General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsObamacare is an effective middle-class tax cut; GOP repeal would be an effective tax increase

by Laurence Lewis

As usual, serving their corporate owners, Republicans are trying to undermine President Obama's Affordable Care Act, now casting it as a tax increase, with Mitt Romney as usual sometimes sort of agreeing, except when he doesn't. Also as usual, the Republicans and Romney are factually wrong:

The Center for American Progress offers this graphic (full version here):

- more -

http://www.dailykos.com/story/2012/07/06/1106885/-Obamacare-is-an-effective-Middle-Class-tax-cut-GOP-repeal-would-be-an-effective-tax-increase

MannyGoldstein

(34,589 posts)premiums to insurance companies? Mostly from the upper-middle class, I'd wager. They pay the highest % of our income in taxes.

ProSense

(116,464 posts)"And where does the money come from to subsidize premiums to insurance companies? Mostly from the upper-middle class, I'd wager. They pay the highest % of our income in taxes."

...you consider "upper-middle class"?

Under Clinton, the top 1 percent paid 33.4 percent; under Bush it paid 29.8 percent; and under Obama it would go back up to 35.3 percent, less than two points than under Clinton.

Meanwhile, under Clinton, the top 0.1 percent paid 36.9 percent; under Bush it paid 32.8 percent; and under Obama it would go back up to 39.7 percent. By contrast, every other group would be paying lower rates under Obama’s proposals than under Clinton. (A table detailing these numbers is right here.)

It’s true that the top 1 percent and the top 0.1 percent would be paying more. But the significance of those hikes shrivel dramatically when you consider how much better these folks have fared over time than everyone else has. The highest end hikes shrivel in the context of the towering size of their after-tax incomes — and the degree to which they dwarf those of everyone else, something that has increased dramatically in recent years.

http://www.washingtonpost.com/blogs/plum-line/post/how-obamas-tax-hikes-will-really-impact-the-rich-in-three-easy-charts/2011/03/03/gIQAmbbLIL_blog.html

I'm all for subsidizing premiums for low-income Americans. You?

MannyGoldstein

(34,589 posts)to pass some of what we pay them to low income Americans? I guess health insurance CEOs, like bankers, are now a federally-protected class.

My preference, of course, would have been to fight as promised for something non-absurd.

But here we are.

While your figures don't really pull out the upper middle class separately, it looks like ACA doesn't particularly burden them. IIRC, the ACA will cost a fair amount. I assume that the reason both parties are calling for slashing Social Security, raising the eligibility age for Medicare, and cutting other 99% programs is to help pay for this. If so, the cost will be borne mostly by the elderly and the poor.

Little Star

(17,055 posts)girl gone mad

(20,634 posts)The government is expecting to raise hundreds of billions of dollars in revenue. However you choose to frame it, this money is being removed from the private sector. When the government removes hundreds of billions of dollars from the private sector in the midst of a recession, you can expect some fairly harsh economic consequences. People will be less able to pay down debts and will see their purchasing power further eroded. That is basic economic reality.

Additionally, all of the healthy young people who now spend very little of their incomes on health care services but decide to buy insurance when faced with this new tax will now be paying a burdensome "tax" to the bloated, parasitic FIRE sector. I can't think of a worse time in our nation's history to implement a policy which shifts more money into the FIRE sector. Right now we should be making every effort to shrink the FIRE sector since it has become a massive drain on the productive sector and is destroying our global competitiveness.

ProSense

(116,464 posts)"It's a fairly significant tax hike."

...it's a tax hike on the top one percent.

"However you choose to frame it, this money is being removed from the private sector. When the government removes hundreds of billions of dollars from the private sector in the midst of a recession, you can expect some fairly harsh economic consequences."

I suppose the same argument could be used against ending the Bush tax cuts for the rich.

Response to ProSense (Reply #5)

Post removed

ProSense

(116,464 posts)Business Insider posted a list of some of these regressive taxes here.

Thanks for linking to RW distortion.

Zalatix

(8,994 posts)33 year old single person earning $28,000 a year, works for an employer who doesn't offer health insurance (because it's cheaper for the employer to pay the fine than to offer group insurance):

http://healthreform.kff.org/SubsidyCalculator.aspx

Unsubsidized health insurance premium in 2014 adjusted for age: $4,598

Actual person/family required premium payment: $2,189

That's the additional burden that a person earning $28,000 a year must pay every year.

This is almost an additional $200 PER MONTH that the working poor will have to spend, unless they want to pay a fine-er, um, an additional tax "non penalty" ![]()

Good job loading more expenses on the poor! ![]()

"That's the additional burden that a person earning $28,000 a year must pay every year. "

...health care premiums were and would be significantly higher without the ACA.

What you call a "burden," others who want affordable insurance will see as an opportunity to finally get coverage.

Here's a handy little chart based on the same calculator:

A couple of notes to address complaints about the Senate bill from the left and the center. (There’s no use addressing complaints from the right; in general, the safest thing when dealing with crazy people is to avoid eye contact.)

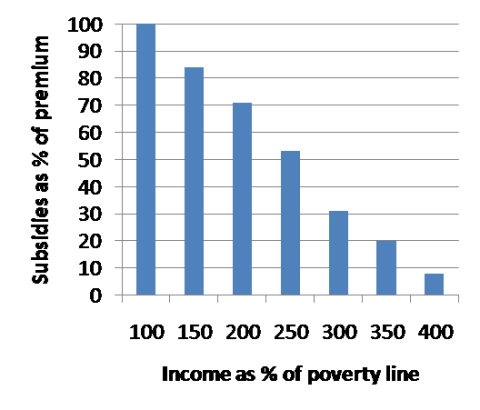

For people on the left who think this is all a big nothing, consider the subsidies. From the Kaiser Health Reform Subsidy Calculator, here’s the percentage of insurance premiums on the individual market that would be covered by subsidies at different levels of income measured as a percentage of the poverty line (all calculations are for a family of 4 headed by a 40-year-old):

Guys, this is a major program to aid lower- and lower-middle-income families. How is that not a big progressive victory?

For people in the center who worry, as my colleague David Brooks puts it, that there may be unintended consequences if you “centrally regulate 17 percent of the economy”: um, it’s a little late for that.

http://krugman.blogs.nytimes.com/2009/12/26/numerical-notes-on-health-care-reform/

And yeah, I didn't particular "like that one" sourcing Grover Norquist and Breitbart.

Zalatix

(8,994 posts)When you can barely make your basic bills, health insurance is something you forego, rather than having your lights shut off or eating cat food. Because when your power is off during the burning summer and you're eating cat food, you're risking the exact kind of big health problems you're trying to avoid with health insurance.

But hey, as long as you have to buy health insurance at $200 extra a month, who cares if you can't pay the electric bill?

ProSense

(116,464 posts)" This assumes that the poor want to pay for health insurance."

So you get to determine what other people "want" to do?

"But hey, as long as you have to buy health insurance at $200 extra a month, who cares if you can't pay the electric bill?"

A person earning $28,000 would not be required to pay $200 per month. Anyone who has to pay more than 8 percent of their income is exempted from the mandate.

http://www.democraticunderground.com/1002881604

Zalatix

(8,994 posts)And a person earning $28,000 would have to pay $182 a month, not $200. $18 bucks difference, whoopty do. And that extra $182 a month is not 8%. That's 7.8%. I gave you the link to calculate all that out.

Once again, you are incorrectly assuming that the poor want to pay for health insurance. Which means YOU are assuming what other people want to do.

"Your math is nonsense."

...this is your quote: "But hey, as long as you have to buy health insurance at $200 extra a month, who cares if you can't pay the electric bill?"

It seems to me you were throwing around the $200 number, but another poster provided the accurate number: http://www.democraticunderground.com/1002913676#post10

Zalatix

(8,994 posts)I gave a ballpark estimate of $200. The post you're referring to put it at $182. $18 off ain't too inaccurate for calcs done in one's head.

Moosepoop

(1,920 posts)Premium of $2189 a year... and how much would one trip to the ER be? One broken bone? One ruptured appendix? One serious illness?

Also, these figures are only for a SINGLE person making that wage. Start adding family members without raising the income and the required premium goes down. For a family of four at the same income the whole family will qualify for Medicaid. So the assertion that the

"Actual person/family required premium payment: $2189"

is incorrect... it is not for a "family" of any size, only a 33 year old individual.

Any individual making $28,000 a year who doesn't want to pay the $2189 (or $42 a week) can simply pay the penalty instead.

Zalatix

(8,994 posts)That shows just how little you understand the plight of the working poor. They simply do not have that kind of money to piss away. Not for the tax penalty, and certainly not for that ultra expensive health insurance. Read: ultra-expensive means something different for the working poor than for you or me.

You must think all these people own iPads and BMW's or something. ![]()

Yes, those figures also apply for family members, but it does not invalidate the burden it presents to single people. And if that extra family member is unemployed guess what, you're really rogered. In many states you can't get medicaid on $28,000 household income a year; and more now since they're using the SC ruling to bow out of increased medicaid coverage.

And.... pay the tax penalty? That kind of thwarts the whole "get insurance" thing. We're trying to shake people down for insurance money, right? The tax penalty doesn't help at all - especially when it's lower. That money doesn't go back to give health care to the poor. It goes into the general fund.

The individual mandate is a cancer upon the ACA. We should have funded it with taxes on the rich.

ProSense

(116,464 posts)"And.... pay the tax penalty? That kind of thwarts the whole "get insurance" thing....The individual mandate is a cancer upon the ACA. We should have funded it with taxes on the rich."

...pay the penalty and consider it a down payment on any use of the health care system. It's a strange argument because regardless of the type of system, one has to get insurance or not. Most systems are compulsory.

Also, the ACA is funded by taxing the rich.

http://www.democraticunderground.com/?com=view_post&forum=1002&pid=913866

Did you actually believe the small amount collected via the mandate is funding the health care law?

Moosepoop

(1,920 posts)You must think all these people own iPads and BMW's or something. You must think all these people own iPads and BMW's or something.

You seem to be under the mistaken impression that I am NOT the "working poor" since I replied to your post concerning the premium payments for a person making $28,000 a year.

I make under $17,000 a year. I have no health insurance and haven't for about 5 years now, ever since my ex-husband lost his job (we are now divorced). My job does not offer health insurance. There is no Medicaid available in my state for an adult who is not a parent of a minor, disabled, or elderly -- none of which apply to me. I AM THE WORKING POOR.

Assuming my income is still the same in 2014 (and assuming that I am still alive), I will finally be able to purchase health insurance for around $11 a week with the subsidy. That $11 a week means as much to me at my mid-$16K wages as the $42 a week does to the person at the $28K wage range.

Um, what?? If you have a family, and a family member (spouse, child) is unemployed your premium goes DOWN, not up. Roger that?

True, in many states right now you can't get medicaid on $28K, family or not. That's right now -- the ACA changes that depending on the size of the family. A family of four would all be covered by Medicaid. Not sure for families of two or three (the calculator doesn't give those options and I haven't done the math myself), but each additional unemployed person increases the subsidy -- and therefore reduces the premium paid by the policy holder, up to and including free Medicaid coverage for four or more people.

Some states are refusing -- as you said -- the funding for the increased medicaid coverage. This is not the fault of the ACA, the bad guys here are the legislators in those states. Put the blame for that where it belongs. Also, I'll be surprised if all (any?) of them actually follow through with their chest-pounding threats. The deal to the states being offered by the federal government is simply too good to pass up. And if they do stick to their misguided guns, the people in those states will be more likely to get rid of them at the first opportunity. Would that bother you?

Let's look at this line of yours again (with the emphasis changed by me):

So you are saying that you are not the working poor.

Then why are you lecturing me -- the working poor -- on what I want? What makes you think that you speak for me?

I'll speak for myself, thank you very much. I much prefer the upcoming opportunity to have health insurance again to these past years in which I have not seen a doctor for anything except for the recent removal of a cyst, which my daughter paid for in cash. One good illness, one broken bone, one health episode of any real magnitude would cost me everything. The ability to have coverage for $11 a week, and the peace of mind that will bring, is everything to me.

Don't talk to me about the mandate being a cancer. When you've personally watched cancer take a parent or a sibling because they didn't have the $$ to see a doctor in time, then talk to me about what a cancer is.

Go play with your iPad, and have a nice day.

Response to Moosepoop (Reply #36)

Zalatix This message was self-deleted by its author.

...retroactive hypotheticals? "USED to be"? You're not now, and still lecturing someone who is currently among the working poor.

That's just condescending, insensitive and nasty.

Zalatix

(8,994 posts)I would have had to choose between eating or paying the tax penalty or the increased insurance cost. I'm not backing down from that because it is the truth.

Call it a lecture all you want. I'm standing my ground on this because had the individual mandate happened when I was in college, I wouldn't have found a soup kitchen that would have supported me for that long. I don't know where I'd be now - except, perhaps, not nearly as healthy. It was hard enough studying as it was with constantly being hungry and begging for food.

Zalatix

(8,994 posts)I USED to be one of the working poor. I know for a fact that an extra $11 or extra $42 a week would have forced me to choose between health insurance or eating/keeping the lights on, and back then I didn't own an iPad, I didn't have cable TV, and I used the internet at school, and I took the bus, too. In one semester I had to make one package of Ramen last a whole day.

I'm lucky I lived in a place with a cheaper cost of living back then, too. Where I'm at now, back when I owed a mortgage it came out to half that kind of income. Rent is probably just as bad. I would have had to choose between eating and paying this fucking forced insurance purchase/tax penalty bullshit. I would not have appreciated being told I had to starve or suffer malnutrition now to avoid problems in the future.

"Starving students" isn't a hyperbole.

And for the states that are refusing Medicaid funding - yeah, blame the legislators. But the individual mandate leaves people who live in those states vulnerable to these idiot legislators. As for getting rid of them? Please. Some of these places have been Republican since at least 1964 and will stay Republican for at least the next few decades.

Finally... I am glad that this Individual Mandate didn't pass 20 years ago when I was one of the working poor. Because I would not have appreciated you or anyone else telling me I have to add more expenses to my budget which was ALREADY bare bones, which means I'd have to choose between eating and paying health insurance or an extra tax penalty.

Now go play with YOUR IPAD and have a nice day!

Oh and one more thing - HELL NO to the individual mandate.

PS: I deleted the cancer comment because it's obviously jury bait and I don't want the rest of what I said hidden. However it STILL reflects my feelings. Nobody wants to starve, and when I was poor, I was faced with just that. Soup kitchens were almost as overwhelmed then as they are now.

Moosepoop

(1,920 posts)But do carry on. ![]()

Zalatix

(8,994 posts)It will blow up in America's face.

SidDithers

(44,228 posts)Any port in a storm, I guess.

Sid

SidDithers

(44,228 posts)which are sourced (with links) from The Wall Street Journal, Grover Norquist's Americans for Tax Reform, and Breitbart.com.

Great sources you've got there.

Sid

BlueCaliDem

(15,438 posts)ProgressiveEconomist

(5,818 posts)Middle class ACA TAX CREDITS are FIFTEEN TIMES estimated penalties for individuals who can afford to buy health insurance but don't.

Thus ACA is a huge tax CUT for the middle class, not a tax increase. Individual penalties for not buying health insurance are estimated to raise $45 billion over 10 years, while individual tax CREDITS and other health insurance exchange costs are estimated at $681 billion over 10 years, FIFTEEN TIMES AS MUCH.

See http://www.democraticunderground.com/1002890826 for a summary of and link to a crucial March 2012 table of Congressional Budget Office details about its budget estimates for the Affordable Care Act.

Skittles

(153,169 posts)I don't don't know how you survive the dizziness with all your non-stop spinning ![]()

Zalatix

(8,994 posts)Boom, global energy crisis solved!

Skittles

(153,169 posts)ProSense

(116,464 posts)"I don't don't know how you survive the dizziness with all your non-stop spinning "

...sure you're not the one suffering "dizziness"?

I mean, the OP wasn't written by me, and certainly I'm not Krugman, who I also reference in this thread, or the CBO also referenced in this thread.

ThomasP

(29 posts)Is that this plan enriches insurance companies. We now compel people to buy something from a set of corporations that have NEVER had our best interest in mind. If you are going to spend the amount of political capital it took to pass this why not go all the way and simply expand medicare to cover everyone.

Now if Obama loses this fall we have Mittens come into office in January with a right wing agenda for healthcare and he would probably have the votes in congress to do what he wants.

I don't think Mittens will win but the thought is terrifying.

Zalatix

(8,994 posts)and ram it right up the working class's backside.

SidDithers

(44,228 posts)Sid

Zavulon

(5,639 posts)When I lose my health care coverage, as I will at the end of the year, I won't be able to afford my own policy OR the $50 a month given that I barely make ends meet as it is, but you can bet the cutoff will have me on the side of "Gee, he can afford it, let's fine his ass, Ramen is good for him." The ACA is an unaffordable tax increase on me and it will make health care unaffordable to me. Forgive me if I don't view this is a tax cut.

ProSense

(116,464 posts)useful information

Chart illustrates how the mandate works

http://www.democraticunderground.com/1002881604

How Obamacare Would Have Helped Workers Laid Off By Bain

http://www.democraticunderground.com/1002912536

Zavulon

(5,639 posts)that doesn't help much. I don't make a great living, but I certainly make more than $9350 a year. What it means is that thanks to the ACA, instead of having my employer pick up the cost of my health care I get to pay $695 to have NONE.

So much for keeping my doctor, my policy and everything else I was promised. And since I highly doubt I work for the country's only small business which will opt to pay the fine instead of provide health care to employees, the "Affordable" Care Act has become anything but for more than just me.

ProSense

(116,464 posts)So much for keeping my doctor, my policy and everything else I was promised. And since I highly doubt I work for the country's only small business which will opt to pay the fine instead of provide health care to employees, the "Affordable" Care Act has become anything but for more than just me.

...not apply to employers with less than 50 employees.

Zavulon

(5,639 posts)my boss fires enough employees to get below the threshold or not.

Igel

(35,317 posts)"The average penalty forall income levels would be $1,077 in 2016" By buying insurance through exchanges, you avoid the new penalty.

Avoidance of the new penalty is to be viewed as a tax reduction from current taxation levels? Hardly. The tax credit is a credit from increased levels of taxation; the only possible salvation from a cheap swindler's trick is the possibility of saving money given the insurance exchange prices for insurance. That depends crucially on actual facts at the time--we have no future facts, just projections and models that I, personally, don't have much faith in simply because pretty much every model that's been tested by comparing projections with outcomes has failed. Sometimes spectacularly. (We maintain that those that haven't been tested are, however, 100% accurate. This strikes me as requiring a kind of religious fervor that I lack.)

But I digress. I said I can't reconcile two numbers and then went off on a tangent after saying one number. Here's the second number.

"$600. Average annual penalty paid by those who decline the tax credit and do not purchase insurance."

I can't square the $1,077 penalty per household not paid with the $600 penalty per household that will be paid. I assume it's mixed up with the "premium tax credit" blather that, perhaps, one day I'll understand.

Now, the $600 figure has no date. Rather makes me wonder if perhaps the $600 isn't the first year's tax, given Congress-stipulated assumptions, while the 2016 number is in year 3 after the penalty's ramped up.

There will be substantive tax credits. How, exactly, to implement them is a mystery. But the only true tax credits--tax credits granted to at least partially nullify a simultaneous tax increase--will be to those who can't afford to pay for insurance. That's not likely to be many in the "middle class."

In the absence of (R) governor's expanding Medicaid, either the amount of money going to lower-class tax credits is going to be very high (leading to trashing the original rosey budget projections) or there are going to be a lot of uninsured poor people while those making more get health-insurance tax credits.

Number23

(24,544 posts)derby378

(30,252 posts)At least, that's what they're telling me. Both of them are now on Medicare and are under the belief that their premiums are going up as a result of Obamacare. Is this just more FOX News bullshit?

Moosepoop

(1,920 posts)Unless your parents are in the top 2% of Medicare beneficiaries in income, it's just more FOX News bullshit.