General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe Banksters who Stole Uncounted Trillions Should PUT IT BACK.

From when the trail was FRESH:

Know your BFEE: Phil Gramm, the Meyer Lansky of the War Party, Set-Up the Biggest Bank Heist Ever.

The Sting

In the best rip-off, the mark never knows that he or she was set up for fleecing.

In the case of the great financial meltdown of 2008, the victim is the U.S. taxpayer.

Going by the lack of analysis in Corporate McPravda, We the People are in for a royal fleecing.

Don’t just take my word about the current situation between giant criminality and the politically connected.

[font color="green"][font size="5"]You see, there is evidence of conspiracy. An honest FBI agent warned us in 2004 about the coming financial meltdown and the powers-that-be stiffed him, too.[/font size][/font color]

The story’s below. And it’s not fiction. It is true to life.

The Set-Up

You don’t have to be a fan of Paul Newman or Robert Redford to smell a BFEE rat. The oily critter’s name is Gramm. Phil Gramm. He helped Ronald Reagan push through his trickle-down fiscal policy and later helped de-regulate the nation's once-healthy Saving & Loan industry. We all know how well that worked out: Know your BFEE: They Looted Your Nation’s S&Ls for Power and Profit.

In 1999, then-super conservative Texas U.S. Senator Gramm helped pass the Gramm-Leach-Bliley Financial Services Modernization Act. This law allowed banks to act like investment houses. Using federally-guaranteed savings accounts, banks now could make risky commercial and real-estate loans.

The law should’ve been called the Gramm-Lansky Act. To those who gave a damn, it was obviously a potential disaster. During the bill’s debate, the specter of a “taxpayer bail-out” was raised by Sen. Byron Dorgan of North Dakota, warning about what had happened to the deregulated S&Ls.

Gramm wasn’t alone on the deregulation bandwagon. The law passed, IIRC, like 89-9. More than a few of my own Democratic faves went along with this deregulation, “get-government-off-the-back-of-business” law.

Today we have their love child, MOAB—for the Mother Of All Bailouts.

The Mark

In a sting, someone has to supply the money to be ripped off. Crooks call that person the mark or target or mope. In the present case, that’s the U.S. taxpayer.

Today’s financial crisis seems like a re-run of what happened to the Savings & Loans industry in the late 1980s. Well it is a lot like what happened to the S&Ls. Then, as now, it’s the U.S. taxpayer who gets to pick up the tab for someone else’s party.

Don’t worry, U.S. taxpayer. You’re getting something (among several things) for your $700 billion. You’re getting all the bad mortgage-based paper on almost all of Wall Street. I’d rather have penny stocks, because if there ever was something of negative value it’s the complicated notes and derivatives based on this mortgage debt.

When it comes to Bush economic policy, left holding the bag are We the People, er, Mopes. Don’t worry, it can’t get worse. As St. Ronnie would say, “Well. Yes.” You see, what the bag U.S. taxpayers hold is less than empty. It’s filled with bad debt.

The Mastermind

Chief economist amongst these merry band of thieves and traitors was one Phil Gramm (once a conservative Democrat and then an ultraconservative Republican-Taxus). An economist by training and reputation, Gramm was one of the guiding lights of Reaganomics, the cut taxes, domestic spending, and regulations while raising defense-spending to new heights. In sum, it was a fiscal policy to enrich friends – especially the kind connected to the BFEE.

Foreclosure Phil

Years before Phil Gramm was a McCain campaign adviser and a lobbyist for a Swiss bank at the center of the housing credit crisis, he pulled a sly maneuver in the Senate that helped create today's subprime meltdown.

David Corn

MotherJones.com

May 28, 2008

Who's to blame for the biggest financial catastrophe of our time? There are plenty of culprits, but one candidate for lead perp is former Sen. Phil Gramm. Eight years ago, as part of a decades-long anti-regulatory crusade, Gramm pulled a sly legislative maneuver that greased the way to the multibillion-dollar subprime meltdown. Yet has Gramm been banished from the corridors of power? Reviled as the villain who bankrupted Middle America? Hardly. Now a well-paid executive at a Swiss bank, Gramm cochairs Sen. John McCain's presidential campaign and advises the Republican candidate on economic matters. He's been mentioned as a possible Treasury secretary should McCain win. That's right: A guy who helped screw up the global financial system could end up in charge of US economic policy. Talk about a market failure.

Gramm's long been a handmaiden to Big Finance. In the 1990s, as chairman of the Senate banking committee, he routinely turned down Securities and Exchange Commission chairman Arthur Levitt's requests for more money to police Wall Street; during this period, the sec's workload shot up 80 percent, but its staff grew only 20 percent. Gramm also opposed an sec rule that would have prohibited accounting firms from getting too close to the companies they audited—at one point, according to Levitt's memoir, he warned the sec chairman that if the commission adopted the rule, its funding would be cut. And in 1999, Gramm pushed through a historic banking deregulation bill that decimated Depression-era firewalls between commercial banks, investment banks, insurance companies, and securities firms—setting off a wave of merger mania.

But Gramm's most cunning coup on behalf of his friends in the financial services industry—friends who gave him millions over his 24-year congressional career—came on December 15, 2000. It was an especially tense time in Washington. Only two days earlier, the Supreme Court had issued its decision on Bush v. Gore. President Bill Clinton and the Republican-controlled Congress were locked in a budget showdown. It was the perfect moment for a wily senator to game the system. As Congress and the White House were hurriedly hammering out a $384-billion omnibus spending bill, Gramm slipped in a 262-page measure called the Commodity Futures Modernization Act. Written with the help of financial industry lobbyists and cosponsored by Senator Richard Lugar (R-Ind.), the chairman of the agriculture committee, the measure had been considered dead—even by Gramm. Few lawmakers had either the opportunity or inclination to read the version of the bill Gramm inserted. "Nobody in either chamber had any knowledge of what was going on or what was in it," says a congressional aide familiar with the bill's history.

It's not exactly like Gramm hid his handiwork—far from it. The balding and bespectacled Texan strode onto the Senate floor to hail the act's inclusion into the must-pass budget package. But only an expert, or a lobbyist, could have followed what Gramm was saying. The act, he declared, would ensure that neither the sec nor the Commodity Futures Trading Commission (cftc) got into the business of regulating newfangled financial products called swaps—and would thus "protect financial institutions from overregulation" and "position our financial services industries to be world leaders into the new century."

Subprime 1-2-3

Don't understand credit default swaps? Don't worry—neither does Congress. Herewith, a step-by-step outline of the subprime risk betting game. —Casey Miner

CONTINUED…

http://www.motherjones.com/news/feature/2008/07/foreclo...

A fine mind for modern Bushonomics. Kill the middle class. Then, rob from the poor to give to the rich.

The Mentor

Anyone who’s ever heard him talk knows that Gramm must’ve learned all this stuff from somebody. He could never think it all up on his own. He had to have help. That’s where Meyer Lansky, the man who brought modern finance to the Mafia, comes in.

Money Laundering

Answers.com

EXCERPT...

History

Modern development

The act of "money laundering" was not invented during the Prohibition era in the United States, but many techniques were developed and refined then. Many methods were devised to disguise the origins of money generated by the sale of then-illegal alcoholic beverages. Following Al Capone's 1931 conviction for tax evasion, mobster Meyer Lansky transferred funds from Florida "carpet joints" (small casinos) to accounts overseas. After the 1934 Swiss Banking Act, which created the principle of bank secrecy, Meyer Lansky bought a Swiss bank to which he would transfer his illegal funds through a complex system of shell companies, holding companies, and offshore accounts.(1)

The term "money laundering" does not derive, as is often said, from Al Capone having used laundromats to hide ill-gotten gains. It was Meyer Lansky who perfected money laundering's older brother, "capital flight," transferring his funds to Switzerland and other offshore places. The first reference to the term "money laundering" itself actually appears during the Watergate scandal. US President Richard Nixon's "Committee to Re-elect the President" moved illegal campaign contributions to Mexico, then brought the money back through a company in Miami. It was Britain's Guardian newspaper that coined the term, referring to the process as "laundering."

Process

Money laundering is often described as occurring in three stages: placement, layering, and integration.(3)

Placement: refers to the initial point of entry for funds derived from criminal activities.

Layering: refers to the creation of complex networks of transactions which attempt to obscure the link between the initial entry point, and the end of the laundering cycle.

Integration: refers to the return of funds to the legitimate economy for later extraction.

However, The Anti Money Laundering Network recommends the terms

Hide: to reflect the fact that cash is often introduced to the economy via commercial concerns which may knowingly or not knowingly be part of the laundering scheme, and it is these which ultimately prove to be the interface between the criminal and the financial sector

Move: clearly explains that the money launderer uses transfers, sales and purchase of assets, and changes the shape and size of the lump of money so as to obfuscate the trail between money and crime or money and criminal.

Invest: the criminal spends the money: he/she may invest it in assets, or in his/her lifestyle.

CONTINUED...

http://www.answers.com/topic/money-laundering

The great journalist Lucy Komisar has shone a big light on the subject:

Offshore Banking

The U.S.A.’s Secret Threat

Lucy Komisar

The Blacklisted Journalist

June 1, 2003

EXCERPT…

In 1932, mobster Meyer Lansky took money from New Orleans slot machines and shifted it to accounts overseas. The Swiss secrecy law two years later assured him of G-man-proof banking. Later, he bought a Swiss bank and for years deposited his Havana casino take in Miami accounts, then wired the funds to Switzerland via a network of shell and holding companies and offshore accounts, some of them in banks whose officials knew very well they were working for criminals. By the 1950s, Lansky was using the system for cash from the heroin trade.

Today, offshore is where most of the world's drug money is laundered, estimated at up to $500 billion a year, more than the total income of the world's poorest 20 percent. Add the proceeds of tax evasion and the figure skyrockets to $1 trillion. Another few hundred billion come from fraud and corruption.

Lansky laundered money so he could pay taxes and legitimate his spoils. About half the users of offshore have opposite goals. As hotel owner and tax cheat Leona Helmsley said---according to her former housekeeper during Helmsley's trial for tax evasion---"Only the little people pay taxes." Rich individuals and corporations avoid taxes through complex, accountant-aided schemes that routinely use offshore accounts and companies to hide income and manufacture deductions.

The impact is massive. The IRS estimates that taxpayers fail to pay in excess of $100 billion in taxes annually due on income from legal sources. The General Accounting Office says that American wage-earners report 97 percent of their wages, while self-employed persons report just 11 percent of theirs. Each year between 1989 and 1995, a majority of corporations, both foreign- and U.S.-controlled, paid no U.S. income tax. European governments are fighting the same problem. The situation is even worse in developing countries.

The issue surfaces in the press when an accounting scam is so outrageous that it strains credulity. Take the case of Stanley Works, which announced a "move" of its headquarters-on paper-from New Britain, Connecticut, to Bermuda and of its imaginary management to Barbados. Though its building and staff would actually stay put, manufacturing hammers and wrenches, Stanley Works would no longer pay taxes on profits from international trade. The Securities and Exchange Commission, run by Harvey Pitt---an attorney who for more than twenty years represented the top accounting and Wall Street firms he was regulating---accepted the pretense as legal.

"The whole business is a sham," fumed New York District Attorney Robert Morgenthau, who more than any other U.S. law enforcer has attacked the offshore system. "The headquarters will be in a country where that company is not permitted to do business. They're saying a company is managed in Barbados when there's one meeting there a year. In the prospectus, they say legally controlled and managed in Barbados. If they took out the word legally, it would be a fraud. But Barbadian law says it's legal, so it's legal." The conceit apparently also persuaded the Securities and Exchange Commission.

CONTINUED…

http://www.bigmagic.com/pages/blackj/column92e.html

Socialize the risk for Wall Street. Privatize the loss to Uncle Sam’s nieces and nephews. Congratulations, Dear Reader! Now you know as much as Phil Gramm.

The Diversion

Still, a global financial meltdown sounds like something bad. Making things worse, we’re hearing that Uncle Sam is broke! Flat busted. Tapped out.

That’s odd, though. We the People see the Treasury being emptied with tax breaks for the wealthy and checks to the companies they own that make money off of war. Want to know how to make a buck these days? Invest in the likes of Halliburton and Northrup Grumman. Anything in the warmongering business connected to Bush and his cronies will weather the downturn or depression.

The Wall Street Journal -- a paper owned and operated by Fox News’ head, Rupert Murdoch – was very quick to promote the crisis, as DUer JustPlainKathy observed. The paper was even faster to pounce on a solution: What’s needed is a safety net for banks. And quick as a wink, they found the answer!

Only the U.S. taxpayer has the wherewithal to prevent the collapse of the global financial system -- a global economic meltdown that would freeze up credit and investment and expansion and prosperity and a return to the Great Depression. Who can be against that?

Oh. Kay. Sounds about right – Rupert the Alien agreeing with what Leona Helmsley said: “Only the little people pay taxes.”

Gramm and McCain also are in favor of privatization. How nice is that?

The Getaway

George Walker Bush and his right-wing pals feel they can get away with this, their latest rip-off the American taxpayers. Who can blame them? When compared to their clear record of incompetence, lies, fraud, theft, mass-murder, warmongering and treason, what’s a few trillion dollar rip-off?

Still, it's weird how they act.

They must really think they’ll be welcomed with open arms in Paraguay and Dubai and Switzerland.

Going by the welcome the world gave the Shah of Iran, they’re in for a big surprise.

The FBI Guy

Don’t say we weren’t warned. An intrepid FBI agent with something sorely lacking in the rest of the Bush administration, integrity, blew the whistle on the bank thing…

FBI saw threat of mortgage crisis

A top official warned of widening loan fraud in 2004, but the agency focused its resources elsewhere.

By Richard B. Schmitt

Los Angeles Times Staff Writer

August 25, 2008

WASHINGTON — Long before the mortgage crisis began rocking Main Street and Wall Street, a top FBI official made a chilling, if little-noticed, prediction: The booming mortgage business, fueled by low interest rates and soaring home values, was starting to attract shady operators and billions in losses were possible.

"It has the potential to be an epidemic," Chris Swecker, the FBI official in charge of criminal investigations, told reporters in September 2004. But, he added reassuringly, the FBI was on the case. "We think we can prevent a problem that could have as much impact as the S&L crisis," he said.

Today, the damage from the global mortgage meltdown has more than matched that of the savings-and-loan bailouts of the 1980s and early 1990s. By some estimates, it has made that costly debacle look like chump change. But it's also clear that the FBI failed to avert a problem it had accurately forecast.

Banks and brokerages have written down more than $300 billion of mortgage-backed securities and other risky investments in the last year or so as homeowner defaults leaped and weakness in the real estate market spread.

SNIP…

Most observers have declared the mess a gross failure of regulation. To be sure, in the run-up to the crisis, market-oriented federal regulators bragged about their hands-off treatment of banks and other savings institutions and their executives. But it wasn't just regulators who were looking the other way. The FBI and its parent agency, the Justice Department, are supposed to act as the cops on the beat for potentially illegal activities by bankers and others. But they were focused on national security and other priorities, and paid scant attention to white-collar crimes that may have contributed to the lending and securities debacle.

Now that the problems are out in the open, the government's response strikes some veteran regulators as too little, too late.

Swecker, who retired from the FBI in 2006, declined to comment for this article.

But sources familiar with the FBI budget process, who were not authorized to speak publicly about the growing fraud problem, say that he and other FBI criminal investigators sought additional assistance to take on the mortgage scoundrels.

They ended up with fewer resources, rather than more.

CONTINUED…

http://www.latimes.com/business/la-fi-mortgagefraud25-2008aug25,0,6946937.story

We were warned and nothing happened.

Repeat: And nothing happened.

They must think We the People are really stupid. Are we supposed to believe that all that $700 billion in bad debt just happened? Where did all that money go? Who got all the money?

Meyer Lansky moved the Mafia’s money from the Cuban casinos to Switzerland. He did so by buying a bank in Miami. Phil Gramm seems to have done the same thing as vice-chairman of UBS, except the amounts are in the billions.

Who cares? He’s almost gone? Nope. That money still exists somewhere. I have a pretty good idea of where it might be. And George Bush and his cronies are poised to get away with a whole lot of loot.

Who Should Pay for the Bailout

If you are fortunate enough to be one, good luck American taxpayer! You’re in for a royal fleecing. Once the interest is figured into the bailout, we’re looking at a couple of trill.

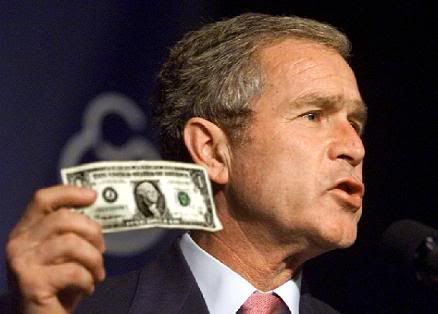

[font size="4"][font color="red"]The people who should pay for the bailout aren’t the American people. That distinction should go to the crooks who stole it -- friends of Gramm like John McCain and George Bush and the rest of the Raygunomix crowd of snake-oil salesmen. For them, the Bush administration -- and a good chunk of time since Ronald Reagan -- has not been a disaster. It’s been a cash cow.[/font color][/font size]

The above was posted on DU on Sept. 21, 2008. (Check out the responses, lots of info from DUers.) What's changed since then? Nothing near what I'd hoped for, certainly.

TeeYiYi

(8,028 posts)TYY

Octafish

(55,745 posts)Now in its 32nd year...

"You can't help those who simply will not be helped. One problem that we've had, even in the best of times, is people who are sleeping on the grates, the homeless who are homeless, you might say, by choice." -- President Reagan, 1/31/84, on Good Morning America, defending his administration against charges of callousness.

You want more Trickle-Down Voodoo Reaganomics?

Then Friend Larry Summers.

Evidence of an American Plutocracy: The Larry Summers Story

By Matthew Skomarovsky

LilSis.org

Jan 10, 2011 at 19:31 EST

EXCERPT...

Another new business model Rubin and Summers made possible was Enron. Rubin had known Enron well through Goldman Sachs’s financing of the company, and recused himself from matters relating to Enron in his first year on the Clinton team. He and Summers went on to craft policies at Treasury that were essential to Enron’s lucrative energy trading business, and they were in touch with Enron executives and lobbyists all the while. Enron meanwhile won $2.4 billion in foreign development deals from Clinton’s Export-Import Bank, then run by Kenneth Brody, a former protege of Rubin’s at Goldman Sachs.

Soon after Rubin joined Citigroup, its investment banking division picked up Enron as a client, and Citigroup went on to become Enron’s largest creditor, loaning almost $1 billion to the company. As revelations of massive accounting fraud and market manipulation emerged over the next years and threatened to bring down the energy company, Rubin and Summers intervened. While Enron’s rigged electricity prices in California were causing unprecedented blackouts, Summers urged Governor Gray Davis to avoid criticizing Enron and recommended further deregulatory measures. Rubin was an official advisor to Gov. Davis on energy market issues at the time, while Citigroup was heavily invested in Enron’s fraudulent California business, and he too likely put pressure on the Governor to lay off Enron. Rubin also pulled strings at Bush’s Treasury Department in late 2001, calling a former employee to see if Treasury could ask the major rating agencies not to downgrade Enron, and Rubin also lobbied the rating agencies directly. (In all likelihood he made similar attempts in behalf of Citigroup during the recent financial crisis.) Their efforts ultimately failed, Enron went bust, thousands of jobs and pensions were destroyed, and its top executives went to jail. It’s hard to believe, but there was some white-collar justice back then.

SNIP...

Summers also starting showing up around the Hamilton Project, which Rubin had just founded with hedge fund manager Roger Altman. Altman was another Clinton official who had come from Wall Street, following billionaire Peter Peterson from Lehman Brothers to Blackstone Group, and he left Washington to found a major hedge fund in 1996. The Hamilton Project is housed in the Brookings Institution, a prestigious corporate-funded policy discussion center that serves as a sort of staging ground for Democratic elites in transition between government, academic, and business positions. The Hamilton Project would go on to host, more specifically, past and future Democratic Party officials friendly to the financial industry, and to produce a stream of similarly minded policy papers. Then-Senator Obama was the featured political speaker at Hamilton’s inaugural event in April 2006.

Summers joined major banking and political elites on Hamilton’s Advisory Council and appeared at many Hamilton events. During a discussion of the financial crisis in 2008, Summers was asked about his role in repealing Glass-Stegall, the law that forbade commercial and investment banking mergers like Citigroup. “I think it was the right thing to do,” he responded, noting that the repeal of Glass-Stegall made possible a wave of similar mergers during the recent financial crisis, such as Bank of America’s takeover of Merrill Lynch. He was arguing, in effect, that financial deregulation did not cause the financial crisis, it actually solved it. “We need a regulatory system as modern as the markets,” said Summers — quoting Rubin, who was in the room. “We need a hen house as modern as the food chain,” said the fox.

CONTINUED...

http://blog.littlesis.org/2011/01/10/evidence-of-an-ame... /

These are the richest times in history, with seven-eighths of all wealth ever, per David Stockman, Ronald Reagan's own Budget Director. Until we see economic fairness restored through fiscal and other government policies, laws and regulations; the rich will keep getting richer, the middle class will continue dissolving into the new poor, and the poor will become the super-majority. Of course, as money pays for lobbyists who write the laws and speech and cash are the same thing when it comes to elections, the democratic perspective on policy will be silent as the grave -- unless more people wake up.

Thanks, TeeYiYi. We can still follow the money. Then, we can demand it back.

sabrina 1

(62,325 posts)Instead of heeding this oracle's warnings, Greenspan, Rubin & Summers rushed to silence her. As the Times story reveals, Born's wise warnings "incited fierce opposition" from Greenspan and Rubin who "concluded that merely discussing new rules threatened the derivatives market." Greenspan deployed condescension and told Born she didn't know what she doing and she'd cause a financial crisis. (A senior Commission director who worked with Born suggests that Greenspan and the guys didn't like her independence. " Brooksley was this woman who was not playing tennis with these guys and not having lunch with these guys. There was a little bit of the feeling that this woman was not of Wall Street."

In early 1998, according to the Times story, one of the guys, Larry Summers, called Born to "chastise her for taking steps he said would lead to a financial crisis. But Born kept at it, unwilling to let arrogant men undermine her good judgment. But it got tougher out there. In June 1998, Greenspan, Rubin and the then head of the SEC, Arthur Levitt, Jr., called on Congress "to prevent Ms. Born from acting until more senior regulators developed their own recommendations." (Levitt now says he regrets that decision.) Months later, the huge hedge fund Long Term Capital Management nearly collapsed--confirming some of Born's warnings. (Bets on derivatives were a key reason.)

"Despite that event," the Times reports, " Congress (apparently as a result of Greenspan & Summer's urging, influence-peddling and pressure) "froze" Born's Commissions' regulatory authority. The next year, Born left as head of the Commission.Born did not talk to the Times for their article.

And as we all know, she was correct. Were they just stupid, or did they KNOW she was right but saw the potential for all that corrupt money going down the drain if the truth was revealed?

I don't know which would be worse in terms of the American people. If it is the former, then the PROOF of their devastating ignorance should have precluded them from ever again being allowed anywhere near any position of power.

If the latter, and I'm sure they would deny that (Greenspan eg, and Levitt have both said, too late, they regret their decisions) then they are con artists of the highest order and should be sitting in jail somewhere. Either way, these men do not belong in positions where they can influence decisions in this country. Yet, they are still viewed as 'brilliant' by some.

Yes, get the money back a it was stolen by greedy manipulating, arrogant, possibly criminal people who have yet to pay any price for the suffering they have caused, around the world.

Octafish

(55,745 posts)A Whistleblower who was, IMO, willfully ignored.

First of all, we didn't truly know the dangers in the market because it was a dark market. There was no transparency. But generally, in any financial market, if there is not government oversight to control abuses like fraud and manipulation, to limit speculation, to make sure that a major default won't cause a domino effect throughout the economy, the public interest is exposed and in danger. -- PBS "The Warning"[/b]

She spelled it out to her bosses in the Clinton administration and to Congress. And so trillions of dollars went "Poof!" and the friends of Greenspan, Rubin and Summers are living quite well. The rest of us, not so much, but at least we have our integrity.

Enthusiast

(50,983 posts)Octafish

(55,745 posts)"Yeah. See. Move on!"

From the "DU Told You So Department"...

Parsons Blames Glass-Steagall Repeal for Crisis

By Kim Chipman and Christine Harper - Apr 19, 2012 8:48 PM ET

Bloomberg

Richard Parsons, speaking two days after ending his 16-year tenure on the board of Citigroup Inc. (C) and a predecessor, said the financial crisis was partly caused by a regulatory change that permitted the company’s creation.

The 1999 repeal of the Glass-Steagall law that separated banks from investment banks and insurers made the business more complicated, Parsons said yesterday at a Rockefeller Foundation event in Washington. He served as chairman of Citigroup, the third-biggest U.S. bank by assets, from 2009 until handing off the role to Michael O’Neill at the April 17 annual meeting.

SNIP...

U.S. Bailout

“People have a sort of a notion that ‘well, we can decide that’s too big to manage,’” he said. “But it got that way because there was a market need and institutions find and follow the needs of the marketplace. So what we have to do is we have to learn how to improve our ability to manage it and manage it more effectively.”

Citigroup, which took the most government aid of any U.S. bank during the financial crisis, has lost 86 percent of its value in the past four years, twice as much as the 24-company KBW Bank Index. (BKX) Most shareholders voted this week against the bank’s compensation plan, which awarded Pandit about $15 million in total pay for 2011, when the shares fell 44 percent.

CONTINUED...

http://www.bloomberg.com/news/2012-04-19/parsons-blames-glass-steagall-repeal-for-crisis.html

What makes me sad: I believed if only Washington knew about this, they'd do something to stop the bank robbers. Then, I saw the cops were the ones holding open the doors at the bank. I'm thinking they got a nice contribution in their pension fund.

sabrina 1

(62,325 posts)Mnemosyne

(21,363 posts)Octafish

(55,745 posts)The former Republican Senator (and Democratic US Rep) from Texas who co-wrote the act that undid Glass-Steagall:

“I’ve never seen any evidence to substantiate any claim that this current financial crisis had anything to do with Gramm-Leach-Bliley. In fact, you couldn’t have had the assisted takeovers you had. More institutions would have failed.”

Thanks to The Big Picture.

I'd tell the weasel eyed Phil to put on his glasses, but with his big job at UBS Wealth Management USA, he can afford to have someone read out loud to him.

Mnemosyne

(21,363 posts)Wasn't happening, I have a conscience. I'd rather be nearly broke than invest in evil.

I completely despise pols that switch parties, especially with cross-filing as we have in PA.

Everything out of Gramm's piehole is a lie, backed by weasel words. (no offense to weasels)

Octafish

(55,745 posts)by William F. Jasper

October 8, 2001

Financial mogul Maurice Greenberg presides over a vast and expanding insurance empire. Meanwhile, he consorts with and lobbies for the barbaric Communist regime in Beijing.

Maurice R. "Hank" Greenberg leads a charmed and busy life. As chairman and CEO of one of the world’s largest insurance and financial conglomerates, American International Group (AIG), Greenberg sits atop a very profitable and powerful empire. He dines with presidents and potentates and sups with the likes of Federal Reserve Chairman Alan Greenspan, global "wise man" Henry Kissinger, and chairman-of-the-world emeritus David Rockefeller. The New York-based magnate appears equally at home with the commissars of Communism, counting China’s premier, Zhu Rongji, and president, Jiang Zemin, as longtime friends.

Business has been very good for AIG. Greenberg’s "Letter To Shareholders" in AIG’s Annual Report 2000 noted:

AIG started the new Millennium on a positive note. Net income rose 11.5 percent to a record $5.64 billion, while earnings per share totaled $2.41, an increase of 12.1 percent over 1999.... et income gained 14.8 percent to $5.74 billion, or $2.45 per share. In addition, Revenues gained 13.1 percent to $45.97 billion; Assets rose 14.3 percent to $306.58 billion; Shareholders’ equity reached $39.62 billion at year-end, compared to $33.3 billion at year-end 1999; and Return on equity was 15.6 percent.

Behemoths the size of AIG have voracious appetites — and deep pockets. So, over the past few years, Greenberg has led the company on a worldwide acquisition binge. Some of the firms devoured by AIG include the Los Angeles-based financial services company SunAmerica, Inc. ($18 billion), the Hartford-based HSB Group ($1.2 billion), Egypt’s Pharaonic Insurance Company ($18 million), the financial units of Korea’s Hyundai Group ($860 million), the Canada-based Norwich Union Holdings, Ltd ($159 million), and the Chiyoda Mutual Life Insurance Company of Japan ($522 million). Most recently, Greenberg received accolades from Wall Street and the investment community for his August 29, 2001 acquisition of American General Corporation (for $23 billion).

Powerbroker

SNIP...

Greenberg is chairman of The Asia Society, the Starr Foundation, and the Nixon Center, as well as the founding chairman of the U.S.-Philippines Business Committee and past chairman of the U.S.-China Business Council. He is vice-chairman of both the U.S.-ASEAN Council on Business and Technology and the Center for Strategic and International Studies, and has long been a major force in The Business Roundtable and the President’s Advisory Committee for Trade Policy and Negotiations. He is also a member of the Board of Directors of the New York Stock Exchange, a member of the Trilateral Commission, a director of the United Nations Association, and the past chairman, deputy chairman, and director of the Federal Reserve Bank of New York. President Clinton appointed him to the Advisory Committee of the President’s Commission on Critical Infrastructure Protection.

COMMTINUED...

http://www.freedom4um.com/cgi-bin/readart.cgi?ArtNum=86898&Disp=2&Trace=on

Guy's retired now, steamed at the public perception what happened to his company is somehow his OSS/CIA/Banster chums' fault.

Warpy

(111,339 posts)You've put it together better than I ever could.

I've long noticed the similarity to what went on in the mobs in the 50s and 60s creeping into the financial sector and there have been a few darker times when I've thought their "legitimate" jobs went exactly there. I know their advice did.

Octafish

(55,745 posts)...makes a pretty good case:

The Bush Family: A Continuing Criminal Enterprise?

Gary W. Potter, PhD.

Professor, Criminal Justice, Eastern Kentucky University

EXCERPT...

Jeb Bush: Influence Peddling for a “Bust-Out” Scam

But, Neil Bush was not the only Bush brother involved in the Savings and Loan collapses. Jeb Bush’s, the current Governor of Florida, curious relationship with Miguel Recarey is another illustration. Recarey was a long-time business associate of Tampa organized crime figure Santos Trafficante. Recarey also fled the U.S. facing three separate indictments for labor racketeering, illegal wiretapping and Medicare fraud (Freedburg, 1988: A1). Recarey’s business, International Medical Centers, was the largest health maintenance organization for the elderly in the U.S. and had been supported from $1 billion in payments from the Medicare program. International Medical Centers went bankrupt in 1988 (Freedburg, 1988: A1; Royce and Shaw, 1988: 4). When International Medical Centers went under it left $222 million in unpaid bills and was under investigation for $100 million in Medicare fraud (Freedbrug, 1988: A1; Frisby, 1992: G1). The U.S. Office of Labor Racketeering in Miami referred to Recarey and his company as “the classic case of embezzlement of government funds ... “a bust-out operation” (Freedburg, 1988: A1)

Jeb Bush’s role in this saga being in 1985 when Recarey’s attempt to create his “bust-out scam” corporation ran into a federal regulation that said no HMO could get more that 50% of its revenue from Medicare (Freedburg, 1988: A1; Royce and Shaw, 1988: 4). Jeb Bush intervened on Recarey’s behalf with Helath Human Services Secretary Margaret Heckler and one of her top aides. Convincing them to waive the regulation in the case of Recarey’s company (Freedburg, 1988: A1; Royce and Shaw, 1988: 4). In addition to Jeb Bush’s intervention, Recarey had paid $1 million to senior Republican lobbyists in Washington, who were also working the staff of Health and Human Services in pursuance of a waiver (Freedburg, 1988: A1; Royce and Shaw, 1988: 4). In addition, Jeb Bush had contacted Secretary Heckler earlier about complaints from doctors over the quality of International Medical Centers’ care and allegations that Recarey had embezzled funds form another hospital (Royce and Shaw, 1988: 4). Jeb Bush told an aide to Secretary Heckler that “contrary to any rumors that were floating around concerning Mr. Recarey, that he was a solid citizen from Mr. Bush’s perspective down there (in Miami), that he was a good community citizen and a good supporter of the Republican Party” (Royce and Shaw, 1988: 4).

Not surprisingly, in 1988 Recarey’s company gave Jeb Bush’s real estate company $75,000 to help it find a site for a new corporate headquarters (Freedburg, 1988: A1; Royce and Shaw, 1988: 4). It was a bad investment because International Medical Centers had already selected a corporate headquarters location when it hired Jeb Bush (Royce and Shaw, 1988: 4).

Jeb Bush had a role in yet another Savings and Loan fiasco when he defaulted on a loan from Broward Federal Savings and Loan (LaFraniere , 1990: A24). Broward Federal loaned $4,565.000 to J Edward Houston, a real developer in February, 1985. The loan was secured only by Houston’s personal guarantee. On the same day, one of Houston’s company lent the same amount to a partnership made up of Jeb Bush and Armondo Codina for the purpose of purchasing a building in Miami. The Bush-Condina partnership was required to repay the loan only if revenues from the building were sufficient to cover the repayment. Bush and Condina made no payments on the loan at all and in 1987 Houston defaulted on the Broward Federal loan and the Bank sued both Houston and the Bush-Condina real estate partnership. In a sweetheart settlement with the Federal Deposit Insurance Corporation, Bush and Codina only had to repay $500,000 of the $4.5 million loan and got to retain ownership of the building which had been the collateral on the loan. In 1991, the FDIC sued the officers and directors of Broward Federal charging that the loan ultimately used by Bush and Codina was an example of the bank’s negleient lending practices (Frisby, 1992: G1). The Bush-Codina loan played a key part in the failure of Broward Federal which cost taxpayers $285 million (LaFraniere , 1990: A24).

CONTINUED...

http://critcrim.org/critpapers/potter.htm

PS: As one who's long admired your posts on DU, please know you are TOPS! Standing up, especially online, not only lets the spymasters know who's who -- it shows them who's got integrity and won't stand with the crooks -- no matter how rich or powerful.

Warpy

(111,339 posts)He had similar sweetheart deals going on with developers, which is why you can seldom get onto one of the beaches on the east coast unless you own a time share in an unending wall of high rise yuppie warrens.

All the Bush brothers have been caught with their hands in the till, even Marvin.

woo me with science

(32,139 posts)Octafish

(55,745 posts)Swiss-based international banking giant UBS welcomed deregulator extraordinaire Phil Gramm as Vice Chairman after his career in Washington. In other news that never seems to make it into Corporate McPravda, UBS was on the receiving end of $183 Billion in U.S. taxpayer bailout dollars. Small world.

UBS was one of eight large investment banks that benefited from the now-infamous backdoor bailout of AIG—resulting in government cash infusions totaling $182.5 billion—in the dark days of September 2008. At the hearing, the Special Inspector General for the Troubled Asset Relief Program, Neil Barofsky, revealed to the House Oversight and Government Reform Committee that UBS was the only bank willing to settle its soured credit default swaps (CDS) contracts for less than their face value. Why did UBS play ball when all the other banks didn't? As the Washington Independent reported, "Barofsky speculated that the firm probably simply recognized that the American taxpayers 'had taken the global economy on its back.'"

The financial crisis has proved time and again, big banks don't account for taxpayers—except when they need their help. And that's the more likely explanation for UBS' good behavior during the AIG rescue. Like the rest of the global financial industry, UBS was hurting from the subprime mortgage meltdown. (The bank's colossally bad bet on the US housing market—it had already written down $38 billion in bad loans as of April 2008—earned UBS the nickname Used to Be Smart.) But unlike its intransigent peers on Wall Street, the Swiss banking giant also faced the mounting threat of a US federal investigation. It was in no position to play hardball.

SOURCE:

http://m.motherjones.com/mojo/2010/01/ubs-good-bank-aig-bailout

Can't wait for Detroit schools, for instance, to get a bailout. Amongst others.

FiveGoodMen

(20,018 posts)If only our nation -- and indeed, this very site -- were not conditioned to turn off their brains at the mere mention of the word "conspiracy".

Response to FiveGoodMen (Reply #6)

Adam051188 This message was self-deleted by its author.

Octafish

(55,745 posts)November 22, 1963.

CIA Document #1035-960, marked "PSYCH" for presumably Psychological Warfare Operations, in the division "CS", the Clandestine Services, sometimes known as the "dirty tricks" department.

CIA Instructions to Media Assets

RE: Concerning Criticism of the Warren Report

1. Our Concern. From the day of President Kennedy's assassination on, there has been speculation about the responsibility for his murder. Although this was stemmed for a time by the Warren Commission report, (which appeared at the end of September 1964), various writers have now had time to scan the Commission's published report and documents for new pretexts for questioning, and there has been a new wave of books and articles criticizing the Commission's findings. In most cases the critics have speculated as to the existence of some kind of conspiracy, and often they have implied that the Commission itself was involved. Presumably as a result of the increasing challenge to the Warren Commission's report, a public opinion poll recently indicated that 46% of the American public did not think that Oswald acted alone, while more than half of those polled thought that the Commission had left some questions unresolved. Doubtless polls abroad would show similar, or possibly more adverse results.

2. This trend of opinion is a matter of concern to the U.S. government, including our organization. The members of the Warren Commission were naturally chosen for their integrity, experience and prominence. They represented both major parties, and they and their staff were deliberately drawn from all sections of the country. Just because of the standing of the Commissioners, efforts to impugn their rectitude and wisdom tend to cast doubt on the whole leadership of American society. Moreover, there seems to be an increasing tendency to hint that President Johnson himself, as the one person who might be said to have benefited, was in some way responsible for the assassination. Innuendo of such seriousness affects not only the individual concerned, but also the whole reputation of the American government. Our organization itself is directly involved: among other facts, we contributed information to the investigation. Conspiracy theories have frequently thrown suspicion on our organization, for example by falsely alleging that Lee Harvey Oswald worked for us. The aim of this dispatch is to provide material countering and discrediting the claims of the conspiracy theorists, so as to inhibit the circulation of such claims in other countries. Background information is supplied in a classified section and in a number of unclassified attachments.

3. Action. We do not recommend that discussion of the assassination question be initiated where it is not already taking place. Where discussion is active addresses are requested:

a. To discuss the publicity problem with (?)and friendly elite contacts (especially politicians and editors), pointing out that the Warren Commission made as thorough an investigation as humanly possible, that the charges of the critics are without serious foundation, and that further speculative discussion only plays into the hands of the opposition. Point out also that parts of the conspiracy talk appear to be deliberately generated by Communist propagandists. Urge them to use their influence to discourage unfounded and irresponsible speculation.

b. To employ propaganda assets to and refute the attacks of the critics. Book reviews and feature articles are particularly appropriate for this purpose. The unclassified attachments to this guidance should provide useful background material for passing to assets. Our ploy should point out, as applicable, that the critics are (I) wedded to theories adopted before the evidence was in, (II) politically interested, (III) financially interested, (IV) hasty and inaccurate in their research, or (V) infatuated with their own theories. In the course of discussions of the whole phenomenon of criticism, a useful strategy may be to single out Epstein's theory for attack, using the attached Fletcher article and Spectator piece for background. (Although Mark Lane's book is much less convincing that Epstein's and comes off badly where confronted by knowledgeable critics, it is also much more difficult to answer as a whole, as one becomes lost in a morass of unrelated details.)

4. In private to media discussions not directed at any particular writer, or in attacking publications which may be yet forthcoming, the following arguments should be useful:

a. No significant new evidence has emerged which the Commission did not consider. The assassination is sometimes compared (e.g., by Joachim Joesten and Bertrand Russell) with the Dreyfus case; however, unlike that case, the attack on the Warren Commission have produced no new evidence, no new culprits have been convincingly identified, and there is no agreement among the critics. (A better parallel, though an imperfect one, might be with the Reichstag fire of 1933, which some competent historians (Fritz Tobias, AJ.P. Taylor, D.C. Watt) now believe was set by Vander Lubbe on his own initiative, without acting for either Nazis or Communists; the Nazis tried to pin the blame on the Communists, but the latter have been more successful in convincing the world that the Nazis were to blame.)

b. Critics usually overvalue particular items and ignore others. They tend to place more emphasis on the recollections of individual witnesses (which are less reliable and more divergent--and hence offer more hand-holds for criticism) and less on ballistics, autopsy, and photographic evidence. A close examination of the Commission's records will usually show that the conflicting eyewitness accounts are quoted out of context, or were discarded by the Commission for good and sufficient reason.

c. Conspiracy on the large scale often suggested would be impossible to conceal in the United States, esp. since informants could expect to receive large royalties, etc. Note that Robert Kennedy, Attorney General at the time and John F. Kennedy's brother, would be the last man to overlook or conceal any conspiracy. And as one reviewer pointed out, Congressman Gerald R. Ford would hardly have held his tongue for the sake of the Democratic administration, and Senator Russell would have had every political interest in exposing any misdeeds on the part of Chief Justice Warren. A conspirator moreover would hardly choose a location for a shooting where so much depended on conditions beyond his control: the route, the speed of the cars, the moving target, the risk that the assassin would be discovered. A group of wealthy conspirators could have arranged much more secure conditions.

d. Critics have often been enticed by a form of intellectual pride: they light on some theory and fall in love with it; they also scoff at the Commission because it did not always answer every question with a flat decision one way or the other. Actually, the make-up of the Commission and its staff was an excellent safeguard against over-commitment to any one theory, or against the illicit transformation of probabilities into certainties.

e. Oswald would not have been any sensible person's choice for a co-conspirator. He was a "loner," mixed up, of questionable reliability and an unknown quantity to any professional intelligence service. (Archivist's note: This claim is demonstrably untrue with the latest file releases. The CIA had an operational interest in Oswald less than a month before the assassination. Source: Oswald and the CIA, John Newman and newly released files from the National Archives.)

f. As to charges that the Commission's report was a rush job, it emerged three months after the deadline originally set. But to the degree that the Commission tried to speed up its reporting, this was largely due to the pressure of irresponsible speculation already appearing, in some cases coming from the same critics who, refusing to admit their errors, are now putting out new criticisms.

g. Such vague accusations as that "more than ten people have died mysteriously" can always be explained in some natural way e.g.: the individuals concerned have for the most part died of natural causes; the Commission staff questioned 418 witnesses (the FBI interviewed far more people, conduction 25,000 interviews and re interviews), and in such a large group, a certain number of deaths are to be expected. (When Penn Jones, one of the originators of the "ten mysterious deaths" line, appeared on television, it emerged that two of the deaths on his list were from heart attacks, one from cancer, one was from a head-on collision on a bridge, and one occurred when a driver drifted into a bridge abutment.)

5. Where possible, counter speculation by encouraging reference to the Commission's Report itself. Open-minded foreign readers should still be impressed by the care, thoroughness, objectivity and speed with which the Commission worked. Reviewers of other books might be encouraged to add to their account the idea that, checking back with the report itself, they found it far superior to the work of its critics.

SOURCE: http://www.boston.com/community/forums/news/national/general/cia-instructions-to-media-assets-doc-1035-960/80/6210620

From 2003, first OP on DU I could find on it: http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=104x765619

It's been "money trumps peace" ever since. If it weren't so, the nation's broadcast media would have the decency to air what Rory Kennedy and Robert F. Kennedy, Jr. told Charlie Rose.

FiveGoodMen

(20,018 posts)I had not heard of that.

Thanks! ![]()

Octafish

(55,745 posts)That's why I attended "Passing the Torch: An International Symposium on the 50th Anniversary of the Assassination of President John F. Kennedy" at Duquesne University:

Octafish to attend JFK assassination conference. Do you think JFK still matters?

JFK Conference: Amazing Day of Information and Connecting with Good People

After JFK Conference, when I got home, I felt like RFK.

JFK Conference: Bill Kelly introduced new evidence - adding Air Force One tape recordings

JFK Conference: Rex Bradford detailed the historic importance of the Church Committee

JFK Conference: Lisa Pease Discussed the Real Harm of Corrupt Soft Power

JFK Conference: James DiEugenio made clear how Foreign Policy changed after November 22, 1963

JFK Conference: Mark Lane Addressed the Secret Government’s Role in the Assassination

JFK Conference: David Talbot named Allen Dulles as 'the Chairman of the Board of the Assassination'

JFK Conference: Dan Hardway Detailed how CIA Obstructed HSCA Investigation

Noah's Ark - Nov. 22, 1963

JFK Remembered: Dan Rather and James Swanson talk at The Henry Ford

Machine Gun Mouth

Truth is what Democracy needs, what Justice demands, and what the Republic requires.

Initech

(100,102 posts)But who can pass as a cowboy so the masses have a leader "they could have a beer with". ![]()

Octafish

(55,745 posts)Where "They" learned their craft:

Bush & a CIA Power Play

Robert Parry

ConsortiumNews.com

EXCERPT...

The Blond Ghost

SNIP...

After retiring, (Ted) Shackley went into business with another ex-CIA man, Thomas Clines, a partner with Edwin Wilson, the rogue spy who later would go to prison over shipments of terrorist materials to Libya. Clines himself would be convicted of tax fraud in the Iran-contra scandal, another controversy in which Shackley's pale specter would hover in the background.

But in 1980, Shackley was set on putting his former boss, George Bush, in the White House and possibly securing the CIA directorship for himself. Shackley volunteered his prodigious skills to Bush in early 1980. Though that fact has come out before, Shackley's involvement in the Iran hostage issue, the so-called October Surprise controversy, has been a closely held secret, until now.

In 1992, the House investigators should have jumped when they saw the Shackley tie-in. The task force, which was examining charges that Republicans sabotaged Carter's hostage talks, already knew that other ex-CIA men were managing a 24-hour-a-day "Operations Center" at Reagan-Bush campaign headquarters to monitor Iran developments. Richard Allen had called the ex-spies a "plane load of disgruntled CIA" officers "playing cops and robbers."

Some House investigators wanted the behind-the-scenes CIA role mentioned. A "secret" draft chapter of the House task force report, which I also found in the storage room, stated that: "Many of the (Operations Center's) staff members were former CIA employees who had previously worked on the Bush campaign or were otherwise loyal to George Bush." But that section was deleted from the publicly released version.

Another task force discovery -- also dropped from the final report -- was that conservative "journalist" Michael Ledeen, another Shackley associate, was privately collaborating with the Reagan-Bush campaign on the Iran hostage issue. The draft chapter said Ledeen was an unofficial member of the campaign's "October Surprise" group. A separate page of Allen's notes revealed Ledeen joining campaign director, William J. Casey, in a Sept. 16 meeting for what was called the "Persian Gulf Project."

http://www.consortiumnews.com/archive/xfile7.html

This crew foisted the Safari Club and the October Surprise and all the way up to PNAC and forever wars with profits without end, among other forms of undemocratic death, into our body politick.

Glad you know how to judge a book by its content, Initech.

antigop

(12,778 posts)Octafish

(55,745 posts)By BOB HERBERT

The New York Times

Published: January 17, 2002

When Senator Phil Gramm and his wife Wendy danced, it was most often to Enron's tune.

Mr. Gramm, a Texas Republican, is one of the top recipients of Enron largess in the Senate. And he is a demon for deregulation. In December 2000 Mr. Gramm was one of the ringleaders who engineered the stealthlike approval of a bill that exempted energy commodity trading from government regulation and public disclosure. It was a gift tied with a bright ribbon for Enron.

Wendy Gramm has been influential in her own right. She, too, is a demon for deregulation. She headed the presidential Task Force on Regulatory Relief in the Reagan administration. And she was chairwoman of the U.S. Commodity Futures Trading Commission from 1988 until 1993.

In her final days with the commission she helped push through a ruling that exempted many energy futures contracts from regulation, a move that had been sought by Enron. Five weeks later, after resigning from the commission, Wendy Gramm was appointed to Enron's board of directors.

According to a report by Public Citizen, a watchdog group in Washington, ''Enron paid her between $915,000 and $1.85 million in salary, attendance fees, stock options and dividends from 1993 to 2001.''

SNIP...

An article in yesterday's Times noted the extensive links between Enron and the powerful Texas congressman Tom DeLay. Mr. DeLay became unhappy when Enron wooed a Democrat -- a senior treasury official in the Clinton administration -- to run its Washington office. ''Still,'' the article said, ''whatever the tensions last year, Mr. DeLay and Enron had a natural alliance. In his days in the Texas Capitol, Mr. DeLay was called Dereg by some because of his support of business. And in Congress he has been a longtime proponent of energy deregulation, an issue dear to Enron.''

CONTINUED...

http://www.nytimes.com/2002/01/17/opinion/17HERB.html

Of course, the nation's press, especially its television and radio station, failed in their constitutionally mandate right (and responsibility under license b the FCC) to pick up the story, let alone follow it from its multi-trillion dollar beginnings.

Enthusiast

(50,983 posts)BrotherIvan

(9,126 posts)Octafish

(55,745 posts)

Banking Is a Criminal Industry Because Its Crimes Go Unpunished

Charles Ferguson

Huffington Post| Jul 16, 2012 08:23 AM EDT

Consider just (July's) news in financial services.

First, Barclay's has been manipulating the Libor, the main interest rate upon which most other interest rates and financial transactions are based, since 2005. Moreover, Barclay's traders were colluding with traders in many other banks to assist them in manipulating the Libor too, so that they could all profit from their bets on it.

Second, JP Morgan Chase is having a really great month. Recent reports describe how it is resisting Federal subpoenas related to price-fixing in U.S. electricity markets. It is also accused (by former employees among others) of deliberately inflating the performance of its investment funds to obtain business. And finally, JP Morgan's failed "London whale" trade, which has now cost over $5 billion, is being investigated to determine whether the loss was initially concealed from regulators and the public.

Third, HSBC is paying a fine because it allowed hundreds of millions, perhaps billions, of dollars of money laundering by rogue states and sanctioned firms, including some related to terrorist activities and Iran's nuclear efforts. But HSBC is only one of at least 12 banks now known to have tolerated, and in some cases aggressively courted, money laundering by rogue states, terrorist organizations, corrupt dictators, and major drug cartels over the last decade. Others include Barclay's, Lloyds, Credit Suisse, and Wachovia (now part of Wells Fargo). Several of the banks created special handbooks on how to evade surveillance, created special business units to handle money laundering, and actively suppressed whistleblowers who warned of drug cartel activities.

SNIP...

Just another month in financial services. Is it unusual? No, it's not. If we go back just a little further, we have UBS, HSBC, Julius Baer, and other banks actively marketing tax evasion services to wealthy U.S. and European citizens. We have senior executives of several banks (including JP Morgan Chase and UBS) strongly suspecting that Bernard Madoff was running a Ponzi scheme, but deciding to make money from him rather than turn him in. And then, of course, we have the financial crisis and everything that led to it. As I show in great detail in my book Predator Nation, we now possess overwhelming evidence of massive securities fraud, accounting fraud, perjury, and criminal Sarbanes-Oxley violations by mortgage lenders, investment banks, and credit insurers (including senior executives of Countrywide, Citigroup, Morgan Stanley, Goldman Sachs, Bear Stearns, AIG, and Lehman Brothers) during the housing bubble that caused the financial crisis. If we go back to the late 1990s, we have the massively fraudulent hyping of Internet stocks, and several banks (including Merrill Lynch and Citigroup) actively aiding Enron in committing its frauds.

CONTINUED...

http://www.huffingtonpost.com/mobileweb/charles-ferguson/bank-crimes_b_1675714.html

Response to Octafish (Original post)

Adam051188 This message was self-deleted by its author.

redqueen

(115,103 posts)Octafish

(55,745 posts)

Pete Brewton's book, “The Mafia, the CIA and George Bush,” is a must-own for those interested in the workings of the Bush Organized Crime Family. Written by a former Houston Post reporter, the book documents, literally, the way the Mafia, the CIA and those connected and related to George Poppy Bush looted more than 1,000 of the nation’s Savings and Loans institutions — and pretty much got away with it, scot-free.

SOURCE: http://www.ringnebula.com/project-censored/1976-1992/1990/1990-story3.htm

One way they did it was to get a person inside the S&Ls to make high-risk loans for imaginary project that would go no where. It could be a mega-mall construction project or a new high-rise condo. Collateral could be something as flimsy as a Xeroxed deed with the real owner’s name “White-Out.”

Then, before even one shovel of dirt gets turned, the loanee goes bankrupt and POOF go $6 million, say. Before it can be retrieved. . By then, the money was offshore and the bankruptee went on with his or her life as normal. The crooks behind them had additional, tax-free revenue. I kid you not, this happened in Pontiac, Michigan in 1989.

Like with other real journalists, writing about this stuff eventually cost Brewton his job. Heck, the original publisher dropped the book after getting "the call."

Brewton's book is a terribly difficult read, because of the complex nature of the conspiracies surrounding the S&Ls, money laundering, black ops, and Big Oil. It doesn’t make an easy to follow, Hansel-and-Gretel-bread-crumbs-through-the-forest story.

Then again, complex is how things are on a detailed road map. Here's what I mean from a info available on-line:

EXCERPT from "The Mafia, CIA & George Bush: The Untold Story of America's Greatest Financial Debacle — Corruption, greed and abuse of power in the nation's highest office."

The original subscribers to Cotopax, who then turned Skyways Aircraft Leasing over to Bath, were Cayhaven Corporate Services, Ltd., of George Town, Grand Cayman; David G. Bird of George Town; and Grant J. R. Stein of George Town. Bird and Stein are both directors of Cayhaven Corporate Services and attorneys with W. S. Walker & Company, a law firm in George Town headed by William S. Walker.

Cayhaven Corporate Services and Bird were two of the three subscribers to a Cayman Islands company called I.C., Inc., which was incorporated April 26, 1985. I.C. sits right in the middle of a chart drawn by Oliver North, and found by investigators in North's White House safe, that shows the private network that provided support and money to the Contras. Here's how it worked:

The money started with donations to Spitz Channell's National Endowment for the Preservation of Liberty (NEPL). Then it was wired from NEPL's account at Palmer National Bank to the account of IBC, a Washington, D.C., public relations company formed by Republican operative Richard Miller at another Washington bank. Next, IBC wired the money to I.C. in the Cayman Islands, which then transferred a majority of it to the Swiss bank account used by North's "Enterprise" to fund the Contras.

On March 7, 1987, the Washington Post published the only account of these transactions. It called the flow of money a "circuitous route" and then stated: "It is not clear from the documents who is behind I.C., Inc., the Cayman Islands company, or why it was needed to transfer the money." Apparently no investigator with the Tower Commission probe of Iran-Contra or the congressional Iran-Contra committees was able, or even tried, to get to the bottom of I.C. either.

CONTINUED...

http://www.webcom.com/~pinknoiz/covert/brewton.html

Don’t worry. The Bushes make out O.K.

The Bush family and the S&L Scandal

The Savings and Loan industry had been experiencing major problems through the late 60s and 70s due to rising inflation and rising interest rates. Because of this there was a move in the 1970s to replace the role of S&L institutions with banks.

In the early 1980s, under Reagan, regulatory changes took place that gave the S&L industry new powers and for the first time in history measures were taken to increase the profitability of S&Ls at the expense of promoting home ownership.

A history of the S&L situation can be found here:

http://www.fdic.gov/bank/historical/s&l /

What is important to note about the S&L scandal is that it was the largest theft in the history of the world and US tax payers are who was robbed.

The problems occurred in the Savings and Loan industry as they relate to theft because the industry was deregulated under the Reagan/Bush administration and restrictions were eased on the industry so much that abuse and misuse of funds became easy, rampant, and went unchecked.

Additional facts on the Savings and Loan Scandal can be found here:

http://www.inthe80s.com/sandl.shtml

There are several ways in which the Bush family plays into the Savings and Loan scandal, which involves not only many members of the Bush family but also many other politicians that are still in office and still part of the Bush Jr. administration today. Jeb Bush, George Bush Sr., and his son Neil Bush have all been implicated in the Savings and Loan Scandal, which cost American tax payers over $1.4 TRILLION dollars (note that this is about one quarter of our national debt).

Between 1981 and 1989, when George Bush finally announced that there was a Savings and Loan Crisis to the world, the Reagan/Bush administration worked to cover up Savings and Loan problems by reducing the number and depth of examinations required of S&Ls as well as attacking political opponents who were sounding early alarms about the S&L industry. Industry insiders were aware of significant S&L problems as early 1986 that they felt would require a bailout. This information was kept from the media until after Bush had won the 1988 elections.

CONTINUED…

http://members.tripod.com/rationalrevolution0/war/bush_...

With big wealth, comes big, eh, tastes...

Neil Bush, for one, shined in the S&L business.

O, Brother! Where Art Thou?

Like Hugh Rodham, the Bush Bros. Have Capitalized on Family Ties

BY LOUIS DUBOSE

Unless you've been reading the Houston Chronicle society page, it's unlikely you've seen any current news about Neil Bush. The third Bush sibling has been almost as invisible as his apolitical brother Marvin, a venture capitalist living in northern Virginia, and his sister Dorothy "Doro" Koch, the youngest of the five Bush siblings, who quietly raises funds for charities in a Maryland suburb near Washington. While Jeb was governor of Florida and George W. was twice elected governor of Texas, Neil was either part of the late Maxine Mesinger's "crème de la crème crowd" at a Houston social event, or a stale S&L footnote: "the director of Silverado Banking, Savings and Loan when it crashed in 1988 at a cost of $1 billion to taxpayers."

In 1990, Bush paid a $50,000 fine and was banned from banking activities for his role in taking down Silverado, which actually cost taxpayers $1.3 billion. A Resolution Trust Corporation Suit against Bush and other officers of Silverado was settled in 1991 for $26.5 million. And the fine wasn't exactly paid by Neil Bush. A Republican fundraiser set up a fund to help defer costs Neil incurred in his S&L dealings. Friends and relatives contributed -- but not then-President and Barbara Bush, which would have been unseemly. Since then, the Bush political combine has done such a remarkable job keeping Neil in the background that what seemed like a 10-year news blackout didn't end until mid-February, when the Austin Business Journal reported that Bush "quietly is heading a local start-up that's raising at least $10 million in second-round funding." According to the business newsweekly, Bush has already raised $7.1 million from 53 investors underwriting Ignite! Inc., an educational software company. After being banned from banking and all but airbrushed out of the family portrait -- or at least the family news profile -- Neil Bush is back.

Bush wasn't just an average S&L exec drawing a big salary and recklessly pushing a federally insured institution beyond its lending limits. As a director of a failing thrift in Denver, Bush voted to approve $100 million in what were ultimately bad loans to two of his business partners. And in voting for the loans, he failed to inform fellow board members at Silverado Savings & Loan that the loan applicants were his business partners. Federal banking regulators later followed the trail of defaulted loans to Neil Bush oil ventures, in particular JNB International, an oil and gas exploration company awarded drilling concessions in Argentina -- despite its complete lack of experience in international oil and gas drilling. It probably helped that the Bush family had cultivated close ties with the fabulously corrupt Carlos Menem, former president of Argentina.

When JNB's rights and obligations were assumed by other investors, Neil tried to persuade another American oil and gas exploration company, Plains Resources, to invest in Argentina. Plains wasn't buying. But it was hiring, and picked up Neil as a consultant for its Argentine market -- because, as Plains executive Carlos Garibaldi told The New York Times' Jeff Gerth in 1992, Neil had "traveled and played tennis with President Menem." Plains President J. Patrick Collins told Gerth at the time that Neil Bush "bent over backwards not to trade on his name."

That claim was hard to make in 1993, when Neil, Marvin, James Baker III, John Sununu, and Thomas Kelly (who had served as director of operations for the Joint Chiefs of Staff during the Gulf War) joined President Bush on a trip to Kuwait. Three months out of office, the elder Bush was traveling on a Kuwait Airlines flight to accept an honorary degree from the country's university and its highest honor from its leader: Emir Sheikh Jabir al-Ahmad al-Sabah. The rest of the Bush entourage was following along to exploit the market in a country that considered the ex-president its savior. Former Secretary of State Baker was doing deals for Enron (the Houston-based energy-related company and contributor to Bush the Elder and later a $525,000 donor to George W. Bush's two gubernatorial races in Texas). Marvin was representing U.S. defense firms selling electronic fences to the Kuwaiti Defense Ministry. And Neil was selling anti-pollution equipment to Kuwaiti oil contractors.

CONTINUED…

http://www.austinchronicle.com/news/2001-03-16/o-brother-where-art-thou/

Money for war and who knows what else.

Organized Crime, The CIA and the Savings and Loan Scandal

Internet article

The savings and loan scandal of the 1980s has been depicted in a myriad of ways. To some, it is "the greatest ... scandal in American history" (Thomas, 1991: 30). To others it is the single greatest case of fraud in the history of crime (Seattle Times, June 11, 1991). Some analysts see it as the natural result of the ethos of greed promulgated by the Reagan administration (Simon and Eitzen, 1993: 50). And to some it was a premeditated conspiracy to move covert funds out of the country for use by the U.S. Intelligence Agency (Bainerman, 1992: 275). All of these depictions of the S & L scandal contain elements of truth. But to a large degree, the savings and loan scandal was simply business as usual. What was unusual about it was not that it happened, or who was involved, but that it was so blatant and coarse a criminal act that exposure became inevitable. But with its exposure, three basic but usually ignored "truths" about organized crime were once again demonstrated with startlingly clarity:

There is precious little difference between those people who society designates as respectable and law abiding and those people society castigates as hoodlums and thugs.

The world of corporate finance and corporate capital is as criminogenic and probably more criminogenic than any poverty-wracked slum neighborhood.

The distinctions drawn between business, politics, and organized crime are at best artificial and in reality irrelevant. Rather than being dysfunctions, corporate crime, white-collar crime, organized crime, and political corruption are mainstays of American political-economic life.

It is not our intent to discuss the unethical and even illegal business practices of the failed savings and loans and their governmental collaborators. The outlandish salaries paid by S & L executives to themselves, the subsidies to the thrifts from Congress which rewarded incompetence and fraud, the land "flips" which resulted in real estate being sold back and forth in an endless "kiting" scheme, and the political manipulation designed to delay the scandal until after the 1988 presidential elections are all immensely interesting and important. But they are subjects for others' inquiries. Our interest is in the savings and loans as living, breathing organisms that fused criminal corporations, organized crime, and the CIA into a single entity that served the interests of the political and economic elite in America. Let us begin by quickly summarizing the most blatant examples of collaboration between financial institutions, the mob, and the intelligence community.

First National Bank of Maryland: For two years, 1983-1985, the First National Bank of Maryland was used by Associated Traders, a CIA proprietary company, to make payments for covert operations. Associated traders used its accounts at First National to supply $23 million in arms for covert operations in Afghanistan, Angola, Chad, and Nicaragua (Bainerman, 1992; 276-277; Covert Action 35, 1990).

The links between the First National Bank of Maryland and the CIA were exposed in a lawsuit filed in Federal District Court by Robert Maxwell, a high-ranking bank officer. Maxwell charged in that suit that he had been asked to commit crimes on behalf of the CIA. Specifically, he charged that he was asked to conceal Associated Traders' business activities, which by law he was required to specify on all letters of credit. Maxwell alleged that he had been physically threatened and forced to leave his job after asking that his superiors supply him with a letter stating that the activities he was being asked to engage in were legal. In responding to Maxwell's lawsuit, attorneys for the bank state that "a relationship between First National and the CIA and Associated Traders was classified information which could neither be confirmed nor denied (Bainerman, 1992: 276-277; Washington Business Journal, February 5, 1990).

Palmer National Bank: The Washington, D.C.-based Palmer National Bank was founded in 1983 on the basis of a $2.8 million loan from Herman K. Beebe to Harvey D. McLean, Jr. McLean was a Shreveport Louisiana businessman who owned Paris (Texas) Savings and Loan. Herman Beebe played a key role in the savings and loan scandal. Houston Post reporter Pete Brewton linked Beebe to a dozen failed S & L's, and Stephen Pizzo, Mary Fricker, and Paul Muolo, in their investigation of the S & L fiasco, called Beebe's banks "potentially the most powerful and corrupt banking network ever seen in the U.S." Altogether, Herman Beebe controlled, directly or indirectly, at least 55 banks and 29 S & L's in eight states. What is particularly interesting about Beebe's participation in these banks and savings and loans is his unique background. Herman Beebe had served nine months in federal prison for bank fraud and had impeccable credentials as a financier for New Orleans-based organized crime figures, including Vincent and Carlos Marcello (Bainerman, 1992: 277-278; Brewton, 1993: 170- 179).

Harvey McLean's partner in the Palmer National Bank was Stefan Halper. Halper had served as George Bush's foreign policy director during the 1980 presidential primaries. During the general election campaign, Halper was in charge of a highly secretive operations center, consisting of Halper and several ex- CIA operatives who kept close tabs on Jimmy Carter's foreign policy activities, particularly Carter's attempt to free U.S. hostages in Iran. Halper was later linked both to the "Debategate" scandal, in which it is alleged that Carter's briefing papers for his debates with Ronald Reagan were stolen, and with "The October Surprise," in which it is alleged that representatives of the Reagan campaign tried to thwart U.S. efforts to free the Iranian hostages until after the presidential election. Halper also set up a legal defense fund for Oliver North.

During the Iran-Contra Affair, Palmer National was the bank of record for the National Endowment for the Preservation of Liberty, a front group run by Oliver North and Carl "Spitz" Channell, which was used to send money and weapons to the contras.

CONTINUED…

http://thirdworldtraveler.com/CIA/S&L_Scandal_CIA.html