Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWolf Richter: The US Oil Bust Just Got Worse

via Naked Capitalism:

Wolf Richter: The US Oil Bust Just Got Worse

Posted on March 14, 2015 by Yves Smith

Yves here. Wolf was early to point out the disconnect between declining rig counts, which the mainstream media has touted as proof that the oil glut was about to end, and rising production. That pattern has not abated.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

The price of oil did today what it has been doing for a while: it waits for a trigger and plunges. As I’m writing this, West Texas Intermediate is down 4.4%, trading at $44.99 a barrel, less than a measly buck away from this oil bust’s January low. It’s down over 20% from the peak of the most recent sucker rally.

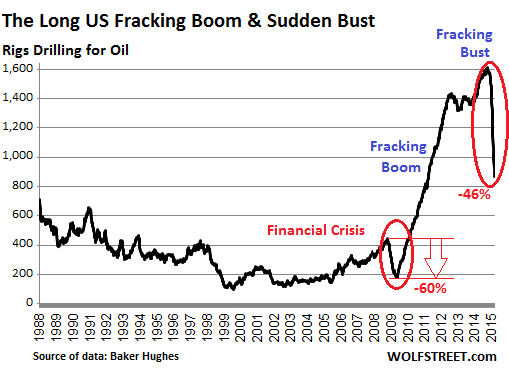

US oil drillers have been responding by slashing capital expenditures, including drilling, in a deceptively brutal manner. In the latest week, drillers idled 56 rigs that were classified as drilling for oil, according to Baker Hughes. Only 866 rigs were still active, down 46.2% from October, when they’d peaked at 1,609. In the 22 weeks since, drillers have taken out 743 rigs, the most dizzying cliff dive in the data series, and probably in history:

You’d think this sort of plunge in drilling activity would curtail production. Eventually it might. But for now, the industry has focused on efficiencies, improved drilling technologies, and the most productive plays. Drillers are trying to raise production but with less money so that they can meet their debt payments. Thousands of wells have been drilled recently but haven’t been completed and aren’t yet producing. This is the “fracklog,” a phenomenon that has been dogging natural gas for years. ............(more)

http://www.nakedcapitalism.com/2015/03/wolf-richter-us-oil-bust-just-got-worse.html

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

7 replies, 1623 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (8)

ReplyReply to this post

7 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

Wolf Richter: The US Oil Bust Just Got Worse (Original Post)

marmar

Mar 2015

OP

Refinery strike plus state fuel taxes and california carbon cap and trade rules.

Spider Jerusalem

Mar 2015

#7

Fumesucker

(45,851 posts)1. The oil bidness has always been cyclical

I wish I had realized that back in the early 80's...

![]()

ffr

(22,670 posts)2. And yet gas prices at the pump extremely high

all over the western U.S. Oil companies must be getting filthy rich of their margins. What, did they all need new mega-yachts?

dixiegrrrrl

(60,010 posts)3. Define "extremely high"....

Gallon of regular here is 2,11, which is lower than 2 days ago.

It had gone down as low as 1.83.

To me, extremely high would be above the 3.89 it used to be in ..."normal" times.

Comrade Grumpy

(13,184 posts)4. $3.35 in Sonoma County, CA. Up 80 cents since January.

That's quite a bump, given the price of oil.

And nearly where it was before the slide began.

What's up with that?

dixiegrrrrl

(60,010 posts)5. I seem to remember that Cal. announced "refinery problems"

a month or so ago.

Cal. has a habit of having "refinery problems" and then raising gas prices, I remember from my time there.

Spider Jerusalem

(21,786 posts)7. Refinery strike plus state fuel taxes and california carbon cap and trade rules.

daleo

(21,317 posts)6. Another reason to move to wind and solar

Oil prices are so volatile and subject to manipulation, that it is not really a reliable resource.