General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe 50-State Foreclosure Settlement -- Why Hasnít Anyone Gone to Jail?

Important analysis that deserves to be shared.

The 50-State Foreclosure Settlement

Why Hasn’t Anyone Gone to Jail?

by MIKE WHITNEY

CounterPunch, Feb. 21, 2012

Under the terms of the 50-state mortgage foreclosure settlement, US taxpayers could end up paying billions in penalties that were supposed to be paid by the banks. That’s the gist of a front-page story which appeared in the Financial Times on Thursday, February 17. The widely-cited article by Shahien Nasiripour notes that the 5 banks that will be effected by the settlement — Bank of America, JPMorgan Chase, Citigroup, Wells Fargo and Ally Financial – will be able to use Obama’s mortgage modification program (HAMP) to reduce loan balances and “receive cash payments of up to 63 cents on the dollar for every dollar of loan principal forgiven.”

And that’s not all. If borrowers stay current on their payments after their loans are restructured, the banks could qualify for additional government funds which (according to the FT) “could then turn a profit for the banks according to people familiar with the settlement terms.”

How do you like them apples? Leave it to the bank-friendly Obama administration to turn a penalty into a windfall. In effect, the settlement will help the banks avoid losses on mortgages that are vastly overpriced on their books and which were probably headed into foreclosure anyway.

Taxpayers will stump up the money for the principle writedowns that will allow the banks to extract even more tribute from underwater homeowners. What kind of penalty is that?

CONTINUED...

http://www.counterpunch.org/2012/02/21/why-hasnt-anyone-gone-to-jail/

Not to be DUplicitous or anything, but shouldn't it be the crooks who pay for the crime?

russspeakeasy

(6,539 posts)everyday criminals because most "white collar" criminals have stolen enough money to put together a pretty good defense team.

Octafish

(55,745 posts)And Mr. and Mrs. Average American Taxpayer are way past tapped out. From the OP:

9 million homes have been lost to foreclosure since 2007, and there will be another 9 million before we’re done. Homeowners have lost $8 trillion in home equity (in the last 4 years) and 11 million people are currently underwater on their mortgages. [font color="green"]All of this is unprecedented. All of this is the result of fraud[/font color].

If I may add, the government now is handicapped by competing to retain competent forensic and regulatory personnel with those who prefer they leave its service for promised riches in the "private sector."

A good audio on these very thing$:

William K. Black explains control fraud at length

KurtNYC

(14,549 posts)Fraud and abuse costs U.S. organizations more than $400 billion annually.

The average organization loses more than $9 per day per employee to fraud and abuse.

The average organization loses about 6% of its total annual revenue to fraud and abuse committed by its own employees.

The median loss caused by males is about $185,000; by females, about $48,000.

The typical perpetrator is a college-educated white male.

Men commit nearly 75% of the offenses.

Median losses caused by men are nearly four times those caused by women.

Losses caused by managers are four times those caused by employees.

Median losses caused by executives are 16 times those of their employees.

The most costly abuses occur in organizations with less than 100 employees.

The education industry experiences the lowest median losses.

The highest media losses occur in the real estate financing sector.

Occupational fraud and abuses fall into three main categories: asset misappropriation, fraudulent statements, and bribery and corruption.

http://www.diogenesllc.com/whitecollarfraudstats.html

Nye Bevan

(25,406 posts)And Andy Fastow? And Jeff Skilling?

russspeakeasy

(6,539 posts)MannyGoldstein

(34,589 posts)Madoff was far more egregious.

Juneboarder

(1,732 posts)I'm upside down by $200,000 and want to refi so I can keep my home, but have no options available because of the negative equity. What sickens me the most is when I enter discussion with people, the response received from so many is that it's my fault for entering into unfavorable mortgage terms.

I'm with Whitney here. The banks stacked the cards against us, and then when everything crumbled we were here to bail the banks out to the tune of billions and trillions of dollars.

As the Occupiers would say - "Banks got bailed out, we got sold out!"

csziggy

(34,136 posts)Because they had no incentive to make sure the mortgages they were selling were good for the borrowers. They made their money by selling the mortgages into the MERS system.

I've read some articles and seen some interviews that claim this deal does not absolve the banks and the MERS people of the fraud they have committed. I hope this is true, but I am not holding my breath for prosecutions.

Juneboarder

(1,732 posts)Eventually the deck of cards will fall, and karma always wins - hands down.

csziggy

(34,136 posts)What really gives it away is that MERS has and never had a single employee. But they "had" many vice-presidents to sign the paperwork for foreclosures.

MERS is the smoke and mirrors for this magic act.

Octafish

(55,745 posts)We are in a similar situation -- we're near break-even, having paid a mortgage here for 12 years. Our home has lost a third of its value. While part of that is due to the slowdown in the economy, and part of it's our location next door to Detroit, the main culprit is the fraud perpetrated by the Too Big To Fail financial institutions.

Bill Black on Financial Fraud Investigations

February 6, 2012

by Theresa Riley

Bill Moyers World of Ideas

EXCERPT...

Riley: It sounds like you don’t think this new working group is going to get the job done. Last week, Schneiderman said that he thinks he has the resources (particularly the IRS and the Consumer Protection Unit) and the political will to pursue the investigation in a meaningful way. Why do you disagree?

Black: First, the “investigation” will not investigate what was by far the largest and most destructive fraud — control frauds — the origination of millions of fraudulent loans. Second, the working group’s resources to investigate secondary market fraud are ludicrously inadequate.

Let me provide specifics on scale.

The total staffing of the working group (once completed in several months) is 55. At peak, there were roughly 1000 investigators (and hundreds of prosecutors) assigned to the S&L prosecutions 20 years ago. The current crisis caused losses far exceeding the S&L debacle and involves frauds that are massively greater than the frauds that drove the S&L debacle.

But the issue of resources is not where the discussion needs to begin. The keys are information, expertise, understanding of control fraud, and prioritization of investigations and prosecutions. Absent criminal referrals from the financial regulators and whistleblowers, absent dozens of banking regulators being “detailed” to serve with the FBI as their internal experts, absent training of the investigators and prosecutors on how to detect and prosecute control frauds (the Justice Department uses the mortgage lending industry’s “definition” of mortgage fraud — and, surprise, it defines the lenders and their CEOs who made millions of fraudulent liar’s loans as the good guys/victims of mortgage fraud rather than the perpetrators), and absent the immediate reversal of the current system of making smaller mortgage frauds our top criminal justice priority — absent all of these things there can be episodic prosecutorial successes, but continued systemic failure is certain.

We will know that there is a real commitment to prosecuting the elite frauds when the Justice Department takes these essential, foundational steps — and the Department quadruples the number of FBI agents assigned to investigate mortgage fraud.

CONTINUED...

http://billmoyers.com/2012/02/06/bill-black-on-financial-fraud-investigations/

Way back when, I helped investigate a local S&L, then part of the largest crime in history, measured in dollars. The S&L rip-off is dwarfed by today's financial crimes.

So, I'm way past time for "settlements" with the banks that just ripped us off. I want to see Justice -- not just banksters and crooked politicians going to jail, I want to see economic justice for everyone who's gotten the shaft by the 1-percent of 1-percent and their toadies on Wall Street and Washington.

riderinthestorm

(23,272 posts)Far western Chicago suburbs.

I absolutely blame the mortgage fraud for this debacle. ![]()

Juneboarder

(1,732 posts)I've been quite the squeaky wheel when it comes to my personal situation. I currently have 7 cases opened with the OCC (Office of Comptroller of Currency) on my behalf by various governmental agencies and figures, and just got notice that my OCC file has been turned over to CFPB (Consumer Financial Protection Bureau) for investigations.

Have you looked into the new HFA programs? I qualify for one, the Principal Reduction Program, offered through the state of CA. The government gave the five "hardest hit" states money to create programs for homeowners current on payments and in situations similar to ours. The only reason I am not (actually I should say cannot) proceed with this program is because my lender and servicer don't participate in these programs to help the general public.

Really, what is government assistance when the banks have the right to opt out of helping their customers?

Here is a link to info on the hardest hit fund and the participating states if you are interested: http://www.treasury.gov/initiatives/financial-stability/programs/housing-programs/hhf/Pages/default.aspx

Hope all goes well for your and your family ![]()

AtomicKitten

(46,585 posts)http://www.dailykos.com/story/2012/01/24/1058158/-BREAKING-Obama-to-Appoint-Eric-Schneiderman-to-Investigate-Mortgage-Crisis

Schneiderman's First Salvo Against The Banks

http://www.buzzfeed.com/nycsouthpaw/schneidermans-first-salvo-against-the-banks

Prosecutor Hints: Bankers Will Be Going To Jail

http://www.buzzfeed.com/buzzfeedpolitics/prosecutor-hints-bankers-will-be-going-to-jail

Octafish

(55,745 posts)...regarding the appointment:

Riley: Speaking of Schneiderman, what’s your view of President Obama’s SOTU announcement of a new Financial Crimes Unit (the Residential Mortgage-Backed Securities (RMBS) Working Group) co-chaired by him?

Black: If Schneiderman had been named Attorney General of the United States, we would know that the administration really intended to hold accountable the frauds that drove the crisis. Instead, the top two Justice Department officials that are supposed to be prosecuting the elite frauds have consistently failed to even investigate the frauds, have denied the existence of material fraud, and came from the same law firm that represented many of the big, fraudulent banks and was critical to the creation of the notorious Mortgage Electronic Registration System (MERS) that contributed to the foreclosure fraud.

AG Schneiderman was appointed to the working group because he has broad credibility as a real prosecutor. His refusal to support the earlier drafts of the robo-signing deal (which was so bad that I described it as the formal surrender of the U.S. to crony capitalism) led the State AGs to kick him out of the settlement discussions.

Schneiderman is only one of the co-chairs of the new working group. The others are federal prosecutors or officials who were the strongest proponents of the cynical deal that would have de facto immunized the elite criminals from civil and even criminal sanctions. The working group is set up so that Schneiderman can give the group credibility while being marginalized. He can be outvoted in any matter in which he proposes vigorous prosecutions.

SOURCE:

http://billmoyers.com/2012/02/06/bill-black-on-financial-fraud-investigations/

Thank you for the kind reminder of Mr. Schneiderman, AtomicKitten. From what I understand, he is a good man -- TOPS. I hope he bags them all.

AtomicKitten

(46,585 posts)Cheers.

Uncle Joe

(58,366 posts)Thanks for the thread, Octafish.

Octafish

(55,745 posts)Lenders Put the Lies in Liar’s Loans and Bear the Principal Moral Culpability

EXCERPT...

The fraud “recipe” for lenders

The reason that accounting control frauds characteristically engage in lending behavior that no honest lender would exhibit was that these perverse practices maximized reported short-term income and the executives’ compensation. There is a four-ingredient fraud “recipe” for lenders.

1. Extreme growth through making

2. Exceptionally bad loans at a premium yield (very high interest rate) while

3. Employing extreme leverage (the lender has vastly more debt than equity), and

4. Providing grossly inadequate allowances for future losses inherent in making bad loans

The same recipe maximizes three things: (fictional) short-term reported income, the senior executives’ compensation, and actual losses. Such a recipe can only come with the blessing of the officials that control the bank. When a significant number of frauds following the same fraud “recipe” use the same “ammunition” (liar’s loans) to feed their accounting fraud “weapon,” those frauds will continue to lend into the teeth of a glut of residential real estate. Epidemics of accounting control fraud can hyper-inflate financial bubbles.

We can now see why mortgage lenders that were accounting control frauds made massive amounts of liar’s loans – and greatly increased the number of liar’s loans they made as the FBI and mortgage fraud experts warned that there was an “epidemic” of mortgage fraud and that liar’s loans would cause catastrophic losses. Liar’s loans were the best available “ammunition” for accounting control fraud. They allowed fraudulent lenders to make vast amounts of loans to the uncreditworthy at premium yields. They also allowed the lender to make the loans without a paper trail demonstrating that the lender knew that the borrowers’ incomes were endemically, and severely, overstated. That paper trail would have made it much easier to prosecute the fraudulent lenders.

CONTINUED...

http://www.neweconomicperspectives.org/2011/10/lenders-put-lies-in-liars-loans-and.html

PS: Thanks, Uncle Joe. Really appreciate that you give a damn it wasn't the little people behind the fraud. The dismal science needs more forensic economists. Until the FBI hires the needed hands, Dr. Black will do his best.

whatchamacallit

(15,558 posts)this is one of the the most obscene. ![]()

Octafish

(55,745 posts)EXCERPT...

In the past month I’ve attended two meetings as a non-speaker: one at the IMF and the other last weekend at Bretton Woods.

At both I asked the same question, from the floor. How is it possible to have these somber and well-informed discussions of financial supervision, replete with experts and high officials, and not one mention of the word “fraud?”

SNIP...

The State Attorneys General, in Minnesota, Iowa and elsewhere, thought differently beginning in 2003.

The FBI thought differently in October, 2004 when it warned, in public, that we could be facing an epidemic—an epidemic—of mortgage fraud.

Fitch Ratings found differently in 2007 when it looked at a bit of mortgage documentation and declared itself startled. There was evidence of fraud, abuse or missing documentation in, quote, “virtually every file.”

CONTINUED...

PS: Thanks, whatchamacallit, for giving a damn about the biggest crooks in this country. For some weird reason, it seems not too many in a position to do something about them are.

whatchamacallit

(15,558 posts)It seems just getting past problems (crimes) with the least pain is the order of the day. The Department of Justice should change it's seal from "Qui Pro Domina Justitia Sequitur" to "No muss, no fuss".

“Justice denied anywhere diminishes justice everywhere” - MLK.

SammyWinstonJack

(44,130 posts)going after medical marijuana dispersaries and medical marijuana patients to bother with the banksters who ripped the whole World off.

That's a great priority there, Obama.

![]()

Marblehead

(1,268 posts)Octafish

(55,745 posts)A top official warned of widening loan fraud in 2004, but the agency focused its resources elsewhere.

By Richard B. Schmitt

August 25, 2008 in print edition A-1

Long before the mortgage crisis began rocking Main Street and Wall Street, a top FBI official made a chilling, if little-noticed, prediction: The booming mortgage business, fueled by low interest rates and soaring home values, was starting to attract shady operators and billions in losses were possible.

“[font color="green"]It has the potential to be an epidemic[/font color],” Chris Swecker, the FBI official in charge of criminal investigations, told reporters in September 2004. But, he added reassuringly, the FBI was on the case. “[font color="green"]We think we can prevent a problem that could have as much impact as the S&L crisis[/font color],” he said.

Today, the damage from the global mortgage meltdown has more than matched that of the savings-and-loan bailouts of the 1980s and early 1990s. By some estimates, it has made that costly debacle look like chump change. But it’s also clear that the FBI failed to avert a problem it had accurately forecast.

Banks and brokerages have written down more than $300 billion of mortgage-backed securities and other risky investments in the last year or so as homeowner defaults leaped and weakness in the real estate market spread.

CONTINUED...

http://articles.latimes.com/2008/aug/25/business/fi-mortgagefraud25

As if. While at the time, the greatest heist in history, today we see the S&L crisis is miniscule compared to what was to come.

What a common refrain about our civil servants: They knew. Yet, they did nothing.

AnotherMcIntosh

(11,064 posts)I think that they acted as as enablers.

Tierra_y_Libertad

(50,414 posts)"Right here in this heart and home and fountain-head of law, this great factory where are forged those rules that create good order and compel virtue and honesty in the other communities of the land, rascality achieves its highest perfection." Mark Twain

Octafish

(55,745 posts)MEMORANDUM FOR THE RECORD ("MFR"

EXCERPT...

Chris Seefer opened the meeting by summarizing the mandate of the Financial Crisis Inquiry

Commission. He explained that the Commission is interested in understanding where to find

data detailing mortgage fraud. Mr. Swecker made clear that he is bound by a signed severance

agreement with his former employer, Bank of America, and could not discuss any proprietary

information regarding the company. He is also prevented from saying anything negative about

Bank of America.

PDF of complete FCIC memo:

http://fcic-static.law.stanford.edu/cdn_media/fcic-docs/2010-03-08%20FCIC%20memo%20of%20staff%20interview%20with%20Chris%20Swecker,%20Federal%20Bureau%20of%20Investigation%20and.pdf

Thank you for seeing what's what and who's who, Tierra_y_Libertad. It's like We the People, even if we wanted to hire professionals, couldn't afford the help.

Blue_In_AK

(46,436 posts)(like Alaska) are appropriating portions of the settlement money to themselves. Our governor, in his infinite wisdom, is seizing 44%, more than almost any other state, despite the fact that our state government is doing just fine, thank you, with millions in reserve, not even counting our Permanent Fund. And despite the fact that he is constantly bleating about federal interference in Alaska's affairs. The guy makes me sick.

http://www.nationalmortgagerefund.info/?page_id=128

Octafish

(55,745 posts)It's a fiscal free-for-all like the tobbacky settlement.

Some money from mortgage settlement to be diverted

By DAVID A. LIEB, Associated Press – 16 hours ago

JEFFERSON CITY, Mo. (AP) — The ink wasn't even dry on a settlement with the nation's top mortgage lenders when Missouri Gov. Jay Nixon laid claim to a chunk of the money to avert a huge budget cut for public colleges and universities.

He's not the only politician eyeing the cash for purposes that have nothing to do with foreclosure. Like a pot of gold in a barren field, the $25 billion deal offers a tempting and timely source of funding for state governments with multimillion-dollar budget gaps.

SNIP...

Vermont plans to use $2.4 million from the settlement to help balance its budget. Maryland Attorney General Doug Gansler said about 10 percent of his state's $62.5 million payment will be made available for the governor and lawmakers to spend as they choose.

In Wisconsin, Gov. Scott Walker wants to use $26 million to plug a state budget hole because the foreclosure crisis had a "direct impact on the economy." But the Republican governor's plan has ruffled some Democrats, including Milwaukee Mayor Tom Barrett.

CONTINUED...

http://www.google.com/hostednews/ap/article/ALeqM5iukyoIUf65FpELcExPtfsIgUp5fw?docId=7ef758ac2fbe43dbbd5907c25a0f4a37

In Michigan, they promise to use the money to help homeless kids. I'll believe it when I see it.

AnotherMcIntosh

(11,064 posts)Octafish

(55,745 posts)So, it's not surprising to see lots of the same players.

And their offspring.

boppers

(16,588 posts)But hey, we haven't had public executions, so yeah, not "enough" is being done.

jpgray

(27,831 posts)Does the US taxpayer have some exposure on paying the settlement? I hope you know the answers to all of the above given your certainty that the deal is adequate.

boppers

(16,588 posts)Renters and other people who didn't speculate on housing are getting completely screwed over.

jpgray

(27,831 posts)boppers

(16,588 posts)People, not so much. Corporations and organizations? By the truckload.

riderinthestorm

(23,272 posts)There's been an epic fraud epidemic on both the front end and in the paperwork process. Have you ever heard of liar loans as just one example? Where the banksters sold fraudulent mortgages to unwitting buyers because that debt paper was worth so much more when it was bundled and re-sold? Easier to con the schmucks signing 80 documents of legalese for a NINA loan that the naive buyers were assured was okay. I'm a really sophisticated landowner and have owned more than a few properties. I last re-financed 5 years ago on a commercial property and when we went to apply, we'd put in for an extension for our taxes - commercial and personal. When the bank asked for that info, I told them we'd applied for an extension and didn't have that year's data. I could give them a reasonable approximation (since you have to do that anyway to file the extension) but couldn't provide specifics. The bank waived us providing ANY documentation about our finances.... (even though I had all other years previous). I was shocked. They actually did the re-fi without us providing any docs. I kept my mouth closed and didn't say anything at the time but in retrospect, it was really weird.

Turns out that was SOP. Now we're a good bet. Unfortunately Joe and Jane Six Pack aren't nearly as savvy. They got took.

We have no idea of the scope of the fraud problems but to pin this on "deadbeat debtors" is ridiculous and incredibly ignorant.

boppers

(16,588 posts)Real Estate people lying about the value of houses.

Banks lying about the value of Mortgages.

Buyers lying about their income and credit.

Markets lying about the value of the con.

midnight

(26,624 posts)stevenleser

(32,886 posts)The problem with righteous indignation articles like this one is that they rarely if ever attempt to connect the dots to an act by an individual.

Anyone can say 'someone ought to go to jail'.

Octafish

(55,745 posts)The interview with Dr. Black starts in around the 5:30 mark.

PS: That was a year and a half ago. Nothing's happened to those three, although more banks have been bailed out and more people have been tossed out.

Overseas

(12,121 posts)woo me with science

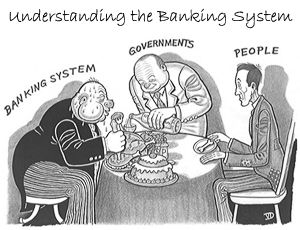

(32,139 posts)It really is that simple.

They built this system, and they own it. They work in collusion with government, because they own the government. This entire damned system is set up to allow them to profit from all of us, from our labor every single day of our lives. The idea that government is there to protect us, or that Obama has any intention of protecting us, or that we have any recourse over what they are doing is an illusion.

Change will not come from inside the system.

Occupy.

Octafish

(55,745 posts)More from the Most People Would Already Be Making License Plates Department.

Why They Should be Indicted

The Case Against Bernanke and Greenspan

by MIKE WHITNEY

MARCH 01, 2010

EXCERPT...

Repeat: The FBI KNEW there was an "epidemic" of mortgage fraud as early as 2004. Ergo: The Fed knew. Greenspan knew. Bernanke knew. And both chose not to perform their regulatory duties to stop the swindle from continuing.

And the FBI wasn’t the only one who knew either. In testimony just last month before the Financial Crisis Inquiry Commission (Jan 14, 2010) FDIC chairman Sheila Bair confirmed that she not only warned the Fed of what was going on, but cited particular regulations under which the Fed could stop the "unfair, abusive and deceptive practices" by the banks. Here is a excerpt from her damning testimony:

"PROBLEMS IN THE SUBPRIME MORTGAGE MARKET WERE IDENTIFIED WELL BEFORE MANY OF THE ABUSIVE MORTGAGE LOANS WERE MADE. A joint report issued in 2000 by HUD and the Department of the Treasury entitled Curbing Predatory Home Mortgage Lending noted that a very limited number of borrowers benefit from HOEPA’s protections because of the high thresholds that a loan must exceed in order for the protections to apply. THE REPORT ALSO FOUND THAT CERTAIN TYPES OF SUBPRIME LOANS APPEAR TO BE HARMFUL OR ABUSIVE IN PRACTICALLY ALL CASES. To address these issues, THE REPORT MADE A NUMBER OF RECOMMENDATIONS INCLUDING THAT THE FEDERAL RESERVE USE ITS HOEPA AUTHORITY TO PROHIBIT CERTAIN UNFAIR DECEPTIVE AND ABUSIVE PRACTICES BY LENDERS AND THIRD PARTIES. During hearings held in 2000, consumer groups urged the Federal Reserve to use its HOEPA rulemaking authority to address concerns about predatory lending. Both the House and Senate held hearings on predatory abuses in the subprime market in May 2000 and July 2001, respectively…."

Naturally, Bair’s testimony was ignored by the media.

CONTINUED...

http://www.counterpunch.org/2010/03/01/the-case-against-bernanke-and-greenspan/

Emphassiss in the original. Thanks for grokking, woo me with science.

treestar

(82,383 posts)Jail does not apply. There has to be a criminal prosecution.

Octafish

(55,745 posts)Pam Martens

CounterPunch, Feb. 10-12, 2012

Yesterday the Department of Justice and 49 state attorneys general announced the long anticipated $25 billion deal with 5 large Wall Street firms — Bank of America Corporation, JPMorgan Chase & Co., Wells Fargo & Company, Citigroup Inc. and Ally Financial Inc. — to settle foreclosure and mortgage servicing abuses. Unfortunately, the settlement is not yet 24 hours old and cracks are emerging.

Each major corruption settlement with Wall Street, and they are legion over the past 15 years, triggers a commemorative magazine cover. I keep some favorites handy.

SNIP...

Why is mortgage loan origination a big deal? Because tens of thousands of consumers were victimized in a bait and switch racket, believing they were getting a fixed rate mortgage only to find out a few years down the road that they had an adjustable rate mortgage that reset and doubled or even tripled their monthly payment – making it impossible to stay in their home; an effective wealth stripping enterprise by Wall Street against decent, hardworking families across America.

SNIP..

In the past, Wall Street knew it could steal billions and settle with its easily maneuvered regulators for millions. It did this time and time again, never having to admit to any crime. Wall Street translated this to mean that crime was a lucrative profit center. This latest settlement raises the potential of this profit center. Wall Street now understands that it can steal trillions and settle for billions.

CONTINUED...

http://www.counterpunch.org/2012/02/10/foreclosure-settlement-just-another-link-in-a-long-chain-of-corruption/

Even if the fish don't notice their oceans are filthy with pollution, systemic corruption still is a crime.

flexnor

(392 posts)you're obviously new here

Octafish

(55,745 posts)So, please, tell me what you know or think about the crooks ripping of the People.

In the meantime, here's a bit of what I've learned:

Know your BFEE: Phil Gramm, the Meyer Lansky of the War Party, Set-Up the Biggest Bank Heist Ever.

PS: Welcome to DU, flexnor.

AnotherMcIntosh

(11,064 posts)AnotherMcIntosh

(11,064 posts)Or so I've been told.

How stupid can people be to support the lack of prosecutions with any excuse?

But, as John Kenneth Galbraith said, "Never underestimate the power of very stupid people in large groups."

http://www.zenzibar.com/quotes.htm

Hotler

(11,425 posts)I may be wrong, but Ithink it has more to do with having the balls, spine or even some fight in him. He could call Eric Holder into his office and chew his butt and tell him to start prosecuting. He could also send a letter to the states AG's and tell them the same thing. It's easier to go after pot smokers than after your rich campaign donors. Remember there are two sets of laws in this country, one for the little people and one set for the rich & powerful.