General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsBlanks

(4,835 posts)MindMover

(5,016 posts)JayhawkSD

(3,163 posts)...Congress made all of those tax rate changes.

MindMover

(5,016 posts)JayhawkSD

(3,163 posts)Why is Obama blaming Congress for all of the failures of his administration? And why has Obama not withdrawn the Bush tax cuts? Why has he not closed Guantanamo as he promised?

That's not criticism of Obama, I just moustrapped you. It is an example of the slipshod way we think about government. We give presidents too much credit. The "buck" most decidedly does not stop at the "top." By the power vested in him by the constitution, the president has no authority whatever over laws or revenue other than to "assure that they are faithfully enforced."

FogerRox

(13,211 posts)JaneyVee

(19,877 posts)JayhawkSD

(3,163 posts)"and GITMO failed in senate" which illustrates my point exactly. What point are you trying to make?

JaneyVee

(19,877 posts)JayhawkSD

(3,163 posts)A president cannot raise or lower taxes by use of the veto. He can only leave them unchanged.

You simply are not going to win the argument that claims that "president so and so raised/lowered the tax rate."

My initial comment was that Congress changed the tax rates, not the presidents, and arguments have become increasingly silly trying to prove me wrong. Read the constitution.

hfojvt

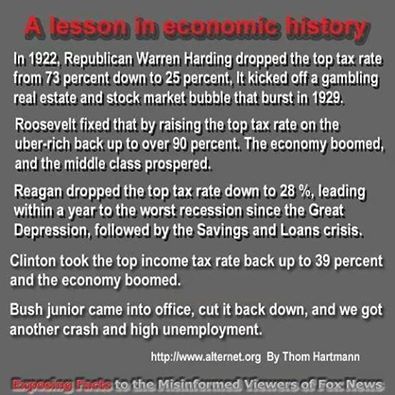

(37,573 posts)Reagan did not cut the rate to 28% until the 1986 Tax Reform Act. The first round of Reaganomics only cut the top rate from 70% to 50%. And the deep recession was in 1982.

And even that one started much too soon after ERTA passed to actually be blamed on ERTA.

This site ( http://www.investopedia.com/articles/economics/08/past-recessions.asp )puts its beginning in July 1981 and ERTA (the Economic Recovery and Tax Act - Reaganomics round 1) was not signed until 4 August 1981.

Interestingly enough wiki blames the SNL crisis at least partly on the tax INCREASES of the tax reform act of 1986. http://en.wikipedia.org/wiki/Savings_and_loan_crisis

Also, the economy did not really slump all that much in 2001. I blame that slump largely on the increase in gas prices that actually started in February 2000, and at the same time the FED increased interest rates, something I tried to advise against at the time. In Iowa, where I lived at the time, gas had gone from 89 cents to about 1.25 which I figured would slow the economy, making it a bad time to raise rates.

The economy was already slumping in late 2000, which did not help Gore any, and Bush came into office saying "we gotta pass the Bush tax cuts to help revive the economy". Which is why Democrats added the $300 rebate checks.

And also, the economy was really already soaring before Clinton passed his tax increases. The economy gained 1.2 million jobs in the first six months of 1993 - before the Clinton tax increases were even passed.

JayhawkSD

(3,163 posts)...that notwithstanding the prating of politicians at all levels of government, tax rates have very little to do with the economy. It rises and falls for other reasons.

bhikkhu

(10,725 posts)the smaller the slice they have to work with, the less they have to balance against large corporate interests. Which have proven time and time again that they will crash an economy if left unmanaged.

former9thward

(32,096 posts)Hoover raised the top rate in 1932 from 25% to 63%. Roosevelt raised that rate in 1937 to over 90%. But the economy did not boom. There was a recession in 1937 and unemployment stayed in double digits until WW II. That is what got the economy booming.

JaneyVee

(19,877 posts)former9thward

(32,096 posts)Do you what another World War to increase jobs?

MindMover

(5,016 posts)and if you are really a former 9th warder ... you really know the importance of a strong government ... !!!!!!!!!!

![]()

former9thward

(32,096 posts)Can you think why that was given the post? If you are referring to NO I am not part of that. My user name refers to a minor elective post I held in Chicago.

pampango

(24,692 posts)The practice of government spending and budget deficits to help get the economy moving had been successful. But that changed in 1937 to a concern about potential inflation and the ivory acne of balancing the budget. Krugman seems to think that it was fiscal policy that caused the 1937, not taxes.

http://krugman.blogs.nytimes.com/2011/06/01/1937-in-2011/?_php=true&_type=blogs&_r=0

http://en.wikipedia.org/wiki/Recession_of_1937–38

Once FDR realized that fiscal policy was he mistake, he corrected it and the economy recovered.

former9thward

(32,096 posts)The economic statistics do not show that. It was only when we got into WW II that we had a boom in the economy.

pampango

(24,692 posts)

former9thward

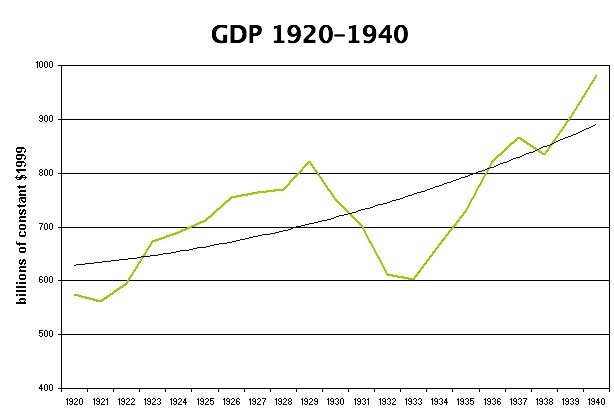

(32,096 posts)Please post a graph of unemployment numbers. Those did not get into single digits until we went to war.

pampango

(24,692 posts)fiscal policy was restored to one of using budget deficits to spur the economy.

You're right that the real recovery of the economy and employment did not happen until massive deficit military spending provided a much, much larger fiscal stimulus to the economy.

Common Sense Party

(14,139 posts)government spending also increased.

pampango

(24,692 posts)more than $1. A person hired by the WPA or the CCC not only increased the GDP by the value of the goods or services he/she provided but also spent their wages in local business contributing more to GDP when those local goods and services were added into the total. Local farmers, businesses, etc. then had more income which they could use to buy goods and services which added more to the GDP.

If the additional $1 in federal spending were just taken home and buried in the back yard then it would only create that $1 in additional GDP (the value of the goods and services that the WPA worker produced, let's say.) GDP would only increase by the value by that $1. OTOH, if that $1 is spent locally, the additional $1 in federal spending had a greater than $1 effect on GDP - a multiplier effect.

It would not be until the early 1940s, with the beginning of World War II, that a strong dose of Keynesian medicine was administered to the American economy. By 1942, total government spending as a share of the economy rose to 52 percent, and peaked at nearly 70 percent in 1944, when unemployment fell to 1 percent.

http://www.nytimes.com/2009/01/27/business/economy/27fdr.html?pagewanted=all&_r=0

The reasons for the discrepancies in the unemployment data that have historically arisen out of the New Deal are that the current sampling method of estimation for unemployment by the BLS was not developed until 1940 (for more detail see here). If these workfare Americans are considered to be unemployed, the Roosevelt administration reduced unemployment from 25 per cent in 1933 to 9.6% per cent in 1936, up to 13 per cent in 1938 (due largely to a reversal of the fiscal activism which had characterized FDR’s first term in office), back to less than 1 per cent by the time the U.S. was plunged into the Second World War at the end of 1941.

In fact, once the Great Depression hit bottom in early 1933, the US economy embarked on four years of expansion that constituted the biggest cyclical boom in U.S. economic history. For four years, real GDP grew at a 12% rate and nominal GDP grew at a 14% rate. There was another shorter and shallower depression in 1937 largely caused by renewed fiscal tightening ... .

This economic relapse has led to the misconception that the central bank was pushing on a string throughout all of the 1930s, until the giant fiscal stimulus of the wartime effort finally brought the economy out of depression. That’s factually incorrect. Most accounts of the Great Depression understate the effect of the New Deal job creation measures, because they don’t show how much of the decline in official employment was attributable to the multiplier effect of spending on direct job creation.

http://www.rooseveltinstitute.org/new-roosevelt/real-lesson-great-depression-fiscal-policy-works

reformist2

(9,841 posts)What we ought to be saying is the truth - tax cuts for the rich have led to risky speculative booms, while tax hikes on the rich have not damaged the overall economy in the least. We don't want to be arguing that tax hikes are always good, or that tax cuts are always bad - that's where Dems were in the 1970s, and why they ended up lost in the wilderness for over a decade.

JayhawkSD

(3,163 posts)Put in other terms, becoming "typecast" with inflexible ritualistic ideology is a path to defeat.

JHB

(37,163 posts)If you don't just look at the rates but also look at where the various brackets kicked in, you see that all of the progressivity in the income tax for very high incomes was eliminated under Reagan and none of the changes since have done much to restore it. Compared to the income levels brackets reached up to historically, Clinton and Obama's tax changes were practically been minor tweaks.

Tax bracket thresholds, adjusted to 2013 dollars, for 1942-2013.

Same thing for 1913-2013. Note that in the 19teens and early 20s, plus the 30s and early 40s, there were brackets that reached into income levels that were the equivalent of 10s of millions today.

Selected years to make it easier to see. Note that there was more progressivity under Harding's tax code than there is today.

How about just looking at the number of brackets. Here's the number of brackets that kick in at a level above $250,000 (adjusted to 2013 dollars). Also: the same for brackets that kick in above $500,000 (adjusted to 2013 dollars), and the total. In the 50s two thirds of the brackets only affected parts of income above 250K, and nearly half above 500K. Compare that to post-1980, and it's a whole 'nother world.

Response to MindMover (Original post)

Name removed Message auto-removed

Laelth

(32,017 posts)-Laelth

"

"