General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsHouse prices hit all time high in Hawaii - $920,00 median per detached house

due to covid, low interest rates, and lowest every housing stock. Condos not too far behind.

https://www.hawaiinewsnow.com/2021/03/31/priced-out-paradise-heres-why-buying-home-hawaii-may-seem-out-reach/

cinematicdiversions

(1,969 posts)Only because Hawaii really got slammed by the pandemic.

Of course Florida (Who also got slammed) is also seeing ridiculous gains.

It really shows the disconnect between real estate and the overall local economy.

PoindexterOglethorpe

(25,862 posts)I'm somewhat surprised that no one is currently talking about a housing bubble.

cinematicdiversions

(1,969 posts)There are certainly fundamental reasons. Low housing stock, lots of people with extra cash sloshing around because they didn't go to five destination weddings last year, Millennials realising en masse that Brooklyn is not all that.

There are some very artificial reasons as well. The eviction moratorium being the most obvious. We will not see any downward pressure while so much of our limited housing stock (esp on the low end) is tied up with a renter that cannot leave.

Once some of the artificial barriers are released, we should see more of a dip than a crash. Of course, all real estate is local and some areas might not even dip.

Celerity

(43,422 posts)yes we (I am a 24yo Zennial, right on the Millennial/Gen Z 1996/97 borderline) all are just FLUSH with cash on average

The unluckiest generation in U.S. history

Millennials have faced the worst economic odds, and many will never recover

https://www.washingtonpost.com/business/2020/05/27/millennial-recession-covid/

After accounting for the present crisis, the average millennial has experienced slower economic growth since entering the workforce than any other generation in U.S. history. Millennials will bear these economic scars the rest of their lives, in the form of lower earnings, lower wealth and delayed milestones, such as homeownership.

The losses are particularly acute on the jobs front. A few brutal months of the coronavirus set the labor market back to the turn of the millennium. In April, the economy bottomed out with about as many jobs as in November of 1999. The economic regression to the Y2K era is a fitting symbol for a generation that — more than any other — has been shaped by recession. Things improved in May, but the improvement just means we’re back to December 2000 levels of employment. For millennials who came of age then, it’s as if all the plodding expansions and job recoveries of their namesake epoch evaporated in weeks.

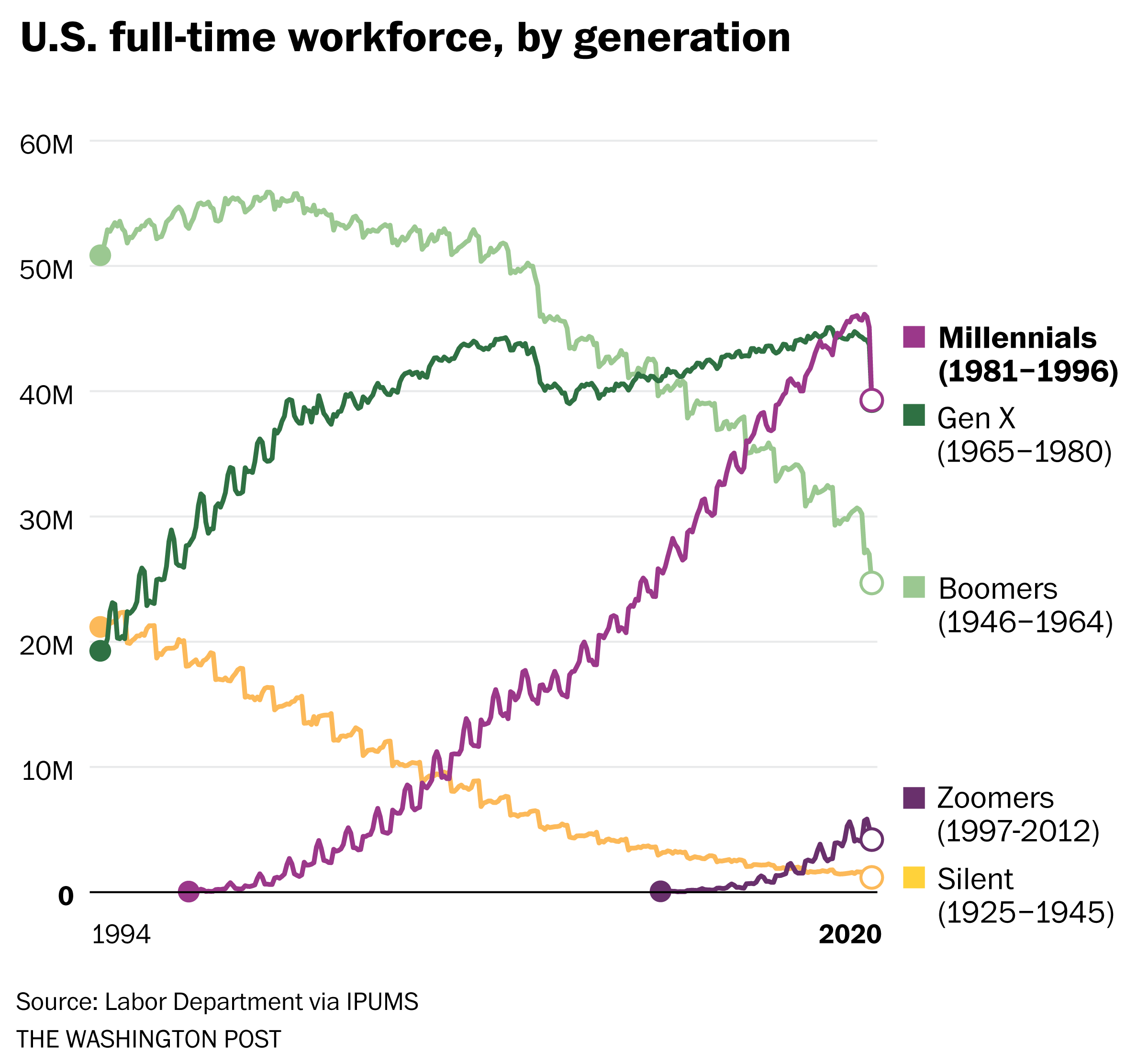

The losses aren’t merely symbolic. This recession steamrolled younger workers just as millennials were entering their prime working years — the oldest millennials are nearing 40 while the youngest are in their mid-20s. Millennial employment plunged by 16 percent in March and April this year, our calculations show. That’s faster than either Gen X (12 percent) or the baby boomers (13 percent). Proportionally, the even younger generation, known as zoomers, suffered worse than all of them. A third of their jobs vaporized in two months in 2020.But Gen Z is only just entering the labor force — the oldest zoomers are in their early 20s — so their losses weren’t as large in absolute terms.

At the beginning of 2019, millennials became the largest generation in the United States’ full-time workforce, surpassing Gen X. But the coronavirus crisis walloped millennials so disproportionately that they’re on the precipice of giving the top generational spot back to Gen X.

Gray Kimbrough, an economist at American University whom we’ve previously and accurately branded a serial millennial myth debunker, points out the oldest millennials, such as himself, lived through the 9/11 terrorist attacks and entered the labor market in the recession that hit around the same time. They spent their early years struggling to find work during a job recovery, only to be hit by the Great Recession and another recovery. And, of course, yet another recession.

snip

Millennials Don’t Stand a Chance

They’re facing a second once-in-a-lifetime downturn at a crucial moment.

https://www.theatlantic.com/ideas/archive/2020/04/millennials-are-new-lost-generation/609832/

APRIL 13, 2020

The Millennials entered the workforce during the worst downturn since the Great Depression. Saddled with debt, unable to accumulate wealth, and stuck in low-benefit, dead-end jobs, they never gained the financial security that their parents, grandparents, or even older siblings enjoyed. They are now entering their peak earning years in the midst of an economic cataclysm more severe than the Great Recession, near guaranteeing that they will be the first generation in modern American history to end up poorer than their parents.

It is too soon to know how the unfurling business-failure and unemployment crisis caused by this novel public-health crisis is hitting different age groups, or how much income and wealth each generation is losing; it is far too soon to know how different groups will rebound. But we do know that Millennials are vulnerable. They have smaller savings accounts than prior generations. They have less money invested. They own fewer houses to refinance or rent out or sell. They make less money, and are less likely to have benefits like paid sick leave. They have more than half a trillion dollars of student-loan debt to keep paying off, as well as hefty rent and child-care payments that keep coming due.

Compounding their troubles, Millennials are, for now, disproportionate holders of the kind of positions disappearing the fastest: This is a jobs crisis of the young, the diverse, and the contingent, meaning disproportionately of the Millennials. They make up a majority of bartenders, half of restaurant workers, and a large share of retail workers. They are also heavily dependent on gig and contract work, which is evaporating as the consumer economy grinds to a halt. It’s a cruel economic version of that old Catskill resort joke: These are terrible jobs, and now all the young people holding them are getting fired.

What little data exist point to a financial tsunami for younger workers. In a new report, Data for Progress found that a staggering 52 percent of people under the age of 45 have lost a job, been put on leave, or had their hours reduced due to the pandemic, compared with 26 percent of people over the age of 45. Nearly half said that the cash payments the federal government is sending to lower- and middle-income individuals would cover just a week or two of expenses, compared with a third of older adults. This means skipped meals, scuppered start-ups, and lost homes. It means Great Depression–type precarity for prime-age workers in the richest country on earth.

snip

cinematicdiversions

(1,969 posts)The pandemic was like a nationwide forced savings plan. All those cancelled vacations and dinners in instead of out added up for a lot of people. Add on the stimulus and yes, people, including millennials, have more money in their bank account than they had ever seen before.

Millennials being in their thirties also are in prime home buying range. (My millennial brother has managed both a home and a baby on the way in the last 24 months.) So the idea that they would need a yard and a lower COL area to live in with good schools was in full swing when the pandemic hit.

There is no one size fits all and a forty-year-old Millennial is not really living the same experience as one who is 26. But make no mistake. They are buying a lot of houses.

Celerity

(43,422 posts)https://www.businessinsider.com/pandemic-widened-millennial-wealth-gap-economic-inequality-rich-poor-henry-2021-1?r=US&IR=T

Widening wealth inequality has been a feature of American life in the 21st century, but the coronavirus pandemic has amplified a growing gap within the millennial generation. At the turn of 2020, a large part of the generation was still grappling with the fallout from the 2008 financial crisis when they were slammed with their second recession before its oldest members even hit 40 (the generation will turn ages 25 to 40 in 2021). This only intensified decade long financial challenges including a dismal job market, sky-high levels of student debt, and soaring living costs.

Generational researcher Jason Dorsey, the president of the Center for Generational Kinetics, calls these millennials who feel behind financially and professionally "me-llennials," and those who are financially ahead of the game "mega-llennials" — and this latter group has seen stable earnings during the pandemic that they've been able to save while the experience economy has been shut down.

The pandemic has ultimately exacerbated the high income inequality that existed among millennials pre-Covid, said Christine Percheski, demographer and associate professor of sociology at Northwestern University. "This pandemic is widening economic inequalities within millennials, with some millennials relatively unscathed economically and others just completely financially devastated by unemployment losses, increased childcare costs, lost economic opportunities, and lingering health problems that they or family members are going to experience," she said. The result is a disparity in which the millennial rich and the millennial poor will recover at different paces. This intergenerational socioeconomic gap is a reflection of the K-shaped recovery that America has been experiencing, in which the wealthy are bouncing back and the lower-earning aren't.

Some millennials are struggling with unemployment and childcare

The affordability crisis millennials were facing prepandemic hindered their ability to build wealth. Those born in the 1980s are at risk of becoming a "lost generation" that may never be as rich as their parents, Insider previously reported, and the generation as a whole hold a shockingly small amount of wealth compared to what boomers had at their age. Such roadblocks have left these "me-llenials" with little to no financial resources to fall back on in the wake of a second recession. That might explain why they were most likely to say that the pandemic was having a "major" impact on their finances (39%) in a Morning Consult survey that polled 4,000-plus Americans in September, including over 1,200 millennials.

snip

speak easy

(9,268 posts)Millennials are the victim of victims (in more ways than one).

Hekate

(90,721 posts)...on the Mainland my whole life. ![]()

For one thing, every scrap of building material has to be shipped in from elsewhere: every nail, every slab of drywall, every plank of wood. Islands by their nature are isolated (as Trump so cogently observed about Puerto Rico: surrounded by water), and have finite resources in every respect, most especially land.

Yes there are still farmers there, but decades ago the population outgrew local ability to feed it. Food needs to be shipped in as well.

The population grows. Tourists and the military bases add bodies — they may not be permanent residents, but they use up resources every day.

I know you know this, msongs, but not everyone does.