General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe Verizon app might be collecting your browsing history and more

The My Verizon app might be collecting information about your browsing history, location, apps, and your contacts, all in the name of helping the company “understand your interests,” first spotted by Input. The program, which Verizon appears to automatically opt customers into, is called Verizon Custom Experience and lays buried in the privacy settings on the app.

The program introduces two different options that appear in the app, Custom Experience and Custom Experience Plus, each of which varies in terms of invasiveness. Verizon provides additional information about both settings within the app, as well as on a FAQ page on its website. It appears that the Custom Experience option is a stripped-down version of Custom Experience Plus, and as Verizon states directly in the app, it helps Verizon “personalize” its “communication with you” and “give you more relevant product and service recommendations” by using “information about websites you visit and apps you use on your mobile device.”

snip>

In April, T-Mobile started automatically enrolling users in a program that shares your data with advertisers unless you manually opt-out from your privacy settings. On AT&T’s privacy center, the company says that it collects web and browsing information, along with the apps you use, and that you can manage these settings from AT&T’s site.

https://www.theverge.com/2021/12/5/22818783/verizon-app-data-collection-browsing-history?scrolla=5eb6d68b7fedc32c19ef33b4

brooklynite

(94,595 posts)Mary in S. Carolina

(1,364 posts)ATT's major shareholder is Vanguard and Blackrock. Vanguard and Black Rock are major shareholders in CNN, MSNBC, FAUX News, and OAN, HULU and Youtube TV. We no longer have an unbiased media and they know our every move.

Silent3

(15,221 posts)...and now AT&T is forcing itself back on me anyway.

We obviously have close to zero antitrust enforcement (which, yes, has been obvious for a long time).

Yo_Mama_Been_Loggin

(108,033 posts)Verizon and AT&T are two different carriers. Verizon was formed by the merger of Bell Atlantic and GTE.

AT&T was primarily the long-distance carrier left over from the breakup of the Bell system.

Each went on to from their own wireless company. If the two ever were to merge there'd be quite an outcry.

I'm a former Verizon employee.

Mary in S. Carolina

(1,364 posts)AT&T recently completed an acquisition agreement with Verizon Wireless

Celerity

(43,408 posts)Alltel and Unicel no longer exist, have not for ages.

https://www.att.com/mergers/unicelminnesota/about-the-merger.jsp

AT&T recently completed an acquisition agreement with Verizon Wireless which included select Verizon Wireless, Unicel, and Alltel properties in your area. The acquisition enhances AT&T's wireless network coverage primarily in rural areas in 79 service areas in Alabama, Arizona, California, Colorado, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, Nevada, New Mexico, North Dakota, South Dakota, Tennessee, Utah, Virginia, and Wyoming. You can see a map of the acquired markets here.

AT&T will launch service on a market-by-market basis as network integration is completed. Your wireless service will transition to AT&T shortly after that. We will contact you and other affected subscribers shortly with more information about your service transition. In the meantime, if you have more questions, please read our FAQs.

AT&T and Verizon swap wireless assets

May 11, 2009

AT&T said it will buy the Alltel assets that Verizon Wireless needs to shed, and Verizon will buy some assets from AT&T's purchase of Centennial Wireless.

https://www.cnet.com/tech/mobile/at-t-and-verizon-swap-wireless-assets/

AT&T tried to but T-Mobile USA in 2011 and were blocked

Attempted purchase of T-Mobile USA by AT&T

https://en.wikipedia.org/wiki/Attempted_purchase_of_T-Mobile_USA_by_AT%26T

Verizon (mobile network)

https://tinyurl.com/2aycchs5

In May 2018, former Verizon executive, Miguel Quiroga, launched the pre-paid carrier Visible in Denver Colorado, which Verizon funds and owns.

On June 8, 2018, Verizon announced that Hans Vestberg had been picked to become CEO on August 1, 2018.

In 2019, Verizon Wireless services were split between two new divisions: Verizon Consumer and Verizon Business.

In 2020 Verizon launched a prepaid mobile phone service named Yahoo! Mobile following acquiring the overall Yahoo! brandname in 2017.

On September 14, 2020, Verizon entered into an agreement to purchase TracFone Wireless which was worth an approximate $6.25 Billion

Mary in S. Carolina

(1,364 posts)Verizon's major institutional shareholder is Vanguard

ATT's major institutional shareholder is Vanguard

OAN is owned by ATT and their major institutional shareholder is Vanguard

MSNBC, CNN and Fox major institutional shareholder is Vanguard

Hulu major intuitional shareholder is Vanguard

YouTubes major institutional shareholder is Vanguard

Blackrocks major institutional shareholder is Vanguard

It is time to make anti-trust laws against institutional shareholders.

Celerity

(43,408 posts)it is a foreign government or a foreign owned firm that holds a large portion of the outstanding shares, especially a controlling interest.

For a case study in regards to that and telecoms, go read about the hoops Deutsche Telekom had to jump through in order to buy out VoiceStream Wireless (thus creating T-Mobile USA).

I did a paper on American wireless telephony M&A history (including the regulatory barriers and institutional guardrails bracketing those processes) whilst reading for my only US (the rest are from UK and EU schools) uni degree (an MBA).

Mary in S. Carolina

(1,364 posts)and if you don't believe this, I have a bridge to sell you.

Celerity

(43,408 posts)you already were wrong with your initial claim, now you are going down another tangential path

have a nice day

Mary in S. Carolina

(1,364 posts)My whole point is that they are all owned by shareholders - the largest institutional shareholder being Vanguard/Blackrock. This forum is about discussion and debate. Unfortunately, you totally missed the point. Feel free to point out if I am wrong, I don't have a problem with that (I am not a narcissist). It would be great if you want to correct my grammar and spelling too like a good assistant.

Celerity

(43,408 posts)Mary in S. Carolina

(1,364 posts)Celerity

(43,408 posts)Celerity

(43,408 posts)as I do agree they have FAR too much power

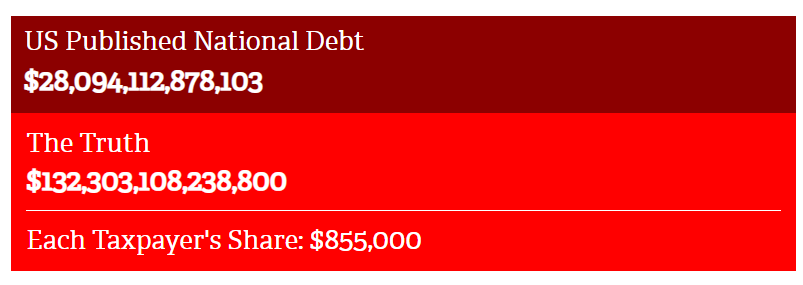

remember this is from May, so not completely up to date

https://www.democraticunderground.com/100215459199#post25

BlackRock United States 49.1 trillion usd assets under custody and/or administration and/or direct management

Vanguard United States 47.5 trillion usd assets under custody and/or administration and/or direct management

Fidelity United States 45.5 trillion usd assets under custody and/or administration and/or direct management

State Street United States 43.9 trillion usd assets under custody and/or administration and/or direct management

Capital Group United States 39.2 trillion usd assets under custody and/or administration and/or direct management

JPMorgan Chase United States 29.1 trillion usd assets under custody and/or administration and/or direct management

Bank of New York Mellon United States 24.3 trillion usd assets under custody and/or administration and/or direct management

those 7 firms have their fingers in the pie directly or indirectly for a total of 279 TRILLION USD in total fiduciary exposure

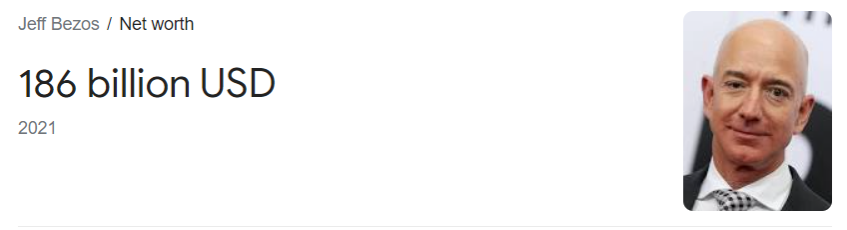

that is almost 10 times the US national debt

or

1,500 Jeff Bezos's

Mary in S. Carolina

(1,364 posts)power in a handful of institutional investors is becoming a disaster for our freedoms and it needs to be regulated by passing anti-trust laws, etc.

Celerity

(43,408 posts)https://upload.democraticunderground.com/100215309952

Economists and policy makers are worried that the Vanguard model of passive investment is hurting markets.

https://www.theatlantic.com/ideas/archive/2021/04/the-autopilot-economy/618497/

The stock market has had quite a year. Plenty of cash is sloshing around, the pandemic recession notwithstanding, thanks to loose monetary policy, rampant inequality, crypto-speculation, and helicopter drops of cash. Plenty of bored people are reading market rumours on the internet, pumping and dumping penny stocks, riding GameStop to the moon, and bidding up the price of esoteric currencies and digital artworks. The markets are swooning and hitting new highs as kitchen-table investing—laptop-on-the-couch investing, really—is having a heyday not seen since the late 1990s. Yet economists, policy makers, and investors are worried that American markets have become inert—the product of a decades-long trend, not a months-long one. For millions of Americans, getting into the market no longer means picking stocks or hiring a portfolio manager to pick them for you. It means pushing money into an index fund, as offered by financial giants such as Vanguard, BlackRock, and State Street, otherwise known as the Big Three.

With index funds, nobody’s behind the scenes, dumping bad investments and selecting good ones. Nobody’s making a bet on shorting Tesla or going long on Apple. Nobody’s hedging Europe and ploughing money into Vietnam. Nobody is doing much of anything at all. These funds are “passively managed,” in investor-speak. They generally buy and sell stocks when those stocks enter or exit indices, such as the S&P 500, and size their holdings according to metrics such as market value. Index funds mirror the market, in other words, rather than trying to pick winners and losers within it. Thanks to their ultralow fees and stellar long-term performance, these investment vehicles have soaked up more and more money since being developed by Vanguard’s Jack Bogle in the 1970s. At first, Wall Street was sceptical that investors would accept making what the market made rather than betting on a market-beating return. But as of 2016, investors worldwide were pulling more than $300 billion a year out of actively managed funds and pushing more than $500 billion a year into index funds. Some $11 trillion is now invested in index funds, up from $2 trillion a decade ago. And as of 2019, more money is invested in passive funds than in active funds in the United States.

Indexing has gone big, very big. For nine in 10 companies on the S&P 500, their largest single shareholder is one of the Big Three. For many, the big indexers control 20 percent or more of their shares. Index funds now control 20 to 30 percent of the American equities market, if not more. Indexing has also gone small, very small. Although many financial institutions offer index funds to their clients, the Big Three control 80 or 90 percent of the market. The Harvard Law professor John Coates has argued that in the near future, just 12 management professionals—meaning a dozen people, not a dozen management committees or firms, mind you—will likely have “practical power over the majority of U.S. public companies.” This financial revolution has been unquestionably good for the people lucky enough to have money to invest: They’ve gotten better returns for lower fees, as index funds shunt billions of dollars away from financial middlemen and toward regular families. Yet it has also moved the country toward a peculiar kind of financial oligarchy, one that might not be good for the economy as a whole.

The problem in American finance right now is not that the public markets are overrun with failsons picking up stock tips on Reddit, investors gambling on art tokens, and rich people flooding cash into Special Purpose Acquisition Companies, or SPACs. The problem is that the public markets have been cornered by a group of investment managers small enough to fit at a lunch counter, dedicated to quiescence and inertia. Before index funds, if you wanted to get into the stock market, you had a few choices. You could pick stocks yourself, using a broker to buy and sell them. (Nowadays, you can easily buy and sell on your own.) Or you could buy into a mutual fund—a collection of investments selected by a vetted manager, promising solid returns in exchange for an annual fee. Then Bogle, the head of a mutual-fund company, turned on the industry. He argued that mutual-fund fees were exorbitant, that mutual funds generally failed to beat the market, and that fund employees had an obvious conflict of interest: Was their priority to maximize returns for the people who bought into the mutual fund, or to make money for the company? He set up a company called Vanguard offering a new kind of mutual fund, one that would buy and hold every stock or bond on a major index and that would devote itself to driving fees as low as possible. Other companies, including Fidelity, State Street, and BlackRock, soon mimicked this strategy, later adding exchange-traded options, or ETFs.

snip

cinematicdiversions

(1,969 posts)Mary in S. Carolina

(1,364 posts)You do realize they are the major industrial shareholder in One American Network via ATT?

ForgedCrank

(1,782 posts)all just funds. In fact, if you have a 401k, you most likely have money in one of those.

They aren't political, they don't care, they are in the business for gains, and they buy into anything that will help in that goal. The connection you are trying to make just isn't there.

Mary in S. Carolina

(1,364 posts)AT&T recently completed an acquisition agreement with Verizon Wireless - ok I agree, ATT is buying up Verizon areas.

Celerity

(43,408 posts)Mary in S. Carolina

(1,364 posts)Verizon's major institutional shareholder is Vanguard

ATT's major institutional shareholder is Vanguard

OAN is owned by ATT and their major institutional shareholder is Vanguard

MSNBC, CNN and Fox major institutional shareholder is Vanguard

Hulu major intuitional shareholder is Vanguard

YouTubes major institutional shareholder is Vanguard

Blackrocks major institutional shareholder is Vanguard

It is time to make anti-trust laws against institutional shareholders, they have way too much power.

Mary in S. Carolina

(1,364 posts)Verizon's major shareholder is Vanguard

ATT's major shareholder is Vanguard

appalachiablue

(41,145 posts)I'm now looking into switching my V. no. to another cellph. service including companies with basic phones and features mainly marketed to seniors.

I have more than enough internet and tech devices.

The only hold up is transferring or copying voice mgs. from my current V. phone.

jcmaine72

(1,773 posts)I've been a Verizon internet and cell phone customer for so long they probably have my DNA and a brain map on file.

Let's face it: If it isn't Verizon gathering and sharing information about us, it's Google, or Micro$oft, or Twitter, or Facebook, or that greedy scumbag Jeff Bezos and his evil Amazonian empire. Sadly, having every movement and transaction we make online tracked, stored, saved and sold by our tech overlords is practically a fait accompli at this point.

The genuinely sad part about all of this is that we often times give them access to our personal information voluntarily without any skullduggery on their part. Hey, want to play the latest Candy-Soda-Whatever-Crush? It's absolutely free!....just click on the install button and allow the company access to your pictures, video and friend's list.

Americans are so worried about our government encroaching on our privacy, yet many of us will gladly surrender a stool sample to even some fly-by-night dev who wants access to our personal information so we can play games on our phones or have access to 50 droll ringtones we'll never use.

Meh...

katmondoo

(6,457 posts)Google does the same, research and then see the item in adds from all sellers. I do not use nor do I have any other devices except my computer. There is no escape. We are all under surveillance.

jcmaine72

(1,773 posts)Even George Orwell himself couldn't have conceived of the Orwellian nightmare we've allowed ourselves to slip into like a favorite old pair of comfy slippers. Orwell was very much a product of his time. In 1984, for example, he imagined tyranny of this type coming in a more traditional form, that being a totalitarian, dictatorial regime using technology to monitor every movement of its citizens.

I honestly don't think Orwell could have envisioned a society like ours comprised of voluntary digital slaves so gullible, dazed and addicted to their own tracking applications and toys that they permit privately owned entities to monitor their every sneeze and bowel movement far more comprehensively and efficiently than anything in the fictional world he created.

There are alternatives, of course. But living off the tech grid, especially for a young person whose friends are all on social media, is tantamount to making oneself a social leper or pariah.

Scary..

dwayneb

(768 posts)I often hear the refrain "but I don't have anything to hide, so why should I worry?".

Part of the reason for stupid reasoning like this is a general loss of critical thinking skills.

Plus, how many young people have read 1984 or bother to understand the implications?

I can absolutely guarantee you that every single one of us has a digital dossier and that the fact that you are a frequent poster here at Democratic Underground is part of that summary.