General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forumslastlib

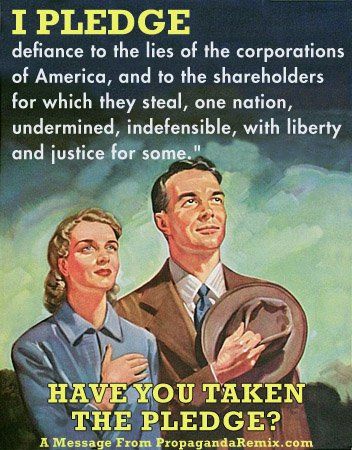

(25,872 posts)"...with liberty and profits for us."

Octafish

(55,745 posts)David Feige explained the picture, back in '08:

Socializing Risk, Privatizing Profit

With an economic meltdown already in full swing, there is little question injecting some liquidity into the economy is a fine idea. Even doing so by buying a boatload of bad securities that no one seems to be able to properly value might not be fully idiotic, but doing so without taking an equity position in the firms being bailed out is just morally indefensible. Allowing greedy billionaires to suck down more cash like Schlitz from a frat house beer bong, sends all the wrong messages to Wall Street and the world: The United States has finally socialized risk, but privatized profit. And though that may be the Kleptocratic Bush administration's ultimate wet dream, it will ruin America in the long run.

CONTINUED...

But did we listen? Well, I mean "We" as in our elected representatives? Nooooo.

WingDinger

(3,690 posts)Thou Shalt Not Covet.

Octafish

(55,745 posts)Last edited Mon Mar 5, 2012, 11:12 AM - Edit history (1)

The Amazing Vanishing Act: Accounting Control Fraud Disappears from the Regulatory Lexiconby William K. Black

Benzinga.com

Criminologists know that accounting control fraud causes greater financial losses than all other forms of property crime – combined.

Some of the world’s best economists, George Akerlof and Paul Romer, praised the S&L regulators’ early recognition of these frauds and set out a formal economic theory of accounting control fraud (“Looting: the Economic Underworld of Bankruptcy for Profit”). They ended their 1993 article with this paragraph, in order to emphasize its importance.

“Neither the public nor economists foresaw that (S&L deregulation was) bound to produce looting. Nor, unaware of the concept, could they have known how serious it would be. Thus the regulators in the field who understood what was happening from the beginning found lukewarm support, at best, for their cause. Now we know better. If we learn from experience, history need not repeat itself.”

The primary reasons that accounting control fraud can produce catastrophic losses are the seeming legitimacy of the firm, the supreme status and respectability of the CEO leading the fraud, the fact that accounting control fraud is a “sure thing” (Akerlof & Romer 1993), the ability of control fraud to hyper-inflate bubbles, allowing the fraud to persist for years and magnify losses, and the paradox that the optimal means for a fraudulent CEO to loot “his” bank is to cause the bank to make exceptionally bad loans.

The last element is so counter-intuitive that despite the accounting control frauds’ dominant role in driving the S&L debacle and the Enron-era accounting control frauds many people cannot really believe that elite CEOs would loot “their” banks despite the many felony convictions of the elite CEOs that drove the two predecessor crises.

CONTINUED... http://www.benzinga.com/general/psychology/12/02/2355842/the-amazing-vanishing-act-accounting-control-fraud-disappears-from-

raouldukelives

(5,178 posts)I pledge to not give those back stabbing, environment destroying, freedom hating, child labor loving criminal enterprises a red cent. I like cash as much as the next guy but not at the cost of principles that I place above the mighty dollar.

Up their ass with Mobil gas!