General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsLet Banks Fail Is Iceland Mantra as 2% Joblessness in Sight

Last edited Thu Feb 6, 2014, 07:27 AM - Edit history (1)

Now, the island is finding crisis-management decisions made half a decade ago have put it on a trajectory that’s turned 2 percent unemployment into a realistic goal.

While the euro area grapples with record joblessness, led by more than 25 percent in Greece and Spain, only about 4 percent of Iceland’s labor force is without work. Prime MinisterSigmundur D. Gunnlaugsson says even that’s too high.

To support households, Gunnlaugsson in November unveiled a plan to provide as much as 7 percent of gross domestic product in mortgage debt relief. The government intends to finance the plan, which the OECD has criticized as being too blunt, partly by raising taxes on banks.

More at Bloomberg

On edit: why the question is relevant:

&feature=player_embedded

newfie11

(8,159 posts)And the banks are still at it![]() no doubt we will be called upon to bail them out again!

no doubt we will be called upon to bail them out again!

leftyohiolib

(5,917 posts)solarhydrocan

(551 posts)because the country is bigger. "Too big to fail" indeed.

The same "argument" was used back when the Netherlands was cited as a place where cannabis decriminalization could be seen as working. "Holland is the size of Virginia!" we were told.

It's past time to prosecute the criminals. And start taxing speculation- Credit Defalut Swaps and the rest. Do that and no one making under say $200,000 per year need to be taxed at all at the federal level.

Next step: Nationalize the Fed!

BelgianMadCow

(5,379 posts)though one has to wonder whether the social cohesion and awareness are high enough.

pampango

(24,692 posts)These measures reestablished American faith in banks. Americans were no longer scared that they would lose all of their savings in a bank failure. Government inspectors found that most banks were healthy, and two-thirds were allowed to open soon after. After reopening, deposits had exceeded withdrawals.

http://www.fdrheritage.org/new_deal.htm

One big difference between Cyprus and Iceland is that the Mediterranean island - as part of the eurozone - cannot devalue its currency as the Nordic island did. "Our recovery (Iceland's) is a typical case based on currency devaluation. Then the exports get more competitive on fish or aluminium sold abroad, also services and tourism got a boost as prices dropped in Iceland," the former spokesman said.

"But we can't forget who's paying for all that - it is the citizens in Iceland, because inflation doubled while salaries stayed the same. We don't pay with high unemployment, but with lower salaries," Omarsson added.

http://euobserver.com/economic/119718

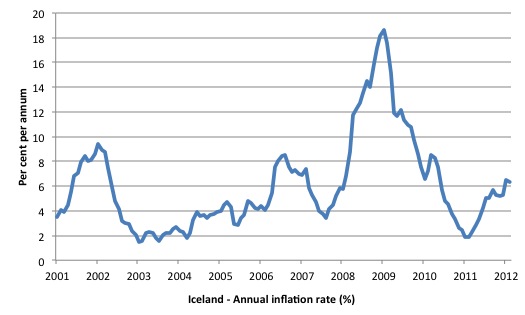

It is clear that there was a spike in inflation (the annual rate went from 3.4 per cent in August 2007 to the peak of 18.6 per cent in January 2009 as the Krona depreciated. Since the economy resumed growth, the inflation rate has averaged around 4 per cent per annum.

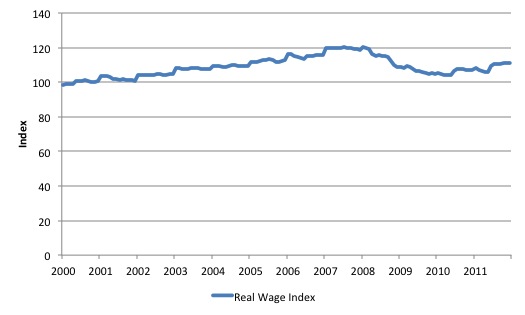

Statistics Iceland also publish a Real Wage Index which is shown in the following graph (from 2000 to 2011). It peaked at 120.2 in January 2008 and then reached a trough in May 2010 at 103.9 (down 13.6 per cent on the peak). It has now recovered some of the loss and in December 2011 was standing at 111.1 (down 7.6 per cent on the peak).

This is a predictable pattern. The exchange rate depreciation erodes the real wage as import price rise.

http://bilbo.economicoutlook.net/blog/?p=18609

merrily

(45,251 posts)And why does what he did about banks apply to now? The other programs he put in place to help Main Street sure didn't apply now.

pampango

(24,692 posts)why do you want to know about the 1933 bank bailout cost?

Oh what the heck:

Besides deposit insurance and a banking act that controlled competition and interest rates, Roosevelt drastically enlarged and expanded the role of the Reconstruction Finance Corporation, which was established in 1932.

The agency made loans to troubled banks, and seized and sold off distressed assets at others. After government inspections, many small banks never reopened, with more than 4,000 closed in 1933. The agency also bought stock in 6,000 banks, at a cost of $1.3 billion. In proportion to today’s economy, the program would amount to about $200 billion.

To insure an adequate supply of currency, the Act provided for the issuance of Federal Reserve Notes.... After the Act was signed into law, the Bureau of Engraving and Printing promptly went into 24-hour production to manufacture the currency....

http://www.nytimes.com/2009/01/27/business/economy/27fdr.html?pagewanted=all&_r=0

Not sure exactly what you mean. Much of 'the other programs he put in place' have been repealed so they cannot help 'now'. Are you saying that or that they would not help if there were still in effect?

Javaman

(62,530 posts)via propaganda we are lead to believe that if we allowed those bastards to fail, then life as we know it would suddenly vanish from the face of the earth.

That everything that we know and love would no longer exist and the slim possibility of ever returning to "normal" wouldn't exist.

so, instead we are forced to believe that by supporting this grifting institutions that we are much better off than the grossly over imagined sensationalistic apocalyptical alternative.

See? that's why it won't work here, because a portion of the population enjoy being suckered by their fears by the wealthy 1%.

while the rest of us get pissed off at not having any say or being accused of being "Un-American" because we want accountability.

whenever a politician says, "the country wouldn't survive it" what they really mean is they will lose their jobs because they are firmly tied to whatever illegal activity that was perpetrated.

liberal_at_heart

(12,081 posts)florida08

(4,106 posts)Hold them accountable. If we did that here our economy and working class would be booming, but sadly we the people are no longer in the constitution.

Ichingcarpenter

(36,988 posts)requiring government help for them to survive. I put a two year timeframe. This includes most of the international big boy banks not local banks.

merrily

(45,251 posts)Or maybe we are.

marmar

(77,081 posts)SamKnause

(13,107 posts)Not only should the US have allowed banks to fail, they should have confiscated their ill gotten gains and returned them to their rightful owners.

The banks are not to blame.

The US government bears all the blame.

They passed every law that allowed the banks to suck the wealth from the people in this country, and around the globe.

They decided to forgo prosecuting those who broke the law.

We need to look forward not backwards.

The justice system is for the 99% only.

dreamnightwind

(4,775 posts)They literally wrote the laws deregulating their industry. Using campaign donations as well as regulatory capture and getting their pet politicians to defund the little regulatory infrastructure that still remains, they very actively work to prevent reforms from being enacted.

I have no interest in defending the politicians who work for them, but let's be clear about who the boss is here. It isn't your nickle and dime congressperson, and it's not even your Senator, who is busy spending roughly 2/3 of his/her work hours phoning corporations asking for donations. It's the donors. They "invest" in our reps, and they get a helluva return on those investments too.

The congress-critters are small-time, and they come and go, often between capital hill and the industries they are supposed to oversee. But the oligarchs remain, calling the shots from their highly secure and opulent estates.

An alternative thesis (which I reject) would be that the banks are just lucky to have a government that likes them so much.

SamKnause

(13,107 posts)You post proves my point.

The banks did absolutely nothing that the US government did not ALLOW them to do.

No one forced the politicians to take bribes or campaign cash.

No one forced the politicians to allow the corporations to write the laws.

No one forced the politicians to cozy up to the lobbyist.

No one forced the politicians not to prosecute the banks.

No one forced the politicians to repeal legislation that protected us from usury and outright theft.

Our government is corrupt to the core.

They are bought and paid for.

I think we may be saying the exact same thing, only is a different way. ![]()

dreamnightwind

(4,775 posts)which means they are owned, which means they do the bidding of their owners, not us. Your post proves my point, LOL.

SamKnause

(13,107 posts)If our government was not corrupt, how could they be owned by the corporations ?

Why does our government allow corporations to write and enact legislation ?

Our government does not represent the needs of the people.

Our government DOES represent the needs of the corporations.

The corporations do not represent the needs of the people.

Who has the power and ability to change this ?

THE GOVERNMENT !!!!

Javaman

(62,530 posts)Now, correct me if I'm wrong, but bank savings are protected by the FDIC for up to 200k.

Look across the spectrum of our society. How many of the 99% have 200k in the bank? probably not many.

and see that's the rub. those in the upper income bracket would be the ones that would suffer the most.

letting the banks fail would have been an incredible social equalizer. those with millions would have lost a bundle and *GASP* would have to suddenly live like the rest of us, the "great unwashed".

and that is, one of the may reasons, the circular clusterfuck of our banking system hasn't been held responsible.

They couldn't possible live like the rest of us. It's beneath them.

And as a side note: those who argue that "letting them fail" would have been catastrophic for the nation, lives with the delusion that nothing at all would have been done to prevent a cascade of trouble across the board.

Let the banks fail and help the people. That's the chant that should have been yelled.

but alas...

dreamnightwind

(4,775 posts)One thing to note is that the 1% have their money in many places, not just in U.S. banks. So for the most part they still wouldn't have had to live like the rest of us. It would, however, have been a great way to more evenly distribute assets. Instead we participated in perhaps the largest transfer of wealth upwards in U.S. history, all to prop up a failed system that didn't play by the rules and that benefits only a tiny elite, and that continues to resist reform to the extent that another crash is not only possible but likely.

Unfortunately these decisions were being made by the usual suspects, people like W., Paulson, Summers, Bernanke, Geithner, Rubin, and the newcomer Obama. Pretty much the only voice being listened to was that of the banks, who had stocked the government and of course the Fed with their own people.

While letting them fail, instead of the money we pumped into the insolvent banks, we could have reduced the principle of underwater mortgages to keep those millions of people from going broke and to keep them in their homes, like Iceland did. The chain reaction caused by the foreclosures has bee devastating and is still going on (my own home is way underwater, I'm long-term out of work but not receiving unemployment, wife left, will soon lose this house, etc.)

Iceland isn't the United States, so we can't directly say that things would have turned out here like it did there, but it is great to have Iceland as an example of a country that pursued that path successfully.

durablend

(7,460 posts)Workers might get all uppity and start demanding stuff!

dreamnightwind

(4,775 posts)Look at all the outrage over the new CBO report that says since health care will no longer be only for the employed, less people will be forced to work. They're spinning this like crazy everywhere. They want maximum leverage over the labor force, easy enough when many are unemployed and desperate.

BelgianMadCow

(5,379 posts)to wit: spend thousands of billions on banks, ask labor market reforms, and now pledge 8 billion to youth unemployment. One would be inclined to think they LIKE high unemployment. Keep everybody else in a "precarious" situation and away from uppitiness.

marble falls

(57,097 posts)Rex

(65,616 posts)that impossible.