Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsHe claimed to run a hedge fund from his frat house. SEC says he spent investors' cash on gambling

Last edited Mon Jun 10, 2019, 01:47 AM - Edit history (1)

and booze.In the fall of 2018, 25-year-old Renee Elizabeth Lorys decided that she wanted to start investing some of the money she was making as a pharmacist. Her brother, an undergraduate at the University of Georgia, knew just the guy: Syed Arham Arbab, a stock-market whiz who had been making amazing returns for other students on campus through the hedge fund he ran out of his room at the Phi Kappa Tau fraternity house.

In texts she later provided to the Securities and Exchange Commission, Arbab told Lorys the hedge fund he ran was different. Artis Proficio Capital targeted young people and college kids, he wrote, and offered lower-than-average fees. Up to $15,000 of her money would be guaranteed, and she could pull out at any time with two weeks’ notice.

“Just let me know if you’re not interested so I don’t keep bothering you with this!” he wrote, touting an investor list comprised of “students, University of Georgia faculty, and local restaurant/bar owners.”

Lorys decided to give it a try. Between October 2018 and April 2019, she invested a total of $45,745 with Arbab, according to her sworn affidavit. The last $20,000 she sent him was supposed to be returned with 8 percent interest in less than two weeks. But instead, she received a wire transfer for $10. Later, she received two more payments to her Cash App account, which still added up to only $600.

-more-

https://www.msn.com/en-us/money/companies/he-claimed-to-run-a-hedge-fund-from-his-frat-house-the-sec-says-he-spent-investors-cash-on-gambling-and-booze/ar-AACxhw6?li=BBnbfcN

Frat bro hedge fund manager? I don't think there was ever a time in my life where I felt inclined to give my money to someone's like that.

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

8 replies, 812 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (7)

ReplyReply to this post

8 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

He claimed to run a hedge fund from his frat house. SEC says he spent investors' cash on gambling (Original Post)

Yo_Mama_Been_Loggin

Jun 2019

OP

"I should have answered that email from the Nigerian prince who saw my name in a dream!"

struggle4progress

Jun 2019

#2

FakeNoose

(32,645 posts)1. Foolish! I'm sorry, there's no other word

Demovictory9

(32,457 posts)6. 8% in two weeks? greedy and stupid.

Skittles

(153,169 posts)8. she exercises that kind of judgement and she is a pharmacist?

struggle4progress

(118,296 posts)2. "I should have answered that email from the Nigerian prince who saw my name in a dream!"

NCjack

(10,279 posts)3. That's why you don't introduce your sister to your frat bro.

He will screw her every time.

Volaris

(10,272 posts)5. You just won this thread hahahahaha!!!

Volaris

(10,272 posts)4. Well, isn't that what a hedge fund manager does anyway?

On a less humorous note, if he were running an MIT-style blackjack team and knew what the fuck he was doing, that's a more solid 'investment' than standard market returns, right?

This government used to HANG market speculators.

Just sayin.

Celerity

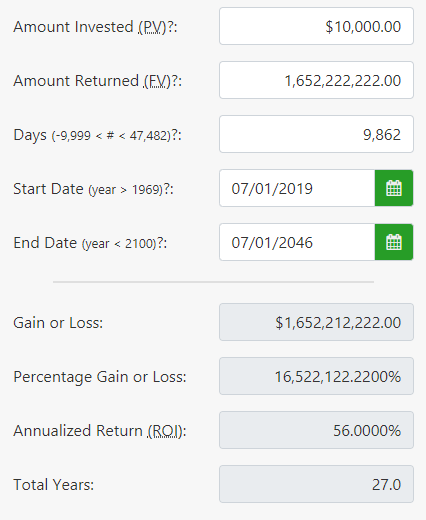

(43,420 posts)7. lol, he was promising 56% annual rates of return, if I took 10,000 USD

and let it ride for 27 years (until I am 50) at 56% ARR

I would have

![]()

Plus, roflmaoooo, sending money to a Hedge Fund over Venmo?????

people are ![]()

![]()

and greedy and

they may be bright, but they sure ain't shining ![]()