General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsCan somebody help explain the Greek Crisis?

I argued with my cousin this morning who accused the Greeks of wasting billions of taxpayer money on early retirement and excessive benefits. Frankly, my argument wasn't so much about the Greek situation as it was about the European "welfare state."

He said the Germans are tired of underwriting all this debt when their citizens are working till 67-years-old, etc.

I thought I knew more about this than I actually do. Nonetheless, I really couldn't argue much, as I don't know enough. I know there have been issues with the world bank & Christine Lagarde has been involved, but frankly I know next to nothing else, specifically the Greek financial melt down! Would anybody care to give me some pointers on dealing with my cousin? I know this is long & obnoxious but would appreciate an answer. ![]()

Lint Head

(15,064 posts)A big percentage of the rich and middle class are just ignoring the fact they should pay taxes.

wandy

(3,539 posts)Do you know that in some less civilized country's the job providers and blue bloods actual put a person of power in which the traitorous bastard can convince public servants not to implement fair tax laws by taking a solemn oath to that effect BEFORE

taking their oath of office. Imagen that! Taking an oath to the wealthy before taking their oath of office.

Yes; history will record the name Grover!

jberryhill

(62,444 posts)It is a form of drama based on human suffering that invokes in its audience an accompanying catharsis or pleasure in the viewing. While many cultures have developed forms that provoke this paradoxical response, the Greek form often refers to a specific tradition of drama that has played a unique and important role historically in the self-definition of Western civilization.

boppers

(16,588 posts)Vincardog

(20,234 posts)The banksters at ShittyBank helped them hide debt and be admitted. They did this so that they (ShittyBank)could make money on

selling Greek Bonds. The usual derivatives were in play until the whole world financial house of cards is on the line, If the Greeks default on their Domestic Bonds but not the international ones. National Bonds begin to trade at a discount to international ones .

IF they default on the International bonds EVERY bond is at risk. The problem is that banksters have spread the debt to the pension funds and everyone else is at risk.

BigDemVoter

(4,150 posts)I appreciate your input. Now I see the anger with "ShittyBank" & the entire busted, rotten system. Could it be related to our own ShittyBank who fu&*ed us with our housing meltdown?

Vincardog

(20,234 posts)care about subjugating everyone to their own advantage. They work thru many guises not the least effective are so called "Centrists"

AKA "Moderates" who always preach half measures in response to the people's demands for REAL effective fundamental change.

izquierdista

(11,689 posts)They had a big hand in saddling the Greeks with too much debt. But don't take my word, listen to the expert:

muriel_volestrangler

(101,321 posts)Greece entered the EU, with an independent currency, long before the Euro was started.

CAPHAVOC

(1,138 posts)The Greeks overspent. They are bankrupt. They have no money printing press like we do for free money. The government sector paid too much and promised too much to the government EE'S. They sold a lot of bonds and can not pay them off. They want to default. But if they do the private bondholders will want to collect on the derivitive CDS (credit default swaps) insurance. The paper is held by the big wall street banks and they can not cover the swaps. Such as MF Global. If the CDS is triggered the banks fail. And bankers go to jail. They are going through the present contortions to try and re-do the scheme so Greece can go bankrupt without triggering the CDS insurance that our big banks can not cover.

FarCenter

(19,429 posts)And don't borrow from the Mafia unless you can pay the vigorish!

Better Believe It

(18,630 posts)So it's not hard to figure out which class we support in Greece.

HopeHoops

(47,675 posts)Well, that WOULD be a crisis!

jberryhill

(62,444 posts)...don't even joke about such an ultimate catastrophe for the planet.

HopeHoops

(47,675 posts)It's like rednecks running out of cheap lite beer. I mean, we're talking apocalypse here!!!

marsis

(301 posts)and claim that they're too big to fail. That should help.

DCBob

(24,689 posts)Taitertots

(7,745 posts)The exact same thing would happen to the US (or any nation with debt) if our interest rates jumped to unreasonable levels.

It has nothing to do with the narrative on TV regarding jealosy in Germany or a "welfare state". No nation with debt can sustain in the face of imposed austerity and usurious interest rates.

Monty22001

(31 posts)Are directed by the risk. Their risk went up first, then rates went up. In this case, they earned it.

Taitertots

(7,745 posts)People acting in markets to maximize their personal profit directs the interest rates.

Lets consider the risk aspect. Why are they at risk of default? 1. Usurious interest rates 2. Economic destruction caused by austerity. It couldn't be caused by risk because the risk came after significant yield hikes.

muriel_volestrangler

(101,321 posts)It turned out they had borrowed a lot more money than had been admitted. The general world economic destruction from 2008 made things worse, as well - increased unemployment (and thus welfare payments), and decreased tax revenue. Greece was more vulnerable to this than other countries, due to having lied about its borrowing. But austerity only came after that. And the yield increases also came after.

Yo_Mama

(8,303 posts)It's so false it could hardly be falser.

The austerity came after the crash. Greece had been cooking the books for a long time, and when creditors finally realized (as a result of more honest numbers) just how huge the deficit was and how big the debt-to-gdp ratio was, rates went up suddenly. But that's because the facts the investors "knew" prior to that were false.

I quote from Wikipedia:

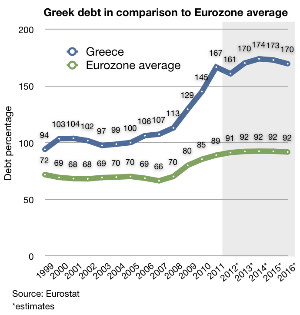

In May 2010, the Greek government deficit was again revised and estimated to be 13.6%[56] for the year, which was one of the highest in the world relative to GDP.[57] Total public debt was forecast, according to some estimates, to hit 120% of GDP during 2010,[58] one of the highest rates in the world.

As a consequence, there was a crisis in international confidence in Greece's ability to repay its sovereign debt. In order to avert such a default, in May 2010 the other Eurozone countries, and the IMF, agreed to a rescue package which involved giving Greece an immediate €45 billion in bail-out loans, with more funds to follow, totaling €110 billion.[59][60] In order to secure the funding, Greece was required to adopt harsh austerity measures to bring its deficit under control.[34]

Greece was accused of trying to cover up the extent of its massive budget deficit in the wake of the global financial crisis.[35] This resulted from the massive revision of the 2009 budget deficit forecast by the new Socialist government elected in October 2009, from "6–8%" (estimated by the previous government) to 12.7% (later revised to 15.4%).

In 2005 the EU changed accounting rules, which caused the Greek economy to look considerably worse. But after that, the government seems to have cooked the books. So what looked like a country that had to careful about new debt turned into a bankrupt country all of sudden:

Here is a working paper from the Bank of Greece, which is hardly in the business of spreading anti-Greek propaganda and indeed manages to present a remarkably rosy outlook on Greek finances, plus ignoring the awkward question of restated finances.

http://www.bankofgreece.gr/BogEkdoseis/Paper2011124.pdf

What they have to say disproves your statement.

Then came a double shock in the autumn of 2009. Two developments combined to disrupt the relative tranquility of Greek financial markets. First, in October the newly elected Greek government announced that the 2009 fiscal deficit would be 12.7 per cent

of GDP, more than double the previous government’s projection of 6.0 per cent.7 In turn, the 12.7 per cent figure would undergo further upward revisions, bringing it up to 15.4 per cent of GDP8. Second, in November 2009 Dubai World, the conglomerate owned by

the government of the Gulf emirate, asked creditors for a six-month debt moratorium. That news rattled financial markets around the world and led to a sharp increase in risk aversion.

In light of the rapid worsening of the fiscal situation in Greece, financial markets and rating agencies turned their attention to the sustainability of Greece’s fiscal and external imbalances. The previously-held notion that membership of the euro area would

provide an impenetrable barrier against risk was shaken. It became clear that, while such membership provides protection against exchange-rate risk, it cannot provide protection against credit risk.

Effectively, private Greek creditors are now being stuck with about a 70% loss. Had they taken the loss earlier or if the ECB bonds were to be included, the writedown would be less, but it would have been over 40% had it occurred at the end of 2010. The current writedown for private creditors outside of Greece will eventually be close to 85%. That's credit risk for ya.

Credit risk is the risk that the borrower cannot pay back the loan. When the Greek government was understating debts and expenditures, lenders looked at the higher-than-average GDP growth rate and thought that Greece basically had it under control, because current debt-to-income ratios (GDP) are a basic measure of sovereign credit risk. Since that was not apparently increasing, creditors were not charging much extra to lend to Greece. Nor did they suddenly push up as Greek debt rose above the 100% mark, but in part that's because they didn't have the figures early on.

Taitertots

(7,745 posts)Why don't you read my post and respond to it?

dipsydoodle

(42,239 posts)Joining the EU using fudged figures for entry and then joining the Euro gave them access to loans at far lower rates than they had paid in the nineties. Use of the funds allowed doubling of the wages of their public sector across a 10 year period. They have an aging population, as do we all, and the most beneficial pensions for public sector workers in the world at over 90% of actual final salary. Add to that the fact that those pensions can be inherited by a single daughter. Your cousin was right in those repects.

Their overall historic reluctance to pay personal tax has never wained and has compounded the situation.

Funds which should've been set aside for debt repayment were blown elsewhere. Now they are screwn. Part of the this bail out deal is that debt repayments / interest are made quarterly with first priority above any other expeniture requirements or liabilities monitored by EU staff on the spot in Greece.

Its not all over yet anyway - there's an FT article today which says they've only got 7 days to implement the plan. Not all affected have accepted the haircut of 50% of current private debt either.

Canuckistanian

(42,290 posts)Comes from the translation of "Goldman Sachs"

TBF

(32,064 posts)Athens 15/7/2011

Political Bureau of the CC of the KKE

Published in Rizospastis, organ of the CC of the KKE on 17th July 2011

The workers are not responsible and must not pay for the public debt. The propaganda of the capitalist power attempts to obscure the real causes of the inflation of the public debt such as:

The fiscal management of the governments of ND and PASOK to the benefit of the monopoly groups in the post-dictatorship period. Basic common characteristics are the legal tax cuts for the profitability of big capital, extensive tax evasion and the goldmine of state support for the business groups (development laws, national participation in the 2nd and 3rd CPS and more generally in EU funding etc). That is to say, during all the previous years, the state borrowed in order to serve the needs of the profitability of capital and now it is calling on the workers to pay.

The public debt dramatically increased during the period of the first PASOK government from 26.9% of GDP in 1981 to 64.2% of GDP in 1989. In the period 1981-85 the government followed a social-democratic form of management with the aim of assimilating a section of the workers through clientelist hiring to the public sector, the nationalisation of problematic private businesses etc

Later on there were measures of a restricted fiscal policy for the workers, while there was a continuation of the scandalous state support of the business groups through state subsidies, the allocation of public works, outsourcing, public-private partnerships, with the most glaring example being the counterproductive state funding of the Olympic Games in 2004. The public debt from 97.4% of GDP in 2003 reached 106.8% in 2006.

The massive spending on armament programmes and missions (e.g. Bosnia, Afghanistan), which do no serve the nation’s defense but the plans of NATO. A characteristic example is that in 2009 Greece’s military spending was 4% of GDP, in comparison to France’s 2.4% and Germany’s 1.4%.

The consequences of the Greek economy’s assimilation into the EU and the EMU. An example of this is that significant sectors of manufacturing have been on a course of shrinking which have been on the receiving end of strong competitive pressure and have been reduced (e.g. textiles, clothing, metal, shipbuilding industry and the manufacture of other means of transport). The expansion of the trade deficit and the rapid increase of imports from the EU had a corresponding impact on the inflation of public debt. The trade deficit has been transformed from 4% of the GDP from 1975-80, to 5% in 1980-85, to 6% in 1985-1990, to 7% in 1990-95, to 8.5% in 1995-2000, and it exploded to 11% of the GDP in the decade 2000-2010, with the accession of the country to the Eurozone. The Common Agricultural Policy led to the agricultural balance of payments, from a surplus of 9 billion Drachmas in 1980, to a deficit of 3 billion Euros in 2010, transforming the country into an importer of food products. The deterioration of the trade deficit was followed by the “external” balance of payments (balance of current accounts), that is to say the overall “annual fund” of the country with other countries, which from a surplus of 1.5% in 1975-80, was transformed into a 0.9% deficit in 1980-1990, the deficit increased to 3% of GDP in 1990-2000,. This deficit exploded with the accession of the country to the Eurozone to an annual average which exceeds 13% of the GDP in the decade 2000-2010, leading to an increase of state borrowing to service the external balance of payments. The profitable activity of ship-owning capital did not reverse this situation.

The reduction of interest rates on loans after the accession to the EMU also had an impact by facilitating the increase of public borrowing of the Greek government to the benefit of big capital.

The high rate of development, on average 2.8% during the decade 2000-10, was the mortgage of the working class and popular income which we are paying today. Of course this process is not exclusively Greek. The increase in the trade deficit of the USA in the decade 1997-2007 is also connected to the increase of the annual public deficit and of course to the public debt.

The lending terms (interest rates, duration, conditions of repayment) led to the increase of the interest from 9 billion Euros annually at the beginning of the decade, to 15 billion Euros in 2011, while certain studies place the overall spending (interest and amortization) which serve the public debt at 21.3% of the GDP in 2000 to 40% of the GDP in 2010.

The impact of the capitalist crisis on the Greek economy.

The outbreak of the crisis contributed to the increase of the annual public deficit and the inflation of the public debt. On the one hand through the reduction of tax income due to the reduction of economic activity ( e.g. reduction of turn-over, closure of businesses, increase of unemployment etc) and on the other hand due to the new state support packages for the banks and other monopoly groups. The impact of the crisis on the inflation of the public debt can be seen throughout the whole of the EU, as in the last four years the overall debt increased by 34%...

Much more here: http://inter.kke.gr/News/news2011/2011-09-06-pb-crisis

applegrove

(118,682 posts)not have allowed them to use the euro as their currency had they known. Then, once they used the euro as currency, they borrowed against the intrinsic value the euro had as the currency of Europe to get more money. They used the borrowed money to give people, a lot of people, phony government jobs or early retirement. Greeks don't trust each other. Neither should we right now. Though there was some banking crap going on, it wasn't of the subprime kind. It was the people and the government who scammed the EU.