General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forumsmadokie

(51,076 posts)good place to begin

1939

(1,683 posts)Is the purpose to punish the rich for being rich, to choose winners and losers in the economy, or to maximize government resources to deal with government expenditures?

If the purpose of taxes is to raise revenues for government functions, raising the rate might not always be the way to go.

Lets say we want to determine the appropriate rate of taxation for income in the one million plus bracket. If we tax that income at zero percent, we will get zero dollars in return. If we tax that income at 1%, we will get X dollars into the government coffers. If we tax that income at 2%, we will get 2X dollars.

At a tax rate of 100%, we will not get 100X dollars, we will get virtually zero dollars because only people who miscalculated and earned over $1 million will pay any taxes on it.

What we have then is a curve plotted with tax rate on the X axis and government income from the taxes on the Y axis. The curve starts with X= 0 and Y=0 and goes to X=100, and Y=0. In other words, government income rises steadily, begins to lvel off, reaches a peak, and then declines back to near zero.

For the purposes of government income there is a "sweet spot" which is a tax rate which is the maximum that the government can realize out of income over $1 mill.

I would like to see a good economic analysis as to where that "sweet spot" is The only one who ever addressed where such a sweet spot might be was GOP Rep Armey who said it was 28%. I would like to see such an analysis done by an unbiased source.

Scuba

(53,475 posts)1939

(1,683 posts)Even if this leaves less tax intake for government spending.

Excellent quantitative analysis on your part.

Scuba

(53,475 posts)... right to hold all the wealth in our nation?

daleanime

(17,796 posts)just seems to be an article of faith with some.

"Blessed are those who are the MIC, for they shall have all the cash."

PETRUS

(3,678 posts)A highway speed limit of 70 mph isn't punishment for people with Porsches and Ferraris. And if someone robs a bank, we don't confiscate 30% of the take and send them on their way, because THAT WOULD NOT BE PUNISHMENT.

hifiguy

(33,688 posts)That big currency-exchange fraud a while back involving all the Too Big To Fails was settled by the banksters paying back $5 billion - a modest percentage of what they stole in the market-rigging scheme.

Angelo Mozilo, the guy who owned Countrywide Mortgage walked away from one of the greatest frauds in history after paying a $67 million dollar fine. He was allowed to keep hundreds of millions of ill-gotten dollars.

Too Big To Fail, Too Rich To Jail - It's the LAW!!

daleanime

(17,796 posts)I must retire to my boudoir until I recover.![]()

![]()

closeupready

(29,503 posts)of income (of ANY form) taxed as income rises.

It's "punishing" if you're rich, "rewarding" if you're not.

Signed, a liberal capitalist.

PETRUS

(3,678 posts)One of the main functions is to establish a currency. A government issues coins/bills/whatever - say, "dollars" - and demands that taxes be paid in "dollars," which makes the currency valuable and creates a market for it. That is not as widely understood or discussed as the idea of taxes as a way to raise funds. Of course, taxes have historically been used to raise funds (and still are), although the reality is that a government with a sovereign fiat currency does not need to tax in order to spend - such a government can "print" money. Taxes are still necessary for the first reason I mentioned, and also to maintain the value of the currency (printing money for spending and failing to tax some of it back will cause inflation and the currency will lose value).

Other than that, taxes can be used for whatever a government wants (in our case, as a democratic republic that supposedly derives its legitimacy from consent of the governed, whatever "the people" want). The tax code can be used to provide incentives or disincentives for certain behaviors, or to adjust "market" outcomes that are seen as undesirable.

All the reputable, data driven studies I've seen (and there are several, I don't know why your only exposure to a conclusion was a GOP politician) suggest that if the goal is to maximize revenue, the top marginal rates should be between 50% and 75% (depending on the study, and with the brackets defined in relation to median incomes). I have never seen a believable analysis that puts it at 28%. Also, describing high marginal tax rates on top incomes as "punishment" is disingenuous right wing bullshit.

Xyzse

(8,217 posts)So, thanks...

1939

(1,683 posts)I keep hearing that we should go back to the 91% top rate under Eisenhower. The Kennedy tax cut (took effect in the 1963 tax year) had government revenues booming.

50% to 75% is an awfully big range. A good analysis ought to be able to narrow that down.

I quoted Armey simply because that was the only hard number that i have ever heard quoted.

PETRUS

(3,678 posts)Enjoy.

Their conclusions are very specific. I imagine the reason the rate varies from study to study is because the economy has so many moving parts and the models used differ.

jwirr

(39,215 posts)rich he was paying for a war. Given that we have never paid for all these modern day wars maybe that does not sound like a bad idea - especially if we somehow tax those who made the profits off these wars.

The other reason for paying taxes IMO is "for the common good" that is, to keep our government and our nation economically healthy and working for all of us. If that was done we would first tax high enough to pay off those wars and it would be higher on the wealthy.

Then we would at least make sure we were taxing enough to pay for what we spend. Not to punish anyone but because this is our country and we want it to be the best we can make it. That does not mean that we would cut programs to make taxes less necessary but we would adjust the level of taxes collected so that we would not have to cut programs. I think in the long run this might actually take care of our thirst for unending wars.

Above all everyone can would pay taxes. It would be nice if all taxes from all levels of government could be considered in the percentage each paid in.

Gormy Cuss

(30,884 posts)You laid out a theory on taxation with no citation other than Armey. Surely you can find papers by economists to support your theory and to define the "sweet spot" on marginal tax rates.

1939

(1,683 posts)1. The paper cited argues out of both side of its mouth before saying the the optimal tax rate on high income earners is 42% to 76% which isn't very precise. The paper also notes that they can't calculate the effect of changes in economic behavior on government income in response to higher tax rates. The paper also calculates that capital income should be taxed at a low rate before just dismissing it out of hand with no justification.

2. I would like the "players" and the "hedge fund execs" to stop getting around taxes. I would submit that having cap gains of less than a year taxed at 125% of the individual tax rate on ordinary income would hurt the players enough to get them out of the business (or at least reduce their effect). By the same turn. i would tax cap gains from 1-2 years at normal tax rates. I would then have a sliding scale to where cap gains phase out to zero after 12-15 years as an encouragement to long term investment in our economy and so that a businessman who has built a small business from scratch doesn't get hammered when he retires and sells the business. Over the long term, capital gains are to a large degree an "inflation tax" where you are paying taxes on inflation of assets rather than growth of assets.

3. I would tax dividends at ordinary tax rates, but I would permit corporations to deduct dividends paid from their corporate profits to eliminate double taxation of the dividends. As an alternative, interest and dividend payers could be taxed at 30% on all interest and dividends paid with the dividends and interest passing to the recipient as a "tax free" transfer with no requirement for all of the annoying 1099 at tax time.

PETRUS

(3,678 posts)The paper notes that the optimal top marginal tax rate for revenue maximization will vary depending on other aspects of policy, but provides an answer for policy as it was at the time of publication: 73%

That said, there will always be some uncertainty in economics. The number and complexity of the variables is extreme, and humans are not entirely rational. Allowing that to induce paralysis in governance would be foolish; we should make the best decisions possible and adjust from there.

Zorra

(27,670 posts)of the wealthy to control our government through the use of their great wealth. They consistently utilize their wealth to neutralize most democratic processes in the US. Because the wealthy have taken away our ability to democratically determine our own destinies, and have maliciously instituted a de facto oligarchy in our nation, we have an obligation to relieve them of the weapon they use for controlling us - this weapon being their wealth.

Wealth needs to be regulated and limited until our country legally eliminates the power of wealthy private interests to control our government.

Unfortunately, because of the very nature of the greed that causes the very wealthy to act to control our government in their own interests, they will never stop manipulating our government with their wealth. Therefore, in order to establish the goals of a more just and equal democracy mandated by the Constitution, we are simply going to have to tax the power out of the wealthy in order to keep them from circumventing democracy and destroying our planet.

The greedy rich kids have not played nice with their toys, and now reponsible moms and dads all over America are going to have to break out the tough love to keep the greedy rich children from hurting everyone else, and destroying our planet, with their playthings.

And, ya know, like, taxing them out of power is just soooo much more preferable, and so much less messy, than the eventual inevitable revolutions and guillotines that will be employed by billions upon billions of hopeless, angry, impoverished folk, if the greedy rich are allowed to continue to own our governments and our planet, while hoarding, controlling, and wasting the critical natural resources that we all need to share wisely in order to provide a pleasant future for all of our children and beyond.

![]()

jwirr

(39,215 posts)Scuba

(53,475 posts)el_bryanto

(11,804 posts)The wealthy always want to keep as much money as they possibly can; and they've put out a lot of propoganda to confuse the issue.

Bryant

lumberjack_jeff

(33,224 posts)What kind of dumbshittery is this?

The fact that it's a common right wing view doesn't make it less delusional.

The purpose of taxes are to finance society's needs. The fact that 75% of the country's wealth is tied up by 10% of the households demands that the bulk of the taxes fall onto them. Don't like unfair treatment on April 15th? Then do something about the unfairness the other 364 days of the year.

Another point that needs to be made: taxes are money (obviously). Money is (less obviously) debt - more specifically, it is the promises of people to commit their labor as repayment. When a wage earner pays taxes, he's paying from the portion of his labor that is left over after his employer's profits and repayment of his debts are withheld. The capitalist is paying taxes on the portion of workers labor that he withheld as profits and/or the loans those workers are repaying to him.

How did we get such an inverted ("job creator"![]() world? The capitalist's profit on someone else's labor and the interest he charges on loans are "his money", but the worker owes fealty to that capitalist for "giving" him a job.

world? The capitalist's profit on someone else's labor and the interest he charges on loans are "his money", but the worker owes fealty to that capitalist for "giving" him a job.

All money has labor as its basis. If your income is dividends, interest, capital gains or business profits, your money has someone else's labor as its basis.

Taxes to the capitalist aren't a levy on his labor, they are a redirection of a portion of the wealth he parasitizes from the labor of others.

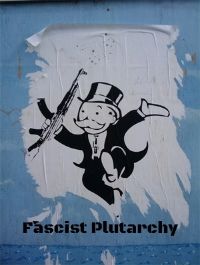

Further, as the image above illustrates, wealth concentration is destabilizing, it erodes community and humanity. This is not only true for the 90% of have-nots but true for the haves as well.

The rich, and in particular their kids know that there's something wrong about our society, and it fucks people up psychologically.

So taxes finance society's needs, and our most pressing need is decreasing inequality and increasing social mobility.

Two birds, one stone.

ProfessorGAC

(65,042 posts)Simplistic double speak dealing in absolutes (zero or 100%) with no other macroeconomic context.

Hotler

(11,421 posts)Welcome and enjoy your stay.

The sweet spot is "lower" no matter what the tax rate is. I learned that by watching Hannity. Right now Sean's tax rate is 587 percent and that's just morally wrong.

Seriously though good point but I think we consistently overlook special tax rates for investors, hedge fund managers and CEOs and people working for a W2 get screwed in comparison including high wage earners.

Major Nikon

(36,827 posts)The foundation of trickled on economics.

treestar

(82,383 posts)I love attempts like this to make us feel bad for the rich. We should feel very guilty about asking them to contribute. They worked so hard! They deserve to have it all while other people starve. If those people just worked, they would have enough. I take it that is how you feel about it?

I've heard before how if we tax the rich they won't invest the money and therefore there will be less money to go around. I mean they won't keep it under a mattress right? Yet the government spending it also stimulates the economy. We just saw that happen since 2009 to some small extent.

A lot of people buying food and housing stimulates more than the 3rd yacht.

PoliticAverse

(26,366 posts)For more on 'Laffer curve' type of analysis see the extensive Wikipedia page:

https://en.wikipedia.org/wiki/Laffer_curve

hack89

(39,171 posts)inverted pyramids are very unstable. Putting your fiscal future in the hands of a small group of people works as long as they all stay rich and keep paying taxes.

jwirr

(39,215 posts)Of course they would disagree with that last sentence.

![]()

![]()

![]()

![]()

hack89

(39,171 posts)once you have structured your budget around them paying their fair share, you cannot afford for too many of them to go bust or you will all of a sudden get a big hole blown into your budget.

Look at what happened in NYC - they are the only city with it's own income tax, which was aimed at Wall Street high earners. The recession hit in 2008, massive layoffs hit Wall Street and all of a sudden NYC was faced with a huge budget deficit.

jwirr

(39,215 posts)rich who do not pay taxes. I am not saying the whole ball of wax should be in their hands but they should be part of the taxpayers like the rest of us are.

PETRUS

(3,678 posts)Revenue will go down during a recession regardless.

hack89

(39,171 posts)It is hard to imagine they would take advantage of the situation. Taxes should be higher, especially for corporations.

PETRUS

(3,678 posts)It makes them less wealthy. Evidence suggests that higher marginal tax rates affect the pre-tax distribution of income, i.e. less income goes to the top and other people get a "raise" (which leads to more tax revenue from regular folk, who still end up with more take home pay).

Enthusiast

(50,983 posts)TacoD

(581 posts)Most municipalities in Ohio do, for example.

jwirr

(39,215 posts)it is given to them.

1939

(1,683 posts)jwirr

(39,215 posts)made off the Korean War I think 91% would have been fair - but not all rich made a profit so even that was not fair if it was based on war profits.

At the moment the brackets are not all that fair either since many rich find ways of getting round that. Would progressive taxation based on income be a better wording? I told you I am not an expert in this area.

Why did the rich accept the Eisenhower 91% tax? I do not remember any tax rebellions.

1939

(1,683 posts)Let us say i am wealthy.

I might make serious investments in things which would help the economy. At the beginning of the tax bracket where the progressive tax rate becomes onerous (to me), I stop my investments and maybe put my money in tax free bonds or some other way of parking my millions.

A good case in point was the widow of one of the Dodge Brothers (the car guys). After her husband's estate was settled, she had one hundred million dollars (in 1940s money). Her advisers put it all in various state and local bonds a 3.5% interest. She then had an annual income of $3.5 million (in 1940s money) and, under the tax laws of the time) didn't even have to file a tax return. Since the 91% bracket started at $256,000 or so, she would have had to earn 32% annual return on her money if she was invested in taxable investments.

She did charitable works, but most of her money was spent on luxury for her and her gigolo second husband.

Anecdotal, but where my father worked in the 50s, the owners refused to expand or raise the dividend because they would be "just working for the government". In the first four years after the Kennedy tax cut, they tripled the size of the business and tripled the number of UAW wage employees working there (my father got a promotion from line foreman to plant manager).

jwirr

(39,215 posts)overseas. We will never be able to convince them to pay for keeping this country going. That is not encouraging.

So I still think that my idea for why we should all pay taxes is a good one but I have no idea how to get the Rs and corporations on board.

I see that they voted for a Highway program today. But as usual not near enough to do the job. Surely even the rich would like to know the bridge they are driving over will not fall down while they are on it.

lumberjack_jeff

(33,224 posts)... the resulting middle class could shoulder the burden.

The US gdp is $53k per person. The source of that is workers working, not investors investing.

Taxes aren't lost money, they are recycled into the society. A primary problem of wealth concentration is sequestration of money.

Enthusiast

(50,983 posts)hack89

(39,171 posts)everyone needs skin in the game - paying more taxes is a good way to get more people involved.

clarice

(5,504 posts)Xolodno

(6,395 posts)TDP: Low taxes on the rich trickle down to everyone else.

Me: Why should it?

TDP: What do you mean?

Me: Ok, I'm a Billionaire. Why should I invest in anything with risk here in the US when I got so much dough, just putting it in safe investments that are chained to a global economy or safe government investments means I'll still make millions. That doesn't trickle down. Plus I don't buy US made goods, because...well, I got a nice house, car, etc. in the US. Now I want one in the French Rivera, an island off Belize, etc. Its trickling down alright...but not here.

TDP: *Blank Stare*

Me: No Billionaire in there right mind would take on more risky investments, you are now at the point of conserving and diversifying your cash piles. Its just like those stupid emails I get on how the US can be completely oil independent...it's absolute BS. If I'm an oil guy and I can sell by barrel of oil for $75 to China and the $60 to the US...guess who I'm selling it to?

Me: You want "trickle down"? Make the taxes higher than what they gain on safe investments....unless of course, they take on some risky investments that advance the economy at home, which, if they fail, they can now write those losses off while countering the higher taxes on safe investments. And if the risk is successful? They got a great new revenue stream and possible market.

TDP: ...that makes sense..

Me: Of course it does, but everyone gets all riled up when they hear "higher taxes". They think that some how, they will also be nailed. Taxes aren't just a tool to rob Peter to pay Paul...even when you think Paul is a lazy good for nothing who doesn't deserve it. Taxes can be written in a way to spur the economy, industry, etc. But voters fall for the soundbites every single time and vote against the common sense. If I were a billionaire, I'd be laughing all the way to the banks I hold money in across the globe.

fadedrose

(10,044 posts)made in a business, factory, or anywhere exorbitant profits are made, especially when made outside the US.

It isn't right to make something cheap and sell it for 1,000 times beyond its cost and then cry about paying taxes in the country that was a partner because it bought the stuff.

clarice

(5,504 posts)Attempts to express that belief through policy could be poorly executed ("insane"![]() - or not. What is insane is officers and shareholders of some companies making billions while other employees struggle to get by.

- or not. What is insane is officers and shareholders of some companies making billions while other employees struggle to get by.

clarice

(5,504 posts)PowerToThePeople

(9,610 posts)who have felt and acted on that perceived entitlement since the dawn of time.

clarice

(5,504 posts)PETRUS

(3,678 posts)It contains a kind of circular reasoning and suggests that you're not thinking much about moral questions. I could just as easily ask why the Walton family is entitled to so much of our money. Who gets how much money depends on the law, and the law is subject to nearly constant revision. It would be miraculous if the present distribution of wealth represented some kind of moral perfection, even putting aside the role of violent conquest, slavery, and dispossession.

Regardless of what I think of your line of questioning, I'm willing to entertain a discussion of morality as it relates to property. I have my ideas, but I don't think moral perfection is possible and in the meantime I'm willing to go along with the idea of consent of the governed sussed out through deliberative democracy as a practical - and morally defensible - second choice. There is evidence that current levels of inequality are having a negative impact on economic stability and growth and various measures of human well being. And these days, consistent majorities think the distribution of wealth is unfair, and support things like higher minimum wages and steeper taxes on larger incomes. That's a mandate, even if our representatives fail to act on it.

What, exactly, do you think is moral?

treestar

(82,383 posts)you revealed yourself to be really a conservative.

Why does the government get any of our money? The tax laws. We are saying the tax laws should take more from the rich to run our government, not that we are entitled to their money. Oh the poor things.

When you put it the way you did, it is likely you are also against welfare, unemployment, Medicaid, etc? Those laws do make poor people entitled to middle class people and rich people's money.

clarice

(5,504 posts)PETRUS

(3,678 posts)When I returned from my dinner engagement, I found not only your question but this as well. You've posted on DU since but haven't been back to this thread...

fadedrose

(10,044 posts)and bring clothing and shoes from China that cost a bundle. They told us originally that we'd get cheaper goods because it costs less to make them, but the companies who order the goods cheaply over there, and then sell the goods here at well over 100 times their cost are making a fortune for the 1%, and then they bank the profits where the US govt can't tax them.

Many of us are insane who let all this get started. Maybe TPP will fix these problems, or maybe it'll make them worse...

It's unfair to us, and really unfair to the poor souls who make close to nothing for their hard work.

lumberjack_jeff

(33,224 posts)The US didn't collapse with a 91% top tax rate. In fact, it thrived.

PowerToThePeople

(9,610 posts)eom

clarice

(5,504 posts)PowerToThePeople

(9,610 posts)

clarice

(5,504 posts)no moral qualms about taking other peoples money.

PowerToThePeople

(9,610 posts)because they took it from others through nefarious and/or illegal means. No one can honestly earn that type of personal wealth.

clarice

(5,504 posts)I would have much more respect for the "equal income " crowd, if they would just come and knock on my door and

say "Can I have some money?" I would then let them explain why they needed it, and then I could make a determination on whether they truly DID need it. But to me, hiding behind a Government agency, and letting THEM do the collecting/re-distribution is just plain cowardice.

PowerToThePeople

(9,610 posts)It seems that is plain cowardice to me.

You appear very self righteous too me. I bow to your moral superiority, NOT.

clarice

(5,504 posts)and provide insurance for, allowing people...REAL people to live. It seems to me that you are

letting your dogma conflict with common sense. That's the problem with some "idealists" They love the idea

of "mankind as a whole" or "The common good" or the "Betterment of all mankind" but in actuality, they hate real PEOPLE.

They would gladly sacrifice the little people in pursuit of their lofty goals. Think about it.

PowerToThePeople

(9,610 posts)41. I would look at the number of people that they employ.....

and provide insurance for, allowing people...REAL people to live. It seems to me that you are

letting your dogma conflict with common sense. That's the problem with some "idealists" They love the idea

of "mankind as a whole" or "The common good" or the "Betterment of all mankind" but in actuality, they hate real PEOPLE.

They would gladly sacrifice the little people in pursuit of their lofty goals. Think about it.

Funny, I thought the corporation was a man made entity, not gods.

If our structures fail to do the task that we want, we have every right to change those structures. I believe our structures should give every person a good life and not sacrifice many for the greedy few.

clarice

(5,504 posts)PowerToThePeople

(9,610 posts)from people such as yourself.

lumberjack_jeff

(33,224 posts)Capitalists; those who acquire their wealth from dividends, interest and corporate profits should have to justify to workers why they deserve such a large cut of the value of other people's labor.

The US gdp is $53,000 per person. That gdp was created by labor, not by investing.

HughBeaumont

(24,461 posts)Elmergantry

(884 posts)made thru "nefarious and/or illegal means"?

demagogue much? ![]()

treestar

(82,383 posts)You don't have to resort to that. Simply argue they get more out of society and should be willing to pay more to keep it running.

I love the idea it's "their" money and shouldn't be taxes. When conservative say that they care about the rich's money but what about the middle class - what about "our" money? Why should they not have moral qualms about the government taking it to run the government? Conservatives sometimes are so convinced they are going to be in the 1% one day that they identify with them more than the class they are really going to spend their entire lives in.

Gormy Cuss

(30,884 posts)'earning' it by suppressing wages, offshoring jobs and jacking up prices, but do go on protecting their interests. They'll take all the help they can get.

Elmergantry

(884 posts)But that the nature of business. Keep costs low, charge as much as the market can bear. We can certainly do things to mitigate the abuses....min wage increase, better trade policies, etc. But taxing the snot out of them would probably be counterproductive. First thing they would probably do is double down on the things we hate to make themselves whole. Also, its a great big world, there are many other places around the world to make a buck. When you are a multi-millionaire/billionaire, you can live/invest wherever you please

Gormy Cuss

(30,884 posts)A five percent effective tax rate increase would be noise to the wealthiest tax payers. There is certainly room to increase taxes on the wealthy and no compelling reason not to do so - the only issues are what level of increase is needed and what level won't cause more problems than it solves.

Elmergantry

(884 posts)that call for ridiculous tax rates...90%, 100%...you think the rich will just let that happen? Heck no, they will just go to Canada! (I would!)

Gormy Cuss

(30,884 posts)and as I wrote, there's room to raise the effective tax rate without causing wealthy earners to do something drastic like move to a different country.

Elmergantry

(884 posts)Marginal or not, if faced with losing 90% of the second million I made, I would consider moving too.

PowerToThePeople

(9,610 posts)We can legislate the movement of currency to offshore locations. That is in our control. We can keep the funds here if we truly want to.

Elmergantry

(884 posts)to seize someones assets because they have decided to leave the country and become a citizen of another country. I don't other countries less free than ours do that either. If a millionaire/billionaire want to become Canadian and move their selves and property there, fine by me, afterall they are the enemy right? good riddance.

PowerToThePeople

(9,610 posts)Elmergantry

(884 posts)And then ruled unconstitutional. And even if it wasn't..sure, take your pound of flesh as the rich guy leaves the country...and you wont get another penny more as he go forth with his business in another country and no longer a citizen. Like I said, its a big world and there are plenty of countries that would welcome his business..

treestar

(82,383 posts)then what's immoral about it? Do you think current tax laws are immoral? Especially where they pay for social programs?

What if they decide to pay for the next war by raising taxes on everyone? Would that too be immoral?

Do you find the progressive tax code immoral? Should there be a flat tax?

Starry Messenger

(32,342 posts)Time for some Febreeze.

PETRUS

(3,678 posts)Starry Messenger

(32,342 posts)PETRUS

(3,678 posts)In another time, we would be admonished to be thankful to our feudal lords for allowing us to eat any of the harvest at all. "Other people's wheat" and whatnot.

HughBeaumont

(24,461 posts)If I wanted to talk to Republicans, I'll go pretty much anywhere else on the internet.

hifiguy

(33,688 posts)Us poor folks are tough and stringy.

Orrex

(63,212 posts)All corporate and personal assets and income in excess of $1M are taxed at a rate of 99%, with the proceeds used to erase the debt, pay for our various wars, completely fund veterans' lifelong care, rebuild the infrastructure, transition to renewable energy, and to guarantee that pensions, medicare and social security are funded for the next two centuries.

After a few years we might even consider scaling the tax rate back to 50% or 60% so that the super-wealthy can afford to have their solid gold toilets re-burnished again or whatever.

Lurker Deluxe

(1,036 posts)There are machine tools that cost hundreds of thousands of dollars, the buildings they sit in are worth hundreds of thousands of dollars, these companies that own these things employ hundreds of thousands of people.

The company I work for has 7 locations in the US, property value alone goes way beyond a million. Machinery, tooling, and materials stock is most likely in the 20M range.

Why would anyone invest this kind of capital to have 99% any revenue it generates confiscated?

Absurd gibberish.

DFW

(54,379 posts)He collected just about none of it, of course. If I made over €1 million a year, I'd move, too, before a bunch of self-righteous, theory-spouting bureaucrats came to confiscate it to blow on their own government-supplied limos, €10,000 a month for life tax-free pensions, and generally declaring that they knew how to spend it better than I did. Some government hack is coming to seize someone else's money? Fine, but lay out BEFOREHAND, please, exactly what you plan to do with it. Building bridges? Feeding the homeless? Hiring teachers? OK, I'm in. But if it's like every time in Europe (where I now live), where so-called "socialist (as opposed to social-democratic)" governments usually spend increased revenue on themselves, it's just a formula for capital flight, and an acceleration of factory space being rented in China.

Anyone can come to take someone else's money. Get me a few guys from South Dallas and some artillery, and I'll be an expert at it inside of 24 hours. It's how you do it, and what you plan to do with the money afterwards that distinguishes a responsible, benevolent government from the gang in South Dallas. Some governments (partially, France and Belgium, e.g.) don't get the distinction, sometimes. I would we don't go there.

Orrex

(63,212 posts)The primary intent was to mock the notion of a flat tax, often put forth as a serious plan despite its grotesque favoritism of the super-rich. The secondary intent was to point out that the wealthy pay a grotesquely low relative tax rate while infrastructure crumbles and war maxes out the nation's credit card.

I picked 99% deliberately because it's an absurd figure that I didn't think anyone would take seriously. Thanks for proving me wrong. Would you have caught the tone if I'd gone with 101% instead?

I should have responded to the other poster in this thread calling for taxing all wealth and income over 1M @ 100%. Guess he is mocking the notion of a flat tax as well ....

Orrex

(63,212 posts)Calista241

(5,586 posts)And both capital gains and income taxes should be raised.

How about a graduated capital gains tax increase, like 15% on all investors with less than $250k invested. 20% on $250k - $1m, and then regular income tax rates on on investors with > $1m invested assets.

I think the top tax bracket for the Feds should be around 50% on let's say $10m annual income. No loopholes. Add, State taxes on top of that, and the mega rich are still paying through the nose on their upper tier incomes. But I suspect it's also not enough for the rich to flee the country or just move the primary stock exchanges to a lower tax country.

Companies also should pay tax. How about a flat 15% or 20% tax rate on revenue. Big companies shouldn't be getting off scot free, and smaller companies shouldn't have to pay the price for large companies skating.

I do think the govt should NOT raise taxes to punish people for being wealthy. That funding should first and foremost be used to pay down our debt. The amount of debt we have and its upward trajectory is just scary. Yes, the debt is down around 450b this year, but that's a still a shitload of money.

Orrex

(63,212 posts)That's like winning a $1M lottery and complaining that you have to drive across town to claim your prize.

Even if we accept the preposterous Libertarian fantasy that taxes are punishment, we must then accept that by this metric the poor are punished even more severely. Better, then, to "punish" the people who can more readily withstand that "punishment."

taught_me_patience

(5,477 posts)Profit margins, even for oil companies, is often in the single digits. A 15% tax on revenue would completely wipe out the profit of most companies. Taxes for companies are always taxed on profits, and the rate is 39%... very high. We probably need to just close the offshoring loopholes and lower the rate a bit, and we'd collect much more money.

Calista241

(5,586 posts)But I was under the impression most small businesses and mid size businesses were already paying higher tax rates, and that it was only the large multinationals that were able to screw over the system.

If that's a mistake, I'll gladly accept changes, but was just offering up ideas.

Elmergantry

(884 posts)When the govt has the power to create fiat money, it can fund itself by simply spending it into existence.

Abraham Lincoln did it, as did Hitler.

Instead, the govt has delegated the Fed Reserve to loan money into existence. Every dollar is owed ultimately to the Fed. That's why your dollar bill says "Federal Reserve NOTE"

When money was "real" that is made of something tangible like gold and silver, the King had to tax the peons because it was a lot easier to obtain the gold he needed that way than plundering/mining for it. No need to collect taxes with fiat money.

PETRUS

(3,678 posts)Elmergantry

(884 posts)Taxation should be used to fund govt, nothing else.

PETRUS

(3,678 posts)You started off saying you didn't think taxes were necessary to fund spending (and they aren't, exactly, but without them the currency loses value so they do have a related function). Now you're saying they should be used only to fund spending. Did you have a sudden change of heart?

All that aside, I still don't understand your point of view. Fiscal policy is one of the tools a society can use to shape itself and express its values and priorities. Removing taxes as an option leaves only spending (or laws that require and prohibit things). That's like disallowing right hand turns. Drivers can substitute three lefts, but that's wasteful.

Elmergantry

(884 posts)Whether it is funded by my admittedly pie-in-the-sky idea or with the current existing method via taxation, I believe funding the purpose of funding the govt is to fund govt functions. Not big on using the tax code to pick winners or losers. For example we can see how large corporations are on the "winning" side of the equation cant we? Remember the power to tax is the power to destroy.

PETRUS

(3,678 posts)You do understand that in the context of a capitalist economy, that is pure right wing (libertarian) ideology.

Also, progressive taxation (which is the subject of the OP and much of the subsequent discussion) has nothing to do with picking winners or losers. Nothing.

Picking winners and losers would mean policy that favors certain business endeavors over others. As it happens, that's what many governments have done, and with good results in terms of more rapid productivity increases and growth of GDP. (Governments won't always get it right, but neither does the private sector.) Most, if not all, of the economic success stories of the last 100 years or so are in nations where the government had a deliberate industrial policy, including the use of fiscal carrots and sticks (subsidies & credits, taxes & tariffs) to guide businesses in specific directions.

One wonders about the thinking behind your comments.

NYC Liberal

(20,136 posts)The first income tax was passed in 1861 under the Revenue Act of 1861, which was signed into law by Abraham Lincoln.

Elmergantry

(884 posts)that Lincoln also created debt-free money known as "greenbacks"

PoliticAverse

(26,366 posts)And because we don't want to end up like the Weimar Republic, Zimbabwe or (currently) Venezuela.

Jetboy

(792 posts)The military budget is huge and it is the rich who own most everything and therefore need to pay for it's protection. If some country invades us and takes over, rich people would lose everything, poor people have nothing to lose.

The rich use all of the transportation facilities shipping their worthless made in China junk to Americans. Poor folks don't travel much and don't put much stress on roads etc.

Scuba

(53,475 posts)Recursion

(56,582 posts)I'm always for taxation becoming more progressive, but our taxes are already more progressive than most Western European countries because we don't have a VAT. The problem is our spending is much more regressive.

Elmergantry

(884 posts)Look at Germany. In addition to an VAT tax they have an income tax. Often we hear praise as to how well their social programs are, but you certainly pay for them. Their tax rates on income are MUCH more regressive. Middle income of 33K Euro to 55K Euro pays 42%, anyone above 55 Euro pay 52%.

PATRICK

(12,228 posts)to return to past levels when the rich were getting more of the upper hand or to match other national standards which hardly have helped the necessary work need on the economy or environment and health care, pensions under dangerous siege.

I also think that small power and small wealth plant corruption in nearly every human being and to desire and work for such makes that pretty self-enforcing. Moral corruption, personal corruption, detachment form the commons and natural reality, entitlement even more evident among the virtuous who practice a sort of noblesse oblige from their excess of ownership of monetary representations of the real world. Attacking individuals or a class should contain humility and compassion and a warning that greater discipline is always required in the realms of power simply to enable humanity to survive per se in own or the natural world.

Real change is coming, but is not yet upon us in awakening or movement. Hopefully we are getting there- and not by blood-soaked increments and failures.

Hope is in the spread of global networking to the masses, the sheer value of good science and the glutted absurdity and decadence of failed capitalism. Change is turning the World upside down for real.