Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 20 June 2012

[font size=3]STOCK MARKET WATCH, Wednesday, 20 June 2012[font color=black][/font]

SMW for 19 June 2012

AT THE CLOSING BELL ON 19 June 2012

[center][font color=green]

Dow Jones 12,837.33 +95.51 (0.75%)

S&P 500 1,357.98 +13.20 (0.98%)

Nasdaq 2,929.76 +34.43 (1.19%)

[font color=red]10 Year 1.62% +0.04 (2.53%)

30 Year 2.73% +0.06 (2.25%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

[HR width=95%]

[center]Planned Parenthood’s action fund is sending a costumed package of birth control dubbed “Pillamina”

out on the campaign trail to highlight Mitt Romney’s opposition to President Obama’s birth control coverage provision.

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Tansy_Gold

(17,871 posts)for today's "live action" 'toon!

I survived the board meeting, but was nearly done in by washing out the garbage can and watering the peach tree....

It's supposed to have a low of 80F (with massive humidity). 80F and Low should never be used in the same sentence.

I think maybe we might become a board, eventually. The world may be ending, but the condo association progresses.

And we'll have nights in August where we'll be lucky if the overnight low is in two digits instead of three. That's when our humidity soars, too. Might hit 20% or even 30.

Demeter

(85,373 posts)Several states have been taking their share of the $25 billion foreclosure fraud settlement that was crafted in February with the nation’s five biggest banks and, instead of using the money for its intended purpose of providing foreclosure relief to troubled homeowners, have used it to bolster other areas of their budgets. Georgia lawmakers, for instance, have been planning to stash nearly $100 million from the settlement into their state’s general fund.

As Kate Little, president of the Georgia State Trade Association of Nonprofit Developers wrote today, that money did indeed wind up in the state’s general budget, where it will be spent on corporate giveaways — economic programs meant to entice companies to move to Georgia — rather than helping homeowners:

Gov. Nathan Deal and the General Assembly decided in the waning days of the 2012 session to divide the money between the Regional Economic Business Assistance (REBA) and the One Georgia Authority.

That means that none of the funds will go to address foreclosures, even though Georgia has consistently ranked in the top five of states across the country with the highest rates of foreclosure.

Georgia is hardly alone in siphoning off foreclosure settlement funds to plug holes in its budget. But using the money for corporate handouts — which often backfire on a state and lead to a race to the bottom as states attempt to out-do each other in terms of the biggest giveaways — is doubly insulting to homeowners depending on the settlement to provide them with a lifeline.

Demeter

(85,373 posts)Deep down we know there's no paradise on earth, but as the children of immigrants who came to this country believing it was a land of milk and honey, we are stalwart. For generations now, it's the middle class that has sustained the dream of "America, the Beautiful" – with a dash of liberty and justice for all. But now the very foundations on which that dream has rested are crumbling. Consider the facts in this recent editorial in the New York Times:

According to a new survey from the Federal Reserve, the median American family’s net worth dropped by nearly 40 percent from 2007 to 2010 — from $126,400 to $77,300 — wiping out 18 years’ worth of accumulated wealth. The crash in house prices accounted for most of that loss. Median family income, which was already edging down in the years before the recession, continued to decline, dropping from $49,600 in 2007 to $45,800 in 2010, about where it was in the mid-1990s.

The middle class was hit the hardest…

The recession "would have been much deeper and the weak recovery much weaker", we are told, but for past government support (for example, payroll tax cuts and extended jobless benefits). Of course, Republicans in Congress opposed these measures. Give the socialist Obama an inch, you see, and he will turn this country into a Marxist dictatorship.

The Times editorial calls for "…more support, including federal spending on education and public-works projects to create jobs, targeted tax credits for hiring, programs to deliver mortgage relief that supports house prices…as well as a renewed commitment to financial regulation to ensure that the system doesn’t melt down again." However, "The Republicans — for reasons of ideology and self-serving election-year politics — are determined to block all of these necessary programs." ...In case you haven't heard: Freedom isn't free. Just ask the rich Republicans who seem to think it's fair that millionaires and billionaires get big tax breaks not available to middle class working families. After all, "earned income" is for losers; winners have "capital gains" to keep them warm. And so what if losers pay a higher rate of tax than winners. Somebody has to pay for all that freedom they…uh, I mean we…enjoy. There are no two ways about it. When the middle class is in decline, the storied "American way of life" is imperiled. Neither a republic worthy of the name nor a robust market economy can exist without a strong and vibrant middle class. That's not bleeding heart schmaltz; it's a fact that only block-headed fools dare to dispute...What we are experiencing in this country is an unsustainable state: the rich get everything they want, and they want everything. It's as though the plutocrats have a death wish. Tragically, they alone are in a position to move the machinery of government toward necessary reforms, but they persist in doing the opposite. If the inequality and injustice of the New Derivative Economy does not provoke a popular uprising, the combination of fundamental structural imbalances and corrupt politics will eventually bring the whole degenerate system crashing down.

No mass consumption society can prosper if its middle-class citizens lack the means to consume and the confidence to invest. And no republic can flourish or long survive when the people's elected representatives get in bed with billionaires and bankers, rig elections, sell votes, polarize society for personal gain, and place partisan interests above the public interest.

Demeter

(85,373 posts)JPMorgan Chase & Co Chief Executive Jamie Dimon said his bank was upfront with investors about its multibillion-dollar trading loss, even as regulators investigate whether JPMorgan disguised a dramatic rise in risk-taking. Dimon, testifying on Tuesday for the second time in a week before lawmakers about the failed hedging strategy, acknowledged that JPMorgan in January changed a "value-at-risk" model for the trading portfolio in question. The bank did not disclose the change until May 10, when Dimon also revealed that the trading portfolio had produced at least $2 billion in losses.

"We disclosed what we knew when we knew it," Dimon told the House Financial Services Committee on Tuesday.

Dimon's comments came after the committee heard from a panel of regulators, including Securities and Exchange Commission Chairman Mary Schapiro, who gave more details about her agency's investigation into the trading loss. Schapiro said the SEC is looking at whether JPMorgan misled investors in its April earnings statements by failing to disclose the value-at-risk (VaR) change. At that time, Dimon also called press reports about a "London whale" trader with an outsized position a "tempest in a teapot".

................................................................................................

Dimon's testimony on Tuesday followed his appearance last Wednesday before the Senate Banking Committee, where senators were mostly deferential. A few members of the House Financial Services Committee went harder at Dimon, asking him repeatedly to defend the size of JPMorgan, the nation's largest U.S. bank by assets.

"No, we're not too big to fail," said Dimon, who at times appeared more tired and exasperated than during last week's hearing. "I don't think there's any chance we're going to fail," he added.

The SEC is investigating the trading loss, along with the Commodity Futures Trading Commission. The FBI has also said it is looking into the losses.

Schapiro on Tuesday gave her most detailed comments yet on her agency's probe.

"The area we're focused on and concerned about is a change with respect to the VaR model they used for their earnings release on April 13 that had the effect, yes, of understating the value-at-risk," Schapiro said.

She said it is hard to say what sort of financial penalty JPMorgan could face, but said the agency has a large number of potential sanctions.

Demeter

(85,373 posts)The top news from Capitol Hill testimony today by JPMorgan Chase CEO Jamie Dimon is that he says "the bank did its best to fully inform investors about its risk strategy several weeks before it suffered a $2 billion-plus trading loss," The Associated Press reports.

But the quote from him that seems to be getting the most attention came in response to a question from Rep. Sean Duffy, R-Wis., who wanted to know if the bank could ever lose "a half a trillion dollars or a trillion dollars?"

"Not unless this earth is hit by a moon," Dimon quipped.

Demeter

(85,373 posts)JPMorgan Chase & Co. Chief Executive Jamie Dimon on Tuesday defiantly defended his lobbying against some new financial regulations as he faced tough questioning by lawmakers about the bank's huge trading loss.

Appearing before a congressional committee for the second time in less than a week, Dimon again said the bank was sorry for the more than $2-billion loss. But he downplayed the consequences for the company and the financial system, saying JPMorgan soon would report a solid profit for the second quarter of the year.

Dimon apologized that JPMorgan's trading loss was distracting Washington officials from fully focusing on the European debt crisis.

“I’m sorry I’ve taken up so many people's time with this loss because it is not significant in the global scheme of things,” Dimon told the House Financial Services Committee....

Demeter

(85,373 posts)...financial analysts Jim Willie and Rob Kirby... contend that the $3 billion-plus losses in London hedging transactions that were the subject of the hearing can be traced, not to European sovereign debt (as alleged), but to the record low interest rates maintained on US government bonds.

The national debt is growing at $1.5 trillion per year. Ultra-low interest rates MUST be maintained to prevent the debt from overwhelming the government budget. Near-zero rates also need to be maintained because even a moderate rise would cause multitrillion dollar derivative losses for the banks and would remove the banks' chief income stream, the arbitrage afforded by borrowing at 0 percent and investing at higher rates. The low rates are maintained by interest rate swaps, called by Willie a "derivative tool which controls the bond market in a devious artificial manner." How they control it is complicated and is explored in detail in the Willie piece here and Kirby piece here. SEE LINKS AT ORIGIN

Kirby contended that the only organization large enough to act as counterparty to some of these trades is the US Treasury itself. He suspected the Treasury's Exchange Stabilization Fund, a covert entity without oversight and accountable to no one. Kirby also noted that if publicly traded companies (including JPM, Goldman Sachs and Morgan Stanley) are deemed to be integral to US national security (meaning protecting the integrity of the dollar), they can legally be excused from reporting their true financial condition. They are allowed to keep two sets of books. Interest rate swaps are now over 80 percent of the massive derivatives market and JPM holds about $57.5 trillion of them. Without the protective JPM swaps, interest rates on US debt could follow those of Greece and climb to 30 percent. CEO Dimon could, then, indeed be "the guy in charge": he could be controlling the lever propping up the whole US financial system.

Hero or Felon?

So, should Dimon be regarded as a national hero? Not if past conduct is any gauge. Besides the recent $3 billion in JPM losses, which look more like illegal speculation than legal hedging, there is JPM's use of its conflicting positions as clearing house and creditor of MF Global to siphon off funds that should have gone into customer accounts and its responsibility in dooming Lehman Brothers by withholding $7 billion in cash and collateral. There is also the fact that Dimon sat on the board of the New York Federal Reserve when it lent $55 billion to JPM] in 2008 to buy Bear Stearns for pennies on the dollar. Dimon then owned nearly three million shares of JPM stock and options, in clear violation of 18 USC Section 208, which makes that sort of conflict of interest a felony. Financial analyst John Olagues, a former stock options market maker, pointed out that the loan was guaranteed by $55 billion of Bear Stearns assets. If Bear had that much in assets, the Fed could have given it the loan directly, saving it from being swallowed up by JPM. But Bear did not have a director on the board of the New York Fed. Olagues also noted that JPM received an additional $25 billion in TARP payments from the Treasury, which were evidently paid off by borrowing from the New York Fed at a very low 0.5 percent; and that JPM executives received some very large and highly suspicious bonuses called Stock Appreciation Rights and Restricted Stock Units (complicated variants of employee stock options and restricted stock). In 2009, these bonuses were granted on the day JPM stock reached its lowest value in five years. The stock quickly rebounded thereafter, substantially increasing the value of the bonuses. This pattern recurred in 2008 and 2012. Olagues has evidence of systematic computer-generated selling of JPM stock immediately prior to and on the dates of the granted equity compensation. Collusion to manipulate the stock to accommodate the grant of options is called "spring-loading" and is a violation of SEC Rule 10 b-5 and tax laws, with criminal and civil penalties.

All of which suggests we could actually have a felon at the helm of our ship of state....Is there no alternative but to succumb to the Mafia-like Wall Street protection racket of a covert derivatives trade in interest rate swaps? As Willie and Kirby observed, that scheme itself must ultimately fail and may have failed already. They pointed to evidence that the JPM losses are not just $3 billion, but $30 billion or more and that JPM is actually bankrupt. The derivatives casino itself is just a last-ditch attempt to prop up a private pyramid scheme in fractional-reserve money creation, one that has progressed over several centuries through a series of "reserves" - from gold, to Fed-created "base money," to mortgage-backed securities, to sovereign debt ostensibly protected with derivatives. We've seen that the only real guarantor in all this is the government itself, first with FDIC insurance and then with government bailouts of too-big-to-fail banks. If we, the people, are funding the banks, we should own them; and our national currency should be issued, not through banks at interest, but through our own sovereign government.

MORE

*************************************************************************************

Ellen BROWN is an attorney and the author of eleven books, including Web of Debt: The Shocking Truth About Our Money System and How We Can Break Free. Her websites are webofdebt.com and ellenbrown.com. She is also chairman of the Public Banking Institute.

Demeter

(85,373 posts)The boss of one of America's biggest banks has been snapped wearing a set of presidential cufflinks, prompting speculation that they were a gift from President Barack Obama.

JPMorgan Chase CEO Jamie Dimon was sporting the cufflinks, emblazoned with the seal of the President of the United States, at a senate banking committee hearing on Wednesday.

One of Wall Street's wealthiest fat cats, Mr Dimon is believed to have a good relationship with Mr Obama, having visited the White House 16 times and the President on at least three of those occasions.

And the love is reciprocated, with Mr Obama describing the millionaire in a May interview as 'one of the smartest bankers we've got' and his bank as 'one of the best managed banks there is'...

Demeter

(85,373 posts)“The question is,” said Alice, “whether you can make words mean so many different things.”

“The question is,” said Humpty Dumpty, “which is to be master— that’s all.”

-Lewis Carroll, Alice in Wonderland

The House Financial Services Committee hearings on the losses in JP Morgan’s Chief Investment Office were an improvement over the Senate version, in that there was comparatively little fawning over Jamie Dimon and more earnest, even if not very successful, efforts to pry information from him (one wonders whether the fact that Chuck Schumer has been hitting Wall Street up for superPac donations was a contributing factor). Even some Republicans got a bit stroopy with him, including the Representative from Bank of America, Patrick McHenry. But to anyone who knows bupkis about finance, the striking thing was how many times Dimon gave sloppy to downright dishonest answers. And they didn’t have the feel of the kind of careful word parsing that Goldman execs did when under Congressional hot lights in 2010, of people who’ve been scripted and rehearsed to give very narrow answers and duck anything that will put them on rocky ground. While there was nothing wrong with Dimon’s manner, our buddy Amar Bhide was right when he called Dimon’s answers Orwellian. He played remarkably fast and loose with words and definitions. It was disrespectful, but not in a way that anyone could have called him out on it. The five minute limit on questions made it impossible to do the sort of questioning it would have taken to nail down Dimon’s misrepresentations.

Let’s give a few examples of Dimon’s crude propaganda efforts. I wish I had a transcript; I’m working from rough notes, and some of the memorable howlers were quick asides.

Brad Sherman presented Dimon with the results of an IMF study (via Bloomberg) that showed that JP Morgan had lower funding costs due to its implicit government guarantee. Dimon responded by arguing that single A industrial companies pay less for funds than his AA rated bank. Huh? Industrial company funding costs are completely irrelevant and Dimon knows this. It’s a “blow smoke” answer.

McHenry argued that the Dodd Frank orderly liquidation authority preserved too big to fail. I happen to agree because I’ve gotten estimates that 30% to 50% of JP Morgan’s derivatives contracts are under UK law, and therefore the FDIC could not override their termination or cross default clauses if it tried putting the parent into liquidation and keeping the subsidiaries going. Since derivatives are booked in the depositary, it’s hard to see how the FDIC can stop derivatives not under US law being terminated or subject to higher haircuts as a result of a parent company resolution, and that not producing a risk of a run on the depositary (which is what the OLA was meant to avoid). McHenry then asked for Dimon to discuss the difference between OLA and bankruptcy. There’s a considerable difference, but Dimon dissed McHenry (whose poorly worded question gave Dimon too much rope) by telling him he saw them as the same.

Dimon (annoyingly) kept claiming the failed trade was a hedge. That’s only because Dimon uses a wildly personal definition of what a hedge is: something to protect you from Bad Things Happening. No, that is either a reserve or insurance. A hedge is a position taken to reduce or limit losses in a position you already have. And he kept promoting the dubious idea that portfolio hedging should include bets against systemic risks (Dimon kept presenting hedging against systemic risk as if it was a unitary phenomenon).

Dimon kept maintaining that because his organization was slow to pick up on how risky the trade was, that regulators couldn’t be expected to have caught it either. That’s barmy. As we stressed, this trade violated a really basic premise of trading desk management: never take a position that is too large for you to unwind quickly (shorter: never get too big relative to that market). Lisa Pollack of FT Alphaville (who wrote extensively that something WAS amiss before JPM woke up to it) demonstrates today that regulators could have seen something suspicious was going on and have tracked it back to JP Morgan from DTCC reports.

Nevertheless, there were some interesting themes throughout the day: jousting over Dimon’s opposition to regulation, Dimon’s insistence that US banks needed the right to compete against those evil foreign banks who got better treatment (this was actually not true when the trade was being put on; Eurobanks were subject to what is referred to as Basel 2.5, meaning a tightening in capital standards as part of the gradual implementation of Basel III. JP Morgan and other US banks are actually arbing the fact that foreign branches, which fall under US regs, are not effectively overseen by US supervisors. The UK’s FSA has argued they’d get better oversight if they were made into subsidiaries, which would put them under the purview of foreign regulators).

But the most important difference of views was on whether banks were serving the real economy or themselves. Some even dared to talk about banking as a utility, and Dimon conceded that if JP Morgan were regulated it could would not have lost money in the CIO trade. Several Congressmen took up the theme, but the most persuasive statement came from Gary Ackerman:

Dimon: When you gamble, on average, you lose. The house wins.

Ackerman: That been my experience in investing.

Dimon offers to find him a better investment advisor and Ackerman looks amused.

Ackerman: I would tend to agree with you. But we seem to be treating them quite the same. I used to think all of Wall Street was on the level, that it facilitated investing, that it allowed people and institutions to put their money into something they believed in and believed would be helpful and beneficial and would grow and make money and especially good for the economy and on the side create a lot of jobs good for our country and good for America

Now a lot of what we are doing with this “hedging,” and you can call it protecting your investment or whatever, but it’s basically gambling. You’re just betting that you might have been wrong. It doesn’t help anything succeed any more or encourage anything any more. It creates the possibility that people say “Do these guys really know what they are doing if they are now betting against their initial bet?” And then if you go and hedge against your hedge, which means you’re betting against your first bet, it seems to me that you are throwing darts at a dart board and putting a lot of money at risk just in case you were wrong the first time. I don’t see how that creates one job in America, I don’t see how it helps the American economy, I don’t see how it helps the housing market or the building market or the “let’s make steel” or widget market one tenth of a zillionth of a percent. What it helps is if you are right a majority of the time, then it makes a bunch of money for the guys who did it, and doesn’t help the company or the industry, the economy, or the country at all. And if you are wrong, it puts systemically everything at risk. And when I mean everything, I mean the confidence the American people, the investing community, and everybody else has in the system. And that’s a loss you can’t hedge against.

This point is essential. Dimon started his remarks by claiming that the US had the best capital markets in the world. Nothing like an appeal to American exceptionalism in DC. But he tried to present himself as aligned with their (US PEOPLE'S INTERESTS). In fact, the success of the US financial markets rests on the size of the American economy and on the fact that in the wake of the Great Depression, we created the best investor safeguards in the world, including regular, audited financial reports and prohibitions against insider trading, front running, and misleading or incomplete disclosures. Dimon and his peers are unabashedly out for what is best for banks, and argue that it is somehow good for the rest of us, when the evidence is overwhelming that the industry is more and more a cancer on the real economy. The US capital markets are running on brand fumes, the global economy is likely to have at best a faltering recovery, with a lot of people ground into penury by protracted joblessness and loss of savings and asset value. When the histories of this period are written, the top bankers like Dimon and their refusal to cede ground to the good of the public will be seen as a primary cause of persistent economic and social distress.

Demeter

(85,373 posts)Hugh says:

June 20, 2012 at 4:37 am

Banksters, like Dimon, are the great villains of our times. They are our Stalins and Hitlers, Berias and Himmlers. They have the blood of tens of thousands of Americans on their hands each year. They have ruined the lives of tens of millions and have damaged the lives of hundreds of millions.

I am reminded of something Hannah Arendt wrote:

Origins of Totalitarianism

Substitute kleptocracy for totalitarian movement and elites for front organizations. And you have the dynamic we see today. We look at the Romneys, Obamas, and Dimons of the world, and we continue to view them as part of the normal world. In the view of the normal world, they can at most be foolish, mistaken, incompetent. Viewing them as normal effectively blinds us to their criminality and downright viciousness. We must, like Arendt, peel back the layers of feigned normalcy to see the festering reality and putrid pathology beneath. When we can begin to see these luminaries of our elites on the level of say a particularly sick and twisted serial killer, then and only then will we begin to see them as they really are. Every shred and trapping of legitimacy, every benefit of the doubt we accord them is just so much cover for them to continue their looting and destruction.

Reply

Up the Ante says:

June 20, 2012 at 5:40 am

” .. the great villains of our times. ”

Like these guys ?,

Michael Duke

Lee Scott

David Glass

Sam Walton

“Viewing them as normal effectively blinds us to their criminality and downright viciousness. ”

Probably exactly Dimon’s view of “these guys”, and what could be greater empowerment of Dimon’s looting ?

Iconic Villains sold to you.

Demeter

(85,373 posts)The Federal Reserve Board’s Open Market Committee (FOMC) meeting this week likely presents its last opportunity to boost the economy before the end of the year. While the FOMC meets every six weeks, as a practical matter the FOMC has historically been very reluctant to take major moves close to an election. After this week’s meeting we will be in the window where the Fed is unlikely to move. This means that it is especially important that the Fed take steps to boost the economy now...The fact that the economy can use an additional boost should not be in dispute. The rate of job creation in the last two months understates the underlying growth path since it is essentially a payback from the stronger growth due to an unusually mild winter.

Even the 165,000 average rate of job creation for the last five months is far too slow. With the economy needing roughly 100,000 new jobs a month to keep pace with labor force growth, it would take us more than 12 years to make up our 10 million jobs deficit at this point. If there is a clear need for more rapid growth, the data also show there is no downside risk of excessive inflation. The consumer price index fell 0.3 percent in May. It has risen by just 1.7 over the last year. The core index rose 0.2 percent last month and is up 2.3 percent over the last year.

Of course many of us have argued that higher-than-normal inflation would be desirable in any case. It would reduce real interest rates in a world the Fed has already pushed the nominal Federal Funds rate as low as it possibly can. That would provide businesses with more incentive to invest. Higher inflation should also help to lift house prices, helping homeowners to rebuild equity. However even if the Fed is unwilling to accept the idea that it should promote higher inflation, as Chairman Bernanke had recommended back in his days as economics professor, it should at least be confident that the data show no reason to be concerned about inflation exceeding its target. In this context the Fed should be prepared to take additional steps to boost the economy. There are two routes the Fed can go. First it could do yet another round of quantitative easing. This amounts to buying up more long-term debt, either Treasury bonds or mortgage-backed securities, with the hope of driving down long-term rates further.

The Fed already owns close to $3 trillion in mostly long-term debt. It could buy another $1 trillion or so in the hope of putting somewhat more downward pressure on long-term rates. In an optimistic scenario, perhaps this would lower the 10-year Treasury rate by 15-20 basis points. That would allow for some additional mortgage refinancing and perhaps be a modest spur to investment. It would also help to lower the value of the dollar, which would increase our net exports; although the improvement on the trade balance will likely take six months to a year to be felt. The alternative route would be to pick up an idea that Bernanke tossed out three years ago. He could target a longer term rate. For example, he could announce that he would set a target of 1.2 percent for 10-year Treasury bonds for the next year (compared with around 1.5 percent at present). This would mean that the Fed would buy as many Treasury bonds as necessary to bring yields down to this level. This would have a similar, but likely somewhat more powerful effect as another round of quantitative easing. In an optimistic scenario it could lower 30-year mortgage rates by 20-30 basis points, allowing for a somewhat bigger impact on mortgage refinancing and investment.

In neither case will the Fed action turn around the economy....

Demeter

(85,373 posts)Two members of the Senate's Judiciary Committee are asking the Supreme Court to provide live coverage of its proceedings when it hands down its decision on the constitutionality of the 2010 health care law.

The ruling is expected by the end of the month, but as NPR's legal affairs correspondent Nina Totenberg told Mark in March, the Supreme Court has never allowed live broadcasts for fear that it could lead to "mistaken impressions" or lead to a decline in the quality of debate.

Sen. Chuck Grassley, a Republican ranking member, and Patrick Leahy, the Democratic Chairman, sent a letter (pdf) to Chief Justice John Roberts yesterday asking the high court to reconsider...

snot

(10,538 posts)Demeter

(85,373 posts)One must be a senile weasel, at least one or the other, but preferably both.

DemReadingDU

(16,000 posts)I am astonished at the elected people that were voted to sit as mayor and council members in our town. It doesn't even matter to vote out the old, and elect new. They are all of the same mode.

GRRRR

Demeter

(85,373 posts)President Barack Obama voiced confidence Tuesday in Europe's ability to "break the fever" of its raging debt crisis as he sought to calm both global financial markets and the election-year worries of voters at home. Obama, speaking at the close of the Group of 20 economic summit, said Europe's leaders showed a "heightened sense of urgency" during two days of talks in this Mexican resort. The president maintained that Europe had the capacity to solve the crisis on its own, indicating the U.S., still battling its own economic woes, would not be offering any financial pledges to help its international partners.

"Even if they cannot achieve all of it in one fell swoop, I think if people have a sense of where they are going that can provide confidence and break the fever," Obama said in a news conference that brought to a close his last foreign trip before the November election.

Obama waded deep into the summit discussions on Europe's debt crisis, which could have repercussions both for a U.S. economy still struggling to recover from a recession and Obama's own re-election prospects. He acknowledged that "all of this affects the United States" but that his administration does not have control over how quickly the Europeans fix the problems.

"All of these issues, economic issues, will potentially have some impact on the election," Obama said. Mindful of his audience of voters in the U.S., Obama said: "The best thing the United States can do is to create jobs and growth in the short term even as we continue to put our fiscal house in order over the long term."

...Despite Obama's endorsement of European efforts, he said the responsibility for creating jobs back in the U.S. lay with his administration and congressional lawmakers, not Europe. He urged Congress to focus on steps they could take to boost job creation and economic growth, pitching legislation he proposed months ago that has little chance of garnering Republican support in an election year.

"I've consistently believed that if we take the right policy steps, if we're doing the right thing, then the politics will follow and my mind hasn't changed on that," Obama said.

...Underscoring the stakes, Obama held a lengthy private meeting with German Chancellor Angela Merkel, whose country plays a pivotal role in addressing the crisis. Obama also held a joint meeting Tuesday with leaders from Britain, Germany, Italy, France, Spain and the European Union....

Demeter

(85,373 posts)The Group of 20 leaders presented a lengthy homework assignment to their European colleagues and said it was critical that some of the work be completed at the European Union summit meeting later this month.

The thorniest task the euro-zone accepted at the meeting in Los Cabos, Mexico will be ”to break the feedback loop” between weak banks and weak sovereigns.

Another challenge will be to make sure that countries like Spain and Italy can borrow at sustainable interest rates...

Demeter

(85,373 posts)After their two-day meeting ended on Tuesday, leaders of the Group of 20 top economies managed to say some of the right things. Focusing on the euro-zone debt crisis — clearly, the largest threat to the global economy — they pledged to do more to spur growth, ensure financial stability and support a stronger European fiscal union.

The question now is whether these words will ever translate into effective action. If the past two years of the euro crisis is any guide, the likely answer is no. As recession and banking crises have enveloped Greece, Ireland, Portugal, Spain and Italy, the crisis response, led by Germany, has been dominated by a relentless insistence on self-defeating austerity and piecemeal rescue plans. The result has been deeper recession, social unrest and political upheaval in Europe’s weaker economies and increasing mistrust between the strong and weak nations of Europe — precisely the wrong conditions for integrating the banks, budgets and politics of Europe in a way that is needed for the long-term survival of the euro.

Will this time be different?

There are mounting reasons for Germany to alter its stance. For one, the stakes are higher. No sooner did the elections in Greece on Sunday ease fears of a disorderly Greek exit from the euro then borrowing costs spiked in Spain and Italy. Both countries must sell government bonds to refinance heavy debt loads, but investors, spooked by recession and financial instability, are instead pulling money out of the countries. That presages far bigger challenges than Europe has faced thus far and underscores the failure of policies to stem the crisis...Against that backdrop, the world leaders had a chance to press Angela Merkel, Germany’s chancellor, to provide stronger and more flexible bailout support — for example, by allowing Greece more time to meet the backbreaking terms of its bailout package or injecting capital from the euro zone directly into Spain’s banks or seeking more aggressive ways to lower interest rates for vulnerable borrowers, including issuance of a common Eurobond or direct bond purchases by the European Central Bank. Ms. Merkel has long rejected such steps. But, next week, when leaders of the European Union meet for a planned summit meeting, the discussions from the G-20 could provide a foundation and political cover for her to begin to take bolder action.

Then again, she could hold firm to her current stance. She has repeatedly insisted on austerity for hard-pressed countries, even when it has been a demonstrable failure. And, while she has correctly asserted that more aid on better terms should be accompanied by greater European unity, the lack of unity appears to be an excuse to delay steps to ensure that adequate aid is available on workable terms. Under current policies, the euro zone and the global economy have been put at high risk.

By next week we will find out whether world leaders at the G-20 got through to Ms. Merkel.

Demeter

(85,373 posts)THE GOP MUST WANT TO THIN THE HERD---OF REPUBLICANS. WANT TO SEE THE HUNGRY HUNTING AND EATING ELEPHANTS IN THIS COUNTRY?

http://www.cbsnews.com/8301-250_162-57455799/republicans-seek-cuts-to-food-stamp-program-with-new-farm-bill/

The 1,000-page "farm bill" being debated in the Senate is somewhat of a misnomer. Four of every five dollars in it — roughly $80 billion a year — goes for grocery bills for one of every seven Americans through food stamps.

Republicans say Congress could cut the cost $2 billion a year by just closing a pair of loopholes that some states use to award benefits to people who otherwise might not qualify. "This is more than just a financial issue. It is a moral issue," says Sen. Jeff Sessions, R-Ala., one of several Republicans pushing for cuts in spending for the Supplemental Nutrition Assistance Program, commonly known as SNAP...Sessions points out that the federal government now spends twice as much on food stamps as it does on fixing the nation's roads and bridges, and that SNAP is now the government's second-largest federal welfare program, following Medicaid...

The program has swelled from 28 million to 46 million participants and its costs have doubled in the past four years. The recession and slow recovery have increased the number of people unemployed over the same period from 8 million to 12 million.

Demeter

(85,373 posts)Demeter

(85,373 posts)...The leading (and right wing) German paper FAZ reports that the ECB was fighting over whether to turn off the money supply to Greece. One has to assume the intent is to tell the Greeks that the rest of Europe is unwilling to negotiate with them (New Democracy has signaled that it won’t push hard; Syriza is taking a bolder stance, but since it has said it thinks leaving the euro would be really bad for Greece, its ability to negotiate effectively depends on being able to project the sort of vengeful unpredictability that Kissinger cultivated on behalf of Nixon {note that Kissinger merely had to tart up reality a bit...]).

Since many NC regulars read the European press, I’ll throw it out to you: what do you deem the odds of Euro breakup to be (with “breakup” defined as at least one country exiting the Eurozone) in the next month? In the next six months? And if you think it will come apart, but later, guesstimate how much later and why you think it will occur later rather than sooner.

POST THOUGHTS IN COMMENT SECTION AT: http://www.nakedcapitalism.com/2012/06/nc-crowdsourcing-will-the-euro-survive.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

jtuck004

(15,882 posts)...

...

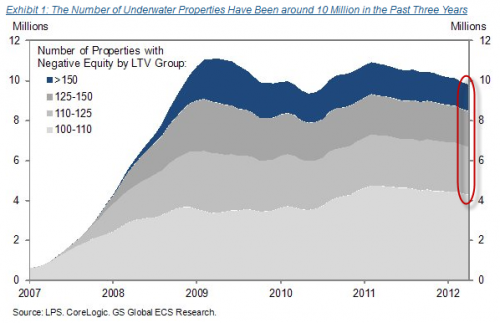

Some are on the cusp of negative equity but over half of these mortgage holders have loan-to-value ratios of 110 percent or higher. Nearly one million homeowners have loan-to-value ratios above 150 percent! This is now becoming a battle of attrition. Those with negative equity levels that high are likely to remain in a negative equity position for probably a decade or more. In many of these cases it is likely better to cut losses and move on either to rent or repair your balance sheet to buy a lower priced home in the future if possible.

...

Housing has continued to move lower therefore pushing the net worth of Americans lower. Negative equity is a transfer to bailout the banks by those still living in overvalued homes. Since 9 out of 10 still pay their mortgage even when they are in a near or negative equity position, you realize that people are more resistant to making a calculated business decision when it comes to housing. Banks have pushed much of the toxic loans to the Fed balance sheet and essentially are only lending out government backed loans. To say housing is in good shape with over 10,000,000 negative equity homeowners is hard to grasp.

They also lose 6% on the sale to an agent, who has the unenviable task of telling homeowners they aren't gonna be able to sell the house for what the amount of their loan.

On top of that 10,000 people a day are turning 65, the precise age when most would have sold their home in preparation for retirement, a home which is larger and more expensive than they need. And when they find potential buyers, everyone wants a big discount to pull the trigger. Even then, it may wind up not being big enough, until we step in with programs only the government can put together, and quit relying on the business fairy to make things better.

And foreclosures are higher than they have been in two years.

We live in an area that is not nearly as bad as Vegas or California, but there are a boatload of homes for sale on Zillow in this zipcode, and a bunch, including the neighbors on either side, whose values drop every month.

This is where Americans put a good chunk of the average retirement for a long, long time.

Better than it was, but this is a drag that will last for years.

I wonder if there is a business converting bigger homes into group homes. At least they will have nice kitchens, after all the money dumped into them over the past few years...

xchrom

(108,903 posts)Game of Thrones political ads.

pretty clever.

Demeter

(85,373 posts)You can skip the donus, if you are counting calories.

xchrom

(108,903 posts)i say donut calories don't count.

![]()

Demeter

(85,373 posts)Joining Teach For America before pursuing a career in business will provide you with the management experience and skills that will help you have a greater impact in the business world. By committing two years to teach in a low-income community, you will have an unparalleled opportunity to assume tremendous responsibility—managing a classroom of students, setting ambitious goals, and inspiring your students to meet those goals. Through this experience, alumni say that they developed invaluable communication and time-management skills that are highly transferable to a career in business.

Partnership Benefits

Eligibility Requirements

New York, Chicago, San Francisco, Houston, Dallas

Deferral Partnership Details

Demeter

(85,373 posts)A California teacher has been given the sack despite winning the prized 'Teacher of the Year' award for her school district.

Sutterville Elementary School sixth-grade teacher Michelle Apperson was handed the pink slip just weeks before being announced Sacramento City Unified School District's best teacher, according to KXTV.

Ms Apperson is among nearly 400 teachers in the area to receive lay off notices in May due to state budget cuts. California law follows a last in, first out policy, firing teachers based on seniority rather than whether they are good at their job or not. 'It hurts on a personal level because I really love what I do,' Ms Apperson told KXTV. 'But professionally, politically, I get why it happens.'

Parents at the school are outraged their top teacher is being given the boot...

Demeter

(85,373 posts)Recently, Barack Obama announced a laudable new policy position on immigration. His administration will no longer deport undocumented immigrants who were brought to this country as children by their parents, as long as they don’t get in trouble with the law. These are people who are essentially Americans without citizenship, and the risk of deportation to a country they don’t really know is a terrifying and unfair. Aside from this serving the cause of justice and human decency, this is a long overdue move to reward a constituency group, happening in an election year. It’s worth understanding how this policy change came about, so that one can get a sense of the incentives that animate the White House policy shop.

Here’s White House advisor David Plouffe on CNN describing the change.

“This is not a political move. This builds on a lot of steps that we have already taken,” Plouffe said on the CNN program “State of the Union.”

So it’s not a political move. Ok. I find that hard to believe, since it’s an election year. And indeed, this was published in the New Yorker a few days ago.

David Plouffe thinks nothing of outright lying on CNN about why the administration changed its policy, in one forum describing it as a useful policy change and denying any political incentives and in another more insider-friendly publication making it clear that it was a reelection gambit. It doesn’t matter whether the politics or the policy were the driving force, it’s a good change. That Plouffe feels that he can so cavalierly lie shows how dishonestly this administration operates. There are more political lessons to be drawn, other than the fact that this administration is full of liars and that Obama usually only helps non-wealthy constituency groups when he is scrambling for his own electoral survival. The political lesson is that pressure matters, but so does leverage. The overall atmosphere on this particular problem – undocumented immigrants who arrived as kids – came to a boiling point through the actions of an entire activism eco-system. There were nationwide marches for immigration reform a few years ago, and undocumented college students bravely marched openly to bring this issue to light. These kids embarrassed the administration, and it must have shown in the polls in terms of dampening enthusiasm to vote in 2012 among Latinos. But even this was not enough. It was only fear of the Republicans outflanking Obama to the left that got the administration to move. When the issue came to a head, and Obama feared that he would pay a political price from the Republicans, all of the excuses – the terrible Republican opposition, a divided country, an intractable Congress with a 60 vote threshold – suddenly evaporated. Faced with losing his own hide, Obama governed.

This is a reasonable template for how to get the Obama administration to act. It’s very very hard, and requires a lot of organizing to raise an issue to level where the Obama administration feels heat and embarrassment. It’s similar to the administration’s stance on gay marriage. Prior to his announced support for gay marriage, Obama backtracked on an executive order banning discrimination among government contractors. He promised to sign the order, and then didn’t. Gay billionaire donors were outraged, and began witholding money from his campaign. And since Obama needed their money to make up for the general lack of excitement for his reelection on both Wall Street and among his small dollar donors, he acted. He tepidly announced personal support for gay marriage, with no corresponding legal or political support. This isn’t a small deal; the President carries moral weight. But it happened because he needed the money.

There’s one additional constraint on the administration’s range of actions. Obama will not make policy changes that negatively affect those with money, unless he can’t avoid it or unless he is rewarding a constituency group that has even more money. Neither gay rights nor immigration will threaten the broad support of the financial services industry and economic injustice, because neither threatens oligarch control of the political system and the economy (marijuana decriminalization is another issue like this). Corporate America is perfectly happy to see more immigration, because immigration can depress wages. Rich people are also perfectly happy to support gay rights, because there are enough openly gay rich elites to have turned opinion in that area. Dick Cheney, for instance, came out for gay marriage years ago. Politicians like gay rights in particular because there’s less and less risk in taking on the issue, but the PR value of being able to call yourself “progressive” and cover up an agenda of supporting increasing economic inequality is substantial. It’s why Lloyd Blankfein of Goldman Sachs is the face of gay marriage for corporate America, having signed up with a gay rights group to push the issue. But even within those “safe” issues, as with the executive order on discrimination which might have forced changes among wealthy government contractors, Obama tends to instinctively side with the more corrupt interest groups if there is money at stake....

bread_and_roses

(6,335 posts)xchrom

(108,903 posts)

G20 leaders meeting in Mexico on Tuesday urged Spain to officially ask for European aid so that the country can move quickly to shore up its ailing banking sector.

Speaking to reporters in Los Cabos, Mexico, German Chancellor Angela Merkel said she believed that Spain will make the formal request “soon.”

“All agreed that once the audit results are available, then Spain should make its application as soon as possible,” Merkel said. “We also talked about how we need clarity on Spain’s application. We all know that banks that are not properly capitalized are the source of turmoil and risk for the economy.”

The conclusions from two independent auditors, Oliver Wyman and Roland Berger, are expected to be released on Thursday when euro finance ministers meet in Luxembourg to discuss the terms of the Spanish bank bailout. On June 9, European finance ministers offered up to 100 billion euros to recapitalize the Spanish banking industry.

Demeter

(85,373 posts)MASSIVE DETAILS ON THE TRIAL

Demeter

(85,373 posts)...Over the past year, a narrative has emerged, fueled by White House leaks and congressional denunciations, that holds one person responsible for the Obama administration’s failure to get Fannie Mae and Freddie Mac to engage in principal reduction. His name is Edward DeMarco, a lifelong career government bureaucrat who currently serves as the director of the Federal Housing Finance Agency — the regulator charged with overseeing Fannie and Freddie. DeMarco has been steadfast in his opinion that principal reduction is a bad idea. His reasoning is straightforward: Principal reduction, he argues, would mean further financial losses for Fannie and Freddie, which would then have to be made up by taxpayers. Since the FHFA is not only Fannie and Freddie’s regulator, but their conservator as they try to emerge from bankruptcy and pay back the government for its bailout, DeMarco’s legal responsibility, as he sees it, is to steer Fannie and Freddie back to profitability. DeMarco’s numbers have been challenged; many housing activists argue that, in the long run, foreclosures cost more to administer than renegotiating mortgages with principal reduction. Furthermore, they argue, taxpayers will benefit more from an improving economy spurred by significant housing relief than from a profitable Fannie Mae and Freddie Mac.

The details get pretty wonky. But the big picture is this: By his own account, DeMarco is very pleased with the choice of Mayopoulos to run Fannie Mae. So the most significant aspect to Mayopoulos’ ascension to the CEO position and his ensuing comments is in how they bolster DeMarco’s apparent ability to resist pressure from the White House and congressional Democrats. That pressure has been fierce. Led by Elijah J. Cummings, the ranking Democratic member of the House Committee on Oversight and Government Reform, and with support from Shaun Donovan, secretary of Housing and Urban Development, DeMarco’s critics have, over the last few months, pressed him vigorously. On May 1, Cummings released documents that purported to show that FHFA’s own research had concluded that principal reduction would save Fannie and Freddie money. But so far, the attacks have made little impact....MORE...But there are some problems with this narrative. First off, there’s the niggling issue that for the first two years of his administration, during which Obama had the greatest latitude to execute his agenda, the White House did not vigorously support principal reduction as a way of addressing the crisis. Mortgage lenders hated the idea of “cramdown” and the administration did not press the issue. Indeed, Obama is actually technically responsible for appointing DeMarco to his position as acting FHFA director in August of 2009. It was only after the 2010 midterms, when Obama lost his ability to push legislation through the House, that his administration started to take a more aggressive tone on principal reduction. As for Republican obstructionism, Obama’s critics argue that he could have replaced DeMarco with a recess appointment, or simply fired him for not following administration policy. This is another contentious point. The director of an independent regulator like FHFA is supposed to only be firable for “cause” and it’s not clear that a disagreement on housing policy finance fits that category. But the critics say that’s just quibbling. Bruce Judson, a former senior faculty fellow at the Yale Management School, who writes frequently on housing issues in a regular column for the Roosevelt Institute, believes Obama could get his way, if he really tried.

“If he wanted DeMarco out, he would be out,” said Judson. “But Obama has never said ‘this man is not serving the country, I am asking for his resignation.’ Do you think DeMarco could last a minute in Washington after that?”

DeMarco has even flipped the table on Obama, and argued that the real problem with principal reduction is that it would be another big giveaway to the banks, a theory that has gotten some prominent media play. The four biggest banks own a massive amount of secondary loans on underwater properties, and according to DeMarco’s reasoning, it will be easier for them to collect on those loans if the principal involved in the primary mortgage gets written down. Some circumstantial support for DeMarco’s position can be found in the fact that William Dudley, president of the New York Federal Reserve Bank, supports principal reduction, as does Treasury Secretary Timothy Geithner, who himself was once president of the New York Fed. Both men are not known for their willingness to go against banking industry interests. But the plot gets muddled here: Republicans are opposing Obama on principal reduction because they worry that the White House will force banks to take losses on their loans, while DeMarco is suggesting that principal reduction is yet another bank bailout? They both can’t be right at the same time.

The explanation that seems the most likely is that as it became clear over the course of the Obama administration that White House efforts to help homeowners avoid foreclosure were not working very well — and the results of the midterm elections sent a strong message that Democrats needed to get more populist — Obama and his advisers decided to get a little more aggressive on housing finance. But in classic Obama fashion, they didn’t get aggressive enough to do themselves, or homeowners, any good. They didn’t pick a real fight. They’ve made incremental changes in their various foreclosure avoidance plans that increase the incentives for banks and mortgage lenders to make loan modifications and perhaps even offer some principal reduction, but not enough to make a significant difference in the lives of enough Americans to end the foreclosure nightmare. There’s even a nightmare scenario in which the entire fight over principal reduction becomes, in Judson’s words, “irrelevant.” That’s because, says Judson, tax law historically treats principal reduction as income to the homeowner who gets it. In other words, if you have a $300,000 mortgage on a house that is now only worth $200,000, and your bank gives you a $100,000 break to bring the mortgage and the home value in line with each other, the IRS will consider that $100,000 break taxable income. Congress recognized this obvious insanity in 2007 and passed a provision that gave homeowners a waiver from that liability, but the waiver will expire on Jan. 1. Not only would the change in tax law mean that getting a principal reduction would make no sense for a beleaguered homeowner, but it would also destroy the market for “short sales” — in which banks allow homeowners to get out of their mortgage by selling their property for less than the mortgage is worth. Judson believes some 30 percent of home sales are currently short sales. Knock the legs out of that market, and you’re asking for serious trouble. “If we hit a train-wreck on Jan. 1,” says Judson, “it will take the housing market and any economic recovery down with it.” Sounds bad — but right now, not only are very few people even warning about the possibility; Republican legislators are saying they oppose extending the waiver. So the morass continues — and the more you know about how housing finance policy works, the more screwed up our economy’s chances of ever fully recovering seem to become.

LOTS MORE ON THE CUTTING ROOM FLOOR...SEE LINK

Demeter

(85,373 posts)EXCELLENT SYNOPSIS OF THE WATERGATE AFFAIR, THE FALLOUT AND CONCLUSIONS:

...Instead, the true "lessons" of Watergate were how we could abandon our responsibilities as citizens, and twist the obligations of self-government, so that "the country" would never have to "go through" anything like that again. What was a triumph of self-government in 1974 was reckoned to be such a national trauma by 1986 that our elite institutions formed an iron circle to keep it from happening to Ronald Reagan and his people because the country "couldn't take another failed presidency." (As illustrated in On Bended Knee, Mark Hertsgaard's essential account of the lapdog press under Reagan, even Washington Post publisher Katherine Graham, who'd stood all the gaff when her newspaper was alone on an island in its early Watergate coverage, was concerned that the press might go too far.) And the final absurd twist came with the impeachment of Bill Clinton for crimes against the Seventh Commandment, an exercise in Kabuki that really was only the final act in an ongoing campaign of dirty tricks. Kenneth Starr had far more in common with H.R. Haldeman than he did with Archibald Cox, and Henry Hyde had more in common with Gordon Liddy than he did with Peter Rodino. History was thereby turned on its head until its brains fell out its ears.

The lasting "lesson" of Watergate, it appears, is that self-government was too dangerous, that the perils of it outweigh its values, and that the obligations of citizenship, beyond those which are purely ceremonial, are too heavy for citizens to bear. Between now and 2014, there are going to be lots of 40-year anniversaries marking the various episodes in the grand pageant of Watergate, and all the usual suspects will deal in all the customary banalities. Good Lord willing and the creek don't rise, the blog will be around to mark them all as well, because Watergate really did mean something at the time. There was a moment, pure and fleeting, where it looked as though another way really was possible.

Read more: http://www.esquire.com/blogs/politics/watergate-40-years-later-9747335#ixzz1yKnFWLSb

IT WAS A TRAUMA, ALL RIGHT. A TRAUMA TO THE ELITES, WHO SAW THEIR IMPERIAL DREAMS MELTING AWAY; SO THEY TOOK A STRANGLEHOLD ON THE COUNTRY, AND CHOKED THE LIFE OUT OF OUR DEMOCRACY.

Demeter

(85,373 posts)The country's going to hell in a very fast handbasket.

Unfortunately, I have to go face my own private hell, and then, it's paper night. Maybe I'll see you all on Thursday...

keep cool and hydrated, y'hear?

bread_and_roses

(6,335 posts)as we were:

http://www.commondreams.org/view/2012/06/18-2

Dark Ages Redux: American Politics and the End of the Enlightenment

by John Atcheson

We are witnessing an epochal shift in our socio-political world. We are de-evolving, hurtling headlong into a past that was defined by serfs and lords; by necromancy and superstition; by policies based on fiat, not facts.

Much of what has made the modern world in general, and the United States in particular, a free and prosperous society comes directly from insights that arose during the Enlightenment.

Too bad we’re chucking it all out and returning to the Dark Ages.

Literally.

... Now, we seek to operate by revealed truths, not reality. Decrees from on high – often issued by an unholy alliance of religious fundamentalists, self-interested corporations, and greedy fat cats – are offered up as reality by rightwing politicians.

For example, North Carolina law-makers recently passed legislation against sea level rise. A day later, the Virginia legislature required that references to global warming, climate change and sea level rise be excised from a proposed study on sea level rise. Last year, the Texas Department of Environmental Quality, which had commissioned a study on Galveston Bay, cut all references to sea level rise – the main point of the study.

We are, indeed, at an epochal threshold.

http://www.colbertnation.com/the-colbert-report-videos/414796/june-04-2012/the-word---sink-or-swim

Demeter

(85,373 posts)The Would Be Emperors were furious that his total fumble threw their timetable off for a decade. So they really put the squeeze on, and maybe, just maybe, that great slumbering beast called the People will awake in time to slaughter them.

But I wouldn't bet on it. Ecuador is looking mighty good now, if they take in Julian Assange as a political refugee...and his mother did such a cogent, perfect defense of her son on BBC, I want to nominate her as Mother of the Year!

Roland99

(53,342 posts)Coming off the lows but S&P was down nearly 0.5%

Oil in the $81.50/bbl range. EURUSD back down to flat on the day.

Roland99

(53,342 posts)westerebus

(2,976 posts)Let's twist again like we did last summer..![]()

Fuddnik

(8,846 posts)Everything was looking rosy this morning when I went out to do some yard work. Now everything is correcting down the tubes.

Roland99

(53,342 posts)DemReadingDU

(16,000 posts)Roland99

(53,342 posts)Fuddnik

(8,846 posts)Demeter

(85,373 posts)CLEAR!