General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThese Real Estate And Oil Tycoons Avoided Paying Taxes for Years

Donald Trump and other ultrarich Americans have earned billions, but they’ve also managed to repeatedly avoid paying any federal income tax by claiming huge losses on their businesses.

By Jeff Ernsthausen, Paul Kiel and Jesse Eisinger December 7, 2021 10:24 a.m.

This story first appeared at ProPublica. ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for The Big Story newsletter to receive stories like this one in your inbox.

Here’s a tale of two Stephen Rosses.

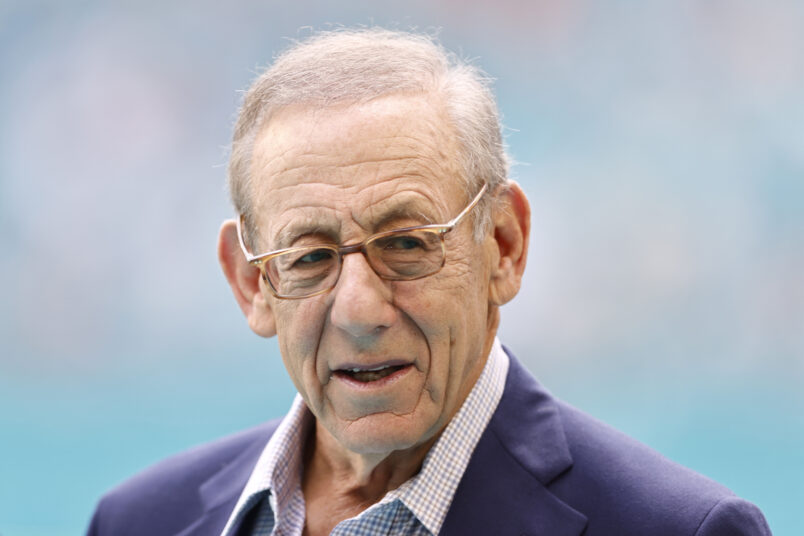

Real life Stephen Ross, who founded Related Companies, a global firm best known for developing the Time Warner Center and Hudson Yards in Manhattan, was a massive winner between 2008 and 2017. He became the second-wealthiest real estate titan in America, almost doubling his net worth over those years, according to Forbes Magazine’s annual list, by adding $3 billion to his fortune. His assets included a penthouse apartment overlooking Central Park and the Miami Dolphins football team.

Then there’s the other Stephen Ross, the big loser. That’s the one depicted on his tax returns. Though the developer brought in some $1.5 billion in income from 2008 to 2017, he reported even more — nearly $2 billion — in losses. And because he reported negative income, he didn’t pay a nickel in federal income taxes over those 10 years.

What enables this dual identity? The upside-down tax world of the ultrawealthy.

https://talkingpointsmemo.com/news/these-real-estate-and-oil-tycoons-avoided-paying-taxes-for-years

Yet during a pandemic I live on Social Security, my wife lost her job.....and I still had to pay taxes....![]()

![]()

Claustrum

(4,845 posts)is better than creating a new "wealth tax". If they are even paying a rate of 20% instead of 0% for the past 20 years, we would have a lot more taxes collected.

I am more for closing the tax loophole.

Faux pas

(14,681 posts)JustAnotherGen

(31,828 posts)On States that went for Clinton.

They knew - and they wanted to punish us for living in high COLA states with small real estate footprints (1200 to 2600 square foot homes).

We pay property taxes twice - Once to our township/county in NJ, and once to the Fed. 9K a year over the past 3 years - do the math.

Sure it would be a lot more if it was from them - but I'm not willing to give my entire salary to the Fed Gov to make up the difference - so we have to do without.

Claustrum

(4,845 posts)It is about a special code for land developers (such as Trump). They can claim their property loss and get a credit to spend for the next 20 years. For example, in 2008, due to the economic crash, they were able to claim millions to billion of property value loss (without actually selling the property at a loss) and convert that into some kind of credit. Then even though the property goes back to the normal value in 2015, and they can sell at the profit again. They still have that loss credit from 2008 to offset their gain. That's the loophole that's talked about in the article, not the SALT credit that you want.

Not to mention, knowing Trump, he did some magical accounting to overstate the property loss to take advantage of the credit.