General Discussion

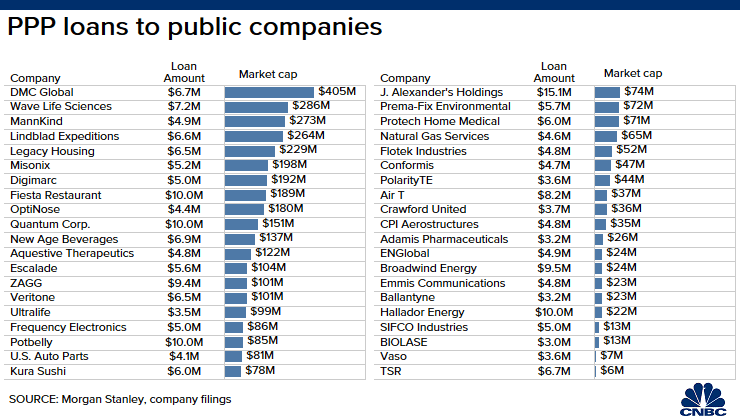

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forumslarge public companies that got bailout money

?v=1587479273&w=740&h=416

?v=1587479273&w=740&h=416sakabatou

(42,163 posts)I'm shocked! Shocked I tell you!

underpants

(182,848 posts)The Dungeons & Dragons owner?

https://en.wikipedia.org/wiki/TSR,_Inc.

rdking647

(5,113 posts)the DnD company was bought by wiazrds of the coast years ago. this TSR is a telecom company

https://tsr-inc.com/

underpants

(182,848 posts)Celerity

(43,458 posts)ProfessorGAC

(65,101 posts)...you don't find it odd that they need a loan $700k above their equity value?

Their debt:equity is 0.08. That's nothing!

Why would they need a bailout in excess of total corporate value?

Interesting fact is there ROE is 5.97% which the analysts consider underperforming in their peer group.

A skim to get cash flush to up dividends & get the analysts off their back.

With taxpayer money.

BTW: given their minimal debt the entire value of the company is equity. If half their total capitalization was debt, the ROE would be 11.94% & nobody would have said a word.

And a 1:1 D/E is below average which is good.

Something's fishy.

Celerity

(43,458 posts)And they are all coming back for more. A truly gigantic wealth transfer up to the pyramidion, and will be used by the Rethugs to try and strangle the already pathetic American social safety net and Social Security, Medicare, etc.

A great looting.

Igel

(35,323 posts)Payroll protection program.

It gives a loan to the company. They use almost all of it to maintain their employees on their payroll instead of laying them off. But it means they can't actually be doing their job--the business has to be closed, this is payroll substitute not payroll subsidy.

No loan, laid off workers file for unemployment, might not come back. Loan, workers keep tenure, stay on the payroll, draw salaries.

If they do that according to the loan's requirements, the loan gets converted into a grant and is forgiven.

A loan above their equity just means that they, for the length that the PPP is good for, have a payroll + 10% that's $700k above their equity value.

People read the name of the program, read what it's for, and then think that it's money that goes to the business for the business to use as it sees fit.

ProfessorGAC

(65,101 posts)They seem to have quite a lot of cash on hand. They actually have enough to pay down all debt with <40% of cash. This suggests they could easily strike a deal with lenders to tack 3 or 4 months on the back end and use existing nonperforming cash to cover overhead.

Essentially no long term external investment but low long term debt & no short term or RLOC.

The FY end May 31, so this last year isn't posted yet.

But FY ending May 2019, shows negative net income, no dividend paid, and oddly enough, no depreciation meaning the net income being negative wasn't because of some large reinvestment in the recent past.

Also, revenue went down $1.6 million 2018 to 2019, but SG&A went up $2.2 million with ZERO R&D.

Cost of revenue was $55million, so you're likely right that holding salary & benefits for 60-90 days would cost $6.5million.

But, these numbers look to me like they're working the system to avoid adding debt. Using tax money to buy them time.

I'm really suspicious about that big jump in SG&A while revenues declined.

While I buy your view on salaries, my suspicions are unabated.

Whiskeytide

(4,461 posts)... restrictions on what they use it for. It’s forgiven if they use it for payroll. If they don’t, they have to pay it back ... at 1%. Taxpayers subsidize it so the banks won’t lose $.

It’s a shitshow. The opportunities for corruption are many, and we will be left holding the bag.

underpants

(182,848 posts)Ferrets are Cool

(21,108 posts)They must know for whom I voted in the last 10 elections.

pwb

(11,280 posts)unemployment insurance ? likely they keep it.

jimfields33

(15,859 posts)I’ve heard of potbelly. I guess a restaurant, but I e never eaten there. I can’t even have a decent boycott on these companies.

Hoyt

(54,770 posts)Last edited Tue Apr 21, 2020, 09:17 PM - Edit history (1)

requirements of employees per location. Not sure how the other companies met the requirements unless they have small staff. But, again, the amount is really small and some -- perhaps all -- of those companies will have to pay it back.

AntiFascist

(12,792 posts)This information should be made part of Biden's campaign.

Stuart G

(38,436 posts)McCamy Taylor

(19,240 posts)keithbvadu2

(36,838 posts)Ruth's Chris Steak House got the maximum $10 million loan TWICE by considering two subsidiaries as separate companies.

They had no problem navigating the troublesome paperwork system.

https://www.democraticunderground.com/100213304091

https://www.democraticunderground.com/100213318707

https://www.forbes.com/sites/nathanvardi/2020/04/20/seventy-one-publicly-traded-companies-got-paycheck-protection-funding-before-money-ran-out/amp/