General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsI hate that "rich pay more taxes" BS.

Last edited Sat Mar 27, 2021, 11:31 AM - Edit history (1)

Hannity will have you believe that, but the truth is the rich pay the most monetarily, but NOWHERE near what we pay in %. The other thing is, an individual rich guy might pay 20 times more cash than I pay in, but he makes 100 or 1000 times what I make! I wish I could get these thoughts on every billboard in the US!

An Analogy for you, a women is stranded on the highway out of gas. A rich guy pulls up with a hummer with a 100 gallon tank, he gives her 2 gallons of gas. Another normal wage guy pulls up with a tiny cheap compact car with a 10 gallon tank and gives her 1 gallon of gas....Who gave more?

Rich guy gave 2% of his gas.

other guy gave 10% of his gas.

Hannity would praise the rich guy!

Elessar Zappa

(14,047 posts)Sure, the rich pay more total in taxes. But they pay nowhere near their fair share.

Mysterian

(4,591 posts)Otherwise, there will be concentration of wealth and power in a few people, as we are seeing right now. It's unsustainable for democracy to have concentrated wealth. They want capitalism, the rich pay the capitalism taxes.

rampartc

(5,435 posts)trump seems to use the federal courts more than any million wage employees.

the rich have more private property to protect by armies, police forces etc.

no dredging is required for my boat to go anywhere wet.

no highway or parking lot is needed for my business.

etcetcetc

mwooldri

(10,303 posts)Who gave more? The rich people who put in a lot of money or the widow who put in two coppers? A Jewish religious man had an answer...

Maeve

(42,288 posts)Two thousand years ago people understood this

albacore

(2,406 posts) ?w=1024

?w=1024

albacore

(2,406 posts)elias7

(4,026 posts)When you say the rich pay nowhere near what “we” pay in percentage, that is just not accurate. The more money you make, the more you pay percentage-wise.

2020 Tax Brackets for Married Couples Filing Jointly

10%-Up to $19,750

12%-$19,751 to $80,250

22%-$80,251 to $171,050

24%-$171,051 to $326,600

32%-$326,601 to $414,700

35%-$414,701 to $622,050

37%-Over $622,050

newdayneeded

(1,957 posts)Donny himself said he paid zero or very little in fed taxes. Once you subtract out the loopholes that they have a team of accountants searching for, their effective tax rate is way less than us mortals.

elias7

(4,026 posts)But for most folks with incomes under $500k, say, there’s not those types of loopholes (and some recently closed two years ago). Hannity probably has entered the realm of income (several millions/yr, I imagine, where he can find those havens and shelter a lot of money.

rickyhall

(4,889 posts)elias7

(4,026 posts)Are you getting the IRS being too weak to collect it, I agree, and these laws to be need to be enforced. how about the Steve Forbes flat tax? Sometimes that sounds pretty good.

Celerity

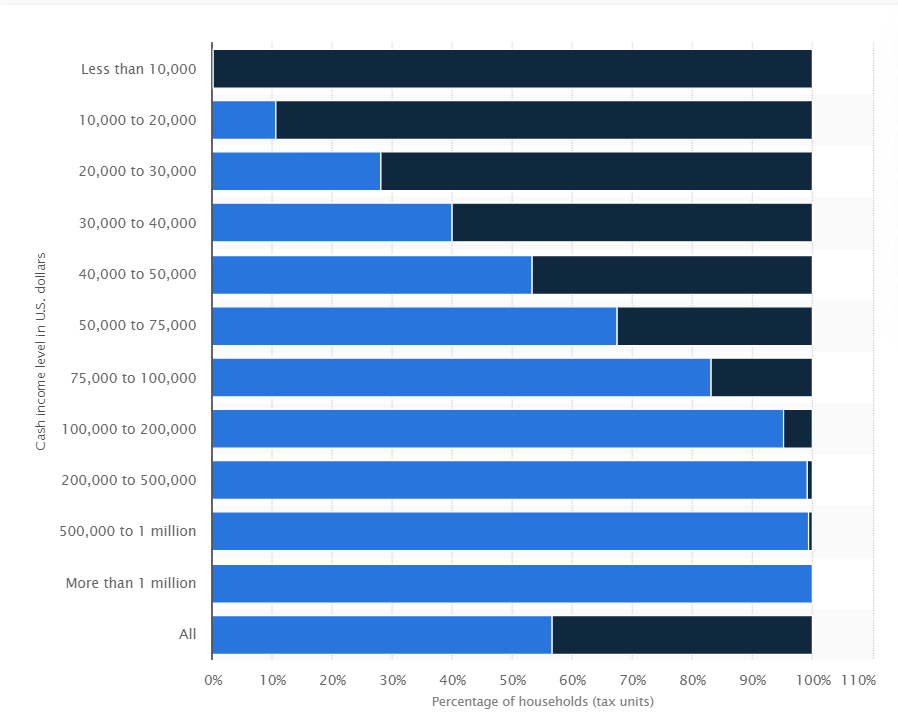

(43,497 posts)federal income tax. I was around 47%, but it is dropping, so more is being extracted the lower half or so of the population. By 2024, only one-third will pay no income tax.

https://www.statista.com/statistics/242138/percentages-of-us-households-that-pay-no-income-tax-by-income-level/

dpibel

(2,852 posts)"In a 2007 interview, Buffett explained that he took a survey of his employees and compared their tax rates to his. All told, he found that while he paid a total tax rate of 17.7%, the average tax rate for people in his office was 32.9%."

elias7

(4,026 posts)I guess the question is are we talking about the wealthiest 500 people in America or those with incomes over $120k (considered upper income in the US). Yes the Uber wealthy have accountants who know how to move money and avoid taxes. Someone making $120k (or even 3-4 times taht) does not have those options.

PETRUS

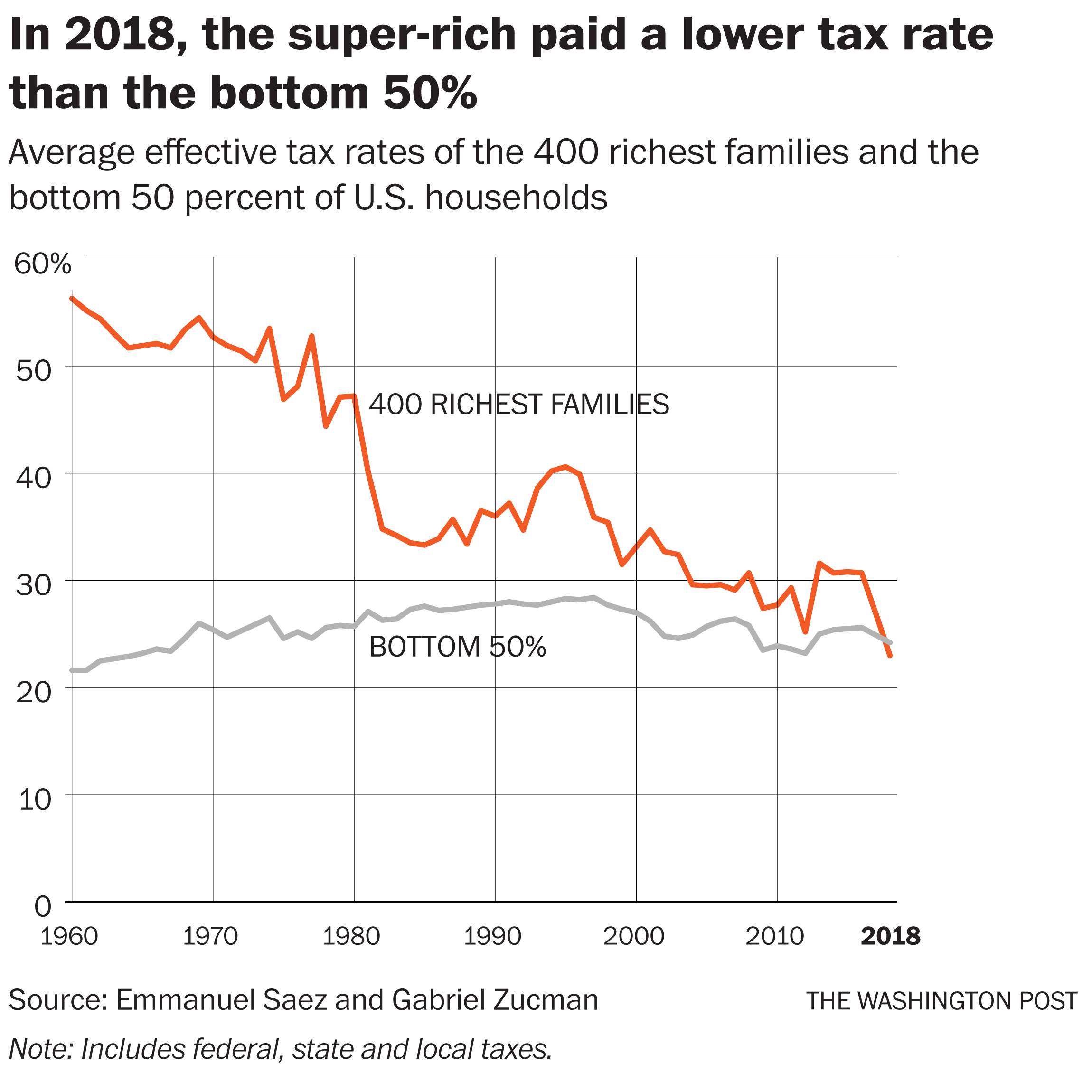

(3,678 posts)Saez and Zucman have provided a graph:

elias7

(4,026 posts)It is not until > than the top 0.01% that the graph dips. That is the top 99.99% of people not paying disproportionately less than the poor man.

PETRUS

(3,678 posts)That statement isn't true. My reply was directed towards you, not the OP.

hibbing

(10,109 posts)RainCaster

(10,914 posts)I know several families in that category. With 10 years of experience, that's quite doable.

MissMillie

(38,578 posts).

hunter

(38,326 posts)The people who work multiple crappy jobs and are barely getting by...

... or someone who owns multiple houses in beautiful places, drives fancy cars, and travels the world first class?

Tax rates SHOULD be steeply progressive, with the very wealthy paying most of them, the affluent paying their fair share, and those barely getting by paying nothing.

Jobs that don't pay a comfortable living wage simply shouldn't exist.

Those who are unemployed or unemployable should receive a basic income, safe comfortable housing, appropriate medical care, and a basic income.

Creating jobs is a trivial problem when taxation is progressive and government can create money.

Healthy people want to work, they want to make their communities a better place. They don't need the threat of starvation, homelessness, and death by treatable medical conditions hanging over their heads as any kind of "punishment" for not working.

Punitive, puritanical societies don't work except for those at the very top seeking and holding vast power and wealth.

Progressive taxation and strong social safety nets are essential to the stability of any free market.

Otherwise society collapses into some version of stagnant feudalism or worse.

&w=916

&w=916