General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsKrugman on Kudlow ...

Link to tweet

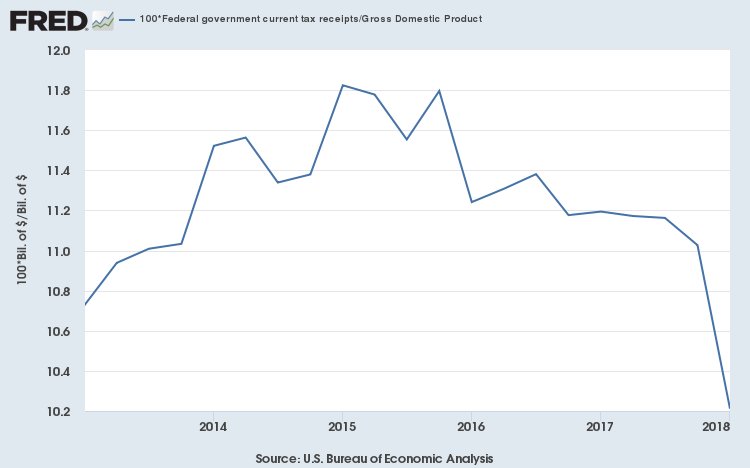

As always, facts have a well-known anti-Trump bias.Below, revenue as % of GDP, falling off a cliff. Is the administration's top economic official ignorant or lying? Does it matter? 2/

Hoyt

(54,770 posts)WhiteTara

(29,718 posts)you say very stupid things. Not to mention the stroke factor.

BSdetect

(8,998 posts)pansypoo53219

(20,981 posts)Jim Lane

(11,175 posts)He shows only that revenues expressed as a percentage of GDP are falling.

The supply-side argument is that lower tax rates will reduce revenues as a percentage of GDP, but will also stimulate enormous gains in economic activity. As a result, revenues will be a smaller share of a larger pie, so that the actual amount of government revenues will be higher even as the percentage is lower.

I agree with him that, historically, it hasn't happened. To show it, however, he needs to present data on gross revenues, not as a share of GDP.

Lucky Luciano

(11,257 posts)...namely 100% is definitely the case as there is no reason to work at all so no revenues for the government unless the taxes are lowered. It is definitely false when taxes are 0% because raising taxes clearly increases revenues from there. Somewhere in the middle is the optimal tax rate for government revenues. Republicans think that rate is close to 0% which is stupid.

I don’t know where that optimal tax rate is.

progree

(10,909 posts)This has the graph. Last observation: 2018 Q1 2038.234 $billions

https://fred.stlouisfed.org/series/W006RC1Q027SBEA

Sorry I don't know how to embed FRED graphs without going through a lot of gymnastics of taking a screen shot and saving as a .jpg or .png or whatever and uploading to my Imgur account and all that.

And the data, of which the last few quarters are shown below. In $billions.

https://fred.stlouisfed.org/data/W006RC1Q027SBEA.txt

2016-01-01 2060.060 Billion dollars

2016-04-01 2096.292

2016-07-01 2131.564

2016-10-01 2112.996

2017-01-01 2133.378

2017-04-01 2150.665

2017-07-01 2176.787

2017-10-01 2178.271

2018-01-01 2038.234

The "2018-01-01 2038.234" is actually 2018 Q1 which BEGINS Jan 1 and ENDS March 31. So yup, the first 3 months of the tax cuts does not seem to be very helpful. 2018 Q1 federal revenues down 6.4% from the previous quarter, and down 4.5% from 2017's Q1.

The news today is that the final estimate of Q1 2018 GDP is a 2.0% annualized growth rate. Not stellar.

But supposedly Q2 is expected to be a lot better with some economists predicting a better than 5% annualized growth rate, supposedly mostly because of the tax cut. LOL.