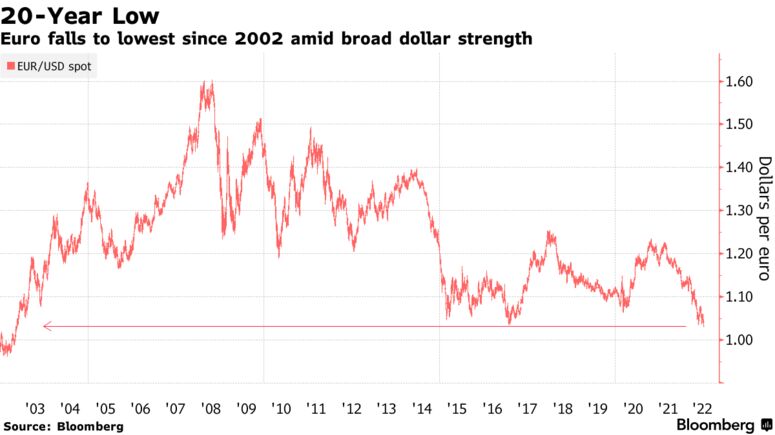

Euro Tumbles to 20-Year Low, Putting Parity With Dollar in Sight

Source: Bloomberg

The euro slid to the lowest level against the US dollar in two decades as investors grappled with the prospect of an energy crisis that risks tipping the region into a recession. The common currency fell as much as 1.8% to $1.0235, its weakest level since December 2002, weighed down by the threat of gas shortages that could disrupt industrial activity across the region if Russia cuts off supplies. Money-market traders trimmed ECB tightening bets against the darkening backdrop, widening the interest-rate differential with the Federal Reserve.

The fallout has hampered the ECB’s ability to raise rates as fast as the Fed despite record inflation, knocking around 10% off the euro’s value from a peak around $1.15 this year. There is now a 60% chance the common currency extends its slide to parity versus the dollar by year-end, up from 46% on Monday, according to Bloomberg’s options-pricing model. “Parity is just a matter of time,” said Neil Jones, head of FX sales to financial institutions at Mizuho. Strategists at HSBC Holdings Plc and Nomura International Plc also see the euro trading on par with the greenback this year.

Germany’s cabinet on Tuesday rushed through legislation allowing it to rescue struggling energy companies, in an effort to prevent the supply crunch from seeping into the broader economy. Russia, the region’s main supplier, has already cut flows to several European Union countries and curbed shipments along the main pipeline route to Germany, the bloc’s biggest economy.

“It is hard to find much positive to say about the EUR,” said Dominic Bunning, the head of European FX Research at HSBC. “There is also little support coming from higher yields.” Traders are betting the ECB will kick off their first tightening cycle in a decade later this month with a 25 basis-point increase, and deliver around 135 basis points this year. That’s down from more than 190 basis points almost three weeks ago. The Fed in contrast has already raised rates by 150 basis points, with markets pricing in an 80% chance of a 75-basis-point hike at their July meeting.

Read more: https://www.bloomberg.com/news/articles/2022-07-05/euro-falls-to-lowest-since-2002-against-the-us-dollar

progree

(10,908 posts)EDF is Electricite de France, the mostly government-owned company that produces most of its electricity and operates its nuclear plants.

https://www.msn.com/en-us/weather/topstories/edf-stock-falls-after-warning-its-nuclear-output-will-be-hit-by-drought/ar-AAZdDuI

(no paywall)

The news is a fresh blow not only to the company, which has already made repeated cuts to its output forecasts for this year due to other technical problems with its reactors, but also to the broader European economy, which is already struggling with sky-high energy costs, due to Russia reducing its natural gas shipments. That has forced countries such as Germany, the Netherlands and Austria to restart coal-fired power plants that had previously been mothballed due to environmental concerns.

French power prices have more than tripled this year and currently trade at just below their record of 403 euros a megawatt-hour.

Around half of EDF’s nuclear reactors are already currently down for planned maintenance or repairs.

Since the topic is the Euro, I found the electric energy price of 403 euros a MWH interesting -- so at $1.02/Euro, that's $395/MWH which is 39.5 Cents/KWH. And that's just for the energy, which is at most 1/3 of the price of electricity (the other 2/3 is capital costs, transmission & distribution, admin and so on). Compare to average U.S. residential rate (which includes everything) of 14.5 cents/KWH.

Although that 39.5 cents/kwh might be the marginal cost of the next kwh, not what the whole kaboodle costs.

Anyway its sad that France, which is normally a steady reliable power producer, is having difficulties.

https://www.msn.com/en-us/news/world/french-nuclear-power-crisis-frustrates-europe-s-push-to-quit-russian-energy/ar-AAYBHki

(it's via MSN so no paywall)

... But the industry has tumbled into an unprecedented power crisis as EDF confronts troubles ranging from the mysterious emergence of stress corrosion inside nuclear plants to a hotter climate that is making it harder to cool the aging reactors.

The outages at EDF, Europe’s biggest electricity exporter, have sent France’s nuclear power output tumbling to its lowest level in nearly 30 years,

The company warned last winter that it could no longer produce a steady nuclear power supply, as it struggled to catch up with a two-year backlog in required maintenance for dozens of aging reactors that was put off during coronavirus lockdowns.

Inspections unearthed alarming safety issues — especially corrosion and faulty welding seals on crucial systems used to cool a reactor’s radioactive core. That was the situation at the Chinon atomic plant, one of France’s oldest, which produces 6 percent of EDF’s nuclear power. EDF is now scouring all its nuclear facilities for such problems. A dozen reactors will stay disconnected for corrosion inspections or repairs that could take months or years. Another 16 remain offline for reviews and upgrades.

BumRushDaShow

(129,062 posts)I'm worried about the Hoover dam and Lake Meade myself and that is hydroelectric in the midst of a record drought. It is getting closer and closer to "dead pool" status, and might no longer be able to pump enough water to turn the turbines to generate electricity.

progree

(10,908 posts)From the first link in #1

https://www.cbsnews.com/news/po-river-italy-dries-up-exposes-1943-shipwreck-zibello/

... The resilience plan includes higher draining from Alpine lakes, less water for hydroelectric plants and rationing of water in the upstream regions.

Probably other areas in Europe hit worse from a hydropower standpoint.

BumRushDaShow

(129,062 posts)so that not only fuels more power usage but with drought patterns - dry begets dry - and it's hard to break that.

DFW

(54,399 posts)The Euro is already at $1.0185. If this keeps up, it will be at parity not by year-end, but more like this weekend!

BumRushDaShow

(129,062 posts)Am guessing they mean "sustained". We're about there with the Pound too.

(it's still remarkable)

DFW

(54,399 posts)I didn’t see the € dip below $1 yet, but if the trend continues, it will be days, not weeks.

BumRushDaShow

(129,062 posts)and not looking closely at the Y axis increments but agree that it might just hit there by Friday.

WTI oil price is down to $98.39/bbl last check, which is back to where it was in April/May (and I did hear about that continued drop on the radio not long ago).