General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsGoldman Sachs Is Above the Law and There's Nothing We Can Do About It.

Last week I became really excited. For the 1st time in 12 years of my battling Goldman Sachs and Bain Capital fraud in our eToys case, a true blue attorney said he would consider taking on the eToys case.

This new found hope is one guy that will obviously not take a bribe. He made a promise to me and I was making arrangements to comply with his terms after our phone call happened on Thursday. Then, this weekend and today, everything has changed; and I'm pissed off ballistic!

Unfortunately Goldman Sachs is Above the Law; and it appears there's nothing I can do about it.

In 2005, we provided Smoking Gun proof that Goldman Sachs law firm lied to become eToys law firm and they (www.MNAT.com) confessed. The Wall Street Journal reported on part of the story (here). The problem with that is Goldman Sachs is the party who took eToys public for $85 per share; but eToys only received $20 each. As reported by the New York Times in March 2013, this is a "spinning" pump-n-dump stock scheme (see Joe Nocera's New York Times article "Rigging the I.P.O. Game"![]() .

.

[br][hr][br]

Goldman Sachs MNAT Law firm utilized Perjury to Destroy Evidence!

Our eToys entity went public in 1999 and Goldman Sachs law firm said it was insolvent in 2001 (which was likely a false "cooked" book report). That is when Goldman Sachs law firm put eToys into bankruptcy. A bribe was offered to buy off the executive, was rejected and reported. So Goldman Sachs law firm puts in a Goldman Sachs CEO and Destroys eToys Books & Records (here) & (here).

[br][hr][br]

Goldman Sachs Sues Goldman Sachs in New York Supreme Court

To make sure that the culprits get away with their crimes, Goldman Sachs law firm (while benefiting from the Perjury deceiving the court and shareholders to become the eToys attorney) - then suggest the firm to the Delaware Bankruptcy Court to sue Goldman Sachs in the New York Supreme Court to recover the monies that Goldman Sachs stole from eToys (which was renamed ebc1 when Bain Capital/ Kay Bee stole the eToys.com domain names).

- - Of course Goldman Sachs can't lose in this case. As Capone has picked Nitti to be the prosecutor.

Ordinarily, once the parties get "caught" (as Goldman Sachs lawyers did in 2005), they would get arrested, go to jail, get a trial and hopefully be convicted. But this is Bain Capital partnering up with Goldman Sachs we are talking about -

And they are ABOVE THE LAW!

To make sure that they would never be prosecuted, in the same way that Goldman Sachs parties magically wind up as senior officials of the SEC. Because - you know - those gals give up $50 million a year to be good public servants.

But one of the best ever Goldman Sachs "arrangements"; is the MNAT law firm partner (Colm Connolly) becoming the Delaware U.S. Attorney in August 2001 (See Colm's Resume from the Department of Justice - HERE).

- - Armed with their very own federal prosecutor, Goldman Sachs attorneys had no reason to stop. They make one of their own CEO of eToys, who - along with Goldman Sachs MNAT law firm - elects Paul Traub to prosecute Goldman Sachs in the New York Supreme Court and they place the ENTIRE case docket under seal (see Nocera's story again - HERE).

[br][hr][br]

eToys v Goldman Sachs case Re-opens in September 2012

Goldman Sachs wins appeal to shut down eToys (ebc1) suit against Goldman Sachs. But the truth is one thing that can't be destroyed. Yes, you can put things under SEAL and tried to hide them. But when you put an entire docket under SEAL - this tends to raise some eyebrows; especially in the New York Supreme Court. So the case of eToys (ebc1) v Goldman Sachs that was closed in 2009 and looked at again, gets closed in 2011. Then, miraculously, eToys v Goldman SAchs gets "RE-opened" in September 2012 (here) and is heard on May 29, 2013 (here).

- - On top of that, yours truly gets a former Federal prosecutor (one who won't take a bribe) to consider taking the case. We talk last week and inform the various parties that they better change their tune on the cases. After all, MNAT has confessed lying under oath and Paul Traub/ Barry Gold confessed they are partners. HENCE

Goldman Sachs parties are fleecing the vaults - AGAIN - after confessing to fraud and Perjury!

[br][hr][br]

Public Corruption Tasks Forces Get Shut Down to Protect Goldman Sachs Crimes

- - But none of the confessions, the evidences and the massive amount of frauds and Perjury acts matter. For we are in the Above the Law Goldman Sachs world. They own federal prosecutors, they put their $50 million per year staff inside the SEC and revolve doors in the Fed and everywhere else. When this pursuer of justice discovered that a Goldman Sachs law firm partner was made to become the Delaware U.S. Attorney (Colm Connolly) - who then refused to investigate and/or prosecute the cases for his entire seven (7) years in office. It was reported to the Public Corruption Task Force in Los Angeles - AND

They SHUT DOWN the Public Corruption Task Force/ Threatening Career Assistant U.S. Attorneys (HERE).

[br][hr][br]

Goldman Sachs Utilizes Federal Corruption to Defeat New York Supreme Court Case

- - Now granted, the various issues of federal venality was because Goldman Sachs partnered up with Bain Capital in the eToys fraud. If Sheldon Adelson can spend tens of millions to put his hand picked man in the White House and get a "friendly" U.S. Attorney General, then Goldman Sachs is entitled to same (and they don't have to spend $100 million and FAIL in the task) Thus having that Colm Connolly federal prosecutor benefited two nefarious masters; Goldman Sachs succeeding in the "spinning" pump-n-dump frauds get hundreds of millions of dollars and Bain Capital getting eToys basically (illegally) for free.

Goldman Sachs is Settling With Goldman Sachs to Make the Whole Thing Go Away!

I'm sorry I don't understand how to make the picture bigger (will work on it tomorrow)

But there they are, placing everything Under SEAL once again. Even the lawyers fees are being redacted out where no one can see them (because we can back the math out and figure the whole dealings out otherwise).

Thus they will shut down the NY Sup Ct case of eToys (ebc1) v Goldman Sachs, as the crooks who have been allowed to keep the keys to the vaults they are fleecing. Now Goldman Sachs has successfully settled with Goldman Sachs, as they're agreeing with each other that it is okay to give back a little of what they stole from eToys. After all, other Goldman Sachs and Bain Capital friendly (handpicked) law firms will get to take part of that money away in "success" fees.

- - Remember - Goldman Sachs is Above the Law!

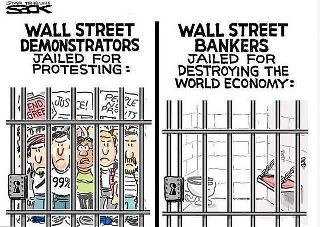

It is not the Wall Street Bankers like Blanfein & Romney who go to jail

It's those who protest about the crimes those guys are doing;

the demonstrators are the truly undesirable blights upon society.

[br][hr][br]

eToys Shareholder Robert Alber had to Shoot/Kill an Assailant After His Life Was Threatened.

As is inevitable, when you have organized criminals doing what they want, there's mayhem, mendacity and murder. They warned me to "back off" in 2004, when I blew the whistle to the federal court. My own attorney (Henry Heiman) emailed me the threat from Paul Traub's firm. Then another attorney abandoned me and my daughter was abducted on my birthday.

eToys shareholder Robert Alber then joined my efforts. He is now knocking on heavens door for trying to do the right thing. In 2010 Alber's lifetime friend (Gary Ramsey) who was also co-owner of their Kingman, Arizona house - simply vanished into thin air. Johann Hamerski offered a bribe to Alber and it was rejected. They told me that "people who chase ghosts become one" and told Alber that "people like you who turn down bribes - Wakes Up Dead"!

Then Alber had to shoot/kill Michael Sesseyoff!

All the local papers skipped all of this stuff when they pointed out how nice a guy Michael Sesseyoff was and made Alber look like the bad guy. Problem is, Michael Sesseyoff was a career criminal with 36 felony convictions; but you won't find that in any of the press stories.

Marty Lackner, directly involved in some of the frauds purported killed himself. He was the brother of J. Lackner.

That's Minnesota Assistant U.S. Attorney J. Lackner!

And don't even get me started on how John "Jack" Wheeler wound up dead in a Delaware Dump!

That's why I'm of the same sentiment....

Chances are Blankfein and Romney don't know this stuff happened. All they had to say is that they needed the problems to go away; and the rank/file simply set out to get it done. Being that the feds are obviously involved in the corruption; whom do you go to - in order to get them investigated and prosecuted?

[br][hr][br]

The Judge in the eToys.com Bankruptcy Case - that is going to approve putting all the crimes under SEAL, is the same judge who told Alber and I that it would be wrong to punish Plaintiff's and reward conflicted attorneys. But then, after Goldman Sachs law firm buddies www.MNAT.com and Paul Traub confessed to lying under oath, she accepted a forgery from them that said yours truly "waived" his right to be paid and gave eToys for Free to Mitt Romney's.

When I said to the judge, during a hearing that is record - that this is absurd - she said;

"Mr. Haas, I'm not going to hear about it"

"Now, if there's nothing else, I'm going to get back to Tweeter"

-------------------------------- That's how overworked your courts are!

[br][hr][br]

longship

(40,416 posts)The latter as Secretary of the Treasury.

laserhaas

(7,805 posts)Great line anyway.... Thanks

longship

(40,416 posts)It's about the TARP bailout and the events leading up to it. It's yet another wonderful HBO produced docudrama. I read the book on which it's based twice (by Andrew Ross Sorkin).

The cast is great.

William Hurt as Hank Paulson.

Paul Giamotti as Ben Bernanke.

Billy Crudup as Tim Geithner.

Tony Shalhoub as John Mack (Morgan Stanley)

James Woods as Dick Fuld (Lehman Bros.)

Edward Asner!!!! As Warren Buffet.

Bill Pullman as Jaimie Dimon (JP Morgan/Chase)

Evan Handler as Lloyd Blankfein (Goldman Sachs)

There are many great supporting roles with Paulson's staff standing out.

This is a great flick, as is becoming increasingly apparent, from the HBO shop. It is told from the Paulson Treasury department's point of view, in other words when Bush was president. But the number of liberals in the cast should tell DUers that it is not Republican propaganda, and it isn't. Ed Asner plays Warren Buffett, for Christ sake.

Highly recommended. A great flick about what actually happened in 2008. It's a real education. It is not very kind to Paulson and staff being totally clueless to what is actually happening in spite of what is happening before their very eyes, the utter meltdown of the global economy.

Giamotti is great as Bernanke, as one would expect.

Here it is:

I also like Cynthia Nixon as Michelle Davis, Paulson's press person.

Enjoy.

laserhaas

(7,805 posts)all of the films such as this. Viewed it the day it was on HBO and a couple of times after. It is BULL [c]hit of the highest order;

a 'Red Herring' (like Newt Gingrich's "King of Bain"![]() . Was a most Excellent production on the $125 billion to the Banks;

. Was a most Excellent production on the $125 billion to the Banks;

but where did the other $575 Billion go?

Cerberus Capital Management & Friends!

----------------------------------------------------------------------

Cerberus and their associates owned 80% of Chrysler and 65% of GMAC; but you didn't hear much about that - Did You?

My enemies are directly connected to Cereberus where Traub, Bonacquist & Fox's Harold Bonacquist is lead counsel for the Consulate General in Istanbul. They protect him so well that he was listed (until I reported the fact) by the New York Supreme Court and State Bar - to be contacted by calling the U.S. Embassy in the Philippines to make an appointment with Bonacquist in Istanbul (a NON-extradict country by the way).

Guess whom he works with over there often! The mouthpiece for Cerberus - DAN QUAYLE....

Who also works with Don Rumsfeld, Mondale, John Snow and others.

(NOTE: They keep redacting these facts from Wiki - good thing Wiki keeps everything Archived)

Wanna know what Cerberus stands for?

------------------------------------------------------- GUARDIANS OF THE GATES OF HELL.....

Ichingcarpenter

(36,988 posts)In the biggest stock sale of his life, former Treasury Secretary Hank Paulson didn’t pay one dollar of capital gains tax. Nearly $500 million worth of Goldman Sachs shares – a profit of hundreds of millions of dollars – and not a red cent went to the IRS. Paulson’s Treasury predecessors Robert Rubin and Paul O’Neil enjoyed a similar tax dodge themselves…as did many other familiar Washingtonians over the last 20 years, like Donald Rumsfeld and Donald Evans.

You could enjoy the shade of this shelter too. All it takes is the President’s blessing.

President George H. W. Bush is the originator of this refuge for the political elite. His Ethics and Reform Act of 1989 – ironically – was a soft-core crackdown on abuse of privilege in government…no more honoraria for federal employees (except Senators, of course), post-employment restrictions on Congressmen, increased financial disclosure and so on. But the Act also introduced Section 1043 of the Internal Revenue Code, a tax shelter available to those that need it the least.

Under the guise of not wanting to “discourage able citizens from entering public service,” Section 1043 is an alteration of the government’s conflict of interest rules. Before 1043, executive appointees (mostly high-up cabinet members and judges) had to sell positions in certain companies to combat conflict of interest – like say, a former Goldman Sachs CEO-turned Treasury Secretary with millions of GS shares. After Sec. 1043, the appointee gets a one-time rollover. Upon their appointment, he or she can transfer their shares to a blind trust, a broad market fund or into treasury bonds. They’ll have to pay taxes on the position one day, but not immediately after the sale… like the rest of us.

http://dailyreckoning.com/dodge-taxes-legally-become-treasury-secretary/

laserhaas

(7,805 posts)I truly had no idea; but it makes a lot of sense.

blkmusclmachine

(16,149 posts)Rex

(65,616 posts)for their hard troubles of destroying the economy and making America go from having a middle class to having a working class. I don't want them to jump, I want my FUCKING MONEY BACK!

laserhaas

(7,805 posts)But there's simply NO way to make it happen.

I'm debating about going to Romney or Blanfein's office and making a scene;

by trying to put my foot in one of their asses.

Because between that and the courts helping me get my money back;

the odds are better with putting my foot where it belongs!

Rex

(65,616 posts)care about that kind of highway robbery. If they are really good at their job, a judge can end up running those very same predatory institutions! Heaven forbid we prosecute white collar crime like it was just normal fucking crime that kills people and puts their families out in the car or out on the streets.

Obviously there are some groups out there that are trying to help, but it pisses me off that is ALWAYS has to be some private sector group doing it...whereas the uber rich assholes that caused all this get their money right from the Treasury.

The disdain for The People is grotesque.

laserhaas

(7,805 posts)I'm going to get drunk now.....

Type to ya'll in the morning......

Rex

(65,616 posts)longship

(40,416 posts)HBO's film "Too Big to Fail"

Also, Michael Lewis' book The Big Short: Inside the Doomsday Machine. A wonderful narrative about insiders who saw the global economic meltdown before the fact. It's a wonderful work about some incredible characters.

laserhaas

(7,805 posts)the first film released was of that same title (the true ownership) - by Alex Gibney.... http://www.imdb.com/title/tt1540814/

It tells the real story and has fantastic interviews with key persons...

PowerToThePeople

(9,610 posts)Living through that first hand, seeing all the corruption is what turned me towards Socialism. But, all of those questions of corruption never got resolved. 9-11 happened and took the heat off the stock market corruption and crash. We can never get a handle on it. We are too far down the rabbit hole. There is no returning to a non-corrupt state.

laserhaas

(7,805 posts)yours truly was in this saga; was simply to help prevent Romney from becoming POTUS.

The "King of Bain" was funded by Sheldon Adelson and the Producer of the film was a former Romney Aid. In the same way that Matt Taibbi was ordered by Rolling Stone editors to skip the eToys case in his September 2012 cover story "Greed and Debt" - they King of Bain film simply skipped over eToys also.

They tested the waters with King of Bain to see if they could control the news with Clear Channel and other efforts, to keep Romney's Achilles heel out of the news. Mitt even lied on his federal campaign finance form about when he was CEO at Bain, to make sure he was not tied to the 2001 period of time. When he got "caught" on that issue, he simply claimed he was "retroactively" retired from August 2001; back to February 11, 1999. Know what else happened in August 2001? Did you pay attention to the notes in the thread above?

Romney/ Goldman Sachs law firm is MNAT and their partner, Colm Connolly - because U.S. Attorney August 2, 2001!

http://www.justice.gov/archive/olp/colmconnollyresume.htm

All the proof of more than 100 felonies (Racketeering) can all be found in the public docket record. That is what is so punishing about all of this. We also have confessions to Perjury & intentional fraud on the court; but everyone in the Department of Justice either gets promoted off, resigns or joins the Gangs!