Economy

Related: About this forumWeekend Economists Salute Our Favorite Bunnies March 29-31, 2013

Yes, that's him! That's Peter Rabbit, who with his widowed mother and sisters Flopsy, Mopsy, and Cottontail, enchants each new generation since Beatrix Potter first captured him in 1902. The book was a success, and multiple reprints were issued in the years immediately following its debut. It has been translated into 36 languages and with 45 million copies sold it is one of the best-selling books of all time.

The story of the rabbit and his biographer was charmingly portrayed in film: Miss Potter, a 2006 film directed by Chris Noonan. It is a biopic of children's author and illustrator Beatrix Potter, and combines stories from her own life with animated sequences featuring characters from her stories, such as Peter Rabbit. The film stars Renée Zellweger in the title role and Ewan McGregor as her publisher and fiancé.

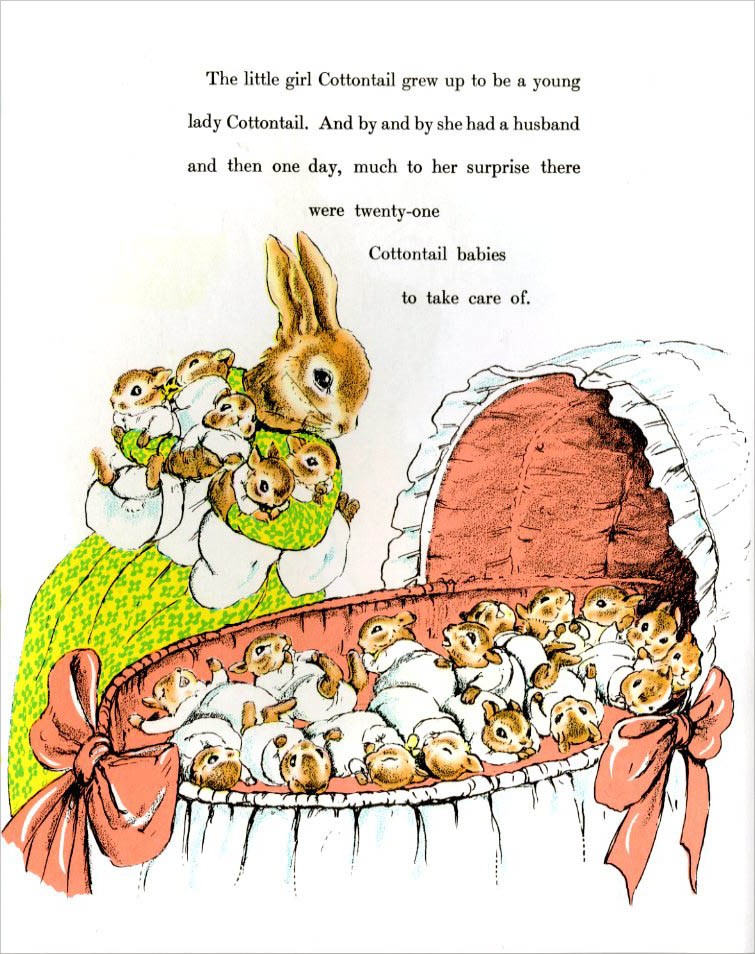

Rabbits have starred in many a folk tale and children's story. One story from my own childhood features another working mother, with affirmative action: The Country Bunny and the Little Gold Shoes, written by Edwin DuBose Heyward, who also wrote Porgy and Bess.

And of course, there's this fellow: Br'er Rabbit (pron.: /ˈbrɛər/), also spelled Bre'r Rabbit or Brer Rabbit or Bruh Rabbit, is a central figure as Uncle Remus tells stories of the Southern United States. Br'er Rabbit is a trickster who succeeds by his wits rather than by brawn, tweaking authority figures and bending social mores as he sees fit. The name "Br'er Rabbit", a syncope of "Brother Rabbit", has been linked to both African and Cherokee cultures.

But when the chips are down and the skies are gray (mercifully, today is sunny and the skies pure blue) there's one bunny who can make anyone smile:

Demeter

(85,373 posts)And Cyprus seems to be running out of candidates, check back to this spot for failures.

Demeter

(85,373 posts)A coalition of groups associated with Occupy Wall Street took to the streets of midtown Manhattan on Thursday evening calling for the abolition of the for-profit health care system in the United States and the creation of a government-run single-payer system. Around 70 protesters marched to four major health insurance companies to list their grievances with each corporation, often by comparing what they see as the wildly disproportionate salaries of CEOs with health costs for regular patients or the company's average worker's salary.

The march was part of a larger project that Strike Debt (which formed from the creative churn of Occupy) is implementing over the week to draw attention to medical debt, which the group sees as a national emergency. Strike Debt also announced that its latest round of a project known as the Rolling Jubilee has bought and abolished over $1 million in medical debt. Activists handed out fliers on the march with statistics on just how damaging medical debt can be to households: "62% of bankruptcies are linked to medical bills" was featured prominently on the flier, as well as on a banner at the front of the march. Also on the handout was perhaps an even more surprising number: "78% of those who declared medical bankruptcy had insurance at the time they became sick."

Strike Debt's mission is to politicize and organize around personal debt, often by arguing that debt is not a moral failing but rather a societal problem that needs to be addressed and resisted collectively. One of the tactics, called Rolling Jubilee, involves buying "debt for pennies on the dollar, but instead of collecting it, abolish[ing] it." The group buys debt on the open market the same way a collection agency would, but cancels the debt instead of collecting it. Funding comes from donors who contribute to the group through its website.

The first Rolling Jubilee took place in November of last year and "abolished" more than $100,000 of medical debt. The People's Bailout, as it was called on Twitter, culminated in a telethon at a New York City music venue and garnered unusually positive press for an Occupy-related action. The second and latest Rolling Jubilee resulted in an even larger amount of debt abolished: over $1 million, according to a post on the group's website, for patients in Kentucky and Indiana. "The average debtor owed around $900," the group wrote, "and we will be abolishing the debt of over 1,000 people." Strike Debt is in the process of sending out letters to patients whose debt has been bought and abolished, as it did following the first Rolling Jubilee...One of the most common questions asked of Strike Debt is whether it can buy and cancel specific people's debt. The answer is no. There are no strings attached for the person whose debt has been bought, though many activists hope that someone on the receiving end of the Rolling Jubilee might throw a few bucks back in the pot – a way of paying it forward, as it were...

MORE

The Wielding Truth

(11,415 posts)Demeter

(85,373 posts)

I think it wasn't until I was reading it to my own children that I could make it to the end.

AnneD

(15,774 posts)I have seen and had to endure more than a human soul should have to endure. But for the life of me, I had difficulty making it through 'The Giving Tree' and "I'll Love You Forever' they were on my daughter's bookshelf but I seldom read them to her. 'The Velveteen Rabbit' and 'Charlot's Web' I read more often but again, it was difficult. Of course, she would make fun of me...but she is just as big a cream puff as her mom, just about different things.

wandy

(3,539 posts) &w=460&h=287&ei=Ch9WUc64CYnwyQH9yoCACQ&zoom=1&ved=1t:3588,r:56,s:0,i:261&iact=rc&dur=779&page=3&tbnh=177&tbnw=284&start=52&ndsp=28&tx=125&ty=86

&w=460&h=287&ei=Ch9WUc64CYnwyQH9yoCACQ&zoom=1&ved=1t:3588,r:56,s:0,i:261&iact=rc&dur=779&page=3&tbnh=177&tbnw=284&start=52&ndsp=28&tx=125&ty=86Demeter

(85,373 posts)Glad to have you join us!

Fuddnik

(8,846 posts)bread_and_roses

(6,335 posts)Curmudgeon that I often am, I dislike Beatrix Potter's bunnies (I know, I know - my loss. I even bought a lovely illustrated version when my daughter was small, but she didn't take to it either ... a congenital defect, I guess), and just about all cartoons. However, I did enjoy the film "Miss Potter."

I also enjoyed - against my own expectations - "Watership Down."

http://en.wikipedia.org/wiki/Watership_Down

From Wikipedia, the free encyclopedia

Watership Down

Richard Adams WatershipDown.jpg

Front cover of first edition

Author(s) Richard Adams

Country England

Language English

Genre(s) Fantasy novel

Publisher Rex Collings

Publication date November 1972

Media type Print (hardback & paperback)

Pages 413 pp (first edition) plus maps[1]

ISBN 0-901720-31-3

OCLC Number 633254

Dewey Decimal 823/.9/14

LC Classification PZ10.3.A197 Wat[2][3]

Followed by Tales from Watership Down

Watership Down is a classic heroic fantasy novel, written by English author Richard Adams, published by Rex Collings Ltd of London in 1972. Set in south-central England, the story features a small group of rabbits. Although they live in their natural environment, they are anthropomorphised, possessing their own culture, language (Lapine), proverbs, poetry, and mythology. Evoking epic themes, the novel is the Aeneid of the rabbits as they escape the destruction of their warren and seek a place to establish a new home, encountering perils and temptations along the way.

Watership Down was Richard Adams' first novel and it is by far his most successful to date. Although it was rejected by several publishers before Collings accepted it,[4] Watership Down has never been out of print, and it is Penguin Books' best-selling novel of all time. It won the annual Carnegie Medal, annual Guardian Prize, and other book awards. It has been adapted as a 1978 animated film that is now a classic and as a 1999 to 2001 television series.[5][6]

Adams completed a sequel almost 25 years later, Tales from Watership Down (Random House, 1996; Hutchinson and Alfred A. Knopf imprints). It is a collection of 19 short stories about El-ahrairah and the rabbits of the Watership Down warren, with "Notes on Pronunciation" and "Lapine Glossary".[7][8][9]

bread_and_roses

(6,335 posts)are charming and delightful ... (Beatrix Potter, I mean)

kickysnana

(3,908 posts)Demeter

(85,373 posts)North Dakota's thriving state bank makes a mockery of Wall Street's casino banking system -- and that's why financial elites want to crush it. North Dakota is the very definition of a red state. It voted 58 percent to 39 percent for Romney over Obama, and its statehouse and senate have a total of 104 Republicans and only 47 Democrats. The Republican super-majority is so conservative it recently passed the nation's most severe anti-abortion resolution – a measure that declares a fertilized human egg has the same right to life as a fully formed person. But North Dakota is also red in another sense: it fully supports its state-owned Bank of North Dakota (BND), a socialist relic that exists nowhere else in America. Why is financial socialism still alive in North Dakota? Why haven't the North Dakotan free-market crusaders slain it dead?

Because it works.

In 1919, the Non-Partisan League, a vibrant populist organization, won a majority in the legislature and voted the bank into existence. The goal was to free North Dakota farmers from impoverishing debt dependence on the big banks in the Twin Cities, Chicago and New York. More than 90 years later, this state-owned bank is thriving as it helps the state's community banks, businesses, consumers and students obtain loans at reasonable rates. It also delivers a handsome profit to its owners -- the 700,000 residents of North Dakota. In 2011, the BND provided more than $70 million to the state's coffers. Extrapolate that profit-per-person to a big state like California and you're looking at an extra $3.8 billion a year in state revenues that could be used to fund education and infrastructure.

One of America's Best Kept Secrets

Each time we pay our state and local taxes -- and all manner of fees -- the state deposits those revenues in a bank. If you're in any state but North Dakota, nearly all of these deposits end up in Wall Street's too-big to-fail banks, because those banks are the only entities large enough to handle the load. The vast majority of the nation's 7,000 community banks are too small to provide the array of cash management services that state and local governments require. We're talking big bucks; at least $1 trillion of our local tax dollars find their way to Wall Street banks, according Marc Armstrong, executive director of the Public Banking Institute. So, not only are we, as taxpayers, on the hook for too-big-to-fail Wall Street banks, but we also end up giving our tax dollars to these same banks each and every time we pay a sales tax or property tax or buy a fishing license. In North Dakota, however, all that public revenue runs through its public state bank, which in turn reinvests in the state's small businesses and public infrastructure via partnerships with 80 small community banks. Banks are supposed to serve as intermediaries that turn our savings and checking deposits into productive loans to businesses and consumers. That's how jobs are supported and created. But the BND, a state agency, goes one step further. Through its Partnership in Assisting Community Expansion, for example, it provides loans at below-market interest rates to businesses if and only if those businesses create at least one job for every $100,000 loaned. If the $1 trillion that now flows to Wall Street instead were deposited in public state banks in all 50 states using this same approach, up to 10 million new jobs could be created. That would effectively end our destructive unemployment crisis.

No Bailouts for the BND...As state government employees, BND executives have no incentive to gamble their way toward enormous pay packages. As you can see, the top six BND officers earn a good living, but on Wall Street, cooks and chauffeurs earn more.

Eric Hardmeyer, President and CEO: $232,500

Bob Humann, Chief Lending Officer: $135,133

Tim Porter, Chief Administrative Officer: $122,533

Joe Herslip, Chief Business Officer: $105,000

Lori Leingang, Chief Administrative Officer: $105,000

Wally Erhardt, Director of Student Loans of North Dakota: $91,725

The very existence of a successful BND undermines Wall Street's claim that in order to attract the best talent big banks need to offer enormous pay packages. Yet somehow, North Dakota is able to find the talent to run one of the soundest banks in the country? The BND is living proof that Wall Street's rationale for sky-high executive pay is a self-serving fabrication. (For more information on financial inequality please see my latest book, How to Earn a Million Dollars an Hour, Wiley, 2013.)

Wall Street Is Gunning for Bank of North Dakota

DETAILS AT LINK

Les Leopold is the executive director of the Labor Institute in New York, and author of How to Make a Million Dollars an Hour: Why Hedge Funds Get Away with Siphoning Off America's Wealth (J. Wiley and Sons, 2013).

Demeter

(85,373 posts)It’s not often we stop to ask ourselves: “What’s going on with North Dakota?” But I believe this is the moment.

The State Legislature has been in a kind of anti-abortion meltdown, piling up bills with what-the-heck abandon. The House and Senate passed a “fetal heartbeat” bill that would prohibit abortions when a woman was about six weeks into pregnancy. They also each passed a “fetal pain” bill that would prohibit abortions at around 20 weeks. Plus a resolution giving fetuses the rights of personhood, which would not only prohibit abortion altogether, but would also outlaw some forms of infertility treatment and contraception. There was also a bill banning abortions on the basis of sex preference or possible genetic defects, none of which would be detectable by the time abortions were already prohibited under some of the other bills. The governor pretty much signed everything they threw at him. “Folded like a tent in a blizzard,” said an editorial in Fargo’s daily paper. Opponents pointed out that while the House was busy protecting fetuses, it had killed a bill providing free milk or juice to impoverished schoolchildren who had actually been born. The Senate rectified that embarrassment, sort of. “They’re taking the money we give to school districts for at-risk children and saying you have to use that money to provide juice and milk programs,” said Corey Mock, an assistant minority leader in the House. Things are in flux in North Dakota. Anything could happen with the milk money. Or the amendment to one anti-abortion bill that would end a federally funded sex education program for homeless teenagers. The bills the governor signed will probably be challenged in court, including a law requiring doctors who perform abortions to have admitting privileges with a local hospital, which could doom the state’s lone abortion provider, the Red River Women’s Clinic.

North Dakota has a strong libertarian streak that comes to a screeching halt when it reaches reproduction rights. Still, this seemed out of character. North Dakotans tend to be emotionally conservative; they don’t approve of getting carried away. Last year, voters soundly defeated a proposal to abolish all property taxes and a “religious freedom” law giving employers the right to refuse to provide health coverage for contraception. A lot of people who found the ideas attractive still feared they carried the dreaded seeds of immoderation. “Middle of the road; that’s what they call the North Dakota Way,” said Jack Zaleski, the opinion editor of Fargo’s daily. This is the state that gave us national figures like Senator Kent Conrad, who was famous for speeches that involved his extensive use of very boring charts, and Senator Byron Dorgan, who liked to remind people that he had been personally honored by the U.S.A. Dry Pea and Lentil Council. I always admired that about North Dakota. What happened?

For one thing, the more aggressive wing of the anti-abortion movement is trying to use the state to stage a test case against Roe v. Wade. In the last election, several of these groups targeted Curtis Olafson, a conservative Republican state senator who had derailed some of their more spectacular bills under the theory that they would just lead to court fights that North Dakota would eventually lose. “I hated to see taxpayers’ money go down the drain for an exercise in futility,” said Olafson, who is now an ex-senator, having lost his seat in a nasty primary. So there’s paranoia.

But maybe the state also has too much money. Until recently, North Dakota had a dwindling population and trouble balancing a very small state budget. Then came the oil boom and multibillion-dollar surpluses. “We could bail out Cyprus, probably,” said Mike Jacobs, the publisher of The Grand Forks Herald. Now the employment problem is a shortage of workers. One of many issues that was not getting resolved while the Legislature worked on its abortion agenda is a preschool crisis in oil-rich parts of the state. “They can’t afford to keep staff at the child-care centers when fast-food restaurants are paying $15 to $16 an hour,” said Kylie Oversen, a representative from Grand Forks. When signing the fetal heartbeat bill, Gov. Jack Dalrymple admitted it would be immediately challenged in court, and he seemed to share Olafson’s dim view of success. But, hey, if legislators want to give it a shot, what the heck? They’ve got cash. “The Legislative Assembly before it adjourns should appropriate dollars for a litigation fund available to the attorney general,” the governor suggested...A shortage of money tends to keep things focused. When a legislature starts going off the rails, cool heads can pull the conversation back into line by reminding everybody that they’re supposed to be focusing on “jobs, jobs, jobs.” It gets a little tiresome after a while, but it does provide a much-needed sense of direction. While our Congress is certainly unsatisfactory in many ways, it’s shown a lack of enthusiasm for having major fights over social issues in recent years, possibly because everybody wants to look jobs-jobs-jobs obsessive.

North Dakota led astray by lucre? Finally, we may have found a good side to recessions.

UNFORTUNATELY, LACK OF MONEY DOESN'T STOP THE TEABAGGERS IN MICHIGAN...

Mojorabbit

(16,020 posts)my specialty is rabbits. They are very difficult to raise but I seem to have a knack for it. We have cottontails and marsh here in Central Fl. I raise them and or doctor them up and release them back out into the wild.

Demeter

(85,373 posts)Demeter

(85,373 posts)If you've been gouged by your bank, discriminated against, sexually harassed, unfairly fired, you'll most likely find that you're barred from the courthouse door. Being wronged by a corporation is painful enough, but just try getting your day in court. Most Americans don't realize it, but our Seventh Amendment right to a fair jury trial against corporate wrongdoers has quietly been stripped from us. Instead, we are now shunted into a stacked-deck game called "Binding Mandatory Arbitration." Proponents of the process hail it as superior to the courts — "faster, cheaper and more efficient!" they exclaim.

But does it deliver justice? It could, for the original concept of voluntary, face-to-face resolution of conflict by a neutral third party makes sense in many cases. But remember what Mae West said of her own virtue: "I used to be Snow White, then I drifted." Today's practice of arbitration has drifted far away from the purity of the concept.

All you really need to know about today's process is that it's the product of years of conceptual monkey-wrenching by corporate lobbyists, Congress, the Supreme Court and hired-gun lobbying firms looking to milk the system for steady profits. First and foremost, these fixers have turned a voluntary process into the exact opposite: mandatory.

Let's look at this mess.

— Unlike courts, arbitration is not a public system, but a private business.

— Far from being neutral, "the third-party" arbitration firms are — get this! — usually hand-picked by the corporation involved in the case, chosen specifically because they have proven records of favoring the corporation.

— The corporation also gets to choose the city or town where the case is heard, allowing it to make the case inconvenient, expensive and unfair to individuals bringing a complaint.

— Arbitrators are not required to know the law relevant to the cases they judge or follow legal precedents.

— Normal procedural rules for gathering and sharing evidence and safeguarding fairness to both parties do not apply in arbitration cases.

— Arbitration proceedings are closed to the media and the public.

— Arbitrators need not reveal the reasons for their decisions, so they are not legally accountable for errors, and the decisions set no legal precedents for guiding future corporate conduct.

— Even if an arbitrator's decision is legally incorrect, it still is enforceable, carrying the full weight of the law.

— There is virtually no right to appeal an arbitrator's ruling.

That adds up to a kangaroo court! Who would choose such a rigged system? No one. Which is why corporate America has resorted to brute force and skullduggery to drag you into their arbitration wringer.

DETAILS AT LINK

Demeter

(85,373 posts)As long as banking activities are allowed to run against the public good, deposits will always be at risk...So it now looks as though Cyprus, a bucolic island of some 860,000 people in the heart of the Mediterranean, really does matter. Here’s how things stand: Bullied by the the European Union, the ECB and the IMF (the unholy trinity of neo-liberalism), Cyprus has now agreed to impose a levy of 20 to 25 percent on large bank accounts as it seeks to overcome final obstacles to a financial rescue and avoid a chaotic bankruptcy. The levy would be applied to deposits exceeding €100,000 at the country’s largest bank, Bank of Cyprus. In exchange, account holders would receive shares in a restructured bank, although government officials have acknowledged that this would imply sharp losses...The principle of deposit insurance, at least up to 100,000 euros, appears to be upheld. It looks like only the uninsured deposits above that threshold will be taxed. So can we now go to sleep comfortably, knowing that we don’t have to stick our hard-earned savings into what the Financial Times’ John Dizard termed “Banco de Mattress”?

Almost certainly not.

Regardless of the ultimate form this bailout takes, it is increasingly hard to view Cyprus as a “one-off,” which has no implications for us here in the US. What Cyprus has demonstrated is that even with deposit insurance, your deposits are not in fact a risk-free guaranteed asset, but actually simply another branch in the creditor tree in relation to your bank if it fails. That was made abundantly clear by no less than the Bank for International Settlements (BIS), the central bankers’ bank back in the heart of the financial crisis. The BIS noted that bank failures had become increasingly expensive for governments and taxpayers and therefore recommended an “Open Bank Resolution,” which would ensure that, as far as possible, “any future losses are ultimately borne by the bank’s shareholders and creditors." (See primer on the Open Market Resolution concept by the Reserve Bank of New Zealand.) Why does this matter? Because, you, as a depositor are legally considered a “creditor” of your bank, not simply a customer who may have entrusted your entire life savings with the very same institution. As Wikipedia notes:

What banks do with your money is far more germane than you might have thought. They not only can blow up the institution through the creative use of toxic derivatives, but could well get you standing in the queue waiting to get paid out if the range of their activities are not strongly circumscribed.

True, it looks like the small depositors in Cyprus now will in fact receive their deposit insurance guarantees. But how credible is a guarantee coming from a country that doesn’t create its own currency? That, by the way, is the problem afflicting all of the countries in the Eurozone. At least in the US, Canada or the UK, such deposit insurance guarantees can be made credible because they are ultimately backstopped by the issuer of the currency. Not so in Cyprus, Spain, Portugal, even France or Germany, because they gave up their currencies for the euro, which is now issued solely by the European Central Bank (ECB). A European-wide system of deposit insurance which does not have the explicit backing of the ECB is as problematic as, say, New York state seeking to backstop all of the deposits of the American banking system without the US Treasury behind it...That institutional peculiarity aside, the Cyprus experience demonstrates that deposit insurance is something ultimately built on trust between a people and its government. When the government arbitrarily undercuts the promise of insurance via tax or other forms of expropriation, it further undermines the stability of the banking system. Yes, governments should do all that they can to avoid bailouts which include penalties against depositors (both insured and uninsured). But the best way to do that is not to create ill-conceived bailout packages in the middle of the night in response to a financial crisis. The thing to do is to restrict the range of activities that created the crisis in the first place. Rather than creating an increasingly complex regulatory system in response to a bunch of newfangled products, which bankers constantly game, we should remember that banks' primary functions should be to facilitate a payments system and provide loans to credit-worthy customers. Attention should always be focused on what is a reasonable credit risk and that should be the starting point for true financial reform.

So in an ideal world, how should we do proper financial reform and prevent the recurrence of another Cyprus? In the first instance, the banks:

Given the importance of financial needs in order for the economic process to start, financial institutions are essential components of the system at all stages of the economic process in order for the economy to grow properly. But the paradox is that for a proper functioning free market economy, the banks have to be tightly regulated. Otherwise, an unshackled financial sector will engender instability, in particular, by promoting the position-making desk (i.e. traders) and reducing the role of the loan-officer desk.

Marshall Auerback is a market analyst and commentator.

Demeter

(85,373 posts)A Central Bank official and a senior Finance Ministry technocrat says that Bank of Cyprus savers with over 100,000 euros could take losses of up to 60 percent.

The officials, who spoke on condition of anonymity because they're not authorized to publicly discuss details of the issue, said Saturday that deposits over 100,000 at the country's largest lender will lose 37.5 percent of their value after being converted into bank shares.

They said they could lose up to 22.5 percent more, depending on an assessment by officials who will determine the exact figure aimed at restoring the troubled bank back to health.

Cyprus agreed Monday to make depositors contribute to a financial rescue in order to secure 10 billion euros ($12.9 billion) in loans from the eurozone and the IMF.

DO I HEAR 70?

Demeter

(85,373 posts)...Cyprus's story has obvious parallels with both Iceland's and Ireland's, with R.M.M.L. — Russian mobster money laundering — as an extra ingredient. All three island nations had a run of rapid growth as their status as banking havens left them with banking systems that were too big to save. Iceland, at peak, had banks with assets that equaled 980 percent of gross domestic product; Ireland was at 440 percent. Cyprus, at around 800 percent, was closer to Iceland in this respect. In all three instances, runaway banking was the source of the crisis — although not everyone seems to get this, even now....Cyprus, unfortunately, seems to be making a hash of it. To be fair, the proposed levy on depositors was actually smaller than the real losses Icelandic depositors took (and they lost on their currency holdings too). But this is just the beginning! Even with the effective default on deposits, Cyprus will need a huge loan from the troika — the European Central Bank, the European Commission and the International Monetary Fund — and the condition for this loan will be harsh austerity. This looks like the beginning of endless, inconceivable pain.

The Russians Are Coming!

The Russians Are Coming!

How big a deal is the Russian factor in Cyprus's crisis? Pretty big, it seems. Over at the Financial Times, the financial blogger Izabella Kaminska reported on some estimates indicating that 19 billion euros in Russian nationals' deposits are in Cyprus banks, which is more than the country's G.D.P. While I'm not expert in this area, I wonder whether this is an understatement; given what we think we know about the nature of much of this Russian money, is all of it really being declared as Russian?

Let me make a broader point: We've now seen three island nations around Europe become huge international banking hubs relative to their G.D.P.'s, then get into crisis because their domestic economies don't have the resources to bail out those metastasized banking systems if something goes wrong. This strongly suggests, to me at least, that we have a fundamental problem with the whole architecture (to use the preferred fancy word) of international finance. As long as you haven't bought into the Barney-Frank-did-it school of thought, you realize that the global crisis of 2008 was in a fundamental sense made possible by the erosion of effective bank regulation. As the economist Gary Gorton has documented, there was a 70-year "quiet period" after the Great Depression in which advanced countries had very few major financial flare-ups; Mr. Gorton argues, and most of us agree, that the key to this quietness was a constrained, regulated financial system that also limited the opportunities for excessive nonbank leverage. But this regulation in turn depended, to an important extent, on limited international capital flows; otherwise regulations made in Washington or elsewhere would have been bypassed via havens like, well, Cyprus. And once those capital controls began to be lifted in the 1970s we entered an era of ever-bigger financial crises, starting in Latin America, then moving to Asia, and finally striking the whole world.

So what are we going to do about this? Cyprus, as a euro-zone country, should really be part of a euro-wide safety net buttressed by appropriate regulation; it's insane to imagine that the euro can be run indefinitely and merely with national deposit insurance. But euro-area deposit insurance doesn't seem to be in the cards — and anyway, there are plenty of other potential Cypruses out there.

All of which raises the question: Is the era of free capital movement just a bubble, fated to end one of these years, maybe soon?

Demeter

(85,373 posts)Cyprus is the latest European country to face a budget and banking crisis. Its deregulated banks have accumulated huge losses and now face imminent bankruptcy. Like the United States government, the government of Cyprus guarantees most bank deposits against losses. So a failure of Cyrpus’s banks would result in a budget crisis for the government as well. While it is easy to fault Cyprus for its failed policies, let’s not forget that the banking system of the United States of America collapsed five years ago. Little Cyprus (population 840,000) held out five years longer than the richest and most powerful country in the world. What’s more, Cypriot banks have failed because they have engaged in all the risky business practices that US banks taught them. On top of that they implemented a US-style regime of self-regulation. As a result, it’s no surprise that Bank of Cyprus is now going the way of Citibank. The surprise is that it took so long.

Unfortunately, the Cypriot government and the European Union are also following the US policy of bailing out their banks, letting managers and bondholders get off scott free.

In the US it was the taxpayers who paid the bill. In Cyprus, though, many of the bank depositors are actually foreign (rumored to be Russian). So in Cyprus they plan to make the depositors pay...Like the United States, European Union countries provide guarantees to bank depositors. In Cyprus your first 100,000 Euros are guaranteed against losses if your bank goes bankrupt. Any deposits over 100,000 Euros are theoretically at risk, but there’s a clear legal hierarchy of who takes losses and who gets paid. First the bank’s owners get wiped out. After all, they’re the ones who racked up the losses that bust the bank. Next the bondholders — the professional investors who lent money to the bank itself — take their losses. Then, only after the pros have been wiped out, do the amateurs — the depositors — lose any money.

That’s the theory of what happens when a bank goes bankrupt. Except that Cyprus’s banks are not going bankrupt. To prevent a bankruptcy, the European Union wants the government of Cyprus to declare a one-time tax on bank deposits..

That’s right. If the government takes 20% of your deposited funds and uses the money to bail out your bank, your bank won’t go bankrupt and your deposits won’t be at risk. Of course, you’ll have only 80% of your money, but technically your 80% is still perfectly safe and guaranteed by government deposit insurance. In other words, it’s the Great Cyprus Bank Robbery. No doubt Cyprus has made many mistakes in its bank regulations and policies. But anyone who thinks that a country of 840,000 is making up its own policies is crazy. Cyprus has implemented the policies that the US and EU have recommended for it.

Now that Cyprus’s banks are in trouble, the EU is demanding that Cyprus bail out its banks — and make the depositors pay for the bailout. It’s no mystery why. Most of the bondholders who lent to Cyprus’s banks are banks in other European countries. Cyprus should let its banks fail, then see where the chips fall. Depositors should be protected as much as possible. Ultimately, if there are deposit insurance bills to pay, the government should pay for them. If that means higher taxes, so be it. But to make bank depositors pay for a bank bailout is sheer robbery. There is no other word for it. A lawyer may argue that legally it is a preemptive tax, but morally it is robbery all the same.

Demeter

(85,373 posts)Back in 2011, in order to prevent the crash of the global economy that could have easily followed a default by the United States of America on its national debt, the president signed a deal with obstinate Republicans so that the government would be allowed to pay its creditors with a lifting of a limitation known as the debt ceiling. The deal the president agreed was said to be such a cup of poison, even to Republicans, that they would never allow it to go into effect. Called sequestration or, simply, “the sequester,” the deal comprised across-the-board cuts to every government agency, including the Republicans’ beloved Department of Defense, set to take place after the presidential election. Surely, they would never allow that to happen.

But then, to the administration’s surprise, they did. Not only did they allow it to happen, they refused all attempts at a compromise to forestall it. What the administration failed to consider is how the sequester, even if hitting Republicans’ favorite programs, offered the GOP a bonus in its war on federal workers -- especially those who belong to public sector unions, which they see as the key to President Barack Obama’s victory in the 2012 election. And it put the administration in the uncomfortable position of having government agencies choose where to find their personnel savings: by hitting the income of government workers, or curtailing contracts for non-government personnel. (Given the clout held by contractors through their K Street lobbyists, it's not hard to determine who's likely to lose in that contest.)

In a matter of days, furloughs of federal workers are set to begin as part of the spending cuts enforced by the sequester. The furloughs mandated by the terms of the sequester consist of mandatory time off -- without pay -- for federal employees. In some agencies, between now and September 30, workers will be required to take off 22 days, with no compensation -- amounting to a 20 percent pay cut for that time period...

MORE 11TH DIMENSIONAL HOKEY-POKEY AT LINK

Adele M. Stan is AlterNet's Washington correspondent. She co-edited, with Don Hazen, the AlterNet book, Dangerous Brew: Exposing the Tea Party's Agenda to Take Over America. Follow her on Twitter: www.twitter.com/addiestan . Send tips to: adele@alternet.org

Demeter

(85,373 posts)Maybe some chocolate will help get the news over...

Demeter

(85,373 posts)Any of the ten richest Americans could pay a year's rent for all of America's homeless with their 2012 income...The first step is to learn the facts, and then to get angry and to ask ourselves, as progressives and caring human beings, what we can do about the relentless transfer of wealth to a small group of well-positioned Americans.

1. $2.13 per hour vs. $3,000,000.00 per hour

Each of the Koch brothers saw his investments grow by $6 billion in one year, which is three million dollars per hour based on a 40-hour 'work' week. They used some of the money to try to kill renewable energy standards around the country. Their income portrays them, in a society measured by economic status, as a million times more valuable than the restaurant server who cheers up our lunch hours while hoping to make enough in tips to pay the bills. A comparison of top and bottom salaries within large corporations is much less severe, but a lot more common. For CEOs and minimum-wage workers, the difference is $5,000.00 per hour vs. $7.25 per hour.

2. A single top income could buy housing for every homeless person in the U.S.

On a winter day in 2012 over 633,000 people were homeless in the United States. Based on an annual single room occupancy (SRO) cost of $558 per month, any ONE of the ten richest Americans would have enough with his 2012 income to pay for a room for every homeless person in the U.S. for the entire year. These ten rich men together made more than our entire housing budget. For anyone still believing "they earned it," it should be noted that most of the Forbes 400 earnings came from minimally-taxed, non-job-creating capital gains.

3. The poorest 47% of Americans have no wealth

In 1983 the poorest 47% of America had $15,000 per family, 2.5 percent of the nation's wealth.

In 2009 the poorest 47% of America owned ZERO PERCENT of the nation's wealth (their debt exceeded their assets). At the other extreme, the 400 wealthiest Americans own as much wealth as 80 million families -- 62% of America. The reason, once again, is the stock market. Since 1980 the American GDP has approximately doubled. Inflation-adjusted wages have gone down. But the stock market has increased by over ten times, and the richest quintile of Americans owns 93% of it.

4. The U.S. is nearly the most wealth-unequal country in the entire world

Out of 141 countries, the U.S. has the 4th-highest degree of wealth inequality in the world, trailing only Russia, Ukraine, and Lebanon. Yet the financial industry keeps creating new wealth for its millionaires. According to the authors of the Global Wealth Report, the world's wealth has doubled in ten years, from $113 trillion to $223 trillion, and is expected to reach $330 trillion by 2017.

5. A can of soup for a black or Hispanic woman, a mansion and yacht for the businessman

That's literally true. For every one dollar of assets owned by a single black or Hispanic woman, a member of the Forbes 400 has over forty million dollars. Minority families once had substantial equity in their homes, but after Wall Street caused the housing crash, median wealth fell 66% for Hispanic households and 53% for black households. Now the average single black or Hispanic woman has about $100 in net worth.

What to do?

End the capital gains giveaway, which benefits the wealthy almost exclusively.

Institute a Financial Speculation Tax, both to raise needed funds from a currently untaxed subsidy on stock purchases, and to reduce the risk of the irresponsible trading that nearly brought down the economy.

Perhaps above all, we progressives have to choose one strategy and pursue it in a cohesive, unrelenting attack on greed. Only this will heal the ugly gash of inequality that has split our country in two.

Paul Buchheit teaches economic inequality at DePaul University. He is the founder and developer of the Web sites UsAgainstGreed.org, PayUpNow.org and RappingHistory.org, and the editor and main author of "American Wars: Illusions and Realities" (Clarity Press). He can be reached at paul@UsAgainstGreed.org.

Demeter

(85,373 posts)Twice a year, Tennessee holds a “health care lottery” that gives some hope to the uninsured residents in the state who can’t afford health coverage. Tennesseans who meet certain requirements — in addition to falling below a certain income threshold, they must be elderly, blind, disabled, or a caretaker of a child who qualifies for Medicaid — may call to request an application for the state’s public health insurance program, known as TennCare.

The lottery is part of TennCare’s “spend down” program, which allows a resident’s income to be calculated after subtracting their medical costs from their total earnings. That means that some Tennesseans who technically earn too much annual income to qualify for public insurance could still be eligible for TennCare if they successfully complete the application process. The New York Times notes that while other states have similar “spend down” initiatives, most don’t limit the lottery enrollment period to a narrow window of call-ins. The unique enrollment process in Tennessee highlights the overwhelming demand for affordable health services, as many low-income Americansfall into a gap between being able to qualify for Medicaid and being able to access private insurance coverage:

“It’s like the Oklahoma land rush for an hour,” said Russell Overby, a lawyer with the Legal Aid Society in Nashville. “We encourage people to use multiple phones and to dial and dial and dial.”

The phone line opened at 6 p.m. on Thursday for the first time in six months. At 5:58, Ida Gordon of Nashville picked up her cordless phone and started dialing. Ms. Gordon, 63, had qualified for TennCare until her grandson, who had been in her custody, graduated from high school last spring. Now she is uninsured, with crippling arthritis and a few recent trips to the emergency room haunting her.

“I don’t ask for that much,” Ms. Gordon said as she got her first busy signal, hanging up and fruitlessly trying again, and then again. “I just want some insurance.”

If Tennessee Gov. Bill Haslan (R) opted to expand Medicaid under Obamacare, more than 180,000 people would be able to be added to the TennCare rolls by 2019. Obamacare’s Medicaid expansion would extend coverage to low-income Americans whose earnings are above the current cut-offs for public assistance — which would include many of the people like Ida Gordon, who are desperately dialing and redialing in the hopes of winning an elusive health care lottery. Haslan has not yet decided whether Tennessee will accept Obamacare’s optional expansion of the Medicaid program, although he has indicated that he may make his decision sometime this week...MORE

Demeter

(85,373 posts)The founder of modern management science, Peter Drucker, considered excessive executive pay an assault on good enterprise management practice. Peter Drucker, the analyst who founded modern management science, died in 2005 at age 95. At his death, business leaders worldwide hailed this Austrian-born American for his enormous contribution to enterprise efficiency. But Peter Drucker also cared deeply about enterprise morality. In his later years, he watched — and despaired — as downsizing became an accepted corporate game plan for pumping up executive paychecks. Drucker could find “no justification” for letting CEOs benefit financially from worker layoffs. “This is morally and socially,” he would write, “unforgivable.” If Drucker were still writing today, he’d likely be even more unforgiving. CEOs these days aren’t just slashing worker jobs to add on to their own rewards. They’re slashing worker pay as well — and no CEO may be benefiting more from shrinking paychecks than Ford chief executive Alan Mulally.

Mulally has restored Ford to profitability, his many business and political admirers never tire of pointing out, without having to take any taxpayer bailout. But Mulally has indeed enjoyed a hefty bailout — from his workers. Entry-level workers at Ford used to make $28 an hour. That rate fell by half when the auto industry financial crunch first hit five years ago and now sits a bit above $19. And since the crunch all Ford workers, not just entry-level workers, have given up cost-of-living wage adjustments and health benefits. Auto industry execs have declared these worker concessions as absolutely necessary. Without lower compensation for auto workers, the argument goes, the auto industry would never become “globally competitive.”

This same reasoning apparently doesn’t apply to compensation for Ford CEO Mulally. Ford has just announced that Mulally’s pay package for 2012 nearly hit $21 million. His personal rewards for the year almost doubled the pay that went last year to his chief German rival, Daimler CEO Dieter Zetsche, and even more stunningly dwarfed the $1.48 million Toyota CEO Akio Toyoda took home. But the magnitude of how well Mulally has done for himself — since Ford workers started coughing up concessions — only swings into real focus when we step back and contemplate the towering pile of Ford shares of stock he now holds. In just over a half-dozen years, CNN Money reports, Mulally “has amassed holdings valued at more than $300 million.”

MORE BAD BOYS AT LINK

Demeter

(85,373 posts)

xchrom

(108,903 posts)David Stockman occupies a rare place in this nation’s public pantheon — the serial apostate.

While heading the Office of Management and Budget under Ronald Reagan, he called out his fellow Republicans for fiscal recklessness and repudiated policies that his boss was promoting. He soon left Washington for a place of presumably sounder financial thinking: Wall Street.

But once again, he encountered mankind’s shortcomings. A financier who built elaborate deals on foundations of debt, Stockman proclaimed the folly of such ways. He ran afoul of a prosecutor who accused him of not complying with accounting standards that Stockman later concluded didn’t make sense anyway.

Now, he has cast his acid eye on the country’s entire economic edifice. What the former divinity student sees doesn’t merely dismay, it outrages him morally, page after page, chapter after chapter. Stockman’s new tract, “The Great Deformation,” is a kaleidoscopic rant against people, institutions and practices he knows well. He attacks, upends, eviscerates, mocks and denigrates them all, usually with some justification, always in the brutalist prose of a manifesto.

Demeter

(85,373 posts)although, it does seem blasphemous.

bread_and_roses

(6,335 posts)it didn't make a lot of sense to me - but then, I'm a financial illiterate ... but one thing I am quite sure of: What we are seeing is not the "corruption" of capitalism but its apotheosis. Its logical outcome as well. Maybe when every acre of land is blasted and poisoned, the seas are dead, the air soup, the land denuded of greenery, every other top predator extinct and the only "wildlife" some extremophile bacteria - maybe then we'll wake up. If any of us are left. I despair of it happening any sooner.

xchrom

(108,903 posts)

Jonathan Fickies/BLOOMBERG - Michael Steinberg, who worked at SAC's Sigma Capital Management unit, exits federal court in New York. Steinberg was indicted by a federal grand jury on five counts of conspiracy and securities fraud.

NEW YORK — A senior portfolio manager for one of the nation’s largest hedge funds was arrested Friday, accused of joining an insider trading conspiracy that the government said made more than $6 million illegally for the powerhouse investment company founded by billionaire businessman Steven A. Cohen.

The arrest broadens the government’s probe of trading practices at SAC Capital Advisors, which manages $15 billion.

Two weeks ago, the Securities and Exchange Commission said that two affiliates of SAC Capital would pay more than $614 million in what federal regulators called the largest insider trading settlement ever. The settlement is subject to court approval.

In the latest development, Michael Steinberg, 41, pleaded not guilty Friday to insider trading charges only hours after being arrested at his Manhattan apartment. The charges were lodged in an indictment unsealed in U.S. District Court in New York City.

xchrom

(108,903 posts)hamerfan

(1,404 posts)Thank you, xchrom. Gonna share it.

Short and to the point, unfortunately for us working stiffs.

Very good!

Demeter

(85,373 posts)Sven Olaf Kamphuis calls himself the “minister of telecommunications and foreign affairs for the Republic of CyberBunker.” Others see him as the Prince of Spam. Mr. Kamphuis, who is actually Dutch, is at the heart of an international investigation into one of the biggest cyberattacks identified by authorities. He has not been charged with any crime and he denies direct involvement. But because of his outspoken position in a loose federation of hackers, authorities in the Netherlands and several other countries are examining what role he or the Internet companies he runs played in snarling traffic on the Web this week. He describes himself in his own Web postings as an Internet freedom fighter, along the lines of Julian Assange of WikiLeaks, with political views that range from eccentric to offensive. His likes: German heavy metal music, “Beavis and Butt-head” and the campaign to legalize medicinal marijuana. His dislikes: Jews, Luddites and authority.

Dutch computer security experts and former associates describe Mr. Kamphuis as a loner with brilliant programming skills. He did not respond to various requests for interviews, but he has communicated with the public through his Facebook page, which includes photos of himself, a thin, angular man with close-cropped hair and dark, bushy eyebrows, often wearing a hoodie sweatshirt.

“He’s like a loose cannon,” said Erik Bais, the owner of A2B-Internet, an Internet service provider that used to work with Mr. Kamphuis’s company, but severed ties two years ago. “He has no regard for repercussions or collateral damage.”

Mr. Kamphuis’s current nemesis is Spamhaus, a group based in Geneva that fights Internet spam by publishing blacklists of alleged offenders. Clients of Spamhaus use the information to block annoying e-mails offering discount Viagra or financial windfalls. But Mr. Kamphuis and other critics call Spamhaus a censor that judges what is or isn’t spam. Spamhaus acted, he wrote, “without any court verdict, just by blackmail of suppliers and Jew lies.” The spat that rocked the Internet escalated in mid-March when Spamhaus blacklisted two companies that Mr. Kamphuis runs, CB3ROB, an Internet service provider, and CyberBunker, a Web hosting service. Spamhaus contended that CyberBunker was a conduit for vast amounts of spam. CyberBunker says it accepts business from any site as long as it does not deal in “child porn nor anything related to terrorism.” Mr. Kamphuis responded by soliciting support for a hackers’ campaign to snarl Spamhaus’s Internet operations. “Yo anons, we could use a little help in shutting down illegal slander and blackmail censorship project ‘spamhaus.org,’ which thinks it can dictate its views on what should and should not be on the Internet,” he wrote on Facebook on March 23.

Mr. Kamphuis later disavowed any direct role in the so-called distributed denial of service, or DDoS, attack, which spilled over from Spamhaus to affect other sites. He took to Facebook to inform the world that the flood of Internet traffic that threatened to cripple parts of the Web emanated from Stophaus, an ad-hoc, amorphous group set up in January with the aim to thwart Spamhaus, a company it claims uses its “tiny business to attempt to control the Internet through underhanded extortion tactics.” Stophaus, which lists no contact or location for the group, claims to have members in the United States, Canada, Russia, Ukraine, China and Western Europe. Mr. Kamphuis said Stophaus was not a front for him; he is merely acting as a spokesman. Nonetheless, the authorities are curious. The Dutch national prosecutor’s office said on Thursday that it had opened an investigation. Wim de Bruin, a spokesman for the agency, which is based in Rotterdam, said prosecutors were first trying to determine whether the DDoS attacks had originated in the Netherlands. Authorities in Britain and several other European countries are also looking into the matter.

Mr. Kamphuis, who is believed to be about 35, is singled out because of his vocal role. “For the Dutch Internet community, it’s very clear that he has a big role in this, even if there isn’t 100 percent airtight proof that he is behind it,” said J. P. Velders, a security specialist at the University of Amsterdam. “He could not be not involved. How much is he involved — that is for law enforcement to figure out and to act upon.”

MORE EGO AT LINK

Demeter

(85,373 posts)In the aftermath this week of one of the most powerful attacks on the Internet, finger-pointing quickly ensued. The organization most suspected, victims said, was Stophaus, an elusive group of disgruntled European Internet users, although Sven Olaf Kamphuis, its spokesman, denied he was responsible for the attacks. At the same time, he shifted blame to Russian Internet service providers, which he said were retaliating against Spamhaus, a European anti-spam group, for blacklisting them. But the real enablers of the attack were the operators of more than 27 million computers around the globe who left their equipment wide open to a motivated attacker. Those enablers are not just companies, but regular people with home cable boxes.

“There is a big possibility that you are part of the problem without even knowing it,” said Paul Vixie, chairman of the Internet Software Consortium, a nonprofit company responsible for the software used by many of the servers that power the Internet. The servers the attackers used — what the Internet community calls open recursive servers or, more commonly, open resolvers — are simply home Internet devices, corporate servers, or virtual machines in the cloud that have been sloppily configured to accept messages from any device around the globe. Open resolvers have been set up in such a way that they are not unlike the naïve users of public Wi-Fi who forget to turn off their file-sharing settings, so that any hacker on the Internet can creep inside the computer. It’s similar to PC users who do not realize that by not updating their software, they let their computers get infected with malware and used as a zombie in a cyberattack. The difference is that if you think of a computer as a digital weapon, then an open resolver is a machine gun. Attackers can use open resolvers to amplify the strength of a cyberattack by a factor of 100.

In this week’s attack on Spamhaus and the company hired to fight it, CloudFlare, attackers made use of more than 100,000 open resolvers to inflict an attack that reached 300 billion bits per second, the largest such attack ever reported. When they could not take down those targets, they aimed and fired open resolvers at the world’s major Internet exchanges, first London, then Amsterdam, Frankfurt and then Hong Kong.

“At some point, we thought, ‘They are going to hit everything at once, and that’s when this gets real,’ ” said Matthew Prince, the chief executive of CloudFlare. “That’s the nightmare scenario that hasn’t happened — yet...We’ve now seen an attack that begins to illustrate the full extent of the problem,” Mr. Prince wrote in a blog post.

Closing an open resolver, unfortunately, is not as simple as flipping a switch or downloading some software. Finding out if your home cable box is an open resolver, for instance, requires you to call your cable company and tell them that you do not want to be running an open resolver — a tough request when most of the world’s population does not even know what an open resolver is. Recent efforts have been made to increase awareness of the issue. Computer security experts have recently started “naming and shaming” the operators of open resolvers. The DNS Measurement Factory, one such group, published a survey of top offenders by network, and more recently the Open Resolver Project published a full list of the 27 million open servers online. The campaign is making slow progress; thousands dropped off those lists in the last few months. But Dr. Vixie calls the open resolvers just the low-hanging fruit. Even if they were all fixed tomorrow, there are other types of servers that could just as easily be used to amplify an attack, a fact that hackers are eager to point out.

“The guys doing the attack indeed use open resolvers, but those are not needed for this type of attack,” Mr. Kamphuis said in an online interview with The New York Times earlier this week. Indeed, there are other servers that amplify attacks — including machines called Simple Network Management Protocol (SNMP) servers — albeit by a significantly smaller magnitude. Dr. Vixie and others have been working on what is called response rate limiting technology, a potential solution to the amplification problem. That technology helps servers decipher between unusual requests and normal traffic, but engineers still need to fine-tune it in such a way that it can be used without slowing Internet speeds. Even if they can pull it off, that still leaves the other half of the problem. To accomplish this week’s attacks, the attackers sent messages forged to look as if they came from their victims, so that when the open resolvers responded, they responded to Spamhaus, CloudFlare and their Internet providers with large blocks of traffic. That digital forging is easy to pull off. But, there too, Internet security specialists have long had a solution. For more than a decade, Dr. Vixie and others have encouraged companies to use what is called Source Address Validation, a technology that filters forged traffic from legitimate traffic. The problem is that the technology is not yet pervasive.

The reason, Dr. Vixie said, was “simple economics.” What incentive do companies have to pay for the cost of adopting the technology and training their engineers to use it when their competitors don’t? The victims of the attacks are usually not those companies, so they bear the expense and reap no direct benefit. Dan Kaminsky, a prominent computer security researcher, said, “The problem is that it’s hard to get someone to care.” This week’s attack, which had halted on Tuesday, resumed Thursday morning. But there is a silver lining. “I’ve been waiting for this attack for a long time,” Dr. Vixie said, “so that we could tell the earth’s population to do something about it.”

Demeter

(85,373 posts)If your daily routine takes you from one noncommercial progressive website to another, you might feel pretty good about the current state of the Internet...Concerns about the online world often fixate on cutting-edge digital tech. But, as McChesney points out, “the criticism of out-of-control technology is in large part a critique of out-of-control commercialism. The loneliness, alienation, and unhappiness sometimes ascribed to the Internet are also associated with a marketplace gone wild.”

...For the most part, what has gone terribly wrong in digital realms is not about the technology. I often think of what Herbert Marcuse wrote in his 1964 book One-Dimensional Man: “The traditional notion of the ‘neutrality’ of technology can no longer be maintained. Technology as such cannot be isolated from the use to which it is put; the technological society is a system of domination which operates already in the concept and construction of techniques.” Marcuse saw the technological as fully enmeshed with the political in advanced industrial society, “the latest stage in the realization of a specific historical project -- namely, the experience, transformation, and organization of nature as the mere stuff of domination.” He warned that the system’s productivity and growth potential contained “technical progress within the framework of domination.” Fifty years later, McChesney’s book points out: “The Internet and the broader digital revolution are not inexorably determined by technology; they are shaped by how society elects to develop them. . . . In really existing capitalism, the kind Americans actually experience, wealthy individuals and large corporations have immense political power that undermines the principles of democracy. Nowhere is this truer than in communication policy making.”

Huge corporations are now running roughshod over the Internet. At the illusion-shattering core of Digital Disconnect are a pair of chapters on what corporate power has already done to the Internet -- the relentless commercialism that stalks every human online, gathering massive amounts of information to target people with ads; the decimation of privacy; the data mining and surveillance; the direct cooperation of Internet service providers, search engine companies, telecomm firms and other money-driven behemoths with the U.S. military and “national security” state; the ruthless insatiable drive, led by Apple, Google, Microsoft and other digital giants, to maximize profits. In his new book, McChesney cogently lays out grim Internet realities. (Full disclosure: he’s on the board of directors of an organization I founded, the Institute for Public Accuracy.) Compared to Digital Disconnect, the standard media critiques of the Internet are fairy tales.

Blowing away the corporate-fueled smoke, McChesney breaks through with insights like these:

“It is supremely ironic that the Internet, the much-ballyhooed champion of increased consumer power and cutthroat competition, has become one of the greatest generators of monopoly in economic history. Digital market concentration has proceeded far more furiously than in the traditional pattern found in other areas. . . As ‘killer applications’ have emerged, new digital industries have gone from competitive to oligopolistic to monopolistic at breakneck speeds.”

“Today, the Internet as a social medium and information system is the domain of a handful of colossal firms.”

“It is true that with the advent of the Internet many of the successful giants -- Apple and Google come to mind -- were begun by idealists who may have been uncertain whether they really wanted to be old-fashioned capitalists. The system in short order has whipped them into shape. Any qualms about privacy, commercialism, avoiding taxes, or paying low wages to Third World factory workers were quickly forgotten. It is not that the managers are particularly bad and greedy people -- indeed their individual moral makeup is mostly irrelevant -- but rather that the system sharply rewards some types of behavior and penalizes other types of behavior so that people either get with the program and internalize the necessary values or they fail.”

“The tremendous promise of the digital revolution has been compromised by capitalist appropriation and development of the Internet. In the great conflict between openness and a closed system of corporate profitability, the forces of capital have triumphed whenever an issue mattered to them. The Internet has been subjected to the capital-accumulation process, which has a clear logic of its own, inimical to much of the democratic potential of digital communication.”

“What seemed to be an increasingly open public sphere, removed from the world of commodity exchange, seems to be morphing into a private sphere of increasingly closed, proprietary, even monopolistic markets. The extent of this capitalist colonization of the Internet has not been as obtrusive as it might have been, because the vast reaches of cyberspace have continued to permit noncommercial utilization, although increasingly on the margins.”

“If the Internet is worth its salt, if it is to achieve the promise of its most euphoric celebrants and assuage the concerns of its most troubled skeptics, it has to be a force for raising the tide of democracy. That means it must help arrest the forces that promote inequality, monopoly, hypercommercialism, corruption, depoliticization, and stagnation.”

“Digital technologies may bring to a head, once and for all, the discrepancy between what a society could produce and what it actually does produce under capitalism. The Internet is the ultimate public good and is ideally suited for broad social development. It obliterates scarcity and is profoundly disposed toward democracy. And it is more than that. The new technologies are in the process of truly revolutionizing manufacturing, for example, making far less expensive, more efficient, environmentally sound, decentralized production possible. Under really existing capitalism, however, few of the prospective benefits may be developed -- not to mention spread widely. The corporate system will try to limit the technology to what best serves its purposes.”

The huge imbalance of digital power now afflicting the Internet is a crucial subset of what afflicts the entirety of economic relations and political power in the United States. We have a profound, far-reaching fight on our hands, at a crossroads leading toward democracy or corporate monopoly. The future of humanity is at stake.

xchrom

(108,903 posts)

The revised GDP data for the fourth quarter released yesterday showed the profit share of corporate income hitting 25.6 percent. This is the highest since it stood at 25.8 percent in 1951. However if we look at the after-tax share of 19.2 percent, we would have to go back to 20.8 percent share in 1930 to find a higher number, excepting of course the 19.3 percent number hit last year.

To put this in context, the after-tax profit share was just 14.5 percent in Reagan's Morning in America days. The difference would have come to roughly $330 billion last year. To put this in the 10-year budgetary window that is the standard framework in Washington these days, the rise in after-tax corporate profits since the Reagan era can be seen as equivalent to a $5.0 trillion tax on the nation's workers.

This surge in profits in a weak economy (profits tend to move with the cycle) is striking but readers of the Washington Post version of AP piece on the data wouldn't know anything about it. This piece includes no mention of the jump in corporate profits in 2012.

There are a few other issues that the piece could have better presented to readers. It noted that:

"The fourth quarter was hurt by the sharpest fall in defense spending in 40 years."

xchrom

(108,903 posts)I fit in with the other 40 percent of Americans who really and truly don’t give a fuck about the S&P 500 and Dow Jones both hitting all-time record highs this month. The rest of us who don’t draw income taxes at a preferential rate by throwing numbers at each other in space can barely keep up with basic necessities, much less have anything left to invest.

After my seasonal political work ended last November (successfully ousting a Tea Party congressman from office and helping out on the Jill Stein campaign as her debates organizer), I’ve been supporting myself with writing. And I know that out of rent, utilities, a car note, groceries, medical bills, gas, moving expenses and a smartphone, one of those bills won’t get paid on a freelancer’s income. I’ve most recently learned how to do without the smartphone, as my service was finally shut off after not being able to pay the bills that have piled up. And because I have a roof over my head and a vehicle, and no student debt nor children to care for, I’m still in a far better financial situation than most Americans.

In the last 40 years, income for the bottom 90 percent of Americans only rose by $59. Income for the top 10 percent rose by more than $116,000. David Cay Johnston noted that on a chart, if the $59 increase was marked by 1 inch, the 84 percent increase in income for the top 10 percent over that same time period would be 163 feet. The top 1 percent’s increase in income would be marked by a line 884 feet high on that same chart. And for the Mitt Romney class, whose average 2011 income was roughly $23 million, the increase over that 40-year period would be nearly 5 miles high. This recent viral video attempts to illustrate those differences. And when you factor in how much the cost of living has risen, that $59 increase would buy far less now than it did 40 years ago. It doesn’t take a math whiz to see that the vast majority of us are being bled dry by an insatiably greedy few at the top.

The problem is, those bleeding us dry don’t see it that way. The corporate executives and Wall Street hedge fund managers, the richest one of whom makes as much in ONE HOUR as the typical family would earn in 29 YEARS, glorify the concentration of wealth into the hands of a few. They’re of the belief that poor and middle class people don’t know how to manage resources or invest money, let alone save it. They believe that the 1 percent who owns 42 percent of all financial wealth in this country deserves it, because they’re the best to manage those resources. The game of capitalism isn’t of human empathy or compassion, but of cold calculation. If they can find ways to rob you of your home, job, pension and savings, then you probably didn’t deserve to have it anyway, and they did. They will continue behaving this way and find ways to rob us even more efficiently until we all collectively stop them from being able to do so.

xchrom

(108,903 posts)The unemployment rate rose to 4.3 percent in February from 4.2 percent the previous month, the government announced Friday, indicating some companies remain reluctant to hire while they await signs of economic recovery.

An official in the Internal Affairs and Communications Ministry, however, took an upbeat view of the job market.

More women are seeking employment amid growing hopes for economic recovery, pushing the jobless rate higher, but it will turn downward once companies start hiring more workers on the back of an expected economic recovery, according to the official.

The ranks of the unemployed fell by 120,000 to 2.77 million, the ministry said in a preliminary report, while the number of people with jobs increased by 160,000 to 62.42 million.

Demeter

(85,373 posts)Most of the Pentagon's nearly 800,000 civilian employees will be put on unpaid leave for 14 days this year, a reduction from the 22 days initially planned, after a new funding bill eased the strain on the Defense Department's budget, Defense Secretary Chuck Hagel said on Monday.

Hagel, speaking at a Pentagon news conference, said the department still faces a $22 billion shortfall in its operations account and would face some difficult funding cuts.

"We're going to have to deal with that reality and prioritize and make some cuts and do what we've got to do" to implement the more than $40 billion in defense cuts mandated by Congress and the president beginning on March 1, he said.

xchrom

(108,903 posts)Low-income people may get Medicaid money to buy health insurance from private plans such as UnitedHealth Group Inc. (UNH) or Humana Inc. (HUM) in a “limited number” of states, U.S. officials said.

Arkansas and Ohio have asked President Barack Obama’s administration to allow them to adjust how Medicaid dollars are used. The U.S. Centers for Medicare and Medicaid Services said yesterday it would allow an unspecified number of states to do this as long as it doesn’t cost the government more than the traditional Medicaid program.

The plan is a departure from the 2010 Affordable Care Act, which calls for an expansion of government-run Medicaid, the health program for the poor. Under the health law, about 12 million people are expected to be added to Medicare’s rolls by 2020 as the program grows to cover people earning as much as about 138 percent of the federal poverty level, or about $32,500 for a family of four.

“We remain committed to working with states and providing them with the flexibility and resources they need to build new systems of health coverage,” Cindy Mann, the agency’s Medicaid director, said in a blog post yesterday. “Premium assistance is simply one option.”

xchrom

(108,903 posts)Who do they think they are, these upstart economies, Brazil, Russia, India, China and South Africa?

That might sum up the feeling in the U.S., Europe and Japan as the BRICS nations consider a new development bank that might challenge the World Bank and International Monetary Fund. The move brings to mind Alice Amsden, the Massachusetts Institute of Technology economist who died last year, and her 2001 book, “The Rise of ‘the Rest.’”

The richest nations can stew about this turn of events, as those on the periphery of the world economic system start seeing themselves as the core. Or developed countries can look in the mirror and consider how their actions have helped accelerate the shift.

Take Japan’s success in weakening the yen 17 percent in the past six months to help stimulate exports. It has prompted talk in China and elsewhere about a return to the currency wars. Concern about exchange-rate volatility that undermines trade and growth is a big reason the BRICS, the vanguard of “the rest,” want to use their combined $4.4 trillion of foreign-currency reserves to protect their economies and raise their international clout.

The yen’s plunge coincides with the contortions of the IMF as it twists every which way, and then some, to preserve the euro. Never mind that the euro zone may be too messy and incompatible to save. Forget that Cyprus never should have been included in the enterprise, or that Spain’s 50 percent youth- unemployment rate makes the euro area’s fourth-biggest economy a potential time bomb. The IMF, run by former French Finance Minister Christine Lagarde, is determined to make the unsustainable in Europe sustainable.

xchrom

(108,903 posts)Banks including Bank of America Corp., Barclays Plc (BARC) and JPMorgan Chase & Co. (JPM) won dismissal of antitrust claims in lawsuits alleging they rigged the London interbank offered rate.

More than two dozen interrelated lawsuits are before U.S. District Judge Naomi Reice Buchwald in New York alleging the banks conspired to depress Libor by understating their borrowing costs, thereby lowering their interest expenses on products tied to the rates. Potential damages were estimated to be in the billions of dollars.

Buchwald yesterday issued a 161-page ruling dismissing antitrust allegations against the banks while allowing some commodities-manipulations claims to proceed to a trial.

“We recognize that it might be unexpected that we are dismissing a substantial portion of plaintiffs’ claims, given that several of the defendants here have already paid penalties to government regulatory agencies reaching into the billions of dollars,” Buchwald wrote. “There are many requirements that private plaintiffs must satisfy but which government agencies need not.”

Demeter

(85,373 posts)I'm firmly in the Hotler Camp now...

snot

(10,530 posts)Demeter

(85,373 posts)Millions of Americans lack adequate health care, using emergency rooms as a costly alternative or getting no care at all. The Patient Protection and Affordable Care Act (ACA), often called "Obamacare," opened the door for an affordable option. The December 31, 2012 deal between Congress and the administration that avoided the so-called "fiscal cliff" has, at least for the moment, closed that door for 26 states.

ACA loans for health care cooperatives

The ACA funds private, nonprofit health insurers called Consumer Operated and Oriented Plans—CO-OPs. It originally set aside $3.4 billion for low-interest loans—seed money for at least one health cooperative in each state, plus Washington, D.C. "Start-up loans" cover such development costs as renting office space, developing provider networks or obtaining contracts with existing provider groups, hiring managers, educating members on how co-ops work, and building enrollment. ACA "solvency loans" are intended to help CO-OPs satisfy state monetary reserve requirements for health insurers. According to the Center for Medicare Services, CO-OP loans could fund cooperatives that operate health care facilities or cooperative insurance that would cover treatment at participating medical organizations. Interest in CO-OPs has been keen. The healthcare.gov website states that, as of December 21, 2012, 24 nonprofits offering coverage in 24 states have been awarded nearly $2 billion.

One of those is the Colorado Health Insurance Cooperative, which received a $69 million ACA grant. "Our state does have a long history of supporting agricultural co-ops to receive better deals and services," CEO Julie Hutchins says. In fact, the Rocky Mountain Farmers Union, founded in 1907, sponsors the new CO-OP. "The CO-OP will be a unique option for the thousands of newly insured Coloradans that will flood the market in 2014," says Hutchins. "We also hope to be a resource for rural Coloradans to access better coverage as these areas of the state have been left with few options in recent years." She expects a minimum of 8,000 people to join the CO-OP in its first year.

Why create CO-OPs?