General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe progressive issue many progressives don't seem to like

There is a spectrum of liberal/progressive concerns—a liberal/progressive approach to political representation, to foreign policy, to domestic policy priorities, to tax policy... in every arena there there is a progressive camp with a progressive view that (whether right or wrong) enjoys strong majority support on DU.

With one exception... the issue that matters the most. The Macro-Economy... what it is up to at its core during this crisis and how it can be repaired.

There are some posters on DU who adhere to the progressive/liberal/Basic-Keynesian view of our current economic crisis, of course, but it doesn't seem to be a majority or even plurality view.

All liberal/progressive economists agree that:

1) There is no inflation worth talking about. (Specific price increases in medicine, milk, energy and higher education are not inflation. Inflation is a broad, universal element of an economy and in our current economy it just doesn't exist.)

2) The economy cannot be stimulated because a) Republicans running Congress are assholes (of course), and b) Fed rates are at zero and we have no inflation.

The republicans prevent any fiscal policy help so we are left with monetary policy... the Fed. Given current economic conditions the Federal reserve would cut interest rates an additional 3-5%, which is a big move, but that is impossible because they are already at zero. (If the current Fed rate was 5% Bernanke would cut it to 1%. But at 0% it cannot be cut to -4%)

[font color=green]Real interest rates = (Nominal Interest Rate - Inflation)[/font color]

When nominal interest rate is zero then the only way rates can be lower (in effect) is for inflation to be higher. The only way the Fed can gain the economic traction of cutting interest rates another 3-5% is to have inflation increase 3-5% without raising the Fed rate.

There is no way this economy can truly recover without inflation. It's basic economics and, since the facts have a left-wing bias, it's the view of the economic left. (The view of the economic right has nothing to do with facts. The RW wants inflation low for the reason they have always wanted inflation low—it hurts workers and retirees while helping only the super wealthy.)

Scuba

(53,475 posts)2) The economy cannot be stimulated because Fed rates are at ZERO. Lowering interest rates is only one way to stimulate the economy. A better way would be to hire people, increase food stamps and unemployment compensation and take other measures to put cash in the hands of consumers.

cthulu2016

(10,960 posts)I would love a congress that would do any of that but we don't have one at the moment.

So there is no fiscal relief on the horizon.

I did not mean to suggest fiscal policy isn't key, merely leaving it aside as practically unlikely.

That leaves monetary policy, and monetary policy cannot do anything more than it is doing currently unless some inflation develops.

Ideally, fiscal and monetary policy would operate in tandem.

Now, one can say that inflation developing is no more likely than Republicans providing fiscal stimulus, and that may be right. But if it does develop and the Fed keeps rates unchanged it would be powerfully stimulative. (When Bernanke keeps saying rates will stay low through 2014 he is essentially promising investors to not raise rates if inflation develops, which is the only way monetary policy can gain traction.)

girl gone mad

(20,634 posts)ZIRP has been largely unsuccessful. In fact, most central bank studies show monetary policy is always fairly ineffective.

Low rates are pulling billions of interest income out of the economy each year, which amounts to a large fiscal drag that has more than offset the negligible increase in borrower demand.

Many of us are Post-Keynesians, MMTers, Minskyians, etc. because we live in the year 2012.

Selatius

(20,441 posts)There's no point in deficit spending to keep a workforce going if they're sending their money to Chinese workers making stuff for Americans.

For Keynesian policy to work again, the US would have to retool trade policy to essentially equalize labor costs between itself and any country it chooses to trade with, including giants such as China. Then, it would have to issue generous tax subsidies to domestic companies to encourage "on-shoring" of jobs vs. out-sourcing the work.

This is the new reality. Prior to this, the US didn't have to do any of what I'm saying simply because every other industrial production center was being actively bombed to bits or occupied by a hostile army or constantly threatened with both in the last world war. They relied upon the United States to manufacture its way to victory and to rebuild a war-torn world and to win a cold war. With China no longer being run by communist zealots and Russia collapsed as an economic and military power, of course American business interests became far more willing to entertain the idea of moving industrial centers to cheaper labor pools in formerly hostile countries. They didn't have to worry anymore about Hitler on a rampage or Emperor Hirohito burning everything up in mainland China. Hell, we're even moving manufacturing to Viet Nam now, and the US bombed that country to shreds for over a decade some years back.

cthulu2016

(10,960 posts)Did the stimulus package stimulate the economy? Yes. Precisely as much as Keynes would have expected.

Was it enough? No. Precisely as insufficient as Keynes would have expected.

Austerity is wrecking the economies of debt-ridden European nations... precisely as Keynsian economics predicted. The people imposing that austerity are not implementng what Keynes demands.

The United States government (congress) and the European central bank or currenly run by people who are not Keynesians and both do disasterous things that have have the bad effects that any Keynesian would expect.

Keynesian economics is not being employed so how can it be failing?

girl gone mad

(20,634 posts)As Richard Koo has rightly illustrated, the world is in a balance sheet recession.

I'd also recommend Koo's book The Holy Grail of Macroeconomics: Lessons from Japans Great Recession to further understand why Keynesian theory falls short in our current economic environment.

The stimulus did fail, and not just because it was insufficient, it was also structured very poorly. What's more, until we address the excess flow of credit to speculative activity and reduce our trade deficit, monetary stimulus and badly designed fiscal stimulus will always end up fueling asset bubbles and contributing little toward productive economic activity.

The current balance sheet recession and debt deleveraging cycle make monetary easing fundamentally useless. People with impaired balance sheets are not interested in increasing their borrowing at any interest rate. I'd look even beyond Koo's proposals and listen to what the Kansas City School has to say since Koo believes governments must borrow and spend to make up for the excess private sector savings, while MMTers understand that the government doesn't need to borrow (and that government borrowing is not true borrowing anyhow).

Selatius

(20,441 posts)Since the 1980s, people replaced lost income with cheap credit or borrowing against their homes to sustain a particular living standard. Well, that was untenable in the long-run. The income was lost when manufacturing centers started moving off-shore to cheaper places, and the jobs that came after were lower wage service sector jobs. Things came to the front far faster after certain parties began manipulating housing prices to make a quick buck, and prices soared to unrealistic levels. Of course the bubble was going to pop. Then, other groups made the situation unimaginably worse by selling risky financial instruments built upon those mortgages before essentially taking out insurance policies on those instruments they knew would fail down the road.

I think we can all agree that what we have now is lack of aggregate demand for products and services, and until that is resolved, unemployment and underemployment is going to be a very big issue for a long time. If people are able to pay off their debts or at least get them under control, there would be more money being spent on products and services, as opposed to financing of debts. The stimulus package was derided as pork barrel spending precisely because a large portion of it was nothing but tax cuts to special interests and money towards roads and bridge construction/repair. There was very little in the form of actually putting money into people's pockets in a massive way. A jobs program the size of PWA/WPA that directly hires people and pays them to do work would've helped the situation. Stimulating an economy through simple tax cuts is, in any scenario, one of the least efficient methods of doing it, but it looks good politically.

cthulu2016

(10,960 posts)"People with impaired balance sheets are not interested in increasing their borrowing at any interest rate."

Your idea of "any interest rate" seems to suffer from a lack of imagination.

Any rational actor will borrow at some interest rate, even if they have nothing they want to do with the money.

If you offer me an interest free loan of a million dollars right now I will take it without hesitation, no matter what my balance sheet looks like.

Now, say that inflation is 5% higher than it is today. Would I borrow that million at 4% interest? It's an even better deal than the interest free loan was.

It is wrong-headed to say, "Look, the Fed is printing money but nobody wants it, so printing money doesn't work." The fact that nobody wants it is not a surprise or a refutation of 20th century economics. It is a normal and predicted circumstance.

A mortgage at 4% is, in this environment, too high. A Fed Funds rate of 0% is too high.

That's why people are not "buying" money... it is too expensive. At a lower cost people will gladly "buy" money. And the only way the cost can possibly be lower is if we catch a break and see some inflation.

dkf

(37,305 posts)Or are you permanently increasing it because dropping it would then be a disaster for them? Perhaps they would have used the extra funds not used for food to create ongoing obligations and then a drop in food staps would be devastating.

The Magistrate

(95,247 posts)Fewer people will be on the relief programs as a result.

dkf

(37,305 posts)Improves?

Scuba

(53,475 posts)As the economy improves, fewer people will need them, in theory. If the gains keep going to the 1% the economy improving will not matter to food stamp recipients.

banned from Kos

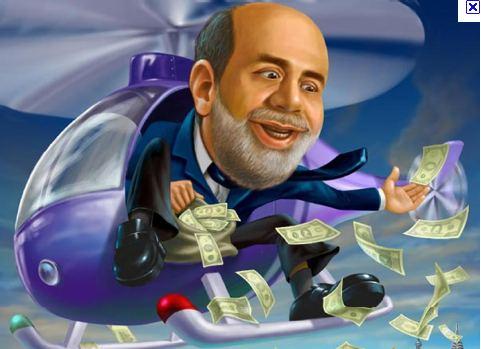

(4,017 posts)the "helicopter drop" (how I hate that term).

I watch the financial news a lot and the Austrians are either in full panic or faking it so nothing happens. The Fed needs twice the amount of bond buying according to Krugman. I am solidly in the Krugman camp. Bernanke is not stoking the fire enough although he has set records as it is.

cthulu2016

(10,960 posts)There is no danger of runaway inflation with high unemployment, and the Fed has infinite room to raise rates in a hypothetical inflationary crisis. It only took Volker about 8% to wring all late-1970s inflation out of the system... 25% mortgage rates and all.

Launch the helicopters.

banned from Kos

(4,017 posts)Its a metaphor for something. But what?

cthulu2016

(10,960 posts)Increasing the "money supply" does not cure non-inflation because the way we increase money supply to to authorize banks to lend more. But in a deflationary environment people don't want to borrow. (Notice how the lowest mortgage rates ever have not repaired the national housing market.)

Japan more than doubled her money supply in a 10-year period without ever creating inflation. We have done something similar.

Somebody has to borrow that money supply and spend it. Congress should do that, but the republicans (and many dems) won't borrow and spend right now.

A government can, however, always create inflation but increasing the physical money supply... giving actual money to the people who will spend it. If enough currency was dropped from helicopters on the populace the value of money would eventually go down (and prices up).

Sending everyone a check is equivalent to the helicopter drop, of course. No real aircraft or currency notes are needed.

But congress has to borrow that money (and thereby create it) and won't.

Ruby the Liberal

(26,219 posts)Dumping cash into the money supply = tossing $100 bills out of a helicopter.

You claim Bernake is the greatest Fed Chair ever in the history of the Fed and you say "no one knows what a helicopter drop is"?

Please.

banned from Kos

(4,017 posts)sheet and earns coupon for the taxpayers and matures without ever going directly to citizens. It only indirectly benefits citizens.

If the Fed printed $1000 per citizen and distributed it evenly that would be akin to a helicopter drop. Republicans and Austrians would go into conniption fits if someone even suggested that.

cthulu2016

(10,960 posts)The thought experiment is how do you fight inflation and how do you fight deflation. The observation is that there is no excuse for deflation because inflation can always be induced, even if it requires dropping currency from helicopters.

But the idea of giving ordinary people cash money is so deeply offensive to our masters that deflationary environments, in Japan and now globally, are treated as an unsolvable mystery.

The literal helicopter drop is unessecary, of course. Any fiscal stimulus is a de facto helicopter drop in that the government borrows money and gives it to somebody to get it into the system.

Increasing the money supply, however, does not function like a helicopter drop. The money supply is not real until someone actually borrows money, which we cannot force people to do.

The government, however, can borrow and then distribute. Hence the government as "borrower of last resort."

KamaAina

(78,249 posts)Ruby the Liberal

(26,219 posts)Response to KamaAina (Reply #91)

Post removed

KamaAina

(78,249 posts)

badtoworse

(5,957 posts)Retirees tend to be on fixed incomes, so substantial inflation is going to hurt them a lot. If that's not the case, then explain where I have it wrong.

cthulu2016

(10,960 posts)The bulk of income for poor and average elderly is Social Security, which is indexed for inflation. (Unlike most wages.)

Seniors are hurt a lot by higher medicine costs, but those increases are not due to inflation. (More like monopolistic profiteering)

The Magistrate

(95,247 posts)People who have savings in retirement tend to place them in interest bearing instruments, whether certificates of deposit or bonds. If you thought you would get a yield of four or five percent, one and a quarter is something of a shock....

cthulu2016

(10,960 posts)The better off elderly, yes. But most elderly people don't have shit for savings. Most people, of any age, don't have large savings.

Since social security is indexed for inflation the elderly would, on average, tend to be hurt less than everyone else.

http://krugman.blogs.nytimes.com/2012/04/20/income-of-the-elderly/

The Magistrate

(95,247 posts)It is certainly true this is becoming less and less the case with people newly retired.

Nor does one have to live off interest income for it to be a part of retirement planning, and missed if it comes in well under expectation.

We are in agreement on the view that the economy needs a bit of inflation, and has much room for it to work before it was possible even to credibly pretend it was becoming a danger.

badtoworse

(5,957 posts)The same is true for Social Security COLA's. The result is a net loss to the retiree.

The Magistrate

(95,247 posts)Calculation of it at present is rigged to chisel, and systematically understates actual increases in prices people experience. This is done in order to postpone the day Congress has to make good on its I.O.U. to the trust fund....

badtoworse

(5,957 posts)ETA: I agree with you about COLA's not being calculated honestly. That is reality and it means that as SS is currently being administered, SS recipients get screwed by high infaltion.

The Magistrate

(95,247 posts)Our political system at present positively prevents sound economic policies being implemented. Any discussion of sound policy thus necessarily takes place in a vacuum.

cthulu2016

(10,960 posts)I didn't belabor it in the OP, but Bernanke is much likelier to use monetary policy for good than Boehnner is to use fiscal policy for good, hence the focus on monetary policy.

I take it as a given that congress will not do anything to help the economy any time soon.

On the other hand, if Bernanke could cut the Fed overnight rate by 3-4% he would be doing it. He can't, but he would.

So in relative terms, our hopes lie in gaining HUGE majorities in congress (since 'moderate' dems are worth little) or in some systemic inflation re-empowering the Fed.

badtoworse

(5,957 posts)We have a situation where no policy is being implemented - a very bad state of affairs.

Zalatix

(8,994 posts)The Chained COLA BS game being played by the Republicans would make you punch holes in walls if you knew the truth.

http://www.huffingtonpost.com/merton-bernstein/proposed-social-security-_b_1326710.html

RobertEarl

(13,685 posts)The bubble we had is what ruined economic progress for now.

And for now, what is keeping us afloat is the SS and pensions that remain.

What we need to do is end the outflow of dollars that go to fuels. We need to get back to a state where our energy dollars circulate at home.

Major industries like cars have bounced back and they need to be restored even more. Seeing retirees driving foreign cars burns my chaps. Buying foreign big-ticket items is the most damaging aspect we do to ourselves.

Pretty much the Democrats have us back on track and we just need more Dems in office.

cthulu2016

(10,960 posts)Deflation is the single most damaging economic phenomenon of all.

It benefits only people with vast cash reserves and wipes out everyone else.

RobertEarl

(13,685 posts)You think the biggest ticket item of all - Housing- and the inflation that occurred was good for us?

Guess here that your idea of a sound economy is 'Grow or Die'?

You do know that is what a cancer cell does, right? Grows and grows.

But.... if you have an example of how deflation is so damaging, lets talk.

The Magistrate

(95,247 posts)This pretty much freezes economic activity above local subsistence.

RobertEarl

(13,685 posts)Being in huge debt is stupidity writ large.

Again: the Grow or Die ideology is a curse upon humans and the planet.

Sustainability is a far better working psychology.

The Magistrate

(95,247 posts)Or straight barter?

cthulu2016

(10,960 posts)is money.

It is good for people with money. It is terrible for people trying to sell something for money.

And what is it that most of us are trying to sell for money?

OUR LABOR.

That's the side of deflation/inflation most often overlooked... labot is a commodity, as surely as milk and gasoline and medicine and houses. And we all depend on the current and future value of that commodity to survive.

RobertEarl

(13,685 posts)This economy is being supported on savings at this point die to the bubble and crash golden bushie years.

Those savings are better served with deflation and sustainability. Paying foreign workers pennies on the dollar of what we Americans make is what is killing the labor prices. That and the lack of construction in housing. We destroyed the construction labor force via a huge inflationary bubble.

badtoworse

(5,957 posts)I'm thinking of students with loans and folks struggling not get foreclosed upon. Deflation would be a disaster for them.

If you're a fat cat with a solid bank account, it would be a windfall.

RobertEarl

(13,685 posts)No one held a gun to them and made them take it on.

I have stayed out of debt. How? By not borrowing.

Sure, inflation would clean up some of their debt, but it would hurt me. Why should I be hurt because I have only received what I paid cash for?

Art_from_Ark

(27,247 posts)I have experienced deflation here in Japan. As a consumer it has been a boon for me since the prices of daily necessities have mostly been declining. However, deflation has also reduced my income, as well as the interest I was receiving for savings. But deflation has also reduced the interest rate on credit cards and home financing. So it has been a mixed bag.

If someone has a loan and there is deflation, then the loan can assumably be refinanced at a lower rate, and the prices of daily necessities should also take less of a bite out of disposable income. People on fixed incomes benefit from deflation since their fixed incomes have more buying power.

And inflation can be a killer if your income does not keep up with it. The CPI is a poor way to gauge inflation for persons on Social Security because it includes a lot of things that most retirees won't be buying, and gives less weight to the things that they tend to spend their money on, like health care, medicines, insurance, transportation, property taxes.

cthulu2016

(10,960 posts)Since interest rates are only meaningful as rate minus inflation it's tricky to say they go down, expect in nominal terms. For instance, mortgage rates are at record lows today but are probably unusually high in real terms. Since our interest rate pyramid has it's base stuck at zero there is only so low mortgage rates can go. Our record low rates are probably inflated... held artificially high.

And consumer reaction backs this up. All rates are much lower but people are borrowing less. These rates that appear low are actually too high... otherwise people would borrow more.

I think the mortgage rate necessary to turn around the housing market may well be zero or even slightly negative. Weird to think about, but to buy into a truly deflationary commodity even an interest free loan would be a bad deal.

All of that said, yes deflation does benefit some people. For someone with a job with fixed and reliable wages the great depression was a pretty good period.

(And I am not saying that any specific Japanese rates were not a good deal for you.)

Art_from_Ark

(27,247 posts)My family had a rather limited income, and it was not keeping up with inflation. We had to cut a lot of expenses out of the family budget (such as not being able to go on certain school field trips, not going on any vacations, switching from fresh milk to powdered milk, reducing automobile and health insurance coverage, and so on). It was a rather difficult time. And now that my mother has retired and is living on a very fixed income, the inflation that she has to deal with is taking an increasingly big bite out of her small income.

Zalatix

(8,994 posts)Deflation means the working class has fewer options to get their hands on money. Demand goes down, production goes down, employment goes down.

Inflation plus chained COLAS, on the other hand, devastates seniors.

HYPER inflation, however, is apocalypse for all if it is sustained. It UTTERLY wipes out the Plutocracy while pushing the working class into a barter system. This is what we need. It will destroy the billionaires while allowing the workers and farmers to slip out of their grasp.

However, sustained hyperinflation is unbelievably unlikely in America. It would require a Zimbabwean-level resource shortage to sustain it and obviously... we don't want that.

cthulu2016

(10,960 posts)It's destructive, of course, but as with anything there are winners and losers.

Glenn Beck would always trot out the famous picture of the guy with billions of marks in his wheelbarrow and note that it took a wheelbarrow full of money to buy a sandwich.

But he would never note:

1) Somehow that guy got a wheelbarrow full of marks. It's not like people were not being paid billions of marks.

2) It sucks that the guy needed a wheelbarrow full of money to buy a sandwich, but if he skipped lunch that day he could pay off his mortgage in its entirety and probably the mortgages of everyone on his block, also.

Hyper-inflation sucks, and I am in no way recommending it, but it sucks hardest if you're an issuer of debt.

Art_from_Ark

(27,247 posts)You can't assume that every worker was being paid at a rate that was keeping up with inflation, because they weren't. A lot of people had to sell off their belongings to make it in Weimar Germany. A few fortunate souls who had precious metals and/or hard currencies were able to get their wheelbarrows of marks by cashing in those assets.

Recently in Zimbabwe, the inflation was so bad that wages were nowhere near to keeping up with it.

And the first time I went to Mexico, I wanted to buy something from a street vendor. Since I was in Mexico, I wanted to pay in pesos. But the vendor begged me to pay him in dollars, because the pesos "would be worth much less" by the time he could exchange them at a bank.

Zalatix

(8,994 posts)The rich REALLY GET SOAKED then.

The winners in that case are farmers and closely-knit communities.

Zalatix

(8,994 posts)In hyperinflation, it sucks hardest if you are a debt-issuer, but as evidenced by the guy wheeling in money to buy a sandwich... it rocks if you own an apple tree.

Dokkie

(1,688 posts)Deflation means the poor people with a little cash suddenly gets richer and inflation means poor people with a little cash gets poorer. The debtors and creditors gain and lose respectively in deflation and inflation and my thing is why artificially create inflation/deflation and hurt either the creditor or debtor?

Anyway here is the video

The Magistrate

(95,247 posts)Creditors benefit tremendously by deflation, and lose by inflation. People with only a little money take harm either way, although the reduced levels of economic activity associated with deflation tend to do more harm to them, by reducing opportunity for work, than does inflation, providing the inflation does not reach high levels.

Dokkie

(1,688 posts)But on the flip side, bankers, huge government contractors, did I already say bankers? gain tremendously from inflation while people of fixed income, working poor lose out from inflation(those whose wages do not rise with said inflation). But why argue about this? why cant we strive for a stable currency instead of pitting 2 groups together and trying to figure out who deserves pain

The Magistrate

(95,247 posts)This statement of yours "The debtors and creditors gain and lose respectively in deflation and inflation" means debtors gain in deflation, the word 'respectively' indicating the things are to be taken in corresponding order of appearance.

Dokkie

(1,688 posts)its obvious that the sentence was a typo, it should have read Creditors and then debtors ......

The Magistrate

(95,247 posts)Not much of a basis for discussion, that, eh?

jeff47

(26,549 posts)You borrow $100.

Inflation happens. That $100 is now worth $90. You have an easier time paying off the loan because you are effectively paying less money.

Deflation happens. That $100 is now worth $110. You have a harder time paying off the loan because you are effectively paying more money.

Now, even if you think taking out loans is a bad idea for yourself, there's enormous use of credit in the economy. Deflation stops credit. So it stops the economy.

Art_from_Ark

(27,247 posts)In the late '60s, that was considered enough to retire on. Today, it won't even cover two years in a nursing home in many places.

However, if you have that same $40,000 in a deflationary economy, it will gain buying power.

Inflation in itself does not drive an economy. If it did, then Zimbabwe would have the best economy on the planet.

jeff47

(26,549 posts)That $40k was loaned out so that you at worst kept up with inflation. Even if you just loan it to your bank via depositing it.

No one is claiming inflation drives the economy. We're claiming deflation is far worse for everyone except bankers.

And no, in a deflationary economy, $40k wouldn't gain buying power because nobody would be selling anything. The economy would be in a tail-spin.

Art_from_Ark

(27,247 posts)I don't know where you get the idea that no one would be be selling anything, but that's just wrong. I'm living in a deflationary economy right now, in Japan, and people are selling stuff everywhere. But my yen buys more today than it did 10 years ago-- except for maybe gasoline, which right now is higher than it was then. And while I'm not getting squat for my bank savings, if I wanted to get a mortgage, I could get one for around 1.5% to 2%. So no, deflation is not something that benefits just a few bankers.

jeff47

(26,549 posts)I'm not saying there would be absolutely no sales in a deflationary economy.

I'm saying the economy would be doing really crappy. If you need examples, look to Spain and Greece. Because of the Euro, they are effectively going through large-scale deflation.

As for Japan, no you aren't in a deflationary economy. Take a look here. Japan reported 0.3% inflation in February (the last month reported). That's about the same as the US.

As for "is deflation is good for Japan", consider Japan's "Lost decade". Everywhere else in the developed world had a booming economy in the 90s. Even with the tech bubble burst, everywhere else was better off at the end of the 90s - GDP, adjusted for inflation, was up. Wages, adjusted for inflation, rose. Wages did so well that for the first time since the 1970s, wages went up at the bottom of the income scale in the US.

Except for Japan. GDP and real wages were flat at best, and fell in some years. Doesn't really help that your Yen can buy 5% more at the market when you're getting paid 6% less. And while an individual might have emerged with their earnings not going down, that isn't true of the economy as a whole.

As for that interest rate, that's because someone with good credit can always borrow a few percent over expected inflation. US expected inflation is about 2% and mortgages are available at 4-someodd %.

cthulu2016

(10,960 posts)A 2% mortgage in one environment is no better than a 10% mortgage in another environment.

If you, personally, have a stable income then deflation is good. But a low mortgage rate based on flat expectations of growth and inflation is not a bargain. It may be a bargain for an individual in one set of circumstances, but it is not a bargain in the totality of the Japanese economy.

Does anybody say that the last 20 years have been relatively good for Japan? For the Japanese people?

Does anybody say the Great Depression, a deflationary crisis was a bonus for people in aggregate?

There are 1,000 ways an individual can benefit from deflation, or from inflation, or from stability. But we know the aggregate effect on a nation and its economy is malignant. Otherwise the Great Depression would be remembered with fondness as a time you could buy a farm for a dime on the dollar.

stevenleser

(32,886 posts)you would have a lot more of them eating cat food or choosing between food and medication with any increase in inflation.

The Magistrate

(95,247 posts)stevenleser

(32,886 posts)cthulu2016

(10,960 posts)Seniors are paying more for medicine, gas and milk but Social Security benefits haven't gone up hardly at all for five years because there is no systemic inflation... there are no COLA increases.

An increase in real inflation would provide the first income increases for poor and average elderly in a long, long, time.

sendero

(28,552 posts)... there is no inflation is ludicrous. Didn't really bother reading past that because it's bullshit.

cthulu2016

(10,960 posts)is what it is. Inflation is a word with a meaning. Our current economy is not inflationary and is very sick because it is not inflationary.

Flat fact.

Sorry to have wasted your time reading the first few sentences, though. Have a lovely evening.

![]()

GeorgeGist

(25,321 posts)that is 'sick' because it is not inflationary.

cthulu2016

(10,960 posts)It sounds bumber-stickery... why is an economy requiring a low level of inflation to not stall a problem? Is a body that has to stay above room tempertature to survive a problem?

And must we call metabolism a fever?

sendero

(28,552 posts)... or gas knows you are simply wrong. Maybe you should pay attention to what is actually happening and eschew the ludicrous "statistics" coming from our ministry of truth.

cthulu2016

(10,960 posts)and your belief that the real world must comport with whatever is going on in your own head do not make for a compelling argument.

There is no systemic inflation in the US economy.

But your gut tells you something different and heaven knows that whatever feelings you have surely trump all empirical evidence.

sendero

(28,552 posts).... increases of most food products is not "anecdotal" it is a fact.

There IS systemic inflation in commodities prices and that translates to higher food and energy prices and that is inflation.

In the things AVERAGE PEOPLE have to buy every day to live, there is inflation - and the fact that hard assets are deflating doesn't really help anything but the cooked up numbers.

banned from Kos

(4,017 posts)Mostly prices have fallen. Crude oil peaked at $147/bbl and is $103/bbl. Gas is only slightly less do to refinery crack spreads.

Gold is in a worldwide fear bubble.

cthulu2016

(10,960 posts)People buy a house every few decades.

So I understand why people don't "get" the reality. but I'm surprised more folks cannot seem to look past annecdote.

If milk goes up $0.75/gallon and your house goes down $100,000 in value that is not inflation.

But we buy mik often. It's a price we follow.

The Magistrate

(95,247 posts)They ought not to be.

cthulu2016

(10,960 posts)then I surely agree! If it costs more to live then it costs more to live.

The housing componant of COLA is probably too large and the daily staples componant too low.

If COLA stood for "systemic macro-economic inflation adjustment" it would be different.

banned from Kos

(4,017 posts)Both got close to $5.00 when they peaked in July 2008 then fell to less than $2.00 in December during the worst of the crisis. Dairy cows were going unfed. Farmers don't have the capital structure to survive on $2.00 milk - another pernicious effect of deflation.

Both have nervously reverted - gas a little more.

sendero

(28,552 posts)... nothing but disinformation from you since that seems to be all you deal in.

There IS inflation in the prices of the necessities of life, there is not in things like hard assets - cars, houses etc. There is a simple reason for that but I won't waste my time explaining it to you.

The fact that houses and cars cost about the same as a few years ago does not help Joe Sixpack put food on the table.

cthulu2016

(10,960 posts)the fact remains that there is not any inflation in this economy.

You don't seem to understand what inflation is. That's fine... there's no law that says you have to. But why get nasty in asserting that ignorance?

Honeycombe8

(37,648 posts)unkachuck

(6,295 posts)....that's easy, most of what passes for the 'Left' in this country are capitalists....you may get them to tweak their capitalist system, but they will never change it....

johnd83

(593 posts)They have a "currency sterilization" program that buys treasury bonds in order to limit the level of inflation. In a normal trade imbalance situation, the exporters currency would rise and the importers currency would fall in value. China is actively stopping this from happening. Why are they doing this? I have no idea; they don't really gain anything at this point sending us stuff in return for our currency. They have enough of our currency to buy the resources and imports they need. So in reality what they are doing sending us cheap stuff isn't benefiting them or us.

jeff47

(26,549 posts)They used to buy treasuries as you describe.

The problem they ran into is it requires exponential growth in the amount of treasuries you buy, and it just became too much money.

China's economy is based on selling us cheap crap. The problem is that improved China's economy and hurt ours.

In a world without government intervention, the Yuan would go up relative to the Dollar. That would make their cheap crap no longer cheap - and so we'd stop buying it. Their political stability is based on about 3-6% economic growth every year. So this would not be a small problem for China - the peasants, no matter what country, get upity when they're starving.

So they bought treasuries to inflate the Dollar relative to the Yuan. The problem is this can't go on forever. They're trying to make a river flow uphill, and the more water you put at the top of the hill, the bigger the bucket you need to use to move the water.

So they gave up. They've been trying to play games with currency pegs, but that isn't as effective and far more problematic in international politics. The result? Business magazines talking about "re-shoring" jobs back to the US....and others looking for the next country with cheap labor that could be exploited.

Zalatix

(8,994 posts)What, in particular, is happening with their purchases of the treasuries? What exactly caused that to become unsustainable?

cthulu2016

(10,960 posts)In addition to whatever reasons Chinese Treasury purchases would decline anyway in an isolated abstract exercise there is probably a very speciffic event-driven reason also...

The competition probably got too fierce. When the world economy collapsed global inflation expectations cratered and desirability of safe-havens increased. Demand for US bonds went up, further supressing rates. The Treasury market is so healthy that no player can manipulate much of anything, and the bonds themselves pay peanuts.

jeff47

(26,549 posts)Remember, they're looking to make the Yuan worth less money, not build up a portfolio. So making a "bad" investment actually helps them - still boosts the Dollar and the "bad" investment hurts the Yuan.

I remember reading some article back in 2007-8ish (when China stopped mass-buying treasuries), which ran some math and predicted that China would have to buy about $10T in treasuries by the 2020s to keep the Dollar up. Since we're issuing way less than that, it's not at all possible. If I get a chance, I'll see if I can dig that story up.

cthulu2016

(10,960 posts)The treasury market is so strong that Chinese intervention would have a reduced effect if tried, but is not necessary.

It doesn't matter to China whether China bids up treasuries -- just that somebody does.

That's all I ment.

jeff47

(26,549 posts)jeff47

(26,549 posts)In fact, it's an exponential growth problem. The number of treasuries necessary to inflate the Dollar and deflate the Yen goes up very, very quickly.

It became apparent that in the near future, buying every single treasury would not be sufficient to sustain the Dollar vs. the Yuan. So they had to give up on that route.

In addition, they were starting to become concerned over holding so much US debt. Just like Greece is getting screwed with debt denominated in Euros, we could screw China because our debt is in Dollars. A skyrocketing Yuan would make that debt worth a lot less than they paid for it.

So at the moment they're kinda muddling through, trying to figure out how to keep their currency low. They're having limited success.

cthulu2016

(10,960 posts)"A skyrocketing Yuan would make that debt worth a lot less than they paid for it."

Worth less in Yuan, but not necessaarily worth less in value. A dollar buys a dollars worth of oil, wherever the Yuan is.

jeff47

(26,549 posts)johnd83

(593 posts)Saw this response in the my posts section...

They are selling us cheap crap in exchange for American dollars, but for use in their country they have to be converted to renminbi. This has the effect of increasing their money supply and thus inflation, but it keeps our money supply in their central bank to be used for foreign transactions. My point is that they already have plenty of our currency for this purpose; they don't gain anything by getting more of our currency because they don't use it domestically. They haven't had any real reason to get more of our currency for a while.

jeff47

(26,549 posts)When you buy $100 in treasuries, they don't send you a piece of paper with a nice picture of Ben Franklin.

Their goal was not to get more dollars, their goal was to inflate our currency relative to theirs. Helping to depress treasury yields did that, for a while. But there's only so much debt we sell.

MadHound

(34,179 posts)You need workers' wages to keep up with a rise in inflation. Of course worker's wages haven't been keeping up with the cost of living for about forty years now, a huge reason we're in the position we're in now.

Furthermore, raising the inflation rate would not bring jobs back to our shores, another huge problem in our economy.

cthulu2016

(10,960 posts)"Of course worker's wages haven't been keeping up with the cost of living for about forty years now"

Yes.

Inflation was wrung out of the economy 1979-1981 and what followed has been a terrible period for labor and a great period for capital. The stock market is through the roof from 1980 while real wages are a flat line.

The pre-Reagan economy and the Reagan economy (which we are still in) are like two different worlds, and workers really get hosed in this world.

(Using mortgage rates as a proxy for long-term inflation expectations.)

Fumesucker

(45,851 posts)A restructuring I have no expectation at all that the Democratic party has any intention of even discussing.

And that's leaving the Republicans and their intransigent stupidity completely out of it..

Mojorabbit

(16,020 posts)saras

(6,670 posts)THAT's the economic issue people don't like to talk about. We built the West's international capitalist empire on a model of infinite expansion of resource extraction. We have no model for how to proceed when that starts to fail across the board except economic failure, tyranny, and war.

JVS

(61,935 posts)Inflation and growth correlate, but it is growth that generates inflation, not inflation that generates growth. Inflation without growth is possible.

cthulu2016

(10,960 posts)The OP is about traction in monetary policy.

Of course inflation doesn't cause growth, intrinsically. Who ever said it does?

Inflation is, however, necessary to monetary policy traction in a liquidity trap environment.

The stimulative benefit would come not from inflation, but from Fed rates being low relative to inflation. Without inflation the Fed cannot effectively "cut" rates. (By leaving them unchanged at zero)

If, however, inflation developed and the Fed raised rates to match then there would be no stimulative effect.

Two step process. 1) Inflation, 2) Fed does not raise rates in response to that inflation.

Actually a thre step process. The Fed also needs to promise in advance, and be believed, that it will not be quick to raise rates in response to inflation. That's why Bernanke keeps announcing that rates will remain at zero into 2014. It's an assurance that the Fed does not plan to pounce on any inflation. The missing ingredient is, of course, the inflation that won't be pounced on. With no fiscal stimulus coming from Republicans that's a tough nut to crack. (The role of that promise is all worked out in Krugman's famous paper on deflation in Japan—an early and important analysis of monetary policy in the context of zero-rates.)

banned from Kos

(4,017 posts)here.

The Inflationistas are quiet these days.