General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsGrieving parents hit with $200,000 in student loans

He and his wife Darnelle immediately took in Lisa's three children -- ages 4, 7 and 9 at the time -- even though they knew it would be a huge struggle to support them. Steve earns less than $75,000 per year as a pastor, while Darnelle earns even less as a director at the same church.

Then the student loan bills started coming.

Mason had co-signed on the $100,000 in private student loans that his daughter took out for nursing school, and the lenders wanted their money.

Unable to keep up with the monthly payments on top of all of the other mounting expenses, the $100,000 balance ballooned into $200,000 as a result of late penalties and interest rates of as high as 12%.

---

Legislation aiming to help people in these situations, including recent bills that would allow student loan debt to be discharged in bankruptcy, have been introduced over the years but have yet to pass in Congress.

http://money.cnn.com/2014/07/28/pf/parents-student-loans/index.html

Student loans are the worst type of loans because they generally cannot be discharged in bankruptcy. Private student loans are particularly very bad. There is very few options if you are ever unable to pay.

If a mortgage goes bad, you sell or give up the house. If a car loan goes bad, you give up the car. It dings your credit but you dont get financially destroyed for the rest of your life. With a student loan, you are screwed.

Jeff In Milwaukee

(13,992 posts)State support for higher education needs to increase. Pell grants need to increase. For-Profit "Universities" need to be run out of town on a rail (at least not qualify for federal financial aid). Schools need to pursue online and blended learning options to keep costs down -- cutting the salaries of Division I head coaches by 80% would also be nice. And student loans should be limited to $5,000 per year - the balance should be non-repayable grants and scholarships.

yeoman6987

(14,449 posts)I am sorry but I would never. Although I would never recommend my children to go to a private college in the first place. $100,000 for a nursing degree? That is just insane. A two year community college and then two years at the state school would still get you the same degree and a chance for a job. I feel bad for the parents in this case, but I think they were thinking with emotion and not necessarily the best way to get a degree.

TBF

(32,064 posts)can you not see the systemic problems at issue here?

yeoman6987

(14,449 posts)Applying to colleges that are 50K a year is a huge problem.

TBF

(32,064 posts)very appalling to see this type of message on a democratic party message board.

closeupready

(29,503 posts)No point in bantering with them, IMO.

laundry_queen

(8,646 posts)one_voice

(20,043 posts)We live in Delaware & both went to the University of Delaware. My daughter got her bachelors there and went to Wilmington University for her Masters. My son is currently working on his Masters (should be done in the spring) he's getting his at UD.

It's costing a damn fortune for them to get their education.

While I agree with you a nursing degree can be done in two years at a tech/community college. You graduate with you RN. That's how my mom got hers. But not all degrees can be gotten this way & not all schools are equal when applying for a job. We have, in Delaware the following:

University of Delaware

Wilmington University.

Delaware State University

and

Delaware Tech and Community College.

You can believe that Wilmington U isn't considered in the same league as UD.

There are not tons of jobs out there anymore kids & their parents are using every edge they can, sometimes that's a more expensive school. None of the colleges I listed are private but all are still overpriced and expensive.

Our country is geared toward the more fortunate. In all areas, health care, education, housing etc.

If my kids were going into college in say 5 years or so it wouldn't be feasible. We just couldn't afford it. And the loans would take a lifetime to pay off. Something needs to be done the divide is too big.

phylny

(8,380 posts)'78 & '80, as out-of-state students, my recollection is that my entire four-year education cost my lower-middle class parents well under $20,000. In fact, during the year my father was unemployed, we took out a loan that I repaid. It was $2,000.

Here's info on tuition that only goes back to 1987 for UD, but it'll give you an idea of how the cost has skyrocketed:

http://www.collegecalc.org/colleges/delaware/university-of-delaware/

Arugula Latte

(50,566 posts)Our state university has an estimated cost-to-attend of at least $25,000 a year.

riderinthestorm

(23,272 posts)closeupready

(29,503 posts)was recommended for the Dean's List in my first semester. Which goes to show you that your education - below a certain level (and here I mean Ivy League) - is mostly what YOU put into it.

That is, $32,000/tuition&fees and all the public accolades and the biggest library and smart peers are useless if the school is simply a bad fit.

riderinthestorm

(23,272 posts)But yeah, 100% agreed. If you hate the school then its an even BIGGER money pit...

closeupready

(29,503 posts)the Capitol Square at State Street (I literally lived on those in college) - or get a Plazaburger. hehe ![]()

riderinthestorm

(23,272 posts)how this is blaming the victim. When you cosign a loan you know you'll be liable if the person can't pay. It doesn't have anything to do with it being a school loan. I'm sorry the man's daughter died, but don't cosign a loan you can't pay back. Isn't that common sense?

TBF

(32,064 posts)involved rather than look at the systemic problem in this country.

Capitalism - I would argue it is working as planned & the ones at the top (no matter how they got there) are taking all the money.

For the crowd who wants to regulate/reign in the capitalism - at least these folks are trying to reign it in so it doesn't destroy everyone.

Apologists - refuse to see that the economic system is the problem and instead choose to blame individuals for making "bad decisions" - when in fact if you are poor you really don't have much of a choice at all.

This is not brain surgery. People are getting ripped off right and left. A very small percentage of people in this country are benefiting by screwing over the rest (and I don't care if you're doing it "legally" or not - this is plain and simple what you are doing. )

RobinA

(9,893 posts)devisable that can totally protect people from not looking out for themselves. Our system has every safeguard necessary to keep these people from being in the fix they are in, and frankly at not an outlandish price, given that every possibility (the woman's death) cannot be avoided.

The only systemic fix for this is to make it mandatory for every person who has dependents to have enough life insurance to make each and every dependent independent, and to mandate that every person with a loan have the loan insured so that it will never fall on someone unable to pay it. That's a whole lot of mandatory in a country where mandatory is already growing by leaps and bounds.

TBF

(32,064 posts)How can you possibly say that with a straight face? I think the "mandatory" we need to focus on is making corporations pay some income tax and not continue to get rewarded for shipping all their jobs to other countries. Since you're obviously lost let me introduce you to economic inequality:

Much more here: http://www.motherjones.com/politics/2011/02/income-inequality-in-america-chart-graph

any of this have to do with how these people could have stayed out of trouble? Shipping jobs overseas? Income inequality? Huh?

TBF

(32,064 posts)that's clear. You are determined to focus on individuals while I try to explain that it is one symptom of an overall systemic failure.

There is a reason the rich folks in this country have paid PR firms to push these types of memes ("individual responsibility"![]() - it is because it encourages low-income people to blame each other while the rich are busy taking all the money.

- it is because it encourages low-income people to blame each other while the rich are busy taking all the money.

YarnAddict

(1,850 posts)It was a private loan. Huge difference.

(I'm with you on this. You can want the best for your adult children, but there is no reason to jeopardize your own lifestyle and retirement plans.)

groundloop

(11,519 posts)Costs are skyrocketing even for PUBLIC colleges, and without student loans a decent education is out of reach for most people. There's really not much way around student loans. The system is badly broken and needs to be fixed.

pnwmom

(108,980 posts)costs?

Most parents would co-sign for such a loan, in the full expectation that their child would be able to pay them back. Nurses make good salaries these days.

earthside

(6,960 posts)Even public universities and colleges need a top-to-bottom scrub.

Many of these institutions have been on build sprees (stadiums; arenas; student unions; recreation facilities; etc.) have presidents pulling in outrageous salaries; have bloated administrations; and are hiking tuition even when taxpayers are funding larger budgets.

There maybe just too many institutions of higher learning now -- we might be better off with more trade schools; apprenticeship programs and certification programs -- that only take a couple of years and only cost a few thousand dollars.

But the social pressure to go to college is enormous, even for individuals who probably shouldn't be there (which is why the graduation rate compared to the enrollment rate diverges).

NJCher

(35,685 posts)And your post is the closest I've ever seen that sums up the situation so well.

In some places, there's actually too much funding of higher education-- like the place I taught in until I couldn't stand it any longer. Because they built the stadiums, rec facilities, etc., they are in such debt that they are letting just anyone in the door now. The students are social misfits and in no way, shape or form are ready for a college education.

In fact they just want to sit in class and text their friends. They really are not interested in the subject at hand.

When I asked why they are even there, they said it was because their parents pressured them to go to school. A trade school or some other option that might be more suitable for them is not an option because the parent wants the prestige of being able to say their kid is in college.

So what I would add to your post is there needs to be a re-thinking of the value that our mechanics, hvac techs, , etc., hold. The world wouldn't run without them and being able to do that kind of work takes a kind of intelligence that the world at large doesn't value. I call it the "fixit" intelligence. I dont' have it, so that's how I know how valuable it is.

Cher

Tetris_Iguana

(501 posts)Jeff In Milwaukee

(13,992 posts)Not every job requires a four-year degree. We're definitely an over-credentialed society.

And some of the building is the ugly side of the "competition" that conservatives love so much. In the fight for the best and brightest students, we're seeing amenities on campuses that were unthinkable a generation ago. Some of that is changing technology -- a wireless network is pretty much a campus requirement these days -- and none of that is cheap. We've created an "arms race" for recruiting, with not nearly enough effort being put into retention.

pnwmom

(108,980 posts)Community colleges can produce aides and LPN's. Not the same thing.

Jeff In Milwaukee

(13,992 posts)One can become a Registered Nurse with a two-year degree. Community colleges offer an Associate Degree in Nursing (ADN), while four-year schools offer a Bachelors of Science in Nursing (BSN). To become a Register Nurse, both have to pass the NCLEX-RN Exam.

Granted that having the BSN is typically a pathway to great advancement opportunities, but one can be an RN without a four-year degree. Many four-year schools also offer specialized programs (RN-to-BSN) that provide registered nurses with an ADN a fast-track toward completing a bachelor's degree.

So one could go to a community college for an ADN, then enroll in a four-year school to complete the BSN, thereby saving a significant amount of money.

hedgehog

(36,286 posts)often adjunct professors - doing piece work in order to make a living, no benefits and no chance for tenure.

nitpicker

(7,153 posts)Once upon a time...

Students could work-study their way thru college, be taught by GI bill retirees (or in one memorable case, a pre-Crash grad) and be able to live in a dorm.

Of course, there were certain minor drawbacks...

Six people, three tiny bedrooms, one shower.

Canned stew on Sunday was the meat of the week.

And trying to find CDC in the phone book on a weekend (its own saga)...

The ROT set in when MY U started chasing after writers and other names to improve public perception of MY U.

And building grandiose things.

Now what was under 1000 a year costs around 15K a year.

And that's if you commute.

Is online more affordable? Unknown to me for now.

But unless you have a sugar source:

NEVER go to a school that makes you move back in with your parents for the next decade even if you get that local job.

And parents:

The ONLY way to make sure your kid doesn't die and leave you as deadbeats is to insist your kid only borrows via DOE

And NEVER COSIGN.

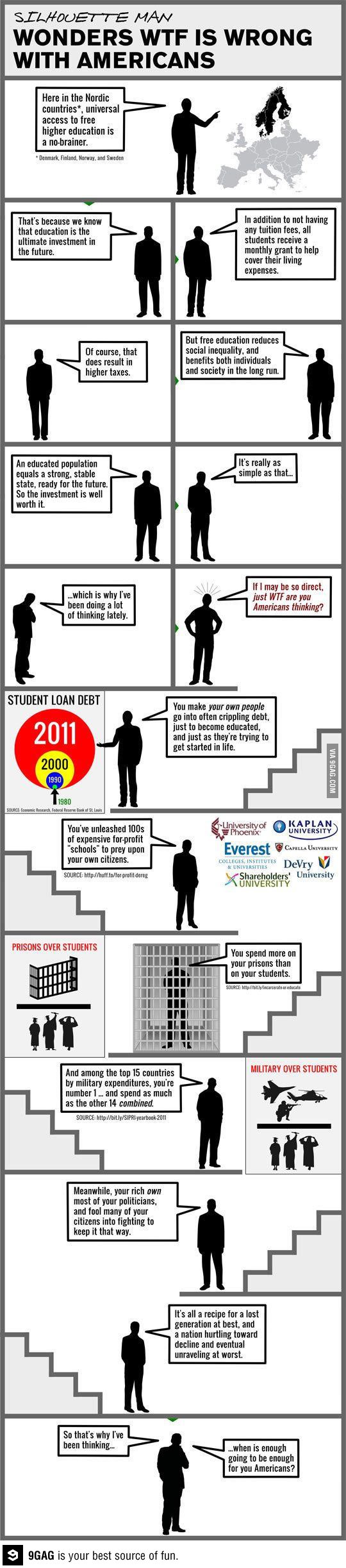

woo me with science

(32,139 posts)

pleinair

(171 posts)Deserves its own thread

malaise

(269,050 posts)Excellent ![]()

dhill926

(16,343 posts)totally nails it….

daleanime

(17,796 posts)I've stolen it before, and I'll steal it again.

smirkymonkey

(63,221 posts)CrispyQ

(36,478 posts)That's just criminal & wrong on so many levels.

riderinthestorm

(23,272 posts)smirkymonkey

(63,221 posts)it's now up to over 130K in about 10 years (paid for a time, went into deferrment for a time during LT unemployment after 9/11 in NYC, then foreberance because I couldn't afford the minimum and they wouldn't let me pay what I could afford). I didn't know what to do. It just kept growing and my income couldn't keep up.

Even w/ income sensitive payments, I am barely making a drop in the bucket on the monthly interest - I can't even touch the principal. I will never pay this off as long as I live. Forget about saving a cent for retirement. The rest of my income goes for living expenses.

Divernan

(15,480 posts)$100,000 here; another $100,000 there - gotta keep that income stream going. Like the man-eating plant, Audrey in the film Little Shop of Horrors, the message from the One Percenters is, "FEED ME"

n2doc

(47,953 posts)But of course one never seems to hear the fundies protesting against it, or pushing for pols who would outlaw it.

questionseverything

(9,656 posts)when he whipped the "money changers" out of the temple

Brickbat

(19,339 posts)run up huge loans, and then ask them to die so as not to pay them.

closeupready

(29,503 posts)WhiteTara

(29,718 posts)They hate people so much that they lock them into death spiral economics.

davidthegnome

(2,983 posts)Where does it average out? Probably somewhere around 35%? I mean, lacking multiple write offs and really clever accounting.

I earn around twelve thousand, probably closer to eleven or so after taxes. My own student loan debt was around eleven thousand the last time I checked - from a year of school. The problem was that I had to borrow too much money because I couldn't find work. I don't even know what the interest rate is, it's all kind of funny to me because there's no frigging way I can pay it any time in the near future. Working on the deferment paperwork now, but sooner or later, my wages will probably be garnished. Two hundred dollars a month for a car, about the same for gas, given my thirty mile commute to work - and the thirty miles home at night. My car transmission broke down, so there's another 2100. If not for my family...

This though, is despicable, it's beyond despicable. I understand that having co-signed, there is a legal obligation to pay off that debt. Two hundred thousand dollars though? For someone who earns a bit less than 75 per year? The woman who borrowed the money is dead. Her parents are trying to raise her three children... isn't there some way we can wipe these out? I mean, shouldn't death pretty much exempt your family from having to repay your college loans? Hell, aren't there any circumstances at all in which these lending vultures develop compassion or mercy?

At work the other day, a federal employee came to my desk to look for the Manager. He needed her to sign paperwork for another employee, a federal withholding form. She went on about how she was always happy to help with those. They talked about how, when they were younger, people had morals, repaid their loans, understood the moral obligations and blah blah blah. People are too lazy today, she said, too immoral, always have their hands out, expecting something for nothing.

When crippling debt and minimum wage or slightly better is the norm - especially where I work.... it infuriates me that they think it's a matter of selfishness, greed, or laziness.

We need some kind of loan forgiveness program and we need exemptions that protect people instead of money. If you borrow so much money and die, there should be a clause that pays off the loan for you. You're fucking dead, so it falls on a co-signer, if you were lucky enough to have one.

I hate this oligarchy shit, these predatory lenders, I hate the fact that the government enables and protects them - while happily garnishing workers already shitty wages for repayment.

marions ghost

(19,841 posts)jwirr

(39,215 posts)ieoeja

(9,748 posts)They would have to make over $405,000 a year to even start paying 35% on their highest income.

At %75,000 they are barely in the 25% bracket. Their average rate is just under 14% before deductions which includes at a bare minimum 5 dependancies.

To average 35% they would have to make $1,157,546 a year (ignoring deductions).

10% on the first $18,150

15% on the next $55,650

25% on the next $75,050**

28% on the next $78,000

33% on the next $178,250

35% on the next $52,500

39.6% on the remainder of their earned income

** At $75,000 total income they would pay 25% taxes on only $1,200 income: 75,000 - 55,650 - 18,150.

Ilsa

(61,695 posts)Were stupid about this. I bet they sent here to a religious private university like Baylor. She probably got a BSN and became an RN. I wouldn't pay $100,000 for that degree from a private university when a state university gets you the same degree and career for half that.

This pastor probably thought his daughter would be morally (and physically) safer at a religious college. Personally, I think that's crap, and I have doubts about it preparing a nurse to be in the real world with real patients.

marions ghost

(19,841 posts)Nobody was "stupid" IMO.

exboyfil

(17,863 posts)In Iowa it is highly competitive to get into the only public BSN school in the state. Fortunately my daughter has a very good private option that will allow her to live at home. It is also structured where the Science and Social Studies/Humanities classes can be taken at local community colleges (or the regional university).

Total tuition, fees, and books for the 15 month accelerated option is $39,000. An additional 68 credit hours have to be earned at a community college before starting the accelerated program (approximately $10,000) with probably another $3,000 for books/access cards. You are at $49K without counting room and board.

If you are successful going community college and then state school. You will still have the $13K and probably are looking at 2 1/2 years at a minimum on campus at $25K/yr (total $62K) for a grand total of $75K. Trust me I have looked at the numbers - my daughter is going into nursing. In her case she will have all the prerequisite courses done for the accelerated program before graduating from high school (approximately 9 classes will be paid for by the high school). The only question remaining is if she can get into the accelerated program after high school graduation. It is competitive but not as much as the state school.

Ilsa

(61,695 posts)Available program slots. I hope she gets in!

Ilsa, RN

exboyfil

(17,863 posts)She has been taking her CNA class this summer between her high school sophomore and junior year, and she seems to be enjoying it (she has a great teacher). She could have taken the course at the high school this coming year, but she learns so much more taking it with more mature students and being able to have class in six hour time blocks vs. 45 minutes.

Another thing about the public school. I mentioned to their admissions people that my daughter was getting her CNA and hoped to work as a CNA while still in high school. They basically dismissed it saying that it might only help on the application. The local private nursing college requires the students to have it before starting the accelerated program. It seems like being a CNA early on will give a student an appreciation of what is expected of a nurse. It seems like a logical progression. Since nurses supervise CNAs it would also give my daughter a better appreciation of CNAs that might be under her supervision in the future.

She eventually would like to work for Doctors Without Borders. Starting out she is looking at the Peace Corps or high need Latino or Native American communities. I am very proud of her.

DesertDiamond

(1,616 posts)taught_me_patience

(5,477 posts)The article stated the interest was 12%... which doesn't seem that excessive given the failed history of repayment.

Initech

(100,080 posts)jwirr

(39,215 posts)people. It will still go to the banksters who loaned the money to them.

AtheistCrusader

(33,982 posts)http://www.nolo.com/legal-encyclopedia/private-student-loans-bankruptcy.html

The laws are certainly stacked against the borrower, no doubt, and it's a major fight every time compared to something more conventional like a mortgage, but it can be done.

Logical

(22,457 posts)tammywammy

(26,582 posts)You can't sell an education you received to someone else.

Logical

(22,457 posts)davidn3600

(6,342 posts)Most lenders of those loans are also willing to settle under such circumstances.

mwooldri

(10,303 posts)I wonder in this case whether life insurance was offered on these loans. If it wasn't offered, maybe the lender has some blame here? If it was turned down and the lender can document this then there goes my idea: suing the lender for failure to adequately explain the loan and failure to offer an insurance product to go along with it.

Overall, IMO private student loans need reform. Federal student loans have enough protections for the borrower - this means in a worst case scenario 25 years after finishing higher education a borrower can have their debt canceled. Yes there will be an income tax issue but it's better than a student loan issue as taxes can be negotiated and settled, even in bankruptcy court.

marions ghost

(19,841 posts)how cruel.

You'd think those fat companies could cancel it in case of death. The parents have lost their "investment."

JayhawkSD

(3,163 posts)When a loan is forgiven someone is "unjustifiably enriched." You are talking about allowing someone to keep money that was not earned. It was borrowed and not repaid.

A school, in this case, gouged a student for $100,000. That money was not a figment of soemone's imagination. It was cash, borrowed from, probably, the government and handed to the school. The student signed the loan without ever the slightest thought of "Wow, I'm going to have to pay this back." The parents cosigned with the idea of helping their kid and no thought as to what thet might mean in terms of payment. By writing it off, the lender is out the money, has paid it out and not received the value for what it paid. The school is enriched by $100,000. By writing it off we are perpetuating the whole stinking rotten system. We're saying, in effect, "Wow, that worked seamlessly, so let's do a lot more of it. Let's borrow a lot more money without thinking about repayment."

A homeowner refinances his home and takes out cash because of the inflated value of his home. The value of his home drops and he is now underwater. The variable interest rate resets and he can't meet the payments. So we forgive the loan because we are a "merciful nation." But that money was given to him in cash. He used it to buy a boat and a vacation and to maintain a lifestyle. Why should he benefit from that cash and not have to pay it back? Why should we weep for him because he is "underwater and can't make his payments?" If we forgive the mortgage his is unjustifiably enriched because he received cash that he spent and is not having to pay back.

These parents cosigned on their daughter's loan. She received the education, good or bad, that the money was for. That she did not live to benefit from it is not the school's fault or the lenders's fault. Why should either of them be penalized for it? Did the parents know what they were doing? If not, why did they do it without asking someone to advise them? If they did know, why are they now saying they should not have to bear the consequences of their decision?

Yes, the terms of the loan are outrageous, but were they not spelled out when the laon was originated? Does any student sign a student loan not knowing that the loan cannot be discharged by bankruptcy? Of course they do because they are not thinking about repaying the loan and they think they are immune to bankruptcy. They are only thinking about today and are not considering the consequences of their actions. That's what kids do. That's why they consult their parents, only today that's what their parents do, too, because the parents assume the government will bail them out.

Responsible for the consequences of our own decisions? That's for people in other countries, not this one.

magical thyme

(14,881 posts)For example, homeowner loans don't get forgiven. They get re-written, or they negotiate a short sale (and the forgiven portion is taxable income, plus the homeowner loses their entire down payment) or the home is foreclosed on. The re-written loan allows the homeowner to continue making payments and stay in his/her home, which contributes to a more stable society. Foreclosures end up costing as much, if not more, but the costs are hidden. For example, having a foreclosure in your neighborhood lowers the property values of the entire neighborhood. That is a cost to everybody. Having empty houses falling apart invites crime and wastes valuable resources. Throwing people out of their homes can cost them jobs, damages their children's education and stability, and ultimately costs society more then re-writing the terms of the loan.

It is no different than bankrupcty of a business; the losses are shared so nobody ends up totally ruined and to contain the losses rather than making things worse.

In the situation cited in the OP, it's hard to feel real sorry for the parents. You can go to nursing school for a lot less than $100K, she should have taken out FAFSA loans, with a lower interest rate, and certainly the parents should have been able to do the math.

Still, the cost of educating their daughter was a lot less than the $100K the school charged and the interest rates are usury and should be illegal. And the parents should at the least have been able to immediatere-negotiate the interest rate and payments down to something affordable.

The entire system does need to be fixed. There is so much massive corruption from top to bottom that anybody can start out doing things right and still end up losing everything.

Punishing people and ruining them financially and ultimately ruining their lives because of mistakes and unforeseen circumstances does not help the situation in the long run.

I know whereof I speak. I did my homework, I did the math, for my recent MLT degree. What I could not foresee was that the government statistics of 14% growth were a flat out lie. What I could not foresee was that HR at the local hospital would flat out lie to both me and a classmate about the starting salary. What I could not foresee was the state university's claim of 100% employment for its graduates was a lie by omission. Twice in the last 4 years I was driven to the brink of suicide by the stress and ruin brought on me. And guess what: that would not pay the loans back either.

JayhawkSD

(3,163 posts)I was actually referring to the large number of calls that underwater loans should be forgiven.

The corruption is why I'm sympathetic. College costs are out of control and are inexcusable. College loan rates and repayment terms are usurious. Sales pitches made by colleges are unforgiveable.

Yes, the parents should be able to have access to a bankruptcy court to resolve the student loan issue, as should homeowners. Protecting mortgage companies and student loans from bankruptcy is a political expedient which results from government guarantees on those two forms of loan and are an argument against the govenment making guarantees on any loans. It props up business ventures to artificial levels of prosperity and creates bubbles which inevitably eventually burst. It increases personal and business indebtedness to unsustainavble levels, levels initially grow the economy but which eventually slow and stop economic growth.

The refusal to allow resolution in bankruptcy is that doing so would transfer the debt from private hands to the government balance sheet.

daleanime

(17,796 posts)you are not sympathetic, the only question to ask is this.

Do we want only the people who can afford it to go to college? If the answer is yes, which is what your implying, then we can plow down 9/10s of the schools that exist right now. There's no need for them.

They won't get plowed under. They will lower their prices pretty damn quick. I went to a state school way back when. I visit it every now and then. Same classroom buildings and library as in the '70's, new fieldhouse, they are on their second student union since I was there, kids live in condos instead of dorms, they have manicured, fenced and lined athletic fields for everything down to intramural [men's/women's] lacrosse practice fields. I know this because each field is labeled with a sign.

They call me periodically for money. I say No, because it seems to me they are investing in athletics and not academics. Pay a professor, buy a book...I'm not financing intramural lacrosse practice fields.

JayhawkSD

(3,163 posts)I was not talking about going to college or not going to college. I was talking about personal choices and accepting the consequences of those choices, be that college, homeownership, or whatever decisions one makes in life.

I was taught that whatever consequential choices I made must be informed decisions; that if I did not know the facts surrounding the decision then it was my responsibility to inform myself of those facts and not allow others to make those decisions for me in the form of promises or false assurances. I was taught that the person selling me something was not a reliable source of information upon which to base my decision.

I was taught that when I made a decision which later bit me on the ass that no one was responsible to bail me out of the consequences of having made that decision. It was up to me to suck it up and repair the situation using my own resources.

If I wanted to do something I paid for it with my own money. If I could not affor to do it I didn't do it, or I borrowed money which I paid back in full and on time. These are values which are obsolete.

meaculpa2011

(918 posts)a few years ago and stumbled upon a student demonstration at NYU.

They were demanding affordable tuition at the most expensive university in America.

I mentioned to one young man that they could have affordable tuition a few blocks north at Baruch University.

He looked at me like I had asked him to drink out of a public toilet.

There are hundreds of thousands, perhaps millions, of bright young people at affordable community colleges and state/city universities. Until Americans can break through this myth that expensive colleges produce guaranteed success this tuition/debt balloon will continue and the kids of honest working Americans will be burdened with debt for life.

Most Ivy League graduates succeed because of associations that were formed before they were born.

Jenoch

(7,720 posts)but there are things that can be done to avoid situations such as this one. Don't get a student loan from a private lender. It's tough enough to get relief of any kind from the federal government, let alone a private lender. Also, this woman had three children and apparently is a single mother. I don't know the details of course, but the father of these children needs to be paying child support. She also should have had life insurance. She had three dependents and needed life insurance for exactly the reasons stated in this story.

Lex

(34,108 posts)I wish the parents had obtained a life insurance policy on the daughter after co-signing her loans in the event she died, but no one really expects the unexpected.

Jenoch

(7,720 posts)I wonder if it occurred to the parents (it didin't occur to me) to buy an insurance policy. Term insurance is cheap and it certainly would have saved them much trouble. It's tough enough that their daughter died, but the financial strain really makes it a difficult situation. On the bright side, they have those beautiful children!

HWPixHend

(1 post)We took out a $75K life insurance policy on our youngest son to cover his private student loan debt (that I have consigned for) he is incurring (and will incur) in college right now (he’s rising junior in Computer Science Engineering at Cornell) for this very reason. It is very cheap, $25/month.

If no one expected the unexpected the insurance industry would wither and die. There were several ways around this situation that don't require an advanced finance degree. We're talking what used to be called Consumer Economics here. Insure yourself so your dependents don't wind up indigent if you die or can't work. Insure your liabilities if they might land on somebody. This is Adulthood 101.

Lex

(34,108 posts)I said I wish the parents would've obtained life insurance on the daughter. Most people who need it don't get it because they simply don't think the unexpected will happen.

Don't fall off your high horse and hurt yourself there pard'ner.

RobinA

(9,893 posts)We've reached the point where advocating common sense and the basic knowledge formerly possessed by people who didn't even graduate from high school is being on a "high horse."

Very sad.

So wonderful to be you, no doubt.

Logical

(22,457 posts)MissB

(15,810 posts)"But mommmmm, the college counselor [at the conference he went to] says that we shouldn't look at price when selecting a college!"

That's nice, dear. But Mommmmm and Dad have $x per year to spend on college and we don't want you taking out loans. We won't be taking out loans on your behalf.

We're fortunate. We can pay $x/year for college with a slight bit of pain but no actual debt. He can attend a state university here, or anywhere else he darn well pleases as long as it does not exceed $x. We don't qualify for a cent of financial aid, so $x has to work. He's collecting AP credits to help himself stay in that rare four year graduation rate. If he doesn't get merit then he goes to a perfectly fine state university.

High school counselor and private college counselors don't exactly take into account a family's finances when suggesting wonderful matches (universities) to students. Our school likes to trumpet the list of selective colleges that their seniors get into, which means that my kid will be likely applying to one or more universities that cost $60k/year. ($60k does not equal $x.) and then we will say no. Period. Unless the cost of attendance = $x + any scholarship, the answer is no.

Best thing I can do for my kids is provide them with an undergraduate education that doesn't require debt. And I'm grateful that I'm able to do that.

My wife started saving for our kids' college when they were born. When they had accumulated enough for a state university education, we stopped contributing. One is in community college the other will be starting next year. When their tuition is due we march them over to the bank and withdraw the required amount. They know that they're spending their money. We put it aside for them, but it's their money.

A friend put money away for his kid and kept putting money away. His business went south a few years ago and he's struggling, but his kid has $220,000 set aside with no desire to attend college.

I get resumes every week from out-of-work Ivy Leaguers. I've never held that against any of them, but most of my hires have been community college/CUNY graduates.

Gormy Cuss

(30,884 posts)It was a mistake to extend them the same protection as Federally-backed student loans without also requiring the private lenders to conform to government-backed loan standards on interest rates, deferrals, and discharges.

Jenoch

(7,720 posts)ieoeja

(9,748 posts)Pre-Reagan student loans were guaranteed by the government. If the student did not pay the bank, the bank just collected from the government. And the government let it slide. Since college graduates make more money they pay more taxes. Far more than the defaulted student loan. So this entire arrangement actually helped the government's bottom line.

Reagan ended that.

Some day someone is going to mention a systemic problem in this country that is not Reagan's fault.

Some day.

meaculpa2011

(918 posts)people of my generation took student loans and defaulted despite the fact that they were able to pay.

Back in 60s and 70s I spoke with plenty of people with good paying jobs who bragged about how they scammed the government.

Tetris_Iguana

(501 posts)And they ruined it for us all.

I think we should go back to pre-Reagan policies, with the caveat that fraudulent defaulting is charged for the crime it is.

There. Everybody wins (except the crooks).

ieoeja

(9,748 posts)The government will collect far more extra taxes from college grads than we lose on student loans.

I think there should be some attempt to collect it. For VA student loans, I happen to be the asshole who started collecting those unpaid loans under Reagan. I was hired for that specific purpose, in fact. There were certainly instances where I quite enjoyed it. There was a lawyer, for instance, who cleared more than his entire student loan in a week. He tried the "as long as I start a payment plan you have to accept it" bullshit. You would think a lawyer would know better. He was already in default. Too late to demand a payment plan.

However, a lot of people took these loans who really weren't the college type. But they were told "if it doesn't pan out, don't pay it", so they took the chance. It was a gamble with a potential reward and no downside. Or so they were told. By the government. Going after these guys was just plain shit.

Going forward, collections could be part of the program from day one. So we wouldn't have that at least. But we could collect it the way I did for the VA. Sure, we sent them collection letters, etc. Threatened to refer them to Collection Agencies**. Those who still did not pay?

You know that IRS tax refund you were suspecting? You ain't getting it now.

We could do the same thing, but exempt them under a certain income so we're not going after people who aren't paying because they can't.

** I was supposed to refer them to a collection agency before garnishing their tax refunds. Had I succeeded, 50% of the tax refunds would have gone to the collection agency since by law any money collected after referral to an agency is assumed to be the result of the agencies efforts. Fortunately, the agency's specification was so full of industry terminology that I could not make heads nor tails of it. So no referral.

I'm thinking somebody's campaign donor ended up wondering where his agency's VA windfall went.

taught_me_patience

(5,477 posts)and the story sounds fishy. First, off, where is the husband? and why is he not paying child support?

Secondly, they co-signed for the loan, which means you are on the hook for the complete amount of the loan balance. Everybody knows this... they lent their credit, so that her daughter could get the loan in the first place. Lastly, the daughter, who appears to be a single mom with three kids with no child support and with 100k in student debt had no life insurance. Completely insane! She could have and a 500k 20 yr. term policy for 250/year.

meaculpa2011

(918 posts)you'll be buried under an avalanche of "blaming the victim" posts.

Logical

(22,457 posts)closeupready

(29,503 posts)And if you were running for public office, I'd run the other way, FAST.

daleanime

(17,796 posts)you have no sympathy at all. And your perfectly fine with the way college is currently funded.

taught_me_patience

(5,477 posts)and the lack of term life insurance. There are a lot of people who risk not having life insurance and get burned. This is one of, I'm sure, thousands of stories of hardship following a death of a young parent without life insurance.

NM_Birder

(1,591 posts)is no longer a priority. Yeah it'll ding your credit but "fuck it" claim bankruptcy and let someone else cover the loan.

It's a trifecta of ignorance, she had no way of paying off a 100k loan and she should have known that, the parents should never have put themselves on the hook by co-signing on a loan they couldn't pay for either, and lastly, the idiots that approved a 100k loan to people that could not pay it back. Three times the stupid, three times the misery.

riderinthestorm

(23,272 posts)Jenoch

(7,720 posts)That does not mean there is not room for much sympathy for this family.

Where is your compassion?

ann---

(1,933 posts)right. $75,000.00 is quite a lott of money, especially with the wife's additional income. And, if his daughter worked, the children are entitled to social security benefits which would help. Families making a lot less than that make ends meet.

where you live. I live on the east coast, Philadelphia 'burbs, and $75,000 plus whatever with 3 kids, a big student loan and whatever else you happen to owe (mortgage, car, etc.) really isn't going to get you very far.

Ilsa

(61,695 posts)Was she working? Most places I know where nurses work have decent benefits packages. If so, didn't she have life insurance naming the children as beneficiaries? Would it have cost that much more to get her debt covered? What about the SSI for the kids? The daddy(ies)?

I hope the parents aren't doing this to play on people's sympathy. There are people a lot worse off.

But yes, I also wholeheartedly agree that the student loan program needs a huge overhaul.

NM_Birder

(1,591 posts)if you borrow money from someone, or some firm,..... you have to agree to their conditions for repayment. If you cannot repay the loan, you get screwed, along with the lender who lends money to people who can't pay it back. If you co-sign on a loan ..... that makes YOU responsible for the re-payment.

This is entry level economics ...... you borrow money, you agree to the terms of repayment, if you agree to repayment terms you can't afford, then you are an idiot waiting for a disaster. If a firm lends money to someone who can't pay it back, THEY are the idiot waiting for a disaster.

Here is the only thing I found shocking ........ A pastor makes 75k a year ? Jesus Fucking Christ, I'll record the Giants games on Sunday's......... if lecturing people on their personal flaws nets me 75k without the stress of a private sector job.

TBF

(32,064 posts)as an economic system. The system is designed so that those at the top, no matter how they get there (beg, borrow, steal, "earn it" - whatever the heck that means, or inherit it) control all the money. Everyone at the bottom is forced to "work for" peanuts and cover anything else they want to do with debt. The system is not broken - this is how the system is designed - and it is rigged.

NM_Birder

(1,591 posts)to go to school, there are many - many more who go to school just fine, don't bury themselves in stupid amounts of debt and are just fine.

Highlighting an example of ignorant borrowing practices, coupled with a tragedy is not what is wrong with capitalism. The system is not rigged, but it does take a certain amount of planning and rational thought. Borrow money, agree to the terms = your problem to deal with regardless of misfortune, that is the way it is.

Single mom, with three kids, borrowing 100k = extreme chance of financial collapse, THAT is why she had to have a co-signer in order to guarantee the loan would be paid back. I'm curious about how long this loan has been a problem, how long have payments been missed ? 100k loan @ 12% is a crystal award winning stupid thing to agree to, but it would still take several years to double to 200k.

BUT,........ I'm still shocked that a Pastor makes 75k !

TBF

(32,064 posts)any thought of systemic issues. This type of thinking, propagated by the very wealthy for their own benefit, is completely disgusting.

And as for salaries, what did Jamie Dimon make last year?

NM_Birder

(1,591 posts)yes, I blame ignorant behavior as the cause for ignorant people's self-caused problems. Highlighting an example of an ignorant borrowing practice, while using her death and three kids as the reason for the "unfairness" is not going to change my mind.

Gump truth "stupid is as stupid does"

TBF

(32,064 posts)pushed by PR firms in this country (paid for by their rich clients - in order to keep themselves rich).

about Jamie Dimon for the purposes of this situation? People cosigning loans they couldn't cover and then getting into trouble is way older than Jamie Dimon. This family's problem is not a systemic issue, unless you count the education system that either didn't teach them, or allowed them to sleep through, basic household economics.

TBF

(32,064 posts)So tiring. So right-wing. So painfully obvious who you are advocating for.

bluesbassman

(19,374 posts)have their wages garnished, and quite possibly do some jail time because the had the temerity to cosign student loans for a child that then had the audacity to die on them and her three children, leaving the poor bankers to suffer the indignity of having to collect on this welshing family.

steve2470

(37,457 posts)I hate to say this, but I'm really inclined to never co-sign on any student loans for my son. I just can't deal with owing $100K at my age. Hopefully by then, my son will have plenty of good options for financing.

tammywammy

(26,582 posts)There are plenty of ways to get through school without private loans.

TBF

(32,064 posts)"You have no choice ... you have owners .... they own you"

GOLGO 13

(1,681 posts)Seen too many kindhearted people get suckerd in. Can't get me to fall for the Okie-dook.

Response to davidn3600 (Original post)

lostincalifornia This message was self-deleted by its author.

discntnt_irny_srcsm

(18,479 posts)...should require the lender to maintain life insurance on the borrower and any cosigners.

The idea of debt like this is just another form of slavery.

![]()

Tetris_Iguana

(501 posts)discntnt_irny_srcsm

(18,479 posts)Their "end" can can freeze to splintery outhouse seat mid-February for all I care.

I think debts where any of the borrowers die should be insured (with said insurance paid by the lender) covering the amount of the loan and releasing any and all remaining borrowers, cosigners, heirs, estates... from all related costs and liability.