Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 24 August 2012

[font size=3]STOCK MARKET WATCH, Friday, 24 August 2012[font color=black][/font]

SMW for 23 August 2012

AT THE CLOSING BELL ON 23 August 2012

[center][font color=red]

Dow Jones 13,057.46 -115.30 (-0.88%)

S&P 500 1,402.08 -11.41 (-0.81%)

Nasdaq 3,053.40 -20.27 (-0.66%)

[font color=red]10 Year 1.68% -0.01 (-0.59%)

30 Year 2.79% -0.01 (-0.36%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

westerebus

(2,976 posts)chirp...chirp...chirp...chirp...

westerebus

(2,976 posts)Warpy

(111,261 posts)I see you've switched to popcorn.

AnneD

(15,774 posts)There are far more crickets and grasshopper than popcorn, but if you wait a bit, the heat and drought will pop all that dried corn in the fields.

westerebus

(2,976 posts)I don't care for the still moving kind, besides the amount of bug debris in any box of cereal qualifies just about everyone as a bug eater. Sugar cures a lot of defects, that and red dye #3 or good old yellow#6.

Where else can one find such diversity of informed humor, financial knowledge, political cynicism, musical appreciation, great cooking, original story telling, and companionship with a large dose loving snark than here? All you'll make my day.

Demeter

(85,373 posts)Had a neighbor complaining of these big ugly bees coming out of the ground by her patio...had to tell her they were cicadas...

Tansy_Gold

(17,860 posts)I don't like bugs.

I prefer the popcorn, too.

AnneD

(15,774 posts)Popcorn Crunch

Here's an easy treat to prepare and take to the drive-in movie. The kids will love it.

1/2 cup butter, melted

1/2 cup honey

3 quarts popcorn, popped

1 cup dry roasted insects, chopped

Blend the butter and honey together in a saucepan and heat gently. Mix the popcorn with the insects and pour the

butter-honey mixture over it. Mix well. Spread on a cookie sheet in a thin layer. Bake at 350° 10 to 15 minutes, or until

crisp. Break into bite-sized pieces. From Orkin

Demeter

(85,373 posts)I've heard some pretty weird stuff before...

AnneD

(15,774 posts)But in other parts of the world bugs are a tasty addition to the diet and a good source of protein. In fact, cicadas are a delicacy in some parts of this country. There are plenty of recipes on the 'net.

kickysnana

(3,908 posts)Where to Buy:

Rainbow Mealworms

126 East Spruce Street

Compton, Calif., 90220

(310) 635-1494

Fluker’s Farms

1333 Plantation Ave

Port Allen, La., 70767

(225) 343-7035

Dry Roasted Insects

Yield 1 serving

Time Two hours

Method:

Spread cleaned insects on paper towels on a cookie sheet. Back at 200 degrees for 60 to 90 minutes until desired state of dryness is reached. To check state of dryness, try crushing insect with a spoon.

Source: Adapted from Entertaining With Insects by Ronald L. Taylor and Barbara J. Carter

---------------------

The things you can find with Google.

AnneD

(15,774 posts)Meal worms sauteed in bacon drippings would taste like bacon....mmmmm![]()

tclambert

(11,086 posts)DemReadingDU

(16,000 posts)Demeter

(85,373 posts)The European debt crisis drags on, dragging Europe down with it. This column argues that one-off capital levies – taxes on the rich – is one way of financing debt reduction. This could be an important step towards deleveraging public budgets without severely damaging the economy...

ONE WAY? HOW ABOUT "ONLY WAY"?

...The crisis rolls on. If it lasts long enough, the problems may drag the Eurozone into a negative spiral of recession and debt that risks exacerbating the crisis and a possibly leading to the collapse of the Eurozone. In the face of these multiple dilemmas, governments should consider imposing one-off capital levies on the rich in order to refinance and bring down national debt (Bach 2012, Bach et al. 2011).

One-off capital levies

The idea behind this is straightforward enough.

Increased levels of public debt are accompanied by mounting private wealth, which is increasingly concentrated on the wealthy elite.

In Germany, for example, two thirds of the national wealth belongs to the richest 10% of the adult population.

According to our analysis, a one-time capital levy of 10% on personal net wealth exceeding 250,000 euros per taxpayer (€500,000 for couples) could raise revenue of just over 9% of GDP.

The wealthiest 8% of the adult population would be liable to the levy. Even with higher allowances of, for instance, €500,000 and €1 million, the levy could raise revenue of about 6.8% and 5.6% of GDP respectively. The number of taxpayers would sink to 2.3% and 0.6% of the adult population.

In the other Eurozone crisis countries, it would presumably be possible to generate considerable amounts of money in the same way.

For these countries, forced loans could be an additional source to secure public debt refinancing, without having to rely on external aid (see, e.g. Feldstein 2012). This would also be a signal to donor countries and international community funds that every effort is being made to regain fiscal stability.

The main benefits of such one-off levies are that they induce no immediate adjustment of economic behaviour. There is only little risk of tax avoidance as long as the fiscal authorities are able to capture taxable assets. Insofar there are no 'excess burdens' in economic terms, unlike with an increase in conventional recurrent taxes, in particular those on higher income and wealth. This is a major concern with tax proposals such as the 50p income tax surcharge in the UK as of 2010, the hike in top income tax rates and wealth taxation recently announced by French president Hollande, similar proposals in Germany, or the ongoing struggle in the USA to continue the tax breaks to the rich...Many countries in crisis have raised VAT or consumption taxes. In the longer run, this might be not a bad policy for the countries in crisis with respect to “fiscal devaluation” (Keen and de Mooij 2012). Yet, in the short term, this pushes these economies into a deeper recession. The same applies to frantic expenditure cuts on social programmes, which, similar to indirect taxation hikes, most affect the poorer strata of the population.

The downside of exceptional wealth taxation is that prosperous people might feel they are being trapped by the government. However, the wealthy elite have been released from taxation over the past few decades in almost all countries in the developed world, and, at the same time, it is only the top incomes that have risen markedly. Moreover, national bankruptcies in the Mediterranean and a collapse of the Eurozone would cause much more harm to the rich in northern Europe, not to mention the impact on the ordinary people. The same is true of financial repression as a result of creeping inflation and low interest rates, which seems to have become the favourable remedy in the UK or the US for fighting the debt crisis. Finally, a sweeping deleverage of private and public debt overhangs is the prerequisite for a return to order in the capital markets and in public budgets, for which someone has to pay sooner or later. Not least, such levies are likely to increase the acceptance of labour market and social reforms or spending cuts in the crisis countries that mostly affect poorer people, leading to social tensions.

Imposing such levies is complex, however, since it involves valuation of assets and preventing tax evasion. If the wealthy elite expect such levies to be repeated, this could discourage investment and encourage capital flight (see the discussion in Eichengreen 1989). Therefore, it is essential to prevent future debt overhangs in the private, financial, and public sectors. The financial industry requires proper regulation. Governments should commit themselves to balanced budgets, which should be bound by constitutional rules as proposed by the European Fiscal Union. Thus, a capital levy would be a feasible instrument for financing debt redemption, in particular, in connection with a 'European Redemption Pact', endorsed by the German Council of Economic Experts (2012).

********************************************************

References

Bach, Stefan (2012), “Capital Levies: A Step Towards Improving Public Finances in Europe”, DIW Economic Bulletin, 8.2012.

Bach, Stefan, Martin Beznoska, and Viktor Steiner (2011), “A Wealth Tax on the Rich to Bring Down Public Debt? Revenue and Distributional Effects of a Capital Levy”, DIW Berlin Discussion Paper 1137.

Birchler, Urs and Monika Bütler (2012), “EU banking union disunites German economists”, VoxEU.org, 10 July.

Eichengreen, Barry (1989), “The Capital Levy in Theory and Practice”, NBER Working Paper No. 3096.

Feldstein, Martin (2012), “Time for householders to buy bonds and save Spain”, Financial Times, 30 April.

German Council of Economic Experts (2012), After the Euro Area Summit: Time to Implement Long-term Solutions, Special Report, 30 July. See also Bofinger et al. 2011 and 2012 on this site.

Keen, Michael and Ruud de Mooij (2012), “Fiscal devaluation as a cure for Eurozone ills – Could it work?”, VoxEU.org, 6 April.

Ghost Dog

(16,881 posts)I'd also prefer to see a more proportionate sliding scale of levies, rather than flat rates above thresholds.

See also:

Barry Eichengreen

Abstract

A capital levy is a one-time tax on all wealth holders with the goal of retiring public debt. This paper reconsiders the historical debate over the capital levy in a contingent capital taxation framework. This shows how in theory the imposition of a levy can be welfare improving when adopted to redress debt problems created by special circumstances, even if its nonrecurrence cannot be guaranteed. If the contingencies in response to which the levy is imposed are fully anticipated, independently verifiable and not under government control, then saving and investment should not fall following the imposition of the levy, nor should the government find it more difficult to raise revenues subsequently. In practice, serious problems stand in the way of implementation. A capital levy has profound distribution consequences. Property owners are sure to resist its adoption. In a democratic society, their objections are guaranteed to cause delay. This provides an opportunity for capital flight, reducing the prospective yield, and allows the special circumstances providing the justification for the levy to recede in the past. The only successful levies occur in cases like post-World War II Japan, where important elements of the democratic process are suppressed and where the fact that the levy was imposed by an outside power minimized the negative impact on the reputation of subsequent sovereign governments.

http://ideas.repec.org/p/nbr/nberwo/3096.html

Demeter

(85,373 posts)Only half of the previously foreclosed homes owned by Fannie Mae are either on the market or being prepared for sale. The remaining properties are currently locked away in some step of the foreclosure system...The National Association of Realtors said in its existing home sales report Wednesday that its officials were pressuring government agencies to release more of their REO in markets short of inventory Many market participants long claimed the government – including Fannie, Freddie Mac and the Department of Housing and Urban Development – are deliberately holding these homes off the market in order to get more for them when home prices recover.

Fannie disclosed for the first time this year where these properties are in the lengthy and complicated REO process. In its second quarter financial filing, the government-sponsored enterprise said 23% of its more than 109,000 repossessed homes are currently available for sale. That's down from 28% at the end of last year. An offer has been accepted on another 19%, and 11% have an appraisal pending, Fannie said. But 47% of its inventory is unable to be marketed.

Roughly 14% of Fannie's entire REO inventory is redemption status, meaning the time frame borrowers and second-lien holders can redeem the property under various state laws. The timelines vary and have come under much change across the country. In Michigan, for example, lawmakers passed a bill last year to extend the redemption period to as much as one year in some cases. The bill was referred back to a state committee in March. Fannie said another 13% of its properties are still occupied by the borrower. The eviction process just hadn't been completed. Interestingly, 8% of its inventory – slightly less than 9,000 homes – are being rented as part of its piloted Tenant in Place or Deed for Lease programs, where the home is rented back to the borrower. Its other piloted program to sell roughly 2,500 homes to investors, who were approved in recent months to rent the properties out, will close at some point in the third quarter....In its financial filing, Fannie showed it's taking fewer losses on its REO sales. The GSE recovered an average 65% of the unpaid principal balance from REO sales in the second quarter, up from a low of 59% at the beginning of last year. But even this metric varies widely across the country. It was able to recover an average 78% of the unpaid principal through REO sales in Texas but only 50% of the original mortgage balance in Nevada sales.

Home prices began to steadily improve in 2012, pushing profits up for the GSE. It signaled to investors that the major hurdle holding back REO sales isn't its own management of the properties but of mortgage servicer difficulties, specifically at the five largest banks. Fannie sold only 5,000 more REO than the 43,700 homes acquired in the second quarter.

"We continue to manage our REO inventory to minimize costs and maximize sales proceeds," Fannie said in its filing. "However, as we are unable to market and sell a higher portion of our inventory, the pace at which we can dispose of our properties slows, resulting in higher foreclosed property expenses related to costs associated with ensuring that the property is vacant and costs of maintaining the property."

WANKERS

Demeter

(85,373 posts)Knight Capital Group Inc. (KCG)’s $440 million loss from a computer malfunction this month highlights the dangers of limiting human input in decisions about canceling trades, according to two industry executives.

Regulators should have discretion to reverse transactions when the outcome puts a firm’s survival at risk, said Neal Wolkoff, former chairman and chief executive officer of the American Stock Exchange and ex-head of ELX Futures LP. They should allow “do-overs” in extreme cases, said R. Cromwell Coulson, CEO of OTC Markets Group Inc. (OTCM) in New York.

MAY I ASK WHY? SOME ANIMALS ARE MORE EQUAL THAN OTHERS?

Knight was forced to accept the loss on Aug. 1 when Chairman and CEO Thomas Joyce failed to persuade the U.S. Securities and Exchange Commission to let NYSE Euronext (NYX) relax rules on voiding trades. While officials of the Securities Industry and Financial Markets Association and New York Stock Exchange said the regulations worked as planned, Coulson said there should be provisions for system breakdowns.

“We really need, as an industry, to have some points when the trade tape could be rolled back if something is going haywire and is not working right,” Coulson, whose firm operates marketplaces for equities not listed on U.S. exchanges, said in a phone interview. “This needs to be an option in the regulator’s toolbox to correct mistakes.”

NO MULLIGANS IN MARKETS!

Demeter

(85,373 posts)ONLY IT TPTB HAVE REALLY LOST CONTROL OF THE GAME BOARD...OTHERWISE, IT'S JUST A GOLD-BUG'S MARKETING PLOY

IF TPTB HAVE LOST CONTROL, A LOT MORE THAN THE PRICE OF GOLD WOULD EXPLODE

http://www.latimes.com/business/money/la-fi-mo-gold-price-fed-stimulus-20120823,0,4302481.story

The spot price of gold lurched up Thursday as anticipation of new stimulus measures worldwide grew. The precious metal was up 1.9% to $1,669.10 an ounce, propelled in part by an unexpected rise in jobless claims that highlighted the job market's weakness. And an HSBC report showing sagging manufacturing performance in China didn't help.

Business activity in the Eurozone, including in normally stalwart Germany, is shriveling so fast that many analysts are predicting a recession for the entire region, based on new data from research firm Markit.

The minutes from the Federal Reserve's most recent rate-setting meeting, which were released Wednesday and featured a discussion of economic growth strategies, stoked talk that the bank would engage in a third round of bond-buying tactics known as quantitative easing, or QE.

Though the price dipped slightly Wednesday, gold has otherwise been on a six-day streak of increases. But the price is down from a year ago, when it soared to $1,858.30 an ounce not long after credit rating agency Standard & Poor's downgraded U.S. debt.

"There's the potential for China, Europe and the U.S. to all do QE at the same time this fall," said Marin Aleksov, chief executive of precious metals broker Rosland Capital in Santa Monica. "It's the perfect storm."

MORE SPECULATING AT LINK

Demeter

(85,373 posts)For approximately three years, our governments, the banking cabal, and the Corporate Media have assured us that they knew the appropriate approach for fixing the economies that they had previously crippled with their own mismanagement. We were told that the key was to stomp on the Little People with "austerity" in order to continue making full interest payments to the Bond Parasites -- at any/all costs. Following three years of this continuous, uninterrupted failure, Greece has already defaulted on 75% of its debts, and its economy is totally destroyed. The UK, Spain and Italy are all plummeting downward in suicide-spirals, where the more austerity these sadistic governments inflict upon their own people the worse their debt/deficit problems get. Ireland and Portugal are nearly in the same position.

Now in what may be the greatest economic "mea culpa" in history, we have the media admitting that this government/banking/propaganda-machine troika has been wrong all along. They have been forced to acknowledge that Iceland's approach to economic triage was the correct approach right from the beginning...What was Iceland's approach? To do the exact opposite of everything the bankers running our own economies told us to do. The bankers (naturally) told us that we needed to bail out the criminal Big Banks, at taxpayer expense (they were Too Big To Fail). Iceland gave the banksters nothing. The bankers told us that no amount of suffering (for the Little People) was too great in order to make sure that the Bond Parasites got paid at 100 cents on the dollar. Iceland told the Bond Parasites they would get what was left over, after the people had been taken care of (by their own government).

The bankers told us that our governments could no longer afford the same education, health care and pension systems which our parents had taken for granted. Iceland told the bankers that what the country could no longer afford was to continue to be blood-sucked by the worst financial criminals in the history of our species. Now, after three-plus years of this absolute dichotomy in economic policymaking, a clear picture has emerged (despite the best efforts of the propaganda machine to hide the truth).

...I have consistently argued that it was a matter of simple arithmetic and the most-elementary principles of economics that "the Iceland approach" was the only strategy which could possibly succeed. When Plutarch wrote 2,000 years ago "an imbalance between rich and poor is the oldest and most fatal ailment of all Republics," he was not parroting socialist dogma (1,500 years before the birth of Socialism). Plutarch was simply expressing the First Principle of economics; something on which all of the modern capitalist economists who followed in his footsteps have based their own theories. When modern economists produce their own jargon, such as the Marginal Propensity to Consume; it is squarely based on the wisdom of Plutarch: that an economy will always be healthier with its wealth in the hands of the poor and the Middle Class instead of being hoarded by rich misers (and gamblers)...

MORE--NICE DIATRIBE~!

xchrom

(108,903 posts)xchrom

(108,903 posts)HSBC Holdings Plc (HSBA), which is under investigation by U.S. regulators for laundering funds of sanctioned nations including Iran and Sudan, is in talks to settle the matter, two people with knowledge of the case said.

The bank, Europe’s largest by market value, made a $700 million provision in July for any U.S. fines after a Senate Committee found it had given terrorists and drug cartels access to the U.S. financial system. That sum might increase, Chief Executive Officer Stuart Gulliver has said.

An HSBC settlement regulators and the Manhattan District Attorney were aiming to conclude as early as September may have been slowed when New York’s banking superintendent accused Standard Chartered of laundering $250 billion for Iran. Regulators had been talking with both banks about universal accords when Benjamin Lawsky on Aug. 6 threatened to revoke Standard Chartered’s license. Deals with the London-based banks next month are still possible, said the people, who asked not to be identified because the investigations are confidential.

“This is an epidemic of banks willfully, consistently violating economic sanctions,” Jimmy Gurule, a former undersecretary for enforcement at the U.S. Treasury, said of sanctioned-nation money laundering. “It calls for more serious sanctions than a monetary fine for an individual bank that does nothing more than harm shareholders.”

Demeter

(85,373 posts)Yves here. A few quick comments on the New York state settlement. Some readers are unhappy that there wasn’t a prosecution. First, as we’ve written before, criminal prosecutions of big financial firms put them out of business (tons of customers are forbidden to do business with them) so they settle pronto (prosecuting individuals is another matter completely). Second, Lawsky is only a banking regulator and does not have prosecutorial powers. To do that, he would have needed Eric Schneiderman’s cooperation. But Lawksy’s boss, Andrew Cuomo and Schneiderman are rivals. And Schneiderman has thrown his lot in with the Obama Administration, which has been ferociously trying to undermine Lawsky. As Neil Barofksy noted in a Bloomberg story:

“I can’t think of another case where there has been such uniformity among federal regulators undercutting an enforcement case”

Marcy’s observation below is very important, and is being glossed over or even denied in the mainstream media. The Wall Street Journal has one of its all too common alternative reality editorial page pieces. Key snippet:

In a word, no.

I HAVE NO PROBLEM WITH PUTTING A BANKSTER BANK OUT OF BUSINESS...THEY ARE MORE THAN WILLING TO PUT ANYONE ELSE OUT OF BUSINESS.

ACTUAL ARTICLE CONTINUES AT LINK

Demeter

(85,373 posts)Yves here. I’m featuring this post not simply because the student debt issue is coming to serve as a form of debt servitude, but also because the backstory is so ugly. Student debt is the only form of consumer lending where the obligation cannot be discharged in bankruptcy. This story chronicles how persistent bank lobbying, including disinformation portraying student borrowers as likely deadbeats, led to increasingly draconian treatment of student loans. A second reason for posting it is that due to technical difficulties at Reuters, the original ran without the hyperlinks, which are of interest to serious readers.

*********************************************************

Lobbyists' trillion dollar revenge on nerds

You have probably mentally catalogued the student loan crisis alongside all the other looming trillion dollar crises busy imperiling civilization for the purpose of enriching the already rich. But it is different from those crises in a few significant ways, starting with the fact that the entire student loan business is arguably unconstitutional. You don’t have to take it from me: a preeminent bankruptcy scholar made precisely this argument under oath before Congress. In December 1975, when Congress was debating the first law that made student loans non-dischargeable in bankruptcy, University of Connecticut law professor Philip Shuchman testified that students “should not be singled out for special and discriminatory treatment,” adding that the idea gave him “the further very literal feeling that this is almost a denial of their right to equal protection of the laws.”

The thing was, discrimination was kinda the whole idea. Stagflation was sending an unprecedented number of Silent Majority members into bankruptcy, and the bank lobby was fighting back with a propaganda assault that scapegoated counterculture student delinquents who were allegedly taking loans with no goal of paying them. As Shuchman and others explained in hearings, only about 4% of people who filed for bankruptcy protection in 1975 had student loans on their balance sheets, and of those fewer than one fifth did not have substantial other debts motivating them to file.

But try telling that to anyone who'd been reading the papers! A typical syndicated dispatch on the surge in student deadbeats was the August 27, 1972 expose of Los Angeles Times reporter Linda Mathews, which began with the personal anecdote of an anonymous “Washington banker” who purported to have once “handed a $1500 check” for the year’s tuition to a nameless “18-year-old college freshman” only to be insouciantly told, “Oh, I never intend to repay this loan.” The kid was merely acting on the advice of “underground newspapers,” the anonymous banker—who had since joined “the staff of the American Banking (sic) Association”—helpfully explained. “Elitist cheaters” and “professional deadbeats” had driven default rates “as high as 40 percent in some cases,” the Chicago Tribune fumed. “Sometimes when I see someone come out before me with a job and no other debt but a college loan—and not even a big one at that—I feel like saying, 'Why you little stinker,'” a judge told the New York Times. A Wall Street Journal editorial on “the educational subculture” blamed the “crisis” on “an attitude of unconcern—that default really isn't like ripping off anybody, just the large, impersonal government that wastes plenty of money on other things” that was apparently pervasive throughout the entire education profession.

But to the credit of the American legislature of the day, the majority of its members were still capable of distinguishing between PR and reality. It concluded its round of hearings in February 1976 bypostponing the vote on the non-dischargeability amendment pending a formal Government Accounting Office study on the matter, which in turn confirmed earlier findings that deliberate student deadbeats comprised a virtually infinitesimal proportion of bankruptcies. In the meantime, mainstream journalists who spent more time in reality than their trend-setting contemporaries uncovered some troubling (and real) trends while scouring bankruptcy filings. Of the small population of twentysomethings who did seek to use bankruptcy protection primarily to discharge student loans, many had been defrauded by fly-by-night "correspondence schools” that had forged the students’ signatures and saddled them with staggering loans. They hadn't even known about them until they started getting hounded by collection agencies. By 1977 even the American Bankers Association had joined the conference of bankruptcy judges in lobbying—formally, anyway—against the cruel and unusual punishment of making student debt non-dischargeable. As James O’Hara, the congressman who had commissioned the GAO study, pointed out in his testimony, to enact such a law would be tantamount to “treating students, all students, as though they were suspected frauds and felons” while according arbitrary second-class creditor status to “the grocery store, the tailor or the doctor to whom the same student may also owe money.” In 1978 the House of Representatives voted to pass a bankruptcy reform bill that specifically restored student loans to their original status as equivalent to any other form of unsecured debt...But then the bill went to conference committee with the Senate, and the clause came back. Like the loans themselves, it could not be gotten rid of. At first this provision applied only during the first five years of the life of the loan; then it was seven, then eternity. Until 2005 it only applied to federally guaranteed loans; now it applies to all.

MORE AT LINK

THIS IS TRULY HORRIFIC, AND IT JUST GETS WORSE...MUST READ AND SEND TO ALL POTENTIAL COLLEGE STUDENTS AND THEIR FAMILIES

xchrom

(108,903 posts)Asian stocks fell, with the region’s benchmark index retreating from the highest level since May, on signs of slower growth in the U.S. and China and amid concern Europe’s leaders aren’t making progress on the debt crisis.

Nissan Motor Co., a carmaker that counts North America as its biggest market, fell 1.5 percent in Tokyo after U.S jobless claims rose more than expected. Aluminum Corp. of China fell 2.1 percent in Hong Kong after Dallas Federal Reserve economists said overstated data may have masked the severity of China’s slowdown. Makita Corp. (6586), a Japanese maker of power tools that depends on Europe for more than 40 percent of sales, slid 1.1 percent.

The MSCI Asia Pacific (MXAP) Index slid 1.2 percent to 120.36 as of 8:21 p.m. in Tokyo, erasing this week’s advance. The gauge yesterday closed at the highest level since May 4.

“The rally seems to have been a bit more about hope over reality,” said Stephen Halmarick, Sydney-based head of investment markets research at Colonial First State Global Asset Management, which oversees about $150 billion. “Clearly economic data has been pretty poor. The practicalities of what needs to be done to address this are huge.”

Demeter

(85,373 posts)I should post more, and empty out the inbox, but I'm unable to bear any more "good news" today....maybe breakfast will help.

In any event, it's the weekend. I was thinking of celebrating Hawai'i's entrance into this unholy union, but I think I did that once already.

Anybody got an alternate theme for the weekend?

I'm also annoyed that I haven't gotten my sound back yet...too many crises! Too little ability to cope.

xchrom

(108,903 posts)i hope the little stuff doesn't snow you in.

![]()

Demeter

(85,373 posts)See you all tonight!

(you may amuse yourselves by posting guesses until I post it!)

Demeter

(85,373 posts)xchrom

(108,903 posts)kickysnana

(3,908 posts)xchrom

(108,903 posts)Xu Biao could sit in his office waiting for orders to roll in during a Chinese building boom two years ago. Now, he’s hitting the road trying to drum up business.

“Life is difficult,” said Xu, a sales manager at Maanshan Fangyuan Slewing Ring Co. (002147), which supplies parts to Sany Heavy Industry Co. (600031), XCMG Construction Machinery Co. and other equipment-makers. “Every client is cutting production.”

Caterpillar Inc. (CAT), which gets 25 percent of sales in Asia, Komatsu Ltd. (6301) and Sany have all slashed output in the world’s biggest construction-equipment market this year as a demand slump caused by slower economic growth spreads from building to mining. Sales of large excavators, mainly used by miners, last month plunged the most since at least January 2009, contributing to the 15th straight decline in the overall market.

“The market is just getting worse,” said Wang Shuangming, an analyst with consultant China Construction Machinery Business Online. “It doesn’t matter if you’re a foreign or domestic producer -- everybody is sitting in the same boat.”

xchrom

(108,903 posts)A former trader for Royal Bank of Scotland Group has claimed that the bank's internal checks were so lax that anyone could change Libor rates.

More than a dozen banks, including RBS, are under investigation by regulators in the US, Europe and Asia for suspected rigging of the London interbank offered rate (Libor), which is used to price trillions of dollars of financial products.

Barclays was fined £290m in June by American and British authorities for its role in trying to manipulate the interest rates, which affect the cost of borrowing for millions of customers around the world.

Court documents filed in Singapore show that Tan Chi Min, who is suing RBS for wrongful dismissal, claimed that in 2008 a trader for the bank, Will Hall, changed the Libor submission himself even though he was part of the Japanese yen swap desk in London.

xchrom

(108,903 posts)

Two cyclists carry conical fish baskets in Hanoi. Photograph: Hemis /Alamy

It's a warm summer's evening in Hanoi, and Nguyen Chu Hoa and her beau are zipping through the capital's tree-lined alleyways using Nguyen's favourite pair of wheels: an electric bicycle.

"Do I love my electric bike? Yes," exclaims the 21-year-old student. "It is clean. It is fast. It is so easy."

Long fashionable in China but slower to take off across south-east Asia, electric bike sales have recently surged in Vietnam, thanks in part to higher fuel prices. At Asama, a central Hanoi bike shop where posters of pretty Vietnamese girls on "e-bikes" adorn the walls, sales have risen fourfold in five years, says shop assistant Nguyen Cat Nhat.

"Our clients are mostly students – people who don't want to ride a bicycle or buy a car, or can't," he says. "If we sell 10 electric bikes, five are for students, three are for older people, and two are for commuters. You have to be 18 to get a licence for a motorbike, so an electric bicycle is the easiest way for high-school students to get to and from class."

And yet, the e-bike still has a long way to go to oust the motorbike as Vietnam's favoured form of two-wheeled transport. Research has shown that lack of government incentive, coupled with so-called "image problems" such as poor performance and low quality, have kept sales significantly lower than in China, which produced nearly 31m e-bikes last year and provides the bulk of e-bikes for sale in Vietnam.

Demeter

(85,373 posts)I'd just love to argue with a double bottom gravel truck on one of those babies!

Or even face a string of unsynchronized stop lights.

Those !@#%$^ing bicycle paths they keep putting in, narrowing already small streets in the face of growing traffic demands...the development agency must be crazy.

And the cyclists! they think rules of the road are optional for them, unless of course, they are injured, in which case it's all somebody else's fault...

xchrom

(108,903 posts)they seem to be both pedestrian and vehicle.

Demeter

(85,373 posts)and no sense whatsoever

Demeter

(85,373 posts)Food and lodging for this family of four costs between $15,780 and $16,680 a year. I have not even gotten to childcare costs yet, which for a child who is around four years old ranges $3,900 to $15,540 a year (PDF) a year.

There is help for this family of four though, the average amount of SNAP benefits available to a family of four is $496 a month, not enough to pay for all of their groceries, however, it is enough to prevent starvation. Even with SNAP benefits it is obvious that in the family of four only one of the adults can work, as the other has to stay home with the children. I cannot imagine how a single parent at this level of income could keep it together let alone get out of poverty.

?1344784666

?1344784666

Those are the numbers that define poverty in America; however, the definition of poverty goes much further than those numbers. The American Heritage dictionary defines poverty as, “the state of being poor; lack of the means of providing material needs or comforts.” ...Things like food, shelter, and stability. You cannot get sick, you cannot take a day off to go to the doctor, you cannot afford to go to the doctor at all. If the price of food goes up you have to take away from some other part of your budget. But what takes the hit? Is your landlord going to allow you to pay less rent? How do you buy school supplies? How do you get to and from work? None of the figures above include transportation...According to conservative mouthpieces if you have a color TV and a refrigerator you are not poor, and several of the memes that exist today say that if you have a newer car and a cell phone you are not poor, discounting that you may have purchased that newer car or cell phone before you lost your job and lost your home. That you need to be drug tested before you can receive any kind of benefits. The poor are second-class citizens who cannot be trusted with the meager benefits that are provided to them. They should, “just get a job,” and “pull themselves up by their bootstraps.” Great advice; however, if you are making minimum wage, you don’t have bootstraps to pull up...The same people who refuse to help the poor because they are, “lazy and shiftless,” have no problem giving a tax break, that is larger than what someone making minimum wage earns in a year, to someone who makes their money through investments, in other words, a tax break to someone who has never worked a day in their lives. Only because they have a higher social status they deserve what amounts to a government handout in the form of a tax break, while someone working for minimum wage every single day does not deserve a hand up.

While I am not a religious man I find it hypocritical that the people who claim to follow Christianity do not follow some of its core teachings. When my mom forced me to go to confirmation classes at Bashford United Methodist Church in my youth I primarily went through the motions just to make her happy; however, one quote that Rev. Rick Pearson taught me has stuck with me all these years, "If anyone has material possessions and sees his brother in need but has no pity on him, how can the love of God be in him? Dear children, let us not love with words or tongue but with actions and in truth - 1 John 3:17-18."

Demeter

(85,373 posts)George Lakoff is right. Republicans are winning the language wars. As half of America is charmed into voting against their own interests, we progressives keep telling them the facts. Instead, we should be concerned about what Joe Romm calls "language intelligence," the ability to convince people of something by moving them both intellectually and emotionally. The Republicans do it so well. They've hijacked the big issues with inflammatory phrases like "class warfare" and "death tax." We have to learn to fight back.

For starters, we might pick some inflammatory phrases of our own. Like "class carnage," inflicted by the super-rich. And "ancestral theft," perpetrated by hustling modern-day entrepreneurs who take most of the profits from technological products developed through decades of public research.

Lakoff emphasizes the need to place words in conceptual frameworks, as Republicans do with "tax relief" to portray taxes as an undue burden that must be relieved. In this spirit, Mike Lofgren proposes that the negatively charged 'entitlements' be reframed as "earned benefits." After all, Americans pay for their retirement benefits.

Or how about the emotionally unstimulating "financial transaction tax"? Boring. In the framing world, the proposal for a tiny imposition on risky high-speed thousand-trillion-dollar trades should be called a "quadrillionaire's fee."

MORE

Demeter

(85,373 posts)xchrom

(108,903 posts)It is almost four years after the global financial meltdown of 2008 and many parts of world are still trying to recover. Given the impact of the crisis, which rocked financial markets across the globe, it is shocking to many that Canada seems to be following many of the same lending trends as we saw in the United States in 2006. These trends were at the core of the subprime mortgage crisis, which led to the global recession of 2008.

In the year and a half leading up to the crash housing prices rapidly increased in the United States, with a corresponding increase in subprime lending. We are now seeing the same trends in Canada. When analyzing the Canadian housing market, housing prices increased almost 100% since 2000, with the average home in Canada costing roughly $348,000. This is almost double our U.S. counterparts.

Big banks have become stricter with lending policies, and have upped the stakes for those looking for mortgage financing. This has created a huge market for sub-prime lenders in the marketplace that didn’t exist before because more and more people who would have been approved five years ago are now being turned away. There is now a huge shift in the lending marketplace. Once small, Canada`s subprime mortgage industry is now booming. More and more Canadians with highly questionable credit are highly benefiting from the available financing.

The Canadian Government has been moving quite aggressively in attempts to cool down the Canadian housing market. As home prices are soaring there are fears that there is a bubble in the making. This is evident through the recent actions of Finance Minister Jim Flaherty who is now acting for a fourth time, reducing the maximum amortization period for government issued mortgages from 30 to 25 years. On top of this he is also lowering the amount of equity that can be borrowed against a property to 80% down from 85%.

Read more: http://feedproxy.google.com/~r/JohnBrownesMarketCommentary/~3/eIXN5IVgEIY/canadian_real_estate_bubble_bubble_toil_trouble#ixzz24SwY9xwm

Demeter

(85,373 posts)Mitt Romney's $250 million fortune is largely a black hole: Aside from the meager and vague disclosures he has filed under federal and Massachusetts laws, and the two years of partial tax returns (one filed and another provisional) he has released, there is almost no data on precisely what his vast holdings consist of, or what vehicles he has used to escape taxes on his income. Gawker has obtained a massive cache of confidential financial documents that shed a great deal of light on those finances, and on the tax-dodging tricks available to the hyper-rich that he has used to keep his effective tax rate at roughly 13% over the last decade....Today, we are publishing more than 950 pages of internal audits, financial statements, and private investor letters for 21 cryptically named entities in which Romney had invested—at minimum—more than $10 million as of 2011 (that number is based on the low end of ranges he has disclosed—the true number is almost certainly significantly higher). Almost all of them are affiliated with Bain Capital, the secretive private equity firm Romney co-founded in 1984 and ran until his departure in 1999 (or 2002, depending on whom you ask). Many of them are offshore funds based in the Cayman Islands. Together, they reveal the mind-numbing, maze-like, and deeply opaque complexity with which Romney has handled his wealth, the exotic tax-avoidance schemes available only to the preposterously wealthy that benefit him, the unlikely (for a right-wing religious Mormon) places that his money has ended up, and the deeply hypocritical distance between his own criticisms of Obama's fiscal approach and his money managers' embrace of those same policies. They also show that some of the investments that Romney has always described as part of his retirement package at Bain weren't made until years after he left the company.

Bain isn't a company so much as an intricate suite of steadily proliferating inter-related holding companies and limited partnerships, some based in Delaware and others in the Cayman Islands, Luxembourg, and elsewhere, designed to collectively house roughly $66 billion in wealth in its many crevices and chambers. When Romney left in 1999, he and his wife retained significant investments in many of those Bain vehicles—he claims they are "passive investments" and that they are managed in a blind trust (though the trustee isn't blind enough to meet federal standards of independence). But aside from disparate snippets of information contained in his federal and Massachusetts financial disclosure forms, his 2010 tax returns, and SEC filings, the nature of those investments has been obfuscated by design.

When he disclosed his finances to the U.S. Office of Government Ethics in 2007, Romney took care to publish the underlying holdings of many funds he invested with—after disclosing his $1 million-plus stake in "GS 2002 Exchange Place Fund LP," for instance, he listed six pages of individual equities the fund held, from Panera Bread Co. to Tribune Co. But when it came to the Bain investments, he simply listed the value of his investments in odd-sounding entities like "Sankaty High Yield Partners II LP" with no indication of what was inside. In an accompanying note, he claimed that he had tried and failed to get the information: "The filer has requested information about the underlying holdings of these funds and values and income amounts for these underlying holdings. However, the fund managers have informed the filer in writing that this information is confidential and proprietary, and has declined to provide such information."

That information—for Sankaty and 20 other funds—is now available here, in the form of 48 documents totaling more than 950 pages. They consist predominantly of confidential internal audited financial statements from 2008, 2009, and 2010, as well as investor letters from the same period, for Bain entities that Romney has previously disclosed owning an interest it. Owing to the timeframe—during and after the catastrophic economic meltdown of 2008—some of the investments show substantial losses. One limited partnership had even entered into liquidation as of October 2008 after failing to meet certain payments owed to partners. Others show astronomical gains...The documents are exceedingly complicated. We don't pretend to be qualified to decode them in full, which is why we are posting them here for readers to help evaluate—please leave your thoughts in the discussion below. We asked an attorney who specializes in complex offshore corporate transactions, including ones involving Cayman Island entities, to review them and help us understand them. (We also asked the Romney campaign. It hasn't responded yet.) The full set can be read here: SEE LINKS AT ORIGIN

tclambert

(11,086 posts)(Sometimes I crack myself up. "No one is above the law." That was a good one.)

Roland99

(53,342 posts)DOW 0.0%

NASDAQ -0.0% [/font]

Demeter

(85,373 posts)October is the traditional month for falling banksters....

Roland99

(53,342 posts)Roland99

(53,342 posts)* Orders for U.S. durable goods rise 4.2% in July

* June durable orders revised to 1.6% gain

* Core capital-goods orders decrease 3.4% in July

* Orders minus transportation fall 0.4% in July

* Transportation orders jump 14.1% last month

RTRS - U.S. JULY ORDERS FOR MOTOR VEHICLES AND PARTS +12.8 PCT, BIGGEST INCREASE SINCE JULY 2011

RTRS - U.S. JULY DURABLE GOODS ORDERS AND ORDERS EX-DEFENSE POST LARGEST INCREASES SINCE DEC 2011

RTRS - U.S. JULY DURABLES EX-TRANSPORTATION -0.4 PCT (CONS +0.5 PCT) VS JUNE -2.2 PCT (PREV -1.4 PCT)

RTRS- US JULY DURABLES ORDERS +4.2 PCT (CONS. +2.4 PCT) VS JUNE +1.6 PCT (PREV +1.3 PCT)

Roland99

(53,342 posts)- Durable Goods ex-transportations decline -0.4% in July, missing expectations of a +0.5% print, with the June number revised down from -1.1% to -2.2%. It gets worse: Nondefense capital goods excluding aircraft tumbled in July, and imploded to -3.4%, crashing below expectations of a -0.2% print, with the previous print revised from -1.4% to -2.7%). This means that indeed the brief blip higher in economic activity in the summer was largely transitory and was purely a byproduct of seasonal adjustment.

Ghost Dog

(16,881 posts)... Bookings for non-military capital equipment excluding planes slumped 3.4 percent, a Commerce Department report showed today in Washington. Total orders for durable goods, those meant to last at least three years, jumped 4.2 percent, paced by a 54 percent surge in demand for civilian aircraft.

Possible U.S. tax increases and spending cuts may prompt companies to rein in spending, while a global economic slowdown threatens overseas sales of companies such as Caterpillar Inc. (CAT) and Deere & Co. Federal Reserve policy makers have signaled they are prepared to take further steps to sustain the recovery if growth doesn’t pick up...

/... http://www.bloomberg.com/news/2012-08-24/orders-for-u-s-capital-goods-decrease-by-most-since-november.html

U.S. stocks rose, paring the Standard & Poor’s 500 Index’s first weekly decline in almost two months, as Federal Reserve Chairman Ben S. Bernanke said he saw “scope for further action,” increasing speculation the central bank will act to boost economic growth.

/... http://www.bloomberg.com/news/2012-08-24/u-s-stock-futures-are-little-changed.html

DemReadingDU

(16,000 posts)Roland99

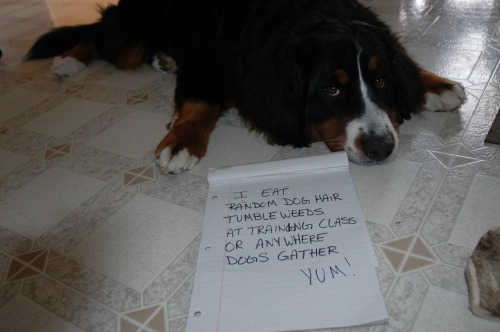

(53,342 posts)I'm sure the dogs of the world are cowering in shame right now!

Demeter

(85,373 posts)I couldn't make it through all ten pages.

Thanks! I NEEDED that!

Voice for Peace

(13,141 posts)I've just discovered the dog shaming.. ![]()

DemReadingDU

(16,000 posts)I don't recall that shameful picture