Economy

Related: About this forumWeekend Economists Haunted by Mozart's Ghost January 25-27, 2013

It is, mercifully, that last weekend in January, a month that will leave indelible psychic scars on many--certainly on me. And Sunday, I am told by NPR, is Mozart's birthday.

My favorite movie website is Mozart’s Ghost, of the stellar “The Net”. Mozart’s Ghost is the best part of the movie’s horrendous “internet effects”. It’s a website which appears to be some super gnarly rock band, but if you click in JUST the right place you are given access to FBI files. Yeah. Seriously. Mozart’s Ghost is where all the super elite hackers hung out like Sandra Bullock. She would eat cold pizza, surrounded by monitors and just hack… stuff… and things… Pretty crazy.

Mozart’s Ghost is just the tip of the iceberg, as this movie features more cliche’s and 90′s internet speak than you can shake a stick at. In fact I think the big bad virus is on a floppy disc. A FLOPPY DISC! Oh the humanity!

I can’t find a video of Mozart’s Ghost from the movie, so you will have to settle for the super bad-ass trailer: AT LINK

http://blog.timesunion.com/tech/1114/retro-thursday-mozarts-ghost/

a completely unnecessary retrospective on a fad that no one remembers.

No one seems to remember this, but there was a brief internet fad in which everyone would have stupid pi symbols in the lower right hand corner of a webpage that would bring you to a secret page that did nothing.

Buckle Up Script Kiddies, here's a quick internet history lesson for you.

The Movie

So there was this terrible movie way back when called "The Net", in which Sandra Bullock plays a computer programmer who works from home and no one knows what she looks like so it is very easy for Jeremy Irons to somehow steal her identity and it's terrible. However, as it was one of the first mainstream movies to deal with the Internet, a lot of geeks (like me) went and saw the movie and even geekier geeks adopted some of the quirks from the movie as conventions.

The Fake Band

So very early on in the movie, the action that gets Sandra Bullock "red-flagged" is that she receives a disk that is ostensibly a promotional digital program for a fictional band "Mozart's Ghost", which is a very terrible site and it sucks, and now that I think about it it was just like those old Launch CDs, but she notices a supposedly hard to see "pi" hyperlink. When you hold shift and ctrl and click on the link you were taken to a secret terminal access page that let you steal everyone's identity or something stupid.

The Fad

So anyway, the completely stupid fad that everyone picked up was that everyone put a stupid pi symbol in the lower righthand corner of their stupid website and thought they were clever. So I thought I'd do the same thing just now. God I feel lame.

The Legacy

Well almost none really. This fad seems to have faded faster than you can say suck.com, and it would probably take hours of trolling the wayback machine to find these reprehensible websites. Still, while I was googling, I did find a pretty thorough rundown of the security concepts touched on and lovingly ignored in the movie that I thought was pretty amusing.

oh! also remember those cool laser whip things from Johnny Mnemonic? those were awesome.

https://sites.google.com/a/infomofo.com/www/mozart%27sghost

Demeter

(85,373 posts)Depositors of 1st Regents Bank's sole branch will automatically become depositors of First Minnesota Bank...As of September 30, 2012, 1st Regents Bank had approximately $50.2 million in total assets and $49.1 million in total deposits. First Minnesota Bank will pay the FDIC a premium of two percent to assume all of the deposits of 1st Regents Bank. In addition to assuming all of the deposits of the failed bank, First Minnesota Bank agreed to purchase essentially all of the assets...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10.5 million. Compared to other alternatives, First Minnesota Bank's acquisition was the least costly resolution for the FDIC's DIF. 1st Regents Bank is the second FDIC-insured institution to fail in the nation this year, and the first in Minnesota. The last FDIC-insured institution closed in the state was First Commercial Bank, Bloomington, on September 7, 2012.

Demeter

(85,373 posts)HCA, the nation’s largest profit-making hospital chain, was ordered on Thursday to pay $162 million after a judge in Missouri ruled that it had failed to abide by an agreement to make improvements to dilapidated hospitals that it bought in the Kansas City area several years ago. The judge also ordered a court-appointed accountant to determine whether HCA had actually provided the levels of charitable care that it agreed to at the time. The ruling came in response to a suit filed in 2009 by a community foundation that was created when HCA acquired the hospitals. Among other things, the foundation was responsible for ensuring that HCA met the obligations outlined in the deal.

The dispute in Kansas City is the second time in recent years that HCA has come under legal fire from officials in communities that sold troubled nonprofit community hospitals to HCA. In another dispute in New Hampshire in 2011, a judge ruled in HCA’s favor, deciding that Portsmouth Regional Hospital would remain part of HCA after community leaders tried to regain control. During testimony in a 2011 trial, a former hospital official claimed he had difficulties getting HCA to pay for what he and others described as critical equipment and facility upgrades.

In an e-mailed statement, a spokesman for HCA said the company was disappointed in the court’s ruling and intended to appeal. He also added that the two cases were “rare exceptions” and that the company had enjoyed positive relationships with communities across the country...The suit is among several problems for HCA. The company disclosed last year, for example, that the United States attorney’s office in Miami had subpoenaed documents as part of an inquiry to determine whether unnecessary cardiology procedures had been performed at HCA hospitals in Florida and elsewhere. At stake in that case is whether HCA inappropriately billed Medicare and private insurers for the procedures. HCA has denied any wrongdoing.

Financially, Thursday’s judgment is a slap on the wrist for HCA, which posted net income of $360 million in just the third quarter of last year. But the ruling may reverberate beyond HCA as communities across the country put their troubled nonprofit hospitals up for sale. In many cases, the buyers with the deepest pockets have been profit-making hospital chains that want to convert the community hospitals to profit status, typically agreeing to spend money to fix them and to maintain certain levels of charitable care in the community...

ONE OF MANY HEALTH CARE VULTURES...MORE DETAILS AT LINK

WASN'T THIS A ROMNEY PROJECT?

Demeter

(85,373 posts)It may not seem like it now, but the dealings of HCA Healthcare, the largest U.S. hospital operator, could be one of the biggest political stories of August. In an unusual happenstance, the company's shares plummeted today after it made two surprising disclosures: First, the cardiology practices at its hospitals were under investigation by the Justice Department; and second, The New York Times was about to publish an investigative piece on the firm's treatment of uninsured patients (or so it assumes). Why should anyone care about the rumored misdeeds of a Tennessee-based health care company? Here are three big reasons.

HCA's connections

Turns out, HCA's biggest shareholder is Bain Capital LLC, the company once led and co-founded by Mitt Romney. And this isn't some tiny asset: HCA own 160 hospitals and 110 surgery centers. As of April, Bain held 20 percent of HCA's outstanding shares, an amount Bloomberg's Alex Nussbaum says is worth $2.2 billion, and just last year, Bain and KKR & Co. took the company public in an IPO that raised $3.79 billion. OK, so there's something of a connection to Mitt Romney—so what? What's the risk of HCA being dragged into the headlines in a supposedly forthcoming Times story? For that answer, you'd have to look at HCA's history.

HCA's history

For years, HCA has attracted government scrutiny of its business practices. After a stellar growth period in the 1970s and 1980s, the firm ran into trouble in the late 1990s for stretching the legal limits of pursuing profits. In 1997, Rick Scott resigned as chairman and CEO and so did his top lieutenant David Vandewater under pressure from the Feds who were investigating into whether HCA "engaged in practices such as fraudulently overstating their expenses to increase their compensation from Medicare, and regularly conducting unnecessary blood tests,"as The New York Times' Kurt Eichenwald reported in 1997. But that was just the beginning. In 2003, the Justice Department announced a settlement with HCA in what was the largest health care fraud case in U.S. history: The company coughed up $631 million in civil penalties and damages related to government allegations of Medicare fraud. At the time, the DOJ issued a litany of offenses dating back to the late 1980s, all of which amounted to the recovery of $1.7 billion from HCA. Per a DOJ release from 2003:

Now that brings us to today. In a statement released on its website, HCA said The Times story probably related to the number of cardiac procedures its hospitals do and how it determines when the procedures are necessary. It also said the newspaper provided it with examples of cases where “individual patients may have had adverse outcomes from the care they received at HCA-affiliated facilities” to which the company noted that its conducted 20 million total visits last year and "we deeply regret any adverse occurrences to even one of our patients."

The timing

Now it's not clear how damning The Times story will be but the fact that a company is under scrutiny from the newspaper and the DOJ, suggests it's in for a major PR hassle. Making matters worse, it's happening near the tail end of a presidential campaign in which one of the candidates has a connection, however tangential, to the company. It should be said that Romney says he gave up management control of the company in February 1999. Bain didn't undertake its $33 billion leveraged buyout of the company until 2006. But that won't likely stop the Obama campaign or its surrogates from using the story. For one thing, it diverts the discussion away from the economy, and for another, it gets into the sticky issue of when Romney actually left Bain (Though he says he left in 1999, SEC documents listed him as CEO and chairman up until 2002.) Regardless of the merits of a potential attack, its the type of thing that's low hanging fruit during the campaign season. But you don't have to take our word for it: Just look at how market analysts are anticipating the story. "My concern is that it gets political legs," Sheryl Skolnick, a CRT Capital Group LLC told Bloomberg. "I think we have to look at it seriously."

Demeter

(85,373 posts)Just days before three people were shot in an altercation on a college campus in Texas, fourteen Texas State Senators co-sponsored a National Rifle Association-backed bill to prohibit colleges from restricting concealed handguns on campuses. The legislation closely resembles a "model" adopted by the American Legislative Exchange Council (ALEC)....On January 22, an altercation at the Lone Star College campus in Houston led to gunfire. According to initial reports, one man involved in the fight was shot, and two bystanders were caught in the crossfire. Both suspects have been apprehended; one of the men had a student identification card.

On January 17, five days before the shooting, Texas State Senator Brian Birdwell (R) introduced SB 182, the "Campus Personal Protection Act," to require all colleges and technical schools to allow concealed handguns on campus for permit holders. The NRA promptly issued a release applauding Birdwell and the bill's thirteen co-sponsors, and urging Texans to contact their legislators in support of the bill.

In 2008, the ALEC Criminal Justice Task Force unanimously approved the Campus Personal Protection Act as a model for introduction in other states. The NRA pushed the legislation after the Virginia Tech massacre.

"This Act will officially become ALEC 'Model Legislation' in 30 days if there is no objection from ALEC's Board of Directors," the NRA noted in its press release. Koch Industries was on the ALEC Board of Directors in 2008 (and remains on the board today); despite this, the company has publicly declared it "has had no role in any ALEC-sponsored legislation concerning gun laws."

DISGUSTING...CONTINUES AT LINK

Fuddnik

(8,846 posts)Frist. That's it.

Demeter

(85,373 posts)Brace yourself. In coming weeks you’ll hear there’s no serious alternative to cutting Social Security and Medicare, raising taxes on middle class, and decimating what’s left of the federal government’s discretionary spending on everything from education and job training to highways and basic research. “We” must make these sacrifices, it will be said, in order to deal with our mushrooming budget deficit and cumulative debt. But most of the people who are making this argument are very wealthy or are sponsored by the very wealthy: Wall Street moguls like Pete Peterson and his “Fix the Debt” brigade, the Business Roundtable, well-appointed think tanks and policy centers along the Potomac, members of the Simpson-Bowles commission.

These regressive sentiments are packaged in a mythology that Americans have been living beyond our means: We’ve been unwilling to pay for what we want government to do for us, and we are now reaching the day of reckoning.

The truth is most Americans have not been living beyond their means. The problem is their means haven’t been keeping up with the growth of the economy — which is why most of us need better education, infrastructure, and healthcare, and stronger safety nets. The real median wage is only slightly higher now than it was 30 years ago, even though the economy is twice as large. The only people whose means have soared are at the very top, because they’ve received almost all the gains from growth. Over the last three decades, the top 1 percent’s share of the nation’s income has doubled; the top one-tenth of 1 percent’s share, tripled. The richest one-tenth of 1 percent is now earning as much as the bottom 120 million Americans put together.

Wealth has become even more concentrated than income (income is a stream of money, wealth is the pool into which it flows). The richest 1 percent now own more than 35 percent of all of the nation’s household wealth, and 38 percent of the nation’s financial assets – including stocks and pension funds. Think about this: The richest 400 Americans have more wealth than the bottom 150 million of us put together. The 6 Walmart heirs have more wealth than bottom 33 million American families combined. So why are we even contemplating cutting programs the middle class and poor depend on, and raising their taxes? We should tax the vast accumulations of wealth now in the hands of a relative few. To the extent they have any wealth at all, most Americans have it in their homes – whose prices have stopped falling in most of the country but are still down almost 30 percent from their 2006 peak. Yet homes are subject to the only major tax on wealth — property taxes.

Yale Professor Bruce Ackerman and Anne Alstott have proposed a 2 percent surtax on the wealth of the richest one-half of 1 percent of Americans owning more than $7.2 million of assets. They figure it would generate $70 billion a year, or $750 billion over the decade. That’s more than the fiscal cliff deal raises from high-income Americans. Together, the two sets of taxes on the wealthy — tax increases contained in the fiscal cliff agreement, and a wealth tax such as Ackerman and Alstott have proposed — would just about equal the spending cuts the White House has already agreed to, totaling $1.5 trillion (or $1.7 trillion including interest savings).

That seems about right.

Demeter

(85,373 posts)Now that Treasury Secretary Timothy Geithner is close to leaving his post, he's opening up more about his role during the financial crisis.

The crisis triggered an economic collapse that threw millions of people out of work or their homes. But making sure justice was served for those Americans wasn't a top priority for Geithner, he said.

"I never felt that was my thing," the Treasury Secretary, who steps down from his post on Friday, told The New Republic in a recent interview, referring to "the understandable need people had for justice" after the financial crisis. "I had some views on the issue, but I didn't give them much weight. I thought my job was to figure out the financial parts."

MORE AT LINK

DemReadingDU

(16,000 posts)Social Security and Medicare programs should be left alone.

Demeter

(85,373 posts)Demeter

(85,373 posts)Wolfgang Amadeus Mozart; baptismal name Johannes Chrysostomus Wolfgangus Theophilus Mozart (27 January 1756 – 5 December 1791), was a prolific and influential composer of the Classical era.

Mozart showed prodigious ability from his earliest childhood. Already competent on keyboard and violin, he composed from the age of five and performed before European royalty. At 17, he was engaged as a court musician in Salzburg, but grew restless and travelled in search of a better position, always composing abundantly. While visiting Vienna in 1781, he was dismissed from his Salzburg position. He chose to stay in the capital, where he achieved fame but little financial security. During his final years in Vienna, he composed many of his best-known symphonies, concertos, and operas, and portions of the Requiem, which was largely unfinished at the time of his death. The circumstances of his early death have been much mythologized. He was survived by his wife Constanze and two sons.

Mozart learned voraciously from others, and developed a brilliance and maturity of style that encompassed the light and graceful along with the dark and passionate. He composed over 600 works, many acknowledged as pinnacles of symphonic, concertante, chamber, operatic, and choral music. He is among the most enduringly popular of classical composers, and his influence on subsequent Western art music is profound; Beethoven composed his own early works in the shadow of Mozart, and Joseph Haydn wrote that "posterity will not see such a talent again in 100 years."

Demeter

(85,373 posts)The html tags have disappeared, and all youtube posts appear as "advertisement".

I have no idea what's going on...maybe Mozart's Ghost program?

Demeter

(85,373 posts)Going to rustle up some food for the Kid...

Fuddnik

(8,846 posts)Demeter

(85,373 posts)No, I'm having trouble doing quality posts.

It's as if we were back in DU 1...or less.

Demeter

(85,373 posts)The response of the citizens is less familiar. Here is one. Mrs. Anna Amelia Holshouser, whom a local newspaper described as a “woman of middle age, buxom and comely,” woke up on the floor of her bedroom on Sacramento Street, where the earthquake had thrown her. She took time to dress herself while the ground and her home were still shaking, in that era when getting dressed was no simple matter of throwing on clothes. “Powder, paint, jewelry, hair switch, all were on when I started my flight down one hundred twenty stairs to the street,” she recalled. The house in western San Francisco was slightly damaged, her downtown place of business— she was a beautician and masseuse— was “a total wreck,” and so she salvaged what she could and moved on with a friend, Mr. Paulson. They camped out in Union Square downtown until the fires came close and soldiers drove them onward. Like thousands of others, they ended up trudging with their bundles to Golden Gate Park, the thousand- acre park that runs all the way west to the Pacific Ocean. There they spread an old quilt “and lay down . . . not to sleep, but to shiver with cold from fog and mist and watch the fl ames of the burning city, whose blaze shone far above the trees.” On their third day in the park, she stitched together blankets, carpets, and sheets to make a tent that sheltered twenty- two people, including thirteen children. And Holshouser started a tiny soup kitchen with one tin can to drink from and one pie plate to eat from. All over the city stoves were hauled out of damaged buildings— fire was forbidden indoors, since many standing homes had gas leaks or damaged flues or chimneys— or primitive stoves were built out of rubble, and people commenced to cook for each other, for strangers, for anyone in need. Her generosity was typical, even if her initiative was exceptional.

Holshouser got funds to buy eating utensils across the bay in Oakland. The kitchen began to grow, and she was soon feeding two to three hundred people a day, not a victim of the disaster but a victor over it and the hostess of a popular social center— her brothers’ and sisters’ keeper. Some visitors from Oakland liked her makeshift dining camp so well they put up a sign— “Palace Hotel”— naming it after the burned- out downtown luxury establishment that was reputedly once the largest hotel in the world. Humorous signs were common around the camps and street- side shelters. Nearby on Oak Street a few women ran “The Oyster Loaf ” and the “Chat Noir”— two little shacks with their names in fancy cursive. A shack in Jefferson Square was titled “The House of Mirth,” with additional signs jokingly offering rooms for rent with steam heat and elevators. The inscription on the side of “Hoff man’s Café,” another little street- side shack, read “Cheer up, have one on me . . . come in and spend a quiet evening.” A menu chalked on the door of “Camp Necessity,” a tiny shack, included the items “fleas eyes raw, 98¢, pickled eels, nails fried, 13¢, flies legs on toast, .09¢, crab’s tongues, stewed,” ending with “rain water fritters with umbrella sauce, $9.10.” “The Appetite Killery” may be the most ironic name, but the most famous inscription read, “Eat, drink, and be merry, for tomorrow we may have to go to Oakland.” Many had already gone there or to hospitable Berkeley, and the railroads carried many much farther away for free.

About three thousand people had died, at least half the city was homeless, families were shattered, the commercial district was smoldering ashes, and the army from the military base at the city’s north end was terrorizing many citizens. As soon as the newspapers resumed printing, they began to publish long lists of missing people and of the new locations at which displaced citizens and sundered families could be found. Despite or perhaps because of this, the people were for the most part calm and cheerful, and many survived the earthquake with gratitude and generosity. Edwin Emerson recalled that after the quake, “when the tents of the refugees, and the funny street kitchens, improvised from doors and shutters and pieces of roofing, overspread all the city, such merriment became an accepted thing. Everywhere, during those long moonlit evenings, one could hear the tinkle of guitars and mandolins, from among the tents. Or, passing by the grotesque rows of curbstone kitchens, one became dimly aware of the low murmurings of couples who had sought refuge in those dark recesses as in bowers of love. It was at this time that the droll signs and inscriptions began to appear on walls and tent flaps, which soon became one of the familiar sights of reconstructing San Francisco. The overworked marriage license clerk has deposed that the fees collected by him for issuing such licenses during April and May 1906 far exceeded the totals for the same months of any preceding years in San Francisco.” Emerson had rushed to the scene of disaster from New York, pausing to telegraph a marriage proposal of his own to a young woman in San Francisco, who wrote a letter of rejection that was still in the mail when she met her suitor in person amid the wreckage and accepted. They were married a few weeks later.

Disaster requires an ability to embrace contradiction in both the minds of those undergoing it and those trying to understand it from afar. In each disaster, there is suffering, there are psychic scars that will be felt most when the emergency is over, there are deaths and losses. Satisfactions, newborn social bonds, and liberations are often also profound. Of course one factor in the gap between the usual accounts of disaster and actual experience is that those accounts focus on the small percentage of people who are wounded, killed, orphaned, and otherwise devastated, often at the epicenter of the disaster, along with the officials involved. Surrounding them, often in the same city or even neighborhood, is a periphery of many more who are largely undamaged but profoundly disrupted— and it is the disruptive power of disaster that matters here, the ability of disasters to topple old orders and open new possibilities. This broader effect is what disaster does to society...."

AN ENGROSSING READ...I'M GOING TO HAVE TO GET THE BOOK!

GOOD PREPARATION FOR OCCUPIERS

Demeter

(85,373 posts)If the dynamic of a diverse safe space in which people dismantle oppressions through conflict resolution is at the root of Occupy's transformative potential, then perhaps there's not a distinct formula that can be reproduced, but simply spread - a culture - that people can choose to adopt. Occupy Sandy has been lauded as more American than FEMA. Strike Debt, an Occupy offshoot, is pioneering the "Rolling Jubilee" of debt forgiveness to the adoration of publications like Business Insider. While popular in some circles, these initiatives have also led to bitter divisions that ultimately surround the narrative of the Occupy movement.

Some say Occupy died long ago and that these imitations are attempting to export an unperfected product. Some argue further that these Occupy offshoots are destructive, misusing terms like "mutual aid" (masking the actual lack of community) and providing recovery efforts of the status quo (simply replacing government support with charity), distancing Occupy further from its true nature of rupture. Others counter that Occupy has transformed, or perhaps self-immolated, disposing of its clunky general body to make use of its network, carrying out revolutionary work in more agile campaigns. They argue that these campaigns are in the spirit of the movement by promoting neighborliness, self-reliance and community infrastructure over mass institutions.

This is not just a question of credit or labeling; the debate calls for an etymological investigation of the definition of Occupy Wall Street in pursuit of its revolutionary potential. After well over a year, can we make useful statements about what Occupy really was - or is?

I think we can. Occupy is a movement that has brought about revolutionary personal growth for thousands through a dialectical process. It crammed the contradictions of our modern hierarchical society - a diverse group of people - into small parks, creating a horizontal "safe space," in which under-represented folks could share their perspective of these hierarchies. It enacted systems of communal facilitation to use the emergent conflict as fuel for the decolonization of each individual's internalized oppressions. Through this process, it produced people who are committed to inter-relating horizontally (and therefore anti-oppressively) - a cultural idea so counter to the logic of capital as to be revolutionary....(MASSIVE DEVELOPMENT OF IDEA AND ANALYSIS OF OCCUPATION TO DATE)...Another crisis is likely not far. When it does hit, perhaps enough people will be ready to be "Occupiers," so that a new cultural vision can be adopted. If Occupiers spread their shared culture, then we may humbly approach qualitative change.

*************************************************************

Zachary Bell has published video, photo and written essays in The Daily Pennsylvanian, Campus Progress, Toward Freedom, TheNation,com and Truthout. He blogs about Occupy and other social movements at http://zacharyabell.com/, and can be followed on Twitter @ZacharyABell. He is a recent graduate from the University of Pennsylvania with a bachelor of arts in urban studies. Zach is proudly from New Haven and currently lives in Philadelphia.

Follow him on Twitter @ZacharyABell.

Demeter

(85,373 posts)THIS POST CONTINUES THE DISCUSSION STARTED IN TODAY'S STOCK MARKET WATCH THREAD...GO SEE IT AT:

http://www.democraticunderground.com/111629623

http://www.truth-out.org/news/item/14065-seventy-years-of-nuclear-fission-thousands-of-centuries-of-nuclear-waste

On December 2, 1942, a small group of physicists under the direction of Enrico Fermi gathered on an old squash court beneath Alonzo Stagg Stadium on the Campus of the University of Chicago to make and witness history. Uranium pellets and graphite blocks had been stacked around cadmium-coated rods as part of an experiment crucial to the Manhattan Project - the program tasked with building an atom bomb for the allied forces in World War II. The experiment was successful, and for 28 minutes, the scientists and dignitaries present witnessed the world's first manmade, self-sustaining nuclear fission reaction. They called it an atomic pile - Chicago Pile 1 (CP-1), to be exact- but what Fermi and his team had actually done was build the world's first nuclear reactor.

The Manhattan Project's goal was a bomb, but soon after the end of the war, scientists, politicians, the military and private industry looked for ways to harness the power of the atom for civilian use, or, perhaps more to the point, for commercial profit. Fifteen years to the day after CP-1 achieved criticality, President Dwight Eisenhower threw a ceremonial switch to start the reactor at Shippingport, Pennsylvania, which was billed as the first full-scale nuclear power plant built expressly for civilian electrical generation.

Shippingport was, in reality, little more than a submarine engine on blocks, but the nuclear industry and its acolytes will say that it was the beginning of billions of kilowatts of power, promoted (without a hint of irony) as "clean, safe and too cheap to meter." It was also, however, the beginning of what is now a weightier legacy: 72,000 tons of nuclear waste....MORE

Demeter

(85,373 posts)WHEN THE CONSERVATIVES' WORST WEEK STILL LOOKS BETTER THAN DEMOCRATS' BEST, THEN WE STILL HAVEN'T SUCCESSFULLY MADE A TRANSITION...DEMETER

AND HARRY? THANKS FOR NOTHING!

http://www.rollingstone.com/politics/blogs/taibblog/conservatives-have-their-worst-week-ever-20130123

Watching America's political conservatives try to counter-maneuver opposite Barack Obama's re-inauguration over the course of the last week has been an incredible comedy – like watching the Three Stooges try to perform a liver transplant on roller skates....Let's review the basic timeline. First, Political Media, a conservative action group, decided to try to make an appeal to win the hearts and minds of Americans everywhere by declaring January 19th – previously known as Martin Luther King Day, to the rest of us – to be "Gun Appreciation Day." They solicited hundreds of sponsors and sought to get 50 million people to sign a goofball petition (written in the style of the Declaration of Independence, with a plethora of "Whereas…"-es... Why do gun people insist on trying to use 18th-century syntax?) against the "tyrannical governments" that were out to take their guns. "Gun Appreciation Day" would also involve gun shows and other local events all over the country, meant as a counter-balance to the candle-toting gun control protests that were springing up over last weekend in anticipation of Obama's inauguration and the rumored plans for new gun legislation. But even before their excellent idea gets out of the gate, it stalls out, as obnoxious reporters check the list of "Gun Appreciation Day" sponsors and find that the "American Third Position," a group that purports to represent the "unique political interests of White Americans," is one of the event's sponsors.

So now, Political Media has not only decided to hold its Gun Appreciation Event on a holiday meant to celebrate the life of a black leader who was a symbol of nonviolent protest and who was killed by a white man with a gun, it's done so with the financial help of some yahoo white supremacist group. But this doesn't derail the whole thing, as it's of course just an innocent mistake. Political Media kicks "Third Position" out and appropriately issues a statement, saying, "We have removed the group and reiterate this event is not about racial politics, it is about gun politics."

So far, so good, right? Well, then they go and actually hold their "Gun Appreciation Day" rallies all over the country, on Martin Luther King Day. And what happens? Five people get accidentally shot!

You can't make this stuff up....

Demeter

(85,373 posts)I was shocked when I heard that Mary Jo White, a former U.S. Attorney and a partner for the white-shoe Wall Street defense firm Debevoise and Plimpton, had been named the new head of the SEC.

I thought to myself: Couldn't they have found someone who wasn't a key figure in one of the most notorious scandals to hit the SEC in the past two decades? And couldn't they have found someone who isn't a perfect symbol of the revolving-door culture under which regulators go soft on suspected Wall Street criminals, knowing they have million-dollar jobs waiting for them at hotshot defense firms as long as they play nice with the banks while still in office?

I'll leave it to others to chronicle the other highlights and lowlights of Mary Jo White's career, and focus only on the one incident I know very well: her role in the squelching of then-SEC investigator Gary Aguirre's investigation into an insider trading incident involving future Morgan Stanley CEO John Mack. While representing Morgan Stanley at Debevoise and Plimpton, White played a key role in this inexcusable episode. As I explained a few years ago in my story, "Why Isn't Wall Street in Jail?": The attorney Aguirre joined the SEC in 2004, and two days into his job was asked to look into reports of suspicious trading activity involving a hedge fund called Pequot Capital, and specifically its megastar trader, Art Samberg. Samberg had made suspiciously prescient trades ahead of the acquisition of a firm called Heller Financial by General Electric, pocketing about $18 million in a period of weeks by buying up Heller shares before the merger, among other things.

"It was as if Art Samberg woke up one morning and a voice from the heavens told him to start buying Heller," Aguirre recalled. "And he wasn't just buying shares – there were some days when he was trying to buy three times as many shares as were being traded that day."

Aguirre did some digging and found that Samberg had been in contact with his old friend John Mack before making those trades. Mack had just stepped down as president of Morgan Stanley and had just flown to Switzerland, where he'd interviewed for a top job at Credit Suisse First Boston, the company that happened to be the investment banker for . . . Heller Financial. Now, Mack had been on Samberg's case to cut him in on a deal involving a spinoff of Lucent. "Mack is busting my chops" to let him in on the Lucent deal, Samberg told a co-worker. So when Mack returned from Switzerland, he called Samberg. Samberg, having done no other research on Heller Financial, suddenly decided to buy every Heller share in sight. Then he cut Mack into the Lucent deal, a favor that was worth $10 million to Mack.

Aguirre thought there was clear reason to investigate the matter further and pressed the SEC for permission to interview Mack. Not arrest the man, mind you, or hand him over to the CIA for rendition to Egypt, but merely to interview the guy. He was denied, his boss telling him that Mack had "powerful political connections" (Mack was a fundraising Ranger for President Bush). But that wasn't all. Morgan Stanley, which by then was thinking of bringing Mack back as CEO, started trying to backdoor Aguirre and scuttle his investigation by going over his head. Who was doing that exactly? Mary Jo White....

MORE SLEAZE AT LINK

Demeter

(85,373 posts)A federal appeals court, dealing a defeat to President Obama, has sharply limited the chief executive’s power to bypass the Senate and to make temporary “recess” appointments to fill vacant slots in government agencies.

The Court of Appeals for the D.C. Circuit, in a 3-0 ruling, said the president can make recess appointments only when the Senate has formally adjourned between sessions of Congress, not when lawmakers leave Washington for a brief break.

The Obama administration is almost certain to appeal the decision to the Supreme Court. But if the ruling stands, it strengthens the power of the Senate’s Republican minority at the expense of Obama and the Democrats...

MORE

Demeter

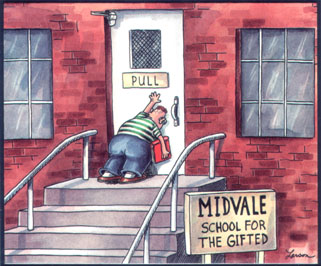

(85,373 posts)AFRAID WOULD LOOK VERY DIFFERENT. THEY ARE JUST GOING CRAZY. BECAUSE THIS CARTOON DESCRIBES EXACTLY WHAT THEY ARE DOING, EXCEPT NOW THEY ARE BEATING AND HAMMERING AND SCREAMING:

?w=300&h=248

?w=300&h=248

http://www.truth-out.org/news/item/14139-finally-the-republicans-are-afraid

For anyone who has lived through the past several decades of Republican bullying – from Richard Nixon’s anything-goes politics through Karl Rove’s dreams of a “permanent Republican majority” – it had to be startling to hear House Speaker John Boehner complaining that President Barack Obama’s goal was “to annihilate” the GOP.

During a private luncheon of the Republican Ripon Society on Tuesday, Boehner cited Obama’s progressive agenda as outlined in his Second Inaugural Address as representing an existential threat to the GOP.

“It’s pretty clear to me that he knows he can’t do any of that as long as the House is controlled by Republicans,” Boehner said. “So we’re expecting over the next 22 months to be the focus of this administration as they attempt to annihilate the Republican Party.” The Ohio Republican also claimed that it was Obama’s goal “to just shove us into the dustbin of history.”

Of course, Boehner may be wildly exaggerating the Republican plight to shock the party out of its funk, raise more money, and get right-wing activists back to the barricades. Still, his comments marked a remarkable reversal of fortune, like the playground bully getting his nose bloodied and running to the teacher in tears...

Hugin

(33,154 posts)After all, they worked so hard to get the now Senator Warren into the top seat of the Consumer Protection Agency. ![]()

The Republicans working unchallenged to rig the national level elections by openly gerrymandering the Electorate, Reid caving on the filibuster and now this?

The U.S. has become so mean and hateful it's hardly recognizable as the beacon of hope and opportunity to the downtrodden it once was.

DemReadingDU

(16,000 posts)Just wondering

Hugin

(33,154 posts)I don't have the heart to look for it right now.

But, basically Reagan had by far the most (at around 30) followed by the Bushes, Clinton and Obama in a distant last place with around 9.

Fuddnik

(8,846 posts)Republicans wouldn't flex their new found muscle would they?

Saggy-faced Mitch wouldn't strive to make Obama a two-term president would he?

The entire government is dysfunctional and irrelevant any more. Shitcan it. We're a failed state.

Demeter

(85,373 posts)The largest global disasters of 2012 were Hurricane Sandy (with a cost of $65 billion) and the year-long Midwest/Plains drought ($35 billion). The U.S. had the world's top two costliest natural disasters in 2012, according to a report released Thursday by global reinsurance firm Aon Benfield, based in London.... the company's Annual Global Climate and Catastrophe Report, which was prepared by Aon Benfield's Impact Forecasting division.

The $35 billion figure is one of the first estimates of the U.S. drought cost, which "comes from a combination of anticipated losses sustained by the agricultural sector and other factors such as business interruption," says Aon Benfield meteorologist and senior scientist Steve Bowen.

Sandy and the drought accounted for nearly half of the world's economic losses but, owing to higher levels of insurance coverage in the U.S., 67% of insured losses globally, the report states. Total economic losses include the entire cost of an event, while insured losses are the amount of economic losses that are covered by insurance, says Bowen.

The U.S. alone accounted for nearly 90% of all the world's insured losses in 2012. In addition to the drought and Sandy, several severe weather events and Hurricane Isaac contributed to this total. The U.S. typically represents 64% of the insured losses. Why does the U.S. percentage tend to be so high each year? "From an insurance perspective, the United States has generally been the dominant region of the world for costliest natural disaster events," Bowen says. "The U.S. has a higher level of insurance penetration than most countries, which in turn leads to more of the economic losses being covered."

MORE

Demeter

(85,373 posts)We'll be neck deep in sleaze again, tomorrow!

Demeter

(85,373 posts)

Demeter

(85,373 posts)If I'd spent the past five years living in a monastery or something, I would take the Treasury Department's recent declaration that the trillion-dollar coin option is out as a sign that there's some other plan ready to go. Maybe the 14th Amendment, maybe moral obligation coupons or some other form of scrip, but something...And maybe there is a plan. But as we all know, the last debt ceiling confrontation crept up on the White House because President Obama refused to believe that Republicans would actually threaten to provoke default. Is the White House being realistic this time, or does it still rely on the sanity of crazies?

The thing is, the coin option sounds silly, but it clearly obeys the letter of the law. As far as I can tell, none of the other options — other than outright surrender — has the same virtue. Failing to pay debt service would be a breach of contract. Paying contractors, and maybe Social Security recipients, in scrip would violate the law, which says that they should be paid, not given I.O.U.'s. A decision that the president has the right to ignore the debt limit after all would avoid these legal breaches at the expense of another breach. And default in any of these senses would risk a huge collapse of confidence. So is there a plan, or will it just be another case of tough talk followed by a tail-between-the-legs retreat?

As I said, if we didn't have some history here I might be confident that the administration knows what it's doing. But we do have that history, and you have to fear the worst...

TROT OUT THE N-DIMENSIONAL CHESS ARGUMENT, YOU CULTISTS...

MORE DISCUSSION OF MORAL IOU'S FOLLOWS....

DemReadingDU

(16,000 posts)1/25/13 Marc Faber Fears 1987 Redux As "Markets Will Punish Interventionists"

"Regardless of what the markets do near-term, a correction is overdue," Marc Faber tells Bloomberg TV's Betty Liu. From discussing Europe's 'apparent' stabilization - "anything can go up when you print money"; to US equity exuberance - "a correction is overdue and February is a seasonally weak month"; Faber sees no change from Geithner's handover to Lew as he opines: "The only thing I know is one day the markets will punish the interventionists, the Keynesians and the monetary policy that the Federal Reserve and ECB has enforced because the markets will be more powerful one day. How will this look like? Will the bond market collapse or equity markets become a bubble, which would be embarrassing for the Fed's sake if the U.S. market became a gigantic bubble and at the same time the economy does not recover."

more, and a Bloomberg video at link

http://www.zerohedge.com/news/2013-01-25/marc-faber-fears-1987-redux-markets-will-punish-interventionists

Demeter

(85,373 posts)These are Cronyists. Not even in the same league as Keynes.

Fuddnik

(8,846 posts)Without the shoes.

Demeter

(85,373 posts)I was sleeping in, until the older cat started yanking my hair...I don't know what she wanted...I'd gotten up and fed her at 5...

But I'm taking care of the homestead today. It feels good to do something for myself for a change. Should do that more often.

As you can see, the January thaw (after the election blizzard of bullshit) has revealed a number of festering wounds in the body politic and the economic bloodstream is on the verge of septicemia. And the BS continues, as our Democratic leadership insists on following the lemmings.

So, what can we do? Lay low, clean up our own lives, build family and friendship and network (not for gain, but for reinforcements).

New year, same game plan.

Demeter

(85,373 posts)Let's start here, with a question from the website Wall Street Parade:

Both Eric Holder, the U.S. Attorney General, and Lanny Breuer, the Assistant Attorney General for the Criminal Division were Covington & Burling partners before they joined the Justice Department. Dan Suleiman, who also worked at Covington and Burling, became the new deputy chief of staff and counselor to Lanny Breuer on July 16 of this year. Since 2008, employees of Covington & Burling have contributed $347,951 to President Obama’s campaigns.

In the past, Covington & Burling's clients have included Monsanto, Union Pacific, Merck, Warner-Lambert, Eli Lilly, Turner Broadcasting, IBM, General Motors, BankBoston Corporation, Morgan Stanley, Bank of America, Blackwater (Xe), Chiquita Bananas (in which Eric Holder defended the company against a lawsuit brought by families of individuals slain by Colombian paramilitary groups receiving money from Chiquita), the Southern Peru Copper Company (accused of human rights violations and pollution) among a bevy of other mega-financial and corporate entities.

Among this list, it is important to remember that Covington & Burling received a lacerating critique from a federal judge in 2006 for its long-term representation of the Tobacco Institute and Philip Morris. Judge Gladys Kessler of the U.S. District Court for the District of Columbia reprimanded attorneys for not just representing Big Tobacco, but for taking part in a conspiracy to deceive the public and regulators:

Wall Street on Parade discusses Judge Kessler's ruling:

The Court further noted in a footnote that wrongdoing on the part of lawyers for the tobacco industry appeared to be continuing into the present. The Court made the following findings specific to Covington & Burling, the law firm that has three top posts in today’s U.S. Justice Department.

On Covington & Burling's website, it describes its fields of expertise on a page called "firm overview," some of the fields are excerpted below:

In the corporate, tax and benefits area, we take a multi-disciplinary approach, resulting in an ability to deliver innovative and creative solutions. Clients benefit from the collaboration of teams of lawyers having expertise in mergers and acquisitions, securities, finance, corporate governance, tax and benefits, bankruptcy and real estate.

Our regulatory lawyers are recognized as experts in their fields and regularly combine their talents on behalf of the world’s top financial institutions, pharmaceutical and life sciences companies, telecommunications and technology companies, utilities, railroads, sports leagues and consumer goods companies, among others.

Breuer is soon to leave the Department of Justice, as reported in the BuzzFlash at Truthout's commentary yesterday. Admittedly, the revolving door between ultra-rich white collar defense attorneys and prosecutors is quite common in government. But the Covington & Burling triple play at the Department of Justice should have set off a special alarm Of course, in Washington DC, the mainstream media just regards the elite -- whether on the government or corporate/financial side -- as the enviable insiders who the journalists would rarely think of upsetting due to their own career and social status goals. Covington & Burling is the modern day adjunct to global corporations; the global law firm to service those global corporations, with offices around the world including Beijing, London, Seoul, Silicon Valley, Washington, New York, Shanghai and Brussels among other locations. To be an attorney, and particularly a partner (which both Holder and Breuer were – and possibly will be again in the future), at Covington & Burling, you have to be among the legal elite with the sharpest strategies for protecting the interests of clients and have the keenest of legal minds. When you are hired by Covington & Burling, you enter the corporate legal pantheon – and are compensated accordingly.

That is why the excuses that the Covington & Burlington three who are ultimately responsible for criminal prosecution ring hollow when it comes to why they did not prosecute Wall Street executives. If they couldn't make a case against the guys who brought the US economy to its knees by allowing fraudulent mortgage selling schemes, sketchy hedge funding, false reporting to the government and stockholders, and overselling junk mortgages, then why were they senior attorneys at Covington & Burling? If they couldn't indict and convict Wall Street CEOs or higher ups of violating at least the Sarbanes-Oxley Act, then one has to ask why any corporation or financial firm would hire them? Because cases under Sarbanes-Oxley (which provides civil and criminal punishment for fraud and violations of transparency to stockholders, the government, etc.) -- given what happened on Wall Street -- appear pretty much to have been a slam dunk were they pursued.

The Covington & Burling trio (including Holder) at the DOJ didn't lack the skill set to prosecute Wall Street executives; they chose not to. That choice was a dereliction of duty to the American people.

Demeter

(85,373 posts)"Lanny Breuer, Justice Department criminal division chief, is stepping down," a Wednesday Washington Post headline announced. We'd like to think that it was a Tuesday BuzzFlash at Truthout commentary that did the trick: "The New Untouchables Are Wall Street Executives, Despite Evidence Many Likely Criminally Violated Sarbanes-Oxley Act." In that piece, BuzzFlash observed that Breuer is ultimately responsible for not prosecuting any key Wall Street executives, many of which – on the evidence available – oversaw a tsunami of criminal violations of the 2002 Sarbanes-Oxley Act. Many Americans are not aware of Sarbanes-Oxley, which has many legal requirements in it. A key regulation it places on corporations, under penalty of law, is full disclosure of financial transactions and any discovered fraudulent activity. The latter breaking of the law was key to how the subprime mortgage breakdown was the gateway to the collapse of the economy in 2008.

Yet, Breuer, who was – and likely will be again – an insider DC megabucks lawyer representing banks too big to fail and global corporations, settled on fines (or let the Securities and Exchange Commission do a slap on the wrist to corporate and financial masters of the universe). As the Washington Post confirms, "Prior to his appointment at the Justice Department, Breuer worked at the Washington office of the Covington & Burling law firm, alongside Eric Holder." In short, Breuer and Holder are responsible to the American people for prosecuting the same masters of the universe clientele who they represented for lavish salaries at Covington & Burling. We can't read the minds of Breuer and Holder, but given DC precedent, it is quite likely that they will return to mega-bucks salary partnerships at a DC law firm again representing the kind of people who they are supposed to be prosecuting. If they criminally indict Wall Street executives, their financial value as attorneys decreases. That's the bottom line. Besides, these guys are of the same elite managerial class that the Wall Street "made men" are.

So Breuer did not prosecute one Wall Street executive during his term as head of the criminal division, not one. Instead the likes of the Washington Post praise him for occasionally imposing fines that were merely the cost of doing business (think of drug cartels paying off Mexican and US government officials 5 or 10% for letting shipments go through, while pocketing 90 or 95% in profits – basically analogous to a DOJ or SEC fine, even if seemingly large.) What this means is that Wall Street financial firms and corporations just factor the fines into a smaller profit, but a large profit they still make on illegal activity – and a handsome one to boot.

As BuzzFlash wrote in its Tuesday commentary:

He also made an astounding assertion for the head of the criminal division of the DOJ. Breuer, who had claimed the LA feds had done an exhaustive job of looking into Countrywide, said that it was the duty of the compliance exec at Countrywide to come forward. He was at a loss to explain why she wouldn't have been interviewed as part of a thorough inquiry.

It should be noted that Breuer is responsible for the approval of the brutally excessive prosecution of Aaron Swartz by US Attorney Carmen Oritz. Although we can't say with certainty that Breuer is the kind of DC insider who values career advancement over the impartial and fair administration of justice, it certainly has that appearance.

As BuzzFlash has noted many times, the DOJ has a double standard for the rule of law: one of exoneration and impunity for the elite financial and political managerial class – and another for those US citizens who challenge the status quo.

As far as the head of Countrywide, "60 Minutes" revealed the same troubling lack of DOJ prosecution under Breuer -- and the same profiting from crime by a financial CEO:

Mozilo, who admitted no wrongdoing, accepted a lifetime ban from ever serving as an officer or director of a publicly traded company, and agreed to pay a record $22 million fine, less than five percent of the compensation he received between 2000 and 2008.

As BuzzFlash observed in another recent commentary, "JPMorgan Chase CEO Jamie Dimon Gets Impunity, While DOJ Puts 'Small Fry' Check Cashing Manager in Prison for Five Years":

Just think, is anyone getting prosecuted for all the leaks, including a book, about the Osama bin Laden raid? Not a chance.

BuzzFlash, also pointed out, as have numerous others, that the Wall Street bank fraudsters get bonuses and impunity, while the small fish of the financial world get prosecuted with an iron fist so that the Department of Justice (DOJ) can claim that it is enforcing the law. It's the appearance of abiding by the "rule of law," but in reality abandoning that standard for the powerful elite. For them the DOJ observes the ruling managerial class standard of omerta. It is the DC "masters of the universe" code of silence.

Top Wall Street dog and Obama favorite Jamie Dimon, JPMorgan Chase's CEO, recently endured the "punishment" of having his yearly bonus reduced to $10 million dollars for not driving Chase's stock price and profit even higher. (Meanwhile, Chase cut its staff by 1500 last year.)

But the venerable Marcy Wheeler at emptywheel.net recently wrote a commentary that nailed down how the DOJ gives Dimon and bank executives at behemoths like HSBC a legal pass on criminal prosecution, while forcing a small fish in Los Angeles to go to jail for five years for lesser crimes. In this case, it involves the Bank Secrecy Act/Anti-Money Act. Wheeler describes how the Office of the Comptroller of the Currency issued orders to JPMorgan Chase to comply with the act (which is primarily meant to reduce the illicit money laundering of cash). But JP Morgan Chase continues to flout the law.

No it wasn't BuzzFlash at Truthout that brought down Breuer, it was a Frontline program on Tuesday night. In it, according to the website Wall Street on Parade,

Following is the verbatim transcript of that portion of the program:

…..

MARTIN SMITH: We spoke to a couple of sources from within the Criminal Division, and they reported that when it came to Wall Street, there were no investigations going on. There were no subpoenas, no document reviews, no wiretaps.

LANNY BREUER: Well, I don’t know who you spoke with because we have looked hard at the very types of matters that you’re talking about.

MARTIN SMITH: These sources said that at the weekly indictment approval meetings that there was no case ever mentioned that was even close to indicting Wall Street for financial crimes.

Meanwhile, ProPublica just posted this bombshell, "Morgan Stanley Peddled Security Its Own Employee Called ‘Nuclear Holocaust’."

Ha ha. Those hilarious investment bankers.

Then they gave it its real name and sold it to a Chinese bank.

We are never going to have a full understanding of what bad behavior bankers conducted in the years leading up to the financial crisis. The Justice Department and the Securities and Exchange Commission have failed to hold big wrongdoers to account.

Morgan Stanley is a client of Covington & Burling, as previously noted the former – and perhaps future -- law firm of Breuer and Holder. Bank of America is also a major client of Covington & Burling. In 2008, Bank of America purchased Countrywide Financial, whose CEO -- cited above -- was let off the hook by the DOJ as far as criminal charges. Breuer's been a good consigliere – he made sure his former law firm's clients made money even when fined and kept them out of jail – but a disgrace as head of the criminal division in the Department of Justice.

Demeter

(85,373 posts)As expected, the weak, watered-down filibuster reform plan that does not actually reform the filibuster was easily approved by the Senate last night, 78 to 16. Some of the Democrats who took the lead in pushing for bolder changes, including Sens. Jeff Merkley (D-Ore.) and Tom Udall (D-N.M.), grudgingly went along, knowing it was this or nothing. But once it became clear that the measure would pass, reformers tried to put a positive spin on the developments. This package fell far short of expectations, they said, but if these minor changes fail to improve matters, and the Senate remains a dysfunctional mess, Democrats can and will return to the issue and push for more sweeping improvements.

But if reformers are hoping to get another bite at this apple, they should know they'll have to wait until 2015, at the earliest. Sahil Kapur reported this morning that Senate Majority Leader Harry Reid (D-Nev.) promised Republicans "he will not seek to make any further changes to the filibuster or other rules in the 113th Congress without Republican consent."

The Democratic leader was categorical in his response. "That is correct," Reid responded. "Any other resolutions related to Senate procedure would be subject to a regular order process including consideration by the Rules Committee."

In other words, the "constitutional option" (or "nuclear option"

WELL, THE FIRST THING I WOULD DO IS GET HARRY REID OUT OF OFFICE ENTIRELY...

Update: Reid's spokesman, Adam Jentleson, told Kapur this morning that there are other options for rules changes, and that Reid hasn't "ruled out" the possibility of additional actions in this Congress.

SURE THERE ARE, HARRY....

DemReadingDU

(16,000 posts)1/25/13 No Fool Left Behind

This market is doing what every phony rally in history does, which is to pull in as much money as possible before rolling over (again) and heading into oblivion. The latest sentiment making its rounds is that a *new* bull market has begun. Yet contrary to this late breaking euphoria, I can't be impressed by a market that has had an unprecedented $8 trillion of combined monetary and fiscal stimulus thrown at it and still hasn't taken out its high from 2007 - or from 1999, for that matter. It's mind boggling to realize that a mere money market account has outperformed the stock market on a fourteen year timeframe - with zero volatility. Not something we will ever hear the dunced cheerleaders at CNBS ever talking about...

.

.

You get the idea. Only a fucking moron, or a government policitian, a Faux News anchor, a PhD in Economics, a Central Bankster, a Wall Street con artist would actually think this is in any way a good strategy...

http://www.ponziworld.blogspot.com/2013/01/no-fool-left-behind.html

Demeter

(85,373 posts)The fact that the market can't surpass itself is the surest sign of continuing deflation of paper assets, despite all the hot air pumping the Fed and Treasury has been doing.

Demeter

(85,373 posts)Leading British newspaper the Telegraph reports today:

Economists from the Royal Bank of Scotland said the last four years have produced the worst economic performance in a non post-war period since records started being collected in the 1830s.***

“It’s the worst economic performance since at least 1830, outside of post-war demobilisations,” he told The Daily Telegraph. “It’s worse than the 1920s, it’s worse than the Great Depression.” He said the economy has been “heading this way for a long time” because of the scale of the problems that came to a head in the 2008 financial crash.***

The top economist at RBS, which is mostly owned by the Government, said it is difficult to recover when much of the world is facing similar problems. “It’s the scale of what happened in 2008 but also the build-up to that,” he said. “Compared with other recessions [like in the 1980s and 1990s], this is happening all over the world. There’s not a quick and easy way to export your way out of this.”

(In a separate article, the Telegraph notes that the UK is heading for an unprecedented triple dip, as its economy shrunk .3 percent in the fourth quarter of 2012).

We’ve repeatedly warned that this is worse than the Great Depression …

What Do Economic Indicators Say?

We’ve repeatedly pointed out that there are many indicators which show that the last 5 years have been worse than the Great Depression of the 1930s, including:

The housing slump

The bank charge off rate

The collapse in world trade

The withdrawal of short-term credit

The level of inequality between rich and poor (too much inequality destroys economies)

The interconnectedness of financial systems and economies worldwide (interconnectedness leads to financial instability)

Runaway spending and greed

Mark McHugh reports:

In just four short years, our “enlightened” policy-makers have slowed money velocity to depths never seen in the Great Depression.

(As we’ve previously explained, the Fed has intentionally squashed money multipliers and money velocity as a way to battle inflation.) Indeed, the number of Americans relying on government assistance to obtain basic food may be higher now that during the Great Depression. The only reason we don’t see “soup lines” like we did in the 30s is because of the massive food stamp program. And while apologists for government and bank policy point to unemployment as being better than during the 1930s, even that claim is debatable.

What Do Economists Say?

Indeed, many economists agree that this could be worse than the Great Depression, including:

Fed Chairman Ben Bernanke

Former Fed Chairman Alan Greenspan (and see this and this)

Former Fed Chairman Paul Volcker

Economics scholar and former Federal Reserve Governor Frederic Mishkin

The head of the Bank of England Mervyn King (and see this)

Nobel prize winning economist Joseph Stiglitz

Nobel prize winning economist Paul Krugman

Former Goldman Sachs chairman John Whitehead

Economics professors Barry Eichengreen and and Kevin H. O’Rourke (updated here)

Investment advisor, risk expert and “Black Swan” author Nassim Nicholas Taleb

Well-known PhD economist Marc Faber

Morgan Stanley’s UK equity strategist Graham Secker

Former chief credit officer at Fannie Mae Edward J. Pinto

Billionaire investor George Soros

Senior British minister Ed Balls

Bad Policy Has Us Stuck

We are stuck in a depression because the government has done all of the wrong things, and has failed to address the core problems. Instead of bringing in new legs, we keep on recycling the same old re-treads who caused the problem in the first place.

For example:

This isn’t an issue of left versus right … it’s corruption and bad policies which help the super-elite but are causing a depression for the vast majority of the people.

Demeter

(85,373 posts)Hasbro, the second largest toymaker in the US behind Mattel, confessed that it would miss fourth-quarter revenue estimates. Christmas wasn’t kind. Despite “double digit growth in our emerging markets business,” as CEO Brian Goldner said, revenues fell by 2% for 2012 and by 3.8% for the quarter. But 4% inflation, preferably more, would have covered up that debacle. The consequences are brutal. There will be a pile of restructuring charges, and 10% of the people will be axed—a collective punishment that the Romans used to dish out to lackadaisical legionnaires. They called it “decimation” (Latin for “removal of the tenth”). One in ten soldiers, determined by drawing lots, would be stoned or clubbed to death by his buddies. It did wonders for morale, and the whole empire collapsed.

Procter & Gamble, the consumer products giant with a myriad of ubiquitous brands, brimmed with optimism in its earnings call on Friday as CFO Jon Moeller praised its “growth strategy.” But in the end, sales grew only 2%, about the rate of inflation. It’s tough out there. A decimation had already been announced last February: 10% of non-manufacturing employees, “roughly 5,700 roles,” he said. Not people, but “roles.” 5,500 of these roles were already gone. The rest would be gone soon. Ahead of schedule. But it still wasn’t enough. In November, P&G “committed to do more,” that is axe another 2% to 4% of “non-manufacturing enrollment,” but “any additional enrollment progress”—enrollment progress!—in fiscal 2013 would give P&G a “head start” for their 2014 to 2016 “enrollment objectives”. But why this decimation? Sales growth. Or rather, the lack thereof. Which Moeller said, would be “1% to 2%.” Below the rate of inflation. Other large companies are in a similar predicament. Microsoft, for example, admitted on Thursday that its revenues rose a paltry 3%. Inflation is just too embarrassingly low for these corporate giants that are dependent on incessant price increases to doll up their top line.

Fed to the rescue! And it has been trying. After years of escalating waves of QE, the Fed has finally managed to print so much money that its balance sheet officially as of Friday, and for the first time in US history, broke through the $3 trillion mark. Here is a screenshot to eternalize the historic event:

On August 1, 2007, when the prior all-time-craziest Fed-inspired credit bubble was showing signs of blowing up, there were “only” $874 billion in assets on that balance sheet. Over the last two months alone, the Fed printed enough dollars to mop up $160.4 billion in securities. The two largest asset groups on the balance sheet: US Treasuries ($1.697 trillion) and mortgage-backed securities ($983 billion). Every month the Fed will add $45 billion in Treasuries and $40 in mortgage-backed securities. Until it comes up with something new...Other central banks have also run their printing presses until they’re white hot. As all this money went looking for things to buy, it pushed bonds into the stratosphere, and yields into hell. Risk is no longer compensated. Some governments have been borrowing at negative yields. Even 10-year Treasuries yield less than inflation. And junk bonds with a considerable chance of default, if the free money ever dries up, yield as little as a 1-year FDIC-insured CD used to yield before the financial crisis. Commodity prices have been driven up. Food has become unaffordable for many people in poorer parts of the world. And equities have been driven to lofty heights. China just warned that “hot money” fresh off the US and Japanese presses would wash over China and drive asset bubbles to even more insane and dangerous heights. But the one thing all this money-printing just hasn’t done in the US in 2012 is create the kind of substantive inflation that a lot of corporations need to beautify their revenues. Inflation creates the pretense of growth—just like salaries that have been rising, but less than inflation. It makes things look good on the surface, and analysts can go around and hype the company’s “growth strategy,” and everybody is happy. Reality be damned...

Demeter

(85,373 posts)The Bernanke Fed's policy has contributed to unemployment by rewarding banks for not making loans to consumers and businesses. Eighty-five percent of the Bernanke Fed's printing press expansion since August 2008 is sitting idle in the nation's banks as excess reserves (which is 56 percent of the August 2012 monetary base). The monetary base of the money supply (currency, coin and bank reserves) is the Fed's primary instrument for its operations...From August 2008 to August 2012 the Bernanke Fed exploded the monetary base by $1.74 trillion (from $908 billion to $2.64 trillion). The nation's banks received huge deposits -- most of which they kept in idle money (excess reserves) that they were not required to hold. Idle reserves increased by $1.48 trillion ($1.482 billion in August 2008 to $1.483 trillion in August 2012).

One incentive the banks have for holding these idle reserves is that the Bernanke Fed has paid the banks one quarter of one percent interest on their reserves since October 2008, one month after the huge financial crash. Generally, banks pay extremely low interest on the money from their depositors -- near zero as long as the Fed is trying to keep interest rates near zero. If the banks can pay little more than zero to get the deposits, they may choose to let the deposits sit idle and draw risk free interest from the Bernanke Fed.

You might think that one quarter of one percent interest is peanuts -- the Fed paid the banks $3.764 billion interest on their reserves in 2011 -- but even a Federal Reserve bank president disagreed with this Fed policy. On Aug. 23, 2012, St. Louis Federal Reserve Bank President James Bullard, speaking on CNBC, rattled the stock markets and certainly the printing press enthusiasts on the Fed's decision making committee. Bullard disagreed about another major injection of money into the economy. Asked if he thought there should be another major injection: Bullard said, "I don't think so." Three cheers for Bullard who said he would be willing to consider reducing the interest paid on excess reserves held by the nation's banks that they are not required to hold.

One month after the September 2008 massive financial crisis the Bernanke Fed began paying interest on the banks' reserves. In January 2012, I began to publicly question this policy. I spoke at the National Press Club, sponsored by Ralph Nader, and at Chapman University. Jim McTague, Washington Editor of Barron's, wrote:

Recently, Sept. 13, 2012, the Federal Reserve announced a new monetary base expansion. The Fed will pump $40 billion a month into the economy until their officials see an unspecified decline in unemployment. Since they will continue an existing program of purchasing Treasury securities the expansion will amount to $85 billion a month until the end of this year. Where will most of that $255 billion go: consumer and business loans or into bank reserves?

MORE

Follow Robert Auerbach on Twitter: www.twitter.com/prof2718

DemReadingDU

(16,000 posts)1/27/13 Credit Suisse Inherits $2 Billion National Century Claim

Credit Suisse Group AG (CSGN) was ruled by a judge to be liable for all damages that could be awarded to noteholders suing the bank over fraud at National Century Financial Enterprises Inc., a figure investors’ lawyers put at more than $2 billion. U.S. District Judge James Graham said yesterday that because New York law governs apportionment of fault in the case, Credit Suisse will be liable for 100 percent of former Chief Executive Officer Lance Poulsen’s share of damages. “If the jury finds at trial that Credit Suisse and Poulsen each committed fraud that caused plaintiff’s losses, then under New York law Credit Suisse will be liable, as to plaintiffs, for 100 percent of Poulsen’s share,” Graham said.

Noteholders claim the bank, the placement agent, knew or should have known of a $2.9 billion fraud that led to National Century’s collapse in 2002. Ten executives of the Dublin, Ohio- based health-care financer were convicted of crimes, including Poulsen, who is serving 30 years in prison. Kathy Patrick, an attorney for investors, said a trial is scheduled for April. “Our clients are eagerly looking forward to presenting this case to a jury,” she said in a phone interview. “We will ask the jury to hold both Credit Suisse and Poulsen responsible for the $1.5 billion in damages the plaintiffs have suffered as a result of their investment in NSFE-related investments.” Interest would drive the damages to more than $2 billion, Patrick said.

Credit Suisse argued that the share of liability assigned to Poulsen, presumed insolvent, should be divided among the bank and other defendants that settled with noteholders, according to Graham’s ruling.

a bit more...

http://www.bloomberg.com/news/2013-01-26/credit-suisse-inherits-2-billion-national-century-claim.html

One might recall the links I posted a couple years ago concerning the Ohio saga of National Century Financial Enterprises...

http://www.democraticunderground.com/discuss/duboard.php?az=show_mesg&forum=102&topic_id=4734921&mesg_id=4735016

xchrom

(108,903 posts)xchrom

(108,903 posts)Vietnam on Sunday inked a deal with firms from Japan and Kuwait to build an oil refinery complex worth nearly $9 billion as part of efforts to meet its growing energy needs.

The Nghi Son refinery, which is due to start operating by 2017 in Thanh Hoa province, about 200 kilometres (125 miles) south of Hanoi, will turn Kuwaiti oil into petrol and other petroleum products.

It will be able to process 10 million tonnes of crude oil a year, the government said.

State-owned PetroVietnam will own a 25.1-percent stake in the joint venture while Japan's Idemitsu Kosan and Kuwait Petroleum International will each hold 35.1 percent. Mitsui Chemicals of Japan will own the remaining 4.7 percent.

Read more: http://www.businessinsider.com/japan-and-kuwait-struck-black-gold-in-vietnam-2013-1#ixzz2JBZg4OQl

xchrom

(108,903 posts)The World Economic Forum's annual meeting broke up on Saturday night amid warnings that attendees were too relaxed and optimistic about the state of the global economy.

Delegates left the congress centre in Davos with the words of Axel Weber, chairman of Swiss bank UBS, ringing in their ears. "In my view the mood [at Davos] borders on complacency," Weber said. "The mood has been good, in brackets too good to be true."

Many speakers at the four-day meeting at the Swiss ski resort predicted that the worst of the financial crisis was over, as stock markets continued to rally this week. Weber, though, warned that an unexpected event could easily puncture the mood, citing political events such as autumn's general election in Germany.

"My fear is that 2013 will be a repeat of 2012," explained Weber in a panel session to debate the global agenda for the next 12 months. He said that last year also began well, with companies posting solid financial results, before markets became gripped by fears that Greece would topple out of the eurozone.

Read more: http://www.businessinsider.com/world-economic-forum-ends-with-stark-warning-over-global-economy-2013-1#ixzz2JBaOqT2I

xchrom

(108,903 posts)

New Jersey Gov. Chris Christie led the conservative charge to wiggle out of pension promises. (Bob Jagendorf/Flickr/Creative Commons)

It’s a common refrain in local papers: State faces pension funding crisis! Retiree benefits out of control! Public pensions bog down taxpayers! Pension costs seem to loom over so many state and local budget battles like a sinister sword of Damocles, a dark reminder of Big Government’s tyrannical profligacy.

Should we panic? Well, according to a new report by the Pew Center on the States, 61 cities face a collective fiscal retirement burden of more than $210 billion, in part because consistent underfunding of benefits leaves yawning gaps in long-term cost projections. The report surveyed all U.S. cities with populations over 500,000, along with the most populous city in each state. Some cities are doing better than others in maintaining funds, but gaps persist, according to Pew’s estimates for fiscal years 2007-2010, especially in municipalities where local governments have lacked the “fiscal discipline” to keep up pension fund contributions—a situation exacerbated by the Great Recession.

But different political actors have different motives for expressing alarm over pension gaps. In some cases, dubiously calculated figures have inflated public concern.

Sometimes, politicians frame cost-cutting proposals as if “generous” benefits themselves are the problem, as opposed to officials failing to uphold the commitments they've made to civil servants.

xchrom

(108,903 posts)International financial leaders have wrapped up the World Economic Forum meeting in Switzerland with warnings that much remains to be done to stabilize the global economy.

International Monetary Fund chief Christine Lagarde, speaking Saturday in Davos, said the IMF outlook for a "fragile and timid" recovery depends on leaders in the top economies of Europe, the United States and Japan making "the right decisions."

She warned against complacency among the 17 European nations using the euro, while noting that two major European economies, Italy and Spain, have survived the worst of the European crisis.