Economy

Related: About this forumWeekend Economists Host a Lion July 5-7, 2013

Nelson Rolihlahla Mandela (Xhosa pronunciation: [xoˈliːɬaɬa manˈdeːla]; born 18 July 1918) is a South African anti-apartheid revolutionary and politician who served as President of South Africa from 1994 to 1999. He was the first black South African to hold the office, and the first elected in a fully representative, multiracial election. His government focused on dismantling the legacy of apartheid through tackling institutionalised racism, poverty and inequality, and fostering racial reconciliation. Politically an African nationalist and democratic socialist, he served as the President of the African National Congress (ANC) from 1991 to 1997. Internationally, Mandela was the Secretary General of the Non-Aligned Movement from 1998 to 1999.

A Xhosa born to the Thembu royal family, Mandela attended Fort Hare University and the University of Witwatersrand, where he studied law. Living in Johannesburg, he became involved in anti-colonial politics, joining the ANC and becoming a founding member of its Youth League. After the Afrikaner nationalists of the National Party came to power in 1948 and began implementing the policy of apartheid, he rose to prominence in the ANC's 1952 Defiance Campaign, was elected President of the Transvaal ANC Branch and oversaw the 1955 Congress of the People. Working as a lawyer, he was repeatedly arrested for seditious activities and, with the ANC leadership, was prosecuted in the Treason Trial from 1956 to 1961 but was found not guilty. Although initially committed to non-violent protest, in association with the South African Communist Party he co-founded the militant Umkhonto we Sizwe (MK) in 1961, leading a bombing campaign against government targets. In 1962 he was arrested, convicted of sabotage and conspiracy to overthrow the government, and sentenced to life imprisonment in the Rivonia Trial.

Mandela served 27 years in prison, first on Robben Island, and later in Pollsmoor Prison and Victor Verster Prison. An international campaign lobbied for his release, which was granted in 1990 amid escalating civil strife. Becoming ANC President, Mandela published his autobiography and led negotiations with President F.W. de Klerk to abolish apartheid and establish multiracial elections in 1994, in which he led the ANC to victory. He was elected President and formed a Government of National Unity in an attempt to defuse ethnic tensions. As President, he established a new constitution and initiated the Truth and Reconciliation Commission to investigate past human rights abuses. Continuing the former government's liberal economic policy, his administration introduced measures to encourage land reform, combat poverty and expand healthcare services. Internationally, he acted as mediator between Libya and the United Kingdom in the Pan Am Flight 103 bombing trial, and oversaw military intervention in Lesotho. He declined to run for a second term, and was succeeded by his deputy Thabo Mbeki, subsequently becoming an elder statesman, focusing on charitable work in combating poverty and HIV/AIDS through the Nelson Mandela Foundation.

Controversial for much of his life, right-wing critics denounced Mandela as a terrorist and communist sympathiser. He has nevertheless received international acclaim for his anti-colonial and anti-apartheid stance, having received over 250 awards, including the 1993 Nobel Peace Prize, the US Presidential Medal of Freedom and the Soviet Order of Lenin. He is held in deep respect within South Africa, where he is often referred to by his Xhosa clan name of Madiba or as Tata meaning Father; he is often described as "the father of the nation".

http://www.nelsonmandela.org/

Demeter

(85,373 posts)Edward Snowden and the NSA and the 4th Amendment have taken economics off the radar.

Now, I'll grant you, this is a vacation weekend for many, but what does it mean when all discussion of the economy evaporate like that?

The more I learn of the NSA's various programs, what they do, how they operate, etc., the more I wonder:

WHO THOUGHT THE US GOVERNMENT NEEDED TO TRACK AND STORE ALL THAT INFORMATION ON EVERYONE ON THE PLANET?

WHERE IS IT WRITTEN IN THE CONSTITUTION THAT THIS IS A PROPER FUNCTION OF GOVERNMENT?

WHY IS THERE NO MONEY FOR ANYTHING USEFUL, BUT BILLIONS FOR THIS GREAT WASTE OF TIME, ENERGY (THE ELECTRICITY BILLS ALONE ARE MIND-BLOWING) AND TECHNOLOGY?

IF THIS INFORMATION ISN'T GOING TO BE USED, WHY COLLECT AND STORE IT? IF IT IS GOING TO BE USED, HOW ON EARTH CAN THAT BE COMPATIBLE WITH THE CONSTITUTION AND THE RULE OF LAW?

We have been had, people. Perhaps dropping all other concerns and just focusing on this one is the most appropriate use of our remaining time on this planet.

I will not be saying more on the subject; I will be devoting my time to the economics issues of the day. But keep that awareness in the back of your mind....this is the time to come to the aid of your fellow people.

Hugin

(33,159 posts)Last edited Mon Jul 8, 2013, 04:46 AM - Edit history (1)

Is that to do so is monumentally stupid beyond all rationality.

Just like Congress.... *ahem*

Let's take these charges apart and look at them in the light of rational thinking adults. First of all, we have to assume there is some surveillance occurring and that it didn't just now in the last few years (in Obama's term) start. Surveillance is a human condition... It has been done since there were more than two people to watch each other.

But, I digress.

How is comprehensive surveillance actually going to serve it's purpose? To collect and store all of everything both domestic and foreign is a huge task requiring unimaginable resources. Also, you'd have to think that 99.999999999999999999999999999% of the things collected would be useless from an intelligence and national security viewpoint.

I can not stress this enough... It's USELESS. On top of that, the vast majority of it will never be useful, ever.

So, now because some schmuck who went to work at a contractor for the NSA says the government is collecting all of the data all of the time... Well, we're supposed to drop everything and believe it because he claims he has a power-point slide show from some secret network that says it's true?

I.DO.NOT.BUY.IT.

My BULLSHITSTORM alarm is going off full blast.

Demeter

(85,373 posts)But he's been corroborated...even by Congress critters of the Democratic persuasion.

The only BS we've been getting is from the Fascists among us, insisting that there's nothing wrong with this monumental waste of resources AND violation of the 4th Amendment, and if you've done nothing wrong, you have nothing to fear.

You may be too young to remember FBI director J. Edgar Hoover. His tendency to collect personal information illegally (and use it to blackmail Presidents and other public figures) is a matter of record.

This current program is Hoovering on steroids.

Nobody needs to drive a wedge between North and South America. It's a gap much bigger than the Panama Canal...which, by the way, the Latinos are trying to usurp by building a newer, bigger one that ISN'T under US control.

And you may not remember the massive propaganda that was purveyed during the Peace Movement to discredit people: the trumped up charges, the beatings, the framing of innocents, the illegal raids. It still goes on, they are just getting better at it.

And even if only 10% of the claims are true, it is more than our fragile democracy can tolerate.

Demeter

(85,373 posts)Big Data, n.:

Big Data, n.: the belief that any sufficiently large pile of shit contains a pony with probability approaching 1

A tweet by James Grimmelman.

A perfect summary of the non-corrupt reasoning behind the PRISM project!

The corrupt reasons are about the money for contractors and agency bloat.

AND THEN THERE ARE THE BLACKMAIL OPPORTUNITIES...

Hugin

(33,159 posts)A functional public government in this country ceased to exist 30 years ago.

It's a private endeavor now.

Private Hospitals.

Private Corrections.

Private Schools.

Private Military.

Private Intelligence. Keep in mind that nowhere during this whole affair has the whole truth about BAH's role been discussed. It always veers into how the Gubment is sooooo evilz.

Demeter

(85,373 posts)That's what makes it so perverse and the nation so unstable.

Hugin

(33,159 posts)Plus, whatever else they can squeeze out by hiring the unqualified, under-qualified, and cutting every corner possible.

Oh, and NOT paying taxes.

Yep.

Demeter

(85,373 posts)WELL, THIS STRADDLES THE TWO ISSUES: ECONOMICS AND CONSTITUTIONALITY...I KNOW I AM CHEATING, BUT IT'S IMPORTANT, DAMMIT!

http://my.firedoglake.com/masaccio/2013/07/05/what-did-these-idiots-think-would-happen-if-we-hired-contractors-to-handle-spying/

Apparently it has escaped the notice of politicians and bureaucrats that the interests of contractors are not the same as the interests of their customers. The contractor wants to make lots and lots of money. The contractor wants to make the customer happy, so it tells the customer whatever it wants to hear: oh sure, we can do that; or oh sure, that’s a great idea, you must be very smart to have thought of it; or I’m sure you’ve heard about the steps being taken by your competition, but fortunately we can stop them. The contractor has no interest whatsoever in completing the work, because that stops the money flows.

The contractor benefits from sleazy practices: hiring high-ranking government people to lobby their friendly former employers, or promising, wink wink to hire them in the future; hiring lower-level government employees who actually know how to do the work, leaving the government less able to do the work; paying off politicians with massive campaign contributions and in-kind goodies and trips and payments for speaking at corporate events; and lots more.

We know this because we can read the paper, because pretty much all of this is standard practice, and none of it is illegal. And we can see the results: massive boondoggles in every sphere of government, software that doesn’t work, hardware that doesn’t work, combinations that don’t work, purchases of unnecessary and useless hardware, and money pouring into the private sector, at least to the people at the top of the private sector.

Which government official thought this wasn’t applicable to spying? According to the Defense Department, General Keith Alexander, director of the National Security Agency, chief of the Central Security Service, and commander of the US Cyber Command testified before the Senate Appropriations Committee that

The New York Times has a slightly different take:

Fourteen years ago would have been 1999. The NYT’s implication that this has something to do with 9/11 seems really wrong.

Systems administrators for all intelligence operations working for contractors? These people have access to pretty much everything on the system. They could look at the private emails of General Alexander, other government workers, senators, representatives, staffs, administrative agencies, purchasing officers, planners, pretty much anyone, and pretty much everything they see or do on the internets. And if they did, they could tell their bosses what those government workers thought about things. Who would know? How would they know?

What could possibly go wrong with that in a system already rotting from crony capitalism?

THE COMMENTS (SEE LINK) ARE EQUALLY INTERESTING...

Demeter

(85,373 posts)DemReadingDU

(16,000 posts)Just returned from 3 days in Indiana with family. No one talked about the economy, jobs (lack of), Snowden, spying, coup in Egypt. The discussion mainly was vacations that had been taken and the next vacation.

I need to get caught up what is really going on in the world.

hamerfan

(1,404 posts)In electronic communications, there has been no such thing as privacy ever since the "digital revolution".

FWIW, I do use Ixquick for my only search engine. They say they don't collect IP addresses. I believe them.

[link:https://www.ixquick.com/|

And this one, also by Ixquick:

[link:https://startpage.com/eng/|

DemReadingDU

(16,000 posts)I don't see the last part of your posting following "also by Ixquick:"

Demeter

(85,373 posts)As ObamaCare inches painfully closer to its October 1 launch date, we’re getting more and more detail on how the exchanges (or “marketplaces”) will actually work. By design, ObamaCare doesn’t treat health care as a right, and does not give all citizens equal access to health insurance, let alone to health care. By design, ObamaCare preserves private health insurance as a rental extraction mechanism, along with its complex and bug-prone system of eligibility determination by past (and projected) income, age, existing insurance coverage, jurisdiction, family structure, and market segment. I’ve heard it said in software engineering that complexity is the enemy of quality and, I would speculate, the same goes for social engineering too. In any system as baroque and Kafaesque as ObamaCare, some citizens will get lucky, and go to HappyVille; others, unlucky, will go to Pain City. The lucky are first-class citizens; and the unlucky, second class. In two earlier posts, I gave examples of the whimsical and arbitrary distinctions that ObamaCare makes between citizens who should be treated equally; in this post, I’d like to give two more.

First, ObamaCare will use consumer reporting agency data to verify your identity during the eligibility determination process.* Reuters explains, today:

T

Hmm. Never mind that this is the first time we’ve heard that the exchanges are going to ask for the color of my old Volvo; or that there are no such questions in the Enroll UX 2014 prototype. And never mind that healthcare.gov says this:

Nothing there about license plate numbers or the color of my old Volvo, eh?

The real issue is that credit bureau data is dirty, and the credit bureaus make it very difficult to fix, as we’ve shown. How corrupt is the data? CBS:

The bottom line here is that ObamaCare has created yet another way to treat some citizens as first class, and other citizens as second class, and on an entirely random basis (!). As I read Reuters, the first hurdle — the very first thing — you’ve got to do to get into an exchange is prove your identity by responding a series of challenges generated off your Experian data. If your Experian data is clean, and you get the responses right, you go straight to Happyville in the first-class carriage! (To the extent that being forced to purchase a defective product — health insurance — is going to Happyville, of course.) But if your Experian data is dirty, you can’t get into the exchange at all!*** So you don’t pass the hurdle, can’t get into the system, can’t fix your Experian data, and … Is there even an appeals process for people who can’t set up their ObamaCare account to begin with? Pain City even if there is, and in the slow coach.

How many people will end up in Pain City because of dirty Experian data? I’m not sure there’s a better answer than “Could be a lot.” We do know that 10% of all Americans have been subject to identity theft, so if Experian thinks you’re John Doe2, who has a yellow Dodge Dart, instead of who you are, John Doe1, with a red Volvo, you’re in trouble. More subtly, the Experian challenge/response is to identify you, not by an identifier unique to you, like (in theory) your SSN or a retinal scan, but by the sum of your answers to the questions Experian generates from your data. So, in the exchange’s mind, you equal not “457-55-5462″ (your SNN) but {“car color: red” + “car brand: Volvo” + “LIC: GO NC!” + “address: 123 Main Street, Anytown USA”} (challenges with responses). The problem here — and I am speculating — is that not all these fields will be equally maintained. For example, Experian might be more likely to keep addresses clean and current because most of its clients want to send out bulk mailings frequently. Not so car color. The thing is, when you’re trying to prove you are who you are to ObamaCare, you could get car brand, license plate, and address all right, and then stumble on the car color — maybe you repainted it? — and have your identity rejected. You know captchas, and how everybody hates them? Because they feel random? With Experian’s Q&A system, ObamaCare’s exchanges will have the mother of all captchas...

THIS IS MADNESS! IT CONTINUES AT LINK

Tansy_Gold

(17,860 posts)We who dared to state that this . . . this thing was not going to be what we were told it would be.

Not long after "it passed," an acquaintance of mine who has excellent health insurance through her husband's corporate retirement package plus Medicare congratulated me on my finally obtaining affordable health insurance through Obamacare. She is a good Democrat, and so I knew she was not being sarcastic. When I told her that, hello, excuse me, none of it goes into effect for years and years and years, she just looked at me, totally surprised. She had no clue. When I pointed out that none of Obamacare really gave too many people very much in the way of actual access to affordable health care, but was really a massive gift to the insurance companies that would still set the parameters, she really didn't believe me.

So the teabaggers hate Obamacare for the wrong reasons and (some) Dems love it for the wrong reasons, and of course the insurance companies love it because it is a huge ribbon-wrapped gift to them.

I tried to explain it to her, but she really didn't want to hear it. She's old enough to have good coverage, and so she just shut out other people's reality.

Obamacare may have made health care a little more affordable, a little more accessible for a few people, but for the majority of the people who didn't have health insurance before Obamacare, not a whole lot has really changed, at least not for the better, nor will it change very much for the better.

As usual, we was had. Big time.

westerebus

(2,976 posts)I would like to point out that the current POTUS stated often he wanted his legacy to be the first POTUS to have passed health care reform.

Given the current delay in the implementation of said reform, in total, it may not happen.

There's being had and then there's once he's had you, he never was really THAT into you.

bread_and_roses

(6,335 posts)or so I understand - with of course the "Platinum" being the most expensive and thus available only to those who can afford it - not necessarily to those who might need it? And for that matter the notion that any of us know what level of "insurance" we'll need tomorrow is insane.

Since when is parsing people into the categories of differently priced/worth metals (obviously making the point that some are "worth" more than others based on their bank accounts) "democratic?"

I confess to have read little and that little carelessly about this unutterably corrupt program - though I did note that the other day that the employer mandate has been delayed and found out that the obscene "Doughnut hole" won't be closed for years and years .... both read on this very site.

Demeter

(85,373 posts)MORE THAN YOU EVER WANTED TO KNOW ABOUT CHICKEN FARMING FACTORY INDUSTRY

http://clatl.com/atlanta/the-future-of-big-chicken/Content?oid=8528249&showFullText=true

Demeter

(85,373 posts)HERE'S A HAVE-YOUR-CAKE-AND-EAT-IT-TOO KIND OF ARTICLE....I'M STILL SWEARING OFF THE SUBJECT, I PROMISE! IT'S LIKE AN ADDICTION--CUTS TO THE HEART OF EVERYTHING....

http://www.reuters.com/article/2013/06/28/us-dealtalk-boozallen-carlyle-idUSBRE95R13R20130628

The Edward Snowden saga may be a headache for his former employer Booz Allen Hamilton Corp (BAH.N) and its 67 percent owner, the private equity firm Carlyle Group LP (CG.O), but it could turn out to be a bigger problem for some of Carlyle's rivals. Like Carlyle, a whole host of other private equity firms piled into the defense and intelligence sector between 2007 and 2011, snapping up various contractors and consultants. Unlike Carlyle, though, most have not recouped their original investments and some of them may be staring at losses if they sold the assets today. The industry is under growing pressure because of a series of apparent security problems that allowed Snowden to leak details of secret U.S. surveillance programs and, according to government officials, badly compromise U.S. national security.

Among the questions being asked by lawmakers and investigators are how Snowden, who worked as a Booz contractor at a National Security Agency facility in Hawaii, obtained security clearance despite red flags in his background. There is also concern about how he was able to download many top-secret documents and flee for Hong Kong only about a month after starting in the job, without triggering massive alarm bells. The result will likely be increased scrutiny of government contractors by the NSA and other parts of the defense establishment, and greater oversight from Congress. Some contracts may be reduced or taken away from individual firms. All of that could hurt revenue and margins in a business that is already under increasing stress because of defense industry cuts, including the sequestration that began hitting in recent months.

Still, while the storm could damage some companies, most experts think it will blow over for the industry as a whole. It isn't as if the Pentagon and related agencies are going to be able to reduce their massive reliance on contractors overnight, nor will they want to, given the huge skill set from the private sector that they rely upon. Indeed, NSA head General Keith Alexander said on Thursday that "we couldn't do our job without the support we get from industry. One individual has betrayed our trust and confidence, and that shouldn't be a reflection on everybody else."

Hardest hit may be Providence Equity Partners. A U.S. government watchdog is already examining USIS - the largest private provider of federal government background checks - which conducted a 2011 background investigation into Snowden. USIS is a unit of Altegrity Inc, which in turn is owned by Providence. On Thursday, the Washington Post reported that federal investigators have told lawmakers they have evidence USIS repeatedly misled the government about the thoroughness of its background checks, citing people familiar with the matter. The Post said that the problem is so serious that the watchdog plans to recommend to the Office of Personnel Management, which oversees most background checks, that it end its relationship with USIS unless it can show it is performing responsibly. This could exacerbate Altegrity's serious financial woes....

YA THINK? MORE MADNESS AT LINK

Demeter

(85,373 posts)How many people in the world have a million dollars or more in financial assets? That is, leave aside the value of real estate or other owned property. Capgemini and RBC Wealth Management provide some estimates in a report that seeks to define the global market for the wealth management industry, the World Wealth Report 2013.

The report splits High Net Worth Individual (HNWI, natch) into three categories. Those with $1 million to $5 million in financial assets are in the "millionaire next door" category, and while I find that name a bit grating, it's fair enough. After all, a substantial number of of households in high-income countries that are near retirement, if they have been steadily saving throughout their working life, will have accumulated $1 million or more. The next step up is those with $5 million to $30 million in financial assets, who this report calls the "mid-tier millionaires." At the top, with more than $30 million in financial assets are the "ultra-HNWI" individuals. Here's the global distribution:

http://1.bp.blogspot.com/-rp-UeN4UtRE/UcdZk6Rx0JI/AAAAAAAAD70/kjtaQgbfiE4/s800/high+net+worth+1.jpg

A few quick observations:

1) The "ultra-HNWI" individuals are less than1% of the total HNWI population, but have 35% of the total assets of this group. The "millionaires next door" with $1 million to $5 million are 90% of the high net worth individual population, and have 42.8% of the total net worth of this group.

2) Another table in the report shows that 3.4 million of the high-net worth individuals--about 28% of the total--are in the United States. The next four countries for number of people in the high net worth category are Japan (1.9 million), Germany (1.0 million), and China (643,000) and the UK, (465,000).

3) World population is about 7 billion. So the 12 million or so high net worth individuals are about one-sixth of 1% of the world population.

Demeter

(85,373 posts)Max Zahn, founder of the new website Buddha on Strike, is currently on strike in front of Goldman Sachs. I asked him a few questions about what he’s up to...

So what is it that you’re doing, and why?

Over the past seven business days, I’ve been meditating for 3 to 4 hours directly outside the entrance of Goldman Sachs headquarters. And I intend to continue sitting silently at Goldman HQ every single business day for the coming weeks and months. Soon this effort will grow beyond me, however. Starting yesterday, we’re holding hour-long group meditations three days per week.

The reason for my meditating at Goldman is that I seek to extend compassion to its employees and demand that they do the same for the worldwide billions affected by the bank’s practices. By meditating, I’m quite literally modeling a technique that cultivates the capacity for emotional states like compassion and empathy. On another level, I’m trying to communicate that I come in peace; I understand that Goldman Sachs bankers are people just like you and me. There’s nothing inherently evil or malicious about them. Like all people, they are the beautifully complicated products of a personal and social history.

Does that mean that we allow them to acquire huge amounts of money, while exacerbating global inequality and its effects? Absolutely not. But we intervene in the way that a family might intervene when their son has a drug addiction. That’s how I think of Goldman Sachs: addiction to greed. And greed, in its various forms, is something that everyone struggles with. The difference with Goldman Sachs is that greed on this scale is causing atrocious human suffering. So we need to put the harmful practices to an end, but with the love and goodwill of a global family...

MORE

Demeter

(85,373 posts)Mandela was born on 18 July 1918 in the village of Mvezo in Umtatu, then a part of South Africa's Cape Province.

Given the forename Rolihlahla, a Xhosa term colloquially meaning "troublemaker", in later years he became known by his clan name, Madiba.

His patrilineal great-grandfather, Ngubengcuka, was ruler of the Thembu people in the Transkeian Territories of South Africa's modern Eastern Cape province. One of this king's sons, named Mandela, became Nelson's grandfather and the source of his surname. Because Mandela was only the king's child by a wife of the Ixhiba clan, a so-called "Left-Hand House", the descendants of his cadet branch of the royal family were morganatic, ineligible to inherit the throne but recognized as hereditary royal councillors.

Nonetheless, his father, Gadla Henry Mphakanyiswa, was a local chief and councillor to the monarch; he had been appointed to the position in 1915, after his predecessor was accused of corruption by a governing white magistrate. In 1926, Gadla, too, was sacked for corruption, but Nelson would be told that he had lost his job for standing up to the magistrate's unreasonable demands. A devotee of the god Qamata, Gadla was a polygamist, having four wives, four sons and nine daughters, who lived in different villages. Nelson's mother was Gadla's third wife, Nosekeni Fanny, who was daughter of Nkedama of the Right Hand House and a member of the amaMpemvu clan of Xhosa.

— Mandela, 1994.

Later stating that his early life was dominated by "custom, ritual and taboo", Mandela grew up with two sisters in his mother's kraal in the village of Qunu, where he tended herds as a cattle-boy, spending much time outside with other boys. Both his parents were illiterate, but being a devout Christian, his mother sent him to a local Methodist school when he was about seven. Baptised a Methodist, Mandela was given the English forename of "Nelson" by his teacher. When Mandela was about nine, his father came to stay at Qunu, where he died of an undiagnosed ailment which Mandela believed to be lung disease. Feeling "cut adrift", he later said that he inherited his father's "proud rebelliousness" and "stubborn sense of fairness".

His mother took Mandela to the "Great Place" palace at Mqhekezweni, where he was entrusted under the guardianship of Thembu regent, Chief Jongintaba Dalindyebo. Although he would not see his mother again for many years, Mandela felt that Jongintaba and his wife Noengland treated him as their own child, raising him alongside their son Justice and daughter Nomafu.

As Mandela attended church services every Sunday with his guardians, Christianity became a significant part of his life. He attended a Methodist mission school located next to the palace, studying English, Xhosa, history and geography. He developed a love of African history, listening to the tales told by elderly visitors to the palace, and becoming influenced by the anti-imperialist rhetoric of Chief Joyi. At the time he nevertheless considered the European colonialists as benefactors, not oppressors. Aged 16, he, Justice and several other boys travelled to Tyhalarha to undergo the circumcision ritual that symbolically marked their transition from boys to men; the rite over, he was given the name "Dalibunga".

Demeter

(85,373 posts)Nunzio Scarano and others accused of trying to smuggle $26m in cash into the country from Switzerland by private jet...

A senior Vatican cleric and two other suspects with connections to the Vatican bank have been arrested in a money smuggling case in Italy. Monsignor Nunzio Scarano, 61, and others were accused of trying to smuggle 20 million euros ($26m) in cash into the country from Switzerland by private jet. Italian prosecutor Nello Rossi told reporters that Italian financier Giovanni Carenzio, and Giovanni Zito, who at the time of the plot was a member of the military police's agency for security and information, were arrested along with Scarano on Friday. Scarano, who was being held at a prison in capital Rome, was already under investigation in a purported money-laundering plot involving the Vatican bank.

Vatican Bank inquiry

The arrests came just two days after Pope Francis created a commission of inquiry into the Vatican bank to get to the bottom of the problems that have plagued it for decades and contributed to the impression that it is an unregulated, offshore tax haven. The high-powered, five-member panel, which includes four prelates and a woman Harvard law professor, will report directly to the pope, bypassing the Vatican bureaucracy which has sometimes been tainted by allegations of scandal and corruption.

The bank, formally known as The Institute for Works of Religion (IOR), has a troubled history, which includes the collapse of the Banco Ambrosiano, in which the Holy See was the main shareholder, and had been accused of laundering money for the Sicilian mafia. The IOR, which does not lend money, manages assets of 7.0 billion euros ($9.3bn) and handles funds for Vatican departments, Catholic charities and congregations and priests and nuns living and working around the world.

Demeter

(85,373 posts)

This chart comes from Gavyn Davies’s excellent post on Fed tightening, which ought to be required reading for all members of the FOMC. He demonstrates the effect of the Fed’s tapering warnings in two ways: by showing that the expected short-term interest rate in mid-2016 is now about 100bp higher than it was at the beginning of May; and also, with the chart above, by showing that the market is now expecting rates to start rising much earlier than it had previously anticipated. This chart isn’t, strictly, a tapering chart: it shows when people expect the Fed to start raising interest rates, rather than slowing down on QE. But that all-important first rate hike now has a 65% probability of taking place in 2014, according to the market — up from less than 15% in the NY Fed’s April survey.

Which raises the trillion-dollar question: given that the Fed hasn’t changed its messaging on rate hikes at all, what has caused this enormous change in expectations? Davies explains:

There is evidence that this signalling effect of Fed balance sheet changes might be very powerful. If the Fed is not willing to “put its money where its mouth is” by buying bonds, then the market might take its promises to hold short rates at zero less seriously than before. According to this recent research by the San Francisco Fed, it is possible that a sizeable proportion of the total effect of QE on bond yields came from these signalling effects rather than the portfolio balance effects which have usually been emphasised by the central banks.

Put another way, you and I and Ben Bernanke might think that QE works because when you drop money from helicopters and that money is used to buy bonds and take them out of circulation, the price of those bonds goes up and their yield goes down. But in fact, the main reason that yields fell has nothing to do with the mechanistic consequences of buying bonds — as generations of investors have found out, buying up assets generally has only a very short-term and modest effect on the price of those assets....Rather, QE turns out to be a surprisingly effective way of signalling to the market that rates are going to stay at zero for a very long time. And when you say that QE isn’t likely to stay in place much longer, the market takes that as tantamount to saying that rates are not going to stay at zero for nearly as long as they had thought...Fed officials are desperately making a concerted attempt to tell the markets that they’re wrong, but history tells us that when policymakers rail against the markets, the markets smell blood and often end up turning out to be right. The markets don’t care about “forward guidance”; they consider the Fed’s deeds to be more important than its words. As a result, so long as the Fed says that tapering is on the horizon, we’re never going to return to the interest rates we were seeing just a month or two ago.

Demeter

(85,373 posts)I'm willing to bet that given the uproar, there won't be any for several weekends. The system is probably using up the chewing gum and rubber bands at an alarming rate already...nobody wants to get the ultimate blame for upsetting the applecart!

Demeter

(85,373 posts)Back in 2011, I wrote:

Why has the devotion of a great deal of skill and enterprise to finance and insurance sector not paid obvious economic dividends? There are two sustainable ways to make money in finance: find people with risks that need to be carried and match them with people with unused risk-bearing capacity, or find people with such risks and match them with people who are clueless but who have money…

Over the past year and a half, in the wake of Thomas Philippon and Ariel Resheff's estimate that 2% of U.S. GDP was wasted in the pointless hypertrophy of the financial sector, evidence that our modern financial system is less a device for efficiently sharing risk and more a device for separating rich people from their money--a Las Vegas without the glitz--has mounted. Bruce Bartlett points to Greenwood and Scharfstein, to Cechetti and Kharoubi's suggestion that financial deepening is only useful in early stages of economic development, to Orhangazi's evidence on a negative correlation between financial deepening and real investment, and to Lord Adair Turner's doubts that the flowering of sophisticated finance over the past generation has aided either growth or stability.

Four years ago I was largely frozen with respect to financial sophistication. It seemed to me then that 2008-9 had demonstrated that our modern sophisticated financial systems had created enormous macroeconomic risks, but it also seemed to me then that in a world short of risk-bearing capacity with an outsized equity premium virtually anything that induced people to commit their money to long-term risky investments by creating either the reality or the illusion that finance could, in John Maynard Keynes's words, "defeat the dark forces of time and ignorance which envelop our future". Most reforms that would guard against the first would also limit the ability of finance to persuade people that it performed the second, and hence further lower the supply of finance willing to take and bear risks.

But the events and economic research of the past years have demonstrated three things.

I should, before, have read a little further in Keynes, to "when the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done". And it is time for creative and original thinking--to construct other channels and canals by which funding can reach business and bypass modern finance with its large negative alpha. ..

Demeter

(85,373 posts)FRANKLY, AT THIS POINT, ANY KIND OF JOBS THAT PAID A LIVING WAGE WOULD HELP, EVEN IF IT WERE ONLY "DIGGING HOLES AND FILLING THEM IN" AS KEYNES PROPOSED, Book 3, Chapter 10, Section 6 pg.129 "The General Theory.." IT'S THE "LIVING WAGE" CONDITION THAT'S KILLING THIS ECONOMY AND COUNTRY.

http://www.salon.com/2013/06/29/no_manufacturing_jobs_wont_revive_the_economy/?source=newsletter

Stop claiming a factory boom will save the country and lift people up. Here's what these jobs really look like...In the American imagination, the phrases “the decline of the middle class” and “the loss of factory jobs” are almost inextricably linked. But the promise of a U.S. manufacturing revival has gained strength and currency in policy circles, with many arguing it’s a way to turn the economy around. President Obama has trumpeted the growth of factory jobs in speech after speech. “Think about the America within our reach,” he told his audience at last year’s State of the Union address. “An America that attracts a new generation of high-tech manufacturing and high-paying jobs!”

But, for all the optimism and nostalgia for an America that once was, it’s worth asking whether factory jobs are more likely to help workers rise to the middle class today — or leave them stranded among the working poor.

Elena Suarez was on her lunch break, taking a walk on the side of the road in the industrial park where she works, and eating a sandwich as she walked, when I stopped her to ask about her job. She’s a machine operator at Resonetics, a manufacturing company in Nashua, New Hampshire that specializes in precision laser micromachining for the medical device industry.

I asked Suarez how her job pays.

“Poor,” she said. “I pay for working.”

Suarez commutes from Manchester, about half an hour away, and gas and car maintenance eat up quite a bit of her pay. She said she got the job through a staffing agency three years ago at a pay rate of $11 an hour. After two years, she was hired as a direct employee of the company, which meant she got a handful of paid sick days and access to medical and dental plans that cost a significant chunk of workers’ paychecks. Her hourly pay also dropped to $10.50.

Her husband also works at a factory, but even with two incomes, the family has to budget carefully to get by. Suarez said she sees other families with more kids, or with only one working parent, and wonders how they manage...

YES, NASHUA, NH, MY HOME FOR 20+ YEARS...SO GLAD I GOT OUT OF THERE....AND THAT JOB SHE HAS IS EXACTLY WHY I LEFT "LIVE FREE AND DIE" NEW HAMPSHIRE!

bread_and_roses

(6,335 posts)Jobs Report: ‘New Normal’ Is Neither New, Normal nor Acceptable

by Robert Borosage

This month’s lackluster jobs report – 195,000 net jobs created in the month of June with the unemployment rate unchanged at 7.6 percent – leaves Americans adrift.

More than 22 million Americans remain in need of full-time work. The participation rate in the labor force – 63.5 percent – remains mired near recession lows. Wages continue to stagnate; young people struggle to get jobs; young African Americans face devastating rates of unemployment; inequality grows more extreme. And at current rates, it will take an estimated seven years to return to pre-recession unemployment levels.

The new normal is neither new nor normal nor acceptable. The Bureau of Labor Statistics report shows once more that government policy is a hindrance, not a help, to the recovery. In previous recessions, government spending and hiring helped fuel the comeback. In this one, perverse austerity policies are pulling the economy down, not helping it up. And now Congress is gearing up for another mindless fight focused on reducing deficits rather than putting people to work.

Inside the report, little has changed in the past month. Manufacturing – down by 6,000 – isn’t contributing to the recovery. Government continues to shed jobs: a net 7,000 at the national, state and local levels. The housing comeback is generating remarkably few construction hires – up just 13,000 in the month. The jobs being created, largely in service and entertainment industries, continue to be lower in pay and benefits than the jobs that were lost.

(bold emphasis added)

bread_and_roses

(6,335 posts)AND how the stock market jumped on "strong jobs report!" Right on the front page of this very site! And I heard this segment on some NPR show - called "Here and Now" I think, it's new on my station - that asked why so many are still hurting in this "recovery" but never really delved into the UI picture, at least in the bits I heard. (I listen to NPR while in and out of car.) Instead I heard giggling and jokes about a "Party" for this fourth year of the "recovery" or some such grotesqueness .....

Demeter

(85,373 posts)Intending to gain skills needed to become a privy councillor for the Thembu royal house, Mandela began his secondary education at Clarkebury Boarding Institute in Engcobo, a Western-style institution that was the largest school for black Africans in Thembuland.

Made to socialise with other students on an equal basis, he claimed that he lost his "stuck up" attitude, becoming best friends with a girl for the first time; he began playing sports and developed his lifelong love of gardening.

Completing his Junior Certificate in two years, in 1937 he moved to Healdtown, the Methodist college in Fort Beaufort attended by most Thembu royalty, including Justice.

The headmaster emphasised the superiority of English culture and government, but Mandela became increasingly interested in native African culture, making his first non-Xhosa friend, a Sotho language-speaker, and coming under the influence of one of his favourite teachers, a Xhosa who broke taboo by marrying a Sotho.

Spending much of his spare time long-distance running and boxing, in his second year Mandela became a prefect.

With Jongintaba's backing, Mandela began work on a Bachelor of Arts (BA) degree at the University of Fort Hare, an elite black institution in Alice, Eastern Cape with around 150 students. There he studied English, anthropology, politics, native administration and Roman Dutch law in his first year, desiring to become an interpreter or clerk in the Native Affairs Department.

Mandela stayed in the Wesley House dormitory, befriending Oliver Tambo and his own kinsman, K.D. Matanzima.

Continuing his interest in sport, Mandela took up ballroom dancing, and performed in a drama society play about Abraham Lincoln.

A member of the Students Christian Association, he gave Bible classes in the local community, and became a vocal supporter of the British war effort when the Second World War broke out.

Although having friends connected to the African National Congress (ANC) and the anti-imperialist movement, Mandela avoided any involvement. He helped found a first-year students' House Committee which challenged the dominance of the second-years, and at the end of his first year he became involved in a Students' Representative Council (SRC) boycott against the quality of food, for which he was temporarily suspended from the university; he left without receiving a degree.

Demeter

(85,373 posts)As momentous as financial crises have been in the past century, we sometimes forget that major financial crises have occurred for centuries—and often. This new series chronicles mostly forgotten financial crises over the 300 years—from 1620 to 1920—just prior to the Great Depression. Today, we journey back to the 1620s and take a fresh look at an economic crisis caused by the rapid debasement of coin in the states that made up the Holy Roman Empire...

AND USUALLY FOR THE SAME STUPID REASONS AND AN ABIDING DELUSION THAT "THIS TIME IT'S DIFFERENT!"

The Kipper und Wipperzeit (1619–23)

The Kipper und Wipperzeit is the common name for the economic crisis caused by the rapid debasement of subsidiary, or small-denomination, coin by Holy Roman Empire states in their efforts to finance the Thirty Years’ War (1618–48). In a 1991 article, Charles Kindleberger—author of the earlier work Manias, Panics and Crashes and originally a Fed economist—offered a fascinating account of the causes and consequences of the 1619–23 crisis. Kipper refers to coin clipping and Wipperzeit refers to a see-saw (an allusion to the counterbalance scales used to weigh species coin). Despite the clever name, two forms of debasement actually fueled the crisis. One involved reducing the value of silver coins by clipping shavings from them; the other involved melting the coins, mixing them with inferior metals, re-minting them, and returning them to circulation. As the crisis evolved, an early example of Gresham’s Law took hold as bad money drove out good. As Vilar notes in A History of Gold and Money, once “agriculture laid down the plow” at the peak of the crisis and farmers turned to coin clipping as a livelihood, devaluation, hyperinflation, early forms of currency wars, and crude capital controls were either firmly in place or not far behind.

From Self-Sufficiency to Money and Markets

The period preceding and including the early 1600s was marked by a fundamental shift from feudalism to capitalism, from medieval to modern times, and from an economy driven by self-sufficiency to one driven by markets and money. It is within this social and economic context that various states in the Holy Roman Empire attempted to finance the Thirty Years’ War by creating new mints and debasing subsidiary coins, leaving large-denomination gold and silver coins substantially unaffected.

In a simple example, subsidiary coin might initially be minted using only silver, then gradually undergo a shift in metallic content as a growing percentage of copper was added during re-mintings, until the monetary system was effectively on a copper rather than a gold or silver standard. This shift in metallic content created a divergence between a coin’s nominal value and its intrinsic metal value, which led to the rapid debasement of coin. As Kindleberger notes, “Bad money was taken by debasing states to their neighbors and exchanged for good [money]. The neighbor typically defended itself by debasing its own coin.”

Owing to trade and the easy circumvention of laws that forbade the removal of coin from a city, states found that early forms of capital controls were ineffective and that a large portion of circulating coin originated elsewhere. Given this porosity, individual states determined that reforming their own minted coinage by returning to a silver standard did not necessarily allow them to reform the currency circulating within the state. So states sought greater revenue through seigniorage—the difference between the cost of production (including the price of the metal contained in the coin) and the nominal value of the coin—by minting more money and by taking debased coin abroad, exchanging it, and bringing home good coin and re-minting it.

The rapid debasement up to 1622 created a European boom, which turned to mania by early 1622 when average citizens turned to coin clipping as a livelihood, then hyperinflation in 1622 and 1623. Many became rich by exploiting the unknowing—typically peasants. This ultimately led to a widespread breakdown in trade as peasants, fearing that they would be paid in debased coin, refused to bring products to market, creating the spillover to the broader economy.

AND THE BEAT GOES ON...

Demeter

(85,373 posts)Over the past two weeks or so, we've been seeing a very clear portrait of how sick our economies are. Not that you would know it from reading the press. The term deflation pops up only very cautiously. Could that be because people don't understand what's going on? Or are they simply afraid of the word? This is the real thing, guys. And it's going to hurt. Money (actually: credit) has shifted out of emerging markets by the trillions. So where did it go? Not into bonds, stocks or precious metals. Money shifted out of there too, and also by the trillions. Money isn't going anywhere, it's going "poof". It's vanishing and will never be seen again.

Markets may still rise at times to some extent, but only if and when more stimulus is flooded into the system, or people think it will be. Markets have simply been undead for the past 5 years - or so -, as long as central banks have issued stimulus. Take that away and all you're left with is zombies. And even if markets rise, or "normalize", a little in the future, this genie's out of the bottle and won't get back in: bond yields and interest rates will not go back to the extremely low levels of the past few years. Central banks' longer term control of either has always been no more than an illusion. And as for another illusion: you can't call something a "recovery" if you pay for it with more debt, that doesn't make nearly enough sense.

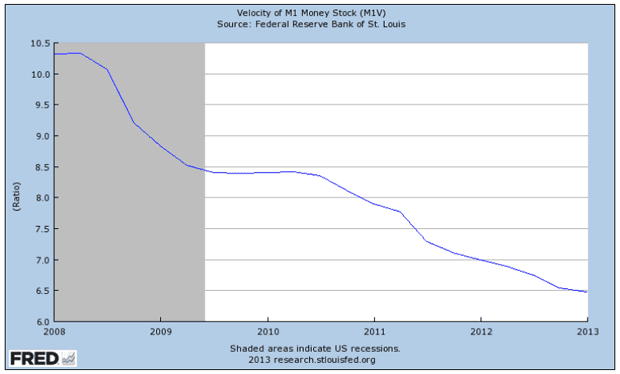

People think they can find the reason behind the vanishing trillions in money/credit in things Ben Bernanke may or may not have said, and perhaps in a hard stance by the Chinese central bank. But they are merely small parts of a bigger story. The problem is not that the Fed hints at tapering, it's that the US economy is too sick to stand up straight without constant and/or increasing credit infusions. A zombie economy propped up with zombie money. And that can't last. It never could. Nothing Ben does, whether it's issuing stimulus or hinting at less stimulus, represents real value. And that, to many people focused on the illusion of value, may have become clear only when Abenomics appeared on stage, seemed a success at first and then showed its true colors in a substantial Nikkei crash. Abenomics is the Fed's QE on steroids; both follow the same trajectory, but it's a matter of the harder they come, the harder they fall. Japan wanted too much too fast, and ended up shattering the stimulus illusion worldwide...How much money/credit has evaporated into thin air in the last few weeks? It's impossible to even estimate, and nobody's trying, maybe because of a fear of some kind, but it's certainly multiple trillions. A Reuters article over the weekend stated that "global equity markets lost $1 trillion on Thursday alone". And Thursday was by no means the worst of the lot. The biggest losses have come not in stock markets, but in the bond markets, and these losses will continue. Not only did central banks never have control here, what's crucial is that nobody believes anymore that they have...Perhaps the clearest, most down to earth and black and white illustration of deflation comes from two graphs that Ambrose Evans-Pritchard posted overnight . Remember, deflation does not equal falling prices, they're just a consequence. Deflation is the combination of the money and credit supply with the velocity of money. We know what that means for Japan, where velocity is extremely low, and PM Abe finds out that he can try to increase the money supply, but he has no control over the velocity. Here are M1 and velocity for the US: -

- See more at: http://www.theautomaticearth.com/Finance/deflation-by-any-other-name-would-smell-as-foul.html#sthash.075seJHR.dpuf

Demeter

(85,373 posts)Carry on, Weekenders!

Demeter

(85,373 posts)BEST EXPLANATION OF THE GOINGS-ON IN EGYPT I'VE SEEN...

Demeter

(85,373 posts)THE MARKET MAY NOT ALWAYS GET THE LAST LAUGH...AT LEAST I HOPE NOT, FOR ALL OUR SAKES!

http://oilprice.com/Geopolitics/Middle-East/Market-Celebrates-Egypts-Coup-But-Its-Not-Over-Yet.html

bread_and_roses

(6,335 posts)surprise, surprise, right?

WIKI

https://en.wikipedia.org/wiki/Nelson_Mandela

(bold emphasis added)

This despite his rather "moderate" (ie, Bankster - IMF/World Bank- friendly tenure as President (see below) and the above noted rejection of the "radicalism" of Biko etc. But then, our Corporate Masters cannot tolerate even the whisper of egalitarianism or fairness or, it seems, even sufficiency for the Commons - we might get ideas, after all.

Demeter

(85,373 posts)HERE WE GO AGAIN...ANOTHER NATION ZOMBIEFIED...ACTUALLY, 28 OF THEM AT ONCE!

http://www.telegraph.co.uk/finance/financialcrisis/10162490/Eurozone-faces-lost-decade-unless-action-taken-on-banks.html

The eurozone faces a Japanese style "lost decade" unless action is taken to address the deep-seated problems of its banks, ratesetter Benoît Coeuré has warned...

UNFORTUNATELY, WE KNOW FROM THE ONSET THAT NO SUCH PROBLEM-SOLVING WILL OCCUR, BECAUSE THE BANKS WON'T PERMIT IT, NOR WILL THEIR 1% ELITEST OWNERS.

Demeter

(85,373 posts)bread_and_roses

(6,335 posts)WIKI again

https://en.wikipedia.org/wiki/Nelson_Mandela

Mandela was an African nationalist, an ideological position he held since joining the ANC,[318] also being "a democrat, and a socialist".[319] Although he presented himself in an autocratic manner in several speeches, Mandela was a devout believer in democracy and would abide by majority decisions even when deeply disagreeing with them.[320] He held a conviction that "inclusivity, accountability and freedom of speech" were the fundamentals of democracy,[321] and was driven by a belief in natural and human rights.[322]

A democratic socialist, Mandela was "openly opposed to capitalism, private land-ownership and the power of big money".[323] Influenced by Marxism, during the revolution Mandela advocated scientific socialism,[324] although he denied being a communist during the Treason Trial.[325] Biographer David James Smith thought this untrue, stating that Mandela "embraced communism and communists" in the late 1950s and early 1960s, though was a "fellow traveller" rather than a party member.[326] In the 1955 Freedom Charter, which Mandela had helped create, it called for the nationalisation of banks, gold mines, and land, believing it necessary to ensure equal distribution of wealth.[327] Despite these beliefs, Mandela nationalised nothing during his presidency, fearing that this would scare away foreign investors. This decision was in part influenced by the fall of the socialist states in the Soviet Union and Eastern Bloc during the early 1990s.[328]

(emphasis added)

I note that

" This decision was in part influenced by the fall of the socialist states in the Soviet Union and Eastern Bloc during the early 1990s."

- a reminder that as vile as the "Communist" (actually authoritarian Potentates of a sort, with those in power as vilely removed from the miseries of the masses as in any Feudal or Capitalist system) - anyway, as vile as they were, their collapse meant that there was not even the germ of an idea to counter the Capitalist "norm."

I found it disappointing that Mandela turned to "charity" works in age. To my mind it bespeaks a weariness and capitulation. Though goddess knows I do not begrudge him his weariness. Nor do such "criticisms" mean I do not revere the man. I do. Our impeding loss of this man is infinitely sad.

xchrom

(108,903 posts)(Reuters) - The European Central Bank said on Friday it was lifting a suspension on the eligibility of Cyprus's debt for use in its refinancing operations after Standard & Poor's upgraded the island state's credit rating.

"The Governing Council of the European Central Bank (ECB) has acknowledged the upgrades of credit ratings of the Republic of Cyprus following the successful completion on 1 July 2013 of the transactions previously announced by the country's Ministry of Finance," the ECB said in a statement.

"In light of the rating changes, the Governing Council has decided that marketable debt instruments issued or fully guaranteed by the Republic of Cyprus shall again constitute eligible collateral for the purpose of Eurosystem monetary policy operations."

"This decision applies to all outstanding and new marketable debt instruments issued or guaranteed by the Cypriot government and will come into force on 5 July 2013 with the relevant legal act, which will also specify the haircuts applicable to these assets," the ECB added.

hamerfan

(1,404 posts)Listen To The Lion by Van Morrison:

(one of my personal favorites)

Demeter

(85,373 posts)"Chicago Tribune" ----- June 10, 1990 -

WASHINGTON — For nearly 28 years the U.S. government has harbored an increasingly embarrassing secret: A CIA tip to South African intelligence agents led to the arrest that put black nationalist leader Nelson Mandela in prison for most of his adult life. But now, with Mandela en route to the U.S. to a hero`s welcome, a former U.S. official has revealed that he has known of the CIA role since Mandela was seized by agents of the South African police special branch on Aug. 5, 1962.

The former official, now retired, said that within hours after Mandela`s arrest Paul Eckel, then a senior CIA operative, walked into his office and said approximately these words: ``We have turned Mandela over to the South African security branch. We gave them every detail, what he would be wearing, the time of day, just where he would be. They have picked him up. It is one of our greatest coups.``

With Mandela out of prison, the retired official decided there is no longer a valid reason for secrecy. He called the American role in the affair "one of the most shameful, utterly horrid" byproducts of the Cold War struggle between Moscow and Washington for influence in the Third World.

Asked about the tip to South African authorities, CIA spokesman Mark Mansfield said: ``Our policy is not to comment on such allegations.``

http://www.informationclearinghouse.info/article35438.htm

Fuddnik

(8,846 posts)AnneD

(15,774 posts)I know it was you, split the take or the crime stopper tip. I would rather split the take.

xchrom

(108,903 posts)Egypt’s interim president moved to pull together a government to restore order in the restive nation, while planned rallies by supporters and opponents of Islamist Mohamed Mursi today threatened to ignite new violence.

The turmoil convulsing Egypt after Mursi’s overthrow by the military last week led to clashes between the two camps on July 5 that killed about three dozen people and wounded more than 1,000. The instability, along with violence in the Sinai peninsula, prompted the military to deploy special forces to guard the Suez Canal, the state-run Ahram newspaper reported.

Security forces today also expanded their crackdown on Islamists, ordering the arrest of a preacher and two senior members of the Muslim Brotherhood group that backed Mursi in his presidential run and is demanding his reinstatement.

The military forced Mursi out, just a year into his term, after months of discontent with his leadership came to a head in days of mass protests. Hundreds of thousands took to the streets to demand he step down, accusing him of betraying the 2011 revolution that toppled Hosni Mubarak by grabbing power for his Islamist backers and exacerbating Egypt’s economic plight and political rifts.

Demeter

(85,373 posts)xchrom

(108,903 posts)The International Monetary Fund may cut its global growth forecast because the expansion of emerging market economies is slowing, Managing Director Christine Lagarde said.

The Washington-based fund predicted in April that the world economy would expand 3.3 percent this year.

“I fear, given what we’re seeing in particular in emerging countries, not the developing and low-income countries but emerging countries, that we will be slightly below that,” Lagarde told a conference in Aix-en-Provence, France.

The IMF is scheduled to publish new forecasts later this week.

Demeter

(85,373 posts)xchrom

(108,903 posts)TEHRAN, Iran (AP) -- Iran's central bank is allowing most importers to buy local currency at half the former official price as part of attempts to attract investors to an economy battered by Western sanctions.

The effective devaluation of the Iranian rial comes as other proposals are being floated to boost commerce, including possibly waiving taxes for foreign companies.

Sanctions over Iran's nuclear program have hit the country's vital oil exports and blocked transactions on international banking networks. Inflation is running at more than 25 percent.

The central bank offered most importers an exchange rate of 24,779 rials for $1 on Sunday, a day after the official announcement. That compares with the previous government-set rate of 12,260 rials.

Demeter

(85,373 posts)Just trying to wrap mind around that....

Demeter

(85,373 posts)Morning, X! I won't call it good, because my blood pressure just shot up into the red zone after reading the article I posted below....

xchrom

(108,903 posts)AIX-EN-PROVENCE, France (Reuters) - The U.S. federal budget cuts are an inappropriate measure that will weigh on potential growth, IMF chief Christine Lagarde said on Sunday, urging Washington to present "credible" fiscal plans.

Washington enacted across-the-board federal government spending cuts, known as sequestration, in March because Congress could not agree on an alternative.

It has meant everything from furloughs for air traffic controllers to fewer planes for the U.S. Navy to smaller subsidies for farmers.

"The budgetary procedure that is in place in the United States, which leads to a budgetary adjustment, seems to us absolutely inappropriate ... because it blindly affects certain expenditures that are essential to support medium and long term growth," Lagarde told an economists' conference in Aix-en-Provence, southern France.

Read more: http://www.businessinsider.com/imfs-lagarde-says-us-budget-cuts-were-absolutely-inappropriate-2013-7#ixzz2YMaf1ui4

Demeter

(85,373 posts)Obama should be taken to the woodshed for ever thinking he knew what he was doing. Economically, he is a Miserable Failure in everything he touched.

DemReadingDU

(16,000 posts)Presidents just need to speak to the people in a way that soothes the masses. Behind the scenes are the handlers who really take care of the business of running the administration.

Fuddnik

(8,846 posts)Oh, wait.

Demeter

(85,373 posts)In more than a dozen classified rulings, the nation’s surveillance court has created a secret body of law giving the National Security Agency the power to amass vast collections of data on Americans while pursuing not only terrorism suspects, but also people possibly involved in nuclear proliferation, espionage and cyberattacks, officials say. The rulings, some nearly 100 pages long, reveal that the court has taken on a much more expansive role by regularly assessing broad constitutional questions and establishing important judicial precedents, with almost no public scrutiny, according to current and former officials familiar with the court’s classified decisions. The 11-member Foreign Intelligence Surveillance Court, known as the FISA court, was once mostly focused on approving case-by-case wiretapping orders. But since major changes in legislation and greater judicial oversight of intelligence operations were instituted six years ago, it has quietly become almost a parallel Supreme Court, serving as the ultimate arbiter on surveillance issues and delivering opinions that will most likely shape intelligence practices for years to come, the officials said...“We’ve seen a growing body of law from the court,” a former intelligence official said. “What you have is a common law that develops where the court is issuing orders involving particular types of surveillance, particular types of targets.”

In one of the court’s most important decisions, the judges have expanded the use in terrorism cases of a legal principle known as the “special needs” doctrine and carved out an exception to the Fourth Amendment’s requirement of a warrant for searches and seizures, the officials said. The special needs doctrine was originally established in 1989 by the Supreme Court in a ruling allowing the drug testing of railway workers, finding that a minimal intrusion on privacy was justified by the government’s need to combat an overriding public danger. Applying that concept more broadly, the FISA judges have ruled that the N.S.A.’s collection and examination of Americans’ communications data to track possible terrorists does not run afoul of the Fourth Amendment, the officials said. That legal interpretation is significant, several outside legal experts said, because it uses a relatively narrow area of the law — used to justify airport screenings, for instance, or drunken-driving checkpoints — and applies it much more broadly, in secret, to the wholesale collection of communications in pursuit of terrorism suspects. “It seems like a legal stretch,” William C. Banks, a national security law expert at Syracuse University, said in response to a description of the decision. “It’s another way of tilting the scales toward the government in its access to all this data.”

While President Obama and his intelligence advisers have spoken of the surveillance programs leaked by Mr. Snowden mainly in terms of combating terrorism, the court has also interpreted the law in ways that extend into other national security concerns. In one recent case, for instance, intelligence officials were able to get access to an e-mail attachment sent within the United States because they said they were worried that the e-mail contained a schematic drawing or a diagram possibly connected to Iran’s nuclear program. In the past, that probably would have required a court warrant because the suspicious e-mail involved American communications. In this case, however, a little-noticed provision in a 2008 law, expanding the definition of “foreign intelligence” to include “weapons of mass destruction,” was used to justify access to the message. The court’s use of that language has allowed intelligence officials to get wider access to data and communications that they believe may be linked to nuclear proliferation, the officials said. They added that other secret findings had eased access to data on espionage, cyberattacks and other possible threats connected to foreign intelligence.

“The definition of ‘foreign intelligence’ is very broad,” another former intelligence official said in an interview. “An espionage target, a nuclear proliferation target, that all falls within FISA, and the court has signed off on that.”

The official, like a half-dozen other current and former national security officials, discussed the court’s rulings and the general trends they have established on the condition of anonymity because they are classified. Judges on the FISA court refused to comment on the scope and volume of their decisions. Unlike the Supreme Court, the FISA court hears from only one side in the case — the government — and its findings are almost never made public. A Court of Review is empaneled to hear appeals, but that is known to have happened only a handful of times in the court’s history, and no case has ever been taken to the Supreme Court. In fact, it is not clear in all circumstances whether Internet and phone companies that are turning over the reams of data even have the right to appear before the FISA court.

Created by Congress in 1978 as a check against wiretapping abuses by the government, the court meets in a secure, nondescript room in the federal courthouse in Washington. All of the current 11 judges, who serve seven-year terms, were appointed to the special court by Chief Justice John G. Roberts Jr., and 10 of them were nominated to the bench by Republican presidents. Most hail from districts outside the capital and come in rotating shifts to hear surveillance applications; a single judge signs most surveillance orders, which totaled nearly 1,800 last year. None of the requests from the intelligence agencies was denied, according to the court. Beyond broader legal rulings, the judges have had to resolve questions about newer types of technology, like video conferencing, and how and when the government can get access to them, the officials said. The judges have also had to intervene repeatedly when private Internet and phone companies, which provide much of the data to the N.S.A., have raised concerns that the government is overreaching in its demands for records or when the government itself reports that it has inadvertently collected more data than was authorized, the officials said. In such cases, the court has repeatedly ordered the N.S.A. to destroy the Internet or phone data that was improperly collected, the officials said.

The officials said one central concept connects a number of the court’s opinions. The judges have concluded that the mere collection of enormous volumes of “metadata” — facts like the time of phone calls and the numbers dialed, but not the content of conversations — does not violate the Fourth Amendment, as long as the government establishes a valid reason under national security regulations before taking the next step of actually examining the contents of an American’s communications. This concept is rooted partly in the “special needs” provision the court has embraced. “The basic idea is that it’s O.K. to create this huge pond of data,” a third official said, “but you have to establish a reason to stick your pole in the water and start fishing.” Under the new procedures passed by Congress in 2008 in the FISA Amendments Act, even the collection of metadata must be considered “relevant” to a terrorism investigation or other intelligence activities. The court has indicated that while individual pieces of data may not appear “relevant” to a terrorism investigation, the total picture that the bits of data create may in fact be relevant, according to the officials with knowledge of the decisions.

Geoffrey R. Stone, a professor of constitutional law at the University of Chicago, said he was troubled by the idea that the court is creating a significant body of law without hearing from anyone outside the government, forgoing the adversarial system that is a staple of the American justice system. “That whole notion is missing in this process,” he said.

The FISA judges have bristled at criticism that they are a rubber stamp for the government... BECAUSE THE TRUTH HURTS, DOESN'T IT?

OKAY, THIS IS OUTSIDE OF ENOUGH. THERE IS NOTHING "CONSITUTIONAL" ABOUT ANY OF THIS SETUP. THIS IS A KANGAROO COURT, AND WE ARE ALL ITS VICTIMS

Demeter

(85,373 posts)After reading the above article, I am literally paralyzed. All my circuits are blown, metaphorically speaking.

I will need some time to adjust and to respond to this outrage.

I apologize for not being sufficiently single-minded, bloody-minded, or whatever it would take to just go on with life as if the floor hadn't vanished beneath my feet. As if I didn't care.

DemReadingDU

(16,000 posts)Seriously, we need a country-wide strike to protest lack of good jobs, expense of health care, spying/surveillance on us, etc. Probably won't happen until most of us have no job, no money, no savings, no credit cards and we're hungry. But by then the government likely will have shut down the internets and cell phones.

bread_and_roses

(6,335 posts)I know just how you feel. It's all too much sometimes. I was going to post more ... but I lost heart and will. It only comes in brief spurts these days, before the despair sets in. We'll regroup better for a little R&R

xchrom

(108,903 posts)On the morning of April 24, 2013, at about 8:45 a.m., the Rana Plaza, a nine-story building housing factories and offices, collapsed in the Bangladeshi capital Dhaka. More than 3,500 people were in the building at the time, and 1,129 died in the wreckage. Mainuddin Khandaker, a senior official at the Ministry of Home Affairs, began his investigation that evening.

Six weeks later, Khandaker is sitting in a carved wooden armchair in his living room. A soft-spoken man in his early 60s who wears gold-rimmed glasses, he lives in Dhaka's government district. It's been dark outside for a while, and a single fluorescent tube, surrounded by fluttering moths, is the only light in the room. Khandaker is balancing a bowl of dark berries on his knees.

In the last few years, he has investigated more than 40 cases of factories that either collapsed or burnt down. But none of those accidents approached the scale of Rana Plaza, the biggest industrial accident in the country's history. The 493-page report Khandaker wrote contains witness statements, photos and structural engineering calculations. It will probably remain under lock and key. An investigative report on the textile industry has never been published in Bangladesh, he says.

Khandaker goes into the next room and returns with a stack of paper, the summary. He eats a berry from the bowl and carefully spits the seed onto the saucer. "Time pressure, lots of money, a lack of scruples and greed -- everything came together on that day," he says.