General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsIceland and Greece, two different tales

In Iceland they choose the people over the Banks that caused the meltdown:

http://www.bloomberg.com/news/2012-02-20/icelandic-anger-brings-record-debt-relief-in-best-crisis-recovery-story.html

Iceland’s approach to dealing with the meltdown has put the needs of its population ahead of the markets at every turn.

Once it became clear back in October 2008 that the island’s banks were beyond saving, the government stepped in, ring-fenced the domestic accounts, and left international creditors in the lurch. The central bank imposed capital controls to halt the ensuing sell-off of the krona and new state-controlled banks were created from the remnants of the lenders that failed.

Activists say the banks should go even further in their debt relief. Andrea J. Olafsdottir, chairman of the Icelandic Homes Coalition, said she doubts the numbers provided by the banks are reliable.

“There are indications that some of the financial institutions in question haven’t lost a penny with the measures that they’ve undertaken,” she said.

While in Greece they demand the workers suffer for the crimes of the Banks:

http://edition.cnn.com/2012/02/20/business/greece-debt-report/?hpt=hp_t1

The 10-page debt sustainability analysis, distributed to eurozone officials last week but obtained by the Financial Times on Monday night, found that even under the most optimistic scenario, the austerity measures being imposed on Athens risk a recession so deep that Greece will not be able to climb out of the debt hole over the course of a new three-year, €170bn bail-out.

It warned that two of the new bail-out's main principles might be self-defeating. Forcing austerity on Greece could cause debt levels to rise by severely weakening the economy while its €200bn debt restructuring could prevent Greece from ever returning to the financial markets by scaring off future private investors.

But will any one in power in this country, from Obama on down, speak the truth, that it's the Banks and Wall Street that caused this and who need to be held accountable, and not try to fix it on the backs of the workers. Which won't work no matter how much pain you inflect.

SammyWinstonJack

(44,130 posts)dipsydoodle

(42,239 posts)simply because they shouldn't have lent them the money at all in the first place. It was that money that allowed the size of their government and public sector to grow out of all proportion to the size of both their population and associated GDP.

Comparisons against Iceland don't make any sense. Not affecting their population assumes an increase in unemployment for 3% to 7% dosen't matter and I doubt that the population found an inflation rate which peaked at 34% in 2010 particularly funny either. In terms of Iceland itself they want to be in the EU but cannot join until debts to both the UK and Holland are satisfied which may be never.

muriel_volestrangler

(101,321 posts)Though the European Free Trade Association surveillance authority is taking Iceland to court over it, which, if it finished in early 2013, might mean earlier repayment, plus interest:

...

The bankruptcy estate of Landsbanki (the parent company of Icesave) hopes to finish paying priority claimants back by the end of 2013; but Sletnes says that one of the key tenants of the EEA legislation is to stop depositors needing to claim their money back as claimants on the bank’s estate.

The court case is expected to conclude by the end of next year and a verdict is expected in early 2013.

Regardless of if Iceland wins or loses the case, the lost funds will be repaid by the Landsbanki estate. If Iceland wins, that money will go directly to the British and Dutch governments, no breach of EEA rules will be recorded and the matter will be closed; whereas if Iceland loses it will become responsible for immediate refund of the money, plus interest. The EFTA court verdict would mean that Iceland would be in breach of the EEA contract until all three nations come to a suitable agreement. The court cannot force payment, but armed with the verdict, the British and Dutch could then go to an Icelandic court with their demands, if they chose to do so.

Read more: http://www.icenews.is/index.php/2011/12/15/efta-to-take-iceland-to-court-over-icesave/#ixzz1n2CdB5wS

dipsydoodle

(42,239 posts).

girl gone mad

(20,634 posts)the Directive on Deposit Guarantee Schemes, which is €20,000 per depositor. It only involves the online branch of Landsbanski, Icesave. Since Landsbanski is already paying out all claims in time, this will essentially decide if depositors are owed interest on payments.

girl gone mad

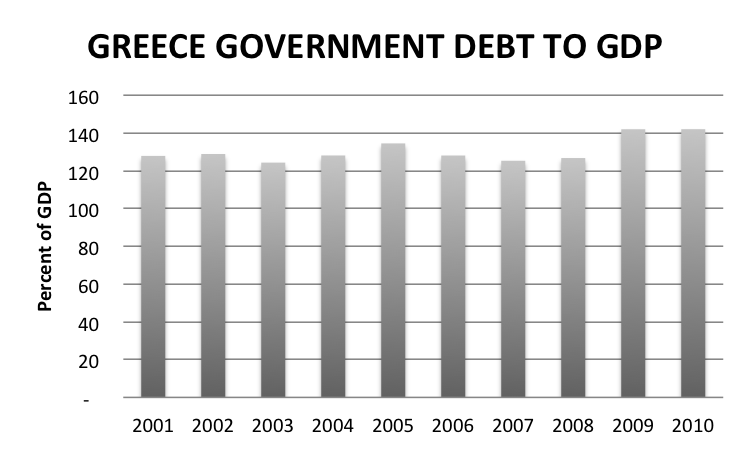

(20,634 posts)look at that crazy growth in government spending:

They really went wild!

I mean, wow, look at this remarkable change in debt to gdp:

You can see clearly how this was the cause of the crisis starting in 2007/2008. ![]()