Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 11 August 2013

[font size=3]STOCK MARKET WATCH, Monday, 12 August 2013[font color=black][/font]

SMW for 9 August 2013

AT THE CLOSING BELL ON 9 August 2013

[center][font color=red]

Dow Jones 15,425.51 -72.81 (-0.47%)

S&P 500 1,691.42 -6.06 (-0.36%)

[font color=black]Nasdaq 3,660.11 0.00 (0.00%)

[font color=green]10 Year 2.49% -0.03 (-1.19%)

30 Year 3.58% -0.03 (-0.83%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)THIS IS THE ONLY PLACE ON DU WHERE I THINK HIS ANALYSIS WILL GET A FAIR HEARING. I'M AMAZED THAT EVEN NOW, THE POM-POMS ARE OUT PUMMELING THE CLEAR-EYED AND PRINCIPLED SNOWDEN SUPPORTERS...

http://www.nakedcapitalism.com/2013/08/opposition-to-obamacare-considered-rational-on-grounds-of-equity.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

From his latest presser, Obama’s partisan perspective on ObamaCare:

[OBAMA:] Now, I think the really interesting question is why it is that my friends in the other party have made the idea of preventing these people from getting health care their holy grail, their number-one priority.

However, from the public purpose perspective, the really interesting question is why our “friends” in both parties refuse to put truly universal coverage — for example, single payer Medicare for All — on the table at all. Remember, ObamaCare is, pathetically, projected to enroll only 7 million people in its first year, and when fully implemented will leave about as many uninsured as newly insured — 25 or 30 million, but with “these people,” who’s counting?

Be that as it may, we’re stuck with ObamaCare for now. And no matter what Obama says, the real problems with ObamaCare are not “glitches” and can’t be solved with “adjustments” or “administrative changes”‘; they are fundamental to its system architecture, which demands that every American be thrown into one eligibility bucket or another, with the number of possible buckets being 1 (Federal) x 50 (states) x 9 (the number of income levels) = 450. At least I think so.* Maybe somebody smarter than me wants to calculate the combinatorial explosion, taking the differences between the actual plans offered in each jurisdiction into account. Anyhow, as I’ve been relentlessly documenting, ObamaCare’s complex, confusing, and Rube Goldberg-esque system of eligibility determination mean that people inevitably get thrown into the wrong buckets, or there aren’t even the right buckets for them. Worse, people are thrown into buckets for whimsical and arbitrary reasons, leading to a fundamental lack of equity, of common fairness, for the entire program. Today I’d like to EXPLORE ObamaCare’s fundamental lack of equitable treatment for all citizens by using Kaiser’s Subsidy Calculator** for people at “the margins”: Those at the top, too well-off to participate in the Exchanges, and those at the bottom, too poor to do so. For continuity with this (conservative) example, the test case will be a family of two 56-year old non-smokers, with two children under 20.*** (Hat tip Beowulf — yes, that Beowulf — for the example, and for extending it to the poor.) First, let’s define the margins:

If your income is lower than 400% poverty level [top, maximum], you will receive assistance paying for your health insurance and if you earn less than 138% poverty level [bottom, minimum], you will be eligible for Medicaid – unless you are in one of those states that made the ridiculous decision not to expand Medicaid coverage for their poorest citizens.

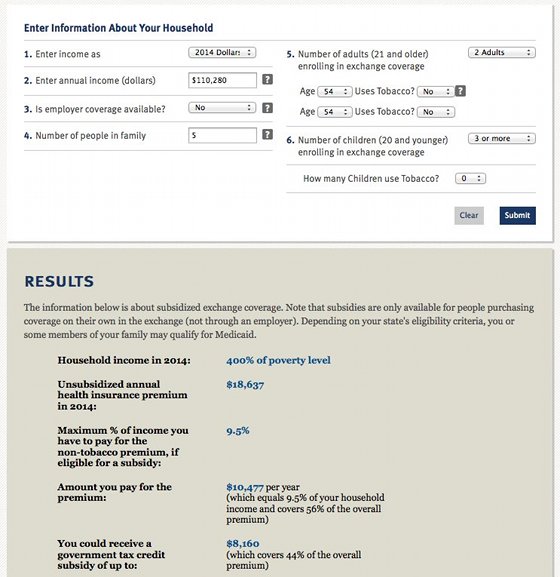

(Matters are actually more complicated; the maximum is 400% of poverty level or 9.5% of income, whichever is least.) Taking our income figures from the 2013 Poverty Guidelines, let’s plug the figures at the top margin (400%) household into the calculator:

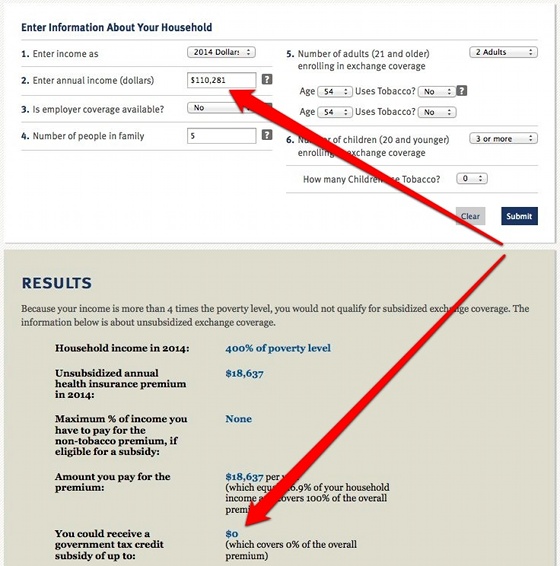

Now, since we’re at the margin — 400% of the poverty level exactly — let’s add a dollar and see what happens:

Before: $18,637 unsubsidized – $8,160 subsidy nets to $10,477. After: $18,637 – 0 = $18,637. That extra dollar of household income at the margin cost you $8,160 dollars worth of (actuarially determined) health care. I ask you: How can effect so grossly disproportionate be fair? Is there any way for a health care program to justify this? And that’s before we realize that a relatively well-off household is going to be able to afford the professional services to manage their income so as to retain the subsidy. Of course, this obvious inequity is a consequence of Obama’s system architecture: Buckets have edges, and people fall in a bucket, or out of it.****

AND THE ANALYSIS GOES ON, MERCILESSLY...THAT'S NOT EVEN COUNTING THE META-EFFECTS; SEE NEXT POST....

Demeter

(85,373 posts)By Gaius Pubius, a professional writer living on the West Coast. Follow him on Twitter @Gaius_Publius. Cross posted from AmericaBlog

This is no longer an NSA data, or DEA data story. It’s a federal, state and local government data-trafficking story.... We recently reported, along with others, on how the DEA has been getting data from the NSA to aid in their “war on drugs” — then getting prosecutors and cops (DEA and otherwise) to cover up the source of their tips to protect their ability to prosecute. As bad as the original Snowden-Greenwald NSA story actually is — and if true, it’s very bad indeed — this is worse. After all, what’s the DEA (and half the cops and prosecutors in the country) doing with all that NSA data at their disposal?

Unlike others, though, we think the NSA-DEA connection as not just a point-to-point story — as in, NSA data–to–DEA database for drug cop use. It’s actually a many-points–to–many-points story, with the special unit within the DEA that keeps the data acting as a convenient one-stop collection place for both data sources and receivers. The real DEA story, prior to the most recent revelation, is that the DEA acts as a clearinghouse for these data sources:

▪ FBI

▪ CIA

▪ NSA (including Google and Apple and friends)

▪ IRS (meaning all your financial data)

▪ Homeland Security

▪ At least 19 other agencies

And it passes the collected data to these receivers:

▪ “About 10,000″ federal, state and local law enforcement agents

▪ All of their cop and prosecutor friends not on the list

▪ All of their cop and prosecutor friends’ non-cop friends

That’s what we used to think. Now we know more. Now we know that one of the receivers of NSA (etc.) data is the IRS. (More on that below.) What this means is that, in all likelihood, all of the providers of DEA-collected data are also receivers of DEA-collected data...One central collection and distribution point

▪ The Special Operations Division (SOD) within the DEA

▪ DEA-maintained DICE database

Likely data receivers and users

▪ FBI?

▪ CIA?

▪ NSA?

▪ IRS (verified)

▪ Homeland Security?

▪ At least 19 other agencies?

Plus known recipients and “friends who have friends”:

▪ “About 10,000″ federal, state and local law enforcement agents

▪ All of their cop and prosecutor friends not on the list

▪ All of their cop and prosecutor friends’ non-cop friends

Again, this is not a DEA story, nor even just an NSA story. It’s a very broad data collection and dissemination story. We now know that the IRS can see what Google collects, if it’s passed to the DEA. Which means that the FBI, CIA and Homeland Security (and all of their friends, and many of their friends’ friends) probably have access to Google, Apple, Verizon data, if it gets into the DEA database as well. Is there IRS data in that database? We’ve been told that there is, and why wouldn’t there be? I can manufacture a justification just sitting here (hint: drugs and money laundering). Can the CIA, FBI and Homeland Security see the IRS data? And who are those “19 other agencies” with a seat at the data-trafficking table? Anyone we should know about? The FBI is part of the Department of Justice, right? Does that mean anyone high enough in the DoJ can ask the FBI to query the database too? How about those servants of business in the Dept of Commerce? Can they use the DICE database to get Google or IRS dirt on labor organizers and pass it to their friends at, say, Walmart — or to whatever other company the DC revolving door might land them at?

It’s time Reuters found out (or revealed) those 19 name, don’t you think? ...And then there’s the corruption angle. The revolving door is a lifeline to the next overpaid job for almost all higher-up federal employees. If I were conscienceless, I’d use that DEA-collected data to make sure the revolving door treated me well. In fact, I’d use it to make sure the revolving door treated me very well. After all, what better job application than to hand, say McDonald, the online search and download preferences of their top 20 troublesome labor organizers — the behind-the-scenes people they can’t fire who are helping organize the low-wage people they can fire. Would that get you a spot on someone’s board of directors, or an office labeled “VP of Where Can We Golf?”

...And that’s just the start of the corruption I can imagine. If I were political director for a conscienceless president, I’d make certain that certain reporters knew their habits were known. And I sure could chase a lot of pesky competition from a lot of state-wide no-name political races with a fistful of their google searches and private preferences...Got more corrupt ideas than these? Post them in the comments. I’d love to see what the bright folks here — were they conscienceless — could come up with. I’ve also got a dozen ways to engage in personal vendettas running in my brain right now. The possibilities multiply themselves.

As I said, folks, this is not a DEA or NSA story. It’s a data-trafficking story. The only thing missing from the data collection are investment records (or is that where the IRS comes in?) and medical histories. With power like this, the world is the oyster of anyone who can get at it, and those who can — bet on it — are mainly corrupt. The least of their sins is being relentless careerist. If you want to find most of the predators, look where the prey — or everything known about them — is gathered.

Now the IRS Story — Reuters Says They’re Using the NSA Database Too

Reuters says the IRS has had access to DEA database data for a while. And just like the DEA, the IRS is abusing their use of it by lying about the sources of their tips and leads. Here’s a good Common Dreams summary of the story from writer Jon Queally:

Reuters reports IRS manual detailed DEA’s use of hidden intel evidence

Following up on exclusive reporting from earlier this week about how the U.S. Drug Enforcement Agency uses NSA surveillance data and tips from a secretive unit called the Special Operations Divisions (SOD) to initiate investigations, Reuters on Thursday reveals that the Internal Revenue Service was aware of and may have also used these “unconstitutional” tactics.

What’s troubling in both cases, according to legal experts, is the manner in which the agencies hide the true source of an investigation’s starting point—never revealing the use of the highly classified sources involved—and then “recreate” a parallel investigation to justify criminal findings.

Additionally troubling is that the IRS and the DEA are only two of the more than twenty federal agencies that work in tandem with the SOD, leading to speculation that the practice of utilizing than hiding surveillance techniques that have not been properly documented or approved could be far-reaching.

From the Reuters story (a good click-through):

Details of a U.S. Drug Enforcement Administration program that feeds tips to federal agents and then instructs them to alter the investigative trail were published in a manual used by agents of the Internal Revenue Service for two years. …

A 350-word entry in the Internal Revenue Manual instructed agents of the U.S. tax agency to omit any reference to tips supplied by the DEA’s Special Operations Division, especially from affidavits, court proceedings or investigative files. The entry was published and posted online in 2005 and 2006, and was removed in early 2007. The IRS is among two dozen arms of the government working with the Special Operations Division, including the Federal Bureau of Investigation, the National Security Agency and the Central Intelligence Agency.

And from an IRS document Reuters dug up:

Adds the writer of the Common Dreams story:

And that’s the problem, say critics, who note that surveillance operations like those developed by the NSA and the DEA are first said to only be used for counterterrorism, but then the public finds out they’re also being used for narcotics investigations. Next, new disclosures surface that criminal gangs are being targeted. Next, financial criminals. It appears a classic slippery slope.

Of course, they say they’re only involved in the program because they care deeply about drug trafficking. (Only they don’t.) Or financial crime. (Only they don’t.) Or something. But we know better. We know by now they all just want access to All Data. We also know by now not to trust anything they say … don’t we? After all, if Obama can lie to Leno on national TV, why on god’s earth would any of them ever tell the truth? You’d have to be a whistle-blower to do that. And those people find the revolving door very tightly closed.

DemReadingDU

(16,000 posts)Why? What's going to happen in the future that access to all our data is being setup to be able to be accessed now.

I thought we lived in America: right to privacy, freedom of speech, nation of laws, the Constitution. What country is this that wants to know everything about us?

and hello Agent Mike(s) from the NSA, IRS, CIA, FBI, all those other 19 agencies

bread_and_roses

(6,335 posts)Demeter

(85,373 posts)Camden was once described to me as “the part of New Jersey that is so bad, everyone tries to forget it exists. Except it’s probably worse than everybody realizes.” But when I got a job at Rutgers University-Camden, I stubbornly decided to live there. So I started asking questions about the city, buoyed by a wonderful previous experience in “dangerous” New Orleans. The more questions I asked, the more I heard, “Why would you move there?” often followed by a brief, obscure reference to corruption, crime, drugs and blight, mostly from people who had never stepped foot inside city limits. While these critiques are real, they miss out on some subtler advantages of Camden. Beautiful waterfront at affordable prices, a lifestyle where I can walk to work, and such easy access to Center City Philadelphia that Camden could be nicknamed Philadelphia East. No one would talk to me about what it was like to live in Camden every day, in part because few in my circles had spent any time there. I moved into a space at the Victor Lofts anyway, happy to find the historic building no longer blighted and back in use.

After a month in the city, what I’ve learned has surprised me. This city is not designed for its residents. And its residents know that.

One story sums up my first month in the city. Recently, I took a trip on PATCO, the commuter rail line connecting South Jersey to Philadelphia. For me, PATCO is a much-needed lifeline from the Camden streets, which are so quiet on weeknights that I daydream I’m in a post-apocalyptic movie set, to Center City Philadelphia, where young professionals are perennially out to play. On this particular day, like so many others, I found myself waiting for a train to Philly, watching as trains moving in the other direction took suburban Jerseyites away from their day jobs and back to their families, passing through Camden unnoticed. The station was almost empty — it was just myself and a homeless man and woman in their mid-20s. I was sitting and reading. They were going through the trash.

“I’m so sorry,” the young woman said to me. “We’re homeless and it’s going to rain, and we need the trash bags to keep dry.” They emptied the trash bags, made holes for their heads and arms, and apologized again. Something about their apologies bothered me. It’s an interaction I find myself returning to time and time again, because there are hints of it in many of my Camden experiences. When I walk through a new neighborhood, I’m inevitably asked if I’m looking to buy a home. If I stop by a new shop, the owner wants to know if I’ve moved to the area. And yes, when I park my car downtown, I’m often blatantly approached and asked if I need drugs.

It’s as if the city so desperately needs people with disposal income that those who have it are catered to relentlessly. And underneath such puzzling interactions is a deep frustration that much of Camden is not designed for its residents because of their low incomes. As a result, residents seem to have a deep suspicion of outsiders hidden under the politeness. They know that the waterfront caters to visitors and tourists. They know that until a recent scholarship program by Rutgers-Camden, the poor public school system meant few local students attended the university. They watch every day as Campbell’s, one of the largest employers in the city, runs buses from the Broadway PATCO stop to its offices so employees don’t have to walk the Camden streets.

The message to local residents is clear: The nice things here aren’t for you. We need other people. That is what it’s like to live in Camden. To be forgotten in your own city. To know that when money is spent, you will be invisible. That the state runs your school system and the county your police department. That $175 million was spent on the waterfront, and your sewage infrastructure is falling apart. That even one of your biggest historical allies, lawyer Peter O’Connor, thinks that half of the poor people in Camden need to be pushed out to the suburbs if Camden is to be reborn.

Living in Camden is knowing all these things and still calling the city home.

Dr. Stephen Danley is an assistant professor of public policy and administration at Rutgers University-Camden. He is a Marshall Scholar and graduate of the University of Oxford. Find him on Twitter @SteveDanley.

Demeter

(85,373 posts)As you may have seen, Japan’s public debt has hit one trillion quadrillion yen. That is roughly $10 trillion. It will reach 247pc of GDP this year (IMF data). No problem. Where there is a will, there is a solution to almost everything. Let the Bank of Japan buy a nice fat chunk of this debt, heap the certificates in a pile on Nichigin Dori St in Tokyo, and set fire to it. That part of the debt will simply disappear. You could do it as an electronic accounting adjustment in ten seconds. Or if you want preserve appearances, you could switch the debt into zero-coupon bonds with a maturity of eternity, and leave them in a drawer for Martians to discover when Mankind is long gone.

Shocking, yes. Depraved, not really.

It also doable, and is in fact being done right before our eyes. That is what Abenomics is all about. It is what Takahashi Korekiyo did in the early 1930s, and it is what the Bank of England is likely to do here (while denying it), and the Fed may well do in America. Japan’s QE will never be fully unwound. Nor should it be. If a country can eliminate a large chunk of unsustainable debt without setting off an inflation spiral, or a currency crash, or the bubonic plague, there has to be a very strong reason not to do it. I have yet hear such a reason. Though I have heard much tut-tutting, Austro-outrage, and a great deal of pedantry.

It is also what the Romans did time and again over the course of the late empire, though less efficiently, since they did indeed inflate. And no, even that was not fatal. The Roman Empire did not collapse because of metal debasement. It revived magnificently under the Antinones. As Gibbon discovered deep into his opus — and too late to change his title — the Decline and Fall of the Roman Empire took an awfully long time, to the point where the concept is meaningless.

Money is hugely important, but also ultimately trivial. The productive forces of a society are what matter in the end.

.........................

These two charts from BNP Paribas are worth a look. They show the BoJ bond buying spree, and the curative effect of a whiff of inflation on the debt trajectory:

The BoJ is currently buying 70pc of the total state debt issuance each month, and my guess is that it will be buying over 100pc before long since the economic rebound will lead to a surge of tax revenues that greatly reduces the fiscal deficit. It will soon enough to be able to carry out some really worthwhile legerdemain. Governor Haruhiko Kuroda cannot admit that the BoJ is now a financing arm of the Japanese finance ministry (as it was under Takahashi), or that the bank is systematically mopping up as much debt as it can get away with, while the going is good, never to be repaid. He cannot utter the word monetisation. So far, he is getting away with it. Ryutaro Kono from BNP Paribas says it is remarkable the Japanese bond vigilantes have not reacted at all to reports that premier Shinzo Abe may delay or lessen the planned rise in VAT....Is there a cost to this? Sure. It is an internal redistribution of wealth within Japanese society from creditors to debtors (debtors in this case being the state). It is an inter-generational transfer. Those retiring in five, ten, or fifteen years will be poorer: but the burden on those who are now young children will be less onerous. That is a political choice for the Japanese people to make. But it does not mean — in itself — that Japan is is bankrupt. It just means that baby boomers will not be comfortable as they expected. Could the whole experiment go horribly wrong? Will there come a moment when the bond vigilantes do wake up, and push yields much higher, setting off a crisis, requiring yet further financial repression, and probably capital controls. Probably, yes. But what is absolutely certain is that Japan was heading for an almighty smash-up under the old BoJ policy of deflation, paralysis, and broken will. High debts and deflation are a calamitous mix.

Japan has to pick its poison. Abenomics is surely the sweeter brew.

Demeter

(85,373 posts)It's not as if the job market is blazing hot for anyone lately, but new data shows that one key demographic group that has historically been a leader, is now badly falling behind. According to Nick Colas, the chief market strategist at ConvergEx Group, recent graduates under 25 years-old are in a particularly bad spot right now.

"It's usually college grads that do well," Colas says in the attached video."They get the first time jobs, they're pretty cheap to employ, and generally have pretty high job satisfaction."

But, he says since the recession new government data shows that this unlucky group stands out in three key ways like never before.

MORE

Demeter

(85,373 posts)The Tax Foundation, that propaganda tank that masquerades as a "nonpartisan" "think" tank, is at it again. Now it's pushing the right-wing agenda of ending any tax expenditures that redistribute resources down to those in the lower-income distributions. It's produced a study on the "benefits" of eliminating the Earned Income Tax Credit that often makes the difference between food security and living in your car for the working poor. Erik Wasson, Tax Foundation Charts Benefits of Ending Earned Income Tax Credit, The Hill (Aug. 6, 2013). The Tax Foundation "study" includes various right-wing assumptions about the working poor and the benefits of tax cuts that are not empirically supportable.

1) While conceding that the EITC helps the "really" poor, the Tax Foundation repeats the old right-wing saw that those working poor who aren't "really" poor will be disincentivized to work by having the EITC, in essence making that old Romney claim that the EITC is a "bad" policy because it provides aid to the poor, which will keep them from taking "personal responsibility" and thus keep them from getting those multiple jobs that would provide them the same sustainability that the EITC provides.

Here's how the Hill story describes the report on this point:

These assumptions are integral to the Chicago School's economic analysis, which depends on nice mathematical equations about humanity that assumes away most of what makes us human, including the fact that we are quite different from one another. Chicago School ideology says that if you give somebody something, they will become essentially addicted to the freebie and no longer work. Do you know anybody for whom that is true? I don't. I know people that my family has assisted through hard times who have worked even harder to show their gratitude for helping them through a tough spot. The Tax Foundation folk apparently see only the mythical "welfare queens" when they think about the EITC.

2) Instead of giving the money to the poor, the Tax Foundation calculates that we could use it instead to provide a rate cut for those who pay taxes of about 5.7%. Now that is outright redistribution upwards. Because of the personal exemption and standard deduction and EITC, most taxpayers in the bottom two quintiles pay no or very little income tax. The benefit to those low-income taxpayers would be redistributed upwards (the only kind of redistribution that the right likes, apparently) to those in the top three quintiles. Ending one of the best anti-poverty/food-security programs in the country in order to add some more to the pockets of the have-mores.

3) Oh, and the Tax Foundation makes their End EITC Now agenda even rosier by assuming a dynamic scoring of the elimination of the EITC--with those poor families not receiving needed aid, the Tax Foundation says the economy should grow by an additional $29 billion above and beyond the dollars saved that currently go to the EITC! Jobs would flow from just cutting out this assistance for poor people.

Now, maybe those rich guys getting the extra tax break will indeed make more money--but the odds of that money being invested in the US are slim, don't you think? And when poor families lose both food stamps (see yesterday's posting about the right-wing's effort to ensure that families placed on the brink of desperation by the financial crisis will be shoved over the cliff by not having enough food) and the EITC, they will cease being participants in the economy and become drains on local city, county and state budgets. They aren't going to get jobs that aren't there. And jobs aren't going to be created by the money "saved" from not helping poor working families. The Tax Foundation study's proposal is not a recipe for economic growth, but another example of the right's class warfare against everybody who isn't already in the upper class and that's a recipe for economic disaster.

xchrom

(108,903 posts)Markets are slightly lower to start the week.

It's nothing but dramatic, but US futures are pointing to a red open. European stocks are slightly in the red. And Japan fell to a 1.5-month low following a pretty sizable GDP whiff last night.

Meanwhile, gold is having a very strong start to the week, having spiked upon the opening of trading in Asia.

It's now at $1330/oz.

With the S&P at 1691, the big question will be about whether the index can regain the 1700 level.

Read more: http://www.businessinsider.com/morning-markets-august-12-2013-8#ixzz2bkq57Wnz

xchrom

(108,903 posts)Japan's economy expanded at a slower pace than most analysts expected in the second quarter.

Gross domestic product grew 0.6% in the April to June period, indicating an annualised increase of 2.6%, according the latest government figures.

That is down from the 4.1% annual rate in the first three months of the year. Analysts were expecting growth of 3.6%.

Japan's Prime Minister, Shinzo Abe, has been trying to revive the economy after years of stagnation.

xchrom

(108,903 posts)The severity of Greece's recession eased slightly in the second quarter, according to the country's statistics body.

Greece's economy shrank at an annual rate of 4.6% in the three months to the end of June, a slight improvement on the 5.6% fall between January and March.

The figure came as the government said its budget had swung into a surplus between January and July.

The budget was boosted by EU subsidies.

Demeter

(85,373 posts)Herve Falciani is a professed whistle-blower - the Edward Snowden of banking - who has been hunted by Swiss investigators, jailed by Spaniards and claims to have been kidnapped by Israeli Mossad agents eager for a glimpse of the client data he stole while working for a major financial institution in Geneva.

"I am weak and alone," Falciani said, as three round-the-clock bodyguards provided by the French government looked on with hard stares. The protection was needed, he insisted, because he faces constant risk as the sole key to decipher the encrypted data - five CD-ROMs containing a list of nearly 130,000 account holders that may be the biggest leak ever in the secretive world of Swiss banking. But as he settled into a deserted bistro for a two-hour lunch, Falciani, a former computer technician who has been on the run since 2008, seemed oddly relaxed for a fugitive. And why not? He is in high demand these days, having cast himself as a crusader against the murky world of Swiss banking and money laundering. Once dismissed by many European authorities, he and other whistle-blowers are now being courted as the region's governments struggle to fill their coffers and to stem a populist uprising against tax evasion and corruption.

"It's an economic war," said Falciani, an angular man of 41 with a dark goatee... "In Switzerland, the banks are so organized that they are able to circumvent new rules and laws to continue to enable tax evasion." Critics, not least at his former employer HSBC, dismiss Falciani as a manipulator more dazzled by money than high ideals. The data he has leaked - some say sold - since 2008 has wreaked havoc within the banking world, as well as the moneyed and political classes of Europe. Falciani's information formed the basis for the now famous "Lagarde list" that has roiled Greek politics with its revelations of oligarchs and politicians who avoided taxes by stashing millions in Switzerland. His data is also credited with helping Spain collect 260 million euros ($345 million) in taxes and identify more than 650 tax evaders, including the president of Banco Santander.

In 2012, Falciani passed his information to US authorities. They, in turn, used the data to pursue an investigation into whether HSBC flouted controls on money laundering, eventually forcing a $1.92 billion settlement with the bank in December. Since being released from jail this year after a Spanish judge denied a Swiss extradition request, Falciani, who is married and has a young daughter, has resurfaced in France. Authorities here have offered protection in exchange for Falciani giving testimony to local prosecutors who are investigating whether HSBC helped French clients dodge taxes.

"My main objective is to help authorities develop a defense," Falciani said.

"We are under attack and losing a lot of tax money," he said of the Swiss banking system. "If you have enemies who want to invade, laws are not enough and you need armies to build an economic defense."

.......

"To our knowledge it has always been Falciani's intention to sell the data," David Brugger, a bank spokesman, said in an email statement. "Only faced with the prospect of extradition and extended time behind bars, Falciani decided to cooperate with the Spanish authorities. A scheme he is now repeating with France and other countries."

.....

In 2012, Swiss authorities gave Falciani safe pass to meet in Switzerland to discuss a deal to plead guilty to data theft with a suspended sentence, provided that he stopped sharing the information. Falciani said he strung them along to protect his own safety, waiting for a new government in France that might take his claims more seriously. Now that the political tide has turned, Falciani wants to continue working with authorities...

SO MUCH MORE AT LINK--FILLS IN A LOT OF THE HOLES IN THE NEWS

xchrom

(108,903 posts)At their White House meeting last week, U.S. President Barack Obama assured Greek Prime Minister Antonis Samaras of his support as Greece prepares for talks with creditors on additional debt relief amid record-high unemployment.

The U.S. should also endorse a new blueprint for recovery based on one of the most successful economic assistance programs of the modern era: the Marshall Plan.

It is clear by now that the European Union’s policies in Greece have failed. Projections that government spending cutbacks would stop the economy’s free-fall proved to be wildly optimistic. The 240 billion euro ($319 billion) bailout from the euro area and International Monetary Fund has shown little sign of success, and Greece is experiencing its sixth year of recession.

The spending cuts and tax increases, along with the dismissal of huge numbers of public-sector employees, demanded as a condition of the loans and assistance have only deepened the economic pain.

Demeter

(85,373 posts)No, that's not what Obama intends...not that the Marshall plan came without strings, either.

The initiative [5] was named after Secretary of State George Marshall. The plan had bipartisan support in Washington, where the Republicans controlled Congress and the Democrats controlled the White House. The Plan was largely the creation of State Department officials, especially William L. Clayton and George F. Kennan, with help from Brookings Institution, as requested by Senator Arthur H. Vandenberg, chairman of the Senate Foreign Relations Committee.[6] Marshall spoke of urgent need to help the European recovery in his address at Harvard University in June 1947.[3][7]

The reconstruction plan, developed at a meeting of the participating European states, was established on June 5, 1947. It offered the same aid to the Soviet Union and its allies, but they did not accept it,[8][9] as to do so would be to allow a degree of US control over the Communist economies.[10] During the four years that the plan was operational, U.S. $13 billion in economic and technical assistance was given to help the recovery of the European countries that had joined in the Organization for European Economic Co-operation. This $13 billion was in the context of a U.S. GDP of $258 billion in 1948, and was on top of $13 billion in American aid to Europe between the end of the war and the start of the Plan that is counted separately from the Marshall Plan.[11] The Marshall Plan was replaced by the Mutual Security Plan at the end of 1951.[12]

The ERP addressed each of the obstacles to postwar recovery. The plan looked to the future, and did not focus on the destruction caused by the war. Much more important were efforts to modernize European industrial and business practices using high-efficiency American models, reducing artificial trade barriers, and instilling a sense of hope and self-reliance.[13]

By 1952, as the funding ended, the economy of every participant state had surpassed pre-war levels; for all Marshall Plan recipients, output in 1951 was at least 35% higher than in 1938.[14] Over the next two decades, Western Europe enjoyed unprecedented growth and prosperity, but economists are not sure what proportion was due directly to the ERP, what proportion indirectly, and how much would have happened without it. A common American interpretation of the program's role in European recovery is the one expressed by Paul Hoffman, head of the Economic Cooperation Administration, in 1949, when he told Congress that Marshall aid had provided the "critical margin" on which other investment needed for European recovery depended.[15] The Marshall Plan was one of the first elements of European integration, as it erased trade barriers and set up institutions to coordinate the economy on a continental level — that is, it stimulated the total political reconstruction of western Europe.--wiki

http://www.britannica.com/EBchecked/topic/366654/Marshall-Plan

Bet you a trillion dollars that it will ALL be debt imposed by banksters....no free money!

Demeter

(85,373 posts)BASIC IDEA--CONGRESSIONAL IMMUNITY TO TAKE DOWN THE SPIES (AND THE ADMINISTRATION THAT COLLUDES WITH THEM)

http://www.nationalreview.com/article/355218/give-snowden-immunity-robert-zubrin

The United States should give former NSA contractor Edward Snowden immunity from prosecution in exchange for congressional testimony.

The suggestion may strike many of my fellow national-security conservatives as outrageous. Snowden certainly violated the law and may have committed treason. But the practical question is not whether he is an evil traitor, a heroic whistleblower, an irresponsible publicity seeker, or anything else. Rather, what should be done now to best serve and protect the American people? The question calls for examining the situation — not in anger, but with cold logic.

There are two important kinds of information that Snowden might reveal. The first is information of value to America’s adversaries in operations against the United States, its armed forces, and its intelligence agencies. The second is information of value to Congress and the American public in assessing the NSA’s domestic operations and in taking action, if necessary, to uphold the Constitution and stop NSA malfeasance.

In Moscow, Snowden is well situated to provide the first type of information to our enemies and poorly situated to provide the second to us. If he were here, on the other hand, he would be well positioned to provide Americans with the second kind of information, and his opportunities to provide our nation’s foreign adversaries with the first kind would be most limited. So we need to get Snowden back, and the only way to get him back is to set forth terms that induce him to return voluntarily. Pleading, whining, screaming, or demanding that Russia extradite him is simply absurd. Russia never has extradited any defector, and never will, because if it ever did, that would be the last defector it would ever get.

One must therefore ask the conductors of the chorus chanting “Death to Snowden” why they prefer to have the analyst talking to Russia, Iran, and North Korea rather than to Congress. Is it because the NSA regards the holders of America’s purse strings as the greater threat? If so, it would appear that the agency’s leadership has misplaced its priorities. On the other hand, Snowden may be lying, or grossly exaggerating, in his accusations of deeply subversive anti-constitutional actions by the NSA. If so, he has done real harm to American freedom by chilling the public with unnecessary fear of a nonexistent panopticon state. Such falsehoods therefore need to be refuted. The NSA has issued denials. Unfortunately, however, because the agency previously lied to Congress and the public about the very existence of the domestic-spying program, those denials have no credibility. If the NSA is now being truthful, it needs to establish that by taking Snowden on in open confrontation.

Snowden and NSA leaders should be brought together face-to-face for questioning in public by a congressional investigatory committee, with both parties allowed to make their points and to counter the assertions of the other. If Snowden is lying, it will come out. If the NSA is lying, it will come out. If either refuses to appear, that party will be discredited.

The truth will set us free.

— Robert Zubrin is president of Pioneer Energy and the author of Energy Victory. His latest book, Merchants of Despair: Radical Environmentalists, Criminal Pseudo Scientists, and the Fatal Cult of Antihumanism, was published in 2012 by Encounter Books.

I DON'T THINK THIS CAN HAPPEN UNDER PRESENT GOVERNMENT...TOO MANY HEADS WILL ROLL. BUT IF WE WERE ABLE TO WREST THE POLITICAL PROCESSES, ESPECIALLY ELECTIONS, AWAY FROM THE 1%....

Fuddnik

(8,846 posts)Pizza should be arriving soon.

Engaging in major blasphemy.....again.

Demeter

(85,373 posts)Where's your wife to prevent such foolishness?

Somebody has to support my lazy ass.

DemReadingDU

(16,000 posts)They'll keep you busy! If not busy enough, get a couple grandkids too. lol

Fuddnik

(8,846 posts)We've had a third one for a few days. Dogsitting, but he goes back home tonight.

AnneD

(15,774 posts)pizza is one of my fav breakfast-cold from the night before, sans beer...after all it IS still breakfast.![]()

xchrom

(108,903 posts)Bond investors trying to divine when the Federal Reserve will reduce its unprecedented monetary stimulus are increasingly looking to the riskiest parts of the debt market, which are booming like before the financial crisis.

The amount of loans made this year that lack standard protections for lenders exceed the all-time high set in 2007, and only one other time have investors pumped more money into funds that buy lower-rated loans than they did last week. Bonds rated in the lowest category of junk accounted for the greatest percentage of speculative-grade offerings last month since 2011.

While Fed policy makers say employment and inflation will be the primary determinants of when and by how much they reduce the $85 billion a month being pushed into the economy every month through bond purchases, signs of excessive risk-taking are likely to also play a part. Chairman Ben S. Bernanke and Fed Governor Jeremy Stein have cited the potential for continued so-called quantitative easing, or QE, to disrupt financial markets.

When to reduce “seems to be a risk-management issue as opposed to a pure economic issue because the Fed hasn’t really met its mandates with respect to employment gains or with inflation,” Christopher Sullivan, who oversees $2.2 billion as chief investment officer at United Nations Federal Credit Union in New York, said in an Aug. 7 telephone interview.

xchrom

(108,903 posts)The U.S. may announce charges as early as this week against former London-based JPMorgan Chase & Co. (JPM) employees related to allegations they tried to conceal losses last year, a person familiar with the matter said.

The situation remains fluid and it isn’t clear who may be charged, said the person, who requested anonymity because the information wasn’t public. Those facing U.S. charges include Javier Martin-Artajo, a former executive who oversaw the trading strategy, and Julien Grout, a trader who worked for him, the New York Times (NYT) reported Aug. 9. Prosecutors also are weighing penalties for the bank, including a fine and a reprimand, the newspaper said in a subsequent report.

The investigation has centered on whether employees at JPMorgan’s chief investment office attempted to inflate the value of trades on the bank’s books by mismarking them, a person with knowledge of the matter said previously. Federal officials are considering charges related to mismarking books and falsifying documents, the person said.

Grout, a French citizen, is in France, which may make it difficult to arrest him if he’s charged because the country has tougher extradition laws than the U.K., a person familiar with the matter said. Martin-Artajo, a Spaniard, lives in London, according to another person familiar with the matter.

xchrom

(108,903 posts)There’s a made-in-Michigan quality to Art Reyes, a third-generation autoworker with a pension, retiree health benefits and income that enabled him to send three of his four children to college.

He’s a product of the old Michigan, which gave birth to organized labor, worker protections and wages that propelled the middle class. That Michigan is almost gone. Now overseeing the nation’s largest municipal bankruptcy in Detroit, the state is at the forefront again, this time playing host to the unraveling of the homemade fabric that cloaked and comforted working families for generations.

“I’m literally one of the last at my facility to have a defined pension and health care as a retiree,” said Reyes, 45, a General Motors Co. employee and president of UAW Local 651 in Flint. His unit has 800 members, down from 9,000 when he joined in 1991.

Just as the bankruptcy of Detroit, the city that put the nation on wheels a century ago, is a symbol of urban decay, the effort to fix it through cost-cutting measures may set a stricter made-in-Michigan standard for the rest of the U.S.

Demeter

(85,373 posts)xchrom

(108,903 posts)The euro-area economy probably edged back to growth last quarter for the first time since 2011, ending the longest recession since the single currency union started 14 years ago.

Gross domestic product in the 17-nation region expanded 0.2 percent in the three months through June after shrinking for the previous six quarters, according to the median of 41 forecasts in a Bloomberg News survey. The European Union’s statistics office in Luxembourg will release the data on Aug. 14. Germany probably grew about 0.75 percent, according to a government estimate, exceeding the 0.6 percent economists predict.

A year of relative calm on financial markets, budget cuts from Spain to Italy and accelerating growth in the U.S., the world’s biggest economy, have helped the euro area start to recover. While the overall outlook has improved, the recession has left the region with a youth unemployment rate of 24 percent, and parts of southern Europe remain mired in a slump.

“The external environment is really getting better, led by signs that U.S. demand is picking up,” said Nick Kounis, head of macro research at ABN Amro Bank NV in Amsterdam. “The second quarter should mark the end of the recession in the euro area, but the recovery will be excruciatingly slow. We’re not getting the champagne out yet.”

***i guess they imposed as much unemployment, skimming money from the 99%, horrible stress as they thought they could get away with

Demeter

(85,373 posts)I smell fear from the 1% that they were going to lose it all by being too greedy....

Good morning, X! Did you have a good weekend? I survived mine, sort of.

It's raining, a good soaker, and I'm back in the groove (or really, a rut).

xchrom

(108,903 posts)went to a DIY pizza party that was fun.

a bunch of gossipy old queens -- all scientists -- and socially inept in that way that really smart people can be.

i always have fun with these guys.

i love summer rains -- as long as they don't turn into mud fests.

i'm glad you seem to be back in the groove and or rut.

it's always good for us to see you.

AnneD

(15,774 posts)my kind of party...a nerd fest.

i'm the only big city, arts degree queen.

AnneD

(15,774 posts)I prefer to be the Queen of Everything!

Demeter

(85,373 posts)Secrets: A Memoir of Vietnam and the Pentagon Papers by Daniel Ellsberg

Viking, 498 pp, US $29.95, October 2002, ISBN 0 670 03030 9

The subject of Daniel Ellsberg’s memoir is the decadence of American democracy. The conditions he began fighting in 1969 are much worse today and far more dangerous to many more people. Yet central casting could not have produced a more perfect foil for the American imperial Presidency than Ellsberg. An infantry lieutenant in the Marine Corps with genuine battle experience in Vietnam, a PhD in economics from Harvard, and a defence intellectual employed by the Rand Corporation of Santa Monica, with the highest security clearances, Ellsberg is as good as the American system can produce in the way of a male citizen working in the foreign policy apparatus. His odyssey from Pentagon staff officer to the man who spirited 47 volumes of top secret documents out of the Rand Corporation, copied them, and delivered them to the New York Times and a dozen other newspapers is breathtaking.

Ellsberg helped end the Vietnam War, but publication of this memoir now is not just a happy coincidence. The features of American government he documents – the cult of Presidential infallibility, the march of militarism, the executive’s routine lying to the other two branches and to the people, and the cancerous growth of official secrecy – are just as relevant today as they were thirty years ago. The United States, even the world, desperately needs more Ellsbergs....

He remembers telling Henry Kissinger in a briefing after Kissinger had become Nixon’s National Security Adviser:

MUST READ!

Fuddnik

(8,846 posts)He really put his ass on the line.

Most people don't have any idea just who he was. He was MacNamara's right hand man. He was a top planner of the Vietnam war, which he opposed. He broke in Henry Kissinger for the job of National Security Adviser. He wasn't the flake they tried to portray him as.

After a fact finding trip to Vietnam, MacNamara called him up to the front of the plane to explain to a bunch of policy makers just why we were losing the war, and had no hope of winning it. After they landed, MacNamara gave the press a briefing. Yada..Yada.. Yada..We see the light at the end of the tunnel, the end of the war is near, we're winning....yada..yada..yada..". Lying sack of shit.

Catch "The Most Dangerous Man in America". You can get it on DVD or Netflix.

xchrom

(108,903 posts)(Reuters) - Portugal is fully committed to delivering 4.7 billion euros (£4.07 billion) in budget cuts by 2014 as agreed with creditors under its bailout, Regional Development Minister Miguel Poiares Maduro said on Monday.

Budget cuts imposed under the rescue programme caused a political crisis that threatened the government in July, prompting two ministers to resign and forcing the promotion of the head of the junior coalition partner to deputy prime minister.

Newspaper Weekly Expresso had reported the government was considering reducing the planned spending cuts to 2 billion euros rather than the larger amount agreed with creditors during their last review of the economy, which ended in March.

The centre-right government is currently drafting the 2014 budget, which is set to include the spending cuts and which has to be presented to parliament by October 15.

xchrom

(108,903 posts)(Reuters) - Greece's recession eased slightly in the second quarter but not nearly enough to boost tax revenues to levels the government needs to meet its bailout targets, figures showed on Monday.

The data follows a magazine report saying Germany's central bank saw risks to the rescue package aimed at keeping Greece afloat and expects the euro member to need more aid in 2014 after it scraped through the last aid review.

As Europe's largest economy Germany has funded a chunk of the bailout but there has been resistance from German voters who are also facing tight budgets. The subject of Greek aid has played into the campaign for elections next month.

The Greek data showed the economy shrank at an annual pace of 4.6 percent in the second quarter, according to the country's statistics agency ELSTAT.

xchrom

(108,903 posts)(Reuters) - German regulator BaFin has completed its report of Deutsche Bank's (DBKGn.DE) role in setting interbank lending rates and is set to submit a copy to the country's flagship lender as soon as this week, a source familiar with the matter said on Monday.

BaFin and other regulators are investigating more than a dozen banks and brokerages over allegations they manipulated benchmark interest rates such as Libor and Euribor, which are used to underpin trillions of dollars of financial products from derivatives to mortgages and credit card loans.

The bank watchdog is continuing aspects of its probe, but has found no evidence of wrongdoing on the part of members of the management board, the source further said.

BaFin declined to comment.

Roland99

(53,342 posts)Trading volume dries up around UMich report following disclosure of early release

http://blogs.marketwatch.com/thetell/2013/08/12/trading-volume-dries-up-around-umich-report-following-disclosure-of-early-release/

That stands in stark contrast to the roughly 200,000 shares in the ETF that typically traded during that 10 millisecond window at the beginning of those 2 seconds in recent years.

...

Prior to the suspension, the news and data firm charged large fees, over $5,000 a month, to grant high-speed-traders access to the data at 9:54:58 a.m. Eastern time.

But Hunsader also pointed out that trading after 9:55 a.m. dried up after press reports revealed the advantage in June. Other investors felt they were getting taken advantage of and stopped trading upon receiving the data at 9:55 a.m. That had the effect of driving the high-frequency traders to stop trading at 9:54:58 because there was no one to front run, he said. The next University of Michigan consumer sentiment report comes out Friday.