General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forumsstruggling on $300,000 in SF.

How making $300,000 in San Francisco can still mean you're living paycheck-to-paycheck

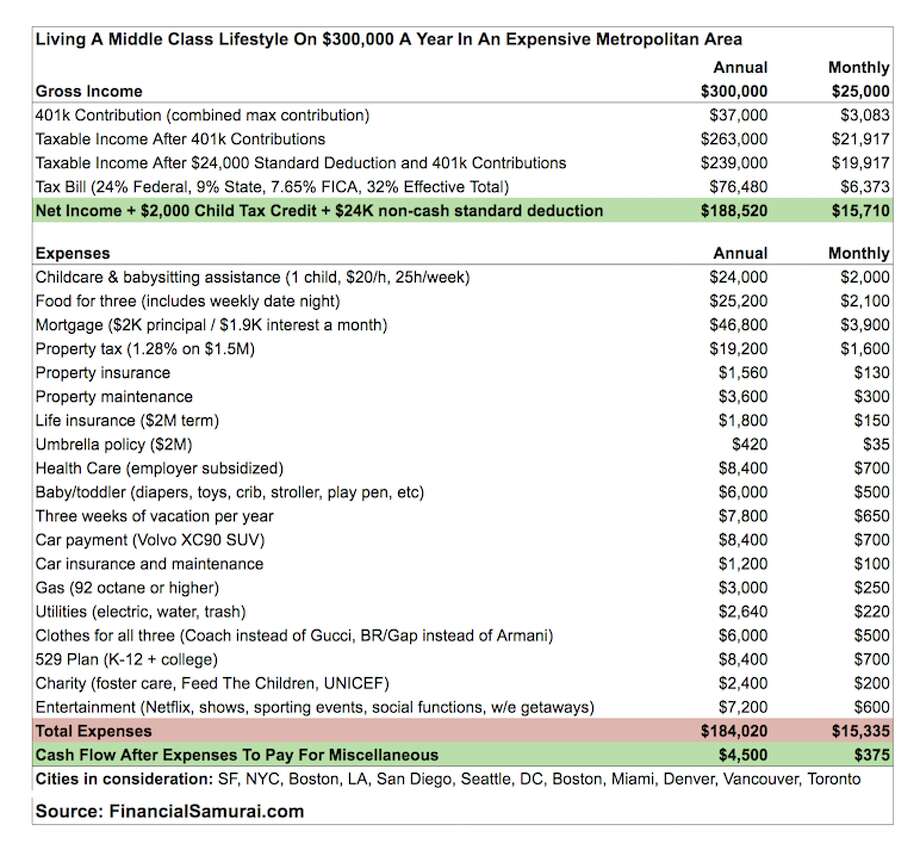

With their feedback, Dogen broke down the budget of a couple with one to two children in San Francisco, Seattle or New York. He found $300,000 is the income necessary to put something away for retirement, save for your child's education, own a three-bedroom home, take three weeks of vacation a year and retire by a reasonable age.

"It's not an extravagant lifestyle," Dogen says. "It's a middle-class lifestyle if you consider a middle-class person should be able to afford a modest home, have at least one car, have a kid or two. There are no private jets in this budget."

Dogen has put together a detailed blog post where you'll find analysis and explanation on each expense, but here are a few points to note:

The $24,000-a-year childcare expense takes into consideration a babysitting rate of about $20 an hour, the standard charge in a city such as San Francisco. Preschool easily costs $18,000 to $20,000 a year in metro areas.

The mortgage is based on a $1.5 million, 1,750-square-foot, three-bedroom, two-bathroom home on a 2,500-square-foot lot.

The car expenses are based on a single larger car that accommodates a family.

Entertainment expenses include everything from Netflix to tickets to an occasional ball game to date night, which easily costs $200 in San Francisco when you consider expense for dinner and babysitting.

ALSO: Why a $400,000 income means you still think you're middle class

Dogen adds that at $300,000, a family is still living paycheck-to-paycheck and not saving outside their 401K and 529 plans.

"We're in this perpetual grind in San Francisco, and it's a city for people who are willing to hustle," he says. "At one point in the past, $300,000 was a lot of money. Now at this amount, you're probably always going to end up working a long time and having a constant struggle to keep up."

His recommendation is to make moving out of the region a goal.

"There's a moving truck shortage in places like San Francisco because so many people are moving out of this expensive city and other expensive coastal cities," he writes. "If you live in an expensive metropolitan area, consider relocating to lower your cost of living or at least try and take advantage of the valuation differential by investing in Middle America.

https://www.sfgate.com/bayarea/article/middle-class-budget-San-Francisco-300-000-13741570.php

I would say that this 300K couple is getting more nutritious food, better child care and a better standard of living than a 50K "pay check to pay check" couple.

Agschmid

(28,749 posts)Demovictory9

(32,457 posts)Mariana

(14,858 posts)For example, how do you spend $70 a DAY on food for three people? Ridiculous.

Rollo

(2,559 posts)I actually grew up in my teen years in SF in the '60's. We lived in rented flats on a very low family income, but we got by.

Now I live across the bay in a home I bought in '97 after renting for many years. Just paid it off. But million dollar homes are relatively rare here. Someone that makes $300k in the City could easily relocate across the by and commute by BART. You can get a very nice house here for under $700k. (I bought mine for $200k).

However, no way could I afford to sell my home and move to SF, nor would I want to.

Meanwhile conservatives are pissing and moaning about having to pay fast food workers $15/hr.

What is wrong with America?

lostnfound

(16,184 posts)It’s characterized as struggling which makes it clickbait.

The article is titled “living paycheck to paycheck”.

Consider how these seem:

A single person making $150,000 in SFO

A married couple making $300,000 in SFO

A married couple with a kid making $300,000 in SFO

A married couple with a special needs kid making $300,000 in SFO

A single parent with a special needs kid and a grandparent with dementia

It’s all unique.

I also notice that this couple does not seem to have any student loans, friends and relatives in financial trouble, or aging parents. Trust me, everyone has friends and relatives in financial trouble.

I don’t think they are “struggling”, at all. That’s not what the article says.

I think they probably have to pay high priced childcare to make up for having two people working at mid level professional jobs in a high cost city, which they probably got because they got a STEM education OR they worked hard and smart and got lucky.

I think people without kids don’t get the choices you make as parents in a big city. Want a cheaper house? Sure - do a long commute and put your kids in extra hours child care.

The house is 1750 square feet, for heaven’s sake.

The effect of such articles is to create hostility between the 80% and the 90%-er, while the 1%-ers are jetting off to Davos.

Goodheart

(5,327 posts)"Three weeks of vacation" a year is listed as an "expense".

LOL

msongs

(67,420 posts)mcar

(42,334 posts)Plus, retirement savings and college savings. Poor dears.

Goodheart

(5,327 posts)LOL

Hubby and I are lucky to get "date night" every few months.

UniteFightBack

(8,231 posts)doing that....both spouses???

MichMan

(11,938 posts)$600 a month in entertainment, $500 a month in clothing ( hey at least they sacrificed by buying Coach instead of Gucci; must be so embarrassing at social events ) $2100 per month on food, $700 a month car payment. Nearly $50K per year alone right there.

Note: none of the expenses above are exclusive to living in SF, they would cost the same anywhere else in the country.

JDC

(10,129 posts)Weekend getaways and 3 weeks a year vacation.

$2100 a month for food for 3, one of which is a toddler in diapers.

2 million term life.

37k In 401k per annum. Probably matched.

My god, how do they keep their heads above water?

Baitball Blogger

(46,736 posts)and we had maybe a week of a real family vacation every three or four years. Vacations were usually weekend or holidays with the grandparents. We had no weekly date night. In fact, the one time we went on back to back weekends for two blockbuster movie openings (One of them was True Lies with Jamie Lee Curtis and Arnold Schwarzenegger) my hubby warned me not to get accustom to it. None of our cars were as extravagant as a Volvo and none of us wore name brand clothes. Today we may have a large internet bill, but we are only now getting to the place where we're contemplating vacations.

I think this concept of middle class is subjective.

TheBlackAdder

(28,209 posts)X_Digger

(18,585 posts)Bonx

(2,053 posts)Bettie

(16,110 posts)I'd be just fine.

And LOL at "Coach instead of Gucci"....yeah, I bought a new purse for 50 bucks when my last one (on sale for 15) wore out. Target brands are about as fancy as we can manage.

trackfan

(3,650 posts)According to similar articles, neither I, nor just about nobody I know would be able to live in Los Angeles. Yet we somehow do. Car payments - what a joke. Our cars are a 1994 and a 2000, and they run fine. If I made $300,000, I certainly wouldn't finance a car, I'd fucking buy one. I haven't had a vacation since 1986. I have a nice house, and eat well.

Recursion

(56,582 posts)Are "unaffordable". People do it, just not with the housing that people think they "deserve" as middle class Americans. I keep telling people there's plenty of affordable housing in DC, right around Naylor Road and Benning Road and Southern Ave (three very African American and immigrant-heavy areas) and they sputter and say "well... I mean... not there...."

PoindexterOglethorpe

(25,862 posts)I take it no one in this family is cooking from scratch.

Car payments. Here's my take on car payments. The very first car you ever buy you might need to have payments for, but after that, you pay it off -- oh, and you don't buy a car that you can't really afford in the first place, meaning no 6 year payment, no being underwater on the car -- after you pay it off you save that payment for the next two years, and you purchase the next car in cash. Yeah, you will probably be buying a used something or another, but imagine this: no car payment!

I drove my most recent car for 12 years, and that's not any kind of a record. And I did pay cash for the replacement car I purchased last September. And my take home is a fraction of that couple's.

Most of my life I've lived fairly close to the edge, although given my take on things like car payments, I've avoided a lot of financial traps many others fall for.

When my oldest was about 7 and learning to roller skate, I decided to buy him his own pair of skates, and put aside $5.00 per week to purchase a not very expensive pair of skates. I seem to recall that the ones we bought were about $35.00, so that would have been seven weeks of savings. What I do recall is that every week I showed my son the five dollars added to the envelope marked "Skates".

JI7

(89,252 posts)and quickly pay it off.

but they probably buy multiple expensive luxury vehicles.

Mariana

(14,858 posts)They're eating out or ordering in every night. They really have to be doing that to spend $70 a DAY on food for three (one of whom is a child in diapers).

SammyWinstonJack

(44,130 posts)Response to SammyWinstonJack (Reply #18)

Name removed Message auto-removed

DangerousRhythm

(2,916 posts)That’s an awful lot on food per month.

Bettie

(16,110 posts)with two of them being teenagers!

JI7

(89,252 posts)many people live in high cost of living areas who make nothing close to that amount.

and people can live very comfortable and well on that amount .

these people can't because they live beyond their means. and beyond their means doesn't mean paying for basics like bread , health care etc. it means they need the most expensive, designer high end shit .

they probably spend a lot of expensive summer camps and other shit like that.

pnwmom

(108,980 posts)Three week vacations? $600 a month in entertainment? $700 month car payment? $2100 per month in food for 2 adults and a child?

And on and on and on.

Captain Stern

(2,201 posts)I mean..literally. Neither the actual headline, or the article itself, say that this hypothetical family is struggling

The article is just illustrating how a family can make 300k a year in San Francisco, and still not have any money to put into savings, if they try to live the idealized middle-class lifestyle.

tazkcmo

(7,300 posts)They are maxing their 401k. Both of them. They are saving and you are correct that there is no struggling. They are living quite well.

Joe941

(2,848 posts)brooklynite

(94,598 posts)For two, that's about $500,000 over their lifetimes at home.

lostnfound

(16,184 posts)If they are NOT healthy kids, it can be bankruptcy.

If they are risk-taking hard-to-manage kids?

If they have major medical or emotional issues?

Can’t put the genie back in the bottle.

Vinca

(50,278 posts)FM123

(10,053 posts)ProfessorGAC

(65,076 posts)Otherwise it wouldn't be an expense. It doesn't cost any outflow to take a day off and hang out at home.

The other part is, there's a lot of saving in this "budget".

With the retirement $ and the education trust, they're over 45 grand. Do that 401k for 20 years and that's 2M dollars. In TWENTY years, not 40.

MichMan

(11,938 posts)ProfessorGAC

(65,076 posts)hatrack

(59,587 posts)SweetieD

(1,660 posts)living paycheck to paycheck and struggling, no way would you have that high a withdrawal for retirement savings.

mercuryblues

(14,532 posts)During our "lean years" we cut the pension funds. When the big promotion came we maxed them out. If trump doesn't fuck up Wall St in the next 6 months, we will do okay in retirement- in 6 months. If he does, we can't retire until Wall St bounces back.

Response to Demovictory9 (Original post)

Name removed Message auto-removed

nini

(16,672 posts)Less expensive car,

less vacations,

less 'entertainment'.

Ditch the weekly date night and make it once a month, reduce the grocery bill.. c'mon now it can be done.

These kinds of pity parties make me want to vomit.

mercuryblues

(14,532 posts)2,100 a month for groceries and eating out? 2 people and a kid. That is 500 a week. Where the hell are they buying their groceries and eating out? In France? Limit your eating out expense to 100 a week and groceries to 100 a week. That saves them over 15,000 a year. Which is more than what many people earn in a year.

500 a month for clothes? Do they ever do laundry or are they too busy eating out, going on vacation and weekend getaways.

Speaking of weekend getaways and other entertainment, 600 a month? Cut that in 1/2 and save 3,600 a year. in 30 years that is 600,000 in savings to supplement their retirement income. Just by cutting by half 2 budgeted items.

All I can say is, it must be rough for them to live "paycheck to paycheck"![]()

madville

(7,412 posts)But not that high. Groceries here are about 50-100% more than where I lived from in Florida.

mercuryblues

(14,532 posts)go grocery shopping on their weekend getaways. That is an astronomical amount of money to spend on 2 people and a young kid.

Rollo

(2,559 posts)I live in the East Bay, and I figure I get along quite nicely, food-wise, for less than $300/mo. I love buying veggies at the local hispanic markets - good quality and often really low prices that put Safeway and Lucky to shame. One can also stock up on staples at Costco, and get other stuff on sale at the aforementioned big chains.

I'm also wondering what the article means about "retiring at a decent age". Full Retirement Age is now about 66 for my gen. I pushed it a year - I'm 67 - but still not retired. LOL. Occasional periods of unemployment I treated as practice retirements - work on house, vehicles, garden, etc. Even went back to school for a while during the Bush recession.

What is unsaid in the article is the cause of higher housing prices in places like SF - the tech boom. That bubble will eventually burst, just like the previous one in 2001. And then the formerly overpaid techies will be fleeing their overpriced big city condos like lemmings...

Response to Demovictory9 (Original post)

Mosby This message was self-deleted by its author.

Amishman

(5,557 posts)And I saw Trump new clips on the news earlier.

There's easily 50k of luxuries in that chart, 80k if you include the choice of living in an extremely expensive area

Kaleva

(36,312 posts)$2100 a month for food for three? $500 a month for clothing? $600 a month for entertainment which includes weekend getaways? A car payment of $700 a month?

Middle class people living an upper class lifestyle.

cbdo2007

(9,213 posts)Comfortably here in Kansas City.

Nobody is forcing anyone to live in San Francisco and if you make $300k and you aren't telecommuting then you are doing it wrong.

madville

(7,412 posts)That is an extravagant and wasteful lifestyle. I still drive an older Camry, ride my bicycle half the time, spend $400 a month on food, I don't even remember the last time I shopped for clothes. My only large expense is rent, $2000 a month on a 600 sq ft apartment on the East Bay side. I save a lot though, about to jump ship at the end of this year and move back east to a low cost of living area where I've already purchased some land to build a small house on. I'll get a job in that area making $50-60k a year doing the same thing.

Just google the city of SF or Oakland salaries, cops, firefighters, EMTs, electricians, public works whatever make $100-200k a year, some $250k+ a year with overtime. With two income earners here $300k a year is not unrealistic, those people in that example above are just bad with money.

vrnyboe

(2 posts)I have been both very poor and very wealthy.

And I can tell you those numbers are not out of line, in fact, I spend a lot more in some categories than they do, especially utilities (and a lot less in others than they do like dinning). The sad fact is.. when you make more... you tend to spend more. So the end result sort of feels the same... you feel like you are living paycheck to paycheck the same as when you had nothing and were earning minimum wage.

It's very hard to resist the temptation to get a bigger house, a nicer car, ect, when you start making more.

So yes, those that said they could go for years on that amount... sure! if you continued to live as you currently do.

mercuryblues

(14,532 posts)compared to a family of 2 with a toddler.

Up thread I posted 2 areas where they could easily cut back, if they were interested in not living paycheck to paycheck. This couple has no control to live within their means. I am actually surprised they have retirement accounts.

vrnyboe

(2 posts)7000 clothing

3500 dining

40000 private school for 4 kids

6000 entertainment

9000 groceries

10000 utilities

70000 mortgage, property taxes and insurance

3000 vacations

this is for a family of 6 and are only the major numbers, but I would never dare to claim to be middle class when I am in the top 2% of income earners in the US

BlueFlorida

(1,532 posts)and it doesn't include the CA state income tax

madville

(7,412 posts)BlueFlorida

(1,532 posts)LonePirate

(13,425 posts)MissB

(15,810 posts)to be able to bribe their way into a spot for their kid at a top university.

But of course some of their spending categories are outrageous. The food, travel and entertainment budgets are ridiculous.

At that level of income, they have choices that most folks can’t imagine.

They just suck at making choices in certain categories.

ansible

(1,718 posts)Bunch of out of touch loons...

Aussie105

(5,401 posts)Your expenses seem to grow as your pay goes up.

Then, if your pay goes down, not being able to buy top quality food or not having overseas holidays tends to feel like poverty.

Strange thing is, my pay before retirement was $70K pa.

Didn't save much.

Now retired, income is $32K. We manage ok. Obviously a lot of slack in my pre retirement spending I wasn't aware of.

I'm sure you could put a similar list together to prove $3M pa is doing it tough too. What with the apartment in Monte Carlo to maintain, and the new house you are building in Spain . . . gets tight, you know!

So the point of the info is what, exactly?

NBachers

(17,120 posts)on Wednesday, so I took a week out of the 40 days vacation time I've save up. Today, we extravagantly went to Golden Gate Park, stretched out a mat, and slept out in the sun, for free. Went to the ocean and watched the sun set; also free. Next week, it's back to work, and I'll probably be working another 10 years, if my brain, eye (only one works now) and feet hold up.

Oh yeah- Saturday, I took a cross-town hike, over the Golden Gate Bridge, and into the Marin Headlands. 23 miles, 11 hours of hiking. Expenses: A home-made smoothie, a jar of home-made ginger / yerba mate tea, and a home-made almond butter sandwich.

My 14 year old 2005 Ford Focus is the best car I've ever owned.

fishwax

(29,149 posts)especially when you're also socking away 37 grand a year (plus matching, presumably) for retirement and paying down a 1.5 million dollar home. And paying 1050/month to drive a nice new car. And spending another 17 bucks per day on clothes. And so on.

SKKY

(11,811 posts)And Coach instead of Gucci? White people problems. On a side note, utilities are cheaper in SF than I imagined. Not much more than I pay and I'm in a relatively low-cost Midwestern city.

Blue_Tires

(55,445 posts)For Christ's sake you'd think urban sophisticates living in SanFran would have a *little* automotive taste... ![]()

Bengus81

(6,931 posts)$4M in life insurance? Am I reading that right?