General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsNo, businesses are not taxed too much

or at least, their effective tax rate is not too high.

PSPS

(13,599 posts)Chancellor of the Exchequer George Osborne’s decision to cut corporation tax to 17 percent by 2020 will bring the U.K. rate to the second lowest among developed countries.

Only Ireland has a lower corporation tax rate -- 12.5 percent -- among the 34 members of the Organization for Economic Cooperation and Development.

Corporation tax is "one of the most distortive and unproductive taxes there is," Osborne said Wednesday in announcing the U.K. budget in the House of Commons. He said the reduction would benefit more than one million companies, large and small. Business groups welcomed the move.

...

In addition to cutting corporation tax, Osborne announced plans to cut the capital gains tax rate from 28 percent to 20 percent. For basic rate taxpayers, capital gains will be reduced from 18 percent to just 10 percent.

Of course, it was the plan all along (i.e., race to the bottom) and, in fact, trying to equate the two is a real non sequitur, and it reveals the real forces behind the "stay" campaign. I guess the UK will be joining the "drowning in the bathtub" club.

eppur_se_muova

(36,263 posts)It's hard to compare.

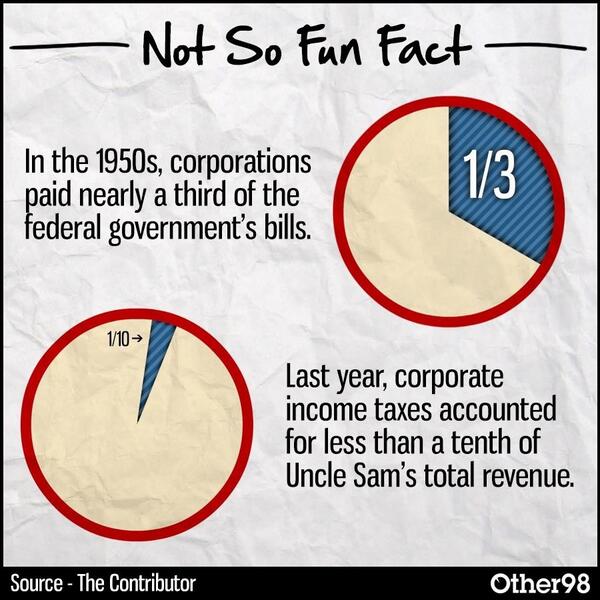

Take this, for instance:

?itok=TIFTigqC

?itok=TIFTigqC

One big difference is the need for payroll taxes. Now, you say, "that's off the back of the workers." But half of FICA and Medicaid is paid by corporations, and reduces their income tax liability because they're a cost of doing business. 7.65% of my salary means my employer's pitching in $3800 a year for me that's not "corporate income tax" but *is* part of federal revenues. In the early '50s it was around 1.5%. That has an effect. Half of worker "payroll tax" is corporate, and a decent chunk of the payroll tax is self-employment income. Hard to know how to quantify that.

The economy was also a bit different then. Much of the reduction in corporate taxes in 2013 (when the infographic was produced) was because of various rebates and tax laws that allowed previous year losses to be carried forward. The 1950s saw a lot of growth even if effective corporate tax rates were twice what they were now (ignoring FICA/Medicaid) because we were among the only players in town. We exported a lot. Competition didn't matter; the limiting factor was how price affected demand, and for a lot of things prices were inelastic. Now we don't need to export for demand to be met, and prices are a lot more elastic. While deductions aren't carried forward from 2008-09, there are still significant rebates to keep prices low while the dollar is strong.

Then again, there were three recessions in the 1950s. Count them, three. And as real tax rates declined, corporate income and investment increased. The first few years of the 1950s were the high point for the effective corporate tax rate. Choose a different date--perhaps one where US industry wasn't so vital and when we weren't between recessions--you'd get a different picture. Leave out payroll taxes (or include them as a kind of corporate tax) you'd also get a different picture.

In fact, much of the reason for keeping offshore profits off shore is differential tax rates. Some should be kept offshore--if you're Corporation X with facilities overseas, some of the profits will be held for investment overseas. Silly to bring them to the US, pay taxes, and then send the money back. Just keep it local and avoid the problem. At the same time, it's not good to keep the actual cash overseas if it's not doing anything but avoiding high(er?) US taxes. A lot of the "money" overseas, though, is in stocks, bonds, and real investments, not just in demand deposit accounts or CDs. Hard to bring those back without engaging in full-blown protectionism.

For kicks, let's consider the groups who should be complaining. I can't find data on federal income tax paid by quintile since the '50s--not enough time to rummage. Here's since '79, and we know that average income hasn't changed much since then (in constant $).

Now, there's little debate that the income of the uppermost quintile, esp. the upper 5%, has soared. Let's see ... Bottom 20% has held constant, far lower effective rates. Top 5% income's soared, rates basically unchanged. So as corporate taxes have fallen, it appears that the bottom quintile or two of households have also had their effective federal income taxes drop.

(No, this isn't the full picture, but it's more complete than the OP's is. The tax rates in the second graph include payroll taxes.)