Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 12 April 2012

[font size=3]STOCK MARKET WATCH, Thursday,12 April 2012[font color=black][/font]

SMW for 11 April 2012

AT THE CLOSING BELL ON 11 April 2012

[center][font color=green]

Dow Jones 12,805.39 +89.46 (0.70%)

S&P 500 1,368.71 +10.12 (0.74%)

Nasdaq 3,016.46 +25.24 (0.84%)

[font color=red]10 Year 2.03% +0.01 (0.50%)

30 Year 3.19% +0.01 (0.31%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Fuddnik

(8,846 posts)I left earlier for reality. It sucks, and it's expensive.

Demeter

(85,373 posts)Aside from the Kid being all out of sorts....the papers came early and there were enough of them, the meeting went well, and we might not need to meet for a while...just do it on line. And I made quiche successfully, after dithering over all possible variations of recipe.

Fuddnik

(8,846 posts)Nothing is foolproof with the right fool.

Tansy_Gold

(17,869 posts)It's not Thursday yet and it certainly isn't Thursday was yet.

(Did that make sense? I didn't think so. But if it weren't for SMW, I'd NEVER know what day it is/was.)

Demeter

(85,373 posts)I was throwing a paper labeled Thursday....

Tansy_Gold

(17,869 posts)On the 11th I transcribe an interview conducted on the 10th and date it the 12th.

I usually know what day of the week it is, but the date? I have to look at SMW. . . . to make sure.

Fuddnik

(8,846 posts)Up some, down some. Don't know if they should shit or go blind.

Tansy_Gold

(17,869 posts)xchrom

(108,903 posts)

Tansy_Gold

(17,869 posts)And then I'll go outside to take pictures of the flowers today. My art group meeting lasted so late last night it was already almost dark before I got home. This is from a couple days ago.

DemReadingDU

(16,000 posts)xchrom

(108,903 posts)Reuters) - Greece's jobless rate rose to a record of 21.8 percent in January, twice as high as the euro zone average, statistics service ELSTAT said on Thursday, as the debt crisis and austerity measures took their toll on the labour market.

Youth unemployment remained at levels where more are jobless than in work.

Budget cuts imposed by the European Union and the International Monetary Fund as a condition for saving the debt-laden country from a chaotic default have caused a wave of corporate closures and bankruptcies.

Greece's average annual unemployment rate for 2011 jumped to 17.7 percent from 12.5 percent in the previous year, according to ELSTAT figures. December's rates was 21.2 percent.

AnneD

(15,774 posts)with 1 in 5 out of work and over 1/2 of the young out of work? I see a barter system springing up and a 'traditional' economy being circumvented. Bet those German accountants are starting to pull out their hair.

xchrom

(108,903 posts)they will burn your shit down if they can't survive.

greece is going to be a very interesting place for the foreseeable future.

DemReadingDU

(16,000 posts)That be us, someday

xchrom

(108,903 posts)AnneD

(15,774 posts)I have a deep affinity and understanding of Greece and the Greek people. Right now, they are hitting their nadir. But watch out as they come back.

These fraudsters will rue the day they ever fucked over Greece.

xchrom

(108,903 posts)(Reuters) - Britain's top share index fell back from opening gains on Thursday, headed by weakness in energy stocks as heavyweight Royal Dutch Shell (RDSa.L) took a battering on worries over a possible oil spill in the Gulf of Mexico.

Royal Dutch Shell shed 3.5 percent after an oil sheen spotted near one of the firm's platforms in the central Gulf of Mexico caused the company to send a spill response vessel and seek aircraft overflights, a Shell spokeswoman said.

Traders said the knee-jerk response by Shell's share price reflected concerns that any possible Gulf of Mexco spill might be compared to BP's Deepwater Horizon rig disaster in 2010.

BP (BP.L) itself was down 1.0 percent. The firm will run the gauntlet of protests from environmentalists and investors alike at its annual shareholder meeting on Thursday where it will make the latest in a series of attempts to put the Gulf of Mexico oil spill behind it.

xchrom

(108,903 posts)(Reuters) - OPEC left its forecast for world oil demand growth in 2012 unchanged for a second month, saying there were signs that a slowdown in global economic activity is easing.

In a monthly report on Thursday, the Organization of the Petroleum Exporting Countries (OPEC) said world oil demand would rise by 860,000 barrels per day (bpd) in 2012, steady from the previous assessment.

The group, which pumps more than a third of the world's oil, had cut its growth forecast from an initial estimate 1.3 million bpd due to a weaker economic outlook. It said on Thursday the outlook was levelling off.

"Some encouraging signs have pointed at a stabilisation of the slowdown in economic activity," said the report, which is written by OPEC economists at the group's Vienna headquarters.

xchrom

(108,903 posts)European Central Bank executive board member Joerg Asmussen said that he doesn't "see any need for additional capital" for Ireland's banks and that ECB's view is that the country won't need a second bailout.

The ECB stands ready to work with Irish authorities on the campaign to restructure so-called promissory

notes used to bail out former Anglo Irish Bank and to deal with loss-making mortgage loans in other banks that track the ECB benchmark rate, Mr Asmussen said in an interview with RTÉ aired today.

Mr Asmussen said he was not aware of any concrete proposal on how to stretch the maturities of the promissory notes. In the meantime, Ireland should honour its commitments on the promissory notes, which are a precondition to entering the market, he said.

xchrom

(108,903 posts)Italian three-year borrowing costs are set to jump by a full percentage point from a month ago at a bond auction today, the latest sign investors' concerns about Spain are spreading to other euro zone countries hit by recession.

Italy's one-year borrowing costs doubled from mid-March at auction yesterday, with the spotlight on its €1.9 trillion debt pile now a rally driven by a huge liquidity injection by the European Central Bank has given way to profit-taking.

Steady domestic demand, however, helped the Treasury raise the planned €11 billion in bills and Italian bonds performed well after the auction, supporting sentiment ahead of today's sale of up to €5 billion.

"I would expect the bond sale to confirm the same trend seen for bills, namely higher yields but also decent demand," said Annalisa Piazza, a market economist at Newedge Strategy.

Demeter

(85,373 posts)John Mack, the former chairman and chief executive of Morgan Stanley, has joined the board of a peer-to-peer lending company that aims to bypass banks and extend credit directly to borrowers. The Lending Club is one of a crop of new peer-to-peer companies, which seek to match lenders directly to borrowers. The club has originated $589m worth of loans since it began in 2006 with a Facebook-based lending platform

Read more >>

http://link.ft.com/r/4RNQTT/VLK02R/WH2F8/SP0U3W/EXGX15/B7/t?a1=2012&a2=4&a3=12

IS THIS THE SHAPE OF THINGS TO COME? AFTER YESTERDAY'S ALUMNI LENDING PROGRAM....

AnneD

(15,774 posts)several months ago. I really feel that this is the future. The interest you can get is higher than anything an average Joe can get in the rigged markets or any other of the current investment vehicles if you are willing to take the chance. Banks should be really concerned about this.

DemReadingDU

(16,000 posts)The banksters don't care about us, they only care about the 1%

AnneD

(15,774 posts)trust me they will outlaw or regulate in. They would steal the pennies of a dead man's eyes!

Demeter

(85,373 posts)The tide has turned on global oil markets, with the tightness seen over the past two years finally beginning to ease, the International Energy Agency said in its closely watched monthly oil market report on Thursday.

But “ongoing geopolitical uncertainties”, particularly over Iran’s nuclear programme, meant that for now the market easing was not translating into significantly lower oil prices, the IEA said.

The Paris-based oil watchdog, which advises the industrialised countries on energy policy, said that first-quarter supply and demand fundamentals “show a clear shift from the seemingly relentless tightening evident over the prior ten quarters”.

Read more >>

http://link.ft.com/r/9ULF66/62NXVR/XBAN6/8ZE7AF/R34364/UP/t?a1=2012&a2=4&a3=12

ONE HAS TO ASK: IS THIS BELIEVABLE? WHAT IS THE PURPOSE OF MAKING THIS PUBLIC STATEMENT

AND THEN, ONE CAN WATCH THE BOTTOM FALL OUT OF THE OIL MARKET, AS THE GLOBAL ECONOMY COLLAPSES BEYOND THE ABILITY OF ANY CABAL TO PUMP IT UP.

Demeter

(85,373 posts)Tehran is trying to skirt US and European sanctions by luring nations to buy its crude on highly advantageous terms, say officials in the industry

Read more >>

http://link.ft.com/r/S4XZQQ/L9V3A8/JQU4J/97QMZ4/GD845T/50/t?a1=2012&a2=4&a3=12

Demeter

(85,373 posts)Benoît Coeuré says bond market conditions faced by Spain are not justified and notes that mechanism to buy eurozone debt ‘still exists’

Read more >>

http://link.ft.com/r/S4XZQQ/L9V3A8/JQU4J/97QMZ4/2OSBHW/50/t?a1=2012&a2=4&a3=12

OF COURSE THEY AREN'T, OF COURSE IT DOES, JUST SIT DOWN AND HAVE A NICE CUP OF TEA OR VINO OR....

Demeter

(85,373 posts)Bank of America Corp's proposed $8.5 billion mortgage bond settlement received fresh opposition on Tuesday from New York's attorney general, who said the accord appears unfair to investors who may deserve to recover more.

Eric Schneiderman, the attorney general, filed papers on Tuesday asking a New York State Supreme Court justice for permission to intervene.

He had made the same request last August before the case moved to federal court. It returned to the state court in February....

GO GET 'EM, ERIC!

xchrom

(108,903 posts)Foreclosure activity fell in the first quarter to the lowest level in more than four years, but mainly because the process of removing people from their homes has slowed. The number of homes just beginning the foreclosure process rose in March for a third straight month, a sign that the nation's housing problems are far from over, according to RealtyTrac, which tracks the figures.

“The low foreclosure numbers in the first quarter are not an indication that the massive reservoir of distressed properties built up over the past few years has somehow miraculously evaporated,” said Brandon Moore, chief executive officer of RealtyTrac.

He said a large backlog of bank-owned properties that has accumulated over the past few years will put added pressure on the housing market when banks eventually list them for sale.

“The dam may not burst in the next 30 to 45 days, but it will eventually burst, and everyone downstream should be prepared for that to happen,” he said in a news release.

Demeter

(85,373 posts)IMO, ANYONE CAN SCAVENGE FOR SALVAGEABLE MATERIALS...IT'S THE TOXIC WASTE THAT IS THE REAL PROBLEM.

Businesses are learning that what they throw away can be just as valuable as what they are making...Last month, the Cradle-to-Cradle certification program officially affixed its first seals of approval to products made — exclusively — with materials that can eventually be returned to the production line as "technical nutrients" or to the Earth as compostable "biological nutrients." Architect William McDonough and chemist Michael Braungar, whose book Cradle to Cradle made the concept famous a decade ago, are fond of summing up this approach as "waste = food."

A few hundred products have been made to the specs, including the two types of office chairs and two carpet brands recently certified by the independent certification body the duo spun off from their consulting activities two years ago. What sets these products apart from conventional wares is the careful selection of raw materials and their thoughtful design into products with more than one "life," so to speak. Ingredients "throughout the supply chain" go through toxicity assessments. The ones that make the cut are assembled into products that can be "continuously" broken down and reused in new products.

While Braungar and McDonough are focused on the manufacturing side of "the life cycle," the concept has also given a boost to the "zero waste" movement that's swept the corporate world and is now gaining traction in cities such as San Francisco, Los Angeles and Malmo, Sweden. It's a radical rethinking of what humans have considered "waste" for millennia. Brought to its natural conclusion, "zero waste" promises an end to dumps, landfills, hazardous waste depots, Superfund sites — essentially, an end of trash as we know it. In the last five years or so, companies including Wal-Mart, Unilever and DuPont have put the rather daunting zero waste theory into practice by revamping production lines, finding new uses for things like shipping pallets and developing recycling markets. Walmart, for instance, says it's expanded the number of waste streams it tracks from 30 in 2009 to "nearly 138" today. More below on whether these companies, not known for their green ethos, have actually been successful.

In roughly the same timeframe, landfills around the country have seen a 10 percent to 35 percent decline in business, but industry experts say that's almost entirely due to the economic crisis. The trend toward zero waste isn't moving nearly so fast, though companies keep telling us — heralding it from rooftops — that they are getting rid of the very concept of waste and even the words associated with it. Yesterday's trash is today's "materials."...More than just recycling on steroids, zero waste involves rethinking the entire "life cycle" of a product. The Grassroots Recycling Network, a national coalition of activists and recycling experts, defines it as "a philosophy and a design principle for the 21st century" that "goes beyond recycling by taking a 'whole system' approach to the vast flow of natural resources and waste through human society. Zero Waste is both a 'back end' solution that maximizes recycling, minimizes waste and reduces consumption as well as an upfront industrial design principle that requires that all products be made with no toxic elements and designed to be reused, repaired, recycled or composted back into the economy or the environment." ....Drawing conclusions about the nation's possibly gargantuan quantities of industrial waste would be difficult, in any event, since it's been more than a decade since anyone has kept track of it. Industrial waste is tallied under 17 different Standard Industrial Classification Codes, some tracked, some not by government agencies, and it typically ends up in several different places — hazardous waste treatment facilities, city dumps and landfills on company premises. The U.S. Environmental Protection Agency says its best guess is that the country produces 7.6 billion tons industrial waste annually — organic chemicals, iron, steel, plastic, resins, stone, clay, concrete, pulp and paper, among other things. But that figure is based on 1980s data, way before the rise of zero waste.

While industrial waste has likely declined along with U.S. manufacturing, it still probably towers over the country's other big trash heap — municipal solid waste — which the E.P.A. tracks closely, right down to individual recycling streams such as paper, aluminum and other metals. The country produced about 250 million tons of municipal solid waste in 2010.

MORE

**********************************************************

Christine MacDonald is an environmental journalist and the author of "Green Inc., An Environmental Insider Reveals How a Good Cause Has Gone Bad" (The Lyons Press).

Demeter

(85,373 posts)...Banks have foreclosed on 4 million homes since 2007, and there are millions more to come. Proposed settlements have been weak, and programs designed to help keep people in their family homes have done little other than funnel money back into the pockets of the same bankers who created the crisis. The latest news doesn't get much better — progressive online organizing group CREDO sent an email out this week claiming that the task force President Obama announced in his State of the Union, led in part by progressive champion New York Attorney General Eric Schneiderman, has been understaffed, perhaps deliberately so.

“This matters not just because of broken promises, but because the foot-dragging has serious consequences. Many of the various types of fraud that this task force is supposed to be investigating have statutes of limitations, some of which will run out on the very last securitization deals completed before the housing bubble collapsed,” wrote David Dayen at FireDogLake. The delay in staffing the task force, he noted, looks a lot like letting the clock run out.

“The latest task force has not provided the needed results, and as a consequence of inaction, homeowners continue to be victimized,” Matt Browner Hamlin, an organizer with Occupy Our Homes, told AlterNet. The big banks are still gaming the system, screwing over working families while continuing to profit. Here's four ways the banks are still doing exactly as they please despite all the task forces and settlements — and some ways you can help fight back.

1. Taking Advantage of Government-Backed Refinance Program to Rake In Profits

2. Refusing to Write Down Principal on Mortgages

3. Continuing Illegal Foreclosures (And Getting Their Behinds Covered by Government Settlement)

4. Abandoning Foreclosed Homes — or Selling Them in Bulk to Hedge Funds

Gross explained that the odds of hedge funders making good landlords for rental properties are pretty slim. Houses are not like stocks — they require upkeep and personal involvement. And then, if hedge funders do manage to buy a bunch of homes from Fannie Mae and Freddie Mac, and flip them at a profit, “it'll be yet another example of public entities absorbing losses while private entities rack up gains.”

MORE

********************************************************************

Sarah Jaffe is an associate editor at AlterNet, a rabblerouser and frequent Twitterer. You can follow her at @seasonothebitch

Demeter

(85,373 posts)In 2005, Citigroup offered its high net-worth clients in the United States a concise statement of the threats they and their money faced. The report told them they were the leaders of a “plutonomy,” an economy driven by the spending of its ultra-rich citizens. “At the heart of plutonomy is income inequality,” which is made possible by “capitalist-friendly governments and tax regimes.” The danger, according to Citigroup’s analysts, is that “personal taxation rates could rise – dividends, capital gains, and inheritance taxes would hurt the plutonomy.”

But the ultra-rich already knew that. In fact, even as America’s income distribution has skewed to favor the upper classes, the very richest have successfully managed to reduce their overall tax burden. Look no further than Republican presidential contender Mitt Romney, who in 2010 paid 13.9 percent of his $21.6 million income in taxes that year, the same tax rate as an individual who earned a mere $8,500 to $34,500....While the poor have overwhelming numbers, the wealthy have higher rates of political participation, more advanced skills and greater access to resources and information. In short, APSA said, the wealthy use their social capital to offset their minority status at the ballot box.

But this explanation has one major flaw. Regardless of the Occupy movement’s rhetoric, most of the growth in the wealth gap has actually gone to a tiny sliver of the 1% – one-tenth of it, or even one-one-hundredth. Even more shockingly, that 1 percent of the 1% has shifted its tax burden not to the middle class or poor, but to rich households in the 85th to 99th percentile range. In 2007, the effective income tax rate for the richest 400 Americans was below 17 percent, while the “mass affluent” 1% paid nearly 24 percent. Disparities in Social Security taxes were even greater, with the merely rich paying 12.4 percent of their income, while the super-rich paid only one-one-thousandth of a percent.

It’s one thing for the poor to lose the democratic participation game, but APSA has no explanation for why the majority of the upper class – which has no shortage of government-influencing social capital – should fall so far behind the very top earners. (Of course, relative to middle- and lower-class earners, they’ve done just fine.) For a better explanation, we need to look more closely at the relationship between wealth and political power. I propose an updated theory of “oligarchy,” the same lens developed by Plato and Aristotle when they studied the same problem in their own times....MORE

******************************************************************

Jeffrey A. Winters is an associate professor of political science at Northwestern University. For a more extensive explanation of his theory of oligarchy, read Oligarchy (Cambridge University Press, 2011).

Demeter

(85,373 posts)IT'S THE ECONOMY, STUPID; IT'S THE STUPID ECONOMY

Matt Stoller is a fellow at the Roosevelt Institute. You can follow him on twitter at http://www.twitter.com/matthewstoller

********************************************************************

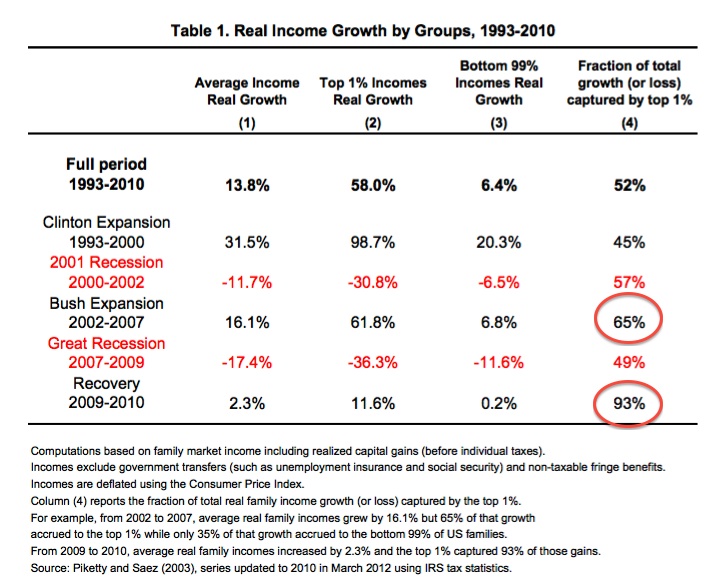

Yesterday, the President gave a speech in which he demanded that Congress raise taxes on millionaires, as a way to somewhat recalibrate the nation’s wealth distribution. His advisors, like Gene Sperling, are giving speeches talking about the need for manufacturing. A common question in DC is whether this populist pose will help him win the election. Perhaps it will. Perhaps not. Romney is a weak candidate, cartoonishly wealthy and from what I’ve seen, pretty inept. But on policy, there’s a more interesting question: A better puzzle to wrestle with is why President Obama is able to continue to speak as if his administration has not presided over a significant expansion of income redistribution upward. The data on inequality shows that his policies are not incrementally better than those of his predecessor, or that we’re making progress too slowly, as liberal Democrats like to argue. It doesn’t even show that the outcome is the same as Bush’s. No, look at this table, from Emmanuel Saez (h/t Ian Welsh). Check out those two red circles I added.

Yup, under Bush, the 1% captured a disproportionate share of the income gains from the Bush boom of 2002-2007. They got 65 cents of every dollar created in that boom, up 20 cents from when Clinton was President. Under Obama, the 1% got 93 cents of every dollar created in that boom. That’s not only more than under Bush, up 28 cents. In the transition from Bush to Obama, inequality got worse, faster, than under the transition from Clinton to Bush. Obama accelerated the growth of inequality.

The data set is excellent, it’s from the IRS and it’s extremely detailed. This yawing gap of inequality isn’t an accident, and it’s not just because of Republicans. It’s a set of policy choices, as Saez makes clear in his paper.

MORE

Demeter

(85,373 posts)The Florida Bar has fielded nearly 1,400 complaints against attorneys relating to the housing crisis, an unprecedented amount that has buried investigators and forced the group to rethink how it will handle widespread grievances in the future.

Beginning in the fall of 2010, as foreclosures receded because of robo-signing revelations, a wave of consumer complaints alleging attorney misconduct began to hit the Bar. The complaint categories - mortgage fraud, foreclosure fraud, loan modification misconduct - didn't even exist three years ago, said Ken Marvin, director of lawyer regulation for the Florida Bar. His first recorded loan modification complaint was in November 2010. Today, 793 cases have been opened.

"They just started coming in and the numbers were incredible," Marvin said. "We never even had a loan modification category or mortgage fraud or foreclosure fraud, and we had to create all of this because we wanted to track these reliably."

The Bar hired an additional attorney to specifically process foreclosure and mortgage complaints, which make up about 17 percent of all open Bar cases....

AnneD

(15,774 posts)lawyers and the size of the scandal, this could be a win/win. If the government were smart-they would offer loan forgiveness to these post grad students and let the banks pay to get it straightened out. Meh, in my dreams....

Demeter

(85,373 posts)See, I'm working on my Capitalist Thug thinking...

AnneD

(15,774 posts)you have a real future in the NWO.

Roland99

(53,342 posts)Roland99

(53,342 posts)Roland99

(53,342 posts)Roland99

(53,342 posts)Roland99

(53,342 posts)maybe because natural gas is falling so much. Sure isn't from the gas we put into our cars! I just had a $60+ fillup yesterday. First time in a looong time.

Demeter

(85,373 posts)There seems to be a pattern emerging as stressed Eurozone nations struggle against the austerity based policy that slowly strangles them. The first stage is a denial that anything is wrong, the second is that there is some problems but with renewed vigour the issues will be solved and the third stage is when reality finally begins to sink in that the country is in serious trouble and some form of external “help” is inevitable.

Given the recent denials by the Spanish economics minister I would suggest we are somewhere between stage 2 and 3 for Spain:

Overnight statements from the Spanish authorities became a bit more direct as they politely asked the rest of Europe to keep their mouths shut about the country’s economic issues:

MORE

Demeter

(85,373 posts)beginning on April 12, 2012, in Brooklyn, New York, the National Know Drones Tour will use three Reaper drone replicas – 8 feet long with wingspans of 11 feet - to undertake sidewalk education on drone warfare and drone surveillance.

The premise of the tour is simply to take information, in however small a way, directly to people, where they already are, and to engage them in conversation. The hook is the drone replica, which has proven to stimulate great curiosity and, always, questions.

The tour is focused exclusively on the home districts of 18 of the 55 members of Congress who are members of the Unmanned Systems Caucus, know informally as the Drone Caucus. These members function within the Congress to promote the interests of the drone industry, which includes all the major aerospace contractors and other makers of robotic machinery.

The schedule for the tour appears on www.KnowDrones.com.

Demeter

(85,373 posts)The latest anti-Obama ad, which blames Obama for rising gas prices, is being financed in part by a hedge fund manager who has pumped up the price of oil through excessive speculation.

Karl Rove’s attack ad network just launched the first nationwide ad against Obama. The ad, called “Too Much,” is being aired by Crossroads GPS, a nonprofit controlled by Rove that does not have to disclose a single donor. Despite oil production levels at the highest point in recent years and Obama’s move to open up new areas to domestic drilling, the ad knocks Obama for high gas prices. Unlike ordinary Super PACs, which fall under F.E.C. disclosure requirements, Crossroads GPS is organized as a 501(c)(4), meaning it never has to divulge any donor information.

But thanks to the work of Peter Stone, an investigative journalist with the Center for Public Integrity, we do know one major donor who has given “seven figure” gifts to Crossroads GPS: Paul Singer.

Singer, who’ve I’ve written about several times in the for ThinkProgress, is a wealthy hedge fund manager. His firm, Elliott Management Corporation, speculates in a number of areas. In the past, Singer has been called a “vulture capitalist” for buying the debt of Third World countries for pennies on the dollar, then using his political and legal connections to extract massive judgments to force collection — even from nations suffering from starvation and violent conflicts. A blockbuster Wall Street Journal story in 2006 revealed that Singer’s firm was among several hedge funds that paid lobbyists to gain political intelligence on an asbestos bill working its way through Congress — with the hope of using inside information to profit off of asbestos-related companies. But what makes Singer interesting in the context of this latest attack ad is how his business interests conflict with the message about Obama causing high gas prices. If anything, Singer should be blamed for high gas prices. Last year, I received a leaked document from the CFTC — the regulatory body that is set up to monitor commodity speculation — revealing the one day oil trading information from 2008. This list of speculators (view a copy of the documents here, a table organizing the information here) shows that Elliott Management is among the top financial firms with the highest volume of trades in the country, up there with Goldman Sachs and Credit Suisse. Currently, most oil speculation is conducted on private exchanges and through investment banks, so the public left in the dark about who is trading the world’s oil supply. The document shows Singer’s firm with bets on over 50 million barrels of oil that particular day....

Demeter

(85,373 posts)MORE DOOM AND GLOOM, BUT FROM ANOTHER PERSPECTIVE

Demeter

(85,373 posts)Yo, pay attention because this past week’s reality check could become important.

So far the only data series that are maintaining their strength as the days stretch out into spring are of the jobs and employment variety. The manufacturing stuff and the consumer/retail stuff is good, not great. Q4 earnings were mixed and Q1 earnings, coming any day now, will be announced against the backdrop of $100 oil and $4-plus gasoline for almost the entire reporting period.

The bright spot that was housing appears to be starting to slide again. Which sucks because the housing “improvement” was an enormous part of the bull case. Also, seasonally housing is supposed to be kicking ass right now. But eagle-eyed Joe Weisenthal notes that every single housing market data point this week was punk:

On Tuesday, housing starts came in just below expectations.

On Wednesday, mortgage applications for the week fell 7.4%. Also existing home sales came in at an annualized pace of 4.59 million, vs. expectations of 4.61 million.

On Thursday, the FHFA house price index showed no gain vs. expectations of 0.%. Last month was revised from a 0.7% gain to just 0.1%.

And then today we got New Homes Sales of just 313K vs. expectations of 325K. Also today, the major homebuilder KB Homes reported a big miss, and the stock is getting crushed.

And housing was the least of it. Stocks hit a post-crisis high on Monday on the news of Apple’s dividend and then dropped pretty much the rest of the week – a very uncharacteristic spate of trading days given how the year has shaped up so far. On the week, only the Nazz recorded a gain, 0.4%. In the meantime, the S&P lost half a percent on the week while the Dow 30 dropped a ball-busting 1.2% according to this wrap-up in the FT. “Hey! Nobody told me these things go down also!”

And those global PMI reports! Just awful, no way to spin ‘em, chooch.

First we heard from BHP Billiton, the massive mining concern, about weak mineral demand in China. This was followed by an HSBC Flash PMI reading of 48.1 – the fifth consecutive reading under the all-important 50 level (which indicates contraction as opposed to expansion). It’s important to remember that HSBC’s PMI survey looks mainly at small and mid-sized enterprises. This as opposed to the official PMI numbers from the government which cover larger firms that have bigger global trade involvement and better access to bank capital. Those official stats come out on April 1st and they are usually market-moving, FYI. The bottom line on China is that anything below 48 implies less than 8% growth – which is a death sentence for all the countries who were hoping to sell into that region.

And worse than China was what we heard out of Germany. As Randall Forsyth so perfectly puts it in Barron’s this weekend, Germany had finally diversified away from selling to its weakling neighbors in Europe and moved on to exporting more into China – just in time for China to begin rolling over. The Euro recession is worsening as is China, this is important because of how highly correlated global GDPs are. Also from the Barron’s piece by Forsyth, a killer quote from RBC’s economists:

“Lest we think the U.S. has the ability to avoid any of the negative reverberations from weak growth outside its borders, remember that the rolling five-year correlation of 32 countries’ GDPs have been on the rise and presently stand at over 90%.”

To recap, we’ve lost housing and some of the momentum in the stock market that’s engendered so much optimism. We still have Apple but weakness in materials ($XLB), energy ($XLE) and the ($XLI) industrials has gone from being slightly irksome to being full-on Tara Reid-post-breast-implant-embarrassing. In addition, the China engine that was meant to devour everyone’s goods is sputtering while Germany, the strongest economy in Europe, sinks into recession.

On top of it all, we’re heading into the “sell in may” period of the year – last year they ran and then peaked this market right in the middle of April and began lightening up early, just as the “January Effect” now begins the week before Christmas.

Now of course, April is a rockstar month for stocks generally; from 2001 through 2010, April has witnessed an average S&P 500 appreciation of 2.66%, the single best month of the year. If you go back 40 years and look at 1971 through 2010, you see an average gain of 1.56% for April, making it the second best month in the calendar for stocks. And who could forget last April, when stocks in developed markets, including the US, posted phenomenal numbers? The MSCI World Index of stocks returned a whopping 4.31% in April of 2011.

Check out the below heatmap and try not to burn yourselves on the sizzling hot returns of a year ago:

But that was then and this is now.

Last spring the prospect of a European meltdown was still hazy and we were still getting high on the residue of the winter QE2 session – massive Fed liquidity was still coating our nostrils and coursing through our bloodstream. But “the guy” isn’t necessarily coming back with more this year – unsinkable gasoline prices and political realities probably have the Fed on hold right now, no matter how many jittery text messages we send him.

If you’re running three sheets to the wind right now, you may want to ask yourself what it is you think is about to happen in the near-term. I just went over the bull case as laid out in five major bullet points from JPMorgan and it has gotten more idiotic, not less, hinging as it does on the fact that “there’s nowhere else to put your money”.

If what we’ve just seen since last Monday represents the start of a new trend, it will be hard for the buyers to maintain their excitement.

We’re watching the market internals and technicals closely, casting a wary glance on housing and global PMIs and hanging onto the jobs trend as pretty much the only major positive at the moment.

So there’s your reality check. Do with it what you will.

Demeter

(85,373 posts)

The International Monetary Fund (IMF) is out with an update of their Global Financial Stability Report, which includes the following graphic of sovereign debt holders of the big three issuers and the Euro area. The IMF notes,

…In the United States, foreign investors have dominated the market for U.S. Treasuries in view of its large size and depth and its high perceived degree of safety. However, post crisis monetary stabilization efforts increased the prominence of the Federal Reserve as a holder of government debt.

In Europe and Japan, domestic banks have played an important role as sovereign debt investors, in each case accounting for about 25 percent of outstanding sovereign debt (Figure 3.6). In the United Kingdom, insurance companies and pension funds have been traditional holders of government securities, although the Bank of England and foreign investors assumed a more prominent role after the global financial crisis.

Demeter

(85,373 posts)This commentary was written by Bill Witherell, Cumberland’s Chief Global Economist. He joined Cumberland after years of experience at the OECD in Paris. His bio is found on Cumberland’s home page, www.cumber.com. He can be reached at Bill.Witherell@cumber.com.

*****************************************************************

The French economy, the second largest in the Eurozone and considered to be a critical part of the “core,” is increasingly seen as “struggling.” Fundamental structural deficiencies that are continuing to gnaw at France’s ability to compete internationally are now being emphasized in a presidential election campaign in which both leading candidates are making election promises that, if fulfilled, would surely make it even more difficult to tackle France’s economic problems. And this is occurring at a time when the Eurozone’s sovereign debt crisis is far from being resolved and much of Europe is in recession. Industrial production declined in February, the third month of declines.

On the positive side, France has more firms in the global Fortune 500 than any other European country. But French companies are struggling to compete with labor costs 10% higher than those for German firms and social charges double those that German firms face. A European Commission survey suggests that French firms also have an innovation deficiency. It perhaps is not surprising that France’s unemployment rate is 10%, compared to 5.8% in Germany.

France is no Greece with respect to public finances, but its finances are going in the wrong direction. Its public debt is 90% of GDP and increasing at a time when the rest of Europe is recognizing the need to take tough austerity measures. In a thoughtful editorial entitled “A Country in Denial,” in the March 31st issue of The Economist, decades of French policies are summed up as follows: “For years France has offered its people a Swedish-style social model of services, benefits, and protection, but has failed to create enough wealth to pay for it.”

Having spent 27 years in France while working at the OECD in Paris, a beautiful city and country, it is with regret that I must agree with The Economist’s views on some of the reasons France has fallen behind in the creation of wealth. Too many of the French reject the free-market system and capitalism. A poll by the polling firm GlobeScan indicates that only 31% of the French agree that the free-market system is the best. Business- and market-friendly reforms face a very strong political headwind in such an environment. The French have never come to terms with the globalization of the world economy, and their attempts to resist globalization have failed....MORE

Demeter

(85,373 posts)The flash crash that knocked $52 billion off Apple's market cap was hardly the first...

By now anybody who reads the business pages knows that BATS Global Markets screwed up its initial public offering big time Friday by mangling trades in a bunch of stock symbols at the top of the alphabet, including Apple (AAPL) and BATS, its own stock. Apple's shares briefly fell by more than $55 per share. BATS, which had been trading for more than $15, fell to less than 4 cents.

NASDAQ quickly erased all those trades and BATS was allowed to cancel its IPO.

The official explanation for what happened -- or at least the one BATS and the Security Exchange Commission worked out Friday -- is that software in a server covering stock symbols from A to BFZZZ went a little haywire, spitting out what are known on the Street as "false prints."

That made more sense than the original explanation -- a so-called "fat finger" trade caused by someone hitting the wrong keys. It's hard to imagine anyone hitting $542.80 -- the price that was entered for Apple -- when they meant to hit $598.23 (the price Apple was trading for) or anything like it...

MORE.. VERRRY INTERESTING...

Demeter

(85,373 posts)The spectacularly botched initial public offering of Bats Global Markets on March 23 is so rich in irony that it’s difficult to know where to begin. What’s far less amusing is the prospect that the current era of high-frequency trading, in which powerful computers sift through massive information flows in search of price discrepancies and split-second trades, will bring even more episodes of market mayhem far more costly to investors and the broader economy.

In the annals of business screw-ups, Bats has certainly made its mark. Bats stands for Better Alternative Trading System and the company runs two exchanges that collectively rank third in terms of U.S. share trading, behind New York Stock Exchange and Nasdaq. The Bats exchanges account for 11 percent to 12 percent of daily U.S. equity trading, according to its website. The company came of age with the expansion of high-frequency trading over the last decade and the proliferation of quant-jock-driven electronic firms that dominate the buying and selling of U.S. equities. Bats founder Dave Cummings is chairman and owner of high-frequency trading firm Tradebot Systems. Today was supposed to be the Lenexa (Kan.)-based company’s moment in the limelight as it tried to sell about 6.3 million shares in the $16 to $18 dollar per share range. Instead, something went terribly wrong. The company’s shares somehow ended up trading for pennies per share early in the trading day on both the Bats bourse and Nasdaq, according to data reviewed in this Bloomberg story. Then tech investors and Apple (AAPL) fanboys the world over were dismayed when a single trade for 100 shares executed on the Bats market sent Apple’s shares to $542 per share, down sharply from recent levels. (The company set a new 52-week high of $609 per share on March 21.) The stock temporarily halted trading and recovered.

It’s far too early to know what went wrong, though Bats took the unusual step of withdrawing its IPO late in the trading day. “In the wake of today’s technical issues, which affected the trading of certain stocks, including that of Bats, we believe withdrawing the IPO is the appropriate action to take for our company and our shareholders,” said Joe Ratterman, chairman, president, and chief executive officer of Bats. As it happens, the Securities and Exchange Commission has started reviewing whether the trading practices of high-frequency trading firms has given them an unfair advantage over other investors. More fundamentally, it’s not clear that the SEC—or even experienced Wall Street traders—really have a handle as to whether computer driven trading is a good thing or a dangerously disruptive one. These days, about 55 percent of U.S. equity-trading volume comes from firms using high-frequency trading strategies, according to Bloomberg.

Stock trading circa 2012 is increasingly controlled by former computer scientists and mathematicians—and the computers at their disposal—that look at stocks not as traditional value investors looking at earnings and growth, but as streams of price data. When, say, the price of a futures contract strays from an underlying stock, the machines pounce and execute a trade. Back in May 2010, during the fabled flash crash, these digital networks temporarily went haywire and triggered a market panic.

High-frequency trading advocates say all this automation creates far more liquidity and makes the markets efficient. That may be true; there is no stuffing this genie back into the bottle. Yet regulators had better figure out whether or not we have the effective safeguards in place to prevent computerized trading system meltdowns from doing serious damage to investors.

Demeter

(85,373 posts)Jon S. Corzine, the former chief executive of MF Global, was told during the brokerage firm’s final day of business that a crucial transfer of $175 million came from the firm’s own money, not from a customer account, according to an internal e-mail.

The e-mail, sent by an executive in MF Global’s Chicago office, showed that the company had transferred $175 million to replenish an overdrawn account at JPMorgan Chase in London. The transfer, the e-mail said, was a “House Wire,” meaning that it came from the firm’s own money. The e-mail, sent at 2:20 p.m. on Oct. 28 to Mr. Corzine and two of his assistants in New York, says the transfer came from a “nonseg” account, industry speak for a noncustomer account.

But the e-mail, a copy of which was reviewed by The New York Times, did not capture the full story behind the wire, which turned out to contain customer money. MF Global employees in Chicago had first transferred $200 million from a customer account to the firm’s house account, people briefed on the matter said. Once it was in the firm’s coffers, the people said, Chicago employees then promptly transferred $175 million of the money to the MF Global account at JPMorgan in London — the account that was overdrawn.

The e-mail chain sheds new light on the chaotic final hours at MF Global and the desperate efforts to cover the overdraft at JPMorgan. The transfer of $175 million, along with other transfers of customer money, ultimately left farmers, traders and other clients of MF Global missing about $1 billion of their money....MORE

I KNOW THIS IS OLD NEWS...BUT IT'S NOT OUT OF DATE IN THE CONTINUING SAGA

I'M ACTUALLY WORKING DOWN THE BACKLOG, AGAIN. THAT MEANS IT'S QUIET OUT THERE...ALWAYS A BAD SIGN. THEY ARE UP TO SOMETHING..AND THAT SOMETHING IS EITHER TAKING DOWN JP MORGAN, OR SPAIN. OR BOTH.

Demeter

(85,373 posts)The LIBOR trading scandal could turn out to be far worse for Wall Street than its mortgage troubles.... Much of the talk about bad behavior on Wall Street since the financial crisis has been about mortgages with a little bit of insider trading sprinkled in. And that makes sense. Everyone immediately understands what a mortgage is. And the housing bust that resulted from all those bad home loans affected us all. And Hollywood has taught us to ooh and ah over insider trading. But there is another scandal that has come out of the financial crisis that at least to me makes the mortgage underwriting scandal look like small peanuts, and it has been heating up lately. Two weeks ago, the government disclosed that it is looking into bringing criminal cases against traders and banks that manipulated a key bank lending rate, called LIBOR. A source close to the case says the government's "may" will be dropped soon. Both Barclays and Deutsche Bank have disclosed that they have been the focus of investigations. Banks have suspended dozens of traders. Today, Credit Suisse announced that it was cooperating with regulators on the case. Traders at UBS reportedly are already working with the government on its investigation. Looking for instances in which Wall Streeters go to jail, unlike mortgages, this may be the one.

And yet, because it is over a technical sounding bank lending rate, and has been developing for years, the scandal has mostly passed over the public without a real knowledge on what it's about. But to understand the real rot on Wall Street, and how widespread it is, you should. Consider what went on here. Banks took a rate that they artificially set themselves, and then went out and convinced municipalities and pension funds and others to bet against them on the rate. LIBOR rates were supposed to be set by bank treasurers reflecting what it cost them to borrow from other banks. But reportedly a number of bank treasurers consulted traders when deciding what rate to report to the organization in London that collected and posted the rates. (LIBOR stands for the London InterBank Offered Rate) What's more, traders at a number of banks were given access to the systems that bank officials used to enter the rate so they could overwrite the rates with ones that would better suit them. When the rate went the way Wall Street traders programed it to do, the banks cashed in millions.

The LIBOR rate also affects what many of us pay on our adjustable mortgage, home equity loans, car loans and others. But that is a little bit of an aside. The real, clear damage is in the contracts that banks set up with municipalities and others to bet on their own manipulated rates. Baltimore was sold as much as $300 million in LIBOR contracts. The city is the lead plaintiff in the class action against the banks. The suits say the LIBOR market is as large as $90 trillion. Though some have put the market of things the rates affects as much as $350 trillion in loans and derivatives. The suit says on average over the period it was manipulated the banks artificially held the LIBOR rate down by 0.87%. Go with the smaller figure and by back of the envelope math, you get that the banks could have made as much as $750 billion on their scheme, but it probably wasn't that much since banks were probably asked to long and short on the rate...The case also says something about the limits of morality on Wall Street. As the manipulation of LIBOR got worse, a number of Wall Street strategists pointed out that something was off here. One strategist Tim Bond at Barclays even went on Bloomberg television and stated quite clearly that he believed the rates were made up. What was he or his firm going to do about it? Nada. He said his bank's treasurer, who he identified as someone who took his role in reporting LIBOR seriously, at one point put his foot down and said he was going to report the bank's real LIBOR rate, which is to say higher than they had been reporting, indicating, you would assume accurately, that the bank was having some problems borrowing. Bond says all the bank got in return was bad press. So Barclay's wasn't going to do that again. Bond didn't return my phone calls for comment.

Another interesting note about the LIBOR case, especially in light of the Greg Smith public resignation from Goldman Sachs and all the scrutiny of that bank, is that this is one scandal Goldman appears not to be a part of. The firm is not named in the suits. There is more than one firm on Wall Street that treats its clients like Muppets.

Demeter

(85,373 posts)I guess I must go off to do something useful...have a good day, not one that will live in infamy! If possible....

xchrom

(108,903 posts)xchrom

(108,903 posts)French presidential candidate Francois Hollande has said he intends to take a no-nonsense approach to financial markets and tackle speculation.

Mr Hollande outlined the need to "dominate finance" and leave investors "with no space to act".

He also criticised rival candidate and current President Nicolas Sarkozy for leaving France with too much debt.

The two men go head-to-head in the presidential election later this month, with Mr Hollande ahead in the polls.

Mr Hollande believes stimulating growth is vital in order to bring down debt levels

xchrom

(108,903 posts)Lehman Brothers has said it will begin paying out $22.5bn (£14bn) to creditors next week, double its initial estimate for the first round of repayments.

The US investment bank, which collapsed in 2008 and only came out of bankruptcy protection last week, has estimated it will repay $65bn in total.

The repayment plan was approved by a bankruptcy judge in December last year.

Lehman's collapse in 2008 was widely seen as one of the key catalysts of the global financial crisis.

Demeter

(85,373 posts)Last edited Thu Apr 12, 2012, 04:10 PM - Edit history (1)

xchrom

(108,903 posts)India's industrial production rose less than expected in February, at 4.1% from a year earlier, the government says.

Analysts had expected growth of at least 6.6%.

Growth was dampened by a weakness in demand for consumer goods and exports and high interest rates.

January's figure was revised from 6.8% to 1.14%, with a data error blamed, leading to expectations that the central bank might lower interest rates for the first time in three years.

Roland99

(53,342 posts)When they were announced in December, their effects were at first largely ignored, but then they were described by many as a "game-changer" in January. Now the worries have resurfaced with a belief that they have done nothing to help the particular weaknesses in the eurozone.

"The idea that the LTRO solved all issues was just incorrect," says Nick Griffiths, head of global rates at Legal & General Investment Management. "For the markets it was a lifeline to give some breathing space but it did nothing for the fundamentals."

Although he expected Spanish yields to rise and was accordingly short on peripheral bonds, the timing of the move this week caught him somewhat by surprise.

Demeter

(85,373 posts)It's not a crisis if you stand there like a bunny, frozen by the sight of the predator...that's more like suicide.

Demeter

(85,373 posts)the doctor thinks the Kid and I have the nasty rotavirus that's making the rounds....I am washing all her bedding and dolls and animals, on top of bleaching the bathrooms. She's a germ factory, she is.

The board is doing okay....I think we've got the finances under control and down to a routine. The only burning issue now is the crappy set of operating documents that our fly-by-night conversion committee foisted upon us in the dead of night. I have a whole new career as a lawyer ahead of me....sigh. Another thing I could gladly live a lifetime without knowing.

Friday is Euchre Night...so the Weekend will start sometime...and I still don't have a theme/artist/hook for it, so any ideas, any at all, will be gladly accepted and considered...

Demeter

(85,373 posts)Goldman Sachs agreed to pay $22 million to settle civil charges arising from company procedures that created the risk select clients would receive market-sensitive information, such as changes to Goldman's recommendation lists and its ratings of stocks. NICE WEASEL WORDING THERE! The U.S. Securities and Exchange Commission and the Financial Industry Regulatory Authority said the charges stemmed from Goldman's weekly "huddles," at which the bank encouraged its stock research analysts to share trading ideas with the company's traders Those traders then passed tips to a select group of top clients, the SEC said, but the agency's charges did not include any allegations of insider trading. Instead the SEC said that Goldman policy required broad distribution of any "new material statements," such as changes to ratings, price targets, earnings forecast and coverage views.

But Goldman revised the policy in 2006, as the company was placing more emphasis on its huddles programs, the SEC said, to exclude "internal messages commenting on short-term trading issues or market color."

"Higher-risk trading and business strategies require higher-order controls," said Robert Khuzami, the SEC's enforcement director.

"Despite being on notice from the SEC about the importance of such controls, Goldman failed to implement policies and procedures that adequately controlled the risk that research analysts could preview upcoming ratings changes with select traders and clients."

Goldman agreed to pay the penalty, split between the two regulators, and revise its policies to correct the problem. A spokesman for the bank, Michael DuVally, said Goldman was pleased to resolve the matter. I'LL BET THEY WERE!

The regulators said the weekly huddles took place from 2006 to 2011 and that analysts would discuss "high-conviction" short-term trading ideas and other "market color" with traders. Then in 2007, Goldman launched a program called the Asymmetric Service Initiative that allowed research analysts to call a select group of priority clients. According to the settlement with FINRA, Goldman at times failed to properly monitor the conversations that took place in the huddles to determine whether any previews of upcoming research changes were discussed.

...Goldman settled a parallel civil case over the huddles with Massachusetts securities regulators in 2011 in which the bank paid a $10 million fine and admitted to certain factual findings, an unusual occurrence for civil settlements. In the SEC and FINRA statements on the settlement, the bank admitted to the same facts it admitted in the Massachusetts case. Goldman's settlements follow a major 2003 deal, wherein a group of big Wall Street firms including Goldman negotiated a $1.4 billion settlement over allegations that they issued overly optimistic research on companies to win their investment banking business. As part of that settlement, 10 banks agreed to separate their research and banking businesses with a so-called "Chinese wall" to avoid conflicts of interest.

At issue in the Thursday agreement is whether Goldman was meeting the terms and spirit of the earlier settlement. WHAT DO YOU THINK, GOLDMAN WATCHERS?