General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsLet's get something straight; The Economy is Not Doing That Well

First off, the economy is proceeding with an improved GDP for only a quarter. The average person doesn't live by the GDP numbers, they live by their own income numbers. The real wage growth is minus .2% (inflation is 2.9%, wage growth is 2.7%). And, that 2.7% wage growth is centered mostly in the urban centers of this country. Trump's voters are seeing very little of that 2.7% and are being hurt the most by tariffs, especially in the rural counties of America. Trump country.

I remember that Trump said he would balance the budget. Yet his military spending and tax cuts for the wealthy have increased the deficit by $300 billion annually to $800 Billion, and is expected to exceed $1 trillion by the end of the year.

Although the stock market his increased, 60% of Americans don't own stocks and the market only affects the average American if it crashes. The trade deficit is up, farmers are on edge, retail stores are closing down and the only beneficiaries of the huge, deficit ballooning tax cuts, are the very wealthy. By the way, where was the increase in the carry trade tax on the real parasites on Wall St.?

Unemployment may be down, but where are the good jobs? The reason the Republicans can't get any political traction from the economy is that there is no benefit to the average worker (unless they work in a union with a collective bargaining agreement, and that's down to 7% of the workforce in the private sector).

If the Republicans think the economy will save them in the mid-terms, they are sadly mistaken. The real numbers, the numbers that the average American sees in his or her paycheck, that number is not good. And with the increase in the cost of health care deductions, the average worker is worse off now than they were 2 years ago.

marylandblue

(12,344 posts)The usual gross measures like GDP and unemployment rate don't measure facts on the ground. A lot of people who lost their jobs 10 years ago got a new job, but the pay is lower and the benefits worse, so they are still not happy.

mahatmakanejeeves

(57,564 posts)Just Over Half of Americans Own Stocks, Matching Record Low

BY JUSTIN MCCARTHY

STORY HIGHLIGHTS

• About half of Americans (52%) say they invest in stocks

• Current figure down slightly from 2014 and 2015

• Middle-class adults, those younger than 35 less likely to invest

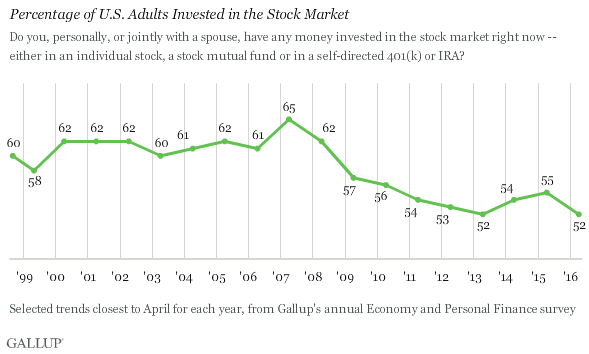

WASHINGTON, D.C. -- With the Dow Jones industrial average near its record high, slightly more than half of Americans (52%) say they currently have money in the stock market, matching the lowest ownership rate in Gallup's 19-year trend.

In 2007, nearly two in three American adults (65%) reported investing in the stock market, the high in Gallup's selected trend on this question for April of each year. But this percentage shrank each year from 2008 to 2013 as the effects of the Great Recession and big market losses took their toll on Americans' sense of job security, confidence in the economy and financial means to invest -- as well as their general confidence in stocks as a place to invest their money.

Though the Dow Jones industrial average has made great gains since bottoming out in 2009, Americans' stock ownership has yet to recover to the level reported prior to the recession.

There were modest gains in the percentage of Americans with stock investments in 2014 and 2015, but reported ownership fell back this year, possibly because of the Dow's tumultuous performance over the past year. Americans' views of stocks as the best long-term investment also dipped this year.

U.S. Stock Ownership Down Among All but Older, Higher-Income

BY JEFFREY M. JONES

STORY HIGHLIGHTS

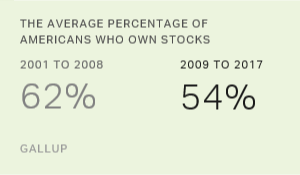

• Stock ownership has dropped to 54% from 62% since financial crisis

• Most major subgroups show lower ownership rates

• No decline among upper-income, older Americans

WASHINGTON, D.C. -- U.S. stock ownership remains below where it was before the financial crisis in the fall of 2008, with declines since then evident among most major subgroups of the population. Adults aged 65 and older and those with an annual household income of $100,000 or more are two groups whose ownership rates have held firm.

{snip chart}

These findings are based on combined data from Gallup's annual Economy and Personal Finance survey, conducted each April and including more than 18,000 U.S. adults since 2001. The survey asks U.S. adults whether they personally or jointly have money invested in the stock market, including in individual stocks and stock market funds such as 401(k)s and individual retirement accounts (IRAs).

Before the 2008 financial crisis, 62% of U.S. adults, on average, said they owned stocks. Since then, the average has been 54%, including lows of 52% in 2013 and 2016. In Gallup's April 2017 update, 54% of Americans report having money invested in stocks.

The stock market lost more than half of its value during the bear market that coincided with the Great Recession and 2008 financial crisis, with many investors responding by taking their money out of the market. Although the stock market has more than made up for those losses, reaching record highs this year, Gallup's data indicate that fewer Americans today are in a position to benefit from those gains.

flibbitygiblets

(7,220 posts)Sorry I just can't.

louis c

(8,652 posts)panader0

(25,816 posts)Okay--this article says 84%--I couldn't find the 90% one:

http://time.com/money/5054009/stock-ownership-10-percent-richest/

wcast

(595 posts)Unemployment numbers mean nothing when you work a minimum wage job with no benefits. Same with the GDP and Dow Jones. We may be riding a 9 year bull market but most Americans have missed the boat.

duforsure

(11,885 posts)For the super wealthy like trump and the KGOP have done to us, ripping away health care, causing skyrocketing rises in energy costs, tariff trade prices increasing rapidly, and take that much out of the pockets of regular Americans , it has a dramatic effect, like it did when W did it. Trumps projecting excuses now because he sees it coming soon too. He has to find something else to blame it on except himself. He's always done this , blames others for his actions, same thing just a different day for con man trump.

kimbutgar

(21,172 posts)A lot of unemployed people. Yeah great economy.

dalton99a

(81,564 posts)It is inevitable.

honest.abe

(8,680 posts)and the gap between rich and poor seems to be widening every day. Even for those that are working and seem to be doing well they are probably a couple of paychecks away from disaster if they lose their job. Also the overall economy is still somewhat precarious. I suspect we could easily slip into another recession if a major negative event occurred.

nature-lover

(1,470 posts)in income (tax cuts) how can there be a net positive outcome?