The State Of The Nationís Housing In 2015: Homeownership Down, Rentals On The Rise

The “American dream” may or may not be a single-family home in the suburbs, but the American reality is looking more and more like a multifamily rental property.

The Joint Center for Housing Studies of Harvard University (JCHS) publishes its “State of the Nation’s Housing” reports annually, and the 2015 edition reveals that housing in the United States continues to evolve in the wake of the housing bust, the slow economic recovery, and the demographic changes in the country’s population.

Overall, the report found that the housing recovery has stalled somewhat, with homeownership rates continuing to drop. Single-family construction is up slightly, but remains at historically low levels. By contrast, rental markets have grown substantially, and the construction of multifamily units has risen. Despite this, the demand for rental properties continues to outpace supply, leading to rising rents and greater burdens on those with the lowest incomes.

The report offers considerable levels of detail on those who own and rent, their ages and incomes, and the continuing evolution of rents, sales and construction in the United States. The JCHS has also made tables with more detailed figures available in Excel format and created an online data explorer.

The study’s key findings on homeownership include:

Homeownership rates continued to fall since the last report, and are now at 20-year lows: Just 63.5% of U.S. houses owned last year, after peaking at 69% in 2004. They are now comparable to levels last seen in 1993.

The homeownership rate for minorities continues to lag: It peaked at 51.3% in 2004, and has now fallen to 47.2%. Of all minority groups, African Americans have the lowest rate of homeownership, just 43.8%.

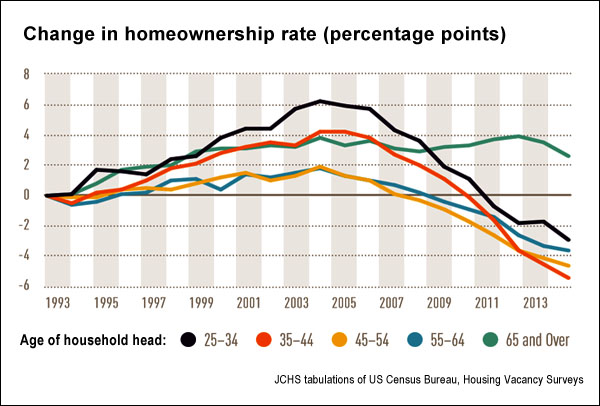

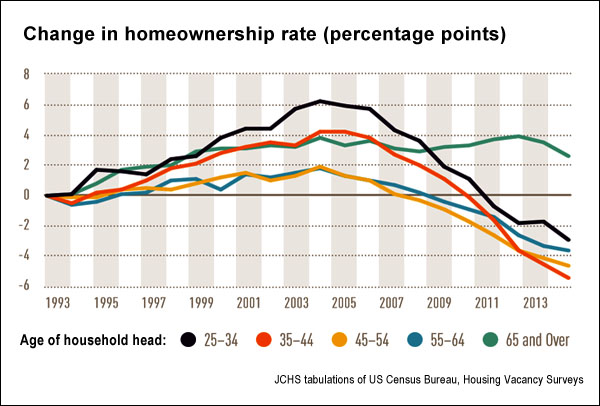

The overall decline observed would have been much greater without the inclusion of those aged 50 to 65 (76.3% ownership) and over 65 (79.9%). “In sharp contrast, it was generation X (also known as the baby bust, born 1965–84) that took most of the hit from the housing bust.”

Change in homeownership rates, 1993-2014 (jchs.harvard.edu)

A key factor in the decline in homeownership is the “steady erosion” of household incomes since the recession began.

Restricted access to financing has also kept people away from the housing market: For those with credit scores between 660 and 720, home-purchase loans decreased 37%, while the decrease for those with higher scores was just 9%.

- See more at: http://journalistsresource.org/studies/economics/real-estate/state-nations-housing-2015?utm_source=JR-email&utm_medium=email&utm_campaign=JR-email&utm_source=Journalist%27s+Resource&utm_campaign=5760b3c04d-2015_Mar_31_A_B_split3_24_2015&utm_medium=email&utm_term=0_12d86b1d6a-5760b3c04d-79641505#sthash.vcG7UggU.dpuf