General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsStudent loan borrowers could be forced into 'unthinkable financial decisions' if Supreme Court rules

against BidenPlan for the worst and pray for the best with these student loans.

https://www.reckon.news/news/2023/02/student-loan-borrowers-could-be-forced-into-unthinkable-financial-decisions-if-supreme-court-rules-against-biden.html

Pinching pennies and starting a student loan debt repayment plan could soon be the reality for federal student loan borrowers. The U.S. Supreme Court will hear two arguments – one case from six Republican-led states and another brought by two borrowers in Texas coming up on Feb. 28. These cases could determine the fate of President Biden’s student loan forgiveness plan. If the high court strikes down the plan, borrowers will have to re-start repaying their federal student loans this year.

“Should payments resume this year, borrowers will be forced to make unthinkable financial decisions like whether or not they can save for retirement, start a family or put food on the table,” Braxton Brewington, press secretary of The Debt Collective, a debt-elimination advocacy group told Reckon. Nearly 26 million Americans who applied for relief are now in limbo, hoping justices will uphold Biden’s plan of canceling $10,000 to $20,000 in student loan forgiveness. If SCOTUS blocks the student loan forgiveness plan, determining next steps for repayment should be at the top of federal borrowers’ lists. Here are a few ideas to consider:

What to know about a repayment plan

Repaying student loan debt is different for every borrower, especially when more than 40 million Americans have benefitted from not having to pay on them for the past three years. A common option for borrowers before the pause was selecting an income-driven student loan repayment plan. By visiting StudentAid.gov or providing income verification to a loan servicer, federal student loan borrowers can set up a repayment plan based on their income.

With student loan payments set to start either 60 days after SCOTUS makes a decision, or 60 days after June 30 (when the pause ends), higher education experts like Mark Kantrowitz have told USA Today, “Sixty days will be enough to forgive student loan debt if the president’s plan survives.” In the event Biden’s forgiveness plan doesn’t survive, he has a newly proposed income-driven repayment plan. This plan is meant to prevent borrowers from getting overloaded with debt by either lowering monthly payments or effectively pausing them, making payments more affordable and manageable.

snip

Read more: ‘Student debt is morally illegitimate

underpants

(190,433 posts)of my balance out. I may look into a loan to pay it off and get away from the daily compounding of interest.

maxsolomon

(36,521 posts)Isn't that where we were BEFORE the Pandemic? That's what I did to pay off my student loans.

Celerity

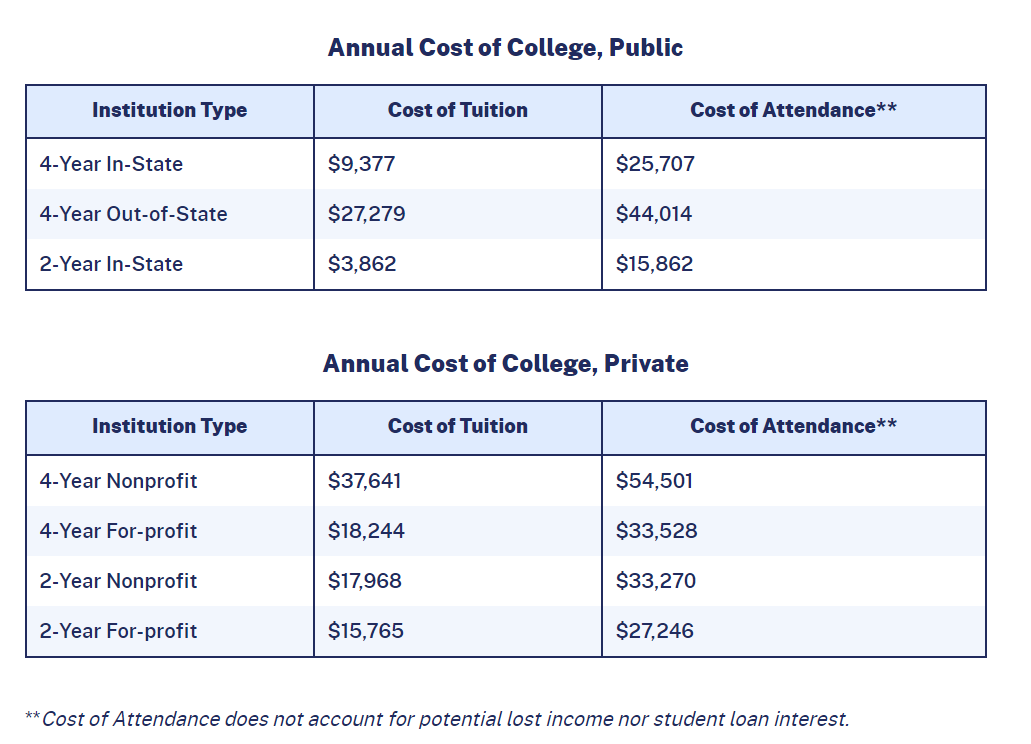

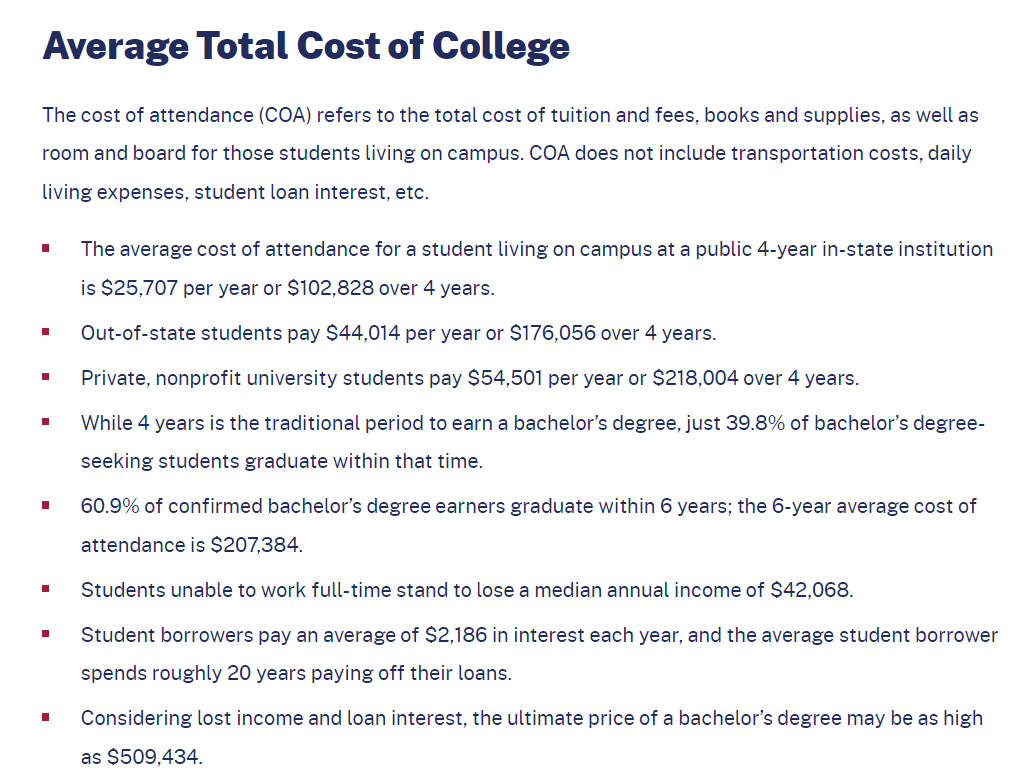

(49,706 posts)average total cost of a public, instate bachelors degree at a 4 year uni has been over 100,000 USD (NOT even counting interest and loss of income) since 2019 or so.

Plus the cost of living, especially rent/mortgage (and other prices as well) is so much higher now than longer ago.

Average Cost of College & Tuition

https://educationdata.org/average-cost-of-college

maxsolomon

(36,521 posts)I consolidated the loans with the Fedrul Gubmint (a repayment plan), and pinched pennies until they were paid off. 40K's worth.

I recognize what you're saying about current costs, but that sentence makes it sound like borrowers were anticipating never having to pay the loans back. That can't be universally true.

My daughter wants loan forgiveness to go through for her, but she wasn't planning on it prior to the Pandemic.

Celerity

(49,706 posts)Good luck to you and your daughter!

![]()

MichMan

(15,062 posts)Anyone who didn't borrow the maximum possible amount allowed would be an idiot.

ForgedCrank

(2,618 posts)themselves have played a big role in driving the costs of education to the ludicrous levels that are now.

As the chances of borrowing and never having to pay it all back rise, expect the tuition and everything else to rise in unison, because that is what is going to happen. The entire system is a scam, just like health insurance and medical costs.

MichMan

(15,062 posts)I have seen no legislation or proposals regarding making college cheaper. Students won't care because they won't be the ones' paying for it. In fact, the more colleges charge, the student figures they are making out even more.

If I was told that my car loans were being forgiven, I'm sure not planning on buying a Kia instead of a Porsche.

ForgedCrank

(2,618 posts)It's unfortunate, but that is how it works.

The entire student loan thing is no less predatory than the mob loan sharks, and it's lower income folks who get hurt the most.

liberal_mama

(1,495 posts)A lot of people have it tough right now.

GoodRaisin

(10,146 posts)loan payment, too bad for the lender. Not a very difficult choice.

Seriously, I’ve long considered this as DOA when it gets to the Republican SCOTUS court. I’d be shocked if they didn’t kill it.

WarGamer

(17,039 posts)Might be a good avenue?

MichMan

(15,062 posts)They also could have passed loan forgiveness and the SC wouldn't even have a case to review. So far they haven't done either.

WarGamer

(17,039 posts)Forgiveness is a Constitutional stretch and it's a hot button issue even among a LOT of Democrats.

49% of Independents oppose it.

Of the general population, only 43% approve of loan forgiveness.

(nbc poll 9/22)

MichMan

(15,062 posts)Someone who is just overwhelmed and can't possibly pay it back, is completely different than a recent graduate who borrows the max, declares bankruptcy shortly after graduation, gets all debts discharged, and then goes out and gets a six figure job on Wall Street or for a big Law firm.

Doubt the level of support for the latter would be very high.