General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsTaxing wealth is the next logical step

That way the wealthy who are sitting on the sidelines with trillions of dollars will have two choices. Invest it in creating jobs themselves or give it to the government so they can invest it to hire new workers and retain the ones we already have and pay them a fair days pay for a fair days work.

Turns into use it or lose it.

There is how to get some investment going.

Don

Taverner

(55,476 posts)MrSlayer

(22,143 posts)Sure, it is the logical thing to do but the House majority passed the Ryan Budget which does the opposite. Which do you think is more likely to happen in reality?

PufPuf23

(8,787 posts)TBMASE

(769 posts)when you have Capital Gains, it's usually on the sale of an asset that has appreciated from its original value, that money is usually invested somewhere else.

Unless we're going to take homes and other assets I wouldn't expect this to be a plan that's realistic

Comrade_McKenzie

(2,526 posts)There should never be 2 for 1, when there's even one instance of none for 1.

TBMASE

(769 posts)it's a one time thing when you take homes other assets, there is no going back and taking more once it's gone

they'll move their cash overseas to protect it

Zalatix

(8,994 posts)TBMASE

(769 posts)NNN0LHI

(67,190 posts)Obama says companies have nearly $2 trillion sitting on their balance sheets

In an address to the Chamber of Commerce in Washington, D.C., on Feb. 7, 2011, President Barack Obama implored business owners to start investing and hiring. And, he said, they've got plenty of cash on hand to do it.

"So if I’ve got one message, my message is now is the time to invest in America," Obama said. "...Today, American companies have nearly $2 trillion sitting on their balance sheets. And I know that many of you have told me that you’re waiting for demand to rise before you get off the sidelines and expand, and that with millions of Americans out of work, demand has risen more slowly than any of us would like. snip

We asked the White House press office where Obama got the statistic, and they pointed us to a Dec. 10, 2010, story in the Wall Street Journal, which ran under the headline, "Companies Cling to Cash."

"Corporate America's cash pile has hit its highest level in half a century," wrote Justin Lahart.

"Rather than pouring their money into building plants or hiring workers, nonfinancial companies in the U.S. were sitting on $1.93 trillion in cash and other liquid assets at the end of September, up from $1.8 trillion at the end of June, the Federal Reserve said Thursday. Cash accounted for 7.4 percent of the companies' total assets — the largest share since 1959.

TBMASE

(769 posts)NNN0LHI

(67,190 posts)It is the businesses choice.

Don

TBMASE

(769 posts)or future obligations.

Many businesses sit on cash when the economy is slower so they're not desperate for cash, relying on receivables when the bills come due. If you've got 10 million in cash but a 1 million dollar payroll to meet every month, it's not really that outrageous

Response to TBMASE (Reply #10)

HangOnKids This message was self-deleted by its author.

TBMASE

(769 posts)and think when people start talking about the confiscation of legally owned and earned property by the government because they don't spend their money in a way that satisfies the government is wrong?

I'm pretty sure there's an amendment to the constitution that prevents this sort of thing

coalition_unwilling

(14,180 posts)quash any constitutional quibbles you might have.

TBMASE

(769 posts)He's not talking about a tax, he's talking about seizure of property if it's not spent or used the way the government wants it spent or used.

if it were a tax, I'd have no issue with it at all. Raise the rates.

coalition_unwilling

(14,180 posts)expropriation of wealth is the same thing as a tax or can be construed as such. AKA "Wealth tax"

TBMASE

(769 posts)That way the wealthy who are sitting on the sidelines with trillions of dollars will have two choices. Invest it in creating jobs themselves or give it to the government so they can invest it to hire new workers and retain the ones we already have and pay them a fair days pay for a fair days work.

Turns into use it or lose it.

There is how to get some investment going

coalition_unwilling

(14,180 posts)has been around for over 50 years in one form or another (although, since Reagan, it has fallen out of popularity).

I'm not sure I understand why you so vehemently oppose it - economists generally concern themselves with incentives and a wealth tax, generally speaking, incentivizes savers to consume.

TBMASE

(769 posts)if the incentive is spend the money in the way the government demands or the government will seize the money, that's an issue no one should stand for.

Just because you call it a tax, it doesn't make it so

Blanks

(4,835 posts)The supreme court allowed the taking of real property where it was for the good of the community. Real property has more intrinsic value than money.

The 'money' probably exists electronically anyway (I doubt that they have huge vaults holding all of it in cash). Wouldn't it be fun to just 'disappear' it. Like so many working class retirements have done.

TBMASE

(769 posts)and their "money" is probably kept in a bank account

muriel_volestrangler

(101,321 posts)It's clear it's a tax. That's what the OP says; that's what is used in some other countries - for instance, France has a wealth tax of 0.25% above €1.3m, and 0.5% above €3m.

TBMASE

(769 posts)"Invest it in creating jobs themselves or give it to the government so they can invest it to hire new workers and retain the ones we already have and pay them a fair days pay for a fair days work.

Turns into use it or lose it. "

muriel_volestrangler

(101,321 posts)If you think the OP was actually saying "seize all savings", then you're living in a different reality.

So, why are you consistently pushing a right wing line these past few days? You haven't answered anyone who's asked you that, yet.

TBMASE

(769 posts)"Invest it in creating jobs themselves or give it to the government"

is it going to be voluntary, that "Use or Lose"?

And I didn't know it was RW to oppose having the government take property because people don't use it the way the government wants it to be used. Now, I realize the eminent domain clause but the 5th amendment requires the government to reimburse the owner for what's taken.

Blanks

(4,835 posts)About the size of a dime, print $100,000 on them and require persons with an amount in excess of that in the bank to redeem the cash for these gold coins.

Didn't they do the opposite in WWII?

How's that for compensation?

Instead of e pluribus unum; it could have the Latin equivalent of 'life's not fair'. And a Ronald Reagan bust.

Everyone wins.

TBMASE

(769 posts)to be reimbursed with gold. The appreciation would be more than adequate to cover their cash and they could still liquidate it.

Blanks

(4,835 posts)But if they think a tiny gold coin is worth more than $100,000. They probably don't deserve to keep the money anyway.

TBMASE

(769 posts)The value of a Government Minted gold coin would exceed the dollar value of the actual value of the gold itself.

Blanks

(4,835 posts)muriel_volestrangler

(101,321 posts)and yes, it is right wing to characterize taxation as 'seizure'. Just look around the internet for all the RW loons who say it. You seem happy to repeat what they say. It obviously has nothing to do with eminent domain or the 5th amendment

BECAUSE IT'S A TAX

though bringing the 5th amendment into it is another 'tell' for a right winger, just like moaning about the 'Maryland taxes driving away rich people' when it's an anti-tax pressure group that told you that.

TBMASE

(769 posts)and Spend the money or give it to the government is a tax

And how is citing the 5th amendment RW?

I cited a CNBC article, the fact that THEY relied on a report from an anti tax group is not my issue, it's yours. And, it seems your only rebuttal to their report is to say that its done by an anti tax group. The Washington Post cited the same study in their reporting too

muriel_volestrangler

(101,321 posts)and the words in the title

[font color="red" size="48"]Taxing wealth[/font]

are the clue that it's a tax, since your sight seems to be failing you. Claiming that federal taxes break the 5th amendment is indeed far right wing - eg

http://www.adl.org/learn/ext_us/TPM.asp?xpicked=4&item=21

You have proved my point; the anti-tax group is the author of the claims, not CNBC or the WP. I pointed out that CNBC also quoted people saying the report was rubbish, but you have chosen to ignore that and go with the right wing talking points. It's your right wing claim, your right wing report, your right wing issue, your right wing problem, and your right wing talking points.

TBMASE

(769 posts)Although that "slogan" actually means USE your leave or LOSE your leave.

Zalatix

(8,994 posts)FDR taxed corporations for sitting on their money. It worked, big time.

Income taxes, capital gains taxes, financial transaction taxes and property taxes are all legitimate and long-standing methods of taxation, and you're essentially calling that confiscation.

There's something wrong here with your logic and I think you can figure it out.

TBMASE

(769 posts)if the government told you it was illegal to save your cash, would you support it?

awoke_in_2003

(34,582 posts)HangOnKids

(4,291 posts)Response to HangOnKids (Reply #11)

mainer This message was self-deleted by its author.

Kingofalldems

(38,458 posts)Because I'm against seizure of private property by the government when said property has been legally earned?

Or is it because I believe the 5th amendment affords protection from government seizure of property without compensation?

lastlib

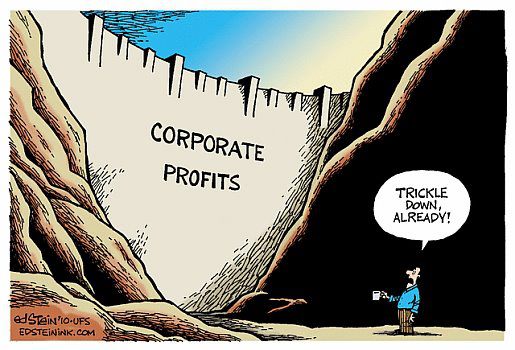

(23,244 posts)This is more like what's happening in today's economy.

TBMASE

(769 posts)and that IS what's happening in today's economy.

But seizing that cash, if it's not spent the way the OP says, isn't going to help anyone in the long run. Corporations will lose the cash, the government gets a one time inflow of cash to pay people for a few years

ErikJ

(6,335 posts)

TBMASE

(769 posts)we have an accrual system in the US. Revenue isn't cash, expenses aren't cash and profit isn't cash

Waltons_Mtn

(345 posts)If so and if hording is some type of mental problem/disability, could we take these corporations to court and have them declared mentally unfit? Remember "corporations are people too my friend".

socialist_n_TN

(11,481 posts)Might work too. Hoarding that much newspaper is DEFINITELY a mental illness.

Of course, I've always liked the idea of eminent domain. Payable with bonds that can't be redeemed for 100 years. And can only be redeemed by individual it's paid to, no proxies or descendents.

AnotherMcIntosh

(11,064 posts)If that is not enough, nationalize the banks and the energy companies.

Initech

(100,080 posts)Churches rake in billions and it's essentially free money. It should be way past time for the IRS to end the free ride. If they want to preach politics - they pay. End of story.

Igel

(35,320 posts)While you're at it.

Nobody really *needs* a Harvard and its preachiness. Or Johns Hopkins.

Or even things like Greenpeace or Sierra Club or the Nature Conservancy. They just take in contributions and it's essentially free money.

Initech

(100,080 posts)Those organizations don't preach politics the way our religious organizations do. I'd suggest reading this: http://www.msnbc.msn.com/id/47907630/ns/politics/t/churches-get-political-us-irs-stays-quiet/

Lucky Luciano

(11,257 posts)Response to Lucky Luciano (Reply #32)

HangOnKids This message was self-deleted by its author.

Lucky Luciano

(11,257 posts)Johonny

(20,851 posts)muriel_volestrangler

(101,321 posts)France is about to expand the amount taken:

The taxes include a wealth tax on the rich and higher taxes on dividends as well as oil companies. Taxes exemption on overtime will be scrapped and higher taxes on stock options will be imposed.

Those with fortunes over 1.3 million Euros will be hardest hit as the government has brought down the wealth tax threshold as well as tightened the inheritance tax laws. In addition, financial transaction tax will be raised to 0.2%, according to the amended budget proposed by the Socialist government.

http://www.egovmonitor.com/node/52096

mainer

(12,022 posts)In the US, with its poor safety net, if you have a miliion dollars and live 30 years beyond retirement, you'd have about $40,000 a year to live on until death. That is not exactly living high on the hog.

muriel_volestrangler

(101,321 posts)This web page says:

http://france.angloinfo.com/money/general-taxes/wealth-tax/

Wikipedia says "In principle all assets are taken into account except for the following: ... capital value of pensions and retirement plans", but doesn't give a source for that.

On edit: I'm not sure 'gut' would be the right word, either. 0.25% on wealth of €1.5m is €3,750 per year. It's something, but unlikely to force them to sell major assets.

Junkdrawer

(27,993 posts)My 2 cents....

http://www.democraticunderground.com/1002926874

Starry Messenger

(32,342 posts)lastlib

(23,244 posts)Beats the livin' hell outa taxing poverty--the GOP strategery (I wonder whut genius thought that idea up? Oh--Cantor/Ryan. 'Nuff said....)

on point

(2,506 posts)BY allowing capital accumulation at the top has created asset price inflation and has reduced liquidity for the majority of the economy causing it to stall at all other levels.

So the top is producing nothing, but is starving the rest of the economy.

Flatulo

(5,005 posts)Heck, medical device maker Boston Scientific moved a whole $2.5b division to China, lock stock and barrel to avoid a measly 2.5% tax on medical devices. Workers, managers, factory - all gone.

As it is, major corporations are now looking at China as a market that's 10x bigger than the US market. Never mind the cheap labor, thats where the customers are.

What's going to stop them? US sales will soon be insignificant compared to Asian markets.

AnotherMcIntosh

(11,064 posts)"medical device maker"?

Then, they rely upon patents.

At a minimum, declare the patents held or used by corporate ex-patriots as void. Then let them see how well China respects their former patents.

Flatulo

(5,005 posts)stolen before they even unpack.

Zalatix

(8,994 posts)Igel

(35,320 posts)And judging by the vitriol here, it would be no better.

It would probably either end with another NEP, to save the butts of those manufacturing lots of vitriol and not much else; or, if they held to their ideology, Zimbabwe.

What people have to remember is that the Soviet citizens and even the Chinese citizens largely held to the politically correct line because they believed. All that sacrifice, all the crappy living conditions, where even for the poor it wasn't all that much better after a few years of Revolution, where the farmers were left to starve because the party bosses' political base was urban and workers, depended crucially on belief--and on having benefits flow to them because of belief. (Lest we think that ideology drove them: No, they wanted stuff and hoped for more stuff. Soviet soul-engineering wasn't nearly as good as their nuclear engineering.) Only later, when belief wasn't enough and nearly 100% compliance was needed did it turn to terror--and then boredom before collapse.

Boredom and collapse are what China and Vietnam are trying to avoid, as Lukashenka (with that Belorusian /a/ just to annoy him in absentia) has kept up low-key terror. Pol Pot didn't get much belief and went straight to terror. Zimbabwe's in terror. Chavez still has belief on his side, while most Cubans are simply bored but things aren't so bad as to necessitate collapse.

Maybe it would be like Russia or Zimbabwe. But rather than compare the US to poor, pre industrial countries you might look for examples of labor assuming political dominance in wealthy modern nations. So maybe it would be more like Norway (which has a wealth tax).

Hippo_Tron

(25,453 posts)Honeycombe8

(37,648 posts)The tax rates for the wealthy are too low, for sure, and should go back to where they were in the '90s, at least.

But taxing someone specifically for saving money instead of spending it how the govt thinks you should? That goes too far. That's like a dictator seizing property for himself or the state.

Response to Honeycombe8 (Reply #41)

HangOnKids This message was self-deleted by its author.

TBMASE

(769 posts)I'll bet you think profits are cash and that billionares are just sitting on a ton of cash like Scrooge McDuck instead of having their money in another form like property or stocks

Zalatix

(8,994 posts)taxes on financial transactions... however their wealth manifests, we can tax it.

TBMASE

(769 posts)Capital Gains are recognized at the time of sale.

The OP is suggesting we TAKE their wealth unless it is spent the way the government wants it spent, specifically Cash

Zalatix

(8,994 posts)Plus corporations TEND to (read: I can't imagine when they don't) get interest on their money sitting in a bank. That is taxable, too.

TBMASE

(769 posts)just as individuals are taxed on interest. The OP says:

"Invest it in creating jobs themselves or give it to the government"

Now, if it were voluntary that's one thing but the OP goes on to say

"It becomes Use or Lose"

Lose it how?

Response to TBMASE (Reply #47)

HangOnKids This message was self-deleted by its author.

TBMASE

(769 posts)it won't change your ignorance.

Response to TBMASE (Reply #109)

HangOnKids This message was self-deleted by its author.

TBMASE

(769 posts)about the subject.

Like I said, you probably think profits are cash and that billionaires are just sitting on piles of cash

Zalatix

(8,994 posts)Companies Shun Investment, Hoard Cash

Corporations have a higher share of cash on their balance sheets than at any time in nearly half a century, as businesses build up buffers rather than invest in new plants or hiring.

Nonfinancial companies held more than $2 trillion in cash and other liquid assets at the end of June, the Federal Reserve reported Friday, up more than $88 billion from the end of March. Cash accounted for 7.1% of all company assets, everything from buildings to bonds, the highest level since 1963.

You were saying?

mainer

(12,022 posts)I assume you'll be next. She likes to call people childish names and then runs and hides because she doesn't want to deal with the blowback. I have a feeling this is not an adult.

TBMASE

(769 posts)Prophet 451

(9,796 posts)I think that a properly progressive income tax system would work better. And yes, there should be incentives to create jobs.

kentuck

(111,102 posts)We can either give all the wealth to the few at the top or...

We can tax them and spread out the wealth for the benefit of the rest of society.

Basically, that is the bottom line.

All the other arguments about "job creators', tax fairness, government control of business, etc, are nothing more than peripheral issues that distort the reality.

mainer

(12,022 posts)Would someone who's saved up a million dollars be wealthy? Someone who's put away 5 million? Will savers be penalized while spendthrifts get away scot free?

My dad (a mere restaurant cook) never spent a thing, lived in the same house for 50 years, and saved close to a million by the time he died. Would his wealth be confiscated?

And if you start taxing savings of those who are careful with a penny (yes it's true, the thrifty CAN save enough to be a millionaire over time) will you keep taxing and taxing until they become un-wealthy and then have to struggle?

cherokeeprogressive

(24,853 posts)Kill them, make sure their kids are strippped of all inheritance and make sure alll their property goes to the state.

All better.

Response to mainer (Reply #49)

HangOnKids This message was self-deleted by its author.

mainer

(12,022 posts)My dad the cook saved close to a million.

Many people from Asian cultures manage to do so.

Save every penny. Bring your lunch to work. Drive your car until it falls apart. Buy a Timex, not a Rolex. Make your own clothes. Buy land and hold onto it. Send your kids to college. Work 16-hour days.

Forget Starbucks; Folgers will do.

Those were my dad's practices. He never took a vacation, never flew anywhere, changed the oil in his own car, didn't smoke, didn't fritter away money. Ask a number of older generation folks, especially those from New England, and you'll find that they have managed to sock away good retirements.

It's not bootstraps; it's sheer stubborn Yankee thrift.

Response to mainer (Reply #105)

HangOnKids This message was self-deleted by its author.

mainer

(12,022 posts)And what are you, a racist? Unable to comprehend that another culture might view savings differently than you do?

A little education is in order:

"Given the higher amount in retirement savings by Asian Americans, it should be no surprise that Asian Americans also contribute more to retirement accounts, 10.3% of a paycheck on average (versus 8.4% in the general population), and $324 on average per paycheck (versus $220 in the general population). Even with the higher contribution to retirement savings, Asian Americans also save more in general with 69% having savings outside of retirement plans (compared with 58% of the general population).

When it comes to routine savings and expenses, its generally considered a good idea to have an emergency cash reserve (90% of Asian Americans say they have one, versus 81% of the general population), and even better if that reserve can cover 6 months of living expenses (51% of Asian Americans have 6 months of reserve versus 32% of the overall population).

When it comes to debt, Asian Americans seem to manage it better than other groups. Only 15% of Asian Americans have student loan debt (compared to 25% overall), 23% of Asian Americans have a car loan (compared to 44% overall). Asian Americans use credit cards more (96% versus 91%), but have better control of them with 35% carrying debt on credit cards, versus 40% overall, and more likely to pay off credit cards in full every month (75% versus 50% overall)."

http://www.8asians.com/2012/02/09/asian-americans-have-mixed-results-in-retirement-study/

You call me shit. I answer with numbers. It's all I can do.

Response to mainer (Reply #107)

Post removed

mainer

(12,022 posts)but it's not OK to call them a clueless kid? You hid TBMASE's post because of THAT?

I think someone threw a few too many nasty grenades and now is whining because those grenades exploded in her face.

Response to mainer (Reply #118)

HangOnKids This message was self-deleted by its author.

TBMASE

(769 posts)Mutual funds paying off one's house putting the extra cash away in investments that grow over time.

Yes, the thrifty CAN save enough to be a millionare over time.

mainer

(12,022 posts)As soon as I could, I paid off my mortgage.

No new cars. No new clothes. No new nothing. First, pay off the mortgage.

No matter what the economy does, a bank can never foreclose on you.

Americans are too quick to take on debt for stupid reasons, and that has been the downfall of many.

unblock

(52,253 posts)economists don't like transaction taxes because they distort the "true" market, leading to misallocations of goods and services. this is the downside of taxes if you care about resource allocation. the income tax discourages income-generating activities, and worse, because different types of earnings are taxed at different rates it encourages unproductive activities such as disguising labor income as investment income, etc.

a wealth tax punishes mostly hoarding, and encourages idle resources to be put into production, so true capitalist economists love this sort of tax. the classic argument is the art collection benefitting no one but the owner -- a tax would encourage the owner to put the exhibit on display (if only to pay the tax bill) thus benefitting more people.

and liberals prefer the income tax only because it's more progressive than most other taxes. well, a wealth tax is likely to be quite progressive, possibly even more progressive than the income tax.

one practical problem with the wealth tax, though, is that it can be much easier to hide wealth than income. income taxes two, and you at least often have to worry about your counterparty reporting their loss or expense. wealth, on the other hand, can be concealed or can be claimed to have been destroyed or damaged.

reformist2

(9,841 posts)What's especially nice about this tax is that it would raises more from the rich than the current income tax, while being a flat tax just like the rich claim to want so badly!

slackmaster

(60,567 posts)Because they will never allow any kind of wealth confiscation as long as they are in power.

AngryAmish

(25,704 posts)/ says it every time someone mentions a wealth tax, still get wealth tax threads

/ can we move on to olive garden or circumcision next

slackmaster

(60,567 posts)But a tax on circumcision would be seen as an attack on religion.

muriel_volestrangler

(101,321 posts)Or are you saying that it would be OK for local government to impose, like property taxes, but not for the federal government - in which case, why?

AngryAmish

(25,704 posts)Also when the constitution was written property taxes have been part of English common law and American common law for centuries. If the framers had intended to make property taxes illegal they would have written it into the Constitution. None of this is controversial in mainstream American constitutional jurisprudence. You learn it the first semester of law school.

muriel_volestrangler

(101,321 posts)by a similar argument. You are taxing it. This would not insist that 1% (or however much) of a stockholding is handed over; it would value the person's wealth (including property) and tax that amount. The person would meet that tax bill with cash.

mainer

(12,022 posts)because you bought it a zillion years ago, how are you going to suck blood from a retiree?

muriel_volestrangler

(101,321 posts)you send them a bill, and let them decide how to pay it.

If they find that they own a million dollar house, but no other assets, and their income isn't enough to cover the wealth tax (a) they might sell up and move to an affordable house (b) you may have set the threshold too low.

mainer

(12,022 posts)and make them move into apartments. That's a real liberal value for you.

Many older people have homes they bought for a pittance, which have grown in value. Sometimes the value is ridiculous, but they DON'T WANT TO LEAVE, just so YOU can get the money out of them and redistribute it.

reformist2

(9,841 posts)Still got a problem with the wealth tax, Mr. Moneybags?

mainer

(12,022 posts)And I do have a problem with a wealth tax because it's based on income that was ALREADY TAXED when it was earned. OK, so you're going to say that $100,000 is considered "wealthy" and should be taxed. Think about it. Let's say I'm a retiree, and I've got $100,000 saved up. I have a life expectancy of around 85. Which means I have the next 20 years to live on $100,000. At today's interest rates, it really only adds up to about $25,000 of income for the rest of my life. Excluding any emergencies. You call that WEALTHY? And you want to confiscate that pittance of an asset, the whole nest egg I've saved up over a lifetime of working? Money that I have earned, that wasn't accrued through anyone's labors but my own?

Try that on America. See what they think.

Answer me. Really. Look me in the face and tell me that, at my age, with a lifetime savings, you are going to take that from me and distribute it ... where? Into YOUR pocket, because you haven't been as prudent and you want to take my earnings from me?

I'm waiting for your answer. And dare you to call me MR. MONEYBAGS again.

slackmaster

(60,567 posts)If you don't like paying property tax, you can always move your property somewhere else.

muriel_volestrangler

(101,321 posts)You must have noticed that there's a bit of a shortfall in government revenue, even after cuts in government spending. Everyone's talking about it.

If you don't like paying a wealth tax, you could move to another country and give up your American citizenship. Just like people do who think American income tax rates are too high.

Junkdrawer

(27,993 posts)Necessary none the less.

Overseas

(12,121 posts)Top tax rates were much much higher for most of our history. And instead of giving it all to the government, business owners decided to invest in their businesses and hire more workers. And the government got enough to maintain our infrastructure and fund vital social safety nets.

We followed Demand Side Economics-- if the middle class earns more money and the poor have safety net funding, they spend more money buying the products made by our businesses and everyone did better.

In the 80's Grandpa Reagan ushered in Supply Side Economics-- give it all to the rich and it will "Trickle Down" to the rest of us. That is when the choice for the rich became-- Invest in America or stash the cash offshore and keep it all for yourself and your immediate family.

Just to be sure the rich got as much as possible, Reagan set about union busting, so the producers of the goods, the workers, couldn't fight against the rich getting it all.

Where we are now is the result of abandoning Demand Side in favor of Supply Side Economics. We have been doing Trickle Down for 30 years. How is that working for us?

http://www.businessinsider.com/plutocracy-reborn

SlimJimmy

(3,180 posts)NNN0LHI

(67,190 posts)Want to know what those new workers did soon after they were hired?

They went out and purchased cars, houses, furniture and appliances with the money from the new job they had.

Know what they would have been purchasing without that new job?

Nothing.

See how it works?

This is really not rocket science if someone gives it just a little bit of thought.

This is about as basic as it gets.

Don

SlimJimmy

(3,180 posts)things? That doesn't pass the common sense test. They hired 200 workers a day because they had a need to hire those workers.

A company hires new workers when they have the sales to support the new hiring. If I make widgets and the market for widgets has dropped 20% over the past year, then I have no need for new workers. Hiring workers in the hope that they will spend money is a fool's errand and a horrible business decision. It's not rocket science if someone gives it just a little bit of thought. That's about as basic as it gets.

mainer

(12,022 posts)My income has already been taxed once. I am self-employed, so I've also had to pay self-employment taxes over the years. And no, I don't work as a banker, I don't exploit my workers (unless you call my own long hours at the job self-exploitation) and I produce a product that actually gets exported and brings money INTO the U.S. I don't trust any safety net to protect my retirement, so I have been faithfully saving for decades, in secure investments such as municipal bonds and CDs. I have accumulated enough to help my kids out with their college educations.

And now, because I've been scrupulous about saving and a careful investor, this OP would levy an extra tax on me, for no reason except that I've socked away enough for a comfortable retirement?

reformist2

(9,841 posts)Taxes are going to have to go up big time, and I think a small 2% flat tax on wealth is far preferable and less damaging to the economy than jacking up income taxes to 75% again.

mainer

(12,022 posts)Wealth, for many of us, is a result of careful savings. Those who save faithfully shouldn't be punished.

Taxing income makes taxation a dynamic process. When you're doing well, you pay more in taxes. When times are tough, your taxes fall. It adjusts for your stage in life.

Taxing wealth would more likely hit the elderly harder.

PETRUS

(3,678 posts)People who advocate for a wealth tax generally suggest a progressive approach exempting holdings below a certain amount (and that is set at a very high threshold). Also, the rates proposed are lower than typical returns. That is, even with a wealth tax people's savings continue to grow, the rate of accumulation is just slowed a bit as the amounts get higher.

mainer

(12,022 posts)but the OP is talking about confiscation and redistribution.

And if you include real estate as part of the taxed wealth, you are going to be sucking blood from people who are house-rich and cash-poor.

I say this because I do have savings, and part of what I've done is bought farmland to grow food for my own family's use. That farmland doesn't bring in any income, but it is worth money -- and if I were to be taxed on it, I'd have to sell it. Right now it's taxed at an affordable agricultural rate, because I have no plans to develop it. I can see older people on fixed incomes forced to sell their water-front homes that they've owned for decades, because those homes have accrued value through all those years.

Junkdrawer

(27,993 posts)You see, I understand just how radical taxing wealth is. I read John Locke in college too.

I also think it's necessary of we want a REAL democracy again.

mainer

(12,022 posts)Don, you've had some great threads. For the most part, I've agreed with you.

But sometimes, DUers have topics that totally drive me off the cliff.

I am totally a social liberal. Gay rights, atheism, freedom of the press, I'm there.

Obama, I'm there.

Higher taxes, I'm there.

But then we get to wealth confiscation and I'm thinking: who ARE you people? Why do you want to take my hard-earned money, earned through no trick of banking or fiscal manipulations, money that I earned through my own talents and hard work and years of acquired skills? Money that I didn't spend on jewelry or fancy clothes or cars, money that I saved because at heart I'm a cheap Yankee? Money that I earned because I got an advanced degree, despite the fact I'm the daughter of an immigrant and a father with a blue collar job?

Why do you think I should be taxed on my savings?

You have this idea that anyone who's successful must have gamed the system. Let me tell you, some of us played by the rules. Many of us are Democrats. Many of us are happy to pay our taxes. I have, for the past decade, paid the maximum income tax rate and was happy to do so. I've contributed to every liberal cause.

But then I come across people on this thread who say they want to take my retirement savings because it happens to add up to more than THEIRS, and that seems to be the only reason why they say so.

And they call me Mr. Moneybags because I protest. They want my farmland confiscated. They denigrate my years of labor as something that was due to, I don't know ... pure luck? The fact they assume I'm a white male? (When I'm neither male nor white.)

These are the things that really confound me on DU. Because I thought DU wasn't about confiscation.

Yet it seems it is.

NNN0LHI

(67,190 posts)Myself and many others only have one form of wealth. Our homes. That is all we have.

Yet we are taxed on that single form of wealth every single year. When the value of our homes go up the property taxes increase. When the value of our homes goes down our property taxes still increase.

And people like me have been paying this type of tax on our only form of wealth every single year for decades. And it will never end.

And at the same time our property taxes have been increasing our incomes have been dropping. This is becoming an unmanageable problem for many of us.

Then I read that some firefighters pay has been cut to minimum wage and I realize this is not right and is unacceptable.

Then I see people posting here every day that people like me should have their property taxes raised to help out with these kinds of financial shortfalls. And when that happens I never see anyone begin talking about confiscation of wealth. They just call it a tax and no one gets heartburn when that is suggested.

I once balked here at DU about my property taxes going up so much and you want to know what kind of response I got? Someone posted, "Sell your house and your problem is over."

Nice, huh?

So why is it alright to tax my only form of wealth but not other peoples forms of wealth? Can you explain that?

Hope I answered your question clearly enough.

Take care and see you later.

Don

mainer

(12,022 posts)And that's why I think taxes should be based on INCOME. Property is sometimes the only wealth you have, and if one has no income, you are reduced to selling your property to pay the taxes.

So if you're going to go with a wealth tax -- which would include the value of your home -- then you are hurting retirees, people on fixed incomes, and people with no incoming cash.

That's where a wealth tax -- which means all assets -- gets you into trouble.

If you were to tax income (and by this, I include capital gains) then I would be in support. But a WEALTH TAX would affect you, me, and everyone who has put their savings into their homes.

NNN0LHI

(67,190 posts)PETRUS

(3,678 posts)And the rate above that is progressive, starting at .5% and topping out at 2%? For example...

By the way, I don't necessarily agree with the following opinion, but I once heard an economist suggest that wealth/property should be the main thing or even only thing we tax. (He also felt modest holdings should be exempt.) His argument was that such a policy would guarantee that major assets would be harnessed for the good of society, both in the sense that the tax would raise revenue for public services and also in the sense that anyone with significant property would have an incentive to put it to use (invest it if it's money, develop or farm it if it's land, etc.) to cover the tax. I'm not really on board with that, but it was an interesting thought.

mainer

(12,022 posts)and offers no stream of money with which the owner can pay taxes.

A good example is fallow farmland or forested land. The only way an owner could make significant money is to cut down the trees and sell the wood, or to sell the land to developers, or to turn it into house lots. Do we really want this to happen? Does every asset a person owns need to be income-producing to pay taxes?

I own farmland, of which only a small part is in orchards/garden plots. It earns no significant income. I pay pretty low taxes on it because it ISN'T developed. I keep it open it to the public for hiking and hunting. I love the fact it's undeveloped and beautiful. I don't WANT an incentive to screw up that land and turn it into a subdivision.

reformist2

(9,841 posts)So says Henry George.

"I don't WANT an incentive to screw up that land and turn it into a subdivision. "

Exactly. That's the first criticism that came to my mind. But again, with a high exemption it makes me think: How many people are sitting on $10+ million worth of non-income producing property that can't afford to pay a small tax? When the DeVos family and a couple dozen other extremely rich people mounted an attack on inheritance taxes one of the arguments that got a little traction with the public was the notion that people would lose family farms and businesses. But you know what? When challenged, they were not able to find a single example of this happening. Not one. Why? Because the exemptions are so high, they are designed to give all but the very richest a pass. A thoughtful tax regime would probably allow for conservation easements and so forth. A well designed policy could make your objections inapplicable.

yawnmaster

(2,812 posts)limpyhobbler

(8,244 posts)This should start right away.