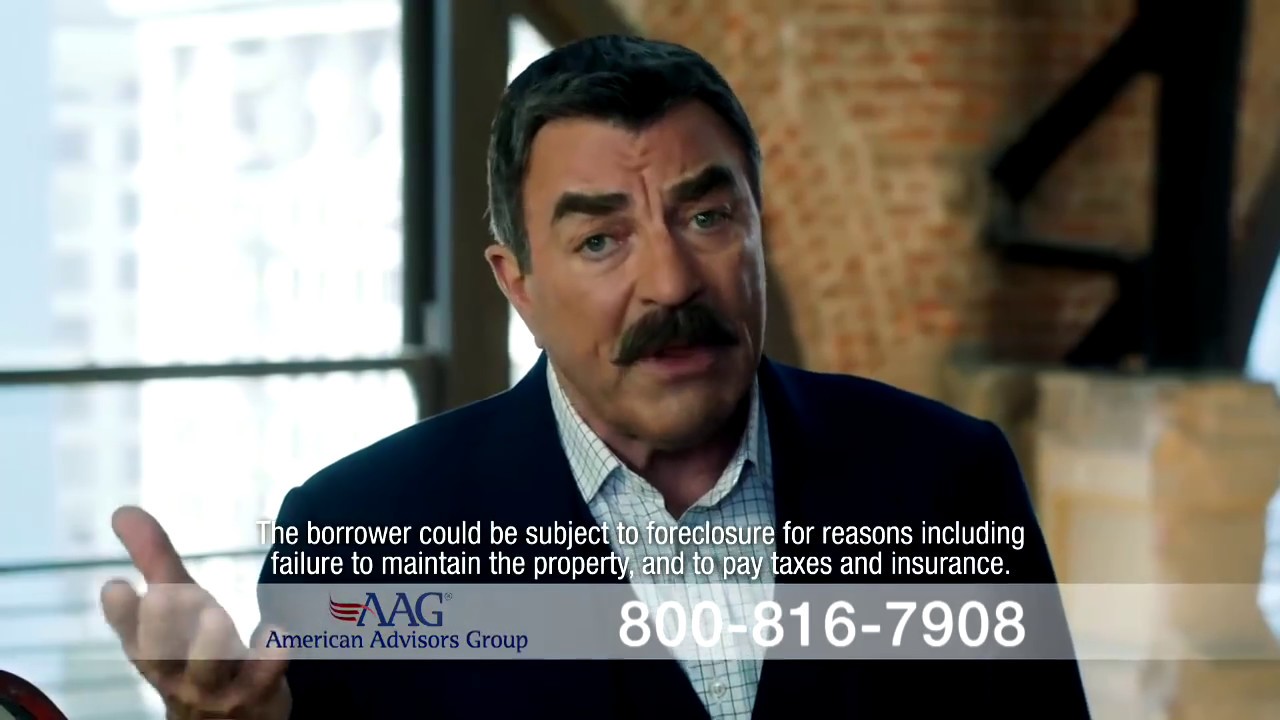

And, I curse these old actors that do these ads. Heck Tom Selleck does them, and I can't imagine he's starving where he has to take these gigs. Of course, I think he's a greedy white winger.

dsc

(52,162 posts)Hoyt

(54,770 posts)BSdetect

(8,998 posts)They are not easily "reversible".

Do your research thoroughly.

Get serious legal advice first if you are tempted to enter such an agreement.

If it seems to good to be true you should activate all your alarms.

Read the article shown by the link in the original post first.

gratuitous

(82,849 posts)But reverse mortgages are marketed very widely, and it's no coincidence that a lot of people get bilked by this predatory industry. A responsible legislature would take steps to rein in these vultures or provide remedies to the folks who get cheated. But at this time, responsible legislatures - particularly our federal one known as Congress - are pretty scarce.

Liberal In Texas

(13,554 posts)The companies where your reverse mortgage ends up aren't regulated enough to keep them honest.

You may think you are dealing with a reputable well-known company and take out the reverse mortgage. The company you just dealt with sells your mortgage off to some servicing/investment company you probably never heard of. It is quite possible you'll end up with a company that has not your best interests as they're business model, but how to get their hands on your house as soon as they can.

They'll send inspectors out and then the elderly RM customer gets a notice in the mail that certain repairs have to be made in a certain amount of time. If you can't prove the repairs were made, they RM company many times will start foreclosure.

In my own experience my elderly mother took out a RM to the objections of my brother and me. She always told us that we would have a year to either sell the house or pay off the mortgage. Indeed the sales pitch is "up to a year." And there's the rub. "UP TO" can mean they'll start foreclosure a week later. When my mother died I complied with everything they told me I had to do. Filled out every form, sent every document etc. About a month after the funeral I got the notice of foreclosure. Luckily I was dealing with a great lawyer to get the estate settled and she went to bat and threw up a paper smoke screen with their lawyers. But, she advised me, she didn't know how long she could stall them and that I should sell the house a fast as I could before they tried to sell it on the courthouse steps.

I was able to get the house sold quickly (even though it wasn't cleared out) due to a hot real estate market in that area, but I know I lost thousands for the estate's heirs because I wasn't able to put the house into a great sales condition and I wasn't in a position to turn down offers and wait for better ones.

I realize there are people who may be destitute and so badly in need of money they feel this is their only option. But they should know, the RM may cause them to lose their house and have no place to live.

exboyfil

(17,863 posts)They allow individuals to maintain their same lifestyle for an extended period. At the end of the day many middle class people are going to go into LTC Medicaid. it is better to do this when not having an asset that can be used to satisfy Medicaid. When you have couples where one is staying in the home, then this is an exception.

My mom has her house completely paid for in Florida. She envisions it as a vacation home for me in the future. Assuming that I still need to remain in my job in Iowa after she completely depletes her savings for maintaining herself in her home, I would prefer that she tap into the equity in the house to maintain that lifestyle until such a point that she can no longer stay in it. I do not need or want a second home. I have no interest in retiring to Florida.

I have not looked at the math in these arrangements. I will study it more when the time gets closer for her to deplete her savings. When she got the mortgage for the home (as she was bridging from her prior home), I personally would have held onto the mortgage and not paid it off. I would have used the borrowed funds and the interest to service the mortgage.

A home is like any other asset. Too many people get emotional about it.

My belief is that you have just enough money to bury yourself at the end. Plan for a long life and save what you can. I fully paid for both my daughters college education. As far as i am concerned, my obligation to help that has ended at that point.

Turbineguy

(37,337 posts)another way to compensate for the fact that nobody is making any money off people who paid of their mortgage.

The bit in the TV commercials: "you can use the money to pay medical bills!"

GeorgeGist

(25,321 posts)you don't trust Tom Selleck?