General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums'Eminent Domain for the People' Leaves Wall Street Furious

http://www.commondreams.org/headline/2013/08/07-4Published on Wednesday, August 7, 2013 by Common Dreams

' Domain for the People' Leaves Wall Street Furious

Housing justice advocates hopeful about innovative Richmond plan to use public seizure laws to save underwater homes from foreclosure

- Sarah Lazare, staff writer

Using the authority of state government to actually help people has Wall Street bankers in a panic, spurring threats of aggressive legal retaliation against the town of Richmond, California simply for trying to help some of its struggling homeowners.

'Eminent domain' has long been a dirty term for housing justice advocates who have seen municipalities invoke public seizure laws to displace residents and communities to make way for highways, shopping malls, and other big dollar projects.

But in Richmond, city officials are using eminent domain to force big banks to stop foreclosing on people's homes in an innovative new strategy known as 'Principle Reduction' aimed at addressing California's burgeoning housing crisis.

Richmond became the first California city last week to move forward on a plan that has been floated by other California municipalities to ask big bank lenders to sell underwater mortgage loans at a discount to the city (if the owner consents), and seize those homes through eminent domain if the banks refuse. The city has committed to refinancing these homes for owners at their current value, not what is owed.

City officials launched this process by sending letters in late July to 32 banks and other mortgage owners offering to buy 624 underwater mortgages at the price the homes are worth, not what the owners owe.

..more..

think

(11,641 posts)Karma....

ljm2002

(10,751 posts)...and when I read it, my mind conjured up an image of Wall Street as a ravenous, slavering, rabid wolf, snarling at We The People.

Screw 'em. I hope Richmond wins this round and I hope a stampede of cities follows suit.

We have to find some way to make the laws work for the people. The bank bailout was a joke, with 100% payouts on the banks for their risky practices, and zip for the Little People, as per usual. The bailout was the last time in recent memory when left, right and center were clearly united: we all opposed the bank bailout. Senators were admitting their feedback was 90% against the bailout... and yet, when the vote came down, we all know what happened.

Our representatives in Washington don't work for us. At least the vast majority of them don't. Looks like Richmond's city hall is trying to do just that. I so hope they succeed.

K&R

G_j

(40,367 posts)and creative..

May it be a model for others!

Skink

(10,122 posts)HiPointDem

(20,729 posts)PowerToThePeople

(9,610 posts)holding the empty bag at the end of the ponzi scheme.

dkf

(37,305 posts)All the better to crash the pension system u guess?

PowerToThePeople

(9,610 posts)Statistically, I would venture to guess it is a 1%er. Let me google the numbers, I do not have them close at hand.

dkf

(37,305 posts)PowerToThePeople

(9,610 posts)Looks like I will likely have to dig at it.

http://www.federalreserve.gov/releases/z1/Current/

But, I agree that someone is going to lose on the deal. And that someone will not be the bankers. All risk is mitigated away to other parties, they just take their cut win or lose.

dkf

(37,305 posts)US retirement assets totalled $17.4 trillion dollars by 2007 accounting for almost 40% of all household financial assets across the US (ICI 2007). Of those retirement assets $4.6 trillion were held in Individual Retirement Accounts (IRAs)1 and a further $4.4 trillion were held in employer-based defined-contribution retirement plans. US Government pension plans including federal and state government plans held $4.4 trillion of assets, while private defined benefit employee plans held $2.4 trillion (ICI 2007 pp.2)

http://web.mit.edu/is08/pdf/Hebb_Beeferman.PDF

PowerToThePeople

(9,610 posts)dkf

(37,305 posts)Those investors will be made whole by you and me the taxpayer. Whose budget that comes out of is the other side of the story.

Bully Taw

(194 posts)I know that everyone wants this to turn out well for all the average people, but average people are going to get screwed either way.

Ikonoklast

(23,973 posts)involved with their investing in finance.

Crash the pension system, my ass. Finance already almost DID THAT.

Don't you tire of being their stooge, you really don't change one thing doing this.

GoneFishin

(5,217 posts)rhett o rick

(55,981 posts)think we should leave Wall Street alone because holding them to task might (maybe) hurt pensioners. I dont agree.

Side with the 99% and not Wall Street.

JimDandy

(7,318 posts)Let me try THIS ONE

JimDandy

(7,318 posts)You were prescient.

LuvNewcastle

(16,846 posts)There are some great ideas to be found on DU.

Orrex

(63,210 posts)You're right--it's often surprising to see DU ideas embraced by the mainstream long after the fact.

Rain Mcloud

(812 posts)To coin a phrase from their sycophant's play book:

"Get over it!"

Spitfire of ATJ

(32,723 posts)And then declare it open to homesteading and coordinate with Habitat For Humanity.

Oh wait,...that would be a real solution.

That can't happen.

TxDemChem

(1,918 posts)Financially, I don't know how it would work, but I like the way you think.

Spitfire of ATJ

(32,723 posts)This would stop people from becoming slum lords.

TxDemChem

(1,918 posts)If Detroit can find a way (financially) to take ownership of those homes and allow others to come in and buy them at reasonable prices, that would be great.

Like I said, it sounds like a great idea. I just hope Detroit would be able to pull it off. I also hope other cities follow suit with this eminent domain action.

Spitfire of ATJ

(32,723 posts)Including the issuing of bonds.

Like I say to people, look on the other side of the river at Windsor.

Detroit got the way it did as part of a PLAN to MAKE the city collapse. Visit Lansing some time and they act like Detroit DESERVES to suffer.

TxDemChem

(1,918 posts)Look at you spitting knowledge! Thanks for passing along this information. I'm sure I'm not the only one who has learned more from this thread.

Lee-Lee

(6,324 posts)And it is so cheap you really don't even need to seize it in many cases.

All the city really needs to do to encourage people to buy these properties is have a program to forgive the back taxes- they are often much higher than the cost of buying the property, and the city is aggressively reassessing tax valuations any time someone rehabs a property and charging even more.

Forgive back taxes and freeze tax valuation at current assessment for the next 5 years and you would see a pretty good increase in people investing in these properties I bet.

Spitfire of ATJ

(32,723 posts)Lee-Lee

(6,324 posts)And a rather unresponsive, difficult to navigate tax collectors office making it hard to be sure what you would owe if you buy.

Spitfire of ATJ

(32,723 posts)Which do you want? To improve the town or to raise money?

Liberals have a saying that sends Right Wingers through the roof....

"It's only money."

JVS

(61,935 posts)Remember the toxic assets that the banks had/have after the real estate crash? Those mortgage based securities. Detroit's back taxes are another toxic asset, meaning that on their books they are owed money totaling $XYZ dollars but they're never going to get paid that money. Neither banks nor cities like to acknowledge their toxic assets. In the long run, Detroit is going to have to face the fact that they aren't going to get that tax money because nobody is interested enough in being there for them to collect it. But in the middle of a solvency crisis, it is unlikely to be politically tenable to make a gift of tax forgiveness to newcomers while not being able to pay off city pensions and bond holders. The only way I could see it being anywhere near fair is if they are able to make sure that the pensioners and bondholders would be the beneficiaries of the tax forgiveness program, which would be complicated.

JVS

(61,935 posts)of properties based on back tax debt alone.

Spitfire of ATJ

(32,723 posts)KansDem

(28,498 posts)...F*ck 'em! Now the tables are turned! ![]()

L0oniX

(31,493 posts)DeSwiss

(27,137 posts) - Which wasn't gonna work anyway.

- Which wasn't gonna work anyway.

K&R

Lee-Lee

(6,324 posts)as in, will any lenders be willing to make loans in these cities going forward, knowing that they stand the risk of taking a huge loss any time values drop and the municipality seizes the property just to refinance the homeowner.

It certainly will have to factor into their risk analysis going forward. They will likely either refuse to lend in these areas or set much higher requirements for down payment and credit scores.

Gravitycollapse

(8,155 posts)Lee-Lee

(6,324 posts)Yeah, it encourages those holding the notes right now to refi and take the small loss instead of a potential bigger one. Makes them choose between one loss or the other by taking the possibility of the homeowner still paying out all the way, either by staying longer or the home values rising so it is no longer underwater, off the table.

But that is short term for existing mortgages.

Long term, for new mortgages, they will likely be looking at what happened and be much more reluctant to underwrite a mortgage in an area that does this. They likely will be much tighter in lending standards to avoid ever being put in that situation again- making it much harder for middle class people to get a loan.

Gravitycollapse

(8,155 posts)I'm not frightened by the prospect of banks going elsewhere. Fuck 'em.

We should be encouraging responsible loans, not absolute proliferation. Not everyone has the money to finance a house. Whether or not you think that's fair is beside the point. Unless you want to grenade the housing market again, we simply cannot provide a house for everyone with a social security number.

Make it so banks are not legally allowed to give out such unstable loans and we will not have to face the long term possibility of banks losing more upended mortgages to state intervention.

SomethingFishy

(4,876 posts)And that's it in a nutshell..

Let me tell you, not only do banks give unstable loans, they try with all their might to force you to take a loan larger than you can afford or need. They want to foreclose on you..

Regulation is desperately needed.

bigapple123

(23 posts)(1) They can't force you to sign a loan if you don't want to.

(2) Why would they want to foreclose on you?

If the house is only worth $400,000 and they make a loan for $500,000, even if they foreclose on you and assuming they can sell the house for $400,000, they are still out $100,000 which has already gone to the original seller. In the meantime, during the foreclosure process, they may have to wait for up to one year with no payments and have to pay legal/maintenance costs.

Gravitycollapse

(8,155 posts)bigapple123

(23 posts)means that when the mortgage is already delinquent, the bank would rather foreclose than reduce principal.

However when writing a new mortgage, the bank would much rather it perform than have it default and be foreclosed. I assumed that the post I was replying to meant that banks have this big evil plan to lend in excess of the value of the house so that they can later foreclose on the house. No, not really. They actually want borrowers to pay their monthly mortgages.

hueymahl

(2,496 posts)The use of logic when talking about banks will get you labeled a Paulbot republican plant. The correct post is "all banks are all bad all the time because they are run by banksters"

Lee-Lee

(6,324 posts)But I suspect the pendulum might swing way too far toward tightening lending standards in these communities.

And if fewer buyers can qualify to buy in a community, that reduces demand, and causes values to drop...

I really hope they sat down and looked at all the possible long term implications of this with people who understand the real estate market before they started it. I fear they did not and just went for the short term gain, financially and politically.

Gravitycollapse

(8,155 posts)And, again, I refuse to give any slack because we fear the banks will run away. I refuse that as an option. We must refuse to be held captive by these financial vampires. If they want to go somewhere else, show them the door and wish them the worst.

Lee-Lee

(6,324 posts)What is your solution for those who want to buy a house when nobody will lend?

Gravitycollapse

(8,155 posts)And hopefully these fictitious prospective homeowners will understand that we've all dodged yet another bullet by white-collared thugs.

dkf

(37,305 posts)Who in their right mind wants to lend there?

Morganfleeman

(117 posts)Not defaulted loans. By definition if the customer has always paid and continues to pay, the argument of the loan's instability doesn't fly. Such a customer has clearly shown the requisite affordability to maintain payments.

7962

(11,841 posts)jtuck004

(15,882 posts)They are criminals, and if they want to take their little criminal enterprise elsewhere, don't let the bank vault door hit 'em in the ass.

We have the GSE's, unless the PTB decides to gift wrap them and hand them over. Otherwise there will be others who will step in. And if they are not local, there are investors all over the world who will take that "chance", which is, today, a far better risk than it was in past years.

Frankly, we should chase them out and start over.

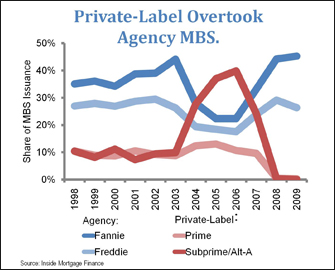

bigapple123

(23 posts)these other investors are already involved in the private label mortgage securities market. they will suffer losses if cities start seizing mortgages. why would any investor either make a mortgage loan directly or buy these securities if so?

who will ever lend to home borrowers again?

jtuck004

(15,882 posts)But until they do, they will always be beholden to and kissing the ass of their Masters.

Btw, if you had paid more attention in 8th grade history to the lesson instead of sticking gum in the hair of the kid in front of you, ![]() you would be aware that this is the very same situation that FDR walked into.

you would be aware that this is the very same situation that FDR walked into.

That is why we have Fannie Mae and, later, Freddie Mac. Because the crooked bankers got greedy, and wouldn't loan, pretended they were the only source. So the government, (that's us, you and me and them, btw) stepped in and made life better for the people it is supposed to serve. Us, again.

(I digress, but this is, partly, why it is so pathetic and sad that the current administration wants to make a gift of these now profitable institutions, who are netting money back to the U.S. treasury, to the very crooked banks that lured them into their little Ponzi scheme and breached the trust of the American people.)

Now, back to the show...

You can read about how this so "necessary to lend to home borrowers private money else no one will" played its part in bringing us the current financial crisis, if you are so inclined, here

And, just in case you missed it, there are whole countries out there that just love to loan to Americans no matter how crooked or lopsided or screwy the deal. When Goldman, et al, exhausted the pool of American suckers in the ongoing criminal enterprise they began in the 2000's, they opened up the doors and borrowed money on nothing but air, again, from investors in several countries, before they tried to screw them too, and the government had to step in, again.

Those same people are just begging for investments today, including China, and please don't fool yourself that they are not.

Don't fall for the uninformed and uneducated opinion that crooked banks are the only source out there. If they can make you believe that, you become nothing more than their house boy, their lackey, a boot-licker to the stars.

(1) To your point about other countries, well once bitten twice shy? I cannot imagine any investor ever willingly buying mortgage pools from a city that seizes mortgage loans using eminent domain.

(2) At the end of the day, someone needs to originate the loan, even if it's passed on to other end investors. That almost certainly means a bank or a mortgage broker. Who else has the community branches and on the ground presence required to appraise home values, meet with borrowers, sign legal documentations, etc.?

(3) The GSE's do not lend money directly (neither does the government or you or me). They buy conforming loans from the originators, securitize them, keep some and sell the remaining to investors (with guarantee).

The problem wasn't that the banks were not willing to lend. They were all to happy to make loans and pass it on to other investors through agency and non-agency securities. Where traditionally they would have kept the loans on their balance sheet (taken on the underwriting risk), now they have every incentive to make loans a volume business to earn the origination fees. Hence all the liar no-docs loans. After all, if the loan defaults, it's someone else's problem (there's this whole reps and warranties settlement going on).

So, if the banks stop lending because cities start seizing mortgages, there really is no one else available to originate the loans. You can't go to the GSE's to ask for a loan.

jtuck004

(15,882 posts)They are seizing them because the banks are not working with them, not because they just don't have anything better to do. The banks want to act like they are the only game in town, and no one else knows how to play. BS.

The banks aren't special. We have lots of smart people with access to a little capital that can put together a bank. And maybe even run it as if honesty mattered. There are lots of out of work bankers, engineers, lawyers, etc., all of them fully capable of putting together a home loan corporation, or a few thousand of them.

The crooked banks started making it a "volume business" in 2000 solely for the fees. There is plenty of documentation that they knew for a fact that the bottom would fall out of their pyramid scheme, and they passed that on to others. So that's nothing new.

You are correct, when it is to their advantage they will hold properties. As a matter of record, they are holding about 7 million bank-owned properties off the books today just to manipulate the prices in the market, fooling people into thinking the prices they are getting, just because there are loans, are real. They aren't, and as the money the feds are paying them dries up, and we turn a few more million full-time jobs into part-time jobs, people will find that their homes are going to stagnate or lose value for perhaps the next decade or longer. This is just delaying the inevitable, and the banks will profit from it as long as we let them. When that comes to a screeching halt, and it will unless the government continues to underwrite them on the backs of 50 million people on food stamps, another 100 million within 200% of poverty, a decaying infrastructure, and a trillion dollars in stupid, I mean student, loans, that are going to cause great poverty or a financial crisis of its own, then we will fix the problem. And if we do it without the banks, so much the better, thieving bastards. (Not all of them, perhaps, but enough).

We can most certainly put orgs together to provide financing, and the GSE's will underwrite them. And if the current administration, say people like Elizabeth Warren and a few others get involved, the GSE's can go back to their previous structure before they became profit-making entities for shareholders, and the they can underwrite homes just like they did when the banks screwed everyone over and Fannie came into existence in the first place.

The banks would like us to believe they are the only game in town, but they aren't. Will we go through more problems to get it straightened out. Absolutely.

But again, it's either that or we stay on the plantation. And that's never the best alternative.

dkf

(37,305 posts)They don't want to pay the current value, they want it at 80% of the current value so the homeowner has to get a loan for 95% and the city and the wheeler dealer split the profit.

This is a reallocation to the entity and the city away from pensioners who are the most likely owners of fixed income securities.

jtuck004

(15,882 posts)in the current scenario they may get nothing. 10 million families across the country have taken a huge hit from foreclosures, with some estimates even higher, millions upon millions of people have lost jobs and careers and retirements, and this is just a small part of that.

The only ones who seem to be sitting phat on all of it are the thieving banks and mortgage makers that caused the current financial crisis in the first place, with no way to recover after 30 years of corporations ridding us of jobs by sending them overseas and cutting the heart out of the ability to create wealth by the middle-class.

Current value is so flippin' bogus anyway. How much value is there as banks withhold 7 million reos from the market to manipulate the prices of the remaining upward, with the government putting $85 billion a month into this continuing Ponzi scheme while letting infrastructure crumble, 50 million remain on food stamps, student loans that will never be paid off languish, schools close and teachers sent home...Detroit is going bankrupt, and part of that is because they owe the sellers of creative derivatives their money, and the losers will be the pensioners from the city.

Pensioners, and everyone else, are losing as we move forward as a poorer country, so they aren't a class unto themselves. At least this way there might be a chance for a few home owners to recover a bit as well, as opposed to none.

I agree with you, but the banks need to work with them or be taken out of the picture.

dkf

(37,305 posts)You think THAT isn't a dangerous precedent? So much room for corruption.

jtuck004

(15,882 posts)the victims of previous corruption that has already taken place out in the cold. And there will be a lot of eyes on this, so perhaps...

Something else needs to happen, and at least they are stepping up and trying.

dkf

(37,305 posts)And this city thinks it will prevent blight, but what if it creates blight as they've made it an undesirable place to do business or to move to. Who wants to buy a house where lenders are afraid to lend? That's one more uncertainty. Maybe lenders will ask for 30% down to prevent being under water. Will they shut down 2nd mortgages and access to emergency funds?

I wouldn't want to live there. Too many unknowns.

jtuck004

(15,882 posts)investments by the wealthy, and the large hidden inventory the banks are using to manipulate the larger market with, this so-called recovery would be dead in the water. There are at least tens of thousands of homes (probably wildly conservative) that the banks have left, in foreclosure, for 2 and 3 years, else those homes would be driving the values down as well. Home ownership is at 1996 levels yet we have 50 million more people, and even POTUS is suggesting that the rental market is so important that we need to make allocate attention to that.

That doesn't sound like much of a recovery.

Those cannot go on forever, and unless the wealth-generating capacity of the larger middle-class reappears in something new we can exploit, like natural resources or people or something, there is nothing but pain ahead.

There will always be someone to loan, the only question is cost, and perhaps new structures to get away from the old ones that don't serve anyone but themselves any longer.

And while one can say they don't want to live "there", I'm not sure that the larger problems don't connect all of us in some way. This earth is becoming very flat.

That whole "undesirable place to do business" is a tired argument usually used by businesses that doesn't want to pay its fair share of the costs of making a place liveable. WA state taxes the gross of your business, whether you make any profit or not. Yet business starts up here all the time. Is Houston the leader in such things? Sure, but no one has enough money to pay me to live there.

You do have a point, in that the city may or may not make it worse. But it is bad now, and just leaving everything as it stands to play out may not necessarily be the best answer.

dkf

(37,305 posts)rhett o rick

(55,981 posts)dkf

(37,305 posts)They are not only saying "no" but "hell no".

They don't want the risk of making loans.

I like: "don't let the bank vault door hit 'em in the ass. "

dkf

(37,305 posts)Lee-Lee

(6,324 posts)If lenders see jurisdictions that do this as an increased risk of taking a loss on a loan, they either won't loan or will only loan to the very, very well off who have a big down payment.

That will shut most working people out. That will reduce demand. That will make housing prices drop....

I was cheering this at first, but the more I think about the long term effects the more I worry.

rhett o rick

(55,981 posts)Dont you agree? Or do you side with BoA?

dkf

(37,305 posts)The risk for a Bank is the same as a credit union.

And right now mortgages ARE pretty much the government aka Fannie and Freddie. Obama wants to get OUT of that area. If the federal government wanted to take those losses it could do so and explode the deficit.

And credit unions don't make a profit so if they are such good deals why don't they have all the mortgages? In reality their workings aren't so different from banks in terms of costs and rates.

Yo_Mama

(8,303 posts)You would just wipe them out.

If the economy goes bad, the credit union mortgages are backed by properties with declining values just the same as those in national pools like the Fannie ones. No lender, no type of lender, no investor can ever count on making mortgages where the underlying value of the property won't fall. The reason that mortgages have historically been so stable is that for the homeowner, what matters is the long term value of the home, not the this-year, that-year value. That matters only to Black Rock and other venture/vulture capitalists, who like volatility and profit from it. And haha, this scheme was hatched by a venture capital company that will make an awful lot of money from it, but the real way that will happen is that the homeowners who do have equity will lose it, and the equity will be transferred to those with money who can afford to buy up the properties very cheaply.

If you make it so that national pools (such as Fannie) can't buy in, then the credit unions will get wiped out anyway. And why then wouldn't they get the same treatment?

Hell, I'm not siding with BOA. I'm siding with the homeowner.

This entire scheme is vulture capitalists at their absolute abysmal worst, using incredibly stupid politicians to make a quick, big return.

Trailrider1951

(3,414 posts)in service to We the People, actual CITIZENS of the community is what? godless COMMUNISM! Those banks can go pound sand, and I hope this spreads like WILDFIRE!

Octafish

(55,745 posts)They'll crap their pants.

And if they complain, there's always the Dr. G's avenger of the people.

bigapple123

(23 posts)(1) For the most parts, banks don't really hold these mortgages on their books anymore even if they may be the servicer. The loans have long been securitized and off-loaded to other investors. Who are these end investors? Pension funds, university endowments, foundations, even mutual funds. Ultimately, these will be the investors who lose money on these securities. Put another way: would you still support the proposal if your own pension fund invested in these non-agency mortgage securities and stood to take a loss?

(2) Eminent domain requires "just compensation" which is usually "fair market value". If the mortgage trust refuses to sell these loans at a discount to the city -- that probably isn't just compensation. Which is why this could end up litigated for years.

(3) Finally, just because a house is worth less than the mortgage doesn't give the borrower the right to demand a write-down in principal. If that's the case, what's to stop people from speculating everything they own in the property market? After all, I get to keep the gains (less the mortgage) but if the price drops I can ask the bank for a reduction in the amount I have to repay. It's well known that cars lose their value the moment they are driven off the dealer's lot. Does that mean the car loan has to be written down to the fair market value of the now-used car?

quaker bill

(8,224 posts)A recent SCOTUS decision makes it clear that a new road or other tangible public infrastructure is not required. The local government can use the power for any discernible public purpose. If moving citizens out of their homes so a developer may redevelop the area is acceptable because it "improves the local economy" (as SCOTUS found), then keeping people in their homes should also pass the test for constitutionality on more or less the same basis.

Now I get the moral hazard argument. However this argument seems to get real traction only when the working class might benefit.

This is a creative solution. It provides a consequence for failure to work with borrowers. The consequence is real as abandoned homes plummet in value and impact values of adjacent properties as well. The eminent domain taking simply causes the mortgage owner to realize the actual losses now.

Morganfleeman

(117 posts)The issue here is that the private institution that Richmond and other municipalities are attempting to partner up with is looking to apply this only to performing loans. These are borrowers making full payments, and the rationale is that they will eventually go into default which will lead to blight.

That would be unprecedented.

First off, I highly doubt Richmond has the expertise to project which borrowers will go into default (and to suggest 100% of them will is ludicrous). There is no supreme court precedent to justify eminent domain in the case of potential blight. The one case on point dealing with this was at the district court level in California where the court noted potential blight is insufficient. If potential blight was sufficient it would justify takings far beyond those already authorized by the Takings Clause.

Xithras

(16,191 posts)The Court upheld that the general benefits of prospective economic growth are sufficient to satisfy the Takings Clause. Because a mortgage is merely property under our law, and can be seized like any other property, the city of Richmond merely needs to demonstrate that the seizure of the mortgages generally benefits the community. Kelo vs. New London also established the acceptability of seizing property even when the intent is simply to transfer it to another private entity.

The distinction between performing and nonperforming loans is irrelevant from a legal perspective. The city can make a claim on any mortgage it wants to, so long as it can demonstrate a benefit to the city as a whole. As for the amount of money they're offering in return, the city merely needs to offer the current market value of the property. United States v. 50 Acres of Land (1984) the Court found that "just compensation" is "the market value of the property at the time of the taking contemporaneously paid in money." In other words, the city merely needs to offer what it is worth NOW, not what it was worth when it was created or sold.

quaker bill

(8,224 posts)They just need to conclude that keeping the current residents in their homes with more reasonable mortgage payments is a "public purpose". They can then "take" the property and then "sell" it back to the current occupant.

Morganfleeman

(117 posts)The stated public use/purpose has to support the taking. And the stated public purpose here is mitigating economic decline and potential blight from prospective foreclosures. By definition you are not mitigating economic decline if you don't effect a taking on properties where the borrower is MOST likely to default, but you do so with respect to loans where the borrower is performing. So yes, the distinction does matter.

As for your just compensation point, again, would completely disagree. What you fail to to see is that the taking relates to a contractual right, i.e., a right to payments on an underlying mortgage. This is completely distinguishable from other takings cases where a property was condemned or seized. What's relevant is the value of the mortgage (See Louisville Joint Stock Land Bank v. Radford for a relevant case). A bondholder does not own the home. It owns contractual rights to cashflows relating to a home. There is a significant difference. I know lawyers have trouble with the numbers side of these issues, as I did before I moved to the commercial side, but it's fairly straightforward, what's being seized is a financial asset (not a real property asset) whose value is contingent upon various parameters, including interest rate, interest rate expectations, remaining term, payment history, expected default and loss based on macroeconomic assumptions. Post Lehman I've spent my career building these valuation models, and if it were as simple as appraising the house value, my job would be a lot easier. It's not merely as simple as what the house is worth. And as much as we've improved valuation techniques post Lehman, there is still wide margin for error, so a flat 20% haircut that's being proposed, is completely detached from reality.

The private institution MRP that is encouraging municipalities to take this approach is well aware that this simplistic valuation methodology is a farce. How do I know? Because their key officers, Steve Gluckstern, Graham Williams and John Vlahoplus all come from the financial industry, banks and funds and anyone from the industry is well aware of all the standard pricing techniques, whether it's regression modeling, monte carlo simulation, transition state models. They're simply hoping for an epic payday buying performing loans at large discounts. This is what also distinguishes this case from Kelo. Kelo involved a taking that was part of a comprehensive urban renewal plan, and there is no such plan here. And Kennedy specifically noted that a one-to-one transfer of property in the absence of an integrated plan would be potentially suspect (and Kennedy was the deciding vote in Kelo). The majority specifically stated "Such a one-to-one transfer of property, executed outside the confines of an integrated development

plan, is not presented in this case."

Let's not even get into the fact that another stumbling block your argument runs up against is that the California takings clause is in some respects more restrictive than the Federal takings clause.

Let's also not get into the fact that you also have potential impingement on interstate commerce issues as the promissory notes that are at risk of being seized are located outside the actual eminent domain boundaries of Richmond or the other municipalities involved and are governed by the laws of various other states (e.g., New York, Delaware).

This issue is infinitely more complex than you make it seem.

Morganfleeman

(117 posts)As a lawyer I structured many portfolio sales and securitizations. And when I went to the business side of the industry I also worked with banks, financial institutions, funds, so this is an area I know a lot about as it's been my whole career.

Your point (1) is spot on. The "vulture fund" universe of investors is actually de minimis relative to the long term bond holders that you normally see in these bonds, which are pension funds. There is no free lunch, so while I think principal reductions need to happen in many cases, doing so will hit pension funds, which are already underfunded.

Point (2) is also a valid point. Just to add to it. It's not merely the house value that's relevant, but it's also the net present value of any future income stream via interest payments. Because it's not merely the house that's being seized, it's the mortgage itself which is suffering impairment and just compensation applies to that lost value. A mortgage where the borrower has a perfect payment history but yet is underwater may still be worth significantly more than what a municipality is willing to offer for the underlying property, because if the loan continues to pay according to schedule the investor will ultimately receive the full value of the investment. Consequently, just compensation would be heavily litigated.

There is also the practical element that you will likely see investors ask to exclude loans from any City that has effected an eminent domain plan. At a very minimum, borrowers in those areas would likely be paying substantially higher rates due to the risk premium attached.

While there is a basis for eminent domain, it's not a slam dunk case from a constitutional perspective. Even the Kelo case decided by the Supreme Court, which was viewed as an overreach by many legal observers, limited the application of eminent domain when private parties are involved “the sovereign may not take the property of A for the sole purpose of transferring it to another private party B, even though A is paid just compensation.”

And this is what we have here, because ultimately there is a transfer between two private parties with the municipality as the intermediary. I'm skeptical that this would pass muster with the current Court.

Another issue, is that this could not apply to FHA backed loans (even if it did pass constitutional muster). A state or a city could not effect a taking or a tax on the Federal government even if the just comnpensation requirement were met. Whether it could apply to Fannie Mae or Freddie Mac backed loans is also debatable because while they are private companies they are currently in government backed conservatorship.

Yo_Mama

(8,303 posts)If the properties were going into foreclosure the city would have a better argument, but as it is it is just taking private property with a very slim public justification, or rather trying to force those who bought these securities to sell their debt below market value with the threat of taking action.

To me the obvious results will be urban blight in Richmond, because the banker who'd write even a commercial mortgage for something in the area would have to be insane, and trusts aren't going to buy mortgages in the area.

Fannie Mae is among those entities authorizing the lawsuit, which I believe will be won after a long and expensive battle.

Those who will win in the end will be vulture real estate investors, because people in the area will be forced to sell to those with lots of money, and those people drive a hard bargain. So the actual taking is also going to come at the expense of older homeowners who have a lot of equity in their homes are are going to be beat out of it. That just sucks.

In the end, the trusts will win. But in the five year interim, the homeowners in the area are the ones who bear the brunt of a highly questionable policy choice. The road to hell is paved with good intentions.

WillyT

(72,631 posts)G_j

(40,367 posts)to catch on.

Occupy eminent domain!

BuddhaGirl

(3,607 posts)Saw her speak last weekend at the Chevron refinery protest... she is awesome ![]()

G_j

(40,367 posts)Samantha

(9,314 posts)The loss on the difference between what is owed on those homes and the new mortgage for the current market value will be taken by the banks.

I have to say it is indeed a thing of beauty to see the people fighting back against the financial community to right the wrongs the banks and their bundlers continue to do. Bravo.

Sam

bigapple123

(23 posts)the losses will be taken by investors in mortgage backed securities.

Who are these investors? Pension funds, university endowments, foundations, mutual funds.

DontTreadOnMe

(2,442 posts)those are the people that needs to lose on their "investments".

Pension funds? You really think they will there for you in 20 years?

Samantha

(9,314 posts)given by the local official involved in this. Seems like that "hit" could trickle down to the investors though as you say.

Sam

brewens

(13,585 posts)that strategy is poison to the crooks on Wall Street.

happyslug

(14,779 posts)One aspect of the Bankruptcy Reform Act of 2005 is that liens (including mortgages) on real property (i.e. homes) can NOT be reduced to the value of the property. Prior to passage of the Bankruptcy Reform Act of 2005, a person could file a Chapter 13 and in the 13 reduce the mortgage to what was the value of the property (and then switch to a Chapter 7 to discharge the other debts of the debtor).

This was made illegal in 2005 (along with stopping evictions from rental property when the eviction was for non-payment of rent).

Under Eminent Domain, all the city has to pay is what the property is worth, NOT what is the total liens on the property. Once the city owns the property, all it has to pay is the value of the property. If that does NOT pay off the Mortgages on the property, that is the bank's loss. The Bank could then sue the home owner for the difference between what they received and what the total amount of the mortgages had been, but since that "deficiency" is a general claim on the home owner NOT the home itself, it can be discharged in Chapter 7 Bankruptcy.

The cost to the City in minimal, all it has to pay is the value of the property and put its own mortgage on the property.

The down side is that it is expected for home values to drop some more within the next six months, but if enough cities do adopt this program, that devaluation may be avoided (i.e. no homes sold under distress, thus home values are maintained). If I was a City I would try to get the home owners to put up $25,000 as a down payment, the reason being is that is the equity value one can have in a house and keep the house in Chapter 7 Bankruptcy (provided the mortgages and taxes are paid up to date).

$25,000 in most homes will protect the City from any drop in home value unless the drop is drastic (and if the drop is drastic, the City will have other problems, such as how to pay pay for anything for tax revenues will just disappear in such a drop). On the other hand the City may be willing to accept a potential loss of $25,000 per home, just to keep the family in a home. Each City will have to make that decision, in many cities the later may be the better choice.

Side Note: The $25,000 is for one person, it is higher for a couple AND it is income indexed, it goes up every year, the $25,000 is the amount of the Equity limit set in the late 1990s when that limit was last adjusted by Congress AND INCOME INDEXED AT THAT TIME.

Yo_Mama

(8,303 posts)The move would be a "huge blow" to the city of Richmond, said Guy Cecala, publisher of Inside Mortgage Finance.

"It is pretty much a death sentence these days in terms of mortgage financing," Cecala said. "It is sort of an atom bomb solution, and the real question is would they pull the trigger on it, or is it just a threat? But it is the kind of thing they could do fairly quickly."

As I pointed out in another reply, no one can afford to write a mortgage in a city that does this, and no one will. The end result will be a fall in property values and a disaster for the homeowners, plus urban blight.

This is truly one of the most insane proposals I have ever come across, and it doesn't do what people think it does - it removes the prospect of homeownership from all but the wealthy. If this is the way mortgages are to work, no one but an idiot will fund them. Instead, they will shift their investments to organizations like Black Rock, which will buy up properties on their own. The end result will be a nation of renters. And then we'll see how high rents will go.

Lee-Lee

(6,324 posts)And people were saying I am wrong.

Why would anybody write a mortgage in a place where they have shown they will seize it if they desire?

Yo_Mama

(8,303 posts)What this policy amounts to is saying that if the property appreciates, the homeowner gets the benefit. If the property depreciates, the loss is handed to the beneficiaries of the mortgages.

You would have to be a genuine lunatic to write mortgages in these circumstances. It is a much better deal to buy the houses, because then you take the loss if the property depreciates but you also get the increased value if the property appreciates.

Rex

(65,616 posts)nt.