General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsBank of Japan Sprays World With Surprising ¥10 Trillion Gift In Valentine's Day Liquidity

In a move that will surely shock, shock, the monetary purists out there, the Bank of Japan has just gone and done what we predicted back in May 2011, with the first of our "Hyprintspeed" series articles: "A Look At The BOJ's Current, And Future, Quantitative Easing" (the second one which discussed the imminent advent of the ¥1 quadrillion in total debt threshold was also fulfilled three weeks ago). So just what did the BOJ do? Why nothing short of join the ECB, the BOE, and the Fed (and don't get us started on those crack FX traders at the SNB) in electronically printing even more 1 and 0-based monetary equivalents (full statement here). From WSJ: "The Bank of Japan surprised markets Tuesday by implementing new easing policies and moving closer to an explicit price target, the latest sign of growing worries around the world about the ripple effects of the European debt crisis on the global economy. With interest rates already close to zero, the BOJ has relied in recent months on asset purchases to stimulate the economy. In Tuesday's meeting, the central bank expanded that plan by ¥10 trillion, or about $130 billion. The facility, which includes low-cost loans, is now worth about ¥65 trillion, or $844 billion." The rub however lies in the total Japanese GDP, which at last check was $6 trillion (give or take), and declining. Which means this announcement was the functional equivalent to a surprise $325 billion QE announced by the Fed. What is ironic is the market reaction: the BOJ expands its LSAP by 18% and the USDJPY moves by 30 pips. As for gold, not a peep: as if the market has now priced in that the world's central banks will dilute themselves to death. Unfortunately, it is only at death, and the failure of all status quo fiat paper, that the real value of the yellow metal, whose metallic nature continues to be suppressed via paper pathways, will truly shine.

and a comment .................

A reader's comments in response to a New York Times article on the situation in Greece (and soon to be the rest of PIIGS+France+U.K.) is purely epic, and I just wanted to share - but let me preface this by saying I'm very much Austrian School, and this reader's comments at least strongly suggest he may be not so inclined; so how incredible is it that he and I have arrived at exactly the same sentiments (with the exception of his 2nd sentence - see my comments after his indented quote in regards to this) on the whos [central fractional reserve bankster parasites] and the whats [enslaving nations] being done, and the instrumentality [debt] being used?:

Bill Appledorf

Accumulation by appropriation. Capitalism in its most primitive form: theft.

Like the Europeans appropriated the assets of the American Indians. Like colonial powers do to indigenous people everywhere: steal the land, steal the resources, price out or kick out the people who are living there.

Debt is war by other means; keep rolling it over until a country can no longer pay it, then the country is yours. Indoctrinate the rubes into blaming the victim, and you'll be able to do it here. All those houses stolen by the banks; AND the banks got $700 billion in taxpayers' cash plus 14 trillion or so in zero-interest loans.

Looting economies without having to drop a single bomb. Enslave a global workforce to boot. Sweet.

http://www.zerohedge.com/news/bank-japan-drowns-world-surprising-%C2%A510-trillion-valentines-day-liquidity-present

Spider Jerusalem

(21,786 posts)it seems to me there is probably a better source for this without the nutty right-wing economic commentary? Anyone who makes their belief in a return to the gold standard and in the widely discredited Austrian school of economics plain is probably not someone you want to rely on for information. The underlying information itself may be sound but I'm sure it's probably available from less questionable sources.

tabatha

(18,795 posts)The right-wing nuttery is creating the economic crap in this world.

One has to read all points of view to see how others view the situation.

Bonobo

(29,257 posts)This is a good thing.

Art_from_Ark

(27,247 posts)If it keeps up like this, some day in the distant future I may be able to break even on the ill-advised "su-pa- doru teiki" that I bought several years ago.

Bonobo

(29,257 posts)Art_from_Ark

(27,247 posts)I took all the risks and am currently in a loss position, while both my bank and the Japanese government have profited from it.

Bonobo

(29,257 posts)But someone told me yesterday, he is a local politician, that there is fear that the yen might weaken tremendously even going to 150 yen/dollar potentially! (outside possibility).

What do you think?

Art_from_Ark

(27,247 posts)スーパー定期 is like a Japanese Certificate of deposit, often in a foreign currency that ostensibly pays more interest than Japanese banks. However, once you factor in the 20% tax that the Japanese government imposes on all interest (thanks to Saint Ronnie for forcing Japan to implement that tax to punish Japanese savers), as well as the foreign currency conversion fees that the banks impose coming and going, then in the case of major currencies you really have to make around 5% interest in one year just to break even, if the exchange rate remains the same. If the exchange rate at maturity is not favorable, you actually lose money, even though you were supposed to be earning 5%!

Bonobo

(29,257 posts)Art_from_Ark

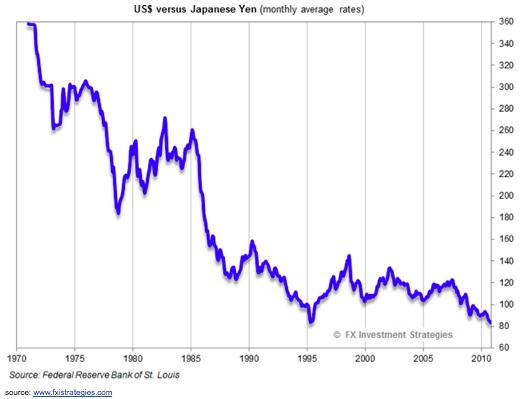

(27,247 posts)In 1994, the yen reached a high of 78 (comparable to where it is now), but in August of 1998, it was briefly trading at 143! So there is historical precedent. But a lot of the business people I have talked to say that 100-110 would be a happy medium for them, so that seems like a more likely scenario.

But, like I said, there is a precedent for wild swings so 150 might be possible (but I wouldn't bet the farm on it).

Lydia Leftcoast

(48,217 posts)¥100-$1 is fine, ¥76-$1 is fantastic, ¥150-$1 would practically send me to the soup kitchens. The lowest yen I've ever experienced as a translator is ¥135, and that was not good.

Bonobo

(29,257 posts)I left America and still have lots of dollars in US bank that are worth practically nothing here and I still have lots of clients paying me in dollars that aren't too keen to give me a raise just because the dollar isn't worth the paper it's printed on.

So we will just have to root on opposite sides of the ball field for the time being.

Having said that, I would be happy to meet you in the middle at 110 or so also ![]()

Bonobo

(29,257 posts)banned from Kos

(4,017 posts)This probably won't move the needle on the dollar/yen out of the normal deviation.

Bonobo

(29,257 posts)In 1985, the yen was at 260/dollar. In just 3 years, it dropped more than 100% to around 120.

More recently, it was in the 100~120 range for over a decade and then dropped quickly around 2007. It is now 78, up from a high of 75.

So what is normal? Tell me please!

Art_from_Ark

(27,247 posts)was in large part due to the Plaza Accord, Reagan's "brilliant" plan of devaluing the dollar to make "exports" more affordable in foreign countries. What it mostly accomplished, however, was adding to the US trade deficit.

Bonobo

(29,257 posts)Art_from_Ark

(27,247 posts)on two or three recent occasions that I can remember. A couple of those times were before the 3-11 disasters, and one time was after. In those cases, the effect was just a blip on the screen. The most recent action seems to have weakened Japan's currency versus the dollar by a couple of yen over the past week, but it's too early to say if this will have a lasting effect.

One wild card here is that the full economic impact of the triple disaster is becoming clearer, which may also work to bring the yen down a bit.