Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

5 replies, 1255 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (11)

ReplyReply to this post

5 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

"Entitlement", you say? (Original Post)

Triana

Jul 2015

OP

PoliticAverse

(26,366 posts)1. From ssa.gov "Internet Myths 2"...

http://www.ssa.gov/history/InternetMyths2.html

Q1. Which political party took Social Security from the independent trust fund and put it into the general fund so that Congress could spend it?

A1: There has never been any change in the way the Social Security program is financed or the way that Social Security payroll taxes are used by the federal government. The Social Security Trust Fund was created in 1939 as part of the Amendments enacted in that year. From its inception, the Trust Fund has always worked the same way. The Social Security Trust Fund has never been "put into the general fund of the government."

Most likely this question comes from a confusion between the financing of the Social Security program and the way the Social Security Trust Fund is treated in federal budget accounting. Starting in 1969 (due to action by the Johnson Administration in 1968) the transactions to the Trust Fund were included in what is known as the "unified budget." This means that every function of the federal government is included in a single budget. This is sometimes described by saying that the Social Security Trust Funds are "on-budget." This budget treatment of the Social Security Trust Fund continued until 1990 when the Trust Funds were again taken "off-budget." This means only that they are shown as a separate account in the federal budget. But whether the Trust Funds are "on-budget" or "off-budget" is primarily a question of accounting practices--it has no effect on the actual operations of the Trust Fund itself.

A1: There has never been any change in the way the Social Security program is financed or the way that Social Security payroll taxes are used by the federal government. The Social Security Trust Fund was created in 1939 as part of the Amendments enacted in that year. From its inception, the Trust Fund has always worked the same way. The Social Security Trust Fund has never been "put into the general fund of the government."

Most likely this question comes from a confusion between the financing of the Social Security program and the way the Social Security Trust Fund is treated in federal budget accounting. Starting in 1969 (due to action by the Johnson Administration in 1968) the transactions to the Trust Fund were included in what is known as the "unified budget." This means that every function of the federal government is included in a single budget. This is sometimes described by saying that the Social Security Trust Funds are "on-budget." This budget treatment of the Social Security Trust Fund continued until 1990 when the Trust Funds were again taken "off-budget." This means only that they are shown as a separate account in the federal budget. But whether the Trust Funds are "on-budget" or "off-budget" is primarily a question of accounting practices--it has no effect on the actual operations of the Trust Fund itself.

Igel

(35,323 posts)2. Dude, don't mellow their harsh. Way uncool, those facts and everything. n/t

freshwest

(53,661 posts)3. Thanks for the facts. Will use this. n/t

Triana

(22,666 posts)5. Mostly, it was the GOP and their huge damn budget deficits...whether Reagan or Bush or whoever.

SOURCE: http://www.huffingtonpost.com/sen-don-riegle/post_1901_b_845106.html

So...whether Reagan or another damn Republican (Bush or whatever other GOP thief) it has been and continues to be Republican deficit spending, budget mismanagement and thievery that evidently has led to "borrowing" from the Social Security trust fund to pay for other things.

The entire HuffPo article above is worth a read. What that paragraph from ssa.gov says is correct ie: off and on-budget changes and even what it says about "taking Social Security money and putting it in the general fund" is true. It's true because that's not what happened if you read the HuffPo piece. The gist of it is still, though, that money was taken from reserves meant to fund Social Security and it's supposed to be paid back.

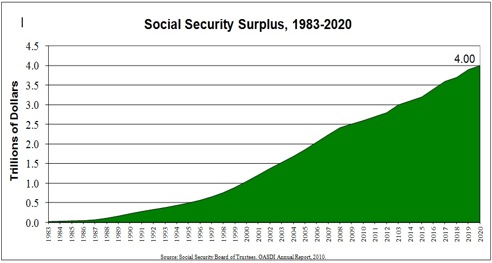

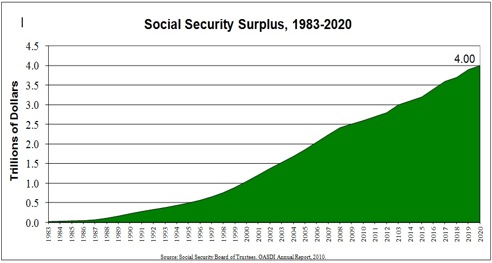

Social Security -- the most fiscally responsible program

Social Security is self-financed, cannot borrow, spends less than one percent on its administrative costs, has a $2.6 trillion surplus which will continue to grow for a number of years, and is off-budget. It does not contribute to the federal deficit or the debt. The Social Security surplus is invested in US Treasuries which enables the federal government to borrow less from other sources. The government borrows these Social Security funds to pay for other government spending -- but is obligated to pay interest on these borrowings -- and pay back the borrowed funds in full when they are needed by Social Security for benefit payments.

Opponents of Social Security obscure the real facts, but they are easy to see in the graph below. The planned build-up of the Social Security Trust Funds since 1983 makes it clear that Social Security has a $2.6 trillion surplus today that will continue to grow:

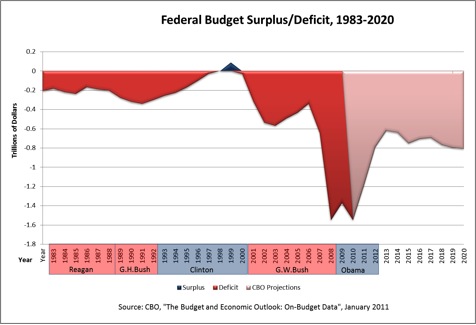

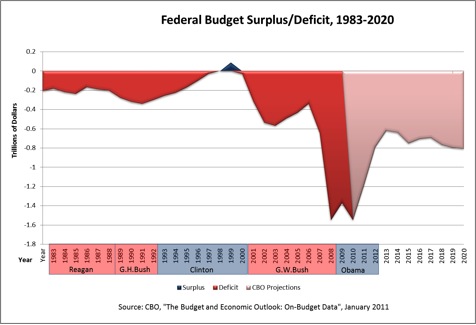

The Federal Budget -- Red Ink

A look at the federal budget over the same time frame reveals a starkly different picture -- many years of deficits, with only a few years of surplus -- a surplus that disappeared during the G.W. Bush Administration. In 1993, a Democratic Congress and President Clinton, without a single Republican vote in either the House or Senate, enacted a budget plan that put it on a path to elimination of the deficits --and brought the budget into balance, and then later into surplus. In his 1999 State of the Union address, with the budget then in balance, Clinton called for the Social Security surplus investments to be held in a special reserve and not used for other government spending.

As a candidate for president, Vice President Gore made a central part of his campaign a plan to put Social Security's surplus in a "lockbox" to keep its assets from being used for other government spending. When the Supreme Court decided the 2000 election in favor of Bush, however, a very different view of the Social Security surplus became operative.

During the same time period in which Social Security was building a surplus the federal budget was more often in deficit than not, as shown below:

The federal budget surplus of 2000 quickly disappeared when Bush took office, turning into a sea of red ink. Bush borrowed heavily from the Social Security surplus to help obscure the fact that federal taxes were not bringing in enough revenue to pay for the wars and his tax cuts.

Given this history and the fact that Social Security has not and does not contribute to the deficit, Social Security should not be "on the table" for deficit reduction now. In fact, it should not be part of the deficit debate at all.

Social Security is self-financed, cannot borrow, spends less than one percent on its administrative costs, has a $2.6 trillion surplus which will continue to grow for a number of years, and is off-budget. It does not contribute to the federal deficit or the debt. The Social Security surplus is invested in US Treasuries which enables the federal government to borrow less from other sources. The government borrows these Social Security funds to pay for other government spending -- but is obligated to pay interest on these borrowings -- and pay back the borrowed funds in full when they are needed by Social Security for benefit payments.

Opponents of Social Security obscure the real facts, but they are easy to see in the graph below. The planned build-up of the Social Security Trust Funds since 1983 makes it clear that Social Security has a $2.6 trillion surplus today that will continue to grow:

The Federal Budget -- Red Ink

A look at the federal budget over the same time frame reveals a starkly different picture -- many years of deficits, with only a few years of surplus -- a surplus that disappeared during the G.W. Bush Administration. In 1993, a Democratic Congress and President Clinton, without a single Republican vote in either the House or Senate, enacted a budget plan that put it on a path to elimination of the deficits --and brought the budget into balance, and then later into surplus. In his 1999 State of the Union address, with the budget then in balance, Clinton called for the Social Security surplus investments to be held in a special reserve and not used for other government spending.

As a candidate for president, Vice President Gore made a central part of his campaign a plan to put Social Security's surplus in a "lockbox" to keep its assets from being used for other government spending. When the Supreme Court decided the 2000 election in favor of Bush, however, a very different view of the Social Security surplus became operative.

During the same time period in which Social Security was building a surplus the federal budget was more often in deficit than not, as shown below:

The federal budget surplus of 2000 quickly disappeared when Bush took office, turning into a sea of red ink. Bush borrowed heavily from the Social Security surplus to help obscure the fact that federal taxes were not bringing in enough revenue to pay for the wars and his tax cuts.

Given this history and the fact that Social Security has not and does not contribute to the deficit, Social Security should not be "on the table" for deficit reduction now. In fact, it should not be part of the deficit debate at all.

So...whether Reagan or another damn Republican (Bush or whatever other GOP thief) it has been and continues to be Republican deficit spending, budget mismanagement and thievery that evidently has led to "borrowing" from the Social Security trust fund to pay for other things.

The entire HuffPo article above is worth a read. What that paragraph from ssa.gov says is correct ie: off and on-budget changes and even what it says about "taking Social Security money and putting it in the general fund" is true. It's true because that's not what happened if you read the HuffPo piece. The gist of it is still, though, that money was taken from reserves meant to fund Social Security and it's supposed to be paid back.

Recursion

(56,582 posts)4. SSA has purchased Treasury bonds since day one

And that's the only sensible way to do it.