General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe misleading information about the "reference pricing" rule.

Here's one of the reports being pushed:

Article by: RICARDO ALONSO-ZALDIVAR

<...>

The new strategy works like this:

Your health insurance plan slaps a dollar limit on what it will pay for certain procedures, for example, hospital charges associated with knee and hip replacement operations. That's called the reference price.

Say the limit is $30,000. The plan offers you a choice of hospitals within its provider network. If you pick one that charges $40,000, you would owe $10,000 to the hospital plus your regular cost-sharing for the $30,000 that your plan covers.

<...>

It's been pioneered in California by CalPERS, a giant agency that manages health and retirement benefits for public employees.

CalPERS started with knee and hip replacements in 2011, steering patients to hospitals that had been vetted for quality and charged $30,000 or less.

- more -

http://www.startribune.com/lifestyle/health/259489931.html

What the snip at the top doesn't mention is that this is about going out of network. The article then states that CalPERS is "steering patients to hospitals that had been vetted for quality and charged $30,000 or less."

That is a network provider. Most insurance companies are not currently using reference pricing.

The reports fail to state clearly that this applies to out-of-network costs. The rule is focused on a group like CalPERS (see the DOL snip below), which uses reference pricing and ensures that providers in its network accept the cap as full payment. The rule doesn't change the basic structure of health care coverage, which is what the misleading reports imply. If and when insurance groups adopt the method, it will likely change the structure of networks, and providers that go above the ceiling costs for the procedure will not be included in a network.

The following article is based on the misleading reports. While it mentions that this applies to out-of-network, it still claims that it "could" cost a person more out of pocket.

<...>

However, the strategy could "surprise" patients who choose treatment at more costly providers, according to the AP/Bee.

For example, if a health plan sets its limit for a knee replacement surgery at $30,000 and a consumer chooses an out-of-network hospital that charges $40,000 for that procedure, the consumer will owe:

- $10,000 to the hospital; and

- Whatever share of the $30,000 that the health plan does not cover.

Further, the strategy could "undercut" financial protections for consumers under the ACA. According to the AP/Bee, the extra $10,000 will be treated as an out-of-network expense and will not count toward the consumer's annual limit on out-of-pocket costs. Under the ACA, the majority of health plans are required to cover the entire cost of health care after a patient has reached the annual out-of-pocket limit, currently $6,350 for individuals and $12,700 for families.

Karen Pollitz of the Kaiser Family Foundation said "the problem" with the cost-control strategy is that "from the patient's perspective at the end of the day, that is who gets left holding the bag" (AP/Sacramento Bee, 5/15).

http://www.californiahealthline.org/articles/2014/5/16/experts-split-on-obama-administrations-new-cost-control-policy

The scenario is if the person chose an "out-of-network hospital," which means intentionally. Currently, a person would be liable for such out-of-network costs.

If you're using an in-network provider, nothing changes. For example, a colonoscopy in network is a covered as preventive care.

From the DOL FAQ mentioned in the reports.

Reference pricing aims to encourage plans to negotiate cost effective treatments with high quality providers at reduced costs. At the same time, the Departments are concerned that such a pricing structure may be a subterfuge for the imposition of otherwise prohibited limitations on coverage, without ensuring access to quality care and an adequate network of providers.

Accordingly, the Departments invite comment on the application of the out-of-pocket limitation to the use of reference based pricing. The Departments are particularly interested in standards that plans using reference-based pricing structures should be required to meet to ensure that individuals have meaningful access to medically appropriate, quality care. Please send comments by August 1, 2014 to E-OHPSCA-FAQ.ebsa@dol.gov.

Until guidance is issued and effective, with respect to a large group market plan or self-insured group health plan that utilizes a reference-based pricing program, the Departments will not consider a plan or issuer as failing to comply with the out-of-pocket maximum requirements of PHS Act section 2707(b) because it treats providers that accept the reference amount as the only in-network providers, provided the plan uses a reasonable method to ensure that it provides adequate access to quality providers.

For non-grandfathered health plans in the individual and small group markets that must provide coverage of the essential health benefit package under section 1302(a) of the Affordable Care Act, additional requirements apply.

http://www.dol.gov/ebsa/faqs/faq-aca19.html

The DOL is concerned about the impact on the "quality" of care within networks. This is a cost-control measure that caps the price of a procedure.

By Melanie Evans

Joint replacement prices at the most costly California hospitals plunged by one-third after the state required its workers and retirees to pay out of pocket all costs above a “reference price” of $30,000 for orthopedic surgery, a new study said.

The average cost of joint replacement among high-priced hospitals dropped to $28,465 after the California Public Employees' Retirement System made the change in 2011, wrote University of California researchers James Robinson and Timothy Brown in the journal Health Affairs. That's down from $43,308 the prior year.

After taking into account other factors that affect price, the average hospital price for joint replacement dropped by one-fifth in response to CalPERS' policy, known as reference pricing. The switch saved an estimated $3.1 million for 447 patients, the researchers estimated.

Hospitals, which in recent years have gained leverage to raise prices through consolidation, seemed to react by dropping their prices as consumers were given a powerful financial incentive to comparison shop, said Robinson, a health economics professor and director of the University of California Berkeley Center for Health Technology.

- more -

http://www.modernhealthcare.com/article/20130805/BLOG/308059996

How many articles have been written on the cost of medical procedures in this country vs. overseas?

US health care prices are NOT higher because we use more services

http://www.democraticunderground.com/10024841926

Colonoscopies Explain Why U.S. Leads the World in Health Expenditures

http://www.democraticunderground.com/10022933285

It's going to take a massive effort to bring the cost of medical procedures in this country in line with the rest of the world. Should CalPERS be a model? Should there be a government agency setting the cap? Should it be hospitals?

By Elise Viebeck

Hospitals will be required to release a standard list of prices for their medical services under a new rule proposed by the Centers for Medicare and Medicaid Services (CMS).

Instituted as part of the Affordable Care Act, the requirement can also be fulfilled if hospitals allow the public access to the data after an inquiry, the CMS said.

The program was outlined in a wide-ranging, nearly 1,700-page regulation on inpatient hospital payments released to lawmakers and the public on Wednesday night.

ObamaCare contains several policies to encourage greater price transparency in healthcare on the logic that better informed consumers will help drive down irrational medical charges.

- more -

http://thehill.com/policy/healthcare/204868-new-price-transparency-rules-for-hospitals-under-o-care

There is absolutely no reason that the same procedure should vary by tens of thousands of dollars from hospital to hospital.

msanthrope

(37,549 posts)ProSense

(116,464 posts)the top article, it's clear that the reporting is speculative and unsure of what the rule is all about. From the piece:

<...>

That's crucial because under the health care law, most plans have to pick up the entire cost of care after a patient hits the annual out-of-pocket limit, currently $6,350 for single coverage and $12,700 for a family plan. Before the May 2 administration ruling, it was unclear whether reference pricing violated this key financial protection for consumers.

Again, the rule isn't changing the structure of health care coverage, which would impact every plan issued in the U.S. People aren't going to suddenly find themselves being hit with additional cost in network. On the face of it, such a claim is absurd: a rule making a fundamental change to health insurance, one that would be worse than the status quo. It's ridiculous on the face of it. Also, note that this isn't about money being paid to insurers, it's to hospitals and other providers who charge more.

Like I said, this is about networks. If and when insurance groups decide to move to this method, it will change the way they structure their networks.

msanthrope

(37,549 posts)Ratfuxking , 101.

ProSense

(116,464 posts)From a 2013 NYT article on the CalPERS model:

In California, a large plan for public employees has been especially aggressive in using the tactic, and the results are being watched closely by employers and hospital systems elsewhere.

Under the program, some employees are being given the choice of going to one of 54 hospitals, including well-known medical centers like Cedars-Sinai and Stanford University Hospital, that have agreed to charge no more than $30,000 for a hip or knee replacement. Prices for the operation normally vary widely in the state, with hospitals billing from $15,000 to $110,000 for the same operation, a spread that is typical for much of the nation.

“It’s a symptom of the completely irrational pricing structure hospitals have,” said Ann Boynton, a benefits executive for the California Public Employees’ Retirement System, known as Calpers, which worked with the insurer Anthem Blue Cross, a unit of WellPoint, to introduce the program.

Overall costs for operations under the program fell 19 percent in 2011, the program’s first year, with the average amount it paid hospitals for a joint replacement falling to $28,695, from $35,408, according to an analysis by WellPoint’s researchers that was released Sunday at a health policy conference.

- more -

http://www.nytimes.com/2013/06/24/health/employers-test-plan-to-cap-medical-spending.html

One thing this should do is begin a debate about cost controls that can have a significant impact.

Whisp

(24,096 posts)lol. Now who would want to peddle that?

K&R

ProSense

(116,464 posts)Response to ProSense (Original post)

Post removed

SidDithers

(44,228 posts)Sid

IronLionZion

(45,447 posts)this site exists to whip up mass hysteria for no apparent reason, because people like to feel self-righteous indignation. We don't have hate radio to feed the rage, so we have this bullshit instead.

K+R

Tarheel_Dem

(31,234 posts)even get it's shoes on". And that saying has never been more true than in recent days.

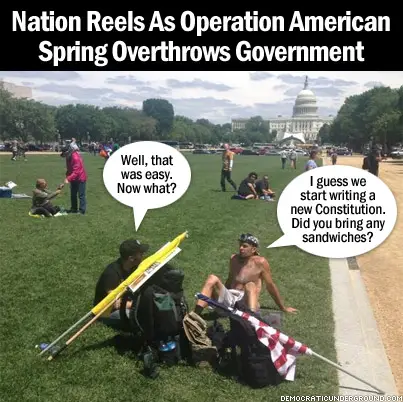

Thanks ProSense, for keeping us informed, and keeping the liars & propagandists honest. ![]() Some are extra pissed that the overthrow has been put on hold.

Some are extra pissed that the overthrow has been put on hold. ![]()

Thanks to EarlG for the hilarious mocking graphic!

ProSense

(116,464 posts)FSogol

(45,488 posts)Bobbie Jo

(14,341 posts)The misleading OP in question has been on my auto-bullshit list for a long time, due to these kind of dishonest attempts.

Sadly, knee-jerk headline readers won't get past the title line, much less perform any due diligence beyond the "he screwed us again," spoon feeding.

Maedhros

(10,007 posts)Say the limit is $30,000. The plan offers you a choice of hospitals within its provider network. If you pick one that charges $40,000, you would owe $10,000 to the hospital plus your regular cost-sharing for the $30,000 that your plan covers.

The extra $10,000 is treated like an out-of-network expense, and it doesn't count toward your plan's annual limit on out-of-pocket costs.

That's crucial because under the health care law, most plans have to pick up the entire cost of care after a patient hits the annual out-of-pocket limit, currently $6,350 for single coverage and $12,700 for a family plan. Before the May 2 administration ruling, it was unclear whether reference pricing violated this key financial protection for consumers.

You claim the information is "misleading" because it refers to out-of-network costs, but the article clearly states the opposite.

"You are missing an important piece of information from the Star Tribune article...You claim the information is "misleading" because it refers to out-of-network costs, but the article clearly state the opposite."

...it's not "missing." The part you bolded is in the OP, and doesn't change the point. That is part of the misleading information. The piece simply fails to mention that the claim, "if you pick one that charges $40,000," leaves out that this in not in network.

As I said above, it's clear that the reporting is speculative and unsure of what the rule is all about. Also from the piece:

<...>

That's crucial because under the health care law, most plans have to pick up the entire cost of care after a patient hits the annual out-of-pocket limit, currently $6,350 for single coverage and $12,700 for a family plan. Before the May 2 administration ruling, it was unclear whether reference pricing violated this key financial protection for consumers.

Again, the rule isn't changing the structure of health care coverage, which would impact every plan issued in the U.S. People aren't going to suddenly find themselves being hit with additional cost in network. On the face of it, such a claim is absurd: a rule making a fundamental change to health insurance, one that would be worse than the status quo. It's ridiculous on the face of it. Also, note that this isn't about money being paid to insurers, it's to hospitals and other providers who charge more.

Like I said, this is about networks. If and when insurance groups decide to move to this method, it will change the way they structure their networks.

Tarheel_Dem

(31,234 posts)pnwmom

(108,979 posts)JDPriestly

(57,936 posts)Thanks for posting.

ProSense

(116,464 posts)JDPriestly

(57,936 posts)I've been a member in HMOs and other such health groups. If you want to go outside the approved care providers you pay any difference between the HMO's cost with providers and the providers you choose. Sometimes you pay the entire bill. If I ask for a referral from my Medicare Advantage org. to an outside doctor, I believe that I pay my bill. I could be wrong, but I think so.

cbdo2007

(9,213 posts)Even yesterday people posted the piece with the misleading article and everyone was freaking out about it. Nice to see some facts posted on DU occasionally and not just hysteria from the "single payer" people.

treestar

(82,383 posts)wondering why the Obama can do no wrong crowd wasn't there, then one of us showed up to debunk the whole thing, and it was pretty funny that they got their wish.

Oh and how dare you use links to back anything up. They are blue!!!!! That's wrong, I tell ya!!