The monetary tightening trap

The over-reliance on interest-rate increases will likely lead to economic disaster in low- and middle-income countries.

https://socialeurope.eu/the-monetary-tightening-trap

The Spanish-American philosopher George Santayana famously warned that ‘those who cannot remember the past are condemned to repeat it’. But sometimes even those who can recall the past have a selective memory and draw the wrong conclusions. This is how the global policy response to the current bout of inflation is playing out, with governments and central banks across the developed world insisting that the only way to tame soaring prices is by raising interest rates and tightening monetary policy.

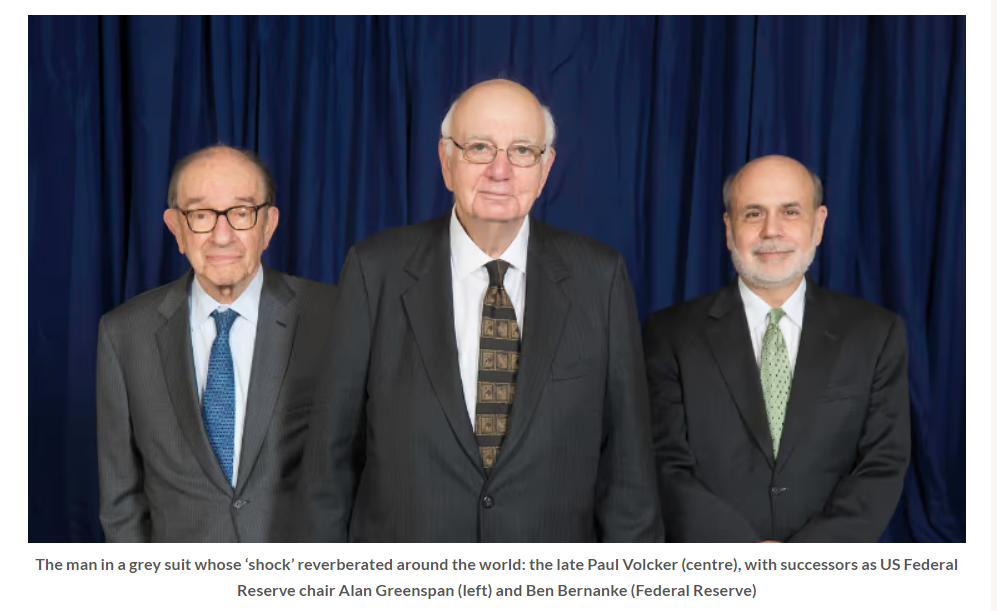

The Volcker shock of 1979, when the United States Federal Reserve, under its then chair, Paul Volcker, sharply increased interest rates in response to runaway inflation, set the template for today’s monetary tightening. Volcker’s rate hikes were intended to combat a wage-price spiral by increasing unemployment, thereby reducing workers’ bargaining power and depressing inflationary expectations.

But the high interest rates triggered the largest decline in US economic activity since the Great Depression, and recovery took half a decade. Volcker’s policy also reverberated around the world, as capital flowed into the US, resulting in external debt crises and major economic downturns which led to a ‘lost decade’ in Latin America and other developing countries.

Rate hikes

The context for this heavy-handed approach was very different from current conditions, because wage increases are not the main driver of inflationary pressures. In fact, even in the US, real wages have been falling over the past year. Yet that has not stopped some economists from arguing that higher unemployment and consequent larger declines in real wages are necessary to control inflation. Even some of the most vocal champions of tight money and rapid interest-rate increases recognise that this strategy will most likely trigger a recession and significantly damage the lives and livelihoods of millions in their own countries and elsewhere. There also seems to be little disagreement that rate hikes have not slowed inflation thus far, probably because surging prices are driven by other factors.

snip

related:

Fed officials crushed investors’ hopes this week

https://edition.cnn.com/2022/11/18/investing/premarket-stocks-trading/index.html

What’s happening: Federal Reserve officials made a series of speeches this week indicating that aggressive interest rate hikes to fight inflation would continue, souring investors’ hopes for a forthcoming central bank policy shift. On Thursday, St. Louis Federal Reserve President James Bullard said the central bank still has a lot of work to do before it brings inflation under control, sending the S&P 500 down more than 1% in early trading. It later pared losses.

Bullard, a voting member on the rate-setting Federal Open Market Committee (FOMC), said that the moves the Fed has made so far to fight inflation haven’t been sufficient. “To attain a sufficiently restrictive level, the policy rate will need to be increased further,” he said.

Those comments come a day after Kansas City Fed President Esther George, a voting member of the FOMC, said to The Wall Street Journal that she’s “looking at a labor market that is so tight, I don’t know how you continue to bring this level of inflation down without having some real slowing, and maybe we even have contraction in the economy to get there.”San Francisco Fed President Mary Daly added on Wednesday that a pause in rate hikes was “off the table.”

A numbers game: Fed officials should increase interest rates to somewhere between 5% and 7% to tamp inflation, Bullard said Thursday. Those numbers shocked investors, as they would require a series of significant and economically painful hikes which increase the chance of a hard landing.

snip

sprinkleeninow

(20,252 posts)Celerity

(43,419 posts)

Why to Be Wary of Another Volcker-Type Monetary Tightening

https://www.ineteconomics.org/perspectives/blog/collateral-damage-from-higher-interest-rates

By Servaas Storm

NOV 5, 2022

For a long time, stagflation was thought to be a thing of the past. But now there is a real risk of it coming back, warns the Bank for International Settlements (BIS 2022), the ‘central bank’ for the world’s central banks. High inflation is expected to be around for a prolonged period of time—as a result of the recurring reinstatements of lockdowns in China, the surge in global energy and commodity prices following Russia’s war in Ukraine, global warming, and the breakdown of global supply chains due to geopolitical tensions.

High inflation, wars in key commodity-producing regions, slowing economic growth, tightening monetary policy and turbulence in commodity stock markets resemble the dominant features of the global economy in the 1970s (UNCTAD 2022; World Bank 2022). “That period ended in the early 1980s,” as Martin Wolf (2022) reminds us, “with a brutal monetary tightening in the U.S., a sharp reduction in inflation, and a wave of debt crises in developing countries, especially in those of Latin America.” This much is true: the collateral damage to the world economy of monetary tightening by the Fed included a lost decade for development in most Latin American and African economies.

No one wants a repeat of this disastrous episode—more so now, right after the worst global recession in 90 years, in which more than 114 million jobs were lost, the cumulative (confirmed) global death toll due to COVID-19 is more than 6.5 million persons (and counting), and about 120 million people were thrown back into extreme poverty. The COVID-19 recession affected the most vulnerable segments of societies disproportionately hard, as the highly uneven fiscal response to the pandemic widened already yawning disparities and inequities within and between countries (United Nations 2021). Higher spending on social protection and pandemic relief and lower revenues from taxation led to higher public budget deficits everywhere, and public debts rose significantly. The average public debt to GDP ratio for emerging economies in 2020 was 64% in 2020, up from an average value of 52% during 2015-19. IMF (2022a) forecasts suggest that the public debt to GDP ratio in emerging countries will rise even further—to 74% in 2026. The higher indebtedness comes with greater vulnerabilities to financial shocks, including higher interest rates.

Soft versus hard landing

Nevertheless, support for a drastic monetary tightening in response to the rise in inflation during 2021-22 is growing in the U.S. and Europe. The most outspoken advocate of Volcker-like monetary tightening is Lawrence Summers (2022) who argues that “The US may need as severe monetary tightening as Paul Volcker pushed through in the late 1970s early 1980s.” Summers claims that the Federal Reserve may have to hike interest rates above 5% to beat back inflation, warning that if the Fed eases up in its inflation fight, this would be a “prescription for much higher interest rates and a sustained and very difficult stagflation that would have serious global consequences.”

snip

progree

(10,909 posts)Nationally, the labor force participation rate has been dwindling from a high point of about 67.3% in 2000 to 62.2% now. (It was 62.2% in January, so there hasn't been any progress in that all year).

Meanwhile the population of elderly (such as me) needing more and more service (me not yet but soon) grows.

Labor force participation rate: http://data.bls.gov/timeseries/LNS11300000

Labor force in thousands: http://data.bls.gov/timeseries/LNS11000000

Anyway this is the dark side of the labor picture as well as wages not keeping up with prices on a 12 month basis (although in the past 4 months they have been with a sharp downturn in inflation).

#######################################

As for inflation, it has been cooling in the last 4 months ....

last 4 months: CPI: 2.8%, Core CPI: 5.3%, PPI: 0.06%, Core PPI: 2.5% (annualized)

All of the above are annual rates

Note also the PPI generally leads the CPI. So that the PPI is 0.06% and Core PPI is 2.5% is a good harbinger for the next CPI report in about 3 weeks from now.

CPI https://data.bls.gov/timeseries/CUSR0000SA0

Core CPI http://data.bls.gov/timeseries/CUSR0000SA0L1E

PPI http://data.bls.gov/timeseries/WPSFD4

Core PPI http://data.bls.gov/timeseries/WPSFD49116

CPI = Consumer Price Index,

PPI = Producer Price Index aka wholesale prices

The Core CPI is the CPI less food and energy

The Core PPI is the PPI less food, energy, and trade services

How the 4 month inflation figures were calculated:

https://www.democraticunderground.com/?com=view_post&forum=1002&pid=17358410