General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsRetirement delayed and broke anyway

From Harper’s Index:

https://harpers.org/archive/2019/09/harpers-index-september-2019/

Percentage of US workers over 50 who lose longtime jobs before they are prepared to retire: 56

Percentage of those workers who never recover their earning power: 90

I posted this on my Facebook wall back in 2019 and I just decided that for my Democratic Underground’s 8000th post, I would write something about this. You see, I’ve been a member of DU for a long time. I saw DU on Bill O’Reilly’s show on Fox Spews years and years ago. After reading for a week, I knew I had found “home” for my political views and never watched that channel again. I became a member later and I wanted to thank DU for everything you’ve taught me.

Back to the Harper’s Index…I took a risk and after finishing my degree in 2005 at age 45, I decided to leave my IT admin job and marry my spouse and move to Germany. We had had a long-distance relationship long enough and I was ready to take the challenge. I tried to get a transfer at the international company I worked at but there was a recession in Europe, so I sent out resumes, I went to temp agencies and tried to learn German while I lived there. We moved to the states in 09 so I thought, this is it, I’ll be able to work here.

Recruiters laughed at me. You haven’t worked since 2006. I can’t even send your resume for temp jobs because you haven’t worked in more than 2 years. I stopped and asked, what do mothers do that were raising their babies? She had no answer. I was just a middle-aged woman looking for a job, any job that would allow me to continue my career in IT or Tech or even something that didn’t require my Bachelor of Science degree in Business Management. I was qualified for many positions but nobody wanted to hire a 50-year-old woman.

So, I’ll be 64 years old next month and I haven’t worked since. Honestly, I gave up. My spouse thankfully earns enough to support us but if I wanted to divorce him or live in the states, I was going to have to live on my social security. But I’ve lost 18 years in earnings because I couldn’t find a position. I can’t work for Walmart; I won’t even shop there! I can’t stand on my feet for hours, I’m 64! I have a mind and it’s been terribly wasted. I can’t even imagine how women just 50 years ago felt that they were unwanted, unneeded and to please just disappear from society.

I just wanted to expose what some of us that have worked since 1976, a generation Jones baby, and we are not the enemy that Gen X or Y or Z make us out to be. Boomers were not always the ones that were making all of the rules but we sure had to live by them, even if it meant we made mistakes in our mid-40s and left our jobs and never worked again. Have mercy on us. My pension is based on the stock market and it lost 40% in 2008 and recovered and now, is losing again. They took away pensions and forced us to be stock market analysts now worrying about our 401k retirement balance. Thanks to Reagan, I can’t even get my full social security until I’m 66 years and 10 months old.

Reality check:

Percentage of US workers over 50 who lose longtime jobs before they are prepared to retire: 56

Percentage of those workers who never recover their earning power: 90

Stock markets should not determine our retirement worth. We worked for decades and should have a decent cost of living payment for all of those years that Congress stole our social security. Vote Blue!

dalton99a

(81,637 posts)PoindexterOglethorpe

(25,916 posts)after age 60. Granted, I wasn't looking for something like IT, but still.

If you have not had paid employment since age 60, chances are you haven't worked a full 35 years, which will make a huge difference in what your SS will be.

Working at something, entry level office work, or even retail, is better than not working at all.

I had been a stay at home mom for some 25 years. I then got a paralegal certificate at my local community college, and got three different paralegal jobs after age 50, actually after age 55.

Getting rid of zero years of FICA payments more than doubled my eventual SS payout.

IT seems to be the very worst field when it comes to not hiring or retaining older workers.

If you actually get a pension, consider yourself extremely lucky. There's precious few of them any more, and too many companies have completely defaulted on theirs. I know, because that happened to me.

LittleGirl

(8,292 posts)I never had children which helped me, I guess, keep jobs except that I moved states many times between 1980-2000. There was an excellent trend where I made more money with each job change and got more college credits but those places didn't have pensions. When I finished my degree, the company I worked for didn't promote me even though two other male colleagues did get promoted. We were in the same college program. They promoted those two but not me. I was furious. I finally had that degree to compliment my 20+ years of IT experience. I started as a secretary after working in restaurants for a decade before that.

ARPad95

(1,671 posts)over your employer's failed pension plan?

https://www.pbgc.gov/wr/trusteed/plans

Did your pension plan fail? If PBGC is now the "trustee" responsible for paying your benefits, find information about your plan using the search box below or use the list at right to access our largest plans.

PoindexterOglethorpe

(25,916 posts)I should have made myself more clear.

I do get a small ($172/month) pension through the PBGC.

It ought to be a bit more than $600/month. Luckily for me, since I worked at that company at the beginning of my work life, I never expected more than a hundred dollars a month. So it's actually more than I'd anticipated. The ones who are truly screwed are the ones who worked 30 or 35 years, assumed the pension would be a significant part of their retirement and then WHAM! Only getting a fraction.

This is why when people complain about 401k plans, I point out that (so long as you don't make or are forced into truly stupid investing decisions) that money remains yours, no matter what.

I am fortunate that I have several other sources of income. And because I've been relatively poor at various times in my life and have never been accustomed to living large, it's not hard for me to live frugally. I do have enough to do various things that matter to me, such as attending my science-fiction things, going out with friends every other week or so.

I really should not complain. Yes, that additional $500 or so would be nice, but it's not the difference between paying my rent or paying the electric bill. It's more like, I'd travel more with that money. It's a loss of luxury money, not necessary money.

I do understand how fortunate I am.

ShazzieB

(16,564 posts)This isn't 100% guaranteed. My husband and I found out the hard way when the economy crashed in 2008 and half the money in our 401Ks "magically" vanished in a puff of smoke. It had nothing to do with our own investment decisions, but with factors in the stock market that were totally beyond our control.

Granted that was an extreme situation, but it did happen, no just to us but a whole lot of people. I'm embarrassed to admit that I was so stupid and naive at the time that I actually didn't know such a thing was possible, but the joke was on me.

As I said, I am not anti 401K. I think they can work very well in many cases, and the portability when changing jobs is a definite plus. I just think people need to be aware that such things can happen, rare as they may be.

It sounds like you are managing quite well, and I think that's great. We're still trying to figure things out.

PoindexterOglethorpe

(25,916 posts)Yes, it may have dropped a lot, but hanging in there meant that your money recovered.

I honestly have little patience with those who talk about supposedly losing everything in 2008. Everything? Really? Ummm, if you had just hung on, you'd have long since recovered.

So did you go from whatever to zero in 2008? I suspect not. Whatever your loss was, it wasn't 100%.

Here's the thing about being in the market long term: You learn that it goes up, it goes down, it goes up and it goes up. Over the long run the market increases. Actually at nearly 10% each year. Really. Do a bit of research. Panicking and selling when the market is down is truly stupid. Hang in there. Things will get better.

I happen to have a wonderful financial guy. I've been with him about 20years, and am very confident in his advice. He got me to buy a couple of annuities some years back, and I'm taking income from them these days. Right now, their current value is less than what I paid for them, but I'm still getting that income. Hooray!

If you'd held on to your investments back in 2008, the should have more than recovered in recent years. It's the panic selling when things go bad that's such a problem. Hanging in there is what you should do.

Here's the thing. Over time, the stock market gives about 10% returns. Obviously, that varies a lot, year to year. So figure 8%, or better yet 6% to calculate what you might earn over time. Here's a useful link: https://www.calcxml.com/do/how-long-will-my-money-last I frequently look at this to figure out if my money will last for me. And I always calculate a 6% return, below the historic record of 8%.

ShazzieB

(16,564 posts)I clearly said that half of it disappeared, not all of it.

And no, we didn't fully recoup our losses. We were in our late 50s at the time, so we didn't have time to do that. Especially since I lost my job at the same time and was never able to land another job that came with a 401K, due to the high unemployment rate at the time.

I worked off and on at whatever temporary gigs i could get for the next however many years until I was old enough to collect social security. I was so demoralized by that time that I jumped at the chance to have actual steady money coming in that I could count on without having to beg and grovel for crumby gigs that never lasted more than a few weeks to a couple of months.

Thanks for totally discounting my experience and that of many, many other people during a terrible economic crisis in this country.

progressoid

(50,000 posts)It sucks.

LittleGirl

(8,292 posts)I'm so sorry you're a member too. I don't know why it is this way? I'm a little bitter about it.

I am also shy of the 35 years by about 10, which I will never catch up on. It is both a h/t to the GOP and to rampant misogyny in our society/workforce. Oh, and an accountant who thinks writing is a hobby, not employment.

PoindexterOglethorpe

(25,916 posts)you should do what you can to get more years in play. Do retail. Get temp jobs. Work in a hotel.

Each zero earnings year you can eliminate matters a lot, even if you don't earn that much money those years. Trust me. I've been there, done that.

I just looked back at Social Security statements going back to 1998, and what I gained by going back to work is astonishing. I also benefited from being divorced and able to collect 50% of what would be my ex's payout starting when I was 66, my full retirement age. When I turned 70 I switched (actually Social Security had the information and made the switch for me) to my own benefit, which was several hundred dollars more per month. If my ex passes away and I become one of his two widows (he's remarried) I will start collecting 100% of his current benefit, whatever that might be. It will be noticeably more than my current benefit. Not sure if I should wish . . . . No, I guess I won't.

sybylla

(8,528 posts)There's no daycare out there for my grandson so that's what I've been doing instead of working. Probably won't change for a couple of years. I've brought up getting an actual paycheck from my kids, then gifting the money back to them so that I can have some income for the year for my SS and not have to work until I'm 70 to have enough years in.

I think I need to get more persuasive. And probably do the math for the number of years I have in.

So much free work that women are expected to do. How the hell do you get 35 years in?

PoindexterOglethorpe

(25,916 posts)That sums it up.

I was a stay home mom for some 25 years. It worked out for me. I was glad to be home, to take care of my kids. I also (and this is probably the most important thing) did not have any kind of career or job in place before I had my kids.

I spent those years volunteering at the school, baking stuff, those kinds of things. I NEVER thought that the working moms were less. I had sympathy for them trying to keep up, do what needed to be done for their kids.

You do need to do the math for the number of years you have in. And you get those 35 years over the fifty or so years you are working. You can also go online to Social Security, set up an account, and figure out exactly where you are.

I got my first job at age 17. Worked more or less full time until age 32, when I got married. During my marriage, I had a couple of temp/part time jobs. By the time my marriage ended, I'd gotten a paralegal degree at my nearby community college, then got a couple of part time paralegal jobs. Moved to New Mexico. Got paralegal work there. Was fired for incompetence. Got various other jobs. The important thing is that I filled in the otherwise zero years of working.

Filling in those zero years is huge. My Social Security essentially tripled by going back to work, and then being able to delay taking my own SS until I was 70.

sybylla

(8,528 posts)But I can stack a few more years on there and consider waiting to take my ss until 70.

shrike3

(3,816 posts)Those of us who graduated in 1982 stepped into a world of 11.9 percent unemployment. We were behind from the get-go.

brooklynite

(94,792 posts)....had no problem getting a job after that.

Retired after 32 years at the same agency where I worked up from Asst Planner to Associate Director. One thing I never did was consider changing jobs in midstream.

shrike3

(3,816 posts)However, those of us who went directly into a job market did not have a very good time, let's just say.

KPN

(15,665 posts)an awful lot like the "if I did it, you could have done it too" mindset. Hopefully, I am wrong. That mindset is responsible for far too much unnecessary socio-economic misery in this extremely wealthy nation.

sheshe2

(83,967 posts)ShazzieB

(16,564 posts)Farmer-Rick

(10,216 posts)Is it a state school or a grad degree in pubic administration?

brooklynite

(94,792 posts)Warpy

(111,383 posts)The 80s had to be the absolute worst decade for workers as they saw their pensions robbed by shady arbitrage deals, profitable companies loaded with debt and allowed to go belly up as a way of ending unions in an industry. There was no recourse to any of it, the Reagan juggernaut was lavishly funded by the 1% while opposition was kept starved of cash. Wages were depressed because rich men thought paying the hired help enough to live on was inflationary (it's not) and certainly didn't want to have to cope with collective bargaining. Benefits were slashed down to nothing, and as taxes were shifted off the rich and onto the poor, services disappeared.

The screw job ushered in by Reagan and his cronies was massive.

LittleGirl

(8,292 posts)shrike3

(3,816 posts)jmbar2

(4,910 posts)I'm glad to see you write this. I feel similarly, that I've been trapped my whole working career.

Edit: I am also female, which I suspect made a big difference from my male age-cohort.

I lived and worked overseas for 4 years, then came back and went to graduate school at midlife, assuming that I'd be able to reenter the labor force at a higher wage job. It left a big hole in my social security earnings, and did not work out as planned. However, I did get to do work that I enjoyed better than the alternatives. But going back to school at midlife was financially not a great decision.

I did eventually get patchy work as a contractor until I retired, but didn't ever have the work stability and career growth that I had hoped for when I went back to school. My "Hail Mary" retirement plan--home ownership--was also wiped out in the 2008 crash.

My solution was to move to a state with Medicaid, live in low-rent housing while it was still available, and become a substitute teacher. It does not pay particularly well, but adds a bit more to your SS. The kids are fun, but also germy. You will need all of your vaccinations and then some. I'm also learning to daytrade, which I hope will take over from subbing soon.

Boomers get trashed a lot, for a lot of things. But the bashers don't realize what it was like to try to have a career in an economy when corporate Amerika decided to ditch lifetime employment. We've been through one recession, crash, corporate bloodletting scheme after another.

It has been very stressful throughout my working lifetime.

Thanks for sharing your story.

---------------

LittleGirl

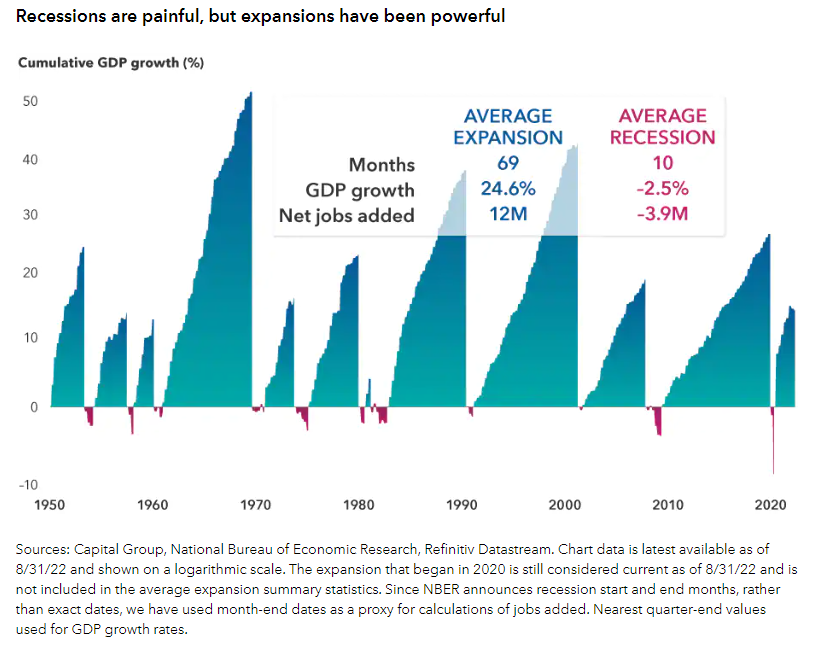

(8,292 posts)Thank you for sharing that graph. Story of my life!

🎯

LisaM

(27,843 posts)Last edited Tue Sep 12, 2023, 05:21 AM - Edit history (2)

It's not Boomers who created this problem (I am a late Boomer myself, sometimes known as Generation Jones). Graduating from college during the Reagan years was abysmal. With my degree, I worked in retail and then at a daycare for years before finally finding a part time job at a law firm that eventually turned into a full time job. I will have to work past retirement age because rents are high and I was never able to afford to buy (every time I got close, housing prices shot up). I have seen many people who are a few years older or younger than I get laid off because of what no one will admit is ageism, worse, there are people in the workplace who actively want us gone and don't mind showing it.

It's unbridled market capitalism that is the issue, not Boomers. To hear some of my younger friends tell it, we all got out of college and caught

a gravy train when they were handing jobs out like candy and houses were free and none of us had student loans, so we all stole all the money and spent it on luxury goods for ourselves. About as far from the actual truth as you can get. Now we refuse to stop working and those who do own houses won't turn them over to younger generations, according to some.

LittleGirl

(8,292 posts)Where's that gravy train eh? I had student loans, I had 7% interest on my home loan that I got with FHA financing and lived frugally because I had no other choice. I just wished I had been able to see that when I left my job at age 46, I would never get hired again. I never had trouble finding jobs. I think the longest I went (after moving to another state) was 3 weeks. I cried many tears since then. Some of them about losing my confidence that I was unworthy of any job. I'm not a 'housewife' but I have had to live as one and it's awful to me. The mental battle is bad enough.

jmbar2

(4,910 posts)It was a class that I was forced to take, and turned out to be the most consequential of my life.

That's where I learned about segmented labor markets, and how the labor market really works. We were all shooting for the American dream job market - you go to school, get a well-paying job and move up the ladder. What we didn't know is that the entry points to the primary labor market are very narrow and path dependent.

To get in on that path, you had to have the right credentials, get in at the right age, and know all the hidden rules for that market. Preferences went to white men. If you step off the right path, you can never get back on.

We thought we were doing the right thing, but all we got for our investment was a rocky ride in the secondary labor markets at best, or routine hourly jobs at worst.

That's why so many people are drowning in student debt. We all thought that if we made the investment, we'd get on the escalator, not realizing that there were a lot more hidden criteria for accessing the American dream.

Our local schools don't even teach career exploration, so we have more generations trying to succeed in a game with many hidden rules and traps. I can understand their anger, but a lot of us boomers were just as much victims as they are.

Capitalism is failing us.

ShazzieB

(16,564 posts)Especially this part:

I like to say my husband and I are "failed" baby boomers, lol. Due to a complicated combination of bad luck, taking the wrong jobs at the wrong times, being good at things that don't come with particularly hefty paychecks, and being idiots about things like saving and investing, we are not nearly as well off financially as college educated baby boomers like us are "supposed" to be. Our millennial daughter and her boyfriend own a home, and we don't. (And more power to them - I'm incredibly proud of them!)

We are now in the process of trying to figure out we can do the retirement thing and still keep a roof over our heads. We'll manage somehow; at least that's what I keep telling myself.

jmbar2

(4,910 posts)I think it's important for the silent boomers to speak up about the realities of the economy we grew up in. We face a lot of dire challenges retiring. I wish you luck. It hasn't been easy.

AllBlue

(66 posts)Last edited Tue Sep 12, 2023, 04:22 AM - Edit history (1)

This coming from a male trader and investor of many decades.

You go girl! =)

(I invite your questions, if you wish)

jmbar2

(4,910 posts)So glad to meet a DU trader!

I am working on my first prop firm challenge --trading futures. Just learned about them and so grateful that they exist. Being under capitalized has held me back for years.

I was trading simple options, but only trade /ES and /NQ futs for now.

AllBlue

(66 posts)Warren Buffet's "prime directive" :

1) Never lose money.

Rule number 2 is : never forget rule number 1.

...and you'll be fine. This doesn't necessarily mean what it sounds like.

How I interpret that rule is to mean understand your risk, and especially

your risk of ruin. The risk of ruin is considerable with futures because

there is so much leverage, meaning for each contract you trade, you are

saying "I'm good for every penny of the actual value of this contract"

if something really goes wrong. I've been trading futures for more than

20 years, and the need for a business-like approach in futures is mandatory.

My own path is moving into a more algorithmic approach as I come to understand

risk better and life gets busier for us again.

"A repeatable, systematic approach is the way."

I wish you well, and again, feel free to reach out if you like.

Fiendish Thingy

(15,686 posts)Sorry this happened to you.

Depending on the state you live, you might be able to earn some income as a substitute teacher.

Rather than attempt to manage your 401k investments yourself, I’d urge you to find a good financial advisor- once you’ve separated from an employer, you should be able to rollover your 401k into an IRA managed by your advisor. we’ve used Ameriprise since the 80’s, and our portfolio has weathered all the market gyrations, losing less than average on dips/crashes, and gaining more than average on recovery/bull markets.

Best of luck to you.

Chi67

(1,076 posts)Tech is ageist AF. You gotta been on your toes at all times as it changes quickly. I'm 56 and on the production side of advertising. We just went through a major tech leap in the last 6 months. I mean MAJOR. I can't imagine being out for two years.

getagrip_already

(14,891 posts)It used to be that once you had a solid it skill, you had years before you had to worry that it would become obsolete. Now it could be months.

Or if you have the right certification, like epic on Healthcare, good luck even getting an interview. But to get certified you have to work for a company that is an epic customer or partner, and that will send you to very expensive training, and who will make you sign very long term non-compete contracts.

And to stay certified, you guessed it, you can't be independent....

Not my circus though.

But get laid off with an aging skill set and you might as well not have been working. Recruiters won't care, employers will never see you.

Chi67

(1,076 posts)It's one of those things where you need to be able to read the tea leaves and see where things are headed to get ahead of the game. You do NOT want to fall behind or think you can rest on your laurels, because you can't.

getagrip_already

(14,891 posts)Things you haven't even heard of they've been working with in labs.

And they will start at half the pay and will work twice the hours.

Or at least that is what they will say, cuz nobody will be able to tell one way or another.

No country for old folk.... but we get by. I'm still working at the top of my field, knock on particle board.

Chi67

(1,076 posts)Fortunately (or unfortunately) in advertising, we're finding the youngsters are not coming out of school very skilled at all. It's both good and bad because, while it might be job security for me, someone has to take over when people like me are gone, and our department is aging rapidly. We do need new blood, but the kids coming out of school seem to only be interested in the creative side of the business, not the tech side. It's very odd.

maliaSmith

(80 posts)When I was 20, I took a Postal Service job that paid even less than the cannery I was working at. I wisely took the job because it offered retirement, health insurance and paid leave for sick and annual. I was paid less than my college educated friends who scoffed at me for not finishing college, I made 1.95 an hour.

Well, I stayed with my job for 44 years, drove the same VW for 20 years, bought 2 houses in Calif on the Monterey Bay, while still not making a ton of money.

I retired at 64 and as always live on less than I make.

I don't feel one bit sorry for those of my friends, college educated, who made fun of me while I was the first female to deliver mail in my town, married a great guy who was an artist and was the person at home for the kids when they got out of school. We lived on my income which was not much. He supported me when I faced countless acts of sexual discrimination while trying to advance my career and seeing unskilled men get promoted in front of me due to my gender. It took one man, who had faith in my skills to finally get promoted and then when I tried to get a Postmaster job, I faced that same old discrimination. I finally got promoted after I let it slip that I would sue the shit out of the Postal service if I didn't get promoted.

Now I'm retired and have a great retirement.

The woman writing this article made a choice to quit her job. I could have quit my job and made a lot more money in Silicon Valley due to my family's connections to the bigger firms. I was even offered a job after I retired, making a ton of money, but I never wanted to put up with the crap they push.

My advice to young people is, get a job with great benefits and stick with it. In the long run, the benefits far outweigh the temporary higher pay.

My two houses that I bought for a total of 168,000 are now worth more than 2 million.

Quanto Magnus

(901 posts)Staying at a single job for 20+ years let alone a lot more does not happen nowadays and hasn't for a long time in many industries.

Layoffs are much more common now for starters and more companies offer little to no raise year over year. Companies will make any excuse they can to not give a pay raise, even with 'excellent' reviews... So does one stay around for that???

Even as an (early) Gen-Xer, that was not really something that could be done. I don't know a single person my age (52) that has been at the same job near their whole career.... I had 1 friend who managed 20 years at one place.... 1 person, but he eventually had to leave his company too.

Times are not just a little different from 40 years ago, they are extremely different. While it's great that you were able to do what you did, your last sentence proves one of the problems that many retired people fail to admit to.

You bought 2 houses for $84K each and they're now worth $1 million each (just averaging on your numbers). I'm guessing you purchased in the 80's, 90's?

Not only did money go further back then, but the relative cost of a house was not so out of whack from salaries as they are now. Salaries have not kept pace with rising costs of everything... Your homes are worth over 10 times what you purchased them for. Salaries are not (in general) 10x what they were, and in most cases they are not even close.

While you were 'not making a ton of money' you were developing your retirement in ways that a vast majority of jobs did not have even then. So you were making decent money, just in a different way (benefits count towards compensation, not just your pay rate. A lot of employers stopped offering retirement because it was such a great benefit to have. Companies even largely stopped 'matching' in the 90's in 401K plans. So on top of vastly increasing prices, employers effectively offered less.

The living paycheck to paycheck is really for so many, your 'simple' solution does not address any of that...

"Oh just get a job and stay there for 40 years!" is not a solution. In fact, those of us who are not Boomers kind of find that attitude insulting, because it completely ignores current times.

maliaSmith

(80 posts)I stayed in my job along with many other people (even today) due to benefits. I always made less than the college educated and we were truly broke most of the time. Our first house cost 40,000 and it was a shack in the Santa Cruz mountains. We rented it out due to a long commute to work.

We then saved for 10 years for down payment for second house bought at 128,000 and I still live in my small house.

I stayed in my low paying job due to the benefits.

Most of my friends got high paying jobs and bought fancy houses and new cars.

By the way, there are still plenty of low paying lifetime jobs available in civil service. Of course, you won't earn as much. You also can still buy a house if you have military service as most of us have.

PoindexterOglethorpe

(25,916 posts)against wages made sense. Yeah, you never had the fancy houses or new cars, but you have stability a lot of others don't have.

LittleGirl

(8,292 posts)I never heard if I passed or not.

Evolve Dammit

(16,781 posts)RobinA

(9,898 posts)to you. I graduated from college in 1980 and into 10% unemployment. I had about a 25 year long slow start, but then I got lucky when laid off at 48, had a fallback career that I could get with a massive pay cut, went to grad school, and just happened to end up in a career where they don't care about age. I was lucky, as I ended up doing OK. However, I will never make up financially for all those years at crap wages. I'm 65 and will be in pretty good shape if I can work to 70. OK shape if one day I just decide to blow this popsicle stand and say I've had enough. ![]()

LittleGirl

(8,292 posts)1980 paid my own way on waitress tips. My income level was part time at 2.01 an hour. I literally lived on tips. My studio apt was 200 a month.

I missed working with interesting people. Enjoy what you can.

LudwigPastorius

(9,195 posts)I went 9 months without any income during the initial shutdown. That robbed my pension fund and SS of any contributions during that time, as well as seriously depleted my short-term savings.

Shortly thereafter, I had to step in to take care of my mom after a stroke. That's meant another year and a half of no contributions and running through my remaining savings.

My advice is to save much more than you think you'll need, because you never know what will happen to derail your planning.

LittleGirl

(8,292 posts)My mother passed in 2021 and covid kept me from seeing her.

There is help out there. Try to cushion the hard times by asking for help. Hugs

LudwigPastorius

(9,195 posts)It’s just awful that you weren’t able to be with your mom.

LittleGirl

(8,292 posts)The borders are shut down. I could have gotten there but I didn’t want to expose her.

Thanks for sharing.

DFW

(54,448 posts)Last edited Mon Sep 11, 2023, 12:39 PM - Edit history (1)

My brother was almost there, as well. He had a good-paying job with a high security clearance in, let's say, "an area of northern Virginia," when all of a sudden, his employer decided to re-structure, and he was suddenly out of a job in his late 50s. He started eating through savings, trying to stave off drastic measures (like selling his house) as long as he could. He is frugal by nature, and had a cushion of a few years, but nowhere nearly enough to retire. Fortunately, his former employer realized that letting him go was a huge mistake, as the productivity in his department suffered noticeably, and they asked him back within 18 months. He just retired at age 67.

My wife was caught in a thankless job (social work), working for a corrupt employer (the Protestant church, Diakonisches Werk). Their purpose was to take in long-term, "hard-to-employ" unemployed people, re-train them if possible, and place them back into the workforce. They were corrupt in that the director had the unemployed do work for him at his house for free, and threatened to kick them out onto the street if they complained. He hated my wife and her co-worker for being "too expensive (i.e. they were there for over a decade, and got government mandated raises)," and for having good relations with the labor department with whom they coordinated job placement. When she had a serious operation at age 60, we sweated for a few days to see if it was cancer again (it wasn't--that came 4 years later), and then her employer offered her an "early retirement package." Even so, it left her without income or health insurance from age 61 to age 65, when her pension and her German version of Medicare kicked in. I was fortunate enough to be able to jump in and pay for her health insurance (about €6600, or $8000 at the time, a year), which was vital, as she got a deadly form of cancer at age 64. She had a drastic operation and a month in the hospital, but was that "one patient in ten thousand" that actually survived this form of cancer, known in German medical circles as "the murderer." Insurance paid for the whole $400,000 package. Her pension, now with an added disability, is about €1200 (about $1320) a month minus taxes. Fortunately, I still work, because in Germany, €1200 a month minus taxes doesn't go far. As the wife of an American citizen, she was also eligible for a small monthly social security benefit. We had absolutely no idea about this. Washington told us this, and we were amazed. They told us to apply, then put us through rings of paperwork and visits to the American consulate in Frankfurt, but she actually got it, which increased her (still taxable) monthly income to about €1900. We are taxed at about 50% all in here, and I am personally taxed at about 73% due to holes in the double taxation treaty (intended to limit individuals to 50% max--sure, I wish), but at least we are not starving.

I am still working full time (we will both be 72 next year), and have been working nonstop for the same outfit since I was recruited in 1975. My employer is American, my wife's employer was German. So, we really can't compare our exact situation to that of anyone we know, but we both know people at the paycheck-to-paycheck level, and have known some who don't even have that (what social worker hasn't?). Not everyone has a free ride by any stretch of the imagination, and some have it downright rough.

PoindexterOglethorpe

(25,916 posts)imagine still working full time at age 71.

I've long said I've never had a job that was better than not working.

I've been reading your posts here for some years, and I know that you do love your life in Germany.

![]()

![]()

DFW

(54,448 posts)I have never had another job, period (just moved up in rank a bit).

My two superiors (no one higher up than they) feel the same way. One is my age (71) and the other is 73. They both have plenty of money, and could retire, but they both say, "THEN what would I do?" And they're in Dallas. I'm in Düsseldorf, but also in Paris, Brussels, Barcelona, Zürich, München and Utrecht, and a LOT of nearby etc. Yeah, I run myself ragged, but if it gets to be too much, if I feel like telling everyone else to wait because I'm chilling out for a week, then it's up to me if I want to chill out for a week.

My wife retired early at 60. She loved her job, but hated the jerk she was working under. She has less free time now than she did when she was working. I know retirement doesn't mean you are obligated to turn into a vegetable. I just fear that I would turn into a vegetable.

DFW

(54,448 posts)I could just as easily have lived in France, Nederland or Switzerland.

When you say I love my life in Germany, change the "l" to "w" and you have the main reason I'm here. She doesn't want to live anywhere else, and I don't want to live with anyone else. It makes for an easy decision!

Johnny2X2X

(19,193 posts)It was intended to be a 3 legged stool. They got rid of pensions and then delayed and lessened social security.

Way too many people are in very bad shape with retirement savings. It's going to be a crisis. Social Security is not enough to live on. What it will look like is families moving in toether in old age. Parents moving in with children. Brothers and sisters moving in together, etc. And some people without familes will become homeless.

And for the op, get a good fiancial advisor, if you're in your 60s, your 401K should not be heavily tied to the stock market anymore.

LittleGirl

(8,292 posts)He’s got an MBA and that is his hobby.

Some of my retirement funds had to go into special accounts because they were civil service jobs and separate from 401ks. I can’t touch them without penalties so they stay where they are.

Losing 18 years of income is what is the hardest to cope with. It should have been my most potential to recoup for the lean years but age discrimination kept me out of work those years.

My brother worked for 38 years but died before he drew a dime of social security and since he wasn’t married, those funds were kept by the government!

Johnny2X2X

(19,193 posts)Would probably be blended funds that are tied to your age and divest from equities as you approach your 60s.

At least you have something, and hopefully it's not ebbing and flowing with the stock markets.

But yeah, you didn't work for 18 years, your well being was tied to your spouse providing for you and so is your retirment now.

And yeah, some people die before they collect any social security, it stays in the general fund to pay for people who outlive what was expected for them to be collecting social security. There's still a minimum social security amount you'd receive too.

At 64, I'd still try to work if I were you, saving even a little can make a big difference. 18 years without working is not going to paint a good retirement picture, sorry that hapened to you.

pandr32

(11,631 posts)Congratulations!

![]()

LittleGirl

(8,292 posts)Kath2

(3,089 posts)I'm a 65 year old female and I have pretty much given up on employment, also. After working full time since 1976, putting myself through college and law school at night, becoming a member of the Maryland and DC Bars and having nearly 30 years of experience in insurance defense litigation you would think I would have a lot of options. Wrong. I renewed my Maryland Bar license last night and I really don't know why I did.

The insurance company I worked for closed claims operations in this state in 2021, leaving me and approximately 500 co-workers without a job. Thankfully, I had enough time in to earn a pension but it is a fraction of my former salary. I thought I would quickly gain a position at another insurance company. Again, wrong. It seems no one in corporate America is even interested in interviewing, much less hiring, a woman in her 60's, regardless of education or experience. So I bounced around finding employment at a grocery store and even doing landscaping at 64. My significant other convinced me to quit work as that landscaping job was hard on my body and didn't pay much.

Now I do some free lance pro bono work, and occasionally for-pay work (legal document review, mainly), for the causes I believe in.

I agree that, after all we have been through, we deserve a decent cost of living in our mid-60's. I don't want a pity party but I do think a lot us who worked hard and played by the rules have been screwed. And, yes, I will be voting Blue!

Response to Kath2 (Reply #21)

Post removed

The Mouth

(3,165 posts)2011. Three weeks after being diagnosed with Diabetes. Had been with State Farm 23 years; they closed our building.

That next year was very very scary, no health coverage, over 1000 apps and resumes, 20 interviews, 6 jobs, let go from the ones that weren't temping. Total failure.

I did manage to get a job doing the same thing, and for a county agency, but it only paid half as much as I had been making.

Age discrimination is very real, both in hiring and in firing.

maliaSmith

(80 posts)Jobs at city, county, state and federal level do pay less, but they have benefits that last.

They have health insurance you can keep after retirement, and retirement benefits that most private sector jobs don't have.

We who worked jobs in government made a lot less than those who worked in private sector and learned to be careful with our limited income. It was a great lesson in how to manage on less.

A lot of people never learn this lesson and are now suffering.

I have friends who made twice what I made, always drove the latest new car, had exotic vacations and bought new wardrobes for themselves and their kids every year.

They're now shocked that they're poor and unable to continue their rich lifestyle, can't afford their medical bills and are throwing a pity party for themselves.

The Mouth

(3,165 posts)Both my wife and I had parents who were effected by the Great Depression, and I saw what the inflation of the 1970's did to my family, so we've always lived way below our means.

When I worked at State Farm, even the hired janitors drove fancier cars than I did; it was depressing, I'd pull a 12 hour shift at a responsible job and then walk past 6-7 really nice cars of the night cleaning crew to get into my 250K miles Dodge Colt. All my co-workers had boats, big trucks, nice vacations.

Not going to be rich in retirement, but hopefully will keep the same lower-middle class lifestyle.

The Mouth

(3,165 posts)is that age discrimination is much less pervasive.

lambchopp59

(2,809 posts)Circumstantially with a sunk below zero start in adulthood up against the the economic ladder cranking up wildly steeper under RayGun, no unskilled jobs in the paper for years, scraping together the $50 per semester California tuition and $80 per month rent I was wildly fortunate to find. It was a young collaborator helped to get me started buying wrecked motorcycles to put together and sell. We had to be slick about that though to avoid requirements to obtain dealer licensure-- a few of my motorcycles were placed under some of my elderly neighbors names who would cooperate with us if I kicked them ten bucks for their signatures from the sales. It got some laughable looks from DMV clerks who were handling 90 year olds with walkers "selling their (late model) motorcycle"

Industrial district growth razed that ramshackle neighborhood and screwed over all those fixed income seniors living there horrifically, at the same time offering no jobs for anyone younger, just the bigger manufacturing monolith displaced us where we once happily lived, filled with machines and laying off the prior assembly line employees.

I'm isolated in age group in my entire extended family.

Years before this, utilizing the inflationary spiral of the 1970's that I did the math in front of my parents and considerably older siblings:

All my older siblings bought their "first homes" long before the upfront shot way out of reach for zero-credit young folks.

My core-boomer age relatives all attended universities even through far higher level degrees in the 1960's for far less than it cost for me to attend community college after losing my advantageous rent, they were making final payments on their 'first house' 20 or more years later, something I'll still never know, life long rent and debt cycle just to maintain my ability to go to work. Emergencies emptied any retirement savings repeatedly, including the biggest and best retirement account I had ever managed a few years ago. A single small cancerous tumor wiped that out.

Economically speaking, it is a do-the-math equation that our age group has far more in common with Gen X than the core "okay boomers" when I presented some of them with the mathematics who were a bit shocked, but reverted right back to "I got mine, get your own" attitude.

shrike3

(3,816 posts)haele

(12,684 posts)Last edited Mon Sep 11, 2023, 02:47 PM - Edit history (1)

The "Silent Generation" (1890's - 1910's) were the almost politically schizophrenic generation that set up both the New Deal policies, trickle down policies, and neurotic fear of Communism; while the "Greatest Generation" (1910's to 1930's) were the definitely politically schizophrenic generation who benefitted from the New Deal policies while expanding the neurotic fear of Communism and a total disregard for any sense of community improvement because they wanted to brush off the dust of small, dying towns or communities and become individually rich. With a good 70% of the population for the first time making enough money to spend on actually purchasing a ready-made house on land, with some left over for entertainment instead of figuring out how to build or expand the house, along with saving every other penny for the inevitable emergency or care during their old age.

The Greatest Generation gave us the nuclear family, suburbs, vacation expectations, the consumer economy, teenagers and mass media babysitting.

And they wasted all of that like giddy frat and sorority kids, leaving Boomers and GenX with "global" finances, credit scores, and technology augmented/automated workplaces that actually reduced the need for employees, just when there was a surge of young adults joining a world where the family farms and businesses were disappearing and approximately 20% of previously good paying jobs (such as computing and filing clerks, general accountants and research/secretarial pools) for individuals were being automated out of existence.

Boomers lost employment opportunities and stability through sheer bad luck and policy changes outside their control. The only thing that might have saved them was strengthening the Unions and actually following through with changing the political mindset from "We're the Champions, Woo-Hoo" to "Where are we going from Here?"

The neurotic Fear of Communism in the 20th Century really f'd the USA up. Yes, Communism has a bad habit of being taken over by dictators simply due to the nature of human beings and tribal dynamic/mob psychology, but in itself, it's no more than a Boogie Man for selfish rich folks. There's absolutely no reason for New Deal policies not to have been able to be expanded to a form of more equitable Social Democracy that could support both the rich and the poor in comfort, along with managing resources and the environment in a healthy, sustainable way.

Haele

Wish this was its own thread

LittleGirl

(8,292 posts)haele

(12,684 posts)The heads of the CIA, Kissinger, most of the banking heads that crawled out from under the rocks after Truman left office and the New Deal started stalling, they were all "Silent Generation" and the smug conservatives from the Greatest Generation. Instead of propping up the New Deal, they pushed to get right back to the Roaring 20's with it's Gilded Age Hedonism and Hustle.

Fed on the smugness from the Strength of the Dollar, Corporate Colonialism, Media pimping, and the cocky assuredness of "We Won, so We get to remake the World instead of tired old Europe with their history...", the Greatest Generation, along with too many Boomers, were perfectly willing to give those poor Rich Men back the money. So long as they could get a piece of it, too.

My dad worked his ass off to raise a family while he got his teaching credentials in California back in 1964/65...Ronald Reagan made sure we had to move out of state and pretty much start over in 1968. And the economy for the working class was never the same since.

Haele

LittleGirl

(8,292 posts)I had every intention of moving to CA where I could get a college education for free. Then Reagan said, oh no, we don't want to do that so there went my plan of leaving the Midwest. I was stuck in a red state with no opportunities or sense of direction for us poor folks. My parents worked in factories with union representation. After Dad died in '75, Mom would freak out every 3 years when the union threatened a strike because, no work, no paycheck. Thankfully, Social Security survivor benefits for us kids under 18 kept us from losing our house. My two brothers and I signed over our checks to Mom so that we could have food, electric and water bills paid. Her pay was abysmal.

I'm sorry about what your Dad went though.

Response to haele (Reply #26)

elocs This message was self-deleted by its author.

SouthernDem4ever

(6,617 posts)but there are sooo many stupid and gullible people out there.

yardwork

(61,715 posts)The same thing has happened to a number of my friends and family. One particular issue is that huge corporations were allowed to take back pensions, promises of lifelong health insurance, and other commitments that they made to people they hired in the 70s and 80s. These benefits were promised and people stayed with the companies, only to have the rug ripped out from under them as they neared retirement age. I don't think it should be legal to do that.

LittleGirl

(8,292 posts)Simply because of their age and being the highest paid for decades of service.

Too young to retire and qualify for social security or Medicare so get a new job? Or to spend your savings, get hit with early withdrawal 401k penalties just to eat…it’s rigged. My brother was promised free healthcare after 30 years and the company sold his division in his 31st year and lost it. He was the last person laid off in his division and he was 57 with 33 years. He was dead in 6 months. Losing his job killed him.

LiberalFighter

(51,170 posts)because their earnings were not the same as men for the same jobs.

LittleGirl

(8,292 posts)aggiesal

(8,938 posts)Congress has never stolen our Social Security.

The SS Funds are purchased with US Bonds and repaid back with interest.

The Treasury has never defaulted on paying back US Bonds, so our money is safe, except for (R)'s.

Voltaire2

(13,213 posts)that Congress stole all the ss funds. Unfortunately it is pervasive.

Apparently fica tax revenue ought to have been stuffed in mattresses instead of invested in t-bills.

roamer65

(36,747 posts)It’s easy to pay it back with devalued dollars, as the Treasury is doing now.

$100 in 2023 only has the purchasing power of $10 from 1965.

90 percent devaluation.

SYFROYH

(34,185 posts)I ask because the common wisdom is that standard of living is better in western Europe and the safety nets are better.

I daydream about moving to another country, but I don't think it will happen.

LittleGirl

(8,292 posts)Last edited Tue Sep 12, 2023, 04:52 AM - Edit history (1)

I never considered German citizenship but am eligible for Italian bloodline citizenship which I’d rather have.

I’m in the process of arranging a move to CA from Europe and it’s not always greener on this side of the pond. Unless you speak the local language, which my husband does, but I don’t, our experiences are completely different. I’ve tried for 9 years but I’m homesick and ready to start over. I’m just so shocked at how much I’ve saved and lost because of my age, my being female in a corporate monopoly against us. I mean, there’s no law for maternity leave! Don’t even get me started about the misogyny I experienced and witnessed.

I had high hopes that in 2000 when I got my dream job, and finally finished my degree…that I did everything I was supposed to do to be successful. That’s what they always said to do. But I blew it? Did I? SMH

Old Crank

(3,640 posts)Once they boot you in a layoff group retraining doesn't work. The tech bros don't want to work with dinosaurs or hire their mothers.

Jump to management as soon as you can in tech.

LittleGirl

(8,292 posts)At will laws gave them permission to fire at will.

Old Crank

(3,640 posts)Jobs are fire at will.

It just increases your chances of finding work later.

Plus even in CA proving age discrimination is hard unless the people say something directly.

erronis

(15,382 posts)So many good comments and observations about the business "system". It does not exist to be benevolent - it is there to maximize profits for its executives and investors.

Every now and then the governments (Germany for DFW and wife as examples) are trying to be helpful. The US seems to lurch between wanting all non-rich to go away, and offering a patchwork of limited assistance.

LittleGirl

(8,292 posts)I haven’t started threads here because I wonder if I’m alone in my circumstances; so it seems I am in the same boat as many here. I didn’t go to college right out of high school because I had no way to pay for it. I hoped for a Pell Grant but the Reagan admin changed the availability and I was over the required maximum by probably 1000 dollars. The recession during the early 80s really screwed us that were looking for good paying jobs. My parents taught me that I would have to work to eat and nobody was going to do it for me.

masmdu

(2,536 posts)Always in demand. You can do lateral entry. Tech skills are desired. Pension vesting in some places in as few as 5 years (but not fully).

TexasBushwhacker

(20,222 posts)to care for children or elderly parents. Pensions were usually based on a person's best 3 to 5 years, maybe 10, but Social Security is based on our best 35 years! I'm 66 and 6 months and I'm eligible to take my SS, but I don't have 35 years with decent earnings. I was my mother's primary caregiver for 9.5 years. I would like to work full time until I'm 70 to fill in some of the gaps, but I don't know if I'll ever have a decent full time job again. I was laid off in May.

Grasswire2

(13,571 posts)I have a developmentally delayed daughter. After she finished public high school (and I was divorced and my three other children grown) I was working at a job as a writer-editor for a large non profit in D.C. They allowed me to bring her to work, and allowed her to volunteer to do some tasks like copying, errands, etc. That was excellent.

But when I quit that job, it was a struggle to figure out how to manage our lives. She did NOT EVER want to be part of labels or programs. And I couldn't leave her home alone while I worked outside the house.

And so I first worked as a free-lance editor. And then I took up selling on eBay, specializing in vintage and antique paper items. We survived, and then my social security kicked in some years after. She also gained social security then, as a disabled dependent.

It's still possible to work "off the grid" and make your own path.

Response to LittleGirl (Original post)

elocs This message was self-deleted by its author.

Backseat Driver

(4,400 posts)flamingdem

(39,332 posts)The job market just loves youth.

And yes boomers are endlessly blamed for the financial problems of millenials and Y and Z.

What a lot of trash talk and division.

The stats here prove the truth.

calimary

(81,527 posts)Wonder Why

(3,276 posts)dropped its pension plan in the late '80s. There are advantages to 401Ks/IRAs over pensions to the extent that you don't lose anything if you go from company to company to move up the ladder rather than stay with a company that doesn't value you. But we look back at our ancestors and saw the good of pensions, never realizing that they could end and so never considered how we would handle it.

Financial planning is never really taught in schools - not to the level that one needs to manage investments. That's for sure.

My wife and I married when I was a poorly paid serviceman so we learned to live on less as our parents did, hers and mine. So we lived on what we had. Shortly after we married, she asked me if I minded if she did no work. I agreed but it was her decision. When I left the service and my income jumped dramatically, we continued to live at a much lower level than we could have with the income I was making. I saw many making much less than I living to and beyond their means. Instead we saved so when the pension ended and it went to a 401K, we maxed out my contributions. Moreover, I knew to invest at that age aggressively, but safely in growing but reliable funds with no following trends. Sure I missed out on the dotcom bubble but was not hurt on the burst. Same in 2008. Then a few years ago, I lost 20% but stayed the course and got it back.

We always paid cash for cars and held them until they got too old which allowed us to save for the next one.

She didn't have enough FICA credits to get SS so I bugged her to work just enough to qualify. When she turned 62, she took her $200/month and saved it. When I turned 662, 2 years later, she started taking her (now higher) spousal SS. We still live mostly on social security because we paid off the house 15 years ago in cash and still live modestly.

One son is like I am and he and his wife live modestly, maxing out their retirement funds. The other struck it rich, sold his company and he and his wife live off the money but spend it all but not more than he earns on investments.

The three biggest problems for which people are ill prepared are, first, thinking far ahead when young - deciding whether to enjoy life now or have enough later with too little education/acuity on how to do it. Secondly, as they approach or are in retirement with a lump sum in their retirement funds, how to use it properly so it lasts if they do and they enjoy it while they do if the don't live as long as they hoped. Third, how to pay for fast rising medical costs as their health deteriorates. Hard to make those kind of decisions when you have never been educated on it, encouraged to think about it, and the future is one big unknown.

Lastly, for women who may go in an out of the business world with the huge disadvantage of sexism in pay and opportunity, and who get married and are dependent on their husbands for the financial lifeline, a huge fourth problem of a broken marriage or a financially unfair one can ruin everything. I promised my wife I would always share everything with her if we ever parted and she would get everything if I died. Now, after 51 years of marriage, it is not an issue to us.

We have been very lucky in love but I do empathize with those without the financial education/acuity. So many things could have turned out different for us but they did not.

PoindexterOglethorpe

(25,916 posts)Making sure your wife had enough FICA credits to get SS. That's huge.

Paying cash for a car is huge. My very first car, I needed to finance through my credit union. And at that it was a very modest car, not at all expensive. It was paid off inside a year.

When my sons were very young, we had them open savings accounts. They had to put half of their allowance, and half of any gifted money into the account. When they were wanting to purchase a car, they each had enough cash to buy a modest used car. No loan. It was a revelation to both of them, that a car could be purchased for cash.

When I was in 7th grade, many decades ago, my math teacher took a week off from the regular math curriculum to teach us a bunch of basic financial things. Like how to write a check. The real cost of a mortgage. This was many decades ago, and so I can't remember many specifics, but I do recall that he taught us a lot of very basic things. The kinds of things that really ought to be taught to kids early on.

I know I tried to teach my sons these things, and I hope I succeeded.

Ziggysmom

(3,426 posts)the labor force. I see more and more older people I know continue working or go back to work in order to afford health care and the rising cost of housing. How disgusting our country has become.

I'm 64 and fortunate to have a good job in IT; I also pick up side contracting jobs programming in COBOL. They said that language would be dead over 20 years ago, what a joke. I have more offers than time available to work transitioning data processes from old mainframe COBOL programs onto more modern platforms and/or cloud based systems. It’s a messy job, but someone has to do it—and the pay is good.

Is there any chance you can pick up & freshen your IT skills with some online training? Even YouTube has free tutorials in IT skills, Excel and other fun areas.

Best of luck to you!

calimary

(81,527 posts)as hireable peers. My first few jobs were because they needed to add a woman to the staff. Climbed up through bigger and better jobs til I got to the AP. And then made permanent. And with a secure job - in broadcasting, no less, I started wondering if we better start a family before my eggs got stale.

By the time years had passed and I had two little ones, I realized I had a slowly developing case of divided loyalties, and that I couldn’t sustain trying “to serve two masters.” One of ‘em had to go. So it was the job.

And that was the end of “my brilliant career.” I never worked again. But contentment came with that. I’d wound up with a job that was far more fulfilling. FAR more. And no regrets.

The job won’t ever love you back.