Obama to Propose Eliminating Fannie Mae, Freddie Mac

Source: CBS News

Obama to propose eliminating Fannie Mae, Freddie Mac

August 06, 2013

As Arizona's housing industry slowly and disjointedly recovers from the massive hit it took after the 2008 bust, it provides the perfect setting for the overarching theme of President Obama's economic message this summer: The economy is recovering, but it's not recovering fast enough.

On Tuesday, Mr. Obama will deliver a speech in Phoenix to, as White House spokesman Jay Carney put it Monday, "lay out proposals for continuing to help responsible homeowners and those Americans who seek to own their homes."

Specifically, the president will lay out a proposal to overhaul the mortgage finance system and urge Congress to phase out Fannie Mae and Freddie Mac, which were bailed out by the government five years ago. In its place, Mr. Obama will propose shifting the bulk of the burden of backing mortgages to the private sector.

Read more: http://www.cbsnews.com/8301-250_162-57597105/obama-to-propose-eliminating-fannie-mae-freddie-mac

PoliticAverse

(26,366 posts)SunSeeker

(51,514 posts)From the article:

Under the bill, Washington-based Fannie Mae and McLean, Virginia-based Freddie Mac, which package mortgages into securities on which they guarantee 100 percent payment of principal and interest, would be liquidated within five years.

Because the bill would force banks to share the losses from bad mortgages, taxpayers will “know that in the future we won’t have a system where there’s private gains and public losses,” Corker said in the Bloomberg Television interview.

The bill calls for private financiers to hold equity capital of 10 percent of the principal of underlying securities to cover any first loss of the loans. Housing finance participants have been critical of that “first-loss” provision, as it is referred to in the bill, saying it is too big a change from the current system.

jtuck004

(15,882 posts)overtime to sell a lie about government, and it was remarkably effective, it appears. Even seems to have "the government" believing it.

Fannie Mae was solvent for 70 years, started in the Great Depression when the thieving bankers were visiting incredible pain on this country and our people. And it stayed solvent until Reagan, Clinton, and Bush made it possible for the banks to create the financial crisis we are in today. So now we are going to put the final nail in one more thing that FDR, who fought against the greedy hand of the money lenders for the people, put in place.

Worth knowing the facts, as if it makes a difference.

Headline:

Private sector loans, not Fannie or Freddie, triggered crisis

Read more here: http://www.mcclatchydc.com/2008/10/12/53802/private-sector-loans-not-fannie.html#storylink=cpy

WASHINGTON — As the economy worsens and Election Day approaches, a conservative campaign that blames the global financial crisis on a government push to make housing more affordable to lower-class Americans has taken off on talk radio and e-mail.

Commentators say that's what triggered the stock market meltdown and the freeze on credit. They've specifically targeted the mortgage finance giants Fannie Mae and Freddie Mac, which the federal government seized on Sept. 6, contending that lending to poor and minority Americans caused Fannie's and Freddie's financial problems.

Federal housing data reveal that the charges aren't true, and that the private sector, not the government or government-backed companies, was behind the soaring subprime lending at the core of the crisis.

...

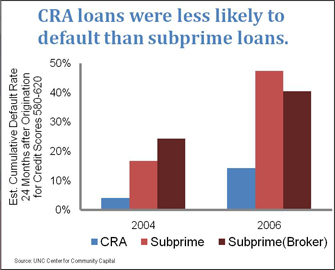

In a book on the sub-prime lending collapse published in June 2007, the late Federal Reserve Governor Ed Gramlich wrote that only one-third of all CRA loans had interest rates high enough to be considered sub-prime and that to the pleasant surprise of commercial banks there were low default rates. Banks that participated in CRA lending had found, he wrote, "that this new lending is good business."

Read more here: http://www.mcclatchydc.com/2008/10/12/53802/private-sector-loans-not-fannie.html#storylink=cpy

Not enough to fund the banks with, what was it on DU's front page a few days ago, $14 trillion so far? Now we are going to give it all up to the criminals that brought tragedy to 10 million families yanked out of their homes in foreclosure.

I think Barry Ritholtz, here, got so tired of ignorant people on the telly blaming F&F and the CRA for the crisis that he offered $10,000 cash to anyone who could back up their bullshit with facts. It was never claimed. Still available, I think

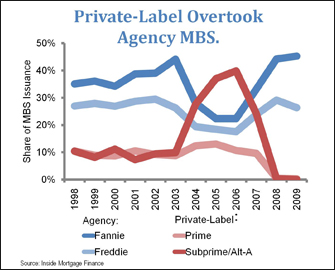

Here's a couple of charts from his site...

F&F were late to the game - it had already started tanking by the time they decided that they were missing the curve...but the Rethugs needed a financial Benghazi to beat the government over the head with...

Just when you thought we couldn't bend over any more...

btw, Ritholtz's book, "Bailout Nation, with New Post-Crisis Update: How Greed and Easy Money Corrupted Wall Street and Shook the World Economy Paperback", may be at your library, if you are in need of fact-based info. It's one of several, but good.

newfie11

(8,159 posts)jtuck004

(15,882 posts)they saw the profits and decided to go from making sure people had homes to making sure they were making more money.

But that can be fixed without handing good work to bad people. It's bad enough that home ownership is back down to 1996 levels, while we have added about 50 million people to the population since then. Our policies are funding banks and investors who are buying 70% of the homes out there now, and we are just turning our backs on the only savings vehicle many people can ever have.

We are becoming a rental nation to our master's and this will do nothing except help them.

Mnpaul

(3,655 posts)that bilked investors. The bogus mortgage securities ripped off many. Getting rid of Freddie, Fannie fixes nothing.

adirondacker

(2,921 posts)jwirr

(39,215 posts)interest rate for student loans administrated by the banksters was sky high. What exactly is going to keep the private sector from doing the same thing with housing? I am not an economist but this looks like closing down two government banks to hand a NEW subsidy to the other banksters. This does not necessarily help the housing sector IMO.

Excellent post.

Morganfleeman

(117 posts)the private sector triggered the crisis, the fact of the matter remains that Fannie Mae was grossly undercapitalized relative to its contingent liabilities.

Helen Borg

(3,963 posts)That is guaranteed.

Snarkoleptic

(5,997 posts)Berlum

(7,044 posts)

TBF

(32,012 posts)bowens43

(16,064 posts)this guy really is a fucking nightmare....

zeemike

(18,998 posts)The GOP has always wanted to, and now the dems must support Obama so it is a slam dunk.

SunSeeker

(51,514 posts)Per the Bloomberg article cited up the thread, the point is to get rid of a system with private gains but public losses.

The new system would be set up like the FDIC, with banks paying fees to insure mortgages and create a Market Access Fund, paid for by the fees, to maintain access to affordable housing, make grants to state housing agencies and conduct borrower counseling programs.

cstanleytech

(26,236 posts)understand why he wont because lets be honest here the truth is such a proposal stands a snowballs chance in hell of getting passed congress or the senate as to many of them (and by them I mean all of congress and the senate) tend to get money either from the banks themselves and or from the people from the banks.

AllTooEasy

(1,260 posts)Gee Wiz, this mindless, anti-Obama, defensive, knee jerk reaction to EVERYTHING has to stop. What a pathetic life!!! I thought people like this were only on the Right Wing Side of the political isle. Listen to the speech first, then judge, but don't go off hinge at a reporter's characterization of what Obama MIGHT say.

Fannie Mae has to change! Bush made that evident. I'm interested in HOW, not "OMG, HE'S CHANGING AN INFALLIBLE PROGRAM!"

Divernan

(15,480 posts)Yes, folks! The American dream of owning your own home is still alive! Chelsea and Marc just

purchased a $10.5 million "home" with 6 bathrooms for 2 adults.

http://www.dailymail.co.uk/news/article-2346656/Chelsea-Clinton-husband-marital-home-market-4-5m-dollars-settle-life-bigger-condo-bought-recently-10-5m-dollars.html

Their new residence lays claim to being one of New York's longest apartments - stretching an entire block from 26th St. to 27th St. off Madison Avenue.

Described as 'a luxury fortress' with one full-time doorman to the horizontal building's four units, it takes almost 30 seconds to walk the 250-foot hallway, according to New York Daily News.

The four-bedroom, 5,000-square-foot apartment is located in The Whitman building next to Madison Square Park, one of the most desirable corners of Manhattan's Flatiron District. The building, which is being marketed by Douglas Elliman Real Estate, has one apartment on each floor and boasts various security features, including a key operated lift and a full time doorman for just four units.

The nearly 90-year-old building has just three $10million homes and one $22.5million duplex penthouse - so far two buyers are in contract, including Ms Clinton.

The couple will also enjoy two dishwashers, two washer/dryers, his and her maze-like closet spaces and commodes, as well as natural light flooding the female dressing room - with double-sided vanity mirrors.

'Wives eyes light up when they see the closets,' said Ms Lazenby, the daughter of James Bond actor George Lazenby.

'They smile and say they'll need more clothes to live here. Their husbands just shake their heads.

'The long apartment, located at 21 East 26th St enables 'one spouse to be fast asleep while the other has a huge dinner party. All on one floor,' she added.

One person who toured the building, which was built in 1924 by luxury textile manufacturer Clarence B. Whitman & Sons, joked that residents of The Whitman will have a longer walk to their kitchen than many New Yorkers have to the corner store.

http://www.nydailynews.com/life-style/real-estate/madison-sq-park-condo-attracts-big-names-chelsea-clinton-article-1.1324579

Myrina

(12,296 posts)I see millionaires' mansions on my drive in to work that a family of maybe 4 or 5 are living in, that are bigger than some of the apartment buildings just a few miles into the city which house probably close to 80 people.

I don't fucking understand humans anymore.

AngryOldDem

(14,061 posts)I was watching a show the other day and someone's house was described as being "as big as Japan." And this person is going to build a **bigger** house because the current one is "too small" for her four kids, all of whom are small kids. And this house will be built on prime land overlooking the Pacific.

I'm with you: ![]() Must be a variation of the old saw of "Why do you climb Mount Everest?" "Because it's there." "Why do you build/buy bigger and bigger places every six months? "Because I can, and I don't give a rat's ass about all the resources I'm wasting to do so."

Must be a variation of the old saw of "Why do you climb Mount Everest?" "Because it's there." "Why do you build/buy bigger and bigger places every six months? "Because I can, and I don't give a rat's ass about all the resources I'm wasting to do so."

Disgusting.

cstanleytech

(26,236 posts)What I do mind though is how low a tax the rich have right now and the trickle down is like during Reagans time not working yet again which is anyone really surprised? I mean the once they have their homes and their cars are the rich really going to be spending enough to that it trickles down to create more jobs? Hell no.

They will invest it in long term things like stocks and real estate so as to grow wealthier like any person with money would.

AngryOldDem

(14,061 posts)Despite even David Stockman himself saying it's a huge crock of shit.

Illusions in America die hard, I guess.

Divernan

(15,480 posts)OK, throw in a half bath for guests, and another one for the servants - that's 3 and a half. The phrases conspicuous consumption and unseemly come to mind.

Conspicuous consumption is a term introduced by the Norwegian-American economist and sociologist Thorstein Veblen in his book "The Theory of the Leisure Class" published in 1899. The term refers to consumers who buy expensive items to display wealth and income rather than to cover the real needs of the consumer. A flashy consumer uses such behavior to maintain or gain higher social status.

The result, according to Veblen, is a society characterized by wasted time and money.

I've always seen Republicans (composed of the wealthy and the wanna-be wealthy) as poster kids for conspicuous consumption. They value each other based upon possessions, not character. It's not a characteristic traditionally valued by Democrats or Democratic politicians.

Beacool

(30,247 posts)They are not asking for public funds to purchase their place. There are far wealthier residences in Manhattan.

![]()

Divernan

(15,480 posts)(1)Because some here promote the idea that she will go into politics also, so we need to take a close look at how she chooses to live her life.

(2) She has sought publicity, whether in exclusive interviews and glamour photo shoots for high end mags like Vanity Fair and Vogue or on this current highly photographed trip with her father.

But most significantly, because it's worth looking at where the money for this lavishly extravagant purchase came from. (And you're wrong if you think there are 30-something couples purchasing "far wealthier residences in Manhattan - but I'll get to that later.)

(3) The money to purchase this came from where? You say, not "public funds". I say that the vast wealth of this young couple stems from their jobs, their families or some combination thereof. And all of those link back to the connections made by their parents while holding public office, which offices were funded by we taxpayers. Marc's' jobs were at hedge fund 3G Capital & investment banking for Goldman Sachs. (Unlike many people fleeced by scams backed by Wall Street firms like Goldman Sachs, he likely did not use a balloon note to pay for the $4 million apt. he bought in 2008, or the more recent $10.5 Million place.)

Post Palo Alto,Chelsea opted to join a private international consulting firm, McKinsey and Company and then a hedge fund, specifically the Avenue Capital Group, big campaign donors for both her parents. These firms hire young people with connections - and this young couple definitely had blue chip family connections.

Marc's father was heir to a small supermarket chain fortune, but none of the 3 other in-laws were millionaires when they went into politics. They accumulated their wealth when they left office. (Marc's mother was a Congresswoman who is still talking about running for office again.) Marc's father, Edward, former congressman and head of Pennsylvania's Democratic party, lost millions and ended up penniless. He was convicted of fraud and served time in federal prison for shady business deals that had prosecutors calling him a "one-man crime wave." Prosecutors claimed that in 20 years of doing business between 1980 and 2000, every single deal he consummated displayed aspects of fraud. After his indictment in 2001, he pleaded guilty to 31 charges of bank fraud, mail fraud, and wire fraud. He tried to raise a defense of diminished capacity due to his suffering from bipolar disorder, but the judge disallowed it.

On Sept. 27,2002, he admitted that he bilked investors who handed over more than $10 million, including friends, law clients and even his late mother-in-law, and was sentenced to nearly 7 years in prison. Some tried to paint this as though he was the victim of scams. It started out that way, with him losing his own money - but then he kept doubling down and losing money of any one he could talk into "investing" with him. His rip-off of almost $10 million (ironic - there's that $10 million number agani!) got him seven years in ClubFed . He and his wife, Marc Mezvinsky's mother, eventually divorced. He reportedly is estranged from his son. http://congressionalbadboys.com/Mezvinsky.htm

Ed Mezvinsky got out of the federal lock-up in 2008. He remained on federal probation through 2011, and still owes $9.4 million in restitution to his victims. So safe to say the young couple got no financial help from him.

http://www.zoominfo.com/p/Edward-Mezvinsky/242942968

But getting back to parental connections stemming from holding elected offices, leading to very high paying first jobs, I'd call that "public funds" once removed.

I think one's choice of employment, especially when one is not faced with grabbing the first minimum wage job that comes along in order to survive, says a lot about one's character. And I think her recent move to pick up a master's in public health is a stragetgic move to improve her credentials for an eventual run for public office. She's not out working at some grotty public health office, "in the field" - she's doing occasional broadcasts for NBC. She is also teaching graduate level classes at Columbia - unprecedented for someone who does not have a Ph.D. to be teaching at the graduate level! Another boost to the resume and example of how she benefits from her parents' prestige/status.

"Hedge funds as they are now constituted were illegal from 1933 to 2000, as their type of activity was outlawed as it was considered as destabilizing speculation that helped cause the Great Depression. In the year 2000, Bill Clinton turned his back on 67 years of proven financial regulation and signed a bill legitimating speculation. Hillary was running for the U.S. Senate in the State of New York, Moloch's Big Town, and needed the big bucks from the free-booting financiers.

Hedge funds have been major financial backers of Democratic candidates ever since Bill Clinton made like Abe Lincoln, the Great Emancipator, and set them free. Chelsea's mother Hillary received mucho hedge fund loot during her 2008 bid for the Democratic Presidential nomination. Hedge fund managers hedge their bets, and they also heavily backed Barack Obama, who rewarded them with a watered down "financial reform" bill that left hedge funds unmolested and hedge fund mangers' incomes taxed at the lower capital gains tax rate.

(Do we all recall former Goldman Sachs trading desk honcho Rahm Emmanul became President Obama's chief of staff, whilst his Supreme Court nominee, Elena Kagan, worked as a paid "adviser" to the financial power house? Goldman Sachs is what J.P. Morgan and the House of Morgan and Paul Mellon and the Mellon Bank were to Republican Administrations in previous years, the marionette master who pulls the strings.)

Since it was Bill Clinton's "centrist" Democratic Leadership Council that sold the soul of the Democratic Party to Wall Street, it is fitting that Chelsea Clinton should be marrying the son of a convicted felon who works for the titan of Wall Street, a firm that engages in legal robbery. It recently got off easy from double dealing in the subprime mortgage market

It was recently revealed that Goldman Sachs, the poster child for Wall Street arrogance and cupidity, used some of its bail-out funds to finance overseas operations. Gobs of taxpayer-provided dollars were used to fund its bonus pools, making employees like Marc Mezvinsky very happy indeed. Wall Street perpetrated a massive fraud on America, made possible in part by Marc Mezvinsky's future father-in-law, but got away relatively scot-free, unlike his own father.

http://voices.yahoo.com/who-marc-mezvinsky-chelsea-clintons-husband-is-6490028.html?cat=49

Divernan

(15,480 posts)Poster Beacool asked me upthread: "Why did you choose Chelsea and Marc as an example? . . .There are far wealthier residences in Manhattan." I beg to differ that other 30-something couples are spending over $10 million on apartments, and below are the reports showing median prices tend to be about ONE TENTH OF THAT AMOUNT, i.e, from $750,000 to $1.26 million, depending upon what part of the City you're in, and even in the luxury apartments, i.e,. the top tenth of all sales by price, the median price is "only" $4.2 million.

http://www.bloomberg.com/news/2013-04-02/manhattan-apartment-prices-climb-as-buyers-compete.html

The median price of all co-ops and condominiums which changed hands in the 3 months through March 31, 2012 was $820,555.

On the Upper West side, the median price of condo resales climbed 20 percent to $1.26 million, while co-op resale prices rose 4 percent to $730,000, Corcoran said.

Prices declined on the Upper East Side, with the median for previously owned condos falling 3 percent from a year earlier to $975,000, Corcoran said. Co-op prices dropped 17 percent to $726,000, as lower-priced studios and one-bedrooms made up more than half of all sales, according to Corcoran.

Listings for luxury apartments, the top 10 percent of all sales by price, didn’t decline as sharply as the broader market as owners were inspired to try their luck after record prices paid for co-ops and condos in 2012, Miller said. Luxury listings fell 15 percent to 1,025, Miller Samuel and Douglas Elliman said, while the median price of completed deals fell 2.7 percent to $4.02 million.

Now granted, there are a few extreme outliers in the price range, but the owners are not 30-something years of age

Steven A. Cohen, the billionaire founder of SAC Capital Advisors LP, is seeking to sell his 10,000-square-foot (930- square-meter) duplex at One Beacon Court for $115 million, two people familiar with the matter said last week.

Steven A. Cohen (born June 11, 1956) is an American hedge fund manager. He is the founder of SAC Capital Advisors, a Stamford, Connecticut-based hedge fund focusing primarily on equity market strategies. (More of that hedge fund money!)

He has an estimated net worth of $9.3 billion as of March 2013, ranked by Forbes as the 106th richest man in the world.[1][2] Cohen is 35th overall in the U.S.[3] In November 2012, he began to be implicated in a large criminal insider trading scandal. In July 2013, SAC was charged by the Securities and Exchange Commission with failing to prevent insider trading.[4][5]

http://en.wikipedia.org/wiki/Steven_A._Cohen

Then there's a triplex penthouse at the Pierre hotel that belonged to Martin Zweig, who predicted the 1987 stock market crash, is also on the market, for $125 million, the New York Times reported March 29.

Life More: Real Estate New York City

Late Investor Martin Zweig's Penthouse Hits The Market For A Record $125 Million

Wikipedia

While the listing has yet to appear, the $125 million price tag makes it the most expensive home for sale in New York City. It narrowly beats a midtown apartment owned by Steve Cohen, which the SAC honcho is reportedly selling for $115 million.

So what does $125 million buy you at the fabled hotel?

According to Finn, the penthouse is "a triplex confection graced by a grand black-marble staircase, arched cathedral windows that replicate a Versailles chapel, 23-foot ceilings, and fireplaces embraced by mantels designed in the 17th, 18th and 19th centuries."

Read more: http://www.businessinsider.com/martin-zweig-penthouse-listed-for-125m-2013-3#ixzz2bEQkZaFa

In new developments, the inventory of apartments fell 42 percent in the first quarter from a year earlier, Miller Samuel and Douglas Elliman said. The median sale price climbed 36 percent to $1.33 million.

woo me with science

(32,139 posts)Thank you.

Divernan

(15,480 posts)Doctor_J

(36,392 posts)More money for bank of America. More change we can believe in. Aren't we privatizing student loans too?

SunSeeker

(51,514 posts)Last edited Tue Aug 6, 2013, 01:29 PM - Edit history (1)

And Fannie and Freddie were already privatized, just the losses weren't, which this aims to fix. In fact, it is the hedge funds that own stock in Fannie and Freddie are opposing the proposal, as noted in the Bloomberg article cited in Reply #1.

Response to SunSeeker (Reply #28)

Post removed

adirondacker

(2,921 posts)(that I purposely refinanced to get away from private banks from handling and payed an extra 1% on for for a GUARANTEED interest rate) were handed over to a private bank Edfinancial Services over a year ago.

http://www.propublica.org/article/student-loan-borrowers-dazed-and-confused-by-servicer-shuffle

The Department of Education has been transferring large batches of federal student loans to new loan-servicing companies — leaving in the lurch some borrowers who are suddenly encountering problems with their loans, such as payments that are mysteriously adjusted up or down.

The switch, which has been going on for months and will ultimately include millions of loans, is mandated by a little-known provision tucked into the 2010 healthcare overhaul. Pushed by a consortium of nonprofit student loan companies, the provision forces the DOE to use nonprofit loan servicers. But at least in the short run, the switch has caused problems.

Borrower Isabelle Baeck said that after a new servicer, Mohela, took over her loans in December, she received a letter saying that her monthly payments had been reduced to $50 — roughly a quarter of what they had been. The change meant Baeck would ultimately pay more in interest over a longer period of time. Concerned, she said she has made repeated calls to get the problem fixed, only to have the payments repeatedly readjusted.

A Mohela representative declined to comment on specific borrower situations but said that the company is working hard to minimize disruption and to resolve issues as they arise.

Baeck is not alone. Since last fall, one million borrowers have had their federal student loans randomly assigned to one of the new companies, all nonprofits or subsidiaries of nonprofit organizations. It is not known what proportion of borrowers has had problems during the switch.

Like their for-profit counterparts, many of these nonprofit student loan companies traditionally originated, bought and insured student loans, with the day-to-day servicing making up only a portion of their business. Several — including at least six that the department has transferred or is planning to transfer loans to — have been touched by scandal in those other capacities, with accusations ranging from bad lending practices to violating state law to overbilling the Education Department."

SunSeeker

(51,514 posts)As your article itself notes, there was "an overhaul of federal student lending, which shifted the government away from backing loans by private lenders — what were known as federally guaranteed student loans — and toward loaning directly to students."

The new nonprofit servicers appear to be having some problems, but you can't blame it on "privatization." The U.S. government is now originating the loans.

Doctor_J

(36,392 posts)and racists

Progressive dog

(6,899 posts)two years later Freddie Mac was created to compete, it was privatized in 1989. They have minimal support from "libertarians." I seriously doubt that anyone will be called "libertarian" or even "racist" over opposition to ending Fannie and Freddie.

I think they should be ended, but only after a new Glass-Steagall act breaks up the "too big to fail" banks.

cstanleytech

(26,236 posts)That was one horsetrade that Bill made a huge mistake in agreeing to.

Lasher

(27,540 posts)http://en.wikipedia.org/wiki/Gramm%E2%80%93Leach%E2%80%93Bliley_Act

Highly prophetic of Representative Dingell. That's just what happened.

cstanleytech

(26,236 posts)didnt charge the people involved for anything and those who kept their jobs after this (most of them) are still receiving big paychecks where as most of us are still reeling from what they did and are struggling week to week to pay the bills.

bitchkitty

(7,349 posts)Mass

(27,315 posts)City Lights

(25,171 posts)Myrina

(12,296 posts)Really, sir?

Now it makes sense why Faux and Rushbo are losing viewers/listeners ... the corporate-GOP is getting everything it wants from this Administration, there's no need to "fan the flames" - the only ones left outraged at POTUS's 'liberalism' are the socio-religious Nutbaggers. The rich folks only use social issues to enrage the rabble when they need the votes to get their kind of politicians in office. And it's become pretty clear, they already have their kind of politician in office with BHO.

![]() So sad for my fellow working folks of America.

So sad for my fellow working folks of America.

PSPS

(13,580 posts)Without these successful programs, which were gamed by the banksters during the bubble, quarter-to-quarter funds will be the best available which means all mortgages will be variable rate. Eliminating these agencies always ranked up there as a priority with the GOP along with eliminating Social Security, so leave it to Obama to come to their rescue. Geesh, what a failure.

cstanleytech

(26,236 posts)Seems like its a decent reason to change how its currently down though as I mentioned in another post breaking up the top 10 big banks should also be done.

Lasher

(27,540 posts)matthews

(497 posts)a Get Out of Jail for Life card and all the taxpayer money their little 'hearts' covet.

JRLeft

(7,010 posts)on point

(2,506 posts)Maybe the change need is to kill them off to give yet more power to the big banks, but to restore the laws and structure that made them a success.

This proposal is more 'heading in the wrong direction' by the stupid DLC

Safetykitten

(5,162 posts)blackspade

(10,056 posts)Shit on a stick....![]()

Xyzse

(8,217 posts)Hasn't he learned enough that the private sector banks would just take him for a ride?

After private sector banks took their bail outs, they leveraged that money for acquisition rather than lending to businesses.

This will only be worse.

In this particular issue, I am very willing to help on opposition.

Kolesar

(31,182 posts)Cutting them loose has been discussed for a while. What is wrong with that?

Xyzse

(8,217 posts)I understand that they are arguing that the demographics are changing, and that trying to buy a house shouldn't be what people should expect to do.

Meaning, their idea is that" housing is fine but owning a house should not be something people should aspire to".

That change in dynamic, though understandable locks people out of a huge tax shelter, investment and a means to improve wealth.

When looking at the causes for the actual crash, I tend to place the blame on the Private Sector with the inflation of the bubble. This was through firms packaging high risk loans in to securities that go beyond the system of Fannie and Freddie. These were investments passed along that were not guaranteed by Fannie and Freddie that brought things down.

Of course, I agree that they also made bad investment decision.

http://www.americanprogress.org/issues/housing/report/2012/09/06/36736/7-things-you-need-to-know-about-fannie-mae-and-freddie-mac/

I can't see cutting them loose completely at the moment. I also can't advocate to a return to new creative packaging that is not somehow guaranteed by an entity such as them.

ConcernedCanuk

(13,509 posts).

.

.

President Obama has an agenda, albeit somewhat curtailed by the MIC, NSA and such.

Obama is a smart man, not at all like Idiot-Son.

He will make sure he and his family are safe,

then make his big move.

He remembers JFK.

bank on it.

CC

GalaxyHunter

(271 posts)complete bullshit.

Beacool

(30,247 posts)The private sector only cares about, well, the private sector. They are in it only to make money.

RIP, dreams of home ownership for many Americans.

![]()

Maven

(10,533 posts)Doctor_J

(36,392 posts)he's fulfilling Reagan's dream

woo me with science

(32,139 posts)

jtuck004

(15,882 posts)woo me with science

(32,139 posts)It would be funny....if any of this were funny at all.

![]()

![]()

jtuck004

(15,882 posts)Only I couldn't find a "disappointed" smiley.

Fire Walk With Me

(38,893 posts)Just something to watch for.