Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums'Greedflation': who wins, who loses?

With inflation driven largely by corporate rent-seeking, rather than suppressing wage claims windfall profits must be taxed.

https://socialeurope.eu/greedflation-who-wins-who-loses

European Union citizens are experiencing inflation not seen for decades. In Germany it has reached double digits at 11 per cent, while in Austria the rate is 9.3 per cent. These rates are due to the disruption in supply chains and the shortage of fossil resources—triggered by the coronavirus crisis and the Ukraine war—on which the two countries were extremely dependent until recently. Prices are exploding not only in energy supply but also in all other essentials, including food. At the same time, companies in certain sectors are making excess profits due to the shortage of strategic resources. Since market mechanisms are no longer working in such a constellation, it is the task of the state to intervene with regulatory policy.

The American energy giant Exxon Mobile announced earnings of $17.9 billion in the second quarter of 2022 compared with $5.5 billion in the first, tripling its profit. BP’s first-quarter profit was three times last year’s $9.1 billion. The German energy group RWE increased its profit by more than a third to €2.8 billion in the first half of 2022. And the Austrian company ÖMV recorded a profit of 124 per cent in the first two quarters. The United States president, Joe Biden, said: ‘We will make sure that everyone knows Exxon profits.’ Implicit in his reproach was that the corporation’s profit was not related to enhanced performance, achieved by investment and technological progress. On the contrary, companies in strategic oligopoly and monopoly positions appear to be exploiting consumers’ dependency in the crisis and charging unreasonable prices for products for which there are no alternatives.

‘Exploiting the war’

This has become known as ‘greedflation’ in the US. In Europe, meanwhile, the president of the European Commission, Ursula von der Leyen, declared war on the phenomenon in her [link:file:///C:/Users/Susanne/Downloads/2022_State_of_the_Union_Address_by_President_von_der_Leyen.pdf|address on the state of the union]: ‘In these times it is wrong to benefit from extraordinary record profits by exploiting the war to the detriment of consumers.’ In the traditional view of the market, focused on redressing imbalances between supply and demand, unlimited profit maximisation by companies is a logical consequence and cannot be described as greed. Greedflation, on the other hand, calls into question whether high selling prices are actually offsetting higher production costs or merely reflect rent-seeking behaviour enabled by monopolistic or oligopolistic power to set the market terms. Even advocates of a ‘free-market’ economy can doubt the self-regulatory power of markets so structured.

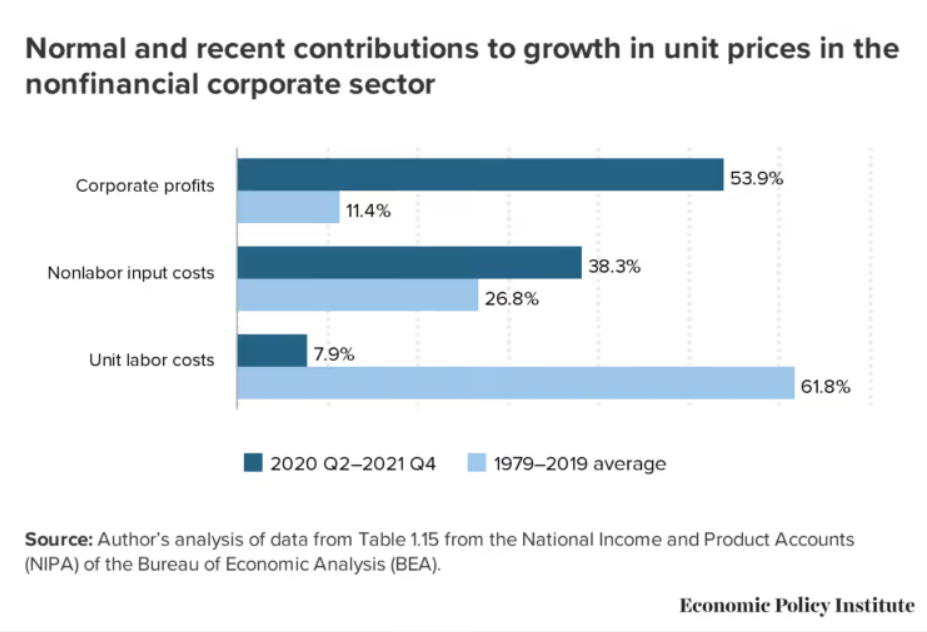

The pricing power of companies in monopolised markets is so great that inflation is accelerated. The windfall gains made will almost inevitably lead to a social crisis unless inflation is cushioned by higher wages—especially taking into account that since 2020 the wage-price ratio has been in a downward spiral. In the US, for example, 61.8 per cent of price increases between 1979 and 2019 but only 7.9 per cent since 2020 can be attributed to wage increases. So, are we entering a time ‘when action matters and history is made’? A time when German and British unions enter wage negotiations with a demand for a 10 per cent increase or French industrial unions demand a 25 per cent increase in the minimum wage?

snip

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

2 replies, 697 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (6)

ReplyReply to this post

2 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

'Greedflation': who wins, who loses? (Original Post)

Celerity

Oct 2022

OP

TheRealNorth

(9,481 posts)1. Shush now

The Fed and some people on this board think that workers have too much money and that we should treat all inflation like its a money-supply issue.

Bettie

(16,110 posts)2. Right?

Even suggest that since margins are higher than they've been in decades, it might not be that workers are getting a pittance more and you get blasted.

It's obvious to anyone who is looking. There is little competition in any market and corps are using that and the cover of inflation to gouge.

Human dragons sitting on their piles of gold.