General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsTHE 1% ECONOMY: WORLD'S RICHEST 62 PEOPLE, NOW HAVE AS MUCH AS POOREST 3.6 BILLION, NEW OXFAM REPORT

Democracy Now! Jan. 21, 2016, Web Excusive Report

OXFAM SAYS PRIVATIZATION, TAX HAVENS DRIVE GLOBAL INEQUALITY TO STAGGERING LEVELS

A new report from Oxfam on global inequality finds the world’s richest 62 billionaires now own as much wealth as half the world. The wealth of the poorest half—3.6 billion people—has fallen by $1 trillion since 2010. At the same time, the wealth of the world’s richest 62 people has increased by more than half a trillion dollars. Oxfam faults a global financial system that has "supercharged the age-old ability of the rich and powerful to use their position to further concentrate their wealth." The report singles out deregulation, privatization and offshore tax havens that have let trillions of dollars go untaxed. The Oxfam report is timed to coincide with the meeting of global elites at the World Economic Forum in Davos, Switzerland. We are joined by Raymond Offenheiser, president of Oxfam America.

- Raymond Offenheiser, President of the International Relief and Development Organization Oxfam America -

~ TRANSCRIPT OF PART 2. *VIDEO REPORT, WATCH AT WEBSITE LINK BELOW, WITH MUCH MORE ~

This is a rush transcript. Copy may not be in its final form.

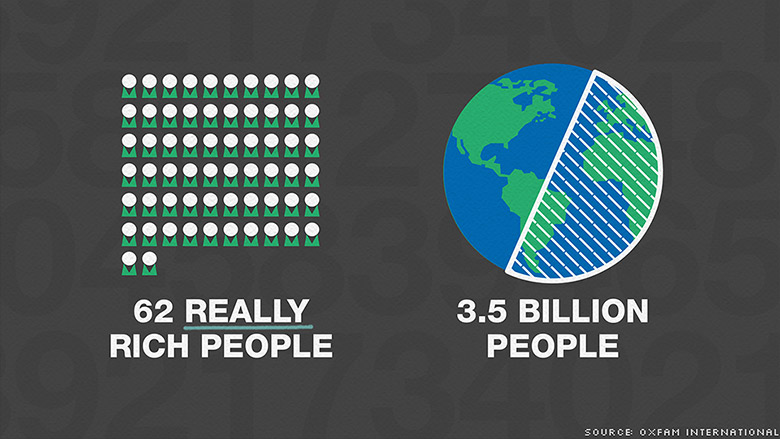

NERMEEN SHAIKH: Five years ago, the combined wealth of the globe’s top 388 billionaires was equal to half the world’s population. If that contrast is shocking, consider how many billionaires it takes for that same divide today: 62. According to a new report from Oxfam on global inequality, it’s now just 62 of the world’s richest billionaires who own as much wealth as half the world’s population. The wealth of the poorest half—that’s 3.6 billion people—has fallen by $1 trillion since 2010. At the same time, the wealth of the world’s richest 62 people has increased by more than half a trillion dollars. Oxfam faults a global financial system that has, quote, "supercharged the age-old ability of the rich and powerful to use their position to further concentrate their wealth."

AMY GOODMAN: The report singles out deregulation, privatization, offshore tax havens that have let trillions of dollars go untaxed. Oxfam says denying governments of this massive source of revenue has hampered efforts to provide basic social services and tackle inequality. A review of some 200 major companies shows 90 percent operate in at least one tax haven. The Oxfam report is timed to coincide with the meeting of the global elites at the World Economic Forum in Davos, Switzerland.

For more, we turn to Raymond Offenheiser, president of Oxfam America.

So, give us these figures. Sixty-two of the world’s wealthiest people have more wealth than half the world’s population. Sixty-two individuals?

RAYMOND OFFENHEISER: That’s correct. And as you noted, that this has been an accelerating pattern. I think what our report is trying to do is really point out the fact that I think we have a global inequality crisis, and we’re trying to legitimize that narrative and through the use of these kinds of numbers. I think what’s been stunning to us is not only the fact that we have, you know, that level of concentration, but the process is accelerating. And I think what we’re trying to understand is, if we allow this process to accelerate, not only here in the United States, but literally in countries around the world and in regions where you’d not expect it—in the Chinas and the Indias and even in Africa—it raises a lot of questions about some of the things you talked about in your earlier broadcast about Michigan, which is: How do we fund public services for the poor? How do we finance development into the future? How do we alleviate poverty, if in fact we’re seeing, you know, underfinancing of infrastructure and schools and health systems and so forth? So, we’re really trying to underline the fact that there is an inequality crisis, and we’ve got to really address directly this accelerating concentration of wealth and the mechanisms and systems, really, that enable it.

NERMEEN SHAIKH: And, Ray Offenheiser, can you explain specifically what the role of tax havens are in this quite staggering inequality that the report points to?

RAYMOND OFFENHEISER: Well, tax havens basically is a mechanism that’s been created by the financial industry and corporations to allow them to basically produce value in one location and then transfer that value—that may have a high tax base or tax rate, and then transfer it, in some fashion or another, to another location with a much lower tax rate, and then pay the tax rate in those locations where it’s much more favorable. And there’s all sorts of accounting mechanisms that allow this to happen, and also legislation that provides loopholes that enable companies to move value overseas. So, for example, here in the United States, companies actually can deduct the cost of moving jobs overseas, in one case. They can actually move the value of brands and trademarks overseas. They can actually—they’re exempt from, for example, taxing the value of subsidiaries overseas. So there’s a variety of ways these tax havens—that tax rules enable the tax havens to work. The banking industry has been a major beneficiary of all this, because this money is then put in bank accounts in these tax havens, so you’ve seen an explosion of banking—you know, offshoring of the banking industry to the Cayman Islands and the British Virgin—

AMY GOODMAN: What’s the Stop Tax Haven Abuse Act?

RAYMOND OFFENHEISER: Well, this is an act that’s been put forward in Congress by Carl Levin and Senator Whitehouse from Rhode Island—Carl Levin from Michigan, Whitehouse from Rhode Island, and Lloyd Doggett from Texas. And it’s an act—it now has 41 sponsors in the House, three in the Senate—that basically tries to close exactly the loopholes I just mentioned and a variety of other ones. Quite frankly, what it really does is it closes those loopholes, and it tries to force, through SEC regulation, greater levels of transparency, and try to get rid of this disconnect between where you generate value and where you report it. And what we really want to force the companies to do is to say—if you produce value in the United States, you know, and you produce value overseas, that should be fully transparent to citizens, so we actually can get a fair deal on taxation of corporations, because it’s that diminished corporate taxation that’s creating the situations we see in Flint and a variety of other locations around the United States and around the world.

NERMEEN SHAIKH: Well, a large number of the billionaires listed in Forbes have inherited their wealth. Could you talk about the importance of estate tax?

RAYMOND OFFENHEISER: Well, I think we believe that the whole issue of wealth of individuals is as important in corporate tax. We’ve been focusing on corporate tax, in some sense, because we see it as really a global issue. I think 47 of the 62 [billionaires] are actually Americans, so we have a really particular problem here at home. But what Oxfam is really focused on is: What does this mean for developing countries, where we’re trying to address poverty issues? What does it mean in Africa? And what does it mean in some of these emerging economies where we see actually wealth and high rates of growth? What we’re trying to focus on is, if we allow the system to continue in the way it’s continuing, those countries will lose critical value they need now to fund their own development. And the endgame we seek is actually one in which countries are taking responsibility for their own development by building strong institutions and building a tax system that will fund their citizens’ welfare.

AMY GOODMAN: What’s the real price of tax dodging?

RAYMOND OFFENHEISER: Well, it varies country to country. I think here in the United—

AMY GOODMAN: Right here.

RAYMOND OFFENHEISER: Right here in the United States, I think we estimate that if we close the loopholes through the Stop Haven Abuse Act, we’d probably have—we’d probably have 220 billion additional dollars that we could invest in the economy over about a five- to 10-year period.

AMY GOODMAN: We’re going to continue this conversation and post it online at democracynow.org. Raymond Offenheiser is president of the international relief and development organization Oxfam America. We’ll link to the report it’s just put out, "An Economy for the 1%: How Privilege and Power in the Economy Drive Extreme Inequality and How This Can Be Stopped."

That does it for the broadcast. We have two job openings: a director of finance and operations and a director of development. Go to democracynow.org for more information.

>Democracy Now! Website with *VIDEO REPORTS ON THIS TOPIC AND MUCH MORE,

http://www.democracynow.org/2016/1/21/the_1_economy_the_worlds_richest

appalachiablue

(43,857 posts)Zorra

(27,670 posts)equally among our fellow citizens of earth.

Why should these unfortunate 62 suffer under such a heavy load? The burden of having so much, when so many others have so little, must be absolutely crushing.

It can do nothing but make them very, very, sick, in heart, mind, and spirit.

The symptoms of this sickness are horrible to behold.

appalachiablue

(43,857 posts)

appalachiablue

(43,857 posts)

appalachiablue

(43,857 posts)Richest 62 people own as much wealth as half the world's population, says Oxfam

Almost half the super-rich individuals are from the United States

Thomson Reuters Posted: Jan 17, 2016 7:52 PM ET| Last Updated: Jan 18, 2016 7:53 AM ET

The wealthiest 62 people now own as much wealth as half the world's population, some 3.5 billion people, as the super-rich have grown richer and the poor poorer, international charity Oxfam said early Monday in London.

■ANALYSIS | Justin Trudeau's Davos trip 1 more star turn before promises meet reality

■Justin Trudeau to address world's rich and powerful in Davos

■VIDEO | Will the dismal economy impact Liberal plans?

The wealth of the richest 62 people has risen by 44 per cent since 2010, while the wealth of the poorest 3.5 billion fell 41 per cent, Oxfam said in a report released ahead of the World Economic Forum's annual meeting in Davos, Switzerland.

Almost half the super-rich individuals are from the United States, 17 from Europe, and the rest from countries including China, Brazil, Mexico, Japan and Saudi Arabia.

"World leaders' concern about the escalating inequality crisis has so far not translated into concrete action — the world has become a much more unequal place and the trend is accelerating," Oxfam International's executive director, Winnie Byanima, said in a statement accompanying the report.

"We cannot continue to allow hundreds of millions of people to go hungry while resources that could be used to help them are sucked up by those at the top," Byanima added.

About $7.6 trillion US of individuals' wealth sits in offshore tax havens, and if tax were paid on the income that this wealth generates, an extra $190 billion US would be available to governments every year, Gabriel Zucman, assistant professor at University of California, Berkeley, has estimated.

As much as 30 per cent of all African financial wealth is held offshore, costing about $14 billion US in lost tax revenues every year, Oxfam said, referring to Zucman's work. This is enough money to pay for healthcare that could save 4 million children's lives a year, and employ enough teachers to get every African child into school, Oxfam said in its report.

■Stubborn pay gap for women persists worldwide

"Multinational companies and wealthy elites are playing by different rules to everyone else, refusing to pay the taxes that society needs to function. The fact that 188 of 201 leading companies have a presence in at least one tax haven shows it is time to act," Byanima said.

Ensuring governments collect the taxes they are owed by companies and rich individuals will be vital if world leaders are to meet their goal to eliminate extreme poverty by 2030, one of 17 Sustainable Development Goals set in September, Oxfam said.

>Continued with News *Video: http://www.cbc.ca/news/world/richest-62-people-own-same-as-half-worlds-population-oxfam-davos-1.3408049

hfojvt

(37,573 posts)than at least 125 million Americans. I mean, I have more wealth than about 42 million households. So figuring an average of 3 per household that's 125 million Americans. Although since that is only 35.3% of all households, that would perhaps be just 109 million people (35% of the US population).

Of course, any person (including a number of people in that 109 million) who has more than $1 in net worth, has more wealth than those 109 million does collectively, because their collective net worth is less than zero.

Of course, if you took just part of that group, the 9.1% of households with a net worth between 0 and $5,000 the net worth of that group would be at least $10 billion. One trouble is that there are 9.05% of households with a total net worth of less than negative $93 billion.

Wealth is not everything though. 8% of the households in the TOP quintile for income have negative net worth. Chances are good that they are living better than most in spite of their lack of wealth.

You lost me.

here are some numbers from the 2011 census of wealth

distribution using the medians

9.05% - less than ($8,610) - group A

9.05% - $8,610 to zero - group B

4.55% - zero to $1,679 - group C

4.55% - $1,679 to $4,999 - group D

2.4% - $5,000 to $7,113 - group E

2.4% - $7,113 to $9,999 - group F

3.3% - $10,000 to $16,039 - group G

the total (100%) is 118.7 million households. These seven poorest groups are 35.3% of all households.

Group A, we know has a negative net worth of less than ($93 billion). They are in debt rather than having ANY wealth.

Group D has a net worth of at least $9 billion.

Because of Group A and Group B the total net worth of all those groups combined - is still negative.

As a group they have ZERO net worth, but most of the members, even of group C have more net worth than that.

Group E has a net worth of at least $14 billion (118.7 times 0.024 times $5,000). We also know that they have less than $20 billion (118.7 times 0.024 times $7,113)

So I have total net worth for combined groups of

Group C + Group D + Group E + Group F = $43 billion to $85 billion

Group G = $39 billion to $62 billion

Any person with even a dollar in net worth has more net worth than those 35.3% of households combined, because the combination has less than nothing.

That is part of the way that Oxfam gets their amazing numbers, because people with negative net worth are always going to be in the bottom 50%.

TBF

(35,573 posts)It's a common tactic. ![]()

TheFrenchRazor

(2,116 posts)raouldukelives

(5,178 posts)There are people who take the plight of minorities, of the least, at home and abroad, seriously, and there are those who benefit and benefit from Wall St.

The more wealth and power corporations acquire, the more individuals that finance them and provide fiduciary cover, the more others will suffer long term pain for their personal choice of selfish and short term pleasure for themselves over the needs of the many.

They do not care. From raising seas to raging fires, from dismantling education to denying health care, destruction is all they know how to profit from. When individuals are at their most vulnerable, you can bet a corporation and its associated owners will be there, en masse, to try to take full advantage of them.

It is why they remind me so much of the Bundy freaks. The more invested, the more that rally around and align themselves with the goals of Wall St, the more lobbying and political power they wield, the more of our common fields they can tear down the fences around and unleash massive herds of corporate free grazers to fill their coffers.

Donald Ian Rankin

(13,598 posts)1 in 10^8 rather than 1 in 10^2, at any rate.

It's worth noting that it's a somewhat misleading claim, though - they may own as much paper wealth, but they don't consume anywhere near as much Stuff.

TBF

(35,573 posts)Rex

(65,616 posts)At one point it will be just Mr. Coke and Mr. Pepsi. And they will own the world, literally.

appalachiablue

(43,857 posts)appalachiablue

(43,857 posts)tabasco

(22,974 posts)Be a good serf and wait for your crumbs.

moondust

(21,183 posts)Time for a shift to economic justice.