General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsBernie lost me with the Robin Hood Tax

Last edited Wed May 20, 2015, 02:47 AM - Edit history (1)

I gave money to Bernie the day he announced.

I am decidedly middle class.

I cannot afford to have my 401k taxed.Or my kid's 529 taxed. Or my tiny investment fund on Betterment that needs to rebalance EFT's in order to make sure I don't lose everything taxed

This was a bad, panderingish, move on Sander's part, or I'm a rube who didn't understand what his stances would have been. Why didn't the proposal go after capital gains instead of the only viable savings/retirement vehicles the middle class and under have available to them?

I'm a man w/o a candidate, and I don't really see anyone inspiring on the horizon.

***UPDATE: Good talk guys. I've got to get to bed. If you reply, I'll respond to you in the morning or during the day. Work is coming early tomorrow.

safeinOhio

(32,713 posts)"high volume trading".

If that's you, can I borrow five bucks?

Joe the Revelator

(14,915 posts)funds that are traded within 401ks, 529, and eft accounts because they are traded in volume. It would not effect Johnny Day Trader buying a share of google.

AgingAmerican

(12,958 posts)Is who he is talking about. Not your 401k.

Joe the Revelator

(14,915 posts)AgingAmerican

(12,958 posts)And I am for it. Everything isn't about me.

Joe the Revelator

(14,915 posts)...but i draw the line at my retirement and savings.

CreekDog

(46,192 posts)Sounds like your OP is questionable and this latest post has it going further south.

Joe the Revelator

(14,915 posts)to those who wanted to do away with it, but I took it and smiled even though it hurt my family.

and What is questionable with the OP? At least I'm not just jumping on a AOBH train or protecting the Queen at all costs of logic. I'm saying I was with Bernie, he went a step to far in my opinion (you can't claim to be a champion of the middle class, and then send a new tax to the middle class right out of the stall). I should be entitled to withdraw support moving forward without all the innuendo.

CreekDog

(46,192 posts)you're on thin ice already, might not wanna dig, but I am curious...

AgingAmerican

(12,958 posts)nt

Joe the Revelator

(14,915 posts)AgingAmerican

(12,958 posts)IMHO

Joe the Revelator

(14,915 posts)piss poor legislation is all of a sudden a shill or a republican. That really does absolutely nothing to prove your point.

My stance is very clear and agendaless. New taxes should not be levied on the middle class, when the upper echelon class has so many more advantages. By backing Bernie, the man who couldn't be bought, I thought i was backing a candidate who would protect the middle class. Instead it looks like he wants to go the Ron Paul route and cater to college kids on the backs of not just the wealthy, but everyone else.

Again, if wanting to protect the middle class makes me a shitty democrat in your eyes, I apologize, but a line has to be drawn somewhere.

TM99

(8,352 posts)New legislation is put forth that mirrors previous ones. Facts suggest it will not be devastating to the middle class just as all other FTT proposals have not been. It still remains to be seen what final details will emerge even if it moves forward, which in the Republican controlled Senate is unlikely.

But now, all of sudden Sanders has lost you over this? One single piece of legislation when he has a history of full support for the middle class. For example, he voted against the flawed bankruptcy bill that Clinton and other Democrats applauded. But this one, this one piece makes you a one issue voter?

I don't agree with every thing Sanders has done or does (personally he is a little too DC pro-Israel for my taste!) but in the aggregate, he is far and above the best candidate for a truly progressive economic and foreign policy platform. I don't dislike Clinton because of one Iraq War vote. I dislike her again in the aggregate for a history of neo-liberal and neo-con positions.

Even if, and right now you and I disagree, even if there is a levied tax on retirement funds, it is minimal for what is being offered. All other civilized countries in this day and age offer free university education. And this tax is no where near the VAT levels in Europe.

Because of how outrageous this seems on the surface, yes, the perception is that you have an agenda and/or were never a supporter of Sanders as a candidate to begin with.

Joe the Revelator

(14,915 posts)then the rest of your points are meaningless. I'll respond further in morning. Its quarter of three here and I have work in four hours.

1StrongBlackMan

(31,849 posts)a call to wait for the final details before opposing something? What a novel ... and, highly selectively applied, concept?

TM99

(8,352 posts)Unlike the TPP, Sanders bill is not secret. It does not have fast track provisions. As a single Senator, he does not have executive veto power. Finally what has been leaked from the TPP is total shit. There may be only one problematic area in this bill, and right now the OP is blowing it the fuck out of proportion.

But hey nice try!

AgingAmerican

(12,958 posts)Irregardless of which candidate is who.

Elmer S. E. Dump

(5,751 posts)Although most dictionaries are now begrudgingly allowing irregardless as an idiom, it's a shame.

positive: Regarding

negative: Regardless or "without regard for"

positive: Irregardless or "without without regard for" - double negative - so it actually means regarding!

Sorry, but this is one of my little language peeves. Sorry to bother you! ![]()

AgingAmerican

(12,958 posts)My mom was an english teacher, we weren't allowed to use double negatives at home. Usually I catch them.

![]()

Elmer S. E. Dump

(5,751 posts)cui bono

(19,926 posts)Joe the Revelator

(14,915 posts)My company has gone from having a PPO, to no longer offering a PPO, to no longer offering HRA,to upping the amount we pay in, to tripling our deductibles, to, the rumor is, setting us loose on the exchange, which like it or not, I took the job for the benefits. Paying 800 dollars a month for a 5k deductible will suck.

CreekDog

(46,192 posts)you're just blaming what your company did on the ACA. charming.

Joe the Revelator

(14,915 posts)However they tie rising costs due to the ACA to their changes year after year, changes which started after the ACA. I support the ACA (which again, if you had read the thread you're jumping into, you would have known that).

And again, who's ice am i thin on? Yours?

CreekDog

(46,192 posts)you're not doing a very good job of this.

delrem

(9,688 posts)I don't believe you lost your healthcare benefits, and "did it with a smile", but are now drawing a line at your "retirement and savings".

I say BULLSHIT.

The only criticism of the ACA I've ever seen at DU is that a faction says that it doesn't go far enough, and a faction of that faction says that the Dem party didn't fight hard enough for a better deal. I've seen NO posts, until yours, complaining that the ACA caused them to lose health care benefits.

Likewise, I don't believe that your "retirement and savings" are at all in jeopardy from the kind of tax Bernie Sanders proposes, so as to fund universal education through college/university (so the USA can catch up with the rest of the world!).

Jeeez.

still_one

(92,358 posts)ACA allows someone to opt out of the ACA if the premium for the Bronze plan exceeds 8% of their salary

delrem

(9,688 posts)But he's drawing the line, now, because Bernie is threatening his retirement?

Interesting reasoning there, still_one.

still_one

(92,358 posts)speculators, which I don't have a problem with and it might stop this high frequency trading garbage

InAbLuEsTaTe

(24,122 posts)yeoman6987

(14,449 posts)He is proposing. Congress will get a say and if this ever happens which I doubt highly, the way it is paid for will be changed a million times before it say the light of day.

Joe the Revelator

(14,915 posts)....his first major proposal goes into middle class retirement accounts and pension funds. Either I misunderstood Sen. Sanders, or he is pandering to college age kids with this bill, which like you said, won't see the light of day. Either way, I can no longer be a faithful supporter.

AgingAmerican

(12,958 posts)Your premise is irrational. Going after the middle class? That is absurd on its face.

Joe the Revelator

(14,915 posts)AgingAmerican

(12,958 posts)Not taxing the rich has almost ruined the economy and destroyed the middle class. Opening up college for everyone would help everyone. College educated people start businesses and generate a LOT of economic activity.

The level of a persons bigotry is inversely proportional to their parents college education level.

This program would solve many, many problems in the long term and would especially help minorities.

There is no downside.

"Ask not what your country can do for you. Ask what you can do for your country."

Joe the Revelator

(14,915 posts)You changed the argument into why free education is good. I agree with you. A tax on the middle class is not the way to pay for it.

passiveporcupine

(8,175 posts)that would proportionally impact the wealthy a lot more than the middle class.

"A small tax would make risky HFT unprofitable, and help reduce the excess speculation on commodities like food and gas that drives up prices, which will protect the economy from computer-generated collapses and market manipulation."

-from Bloomberg

And which would make your 401K more stable. Stable growth is good.

So I’m here to say, in fact, no one should be day trading his or her retirement account. No one."

-Forbes

Now if you want to read why you shouldn't be day trading your 401K, read this:

http://www.forbes.com/sites/kensweet/2012/07/10/6-reasons-why-day-trading-your-401k-is-dangerous/

AgingAmerican

(12,958 posts)I don't buy into the 'tax cut' nonsense.

Chan790

(20,176 posts)it primarily benefits the middle class. In the aggregate, you're ahead on the day. You lose some discretionary late-in-life income (perhaps a total of $100 over your lifetime and probably 1/5 of that) while shifting large portions of the cost of post-secondary education onto the government. This is a tax on the ultra-wealthy...they make the overwhelming disproportionate majority of qualifying transactions.

It's like if I raise your taxes $10/year and give you $120/month in increased earning potential.

Fuck...raise my taxes $20/year and throw in $120/month in food too.

$30/month and subsidized housing? ![]()

I'd rather have high taxes with high social benefits rather than oppose any new tax on the middle class (especially one that will hit the 1% 10x-1000x over) and maintain the shit-pit of the status quo for the middle class.

cui bono

(19,926 posts)The "I support Bernie but why is he ________________? I can't get behind that!" type of person.

This seems like the third or fourth person I've seen proclaiming to support him and then attempting to trash him. Seems to be an agreed upon tactic by some.

AgingAmerican

(12,958 posts)They cannot refute him.

It's more like, "I like Bernie, but he isn't Hillary". That is what they are really saying.

Gregorian

(23,867 posts)Pretty tame considering the benefits.

Joe the Revelator

(14,915 posts)No thanks.

Human101948

(3,457 posts)Which means you will pay taxes on it as income when you withdraw the money.

You should be much more concerned if you are in a fund that takes management fees. You will lose much more through Wall Street's sneaky fees by a factor of hundreds over the long term.

http://www.nerdwallet.com/blog/investing/2013/hidden-401k-fees-plan-retirement-account-study/

And I am surprised that someone on DU sounds like a greedy billionaire worried about a tiny, tiny percentage on TRADING and SPECULATING which will not affect the average American in any significant way. It will hit the hedge funds and in-an-out high frequency traders. If you leave your money in real investments for years and years you will not even notice.

InAbLuEsTaTe

(24,122 posts)newthinking

(3,982 posts)The stock market is constantly being screwed with.

If you really want to get worried about a tax on your 401k there is a lot more to worry about than this. People like Bernie will go after more effective and fair reform in these arena's that will benefit you far more.

They have so screwed our economy that they have had to massively QE the backend for years now. That is having a far greater effect on your pension (I have one too) and yet you are concerned about this????

Bonobo

(29,257 posts)"It would impose a Wall Street speculation fee on investment houses, hedge funds, and other speculators of 0.5 percent on stock trades, a 0.1 percent fee on bonds, and a 0.005 percent fee on derivatives."

Joe the Revelator

(14,915 posts)my position that ANY new tax on supposedly tax free or tax deferred accounts is a non-starter.

Bonobo

(29,257 posts)If that's how you feel, then Sanders is definitely the wrong candidate for you and I suspect he never HAD you.

Joe the Revelator

(14,915 posts)I was a day 1 (or two?) contributor.(A huge $50). Even in small sums, I am a careful as to which politicians I give money to.

Bonobo

(29,257 posts)Joe the Revelator

(14,915 posts)There is no off set.

http://www.sanders.senate.gov/download/collegeforall/?inline=file

Bonobo

(29,257 posts)Not all 401Ks need to be.

geek tragedy

(68,868 posts)under this bill.

Bonobo

(29,257 posts)geek tragedy

(68,868 posts)Bonds get taxed by this bill, unless they're tax exempt munis.

Bonobo

(29,257 posts)I took you at your word.

I was certain you mean it literally since you wrote it in response to my statement that 401Ks need not be linked to money market accounts -as if to refute it.

AgingAmerican

(12,958 posts)Not surprised you would jump on this pro wall street bandwagon.

geek tragedy

(68,868 posts)leveymg

(36,418 posts)A HERETIC I AM

(24,376 posts)Please see my post at the bottom.

hatrack

(59,592 posts)I'd bet it's more than 0.5%

Joe the Revelator

(14,915 posts)nashville_brook

(20,958 posts)Nye Bevan

(25,406 posts)when they could trade a derivative that is directly tied to the stock instead, reducing their tax one hundred fold?

Human101948

(3,457 posts)They are based on the stock going up or down in price. Once the contract such as a stock option expires, it can be profitable or it can be worthless but there is nothing to sell once it expires.

PowerToThePeople

(9,610 posts)Let those current market manipulators play in their own imaginary playground of derivatives. Get them out of the real market where stock price has direct repercussions to the citizens of this nation.

deutsey

(20,166 posts)Seems reasonable to me.

Warren DeMontague

(80,708 posts)I mean, I'm sure there are creative financial instruments which serve some useful and transparent purpose in the investment and capital world, however, the bastards were cooked up specifically, AFAIUI, to be opaque enough to hide crappy mortgages that could then be ground up, packaged, and sold like sausages filled with mystery meat, directly leading to at least part of the financial clusterfuck we experienced in '08-'09.

A basic stock for a basic stock trade is relatively straightforward, by comparison. I'd support being harsher on derivatives.

1939

(1,683 posts)NYC_SKP

(68,644 posts)First, that's not that high.

Second, do you really buy and sell a lot of stock?

Nothing about 401Ks or 529s.

Sanders' bill sets a 50-cent tax on every "$100 of stock trades on stock sales, and lesser amounts on transactions involving bonds, derivatives, and other financial instruments," the group Robin Hood Tax on Wall Street said Monday in a press release.

"The Robin Hood tax would also slow the growth of automated high frequency trading, which makes the stock market more dangerous," the press release stated. "A small tax would make risky HFT unprofitable, and help reduce the excess speculation on commodities like food and gas that drives up prices, which will protect the economy from computer-generated collapses and market manipulation."

http://www.bloomberg.com/politics/articles/2015-05-18/bernie-sanders-wants-to-tax-stock-trades-to-pay-for-free-college

Joe the Revelator

(14,915 posts)every hundred that is moved. Over a 30 year investment career that adds up, not to mention you get taxed again when you want to retire. (which was part of the deal when people started paying into 401ks)

safeinOhio

(32,713 posts)on your kids college education.

Agschmid

(28,749 posts)But I get the bigger issue.

Nye Bevan

(25,406 posts)morningfog

(18,115 posts)Erich Bloodaxe BSN

(14,733 posts)If we'd never started having universities, we'd all still be dwelling in thatch huts we shared with lice and fleas and using outhouses.

geek tragedy

(68,868 posts)Ilsa

(61,697 posts)Quality work and services verses worrying about repaying outrageous student loans. I know I'd rather my doctor think about what I need versus whether she'll make enough to repay her student loans.

geek tragedy

(68,868 posts)to doctors and lawyers.

Doctors are not hurting for money.

F4lconF16

(3,747 posts)Most janitors or any other low income workers have 401k's.

Joe the Revelator

(14,915 posts)Ilsa

(61,697 posts)The amended legislation could exempt lower dollar 401(k)s. Exempt certain pension accounts. Even if the pension account is taxed, it is likely that the janitor still benefits from more people able to get a college education vs the US having a trillion dollars in student loan debt. It's been my experience that janitors get laid off pretty quickly when the economic shit hits the fan.

geek tragedy

(68,868 posts)Not sure I buy your trickle-down argument re: college debt and janitors.

Ilsa

(61,697 posts)And there is enough student loan debt to create huge economic problems if graduates can't find work and pay their debts.

I have friends cleaning their own offices and doing trash duty because the janitors have been let go.

muriel_volestrangler

(101,349 posts)or a couple under $75k.

http://www.sanders.senate.gov/download/collegeforall/?inline=file (Section 503 "OFFSETTING CREDIT FOR FINANCIAL TRANS-

9 ACTION TAX"![]()

passiveporcupine

(8,175 posts)geek tragedy

(68,868 posts)possession.

No such carve out exists for retirement plans such as CalPERS or NYCTRS. They'd have to pay the tax, which means less money available to their beneficiaries.

muriel_volestrangler

(101,349 posts)A pension fund that has a long-term outlook and fairly unchanging needs for its members (money regularly coming in from those working and paying out to retirees) will have a low turnover ratio. It seems quite reasonable to think they'd keep a stock for at least 5 years on average, in which case the tax would be 0.1% or less per year of the fund value.

geek tragedy

(68,868 posts)would come from sales of stocks and bonds. So it's effectively a 1% tax on benefits-.5% upon purchase of assets and .5% upon sale. Assuming no rebalancing or active management, which is almost never the case.

muriel_volestrangler

(101,349 posts)If you want to count it for an individual (or fund) for both purchase and sale, then they each effectively pay 0.25%.

In practice, pension funds will have money coming in from working members, and from dividends, and will be paying that out to retirees, and the amount of new purchases will just be from the amount the capital of the fund is added to, rather than all the benefits. It's the active management that would be the main factor, I think, and I'd expect pension funds to have a long-term outlook - they ought to, anyway. I think it should work out under 0.1% per year for a well-run fund.

In the UK, this duty ('stamp duty reserve tax') already applies, at that 0.5% rate, to all purchases of stocks (it's clear in the UK that the tax is on the purchase, and I think it would need to be clear in the US whether it's on purchase, sale or split, for that under $50k tax credit to be implemented). Funds cope, and so do individual investors.

L0oniX

(31,493 posts)valerief

(53,235 posts)for a socialist democracy.

NYC_SKP

(68,644 posts)By setting the tax rate so low, the measure would not impact the market’s traditional role supporting economic activity. It would, however, reduce certain speculative activities like high-speed computer arbitrage trading. A speculation fee could help to shift Wall Street away from short-term trading. Given the very high volume of financial trading, it will raise considerable funds, badly needed to protect Medicare, Medicaid, and other important federal investments and for reducing deficits.

Earlier this year, a group of 11 European governments agreed to implement a financial transaction tax. The action allows for a tax of 10 basis points on stocks and one basis point on derivatives on financial transactions by the following countries: Germany, France, Italy, Spain, Belgium, Austria, Greece, Portugal, Slovakia, Slovenia, and Estonia.

Joe the Revelator

(14,915 posts)which had carve outs for retirement vehicles. The bill that Sanders introduced today does not.

h

NYC_SKP

(68,644 posts)The above was from 2013, so I stand corrected.

The excerpt below is from this week:

http://www.sanders.senate.gov/newsroom/recent-business/make-college-tuition-free

This legislation is offset by imposing

a Wall Street speculation fee on investment houses, hedge funds, and other speculators of

0.5% on stock trades (50 cents for every $100 worth of stock), a 0.1% fee on bonds, and a 0.005%

fee on derivatives.

It has been estimated that this provision could raise hundreds of billions a year

which could be used not only to make tuition free at public colleges and universities in this country,

it could also be used to create millions of jobs and rebuild the middle class of this count

http://www.sanders.senate.gov/download/collegeforallsummary/?inline=file

Joe the Revelator

(14,915 posts)529's and the like.

LittleBlue

(10,362 posts)I do taxes for small day traders who aren't rich. It's more of a hobby. Some of them cashed out from their retirement (stupidly) when their employer offered them a lump sum. One has cash from a divorce settlement. Some have about $100k cash or less. They day trade to make an extra few bucks. Some lose money so often they're in danger of being ruled a hobby rather than a business. None have the billions it takes to influence the price of a commodity.

I've calculated one who would owe $210,000, twice as much cash as he actually possesses, even during years where he lost money. These aren't rich people, they are just hoping that their bank accounts don't run out before they die.

Sanders is going to lose me if he goes after the middle class and retirees. Transaction taxes suck for this reason. He needs a minimum income threshold or I'm done. Go after the institutions, not old day traders who do it instead of going to the casino slot machines. Robin Hood robbed the rich, not pensioners.

Joe the Revelator

(14,915 posts)padfun

(1,787 posts)Those of us who do lots of casino slot machines pay one hell of a lot of our measley wins to taxes. And if it's a tournament win, the IRS taxes it as non gambling, which means you cant write off gambling losses on it.

just saying... because we gamblers pay a lot more in taxes than stock speculators and 401k investments.

LittleBlue

(10,362 posts)but 99.999999% of slots players are normal slots players, where losses offset wins and owe nothing. Most people lose money.

Imagine a scenario where a woman has a net worth of $250,000, which includes her home minus mortgage. She lost about $4,000 last year. Under this plan, she would owe around $65,000 from that year. Where she lost money. She'd have to sell her home. That isn't fictitious, she's my client.

Ridiculous

Erich Bloodaxe BSN

(14,733 posts)And it sounds like she's folding over and over, paying that fee without actually ever winning anything. I used to daytrade, back when my boss at work did as well, and left one of those real time stock-tracking programs open all the time and let us call our brokers from the office during work hours. And the only thing that suggests to me is that she needs to make sure she doesn't sell quite as fast, but actually ride the stock up enough to cover the transaction tax and then some.

The effect of the transaction tax is to kill off the worst of the trade for pennies on the share trades. To reduce volatility by making people hold stocks a bit longer, and give actual human beings more power again and less to people with their own trade servers located at the exchange with programs running the trading.

She's a gambler, not an investor. And sometimes gamblers lose their houses.

Chan790

(20,176 posts)Sorry...I have no sympathy for hobbyist and/or pensioner day-traders. They're part of the problem...if this bill drives them out of day-trading, that's a good thing.

Joe the Revelator

(14,915 posts)not a tax on rebalancing 401ks

kenfrequed

(7,865 posts)This kind of a tax would actually create an incentive for more stable and long term investments. The idea of continual, daily reinvestment is sort of a numbers game that brokerage houses use anyways to up the benefits to their larger individual investors at the cost of all the pensions and 401K people.

We really shouldn't be encouraging tons of purely hyper speculative investment as it is bad for the economy and tends to create bubbles that destroy the investments of the little guys anyhow. This cloud of speculation, credit default swaps, derivatives, and investment houses that seek to pad their well heeled clients at the expense of everyone else needs to be straightened out.

http://www.cepr.net/documents/ftt-facts-myths.pdf

Joe the Revelator

(14,915 posts)So everytime that happens in your 401k or small ETF fun or whatever, you are going to get taxed on it.

kenfrequed

(7,865 posts)If your broker is calling it "rebalancing" I would question what they are really doing for you and whether they are serving your interests or one of their wealthier clients.

kenfrequed

(7,865 posts)Rebalancing is something that would cost you a lot more in brookerage fees anyhow and should really only be done at most once a quarter. If your investment house is rebalancing you daily than they are screwing you out of a lot of money in traders fees.

LittleBlue

(10,362 posts)They aren't powerful enough to manipulate anything

What I find utterly bizarre is that this same forum will decry sales tax as regressive, but will not recognize a flat tax on trading as regressive.

Are flat taxes regressive? The answer is yes. Then why do you support it?

kenfrequed

(7,865 posts)Do you know a lot of the working poor as having heavy portfolios with speculative brokerage houses? This is a fee on excessive speculation trading that does more harm than good and actually doesn't add anything to the economy.

still_one

(92,358 posts)dannward

(21 posts)At 0.5% (50 cents per $100 in trades; 1/200th of the transaction value), your friend would owe $210k in taxes only if he traded $42,000,000 of transactions a year - around $200k in trades every weekday.

Seems like a very high volume of transactions for no profit. There's no way I'd move twice my liquid assets around in the market every single day - my stomach could never handle that much stress.

Hoyt

(54,770 posts)Joe the Revelator

(14,915 posts)This was a great opportunity to increase capital gains taxes. Not putting hands into retirement funds.

Hoyt

(54,770 posts)Even if you don't , everyone of us benefit from a well educated society. Long-term, your investments will likely increase by more than the half of one percent due solely to better education and kids not saddled with debt.

There's no downside and we all should jump at the opportunity.

questionseverything

(9,657 posts)or maybe we should double personal exemptions as a starting point on helping the middle class

DJ13

(23,671 posts).... should your job be offshored, what would that do to further adding funds to your investments?

The added taxes are a small price to pay if you desire to maintain your current standard of living.

Joe the Revelator

(14,915 posts)Scootaloo

(25,699 posts)All you're doing is making a NIMBY argument.

Joe the Revelator

(14,915 posts)Guy A who's 500 dollar trade gets taxed 3 dollars or a someone who gained 250k on an investment?

What seems more fair? A tax deferred account, actually being tax deferred, or a tax on actual income?

Scootaloo

(25,699 posts)But then I'm also that guy who doesn't think churches ought to be tax-exempt.

If "only" making $497 on a trade really turns your ass around, well then... bye

Joe the Revelator

(14,915 posts)everytime the fund rebalances isn't a new tax on the middle class then maybe you could try the purity test bs. Protecting ALL of the middle class is as good a reason to be a democrat as any.

Agschmid

(28,749 posts)TM99

(8,352 posts)You just got had by the damned Mainstream Media.

The so-called 'Robin Hood Tax' will NOT apply to your 401k or your kid's 529.

Please do more research. Read this article for example --

http://www.nationalnursesunited.org/pages/financial-transaction-tax

Equivalent to sales taxes Americans pay for most goods and services; no similar tax exists on Wall Street transactions.

Would not apply to normal consumer activity including use of ATMs, debit card purchases, 401k pension plans, or obtaining a home loan. Minimal impact on ordinary investors.

Targets major banks, investment firms. Financial giants Citigroup, JP Morgan, Goldman Sachs, and Morgan Stanley alone account for almost 25% of the total overall global market volume share of currency trades.

Should discourage some excessive Wall Street speculation, the main cause of the 2008 economic crash, whose perpetrators were rewarded with bailouts and bonuses. Speculative activity has grown 400% in the past decade; only 2% of currency trades today build the real economy in goods and services.

An international campaign. More than 15 nations, and the seven fastest growing markets, have an FTT. The European Commission has proposed an FTT that would raise 78 billion euros a year.

Highly successful. The London Stock Exchange, with a .5% tax on each stock trade, has been very successful in raising revenues, while not inhibiting financial activity, remaining the largest in Europe.

Tough to evade. In Great Britain, those who fail to pay the FTT do not get title to securities.

Not a new idea. The U.S. had an FTT from 1914 to 1966. After the 1987 U.S. Wall Street crash, major U.S. politicians, including Senate Majority leader Bob Dole and the first President Bush, endorsed reinstating an FTT.

Further -

This is not a bad or pandering move on Sander's part. This type of FTT exists in numerous countries. The UK is specifically referenced in this particular article. It does not target middle class consumers and you will not be penalized in the least!

He is beginning with this (only a $.50 tax on every $100.00 of trade) and I am quite confident given his platform and legislative history that he will put forth the tax on capital gains as well. This does NOT impact the savings/retirement vehicles of the middle class.

Please reconsider your hasty conclusion.

Joe the Revelator

(14,915 posts)My understanding is that it is NOT true for the Sanders plan introduced today. The off set for 401ks and 529's would not be included.

TM99

(8,352 posts)Sanders introduced other variations on this bill in both 2011 and 2012.

The benefits are towards education this time but the specifics have not changed.

http://www.sourcewatch.org/index.php/Financial_transaction_tax

There is nothing new about the FTT.

Where are you getting your counter information?

Joe the Revelator

(14,915 posts)TM99

(8,352 posts)That is the bill summary.

He is referencing the Robin Hood Tax or FTT. All versions are designed to NOT penalize the working investor.

Joe the Revelator

(14,915 posts)TM99

(8,352 posts)further refutes.

For fuck's sake. This is NOTHING new. The Robin Hood Tax and FTT are well known.

This will not penalize you.

questionseverything

(9,657 posts)but lets do capital gains soon too!!

Joe the Revelator

(14,915 posts)geek tragedy

(68,868 posts)TM99

(8,352 posts)http://www.nationalnursesunited.org/pages/financial-transaction-tax

On the whole unions, both public & private, have been on board with variations of the FTT for some time now.

This will not penalize the working class.

geek tragedy

(68,868 posts)It's also a lot more than the amount of DeFazio-Harkin.

TM99

(8,352 posts)are specifically designed to not penalize the 401k's of working class investors.

Here is the summary -

http://www.sanders.senate.gov/download/collegeforallsummary/?inline=file

He specifically mentions the Robin Hodd Tax - the FTT. I linked you to the facts.

This will not impact 401k's.

Can you provide factual information from links to the contrary?

geek tragedy

(68,868 posts)TM99

(8,352 posts)Exceptions are covered on pages 26 through 29.

The normal working investor will not be penalized. Those vehicles, like 401k's, 529's, union pension plans, will be exempt.

As I said, this is the standard FTT (Robin Hood Tax) that he and others have put forth for some time.

geek tragedy

(68,868 posts)It says exchange, broker, or purchaser if there is no broker or exchange.

TM99

(8,352 posts)ERISA is not a fund, it is a federal law.

Among other things, it specifically defines contribution plans including SIMPLEs, 401ks, ESOPs, SEPs, Profit Sharing, etc. which all involve purchasers, brokers, and an exchange.

geek tragedy

(68,868 posts)Point being, where does Sanders' legislation exempt employee retirement funds from having to pay this tax?

TM99

(8,352 posts)geek tragedy

(68,868 posts)employee retirement funds.

As a further aside, query whether the money raised would be better spent on infrastructure or health care.

TM99

(8,352 posts)Read the new bill.

Read the information on the FTT.

I am done.

geek tragedy

(68,868 posts)Joe the Revelator

(14,915 posts)The original FTT bill blatantly had tax off sets for retirement accounts.

This one does not.

http://www.sanders.senate.gov/download/collegeforall/?inline=file

geek tragedy

(68,868 posts)funds.

This bill does not exempt them.

It taxes all stock transactions. All of them.

Joe the Revelator

(14,915 posts)Thank you for that.

A HERETIC I AM

(24,376 posts)For the answer as to why, see my post at the bottom of the thread.

geek tragedy

(68,868 posts)Thus this tax reduces the value of the mutual funds themselves.

A HERETIC I AM

(24,376 posts)The OP is concerned he will be taxed when he rebalances his 401(k).

He has nothing to worry about.

I read the pertinent portion of the bill to see i specified "trades"

As I said in the post I directed you to at the bottom of this thread, Mutual Fund shares do not trade.

Any fees realized by the Fund company will likley be added to the expense ratio of the fund, but I would be surprised if MF's are not exempted, either by language I have yet to read, subsequent additions or lawsuit.

geek tragedy

(68,868 posts)Part of the problem, of course, is that if you take away the taxes on retirement plans, mutual funds, etc then you reduce the amount of tax revenue generated.

So there is a little bit of a sleight of hand going on here--sure you can raise a whole boatload of cash from such a tax, but the more it's treated as a source of revenue, the less it focuses on Wall Street as it then starts hitting retirees.

bunnies

(15,859 posts)FYI - You are not in the middle class. Youre in the billionaire class!

Meanwhile:

Progressive Groups Rally Behind Sanders' Plan to Tax 1% and Fund Higher Ed

http://www.commondreams.org/news/2015/05/19/progressive-groups-rally-behind-sanders-plan-tax-1-and-fund-higher-ed

but dont let that get in the way of your cool story! ![]()

geek tragedy

(68,868 posts)It's not a great idea. High frequency trading should be targeted, but retired workers shouldn't bear the brunt of the expense.

KT2000

(20,586 posts)bear the expense. Look up-thread - there are descriptions of what is targeted

geek tragedy

(68,868 posts)So, it would be a tax on their retirement accounts and pensions.

It would be an indirect tax on retirees who work for state and local governments,and anyone else with a 401k.

bunnies

(15,859 posts)I wouldnt invest my retirement in it. And if your at the point where you have earned a "large transaction fee", Im pretty sure youll be ok.

Joe the Revelator

(14,915 posts)bunnies

(15,859 posts)Joe the Revelator

(14,915 posts)This isn't a tax just on the 1%. Its a tax on anyone who has a 401k or a public pension.

bunnies

(15,859 posts)Your broker might have to pay a tax on his massive transfers and youre upset? This is EXACTLY how republicans get those to vote against their best interests.

geek tragedy

(68,868 posts)before that happened.

I'm not dropping Bernie over one bad piece of legislation that will never become law.

Cheese Sandwich

(9,086 posts)The big financial institutions by far would be the most powerful concentrated opposition to this.

Labor I think will mostly go along with it.

NNU has been the biggest booster for it of all... http://www.democraticunderground.com/1017266587

geek tragedy

(68,868 posts)It needs a carve out to prevent pension funds from getting taxed. Also, if you're going to tax pension funds the money should benefit working people now. Spending every dime of this on college kids misses the mark.

Cheese Sandwich

(9,086 posts)All the tuition comes less than $100 billion / year.

The financial transaction tax could raise significantly more than that, maybe $300 billion / year.

$300 is the estimate Rep. Keith Ellison used for revenue when he introduced the same tax in the House.

That money could be spent on something else, or used to reduce the deficit.

And that's what Senator Sanders indicated in his press conference today, that the extra money could be used to meet other needs.

But having said all that, I strongly disagree with your claim that college tuition is not a working class issue. It is an issue of great concern to working class families.

For one thing you are dismissing "college kids" as not being "working people". For another thing you forget people have families they care about so if mom and dad are working people, it is of no benefit to them if their kids need to take out a $50,000 loan. Student debt hits working families hard. A lot of the debt is taken on by parents as well.

This is in response to your statement:

edit: It's also misleading to describe this as a tax on pension funds. This is not a tax on funds. This is a tax on transactions. When piano players buy mayonnaise they pay sales tax. We don't call that a tax on piano players, or a mayonnaise tax. The tax is on the transaction. Maybe retirement funds should be exempt. That's a valid point.

kcr

(15,318 posts)(Hey, why not. Everyone thinks they're middle class, right? *wink*) I can't afford to have that taxed either, wahh! Best to just stick to more regressive tax schemes and vote for less progressive candidates. That makes sense. That will be sure to help out the *cough middle class *cough* ![]()

Joe the Revelator

(14,915 posts)an equally small 529 account (right now with a whopping $100 in it, granted he was only born in feburary).

The ability to save does not kick one out of the '99%'. We eat a lot of ramen.

kcr

(15,318 posts)The jibe here is you think the most progressive candidate out there has policies that hurts the middle class.

Joe the Revelator

(14,915 posts)If yes, then he does. Which is why I said initially that this is a stupid bill for him to introduce.

kcr

(15,318 posts)For another, I have a hard time believing someone who would use a term like "Robin Hood Tax" was ever all that much of a Bernie supporter to begin with. You realize Robin Hood stole from the rich, right?

Joe the Revelator

(14,915 posts)See the last paragraph here: http://www.sanders.senate.gov/download/collegeforallsummary/?inline=file

And again, this is the full bill. Tell me where I'm wrote about an offset to retirement funds and pensions:

http://www.sanders.senate.gov/download/collegeforall/?inline=file

kcr

(15,318 posts)Huh. That would be pretty stupid if he's doing that.

Joe the Revelator

(14,915 posts)kcr

(15,318 posts)Joe the Revelator

(14,915 posts)...that WILL lose him support.

kcr

(15,318 posts)No one could get elected. I think Bernie is safe to let this one pass. Seriously. Anyone who would worry about this tiny tax isn't worth worrying about.

Joe the Revelator

(14,915 posts)But you are entitled to your opinion. Anecdotally, he lost my support, so he's -1.

kcr

(15,318 posts)Actually, I think that's the goal. The hope is to move leftward. Collateral damage as far as I'm concerned. As I say, anyone worried about this tiny tax...

Joe the Revelator

(14,915 posts)to be voting blue on election day?

Also, on a personal level, I'm finding his supporters, at least by this tread, to be full of not much substance in their support. He's standing on a much more precarious house of cards than I thought.

kcr

(15,318 posts)Nah, I think I'll take my chances. But, thanks anyway. I'm normally not so strident, but I adjust the pepper in my posts according to need. There's something off about you.

Joe the Revelator

(14,915 posts)...other than it would appear that you don't like those who disagree with you. Check my post history, I have been around a LOOOONG time. I was a staunch Obama supporter during the 08 primary, a Howard Dean supporter in 04 (with an admitted crush on Wes Clark) so I'm not some Hillary shill trying to rattle people up. Bernie was my man going into today, but he is no longer. I really shouldn't have to explain an opinion to you

kcr

(15,318 posts)you get called out on it. I'm sure it appears as though I don't like it. I think that's just projection on your part because it's no fun to be told you're wrong.

Joe the Revelator

(14,915 posts)I'll link it for you again. This is off Bernie's own site. This is the bill, warts and all. There is no exception for retirement funds or savings as there was in the original FTT. You're friend below who thought he/she was scoring points was doing nothing but quoting from the '12, '13 bills that Bernie supported at the time, but that are completely different then this bill he has proposed. Please. Read the bill for yourself. I'd love to be proved wrong.

http://www.sanders.senate.gov/download/collegeforall/?inline=file

kcr

(15,318 posts)Tell me why we ignore all the college students in debt? If the quick trade throw your retirement in there and gamble you can be rich too! Woo hoo! scheme works so well that oh boy! That just shouldn't be discouraged in any way whatsoever tax that!? Never! Then how is it that it hasn't worked out for very many?

Joe the Revelator

(14,915 posts)You can change your argument now, but what you're throwing out is a red herring.

And, my friend, i don't think you understand how a 401k works. You're throwing things into a pot of funds that are traded in volume. In order to NOT have it be such a gamble you have to move stocks into bonds at a regular clip in order to keep the ratio correct and the risk level small. Under this bill, doing that will be taxed every time, multiple times a year. Its bad legislation.

A HERETIC I AM

(24,376 posts)Please see my post at the bottom of the thread.

Bonobo

(29,257 posts)Joe the Revelator

(14,915 posts)Bonobo

(29,257 posts)Joe the Revelator

(14,915 posts)Bonobo

(29,257 posts)Joe the Revelator

(14,915 posts)don't be the guy who adds new taxes to retirement funds.

Bonobo

(29,257 posts)The additional tax is for the same reason and justification as the current tax on it. Namely to support the country you live in and its citizenry.

What is the basis for your arbitrary "the tax stops here" argument?

Tax rates have always fluctuated based on the current societal conditions.

Joe the Revelator

(14,915 posts)Billy Fat Cat may not need his retirement funds, but I do.

Bonobo

(29,257 posts)You DO know that is a position that everyone pretty much says when they want to defend their lack of will to help out the brutally suffering underclass, right?

Joe the Revelator

(14,915 posts)I draw the line at retirement accounts. That is changing the rules mid game.

Bonobo

(29,257 posts)

Joe the Revelator

(14,915 posts)on the lower earners, when we have all agreed that the problem is with the highest earners?

Bonobo

(29,257 posts)I would encourage you to support tax increases on those who are disproportianately reaping in $$ from investments though.

The truly poor cannot invest in a system that earns them money for doing nothing.

They deserve to be lifted up for their hard work and given equal opportunities.

The truth is that money accrued from investments should be taxed at a higher rate than they currently are.

The truth is that America is terribly unequal.

The truth is that the Robin Hood tax would be a tax increase which is very, very Progressive and affects mostly the very wealthy.

Joe the Revelator

(14,915 posts)EXACTLY! Capital Gains should be fair gain. The cost of rebalancing a 401k should not.

TM99

(8,352 posts)This is a bill in full on legalese. You will notice there is no mention of Day Trading specifically yet it is covered by what will be taxed. The exemptions do not specifically mention 401k's, 529's, or public pensions by name but they are covered.

This bill was released just hours ago. When it is parsed and analyzed by the financial journalists this will be made apparent.

Joe the Revelator

(14,915 posts)Because I don't see it.

elleng

(131,067 posts)if they are yet available, but don't think this tax is intended to attach to the vehicles/transactions you are concerned about, but rather bigger ones of bigger fish.

Joe the Revelator

(14,915 posts)re:re:re: capital gains tax.

WillyT

(72,631 posts)This is exactly what puts the election up for grabs...

People who don't know a damned thing about the politics of their "position".

![]()

![]()

Joe the Revelator

(14,915 posts)Because it DOESN"T tax the rich, it taxes the middle class.

WillyT

(72,631 posts)Joe the Revelator

(14,915 posts)market.

WillyT

(72,631 posts)Joe the Revelator

(14,915 posts)If effects EVERYONE who happens to have money in the market. Any trade. No offset for 401ks, pensions, 529s ect. Even if you don't trade, you would pay when your account would need to be rebalanced. Its not just the 1% who are in the market.

WillyT

(72,631 posts)Joe the Revelator

(14,915 posts)TM99

(8,352 posts)I addressed all these bogus complaints in various supporting fact links.

The willful denial is making me begin to question the sincerity of the concerns expressed. ![]()

Joe the Revelator

(14,915 posts)TM99

(8,352 posts)I have provided ample facts to back up my assertions.

I have discussed the FTT (Robin Hood Tax). I have linked to the myths, including this one, which have been debunked time and time again. I have referenced the exemptions.

You have not backed up yours one whit!

The bill was released today. All of these specifics will be on all of the news sites in the coming days just as they were in 2011 and 2012 when Sanders introduced similar legislation.

Joe the Revelator

(14,915 posts)You have not, by any means, discussed the bill, that has been provided to you, that is already out there. You don't need the 'news sites' to digest it for you. Here it is:

http://www.sanders.senate.gov/download/collegeforall/?inline=file

Show me where there is an offset for retirement accounts.

bunnies

(15,859 posts)Bernie isnt even polling high is theyre going to these lengths already. lol.

Joe the Revelator

(14,915 posts)before you start implying I'm a shill.

Joe the Revelator

(14,915 posts)Please point out the off-set I missed.

MaggieD

(7,393 posts)You called it in the OP. It's pandering. Not a realistic solution.

WillyT

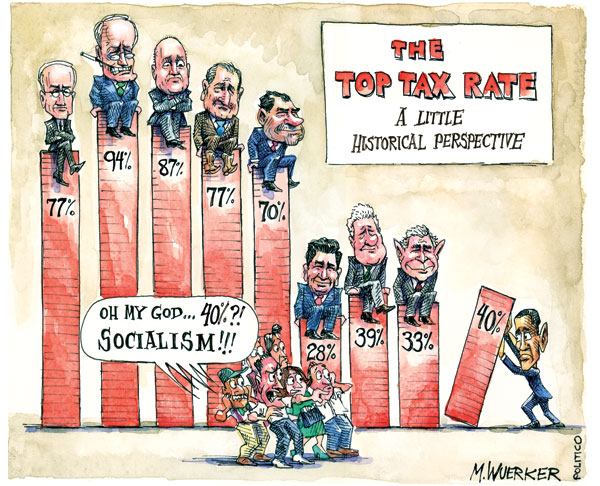

(72,631 posts)

Sometimes known as Bonds... you know...

Public Education, Public Housing, Science/Medicine, Highways/Bridges/Freeways/Etc...

They also used to be called "Tax Shelters".

IOW... if you don't wan't to pay that tax rate... we have a way to fix that for ya ...

MaggieD

(7,393 posts)... No matter how you raise them. The problem is the loopholes. Not the tax rate.

Joe the Revelator

(14,915 posts):thumbsup

WillyT

(72,631 posts)Joe the Revelator

(14,915 posts)I like that.

deutsey

(20,166 posts)and the rich have duped so many of us into thinking that we're in the same boat (or yacht) as them, it's going to be a while before we can get a more rational view to prevail.

The so-called "death tax" is a prime example. Has nothing to do with most of us and everything to do with the ultra-wealthy, but we've been duped into opposing it as if we have some vested interest in it.

I sometimes think we'll have to sink into a third-world, feudal society before the majority of people will start to realize that they're not in The Club that George Carlin told us about.

lancer78

(1,495 posts)and with the right planning, the death tax is completely avoidable. It is ironic that perhaps the most easily avoidable tax is named after the least avoidable thing in life.

Logical

(22,457 posts)Electric Monk

(13,869 posts)“Socialism never took root in America because the poor see themselves not as an exploited proletariat but as temporarily embarrassed millionaires.” ― John Steinbeck

http://www.goodreads.com/quotes/328134-socialism-never-took-root-in-america-because-the-poor-see

Joe the Revelator

(14,915 posts)Joe the Revelator

(14,915 posts)Seriously, its as I've said. If i had millions, i wouldn't be overly concerned about a small tax. Which is why I'm all for an increased capital gains tax.

niyad

(113,524 posts)Half-Century Man

(5,279 posts)Each 401k has to pay the trader for each trade rather than the single (but larger) trade fee paid by an group policy (Pension). Money markets have evolved to occupy the gap of pensions left.

This is why Reagan and his band of merry republicans were so happy to endorse them; they steal from the poor and give to the rich.

If you are forced to rely on a 401k, you are already boned. I was, we all are.

Joe the Revelator

(14,915 posts)Scootaloo

(25,699 posts)Joe the Revelator

(14,915 posts)Travis_0004

(5,417 posts)I would not call that getting boned.

LeftyMom

(49,212 posts)"And under" (you can't even mention the poor because the obviousness of your bullshit would be apparent) don't have the option to save or invest. Fight your own damn battles, you don't give a damn about the poor. ![]()

Joe the Revelator

(14,915 posts)Take a site like betterment.com, you can invest a 1 a week if you'd like.

Putting 3% of my paycheck into a 401k is not magically going to by me a mansion. It MAY allow me to ONE day stop working full time. Maybe. The point is, I've been paying into it.

.

If you're saying that anyone who has the ability to save a couple of dollars here and there is 'rich', then i really don't know what to tell you.

LeftyMom

(49,212 posts)Usually smug bullshit like yours comes out of the mouths of Republicans.

Joe the Revelator

(14,915 posts)Or what rich means. If having a few extra dollars at the end of the month makes one 'rich' then by god I guess I'm rich.

If that makes someone middle class, then I think we'd be using accurate terminology. Genius.

And by all means, keep up the purity test bullshit.

giftedgirl77

(4,713 posts)half of them have no idea what their talking about & they other half is going to hate you & assume that you're an evil 1% for discussing investment concerns.

I'm a single mother of 2 teenage boys & live completely off of my VA disability & Social Security & am middle class. But yes, I have savings & investments & do understand what you are saying.

Joe the Revelator

(14,915 posts)I'm at best middle management, my wife is a public school teacher, and we just had our first kid. Times are very tight at the moment with childcare and just life in general, but I still try to put something away for when we are old and grey, even if it means hot dogs and kraft dinner for supper a couple of times a week. I am fortunate than some, but not to the point where I feel like my retirement account should be fair game, when there are other options.

AZ Progressive

(3,411 posts)Joe the Revelator

(14,915 posts)abelenkpe

(9,933 posts)It doesn't apply to 401ks or your kids 529.

MaggieD

(7,393 posts)Bonobo

(29,257 posts)LOL.

MaggieD

(7,393 posts)... Are part of the 1% now?

TM99

(8,352 posts)The exemptions are clearly presented in the linked-to bill.

This is not a new bill even though it is now being used for college tuition. Sanders brought forth similar bills in 2011 and 2012.

It is the standard FTT (Robin Hood Tax). All of the myths, including this one, have been debunked for some time.

But the disingenuous will perpetrate them to tear down a serious challenger in the Democratic Primary.

Joe the Revelator

(14,915 posts)You may have other information than me, but i searched the entire document for the words 'retirement' '401k' 'off set' ect and there is no such language.

Bonobo

(29,257 posts)But the "Robin Hood" tax would benefit the 99%.

If you don't want the additional tax, put your investment money in a savings account. That's how it was done before Wall St. roped all the rest of us suckers into their greedy mitts.

Joe the Revelator

(14,915 posts)effect the middle class. Most of the middle class is tied up in the stock market via retirement funds. Maybe we're all rubes, but for a lot of us its the only option we have to maybe one day retire.

Travis_0004

(5,417 posts)No thanks.

Joe the Revelator

(14,915 posts)....is a blatantly untrue argument.

Bonobo

(29,257 posts)Maybe you could rephrase.

"A tax constitutes the 1%" makes no sense.

Joe the Revelator

(14,915 posts)I'll go back and try to figure out what i was trying to say there. ![]()

Bonobo

(29,257 posts)that yes, I DO understand that many normal middle class people are invested in the stock market through no particular fault of their own. The 401K money-market rush pulled them all into a game where they are being used as fodder at their own risk.

BUT, compared to the marginal and desperate lives that so many tens of millions of Americans are living in, I cannot in good faith complain about a tiny tax on investments.

Joe the Revelator

(14,915 posts)That would bring the red graph that you posted above higher, and leave the blue line alone.

Again, i said it below, but I thought Sanders' campaign was about equaling the playing field with the fats cats, not the middle class. I guess that is where I was a rube. No blood/no foul, I just don't think I'm his target anymore.

I do disagree that wanted to protect every dollar in a retirement account, at this point, is not as selfish as you and some others make it out to be.

MaggieD

(7,393 posts).... Is part of the 1% now? This is why I have a hard time taking his supporters seriously.

Bonobo

(29,257 posts)Joe the Revelator

(14,915 posts)This tax effects the middle class. I was supporting Bernie because I, apparently misguidedly, thought that he would punish the top earners, not a guy trying to retire in a couple of decades.

Bonobo

(29,257 posts)Scootaloo

(25,699 posts)Joe the Revelator

(14,915 posts)He is the only candidate I have supported this cycle.

uponit7771

(90,353 posts)... the middle class makes through 401ks

LittleBlue

(10,362 posts)People don't realize how fine are the margins on volume trading. Half a percent would put many out of business.

Without factoring in income, this is utter madness.The point is for us to create economic activity and tax it to benefit the poor, not destroy income-generating activities and put people out of work.

muriel_volestrangler

(101,349 posts)They are just betting on the short-term movement of the stock market. This 'utter madness' of a 0.5% transaction tax has existed in the UK forever (well, at 0.5% since 1986; at higher rates before that).

https://en.wikipedia.org/wiki/Stamp_duty_in_the_United_Kingdom

"The point is for us to create economic activity" - exactly. Stock trading is not economic activity; it's 'commentary' on economic activity. Stock trading is a zero sum game.

Erich Bloodaxe BSN

(14,733 posts)and funnel money to the wealthy. This relevels the market towards actual human beings making individual trades, not computers running programs to do 'volume trading' in fractions of a second.

onecaliberal

(32,884 posts)In the words of Bernie, you probably shouldn't be voting for him anyway. The republicans are your cup of tea.

Joe the Revelator

(14,915 posts)That is not protecting the middle class any way you slice it.

onecaliberal

(32,884 posts)I'm sorry if you do to possess the comprehension to understand. If you think a republican is going to protect your investment then I have a bridge, two mansions and a Lamborghini to sell you. Seriously you jest? Stop and listen to yourself.

Trash thread...

Joe the Revelator

(14,915 posts)point out the exemptions. This is not the old FTT bill. New bill. No offsets. Read it for yourself and tell me where I was too dumb to understand the big words:

http://www.sanders.senate.gov/download/collegeforall/?inline=file

bluestateguy

(44,173 posts)Obama, though, proposed taxing 529's, which he abandoned.

Joe the Revelator

(14,915 posts)This bill does not:

http://www.sanders.senate.gov/download/collegeforall/?inline=file

Warpy

(111,327 posts)Last edited Wed May 20, 2015, 02:07 AM - Edit history (1)

but will be magnified on HFT, which is skewing the market badly and skimming money off every trade made. It would be far better to have that money go to things that benefit us all instead of benefiting a few hedge fund boys.

This tax will not affect the middle class, particularly. It won't even affect the upper middle class. Billionaires who rely on skimming money out of the system via computer trading will feel it, while the money will flood into the treasury.

Joe the Revelator

(14,915 posts)the market.

geek tragedy

(68,868 posts)Dirty little secret.

That's why the pension funds fought this in Europe.

http://www.bloomberg.com/news/articles/2013-03-04/pension-funds-clash-with-semeta-on-transaction-tax-harm

“Even small differences in return on long-term savings make huge differences in final pension outcomes,” Matti Leppala, PensionsEurope’s executive director, said in an e-mailed response to questions. “Taxes like FTT would hurt the returns and would have to be paid by current and future retirees.”

The proposed levy would tax trades on stocks, bonds and derivatives with any connection to the nations that sign up to participate. Pension funds aren’t exempt from the effort, which has the backing of 11 nations.

ozone_man

(4,825 posts)High Frequency Trading is where it would hurt most. It would be the best medicine to cure that ill, while raising funds for college education.

Warpy

(111,327 posts)Will edit, thanks.

Maedhros

(10,007 posts)If you're that worried, there's another party over there to the right that will better accommodate your interests.

Joe the Revelator

(14,915 posts)makes me wealthy in your eyes, then I don't think you know who the 99% really is. There are so many lower and middle class people who's retirement is tied to the market and WILL be affected by this proposal.

SheilaT

(23,156 posts)(almost enough to put me in the top 5%), I think this is an excellent idea. The amount of tax is tiny. But there are so very many transactions out there that it will raise a lot of money.

A few years ago my financial adviser moved from one of the big name brokerage houses to a small, independent firm. At the other place, my taxes were a nightmare because my accounts did LOTS of trading, and all those losses and gains needed to be reported. It took my accountant far too many hours just to put in all those trades so he could do my taxes.

Now, it's a lot simpler, because my accounts don't trade as much. I happen to be making more money, which is nice, but I especially love it that my taxes aren't a nightmare.

I do not by any means consider myself rich. But I do recognize that I have a lot more than many people, and if taxing me a bit more means someone else's kids get to go to college without incurring a lot of debt, I say Go for It!

I am like everyone else. I like to see more of my money, wherever it comes from, stay in my pocket. But I also understand that when I or my kids attended public school, those schools were as good as they were because lots of people who didn't have kids helped pay for them. And now that I don't have kids in public school? I'm happy to pay for those kids. They are my future. Heck, when I'm in a nursing home totally ga-ga with dementia, they'll be taking care of me. I get it.

So tax away at my financial transactions. I sincerely doubt I'll see more than a very trivial impact on my bottom line.

Joe the Revelator

(14,915 posts)And the act of rebalancing a 401k has no tax significance currently, but it will under this bill.

Bonobo

(29,257 posts)SheilaT

(23,156 posts)And for those of us who have our accounts within a 401K or some other investment vehicle, we won't even notice it, any more than we notice the charges for managing our funds.

We who have these investments, even though a lot of us are not really wealthy, can afford this tax. And it will hit the higher income folks in the investment class a lot more than it hits us.

Plus, don't you think funding public higher education is worth it? No? Why not?

Joe the Revelator

(14,915 posts)Getting hit every time a 401k or an eft fund gets rebalanced adds up over a 30 year investing career, especially when talking about the paltry sums in my accounts. The entire point is to try to put all your dollars to work. The government should be hands off on retirement funds. That's why every other FTT bill had the carve out language addressing just that.

muriel_volestrangler

(101,349 posts)That's not that much. Compare it to the level of income tax, or FICA.

uponit7771

(90,353 posts)mike_c

(36,281 posts)If I recall correctly, that was one of the fundamental motivations for public policy designed to shift retirement pensions from defined benefit plans to 40lks and similar investment savings plans-- make every working class rube believe that they're riding the same gravy train as the one percenters and harness the power of avarice in the name of capitalism.

kcr

(15,318 posts)But here comes the wave that's going to knock them out of the way. The millennials, who will appreciate bills like this. They are now currently bigger than the boomers. Bernie won't win, but this is the way of the future. They might as well get used to it and stop with the Reaganite way of thinking.

Joe the Revelator

(14,915 posts)Throw the middle class out with the bath water and try to capture of that ol' Ron Paul magic with the college kids.

The middle class are the ones who are already DEALING the the diabolical student loans, or if they are lucky enough, scratched through and paid them off. Do i think anyone else should have to do that? FUCK no, but I don't want your windwall coming out of my already meager savings.

kcr

(15,318 posts)It is you who clings to middle and right wing ideals because they make you feel secure. Why should that be pandered to? You don't want to stop clinging to the little lifeboat that's barely afloat and jump aboard the progressive ship. You feel like the ideals that convince people to do so are pandering. Oh well. The reality is get on board or sink. Your 401 Kayyyyy won't save you. You've been sold a shoddy bill of goods and the truly rich laughed on their way to the bank. Sorry.

BainsBane

(53,050 posts)You seem pretty dismissive of his ability to house and feed himself in his old age. What you think of 401ks is not the issue. It's all he has. I can't even begin to imagine the kind of mentality that calls someone's very survival "right-wing."

kcr

(15,318 posts)Yes, I am dismissive of bullshit.

BainsBane

(53,050 posts)by all means. The great and noble struggle of the 10 percent vs. the 1 percent must take precedence over the poor and elderly.

I don't think the OP needs to worry. With supporters like you insulting everyone who voices any concern, Sanders candidacy is sunk. I'm trying to imagine you folks going into poor neighborhoods and speaking to people as you do here. "Okay, so you want housing and food. Suck it up you greedy pigs. We have priorities. and you're not it. This is about Sanders attracting millennials. Our candidate comes before your miserable little lives."

kcr

(15,318 posts)Are there people who worry about putting food on the table who believe bullshit? Probably, but I can't help that. I'm sorry.

Joe the Revelator

(14,915 posts)....over your ears to things you don't like hearing.

kcr

(15,318 posts)That's not kosher on a progressive board. Really, how dare I? Got it!

Joe the Revelator

(14,915 posts)Every other FTT bill has recognized that fact, because, and stick with me here, it would be a tax on middle class folks trying to stop working one day.

Joe the Revelator

(14,915 posts)Sanders' new tax proposal was not part of the deal. Changing the rules mid-game is not cool. Letting the middle class continue to rot away was supposed to be what Sanders was against (again, as I understood it). I don't need to be pandered to, i just need to left a lone with my mediocrity.

kcr

(15,318 posts)There's no tax on 401ks to begin with, which has been pointed out to you over and over. Your bellowing over this isn't even factual to begin with.

Joe the Revelator

(14,915 posts)with this bill, OR you can actually READ the bill on Sanders senate sight, see that it does not have the carve outs that some folks are clinging to in order to try to make this write. Here, I'll give you a copy of the bill as well, released today:

http://www.sanders.senate.gov/download/collegeforall/?inline=file

Find the language in THAT bill that says it has a carve out or an offset for retirement funds, 529's, and public pensions.

kcr

(15,318 posts)Tell me, how does that not affect 401ks also? Are there no middle class people or retirees that wouldn't affect? I don't have to find the language in the bill to tell you that you basically have no idea what you're talking about.

Joe the Revelator

(14,915 posts)that a real captial gains tax would affect, instead of grouping every shlub with a 401k into his basket.

kcr

(15,318 posts)But they're the reason college students are in debt up to their eye balls and the very retirees you lament are struggling. But go ahead and keep banging your head against the wall and tell me why I'm wrong. That makes sense.

Joe the Revelator

(14,915 posts)I hitched myself to Sanders because i thought he would take a Warrenesque view of saving the middle class. I was wrong. I admit that.

kcr

(15,318 posts)I'm supporting him now because the discussion he provides right now is so vital. Hillary will be the candidate and when she is I'll vote for her. But shitting on these efforts of his? Man, I do not get it. 401-ks are just about one of the biggest scams perpetrated on Americans. There's no saving that, but there is saving our future. Propping up quick turn over trading that only benefits the rich and trashes our economy at the expense of college kids and keeping them in debt? Shame.

Joe the Revelator

(14,915 posts)given up on. My god. I'm 33 years old. I just had my first kid. If I'm a lost cause already, then its going to be a long, lonely existence.

nadinbrzezinski

(154,021 posts)geek tragedy

(68,868 posts)account.

If we want a repeat of 1972 or 1984, by all means defame and degrade everyone who saves for retirement.

Bernie certainly doesn't say hateful crap like that.

BainsBane

(53,050 posts)Some of Sanders supporters are his greatest liability. If they take that kind of attitude with them off line in canvassing poor and working class neighborhoods, they will sink his candidacy for sure.

mike_c

(36,281 posts)...do their part to create a more equitable society. I have a retirement account. I'm happy to pay a little more in taxes if that money can help create a better world for me to retire in.

geek tragedy

(68,868 posts)If it's the middle class and retirees bearing the burden, it's not a tax on Wall Street.

It's especially obnoxious when it goes after the retirement savings of those who have paid for their own college as well as their kids.

Transferring wealth from retired teachers to future dentists and lawyers is not sound policy.

mike_c

(36,281 posts)Big investors, the sort that call themselves the "investor class" and who manipulate the financial markets to concentrate wealth will carry the burden, as they should. The burden will fall on Wall Street, not you and I.

No one should be relying upon 401k accounts for retirement. That's a scam perpetrated by that same investor class that wants to generate more wealth for themselves with other people's retirement savings. I mentioned that I have a retirement acct. Actually, I have two-- a 401k account that I've had for twenty years, and a defined benefit pension from CalPERS. The 401k lost half it's value in the last financial crisis and won't provide more than a year or two of retirement. The defined benefit pension, on the other hand, is a paycheck for the rest of my and my spouse's life, full health coverage, and so on.

Retirement savings plans are a joke for most Americans. They make folks like the OP think they're part of the investor class that makes most of it's money from other people's labor.

geek tragedy

(68,868 posts)defined benefit plans supposed to do, eat cat food?

Retirement funds are a very large part of the equities market.

I see zero problem with this if they don't tax retirement fund trades. Tax Wall Street, not retirees.

BainsBane

(53,050 posts)at least as much on the pro-Sanders side. Additionally, your point has nothing to do with the concern the OP raised. It is simply another insult. You all keep insulting Democrats, and there will be no one left to support your candidate.

I don't think the OP has to worry, since obviously the plan cannot pass congress. Additionally, it doesn't come close to funding all public higher education in the US. I don't believe $300 billion covers even one fifth of what it would cost.

RufusTFirefly

(8,812 posts)I can't imagine how he's ever going to make it without your unflinching, steadfast support.

Buh-bye! ![]()

Joe the Revelator

(14,915 posts)But its all that I have. You can dismiss that all day for all i care. The middle class should not have been on the table.

KingCharlemagne

(7,908 posts)aspirant

(3,533 posts)you have lost you're health insurance, eat hot dogs and TV dinners twice a week and your son's account has $100 in it.

Maybe the people here can give you some financial guidance;

!) How much is in your 401k

2) How much will it cost to insure your family again?

3) How much do you make annually?

Before criticizing and telling DU that Bernie let you down, did you call his office to get more specific info on your concerns. This bill just came out and if Bernie was truly in your heart, why wouldn't you voice your concerns to the campaign and wait for all the facts.

okasha

(11,573 posts)That blows it.

You're not a supporter, you're a worshipper. Please post the time and date of Our Lord Bernie's scheduled stroll across the Potomac. We benighted non-believers want to see it.

hrmjustin

(71,265 posts)Is Bernie a divinity now?

![]()

madokie

(51,076 posts)I seriously doubt you gave him money and if you did it was so you can say you did not because you were for him. Bernie has had the same message from day one in politics and if you didn't know that you are not paying attention. Take this kind of rightwing bull over where it might be appreciated, it isn't here or shouldn't be that is.

delrem

(9,688 posts)Your many many posts castigating and belittling OWS tell me different.

Your complaint is a stretch (just as your complaints about OWS were one hell of a stretch).

The tax Sanders proposes wouldn't impact your, or anyone's, retirement benefits.

zazen

(2,978 posts)First, I can't believe how everyone's piling on the OP. He has a point, and this is the first time I've seen Sanders supporters (of whom I count myself) act as irrationally en masse as some in the HRC crowd. Talk about having my bubble burst.

Second, I think there's a big difference between a Robin Hood tax in a vacuum (or Scandinavia) and one being applied to all investments without acknowledgement that we have a shitty safety net and that everyone but the 1 percent is holding on by bloody fingernails to any kind of security.

New taxes over the next 10 years need to claw back the disproportionate gains of the .01% and be applied according to that ratio, and not punish those in the lower quintiles trying to establish any kind of security.

My Good Babushka

(2,710 posts)A well educated workforce that is not living in debt-penury will quickly put upward pressure on wages and salaries, so you'll be making more, and the tax will be a smaller part of your overall larger take.

Katashi_itto

(10,175 posts)Bobbie Jo

(14,341 posts)This guy has been around here a lot longer than you. ![]()

If there's any "astroturf" going on, it usually comes with a sit it out message. Right?

Erich Bloodaxe BSN

(14,733 posts)If HRC were onboard with this tax, the OP would be a pretty lonely voice, with only a couple of rich supporters bemoaning the death of volume trading.

muriel_volestrangler

(101,349 posts)Yeah, that dangerous revolutionary, opposed to all that is Wall Street, proposed this back in 1989: http://www.stampoutpoverty.org/wp-content/uploads/2012/10/When-Financial-Markets-Work-Too-Well.pdf

This article examines the desirability and feasibility of implementating a U.S. Securities Transfer Excise

Tax (STET) directed at curbing excesses associated with short-term speculation and at raising revenue. We

conclude that strong economic efficiency arguments can be made in support of a STET that throws "sand into the

gears," in James Tobin's (1982) phrase, of our excessively well-functioning financial markets. Such a tax would

have the beneficial effects of curbing instability introduced by speculation, reducing the diversion of resources into

the financial sector of the economy, and lengthening the horizons of corporate managers. The efficiency benefits

derived from curbing speculation are likely to exceed any costs of reduced liquidity or increased costs of capital

that come from taxing financial transactions more heavily. The examples of Japan and the United Kingdom suggest

that a STET is administratively feasible and can be implemented without crippling the competitiveness of U.S.

financial markets. A STET at a .5% rate could raise revenues of at least $10 billion annually.

Admittedly, he does seem to have become opposed to it later - blocking the preference of that other dangerous revolutionary, Barack Obama:

https://en.wikipedia.org/wiki/Financial_transaction_tax