General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsSo I went to the Washington Post website, calculating costs for ACA in 2014...

http://www.washingtonpost.com/wp-srv/special/politics/what-health-bill-means-for-you/Accordingly, with the combined incomes of me and my fiancée, we would be on the hook for anywhere from a 180 to 230 dollar monthly copay, and maximum out of pocket of 27 percent of costs. This is after federal assistance unless I read that website incorrectly.

Marital status apparently doesn't affect this, and we are planning on getting married in 2014. In contrast, the penalty for not signing up to a plan is 87 dollars(rounded up to nearest dollar), which I would much prefer to be the premium itself, considering we can't afford the premium mentioned above, hell, even 87 bucks would be a strain on the current budge, and if either I or her increase our incomes too much from where its at now, look for premiums in the 3-400 dollar range, oh joy!

I do know that most likely our income will increase by then, I don't know if it matters in the calculation above, but my fiancée is on disability and Medicaid right now. When she's well enough to get a job, Medicaid is going to drop her like a bad habit.

So my question is this, are my calculations completely wrong, or are we royally screwed come 2014?

Comrade_McKenzie

(2,526 posts)I'll be covered under Medicaid if I'm still at my shitty job, but my dad cannot afford to add mom to his insurance or pay any type of penalty. He already lives paycheck to paycheck right now without anything added extra.

The administration has been doing a horrible job at explaining all of this to the public. They need to do some massive PR to explain exactly what is going to happen in just about every possible scenario.

I'd feel better getting this info from a calculator on a .gov site, rather than a news site that may have ulterior motives.

Humanist_Activist

(7,670 posts)debt my fiancée is already in due to medical bills, and that was with insurance, this is a quick way to bankruptcy.

At 27 percent maximum out of pocket, I might as well not have health insurance at all, and I really don't want to know what the copays will be for my fiancée’s medications, she has an pre-existing condition.

Response to Humanist_Activist (Reply #3)

FarLeftFist This message was self-deleted by its author.

nadinbrzezinski

(154,021 posts)But it will increase every year. Do the exercise for iirc 2017.

Humanist_Activist

(7,670 posts)fucked either way.

snooper2

(30,151 posts)How about when the Fridge goes out?

Humanist_Activist

(7,670 posts)carry us for 8 months, and the generosity of our parents. At least we rent, so if the Fridge goes out, its not on us, but everything else, yeah its tight right now. I'm trying to get us out of debt, not try to break even. I don't want to owe my credit card company for 20 plus years, I just want to pay it off(and my car as well), as soon as possible without going into further debt. That means a tight budget for probably a few years, its gonna suck, but better than declaring bankruptcy.

Not to mention her bills, most of which are medical in nature, and to the tune of 10s of thousands of dollars in debt.

PoliticAverse

(26,366 posts)progressivebydesign

(19,458 posts)Funny what people's priorities are. My parents taught me that the first thing you pay is for shelter, then food, lights, and health insurance. Not cable, not internet, not trying to pay of credit cards faster. Do you see what you're saying? You're asking the rest of the insured people to subsidize your credit card payments, and exploiting the new law for your benefit. Seriously.. are you just accepting that you'll be in a shit job the rest of your life? Why not try to improve your life situation?

Humanist_Activist

(7,670 posts)payments, when the card, and both our parent's finances maxed out, we had to do without. So get off your fucking high horse!

Humanist_Activist

(7,670 posts)in financial difficulties are irresponsible?

silentwarrior

(250 posts)but some do live beyond their means, so to speak

Humanist_Activist

(7,670 posts)Zalatix

(8,994 posts)Like artists who put their stuff up on Ebay or Zazzle. Legal transcriptionists. Etc.

alcibiades_mystery

(36,437 posts)the new law for your benefit."

That's EXACTLY what the OP is doing. You forgot to add, asking us to feel sympathy for them when they're in the midst of robbing us.

Humanist_Activist

(7,670 posts)2005 at my last job that offered health insurance it at an affordable rate. Hell we shelled out over 2 thousand dollars in COBRA last year and still had to shell out more for actual health care for my fiancee.

Hoyt

(54,770 posts)Iggy

(1,418 posts)what are most people paying for cable now, including one or two pay channels like HBO-- $120 per month?

many people are paying alot more, because they have several pay channels.

C'mon people. if you "can't afford" a couple of hundred bucks a month for health care, there's

something very wrong. I suspect some of these people have expensive cars/motorcycles/boats

they aren't telling us about.

Zalatix

(8,994 posts)Yes, and in this economy it's not something wrong with the person who cannot afford a couple hundred bucks per month.

Iggy

(1,418 posts)my point is middle class employed people whining about co-pays or the potential to maybe have

to pay more for health care-- all while paying $1,500 per year for their cable bill, plus at least

$1,000 per year for their cell phone-- they don't get much sympathy from me.

I don't have cable. I use the saved money for travel and dining out.

Zalatix

(8,994 posts)Cell phone is necessary. How else do you communicate with others? Smoke signals? I'm not talking iPhones with data plans, many people just have basic service. There's a reason why there's a such thing as a Lifeline subsidy.

Cable? Well, you really don't need to know what's going on in the outside world. Rumors work just fine! Especially if you're disabled and can't easily get out. Those folks can just sit in their silent house and rot. ![]()

![]()

Then there's the Internet access thing. That costs money and is seen as a luxury, yet lots of people now use that to earn a living. Try uploading art on a 56K modem. If you can even find a dial-up ISP in your area anymore.

"If you're not down to eating cat food you should buy insurance" is the worst kind of argument. Ever. ESPECIALLY when you have, on the other end, multibillion dollar corporations mulling dropping all of their employees' insurance and saving money by paying the tax penalty, like Southwest is considering.

Iggy

(1,418 posts)you're not listening. I did not state get rid of your cell phone. but you DO realize the monopolistic phone companies

are not done raising their rates, correct? soon we will be paying over $2,000 per year for cell phones-- and most

of the robots won't even blink. so again, let's stop the nonsense that we "can't afforf" to pay for health care.

Look, the phony GOP Randian "philosophy" (I use the term loosely) might work well in a nation of 30 million people.

We have what? 340 million people?

as far as my travel, I did not state I was traveling to Europe. day trips within 100 miles are affordable.

Zalatix

(8,994 posts)Private health insurance has been made a necessity by fiat. Without access to actual health care, it is fairly useless - a lesson we as a country may also learn here soon, if we can't deal with our nurse and general practitioner shortage. You need to square that away before you tell me I'm not listening.

And now you're bringing up "phony" GOP "Randian" philosophy? Do you even know what Randian philosophy is? It has nothing in common with what anyone is saying here, not even your comments.

Many budgets out there are faced with dropping cell phone coverage or not getting health insurance. This is the facts. Your comments spit in the face of people who are forced to make this hard decision. I won't back down on that. Those people need to be spoken for, not talked down to.

Zalatix

(8,994 posts)nadinbrzezinski

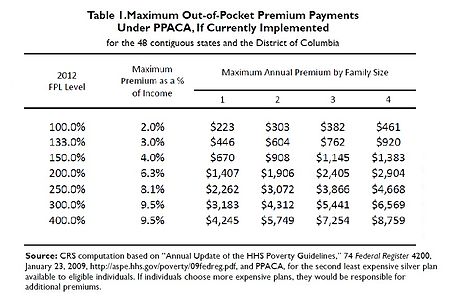

(154,021 posts)Your care will be highly subsidized. If you are at 133% or under of the poverty rate, I believe care is free, or nearly free.

Humanist_Activist

(7,670 posts)TheWraith

(24,331 posts)Above that, it's heavily subsidized up to 400% of the poverty line if I recall. For two people, that would be an income of $61,000 a year or so before your care was no longer subsidized.

nadinbrzezinski

(154,021 posts)But they have done a terrible job of explaining this.

They get a do over, use it.

Humanist_Activist

(7,670 posts)on something that will cost 270+ dollars a month.

nadinbrzezinski

(154,021 posts)Humanist_Activist

(7,670 posts)premiums, this I might be able to afford. If I get married, then it increases to 346 dollars(for two people) a month, something neither of us can afford with our combined incomes.

nadinbrzezinski

(154,021 posts)If I am reading this correctly.

Humanist_Activist

(7,670 posts)Remember, we would be going from 1 person with no insurance, and another on Medicaid+disability to a combined income too great to qualify for Medicaid for either of us, so both would have to go on the exchange. $4,152/12=$346 a month premium to cover both of us.

This is, I'm assuming, after subsidies, if not they may knock off a 100 dollars a month, who knows.

nadinbrzezinski

(154,021 posts)Hint that much higher...I am not being snarky.

Just pointing this out.

It does that because your income and hers are off the poverty line. It is means tested.

Humanist_Activist

(7,670 posts)I have a spare 100 bucks or so left?

nadinbrzezinski

(154,021 posts)Afford what in reality is half, without deductibles, of current private insurance.

I got no answer for you, nor do I know what your debts are.

I know that the penalty will go up every year, and I also know not having it short term may make sense, but if you get hurt or injured....

Humanist_Activist

(7,670 posts)if you wanted to do the calculations, my employer offers health insurance, at about the same rates as mentioned here, except for individual coverage, which is well over 100 bucks a month. Oh, and the deduct is well over 10,000 dollars, I really don't want to get something I can't afford to pay monthly, and then not be able to use the damn thing either, seems like a scam.

That's perhaps the biggest benefit of the exchanges, lower deducts, too bad I can't seem to afford the premiums.

Humanist_Activist

(7,670 posts)Because it seems to me like you don't like what the tables are saying, so are moving the goalposts. Am I or am I not screwed?

silentwarrior

(250 posts)unless you move to a nice little place called Newcastle ![]()

nadinbrzezinski

(154,021 posts)That's what I am saying. I am also saying that if you don't have it, you will be penalized (ok it has no teeth) but the penalties are pro rated to the time without insurance.

Your employer offers health care, don't like it, wait for the exchanges. but by 2016 it may not e worth it to stay on sidelines.

I am not changing goal posts. By the way, this new sysem is actually closer to the German and Swiss model in real life. I suspect, that if it works, even half as well as the German system, rates will drop and service will improve.

Humanist_Activist

(7,670 posts)and I couldn't afford COBRA at the time, so I was screwed. Employer based insurance should be banned.

My point is this, its not a matter of "liking" this or not, its a matter of being able to afford it at all.

nadinbrzezinski

(154,021 posts)Which is not employer based.

Response to nadinbrzezinski (Reply #32)

Humanist_Activist This message was self-deleted by its author.

Autumn

(45,120 posts)I googled it and what I got made no sense to me.

TheWraith

(24,331 posts)On the right. For instance, the poverty line for a family of four is considered to be $23,000 per year, so subsidies extend up to $92,000 total income. For one person, $11,170 is considered poverty level, so subsidies extend up to people making $44,680.

http://en.wikipedia.org/wiki/Poverty_in_the_United_States#Recent_poverty_rate_and_guidelines

progree

(10,918 posts)Here is what I get for a $28,434 income (1 person household, unmarried)

You will have the option of buying a health plan through your state's exchange with federal assistance. Based on your income, your annual premiums for that plan would be no more than $2,289 to $2,701. Your maximum out-of-pocket costs for deductibles and co-payments would be capped at 30 percent of the total cost.

Insurers can’t discriminate against you for having a pre-existing condition, and can only vary rates within a narrow range.

If you do not obtain insurance coverage by 2014 you will be assessed a tax penalty. The penalty becomes progressively greater from 2014 through 2016, when it reaches full strength. At that point assuming your current income remains the same and your household consists of 1 uninsured adult, you would be subject to a penalty of about $695. You are exempt from the penalty if the least expensive plan option in your area exceeds eight percent of your income.

After 2016, the penalty -- $695 or 2.5% of income, whichever is greater -- stays the same as far as the 2.5% number. But the $695 increases with inflation.

Oh, don't ask me why the calculator didn't give 2.5% * 28,434 = $711 for an answer. I'm guessing the "adjusted gross income" which one plugs into the calculator, is behind the scenes reduced by an exemption and maybe a standard deduction, just like on taxes where taxable income = adjusted gross income - exemption - deductions. But I'm just guessing.

Something else -- I think marital status has no impact in the real world on this. I think its just something dumb for this calculator -- if you put in "2" as a household size and choose "unmarried", the calculator assumes the household is an adult and a child. But if you choose "married" it assumes the household is 2 adults. Sigh.

NYC_SKP

(68,644 posts)And I hope you're not thinking of shirking the mandate for the $87 pittance penalty while others actually participate and pay their fair share.

Maybe I'm misunderstanding your post.

Humanist_Activist

(7,670 posts)You know, to pay our "fair share". ![]()

NYC_SKP

(68,644 posts)Humanist_Activist

(7,670 posts)I make too much to go on Medicaid, but I certainly don't make enough to afford to shell out 300-400 bucks on health insurance.

NYC_SKP

(68,644 posts)I replied to an OP elsewhere that I would file for bankruptcy protection if I was that under water, and almost did.

Good luck with all your needs, I don't want to be judgmental.

![]()

Humanist_Activist

(7,670 posts)quarter of my income, you call it a steal, yeah, for someone who makes twice or 3 times as much as me. Hell, it took us borrowing money from our parents for us to maintain my fiancée's COBRA for 4 months, to the tune of 434 dollars a month, until they couldn't afford it to help us any more.

We have rent, food, a car payment, utilities, and gas money to worry about, and after all that, we are lucky to have 100 bucks to spare, much less 300-400 bucks lying around.

ON EDIT: Forgot to mention my 1 credit card, oh and this is take home pay, after taxes, not gross pay.

nadinbrzezinski

(154,021 posts)Humanist_Activist

(7,670 posts)married, apparently, according to one poster below, I'm too poor to be married.

TheKentuckian

(25,029 posts)number.

He is saying that $400 is a quarter of his take home and that is going to be about right for the 27-31 thousand area single earner. He has like $1600/month (give or take but ballpark) to actually work with, it goes fast. If $400 is a STEAL then what the hell happens when you don't get a STEAL? What are we saying is average and what would constitute high (just for premiums, mind you, no care yet)?

When we get to the real rubber meets the road money, many are cutting it very close.

I guess this is a little karma for silly buggers making 8, 10, 15, or really even 20 bucks an hour calling themselves middle class for too damn many years. After decades of wage stagnation most are just over broke.

We can play tax to the dogs come home but if it is a tax, it is damn regressive even with the benefit of the subsidies. You better book it that Bill Gates won't be paying 8.5% and actually much more than that of the post-tax income.

Once we talk average rents and basic transportation, something important is in trouble or will have to be dealt with very carefully.

There is a very odd disconnect at work where people can see depressed wages, too few jobs, and that people are really pressed a thousand different ways but find hundreds of dollars in people's monthly budget they miss searching for change for the tank.

Some, not like you are pretty damn sanctimonious about it and everybody is a little glib with some of these numbers. Folks are laser quick to throw out the 133% of poverty, slow as frozen molasses to talk about minimum wage being to rich to make that cut. Sure the subsidies help even more but they still are designed to get you down to a percentage of income and paycheck to paycheck people are stressed as is. I don't see what blowing that off gets anyone.

nadinbrzezinski

(154,021 posts)His problem is that combined net places him at a higher income bracket.

ProSense

(116,464 posts)"My income, by itself, is about 1300 bucks a month, 300-400 dollars is damn near a...."

...earth are you coming up with a premium of $300 to $400 per month for an income of $1,300?

More: http://www.democraticunderground.com/1002868894

And the subsidies apply to up to 400 percent of the FPL.

nadinbrzezinski

(154,021 posts)But the numbers are after he gets married, he will be at 300 and we already tried to explain subsidies.

Humanist_Activist

(7,670 posts)and would still have to pay over 3,000 dollars annually on premiums.

nadinbrzezinski

(154,021 posts)Go on and take your chances.

There are things you might want to consider about credit cards, and lord knows I know not all folks get into monstrous debt from what people might call irresponsible behavior...hospital bills come to mind. You may, very seriously, consider talking about bankruptcy.

But go ahead and take your chances. I know that there will be far more who will be thankful...3000 is a lot of money, but it is less than the current averages, with life time caps and exceptions.

And it is less too than an average visit to the ER, local BLS ride alone was 1500...

Humanist_Activist

(7,670 posts)to remain poor rather than end up in yet another, higher tier in the premium table linked on this thread.

kelly1mm

(4,734 posts)to qualify for medicaid and/or significant subsidies since the asset limits for medicaid are going away per the ACA. This is exactly the route I am going to be taking to retire early.

There is a discussion about early retirement due to the ACA here:

http://www.democraticunderground.com/1002878851

ProSense

(116,464 posts)"And I tried to explain that, we would get a 600 dollar annual subsidy...and would still have to pay over 3,000 dollars annually on premiums."

...doesn't seem right. That is about $250 per month, not $300 to $400.

Also, you stated your income is $1,300. What will it be when you get married?

You also stated that you would be at 300 percent of the FPL, but that would reduce you liability by a little more than 30 percent. That means, a $3,600 premium would be reduced to about $2,500, or about $200 per month. That essentially means you would each be contributing $100 each to the coverage.

Humanist_Activist

(7,670 posts)about 2400 dollars a month. But calculated separately so she qualifies for Medicaid with her disability payment. Also, as I said, I was using the websites provided, they don't exactly give accurate predictions, probably because most of them don't provide for a family of 2, but families of 4 or individual. Considering how much more the family of 4 estimate was, I figured the individual estimate would be a better gauge as to what the true cost would be.

Some of the website give an estimate of 250 or so, others as high as 360.

ON EDIT: Sorry for the confusion, she's only started getting the disability for the past 2 months, I still think we are poorer than we really are. Not to mention I still have to get used to her getting her medications free from Medicaid, which only kicked in last month. She gets them in the mail, that is awesome, even more awesome to not have to pay 200+ dollars for them at the local pharmacy.

progressivebydesign

(19,458 posts)I thought you posted further up that you have credit cards that you're paying off because you "don't want to pay them for 20 years."

Humanist_Activist

(7,670 posts)in 5 years. But instead I should be fucked on the interest rates so I can get fucked by insurance companies that I would have to pay thousands in deductibles to at the moment before they would even begin to pay for any health care?

SammyWinstonJack

(44,130 posts)My husband is 60 y/o on SSDI and Medicare.

I am 59 y/o have no health insurance and no job.

I can't afford the premium or penalty.

Sgent

(5,857 posts)Depending on his SSDI and other income, it sounds like you would be eligible for Medicaid. If your income as a family is higher (above 20K / year) then you would get subsidized coverage.

SammyWinstonJack

(44,130 posts)turns 62, is $2540/mo after his Medicare deduction.

Based on that, the premium looks to be somewhere between $1200 and no more than $1890.

So that would just be for me since he is covered by Medicare.

No where did that question come up, if one spouse is covered by Medicare and one has no health insurance.

And the full penalty based on this income is $1390. ![]()

nadinbrzezinski

(154,021 posts)SammyWinstonJack

(44,130 posts)nadinbrzezinski

(154,021 posts)Percentage above that is?

http://www.democraticunderground.com/?com=view_post&forum=1002&pid=881345

PoliticAverse

(26,366 posts)Humanist_Activist

(7,670 posts)its gonna cost 271 dollars a month in premiums, and 3,100+ dollars deduct on the insurance.

Question, can one of us go on the exchange and have the other as a dependent spouse? If not, this premium is for each of us, that's over 500 dollars a month for two people.

Bluenorthwest

(45,319 posts)combine your incomes and file jointly, so for those of us denied the right to marry, it clearly matters very much indeed. It will matter to you as well if you present 'combined incomes' prior to your marriage as to do so is a crime. Without an actual legal marriage, you can not combine your incomes for any tax related purpose.

Humanist_Activist

(7,670 posts)while the premium calculations are for individuals in that household, at least that's how I read it, I don't know what affect that has on marital status, if any.

nadinbrzezinski

(154,021 posts)Does not take into account roommates.

Humanist_Activist

(7,670 posts)nadinbrzezinski

(154,021 posts)Humanist_Activist

(7,670 posts)the difference between affordable and unaffordable. The only other option is for us to become a poverty level single income household.

nadinbrzezinski

(154,021 posts)At 100 one person it is 217 year, two is 291... That is for a year.

Humanist_Activist

(7,670 posts)My fiancée pays nothing now(Medicaid), and I make, approximately 179% of poverty level, by myself. She also gets disability, which is a little less than half our combined income. Its enough to jump us to 300% of poverty level, IF it is counted that way(if we are married). So our income would double, and our premium cost would quadruple, according to the table you just showed me.

nadinbrzezinski

(154,021 posts)Humanist_Activist

(7,670 posts)nadinbrzezinski

(154,021 posts)quinnox

(20,600 posts)damn, that sucks. That is the penalty for a year and is less expensive than the premiums would be. So that works out to a new expense of 60 dollars a month just to cover that penalty, on someone like me who makes very little money. This is absurd.

nadinbrzezinski

(154,021 posts)PoliticAverse

(26,366 posts)

bhikkhu

(10,724 posts)In mine (Oregon) they have this calculator: http://www.orhix.org/calculator/

I had figured my costs would be about $100 a month, which I am prepared to do some serious rearranging to afford if I have to, but the state calculator says it will be $0, as long as my wife and two kids are on the plan with me.

I spent a good amount of time today talking to my boss and coworkers about how it might work, as they tend to read the RW end-of-all-things side of it. One guy with just himself and a son should pay $90 a month, one with himself and his part-time employed wife should pay $200 a month, and my boss should get his family covered for $200 a month. Copays are very low, and max out of pocket is very low. That's also looking at costs without counting the 50% tax credit or other things.

...overall, it seems like a great deal, and a huge change here.

Thinkingabout

(30,058 posts)nadinbrzezinski

(154,021 posts)Mass

(27,315 posts)Sadly, a lot of people think they will never be sick, until the day they are and think the system is so unfair.

The fun part is that if this person had single payer, he would probably pay more than this, because his debts would not be taken into account either.

Humanist_Activist

(7,670 posts)to now(a month), if we get single payer and my taxes increase by 250 bucks a month, then we fucked up royally.

ProSense

(116,464 posts)"Actually if I moved to Canada, at my income level, my taxes would drop about 50-60 bucks compared...to now(a month), if we get single payer and my taxes increase by 250 bucks a month, then we fucked up royally."

...not ACA, not single payer, but Canada is your best bet?

Humanist_Activist

(7,670 posts)level (about 20,000 a year) by 250 bucks a month, you fucked up somewhere. Taxes in Canada and GB aren't nearly that high. Hell, I think that would double my tax rate, have to check my check stub.

nadinbrzezinski

(154,021 posts)Are higher in the us, partly because they're used to pay for healthcare.

You may see no bill, but there is a bill.

Humanist_Activist

(7,670 posts)that's the point, after all.

RC

(25,592 posts)I used to date a Canadian and have experience up there. Canadians are not waging wars for fun and profit. That helps keep taxes down.

uppityperson

(115,679 posts)"Your maximum out-of-pocket costs for deductibles and co-payments would be capped at 15 percent of the total cost."

For us this looks great. I can not afford $400/month with $10,000 deductible but can't afford anything else BUT catastrophic. To have it 1/3-1/4 less a month would be great.

progressivebydesign

(19,458 posts)you are planning to pay a penalty the force then rest of us to pay for your healthcare?

If you can't afford 200 a month for insurance, you can't afford to get married. Were you planning on never find a job that had health insurance? Were you planning to ask those of us who pay for insurance to cover the losses from your scheme?

Honestly.. I'm sickened by some of the posts here.

Humanist_Activist

(7,670 posts)Also, did I say anything about my plans, or are all lower income people scum to you?

xmas74

(29,676 posts)for myself and I have insurance through an employer. The calculations according to the site show that I would drop dramatically in rate, saving over half of that a month.

I love this. I might actually be able to afford to take my kid out to the movies every so often with the money I'll save. And I don't have to worry about saving my insurance for catastrophic reasons only.

progressivebydesign

(19,458 posts)We are really far in debt, and scrimping on lots of things, but there is no way I'd go without insurance, nor try to game the system by saying "oh, the fines are cheaper, I'll just get insurance when I'm sick and make everyone else pay for me!!" Which is basically what some people here are saying. Looking forward to finally saving money on my insurance, too!!

xmas74

(29,676 posts)and my income would fall on the higher end of the poverty range, even though I work a full time job and receive no assistance. In this scenario, my child and I would both qualify for the exchange, possibly with full Medicaid. For the first time I'd actually get some help!

By the time I'm done paying for medical, dental, and vision I've paid out nearly a third of my check. (This doesn't include life, which runs the same price as my vision-pretty cheap.) I pay these bills because they need to be paid.

A couple of years ago I had a kidney stone. I was able to go to the doctor and pay for everything out of pocket. I passed it on my own. If I hadn't I would have been admitted and surgery would have been performed. Even with my insurance my bill would have been in the thousands.

I just don't understand this mentality. Most of us can find a way to pay for this. Many of us already find ways to pay for insurance, even if we can't afford it. And for those who are lower income the cost will actually go down.

Humanist_Activist

(7,670 posts)How'd that happen, and how much must your state suck? Even here in Missouri, women with children qualify for Medicaid and their child is covered for health insurance unless they are making well over 30-40 grand.

xmas74

(29,676 posts)The original court order states that insurance is supposed to be covered by my child's father.(It never has been covered, not once.) Now that all cases are reviewed via computer first any applications made for assistance are automatically kicked out. Once a case worker reviews everything I'm approved, only to have notices sent a few weeks later stating that my child has been removed from the system because of a current court order. And I make too much for any other type of assistance. (Except for income based housing, but there's a long waiting list for that-so long they haven't accepted applications in my area for a couple of years.)

My child will be on HealthNet for about three weeks before she's removed from the system for a "prior court case". Three weeks and then it takes another six weeks before she's added back to the system. In other words, the only way to keep continuous insurance coverage on her is through me buying it out of my pocket at work. And the amount spent on insurance does not count towards food stamps or other types of assistance, as my case worker has assured me on a regular basis.

JDPriestly

(57,936 posts)is physical), then she will have at least one pre-existing condition. That can mean that a person either cannot get insurance, period, or that they pay a very high premium for their insurance. She needs to get a job in which she will receive insurance. If she can't do that, she will at least be insured under ACA. If she is now on disability, she needs to make sure she is insured in the future. ACA will be great for her.

When I had to pay for my own insurance, I got a very inexpensive HMO, and it was close to if not more than $300 per month. That was several years ago. It has gone up since then even without ACA in full force. I know someone with Medicare who pays $300 per month for additional insurance. That is not considered to be a lot of money for health insurance.

Healthcare costs money. Sounds like your girlfriend really needs it.

And if you anticipate co-pays of $180-230 per month, sounds like you both need healthcare. How have you managed until now?

Humanist_Activist

(7,670 posts)And her medications were more than 200 dollars a month. This all started around last August, we weren't even self supporting till now and had to wait months for her disability to kick in. Ate a lot of ramen noodles. Still do actually.

On edit: I don't see how 300 dollars is cheap, her COBRA was over 400 dollars and before the disability left us 800 to 900 dollars in the hole every month. Thats with living off of mac & cheese and no luxuries whatsoever. Hell we scraped by the winter with no electricity, thank goodness gas was a little cheaper so we didn't freeze.

nadinbrzezinski

(154,021 posts)Cobra was by design not truly made competitive.

Also all her issues, she will not be denied coverage. With them, before this, you're looking north of 2000 with so many exceptions, and life time caps...which are now gone, by law.

Humanist_Activist

(7,670 posts)that we can afford. Instead its closer to 10%, and that sucks.

muriel_volestrangler

(101,361 posts)Though I would presume you do want insurance, especially with your fiancee being disabled.

You say upthread that you and your fiancee's income will be about 300% of the fed poverty level - which is $15,130 for a married couple ( http://www.frronline.com/?p=2948 ). Yours is about $20,000, so hers is about $25,000, it seems. I presume she gets Medicaid because she's disabled. So you seem to be saying that the problem is that, when you get married, the fact that she's disabled will no longer make her eligible for Medicaid. Is that right?

NotThisTime

(3,657 posts)With your income level sounds to me like you will be far better off with insurance. How much debt did you rack up on your credit cards because you had no insurance?

Based on your 1300/month income this is what the report is

Starting in 2014:You will have the option of buying a health plan through your state's exchange with federal assistance. Based on your income, your annual premiums for that plan would be no more than $468 to $624. Your maximum out-of-pocket costs for deductibles and co-payments would be capped at 6 percent of the total cost.

Humanist_Activist

(7,670 posts)denied her claims, including hospitalization and doctor's visits.

To make it even better, she needs oral surgery now, and guess what is not covered by Medicaid.

Ruby the Liberal

(26,219 posts)Sirveri

(4,517 posts)Though they'll take it automatically out of any future refunds you get, but if you're really close to the wire and that refund check is basically just bonus money then that might be the best plan of action for you. But if I remember right, that's only 87 dollars a year not a month (though I might be mistaken on that), that's what, 6 or 7 dollars a month, should be doable if that's the case. Though your only medical care will be at the ER where they'll bill out the ass for care.

Also I thought I saw she had medical debt, or some other liability, you might consider a bankruptcy attorney for her to discharge that debt before marriage, or at least talking it over with a bankruptcy lawyer before you tie your finances together with a marriage. Otherwise it will smash your credit rating later on, which may or may not matter to you. I know I don't care about mine, but if you're planning on buying a house in the next seven years you probably will care a bit more about it.

Honeycombe8

(37,648 posts)By "copay" do you mean your ins. premium, after govt subsidy?

You didn't say whether you are healthy or have conditions that mean you will have more than annual "well" exams.

No one can tell you if what you found is correct, since we don't have the information necessary to do that.

Honeycombe8

(37,648 posts)and not the protection against a catastrophic illness, then by all means, don't get ins. Pay the small penalty/tax instead.

It's your choice.