Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 11 December 2013

[font size=3]STOCK MARKET WATCH, Wednesday, 11 December 2013[font color=black][/font]

SMW for 10 December 2013

AT THE CLOSING BELL ON 10 December 2013

[center][font color=red]

Dow Jones 15,973.13 -52.40 (-0.33%)

S&P 500 1,802.62 -5.75 (-0.32%)

Nasdaq 4,060.49 -8.26 (-0.20%)

[font color=green]10 Year 2.80% -0.01 (-0.36%)

[font color=black]30 Year 3.84% 0.00 (0.00%)[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)for the wolves.

Demeter

(85,373 posts)and it's that few I'm worried about, tonight. Stay warm and dry, everyone!

Demeter

(85,373 posts)OUTSOURCING WASN'T SUFFICIENTLY APPLIED, THEN. THESE ARE THE PSYCHOPATHS AT THE TOP OF THE FOOD CHAIN...I'VE KNOWN PLENTY OF THOUGHTFUL, CARING GEEKS.

We are in trouble if the techsters and banksters set the moral compass...The health and vitality of a society can be measured by its cultural values, including what it honors and celebrates. For years, the Bay Area could be quite proud of its values. The region has a glorious history of diversity and has championed important political and economic causes. Here at the Express, we are proud to be located in Oakland's Jack London district. London's legacy of concern for working folks and social justice, as well as his personal quirkiness, form one of the defining touchstones of the East Bay. But the times they are a-changin'.

The ugly sustained attacks on middle-class BART workers in the mainstream press over the last year, combined with a blind eye toward Silicon Valley arrogance and large-scale financial criminality, have exposed a growing and worrisome trend in the Bay Area. The heroes of the current age are not the hardest working or most caring or most helpful members of our society. Instead, they are the most arrogant, and in some ways, the most compromised.

Take the tech industry. For all of its coolness and shiny products, values espoused by the leaders of this industry are contributing to a hollowing out of Bay Area progressivism and humanism. This month, Farhad Manjoo, author of the "High Definition" column for The Wall Street Journal , wrote a piece titled "Silicon Valley Has an Arrogance Problem." In it, he argued that many tech entrepreneurs believe that due to "their cultural and economic power," only they have the ability to "shape the future." Non-techies are dismissed as "unimportant to the nation's future."

MORE

Demeter

(85,373 posts)...Dominick Carollo, Steven Goldberg and Peter Grimm were mid-level players who worked for GE Capital. They were involved in a wide-ranging scheme (one that also involved most of America's biggest banks, from Chase to BOA to Wachovia) to skim billions of dollars from America's cities and towns by rigging the auctions banks set up to help towns earn the highest returns on the management of municipal bond issues.

The case was over 10 years in the making and involved offenses that took place long before the 2008 crash. All three defendants were convicted in May 2012, with Goldberg ultimately getting four years and the other two getting three.

Now, they're all free. A New York federal judge last week ordered their convictions overturned in a quiet Thanksgiving-week transaction.

The GE Muni-riggers will now join such luminaries as the Gen Re defendants (executives from an insurance company who were convicted in 2008 of helping AIG conduct a fraudulent accounting transaction) and the KPMG defendants (executives of the U.S. arm of the Dutch accounting giant who were convicted in the 2000s of selling illegal tax shelters) in the ranks of Wall Street line-crossers who improbably made it all the way to guilty verdicts in criminal cases, only to be freed on technicalities later on.

As one antitrust lawyer I know put it: "Apparently, the government can't seem to get criminal trials involving financial executives (as opposed to, well, drug dealers) right. Go figure."

MUCH MORE DETAIL ON A REAL-LIFE CONSPIRACY AT ABOVE LINK

PREVIOUS EXPOSE ON GE CAPITAL CRIMES CASE:

http://www.rollingstone.com/politics/news/the-scam-wall-street-learned-from-the-mafia-20120620

snot

(10,530 posts)I believe statute of limitations is a pretty obvious obstacle.

Demeter

(85,373 posts)The leader of the payments business looks to the future and says Bitcoin is a good idea -- but not yet actually a currency. Tap-to-pay, meanwhile, is a dud. Online payments will look completely different in the next decade, and Bitcoin has a better chance at revolutionizing commerce than the NFC tap-to-pay technology, PayPal President David Marcus predicted Tuesday.

"I really like Bitcoin. I own bitcoins," Marcus said at the LeWeb conference here. However, he believes people today don't correctly understand what bitcoins actually are, and he's not yet ready to let people link their bitcoin wallets with their PayPal accounts.

People are confused. They think because it's called cryptocurrency it's a currency. I don't think it is a currency. It's a store of value, a distributed ledger. It's a great place to put assets, especially in places like Argentina with 40 percent inflation, where $1 today is worth 60 cents in a year, and a government's currency does not hold value. It's also a good investment vehicle if you have an appetite for risk. But it won't be a currency until volatility slows down. Whenever the regulatory framework is clearer, and the volatility comes down, then we'll consider it.

Also, bitcoins aren't widely enough accepted by merchants yet, Marcus added. Marcus is paying close attention to payment changes as part of his effort to re-energize an eBay service that grew sluggish and complacent after the early dot-com years. He's trying to foster innovation at the company and cater to developers, particularly those at start-ups.

Although he has some concerns about bitcoin, he's unequivocal about near-field communications (NFC), the very short-range radio communication that can let people tap a credit card or mobile phone to a payment terminal....MORE

Demeter

(85,373 posts)Bitcoin has fuelled a surge in the number of cyberattacks where computers and personal data are held hostage in return for ransoms paid in the almost-anonymous virtual currency.

Ransomware attacks, where hackers encrypt computer data so it cannot be accessed until they receive a payment, have risen more than ten-fold in the past two and a half years, according to data from security company McAfee.

There were over 300,000 known incidents in the last quarter. Deprived of the use of their computer and important files and with little recourse to the law, victims often feel forced to pay the attackers the hundreds of dollars that they demand to unlock the data.

Cyberattackers prefer to demand ransoms in Bitcoin because it is much harder to trace than credit card payments in conventional currencies. Using Bitcoin is the online equivalent of leaving a suitcase full of cash in a park, with the added advantage that its soaring price – rising above $1,000 last week – gives criminals an extra way to profit from the attacks...

MORE

Demeter

(85,373 posts)The United States Supreme Court on Monday let stand a ruling from New York’s highest court requiring Internet retailers to collect sales taxes even if they have no physical presence in the state.

As is their custom, the justices gave no reasons for their decision not to hear the case, which involved Amazon.com, the online giant, and a smaller competitor, Overstock.com. The two companies challenged a 2008 state law that required online companies to collect sales taxes on purchases made by New York residents.

Brick-and-mortar companies often complain that they are put at a competitive disadvantage when they are required to collect sales taxes and online companies are not.

In March, the New York Court of Appeals ruled that the companies had a sufficient presence in the state because of affiliated independent sites that linked to the retailers in return for a commission. “The bottom line,” Chief Judge Jonathan Lippman wrote for the majority, “is that if a vendor is paying New York residents to actively solicit business in this state, there is no reason why that vendor should not shoulder the appropriate tax burden.”

MORE

Demeter

(85,373 posts)Wall Street banks reeling from a flurry of activity by departing U.S. Commodity Futures Trading Commission Chairman Gary Gensler are considering taking the agency to court.

Gensler has issued more than a dozen advisory opinions directed at reining in the largest financial firms and swap traders without votes by his fellow commissioners. He’s also insisting on tightening the Volcker rule ban on proprietary trading by banks, making last-minute demands that could derail a regulation that must be approved by five U.S. agencies.

The financial industry’s trade groups have consulted with lawyers about how to block Gensler’s final moves, according to four people briefed on the matter. A lawsuit would probably be focused on CFTC guidance issued in July that described when the agency should defer its rules in favor of regulations by foreign derivatives overseers, the people said.

Gensler, 56, has fought a five-year battle with the industry over how to draw up a safer and more open marketplace for derivatives, the products that helped push the world economy to the precipice in 2008. He is trying to cement his legacy, said Fred Hatfield, a former Democratic CFTC commissioner.

MORE

Demeter

(85,373 posts)..."At what point does this stop?" he said, referring to record-setting fines for J.P. Morgan and other large banks. "We should all be concerned," he added, "because at a certain point people become immune to the numbers." ... It was surprising to hear J.P. Morgan's general counsel raise such questions just three days after the announcement of the bank's $13 billion settlement with the Justice Department and other agencies over soured mortgage securities. A person familiar with Mr. Cutler's thinking said he wanted to prompt a discussion about how regulators exercise their power in the future. The comments weren't the product of any personal frustration, the person said.

Acquiescence doesn't come easily to Mr. Cutler, a hard-nosed litigator still remembered for his pursuit of corporate wrongdoing while chief of enforcement for the Securities and Exchange Commission from 2001 to 2005. But the 52-year-old Mr. Cutler met his match in the bank's battle with the Justice Department. He advised J.P. Morgan Chairman and Chief Executive James Dimon that the New York company couldn't afford to play an extended game of chicken, people close to the talks recall. The reason: The U.S. government could potentially put the bank out of business with an indictment.

Instead, last week's settlement carried a record penalty and kept open the threat of a criminal investigation. People close to J.P. Morgan believe additional charges for selling shoddy mortgage securities are less likely. Mr. Cutler "followed the defense playbook by making a lowball offer initially" and asking for a release from criminal liability, said Michael Bresnick, who oversaw the government investigation when he was head of the Obama administration's financial-fraud enforcement task force. J.P. Morgan's top lawyer was "rebuffed at every turn," added Mr. Bresnick, now a partner at law firm Stein, Mitchell, Muse & Cipollone LLP in Washington. The Justice Department's lead negotiator on the case, Associate Attorney General Tony West, praised Mr. Cutler. "Steve is a worthy adversary," said Mr. West. "He and his team are talented professionals."

...........................

Mr. Cutler is worried about the recent escalation in fines for the largest U.S. banks, airing his views at Friday's panel discussion, which was hosted by trade group The Clearing House...J.P. Morgan's top lawyer also expressed concern about what he saw as duplicative behavior by multiple regulators.

"There has to be a better way to allocate government resources," he said, calling for a task force to study the issue.

SUCH TOUCHING CONCERN FOR THE GOVERNMENT! MUCH MORE GABBLE AT LINK, INCLUDING CUTLER'S REVOLVING DOOR TRIPS BETWEEN GOVERNMENT AND JPMORGAN...

Demeter

(85,373 posts)U.S. authorities are conducting a criminal investigation into whether several employees of JPMorgan Chase & Co tried to impede a regulatory investigation into alleged manipulation of power markets, according to multiple sources familiar with the matter.

The probe, which is in its early stages, is being conducted by the Federal Bureau of Investigation and prosecutors in Manhattan U.S. Attorney Preet Bharara's office. It comes after a JPMorgan subsidiary agreed on July 30 to pay a $410 million penalty to settle a manipulation case brought by the Federal Energy Regulatory Commission.

The sources said investigators aim to determine whether individuals at JPMorgan - including three Houston-based employees - gave regulators all the information they needed to investigate JPMorgan's power market deals in California and the Midwest.

Deliberately withholding information from investigators or lying during interviews conducted as part of an investigation is considered obstruction of justice, a criminal offense.

MORE

Demeter

(85,373 posts)The success of the Affordable Care Act could ultimately turn on the performance of an agency that has so far eluded the public spotlight amid the program’s tumultuous rollout.

Whether the new law can be enforced will be up to the Internal Revenue Service, an already beleaguered agency charged under the act with carrying out nearly four dozen new tasks in what represents the biggest increase in its responsibilities in decades. None is more crucial than enforcing the requirement that all citizens secure health insurance or pay a penalty.

But those efforts have been hampered by a one-year delay in applying new insurance regulations to large employers. Those employers had been expected to provide insurance coverage information that the IRS would use to help identify who has insurance and who does not.

While failures in launching the federal insurance Web site and online exchanges have thrust the Department of Health and Human Services to the center of public attention, the IRS also has a huge role in carrying out the law, including helping to distribute trillions of dollars in insurance subsidies and penalizing people who do not comply....Besides lacking coverage information that would help the agency enforce the “individual mandate,” the IRS also is hamstrung in penalizing those who do not sign up. The lawmakers who drafted the health-care law intentionally barred the IRS from using its customary tools for collecting penalties — liens, foreclosures and criminal prosecution. The only means of collecting the fine is to essentially garnish tax refunds for people who overpaid their taxes...

MORE THAN YOU CAN STAND AT LINK

Demeter

(85,373 posts)About three in ten of all Americans forgo getting medical treatment due to the high costs of U.S. health care, according to a new survey by Gallup. Unsurprisingly, the issue is even worse among people who don’t have access to health insurance. Three in five uninsured Americans skip out on care over cost concerns.

Americans pay significantly more out of their own pockets for medical care than residents of all other affluent nations, and correspondingly put off treatment at much higher rates than people in other wealthy countries.

Gallup’s new results are similar to those from its 2012 survey on the subject, and represent significantly higher numbers compared to a decade ago, when about 25 percent of Americans skipped on treatment. Gallup researchers speculate that even insured Americans must at times put off care due to the growing popularity of health care plans that push costs onto policy holders.

“One possible explanation for the higher numbers since then is the increase in the number of high-deductible plans,” wrote the authors. “Americans with serious conditions who have insurance may be putting off treatment to avoid high out-of-pocket costs.”

MORE

Demeter

(85,373 posts)

“If you wish to be a success in the world, promise everything, deliver nothing.” – Napoleon Bonaparte

After months of analysis I can objectively conclude that Obamacare is, to ordinary middle-class people, worse than worthless.

Under Obamacare, those not covered by their employers or Medicaid – a subset of the public consisting mainly of the self employed and people working for small businesses – wind up paying enormous subsidies to help the sick. In the case of my three-person Floridian family the subsidy rate – the difference between the cost to insure ourselves and the cost to insure sick people – is about 10.5% of gross earnings. That is not the cost for insurance; that is the cost over-and-above insuring one’s family. That cost will be lower for those on subsidies, approaching non-existent – because they are the ones receiving the transfer – but for my specific family, in my specific circumstances, my calculations show that figure is 10.5%, which is obscenely high.

No similar financial sacrifice is asked for nor required from people employed by companies with over 50 employees, or government workers, or from those who make slightly less income. Businesses also spread risk but, obviously, virtually everybody in the risk pool for a business is healthy enough to work, or they wouldn’t be in that pool. Conversely, the pool for the employed but under/uninsured includes all uninsurable people, which is almost the exact opposite.

I calculated the 10.5% subsidy figure by purchasing a private policy for my family while comparing rates and coverage to the Obamacare plans. I have researched the Obamacare plans extensively and, make no mistake, this new coverage is much better than the lowest cost Obamacare plans, even with its vastly lower cost. In fact, it is comparable to Obamacare plans that cost almost 3x as much. Let’s repeat that because it refutes the latest Big Lie: these plans, in the real world, for most people, are less expensive and oftentimes better than the “Affordable” Care Act plans.

MORE

Demeter

(85,373 posts)The key point to remember in all discussions of ObamaCare is that neither it, nor indeed the entire private health insurance “industry,” should exist. They are rent-seeking parasites, economic tapeworms. One does not improve a tapeworm; one removes it.

To understand this simple point, all we need to do is look north to Canada, where we see a single payer system — they call it “Medicare” — delivering equal or better health outcomes at dramatically lower cost, without a health insurance industry, and without ObamaCare’s bizarre, mystifying, and above all unfair Rube Goldberg-esque complexity. In fact, if we’d passed HR 676 in 2009, we would have saved hundreds of billions of dollars by now (more than enough to cover everyone) and thousands of lives, though ObamaCare apologists don’t like to talk much about the excess deaths that ObamaCare’s achingly slow rollout caused and is still causing.

So, the squillions and the deaths are two opportunity costs of going the ObamaCare route. But there are three other opportunity costs, each of which comes from the process of entrenching ObamaCare into our political economy, and making it harder to replace with anything better. So there are, as it were, three hooks by which the tapeworm fastens itself to the body of its host, before it begins to feed (or extract its rent).

The first and most obvious opportunity cost of ObamaCare could — if ObamaCare entrenches itself — be “government health care” (if we define, as most Americans would, government-run health care as like Medicare here or in Canada, where the government is the single payer, and not like the UK’s National Health Service, where doctors are government employees)...

MUCH MORE AT LINK...

Demeter

(85,373 posts)Your medical plan is facing an unexpected expense, so you probably are, too. It's a new, $63-per-head fee to cushion the cost of covering people with pre-existing conditions under President Barack Obama's health care overhaul.

The charge, buried in a recent regulation, works out to tens of millions of dollars for the largest companies, employers say. Most of that is likely to be passed on to workers.

Employee benefits lawyer Chantel Sheaks calls it a "sleeper issue" with significant financial consequences, particularly for large employers.

"Especially at a time when we are facing economic uncertainty, (companies will) be hit with a multi-million dollar assessment without getting anything back for it," said Sheaks, a principal at Buck Consultants, a Xerox subsidiary...

MORE

Demeter

(85,373 posts)

You’ve probably heard that every level of law enforcement (as well as our friends at the military NSA) is tracking cell phones — a lot. In many cases, these requests are conducted under authorities that grant prosecutors and police the power to conduct broad fishing expeditions into our private lives. No warrant? No problem.

But how many people are affected by this surveillance-gone-wild, exactly? Thanks to Massachusetts Democrat Ed Markey, we now have a much clearer window into the full picture.

Senator Ed Markey knows that advocacy groups like the ACLU can’t get accurate figures on precisely how often state, local, and federal law enforcement demand access to our private cell phone information. That’s because freedom of information laws don’t grant the public access to information held by private companies. Therefore the only way for the ACLU to request information like this is to ask police departments nationwide, department by department. We tried that a couple of years ago and got good results, but since we didn’t —and practically speaking, couldn’t — ask every single agency in the country for records, the results were a mere sampling. We couldn’t get raw numbers to understand exactly how common are these surveillance demands.

That’s why the Senator’s help is so, well, helpful. Using his gravitas as a member of congress, he has twice sent letters to cell phone companies asking them to disclose how many law enforcement demands they received in 2012, as well as details about those requests. The documents Senator Markey released today reaffirm what we learned from the last batch: police are very hungry for the revealing information about us held by our mobile phone carriers...

MORE

Demeter

(85,373 posts)Demeter

(85,373 posts)The Washington Post reports that the FBI has had the ability to secretly activate a computer's camera "without triggering the light that lets users know it is recording" for years now. What in the hell is going on? What kind of world do we live in?

Marcus Thomas, the former assistant director of the FBI's Operational Technology Division, told the Post that that sort of creepy spy laptop recording is "mainly" used in terrorism cases or the "most serious" of criminal investigations. That doesn't really make it less crazy (or any better) since the very idea of the FBI being able to watch you through your computer is absolutely disturbing.

The whole Post piece about the FBI's search for a bomb threat suspect is worth reading. It shows how far the FBI will go with its use of malware to spy on people and reveals the occasional brain dead mistakes the FBI makes to screw themselves over (like a typo of an e-mail address that the FBI wanted to keep tabs on). Good to know these completely competent folks are watching over us by any means necessary.

SOURCE LINK FOLLOWS

Demeter

(85,373 posts)MUST READ THE WHOLE THING! HERE'S THAT END...

Critics contend that activating any kind of kill switch will do more harm than good. “I find it hard to imagine why an Internet kill switch would ever be a good idea, short of some science fiction scenario wherein the network comes alive a la Terminator/Skynet,” Feld says. “At this point, so much of our critical infrastructure runs on the Internet that a ‘kill switch’ would do more harm than anything short of a nuclear strike. It would be like cutting off our own head to escape someone pulling our hair.” The same argument applies to smothering cellphone service. “The benefit of people being able to communicate on their cellphones in times of crisis is enormous and cutting that off is in and of itself potentially very dangerous,” argues Eva Galperin of the Electronic Frontier Foundation.

Has the government ever turned off cell phones or the Internet? Yes — but the only known reports concern cell service. In 2005, shortly after suicide bombers attacked the London tube, federal authorities disabled cell networks in four major New York tunnels. The action was reportedly taken to prevent bomb detonation via cellphone and according to a National Security Telecommunications Advisory Committee review, it “was undertaken without prior notice to wireless carriers or the public.” (In an April statement to Mother Jones, Verizon denied have any role in shutting down cell service in New York.) In 2009, during Obama’s inauguration, the feds used devices that blocked cellphones from receiving signals to prevent bomb detonation. In 2011, officials for the San Francisco transit system cut off cellphone service in four Bay Area Rapid Transit stations for several hours to preempt a planned protest over BART police fatally shooting a homeless man.

What are the constitutional problems? Civil liberties advocates argue that kill switches violate the First Amendment and pose a problem because they aren’t subject to rigorous judicial and congressional oversight. “There is no court in the loop at all, at any stage in the SOP 303 process,” according to the Center for Democracy and Technology. ”The executive branch, untethered by the checks and balances of court oversight, clear instruction from Congress, or transparency to the public, is free to act as it will and in secret.” David Jacobs of EPIC says, “Cutting off communications imposes a prior restraint on speech, so the First Amendment imposes the strictest of limitations…We don’t know how DHS thinks the kill switch is consistent with the First Amendment.” He adds, “Such a policy, unbounded by clear rules and oversight, just invites abuse.”

What don’t we know about the kill switch plan? A lot. We don’t know the “series of questions” that help DHS determine whether it should activate a kill switch, how DHS will go about implementing the kill switch, how long a shutdown will last and what the oversight protocols are. For example, Jacobs from EPIC says that, it appears that “DHS wouldn’t have to call up the president to implement this, he would be involved in the same indirect way that he is with all kinds of executive branch actions.” This information was requested in the FOIA lawsuit filed by (EPIC) and could be revealed as early as December. “Hopefully exposure of such a lunatic idea will allow the public to beat some common sense into these agencies,” says Feld.

Dana Liebelson is a reporter in Mother Jones’ Washington bureau.

Demeter

(85,373 posts)Over the last few months, we've been bombarded with revelation after revelation about the NSA's unprecedented spying on Americans. But, according to The New York Times, the NSA's untethered snooping is eclipsed by the agents fighting in a war that began long before 9/11: the costly and failed War on Drugs.

The Drug Enforcement Administration's secret Hemisphere Project, news of which broke this week, allows drug law enforcement agencies broad access to billions of AT&T phone records going back a quarter century—to 1987. As The New York Times explained, "the scale and longevity of the data storage appears to be unmatched by other government programs, including the N.S.A.'s gathering of phone call logs under the Patriot Act."

Our government's mass telephonic data-mining has sparked immense and deserved outrage. But to those who have been targeted by the War on Drugs for the last several decades, the Hemisphere Project is only one in a long line of privacy-invading tactics employed by the U.S. government. Many other intrusions – such as the thousands of unconstitutional stops-and-frisks of people of color in cities across the country, the countless doors kicked in by police in search of drugs, the seizure and forfeiture of property of people never convicted of a crime – are representative of the kinds of common corporal intrusions that have been endured by many Americans, disproportionately of color, long before many post 9/11-era invasions of privacy became commonplace for all Americans.

Further, since 9/11, there has been an increasingly entrenched relationship between overreaching national security programs and domestic drug law enforcement policies. Each has fed on the other: the long-running drug war provided useful surveillance blueprints for the massive domestic spying programs that have sprouted up since 9/11. At the same time, domestic drug law enforcement agencies have seized upon the dismantling of basic constitutional protections over the past decade – in the name of national security – and pointed the resulting weapons toward America's own citizens....

Demeter

(85,373 posts)Canada plans to make a claim to the North Pole in an effort to assert its sovereignty in the resource-rich Arctic, the country's foreign affairs minister said Monday.

John Baird said the government has asked scientists to work on a future submission to the United Nations claiming that the outer limits of the country's continental shelf include the pole, which so far has been claimed by no one.

MORE

Demeter

(85,373 posts)A top secret document retrieved by American whistleblower Edward Snowden reveals Canada has set up covert spying posts around the world and conducted espionage against trading partners at the request of the U.S. National Security Agency.

The leaked NSA document being reported exclusively by CBC News reveals Canada is involved with the huge American intelligence agency in clandestine surveillance activities in “approximately 20 high-priority countries."

Much of the document contains hyper-sensitive operational details which CBC News has chosen not to make public.

Sections of the document with the highest classification make it clear in some instances why American spymasters are particularly keen about enlisting their Canadian counterparts, the Communications Security Establishment Canada.

"CSEC shares with the NSA their unique geographic access to areas unavailable to the U.S," the document says.

MORE

Demeter

(85,373 posts)http://www.emptywheel.net/2013/12/08/former-top-nsa-officials-insist-employees-are-leaving-because-obama-is-mean-not-because-they-object-to-nsas-current-activities/

“The agency, from top to bottom, leadership to rank and file, feels that it is had no support from the White House even though it’s been carrying out publicly approved intelligence missions,” said Joel Brenner, NSA inspector general from 2002 to 2006. “They feel they’ve been hung out to dry, and they’re right.”

A former U.S. official — who like several other former officials interviewed for this story requested anonymity because he still has dealings with the agency — said: “The president has multiple constituencies — I get it. But he must agree that the signals intelligence NSA is providing is one of the most important sources of intelligence today.

“So if that’s the case, why isn’t the president taking care of one of the most important elements of the national security apparatus?”

[snip]

A second former official said NSA workers are polishing up their résumés and asking that they be cleared — removing any material linked to classified programs — so they can be sent out to potential employers. He noted that one employee who processes the résumés said, “I’ve never seen so many résumés that people want to have cleared in my life.”

Morale is “bad overall,” a third former official said. “The news — the Snowden disclosures — it questions the integrity of the NSA workforce,” he said. “It’s become very public and very personal. Literally, neighbors are asking people, ‘Why are you spying on Grandma?’ And we aren’t. People are feeling bad, beaten down.”

www.washingtonpost.com/world/national-security/nsa-morale-down-after-edward-snowden-revelations-former-us-officials-say/2013/12/07/24975c14-5c65-11e3-95c2-13623eb2b0e1_story.html?ref=hp

Does “still have dealings with the agency” mean these people still contract to it, indirectly or directly? If it does, how much of this contracting works through The Chertoff Group, where a slew of former officials seem to have had remarkably consistent interests in spreading this line for months? Nakashima might want to provide more details about this in any future of these stories, as it may tell us far more about how much these men are profiting for espousing such views.

After all, while they do provide evidence that NSA employees are leaving, they provide only second-hand evidence — evidence that is probably impossible for any of these figures to gain in depth personally — that the issue pertains to Obama’s response. And there are at least hints that NSA employees might be leaving for another reason: they don’t want to be a part of programs they’re only now — thanks to compartmentalization — learning about

We can look to the two letters the NSA has sent to “families” of workers for such hints. The first, sent in September (page one, page two, h/t Kevin Gosztola), got sent just 3 days after the release of documents showing NSA had been violating just about every rule imposed on the phone dragnet for the first three years it operated (partly, it should be said, because of Joel Brenner’s inadequate oversight at its inception). In the guise of providing more context to NSA employee family members about that and recent disclosures, Keith Alexander and John Inglis wrote,

Some media outlets have sensationalized the leaks to the press in a way that has called into question our motives and wrongly cast doubt on the integrity and commitment of the extraordinary people who work here at NSA/CAA — your loved one(s). It has been discouraging to see how our Agency frequently has been portrayed in the news as more of a rogue element than a national treasure.

[snip]

However, we are human and, because the environment of law and technology within which we operate is so complex and dynamic, mistakes sometimes do occur. That’s where the unique aspect of our culture comes into play. We self-report those mistakes, analyze them, and take action to correct the root causes.

Of course, the phone dragnet problems were not a mistake at all. Rather, they stemmed from the NSA retaining many, if not all, the aspects of the illegal phone dragnet it replaced, even though the FISA Court authorization did not permit many aspects of that earlier program. But Keith Alexander, who almost certainly knew that, and at the very least oversaw the retention of those earlier illegal aspects of the program, felt the need to hand his employees (the overwhelming majority of whom were not read into the phone dragnet) a program ostensibly telling others a narrative that is pretty demonstrably false, all to convince the collective audience that the NSA wasn’t a rogue agency.

Then the NSA used the occasion of Thanksgiving to send another plaintive case, ostensibly to “family and close friends” of NSA employees...

NSA performs its mission the right way — lawful, compliant, and in a way that protects civil liberties and privacy.

NSA analysts do not decide what topics to work. They respond directly to requirements driven by the President’s Intelligence Priorities, documented in the National Intelligence Priorities Framework and managed by the Office of the Director of National Intelligence.

NSA does not target U.S. citizens or permanent resident aliens unless that targeting is premised on a finding or probable cause to believe that the person is a foreign power or the agent of a foreign power. NSA’s activities are governed and constrained by law and policy. We operate under oversight by all three branches of government: legislative, judicial, and executive.

NSA does not and will not steal industry secrets in order to give U.S. companies a competitive advantage.

NSA does not and will not demand changes by any vendor to any product, nor does it have any authority to demand such changes.

MORE WHINING AND JUSTIFICATION AT LINK

Demeter

(85,373 posts)What Constitution? on December 8, 2013 at 4:03 pm said:

I like reading the quote attributed to Joel Brenner concerning NSA minions: “They feel they’ve been hung out to dry, and they’re right.” That, right there, is the practical application of the Mission Impossible Rule: “… the Secretary will disavow any knowledge of your actions.”

Of course, this is only being applied at the “minion” level — the policymakers just lie with impunity and keep their jobs, while the minions take the flak but do, at least, receive a jolly “buck up” from their fearless, albeit anonymous, leaders. I believe it was Pink Floyd who noted “the generals sat and the lines on the map moved from side to side….”

Hear, hear, Rep. Sensenbrenner! Let’s fire and prosecute Clapper!

The ‘beauty’ of the NSA is that you don’t have to send them an email to let them know what you think of them … you can address it to anyone … they read everyone’s mail.

So I made a little signature I attach to all my emails, reminding them of the reality of their situation. I’m sure they’ve circled the waggons at Fort Meade and all their other locations, and are piping in ” we are freedom’s champions ! ” 24/7/365.25 … it’s incumbent upon us all to tunnel the truth in.

They can’t turn it off … without ceasing their criminal activities.

I look upon that as a win-win for the people versus their criminal corporate conspiracy !

Wouldn’t hurt if everyone took a crack at a ‘Hi NSA … you’re the criminal, not me !’ email signature.

–

Hi there, NSA ‘analysts’, in-house and/or contracted.

Just reminding you that if you are reading this you are committing a crime, that you are felons mocking the 4th Amendment of our US Constitution …

“The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated, and no warrants shall issue, but upon probable cause, supported by oath or affirmation, and particularly describing the place to be searched, and the persons or things to be seized.”

… and that someday, really soon I hope, you’re going to have to pay for your crimes.

You’re breaking international laws as well, so if you’re thinking of the ‘I was only following orders!’ defense … Please see Nuremberg Principle IV …

“The fact that a person acted pursuant to order of his Government or of a superior does not relieve him from responsibility under international law, provided a moral choice was in fact possible to him”.

… and start exercising your moral choice. Look upon Thomas Andrews Drake and Edward Snowden as your exemplars and Patron Saints.

I mean … we all have to make a buck. But we don’t have to drone mothers and children in Af/Pak/Yemen or work for the NSA to do it. Chelsea Manning just said no, Edward Snowden just said no, we all need … not to look up … but to look among our brothers and sisters for inspiration.

William Ockham on December 8, 2013 at 9:19 pm said:

Those employee communications were serious blunders. Either management knew they had already lost the confidence of most employees and were just trying to keep the true believers bamboozled or they believe their own bullshit and have no idea that most employees will see right through that crap. Based on my experience with big orgs, I would bet on option two.

Demeter

(85,373 posts)THEN THEY OUGHT TO TALK TO THE RETIREES OF DETROIT FIRST, TO SEE HOW THAT DOESN'T WORK....

http://www.usnews.com/news/articles/2013/12/03/some-nsa-opponents-want-to-nullify-surveillance-with-state-law

Activists say legislation can cut water, kill snooping at Utah Data Center...The National Security Agency has an Achilles heel, according to some anti-surveillance activists. The key vulnerability, according to members of the OffNow coalition of advocacy groups: The electronic spy agency's reliance on local utilities.

The activists would like to turn off the water to the NSA's $1.5 billion Utah Data Center in Bluffdale, Utah, and at other facilities around the country.

Dusting off the concept of "nullification," which historically referred to state attempts to block federal law, the coalition plans to push state laws to prohibit local authorities from cooperating with the NSA. Draft state-level legislation called the Fourth Amendment Protection Act would – in theory – forbid local governments from providing services to federal agencies that collect electronic data from Americans without a personalized warrant.

No Utah lawmaker has came forward to introduce the suggested legislation yet, but at least one legislator has committed to doing so, according to Mike Maharrey of the Tenth Amendment Center. He declined to identify the lawmaker before the bill is introduced...

Demeter

(85,373 posts)IT'S OFFICIAL:TIME TO PANIC, THEN

http://www.bloomberg.com/news/2013-12-06/fukushima-radiation-to-reach-u-s-coast-at-safe-levels-nrc-says.html

Water exposed to radiation from Japan’s wrecked Fukushima atomic plant will reach the U.S. at safe levels, the chairwoman of U.S. Nuclear Regulatory Commission, said as the first isotopes linked to the plant near the West Coast.

“The highest amount of radiation that will reach the U.S. is two orders of magnitude -- 100 times -- less than the drinking water standard,” Allison Macfarlane said in Tokyo today. “So, if you could drink the salt water, which you won’t be able to do, it’s still fairly low.”

The impending arrival of water exposed to the March 2011 accident at Tokyo Electric Power Co. (9501)’s Dai-Ichi plant to the U.S. West Coast has prompted concerns about health impacts. Council members in the San Francisco Bay Area city of Fairfax yesterday passed a resolution calling for more testing of coastal seafood and for international experts to work on reducing radiation emissions from the Japanese plant.

Radiation released during explosions at the plant meltdowns and during subsequent leaks of contaminated underground water will reach mainland U.S. shores by early 2014, according to Woods Hole Oceanographic Institution senior scientist Ken Buesseler.

MORE BS

Demeter

(85,373 posts)Outdoor radiation levels have reached their highest at Japan’s Fukushima nuclear plant,warns the operator company.Radiation found in an area near a steel pipe that connects reactor buildings could kill an exposed person in 20 minutes,local media reported.

The plant’s operator and the utility responsible for the clean-up Tokyo Electric Power Company (TEPCO) detected record radiation levels on a duct which connects reactor buildings and the 120 meter tall ventilation pipe located outside on Friday. TEPCO measured radiation at eight locations around the pipe with the highest estimated at two locations - 25 Sieverts per hour and about 15 Sieverts per hour, the company said.

This is the highest level ever detected outside the reactor buildings, according to local broadcaster NHK. Earlier TEPCO said radiation levels of at least 10 Sieverts per hour were found on the pipe.

The ventilation pipe used to conduct radioactive gasses after the nuclear disaster may still contain radioactive substances, TEPCO added...

MORE

Demeter

(85,373 posts) ?1386576063

?1386576063

At Economix in The New York Times, Nancy Folbre presents some sobering news Monday that is reflected in those two charts above:

The gap between the median earnings of high school graduates and those with a bachelor’s degree or higher – the red versus the purple lines in the graphs above – remains wide. The difference, over a lifetime, is more than enough to justify the expense of attaining a bachelor’s degree.

Here’s the bad news: Adjusted for inflation, median earnings for young men with a bachelor’s degree or higher in 2011 were significantly lower than they were in 1971. Young women have slightly improved their position (by $630) since 1971. But as a comparison between the two graphs shows, their median is still lower than that of male high school graduates in 1971.

And then there's the fact that earnings for college graduates aged 25-34 have fallen some 15 percent since 2000.

As Folbre notes: "Does anyone seriously believe that college graduates today are less skilled or less productive than they were in 1971?"

Behind this are many factors, but a key one is globalization, that race to the bottom that pits Americans with a college education against those in China or India who will work for wages that are only a fraction of those in the industrially developed nations. There are apologists who claim that this situation inevitable, that it is the natural order and that the solution is for college freshmen to give themselves a better chance at higher earnings by choosing the right major, preferably science, technology, engineering and math (STEM). Industry claims that it can't find enough graduates with the right degrees, which is the excuse corporations deploy to justify lobbying for more guestworkers.

As a consequence, American students who choose "the right major" find that is no guarantee they will earn more because nearly half the jobs in those fields are being filled by guestworkers. A study by the Economic Policy Institute found:

• Currently, only one of every two STEM college graduates is hired into a STEM job each year

• Policies that expand the supply of guestworkers will discourage U.S. students from going into STEM, and into IT in particular [...]

Despite a steady supply of U.S. STEM graduates, guestworkers make up a large and growing portion of the workforce, specifically in information technology occupations and industries. IT employers look to guestworker programs as a source of labor that is plentiful even at wages that appear to be too low to attract large numbers of the best and brightest domestic students.

We have jobs flowing overseas, we have guestworkers filling up to half the good jobs and, nearly four-and-a-half years after the Great Recession, we have a wretched recovery in which the median wage is still $1,000 below what it was in 2007, when that recession began. Meanwhile, a third of college graduates are working in fields that don't require a college education of any kind, much less one in STEM...

PRESCRIPTIONS AT LINK

Demeter

(85,373 posts)Many are leaving it to the last minute to tell the Swiss financial regulator whether they will participate in a U.S. programme to settle tax evasion suspicions that could trigger large fines and force them to identify U.S. customers suspected of using their Swiss accounts to dodge taxes.

Listed banks which participate in the programme could start telling investors from next week whether or not they have to take provisions against possible fines.

If they do not settle, individual banks and their senior staff risk criminal prosecution and, if a large number refuse to cooperate, it could hold up a future settlement for around a dozen of Switzerland's largest banks, including Credit Suisse , Julius Baer, Pictet, and local government-backed Zuercher Kantonalbank (ZKB).

Most of the 300 or so smaller banks are expected to participate but they are anxious to find out what others are doing and wrestling with the risk of giving up client confidentiality, which could put off customers.

"Probably a few dozen will risk being pursued by the U.S. later and stay out of the current programme altogether," said a lawyer involved in bank talks.

MORE

Demeter

(85,373 posts)...When the mortgage mess was a hotter topic than it has been of late, we would write from time to time about the second mortgage time bomb sitting at the major banks, particularly Bank of America. Unlike first mortgages, which were in the overwhelming majority of cases securitized and sold to investors, banks in the overwhelming majority of cases kept second liens (which in pretty much all cases were home equity lines of credit, or HELOCs) on their books).

This arrangement led to tons, and I mean tons, of abuses, which regulators chose to ignore or worse, actively promoted. Second liens, as the name implies, have second priority to first liens. In a bankruptcy or resturcturing, they are to be wiped out entirely before the first lien is touched (“impaired” as they say).

But the banks that had HELOCs on their books were often the servicer of the related first liens. And even though they had a contractual obligation to service those first liens in the interest of the investors, they’d predictably watch out for their own bottom line instead. For instance, if a borrower was deeply underwater, it would make sense to at least partially write down the second. If the borrower was delinquent, the servicer should write off the second and restructure (aka modify) the first mortgage. But instead you’d see banks use their blocking position as second lien holder to obstruct mortgage modifications. Worse, Bill Frey of Greenwich Financial documented that Bank of America had modified subprime mortgages securitized by Countrywide (as in reduced their value) without touching the seconds, a clear abuse (notice that this issue was raised in the BofA mortgage settlement, and bank crony judge Barbara Kapnik looks almost certain to sweep it under the rug).

Regulators played a direct hand in this chicanery. If the regulators had forced the banks to write down HELOCs, banks would have much less incentive to try to wring blood out of the turnip of underwater borrowers (particularly if the regulators had made clear they took a dim view of that sort of thing). But the authorities were far more concerned about preserving the appearance of solvency of the TBTF players....

THAR SHE BLOWS! MORE AT LINK

Demeter

(85,373 posts)somebody stop me, before I post again!

DemReadingDU

(16,000 posts)I hardly find time to read thru the daily stock market watch postings

Demeter

(85,373 posts)Plus, things got pretty hot and heavy this summer and fall. It stimulated the newsletters to get longer and more complicated.

Demeter

(85,373 posts)The Department of Agriculture ... approved four Chinese poultry processors to begin shipping a limited amount of meat to the United States, a move that is likely to add to the debate over food imports. Initially, the companies will be allowed to export only cooked poultry products from birds raised in the United States and Canada. But critics predicted that the government would eventually expand the rules, so that chickens and turkeys bred in China could end up in the American market.

“This is the first step towards allowing China to export its own domestic chickens to the U.S.,” said Tony Corbo, the senior lobbyist for Food and Water Watch, an advocacy group that works to promote food safety.

The U.S.D.A.’s decision follows years of wrangling over the issue, and comes as Americans are increasingly focused on the origin of their food. In recent years, imports have been the source of contamination, prompting broader worries about food safety. The Food and Drug Administration just released an analysis of imported spices, showing high levels of salmonella in coriander, oregano, sesame seeds and curry powder.

China does not have the best track record for food safety, and its chicken products in particular have raised questions. The country has had frequent outbreaks of deadly avian influenza, which it sometimes has been slow to report. Recently, an F.D.A. investigation tied the deaths of more than 500 dogs and a handful of cats to chicken jerky treats that came from China. The treats, which were eventually recalled, additionally were blamed for sickening more than 2,500 animals...

READ IT ALL....NOT GOOD NEWS

Demeter

(85,373 posts)The Director of National Intelligence has now responded to the unveiling of the fact that the NSA inserted backdoors in various forms of encryption and recruited internal spies at telco companies with one of his typically ridiculous statements using carefully parsed words. It sounds like the NSA rushed out that statement, because the attempt to assure the public that it's just being used on bad people leaves open a pretty large loophole. See if you can spot it:

Throughout history, nations have used encryption to protect their secrets, and today, terrorists, cybercriminals, human traffickers and others also use code to hide their activities. Our intelligence community would not be doing its job if we did not try to counter that.

Highlighting added by me. Here's a tip: when trying to reassure the public that you're not abusing your powers, and that you're breaking basic encryption used widely across the internet for their own good by narrowly targeting whom it's used against, maybe (just maybe) don't include a hedge word that includes every human being on earth...MORE

Demeter

(85,373 posts)VIDEO AND TRANSCRIPT AT LINK

http://www.informationclearinghouse.info/article36132.htm

Demeter

(85,373 posts)When the great recession of 2008 struck, it hit some of us harder than others. Middle class families, the poor, people of color and the workers of America suffered the most, while those that caused the crisis were largely unscathed -- many even increased their wealth. Today, when we are in danger of going over the notorious fiscal cliff, some repeatedly speak of 'shared sacrifice.' But when the top 2 percent were enjoying their tax breaks and stockpiling their prosperity, there was no sharing with the masses. And instead, these individuals and groups now have the audacity to ask seniors, minorities, folks whose children fought in our wars, the disenfranchised and the most vulnerable among us to sacrifice some more. Does that seem fair to you?

...............................................................

Back in 1988, George H.W. Bush won approximately 61 percent of the White vote and was swept into office. In 2012, Mitt Romney won about the same percentage of White voters and lost. The demographics of the country have undeniably changed. There's a new America and a new electorate. And those who do not comprehend this notion will continue losing support and continue losing elections. Any further negotiations regarding the looming fiscal cliff must also keep this new America in mind.

The new majority of Americans -- Blacks, Whites, Latinos, gays/lesbians, seniors -- cannot pay the bill of the elite 2 percent by having 'entitlement programs' that they disproportionately depend on eliminated or cut, while we continue to give tax breaks to those that have benefited the most from those tax loopholes. In a recent speech in Atlanta, Chairman of the Federal Reserve Ben Bernanke even stated that communities of color must be included on the road to recovery and that they have suffered extensively during these tough economic times, especially with regards to home ownership.

With limited time remaining for talks about the fiscal cliff, the degrading language and the blame game will likely fire up. They will try to paint the new America, the majority of us, as somehow lazy or jealous of their wealth. But it is the majority that played by the rules, paid into Medicare, into Social Security and into other essential programs, and yet still suffered the most while the ones who caused the financial crisis continued to enjoy their tax breaks and amass their riches.

Simply put: if we did not share in the prosperity, then we should not be asked to share in the sacrifice. Period. The New America spoke on Election Day and we want the 2 percent to make sure they hear us now.

snot

(10,530 posts)Demeter

(85,373 posts)THIS HAS "BLOCKBUSTER MOVIE" WRITTEN ALL OVER IT

Demeter

(85,373 posts)Want to know a dirty little secret? Our stock markets no longer work.

They have grown so complex, fragmented and opaque that they don’t serve their stated purpose. Rather than a place where individual and professional investors can put a value on shares and where companies go to raise capital, the markets today look more like a video game. The trouble is, it’s one where only a few understand all the rules.

Excessive complexity has costs. Individuals, wary of an uneven playing field, may choose not to invest. Long-term investors, frustrated by a market that doesn’t value their participation, may take their trading to overseas venues or alternative private networks. Companies, unaccustomed or unprepared for the amount of work needed to go public, may look for other forms of capital, such as debt or private equity.

Capital markets work best when all the participants -- investors and companies -- come together in one place. Although everyone may not have the same interests, at least there is an understanding that a common set of rules exists.

Today, you need a super computer or a doctorate to understand the rules of the stock market. So it isn’t surprising that there is a perception that you, your neighbors and others have no chance of getting a fair price in the market. For example, why go to a store if you think there are two prices -- one for the regular person and one for those with inside knowledge?

MORE

Demeter

(85,373 posts)The recent US presidential election found the Republican Party on the losing end of a political and economic argument. It was Mitt Romney’s contention, both privately and implicitly when he selected Ayn Rand enthusiast Paul Ryan as his running mate, that 47% of the electorate was dependent on government handouts and therefore had no intention of voting for any Republican who threatened to reduce government entitlement spending. Mitt Romney after the election “doubled down” on this statement, insisting that Obama voters were bought off by government largesse.

Romney was defeated handily in the public vote – he achieved, ironically, slightly less than 47.5% of the popular vote – and he was thrashed in the Electoral College vote, which is what really matters. These results are being interpreted by the press and the pundits as a repudiation of Republican policies, and a rebuke to Mitt Romney for his perceived insult to Obama voters that they are lazy and, like parasites, live off the hard work of others.

The problem with this view is that Romney was half-right: there is a dependency class in America, and they do tend to vote Democratic. He was wrong on his interpretation of the motives and work ethic of this dependency class. One man’s handout, after all, can be another man’s means of survival. He was also wrong on his campaign promise to fix this situation by creating millions of jobs so that the moochers and parasites will have no excuse but to find work when the entitlement payouts end. Obama was wrong on this as well; no politician can pretend that they have some magic tool to create millions of jobs and return entitlement payouts to more sustainable levels. Not only is this not possible, but as I will contend here, such thinking makes the problem worse. The dependency class in America is growing, and it is here to stay for many decades into the future. It is a consequence of decades of government and business policies that let such an infra-class arise, and it is a consequence of very long term economic and social forces that operate on a global basis and are beyond the control of any one country. The United States is turning into a third world country, complete with vast pockets of poverty and idleness, and a small elite that dominates wealth and income. A dependency class is a prime feature of third world countries, and the political party which most successfully caters to this dependency class is more than likely to enjoy decades of political power.

The Rise of the Dependency Class

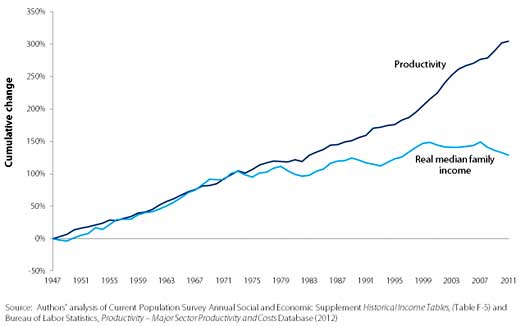

The creation of the dependency class can be linked to the oil price shocks of the early 1970s. Up until this point, real personal income followed an upwards trajectory that was in line with productivity, which implies that labor was benefiting from improvements in productivity as much as corporations were. This link was broken around 1975. Productivity continued on an upwards path, but real personal income began to stagnate.

A MUST READ! MUCH MORE AT LINK

Demeter

(85,373 posts)Charles Krauthammer is upset that Dick Durbin says Social Security is off the table in the fiscal cliff negotiations because it doesn't add to the deficit:

What Krauthammer means is that as Social Security draws down its trust fund, it sells bonds back to the Treasury. The money it gets for those bonds comes from the general fund, which means that it does indeed have an effect on the deficit. That much is true. But the idea that the trust fund is a "fiction" is absolutely wrong. And since this zombie notion is bound to come up repeatedly over the next few weeks, it's worth explaining why it's wrong. So here it is.

Starting in 1983, the payroll tax was deliberately set higher than it needed to be to cover payments to retirees. For the next 30 years, this extra money was sent to the Treasury, and this windfall allowed income tax rates to be lower than they otherwise would have been. During this period, people who paid payroll taxes suffered from this arrangement, while people who paid income taxes benefited.

Now things have turned around. As the baby boomers have started to retire, payroll taxes are less than they need to be to cover payments to retirees. To make up this shortfall, the Treasury is paying back the money it got over the past 30 years, and this means that income taxes need to be higher than they otherwise would be. For the next few decades, people who pay payroll taxes will benefit from this arrangement, while people who pay income taxes will suffer. If payroll taxpayers and income taxpayers were the same people, none of this would matter. The trust fund really would be a fiction. But they aren't. Payroll taxpayers tend to be the poor and the middle class. Income taxpayers tend to be the upper middle class and the rich. Long story short, for the past 30 years, the poor and the middle class overpaid and the rich benefited. For the next 30 years or so, the rich will overpay and the poor and the middle class will benefit.

The trust fund is the physical embodiment of that deal. It's no surprise that the rich, who didn't object to this arrangement when it was first made, are now having second thoughts. But make no mistake. When wealthy pundits like Krauthammer claim that the trust fund is a fiction, they're trying to renege on a deal halfway through because they don't want to pay back the loans they got. As it happens, I think this was a dumb deal. But that doesn't matter. It's the deal we made, and the poor and the middle class kept up their end of it for 30 years. Now it's time for the rich to keep up their end of the deal. Unless you think that promises are just so much wastepaper, this is the farthest thing imaginable from fiction. It's as real as taxes.

Demeter

(85,373 posts)I wrote a post saying flatly, "We don't suffer from runaway spending." Our only long-term problems are an aging population and rising health care costs. That's it. In case you, or a conservative loved one, doesn't believe this, here's a chart I posted last year that tells the basic story of federal spending:

First off, notice that total federal spending is down—not up—from its peak during the Reagan-Bush years. More specifically, the category that contains domestic discretionary spending and miscellaneous mandatory spending ("Other"

Interest expense is also down. Defense spending swelled back up to late-80s levels after 9/11, but is otherwise down over the long term too. And Social Security spending is pretty flat, though it will go up a point or two over the next few decades before it levels out again. The only category that's on a long-term upward slope is Medicare.

In other words, we don't have a discretionary spending problem. We don't have an interest expense problem. Once we withdraw from Afghanistan we don't have a big defense spending problem. And Social Security, at worst, is a very small and very manageable problem. Our only serious problem is Medicare, thanks to an aging population and rising health care costs. That's it. End of story. If you actually care about federal spending, that's the only thing you should be focused on. Pundits and talking heads who complain generically about "out-of-control spending" are either (a) ignorant of basic budget facts or (b) engaged in agitprop.

NOTE: This chart deliberately stops at 2008 in order to show historical trends more clearly. The numbers in the chart have spiked over the past four years because the recession has temporarily depressed GDP and temporarily increased spending, but that spike will disappear naturally as the economy recovers—just as it has after every other recession. It's not an indication of a long-term spiral in federal spending.

snot

(10,530 posts)and it's not even Wed. yet.

Demeter

(85,373 posts)it's been a rough time. I gave up today, stayed home out of the cold, with a virus...

snot

(10,530 posts)look like a abject do-nothing.

Take care of yourself!

Demeter

(85,373 posts)http://www.dailymail.co.uk/news/article-2245682/Nicholas-Deak-Colleague-questions-murder-CIA-financier-killed-homeless-woman.html#ixzz2EdXWTt9k

Nearly 30 years after a former CIA money changer was murdered by a homeless bag lady, new details have emerged that suggest he may actually have been assassinated.

Nicholas L. Deak was nicknamed the 'James Bond of money,' for his suave, confident air and his central role in the 'black ops' world of clandestine CIA operations from World War II until the 1980s.

Following the war, the CIA helped him found Deak-Perera as a front company to help it move money around the world, funding armed coups and friendly regimes, all while insulating the US government.

Deak, a Ph.D. economist, also built it into a legitimate bank, offering foreign currency trades - including American families who often bought its bundled packs of French francs and German marks....

FASCINATING STORY CONTINUES AT LINK

xchrom

(108,903 posts)BERLIN (AP) -- Germany's Economy Ministry says the country will see "moderate growth at most" in the fourth quarter after industrial production declined in October.

In its monthly report issued Wednesday, the ministry said conditions have improved for an upswing carried by domestic demand but significant risks remain, most of them from abroad.

Quarter-on-quarter growth in Germany, Europe's biggest economy, slowed to 0.3 percent in the third quarter from 0.7 percent in the April-June period. Though its recent performance has been unspectacular, it's better than most in the euro area and it's expected to accelerate next year.

Official data this week showed that German exports and imports grew in October but industrial production was down 1.2 percent compared with the previous month, a second consecutive fall. Industrial orders were also down.

xchrom

(108,903 posts)NICOSIA, Cyprus (AP) -- Cyprus has earmarked 340 million euros ($467.5 million) to help combat joblessness, which is expected to peak next year at over 19 percent in the bailed-out country.

President Nicos Anastasiades says 300 million euros - half of which will come from the European Investment Bank - will be channeled to commercial banks for low-interest loans to small- and medium-sized businesses.

Some 7 million euros will help subsidize one existing employee's salary for 10 months at each of 1,000 retail businesses. The government will also pay half the salary of newly-hired jobless persons in the sector for six months.

Another 8.5 million euros will be used to support 2,500 university graduates under 35 to gain six months-worth of workplace experience.

xchrom

(108,903 posts)LONDON (AP) -- Financial markets were sluggish Wednesday as investors remained focused on the prospect of a reduction in the U.S.'s monetary stimulus.

An apparent budget deal in the U.S. Congress failed to have much of an impact even though it would mean another partial shutdown of the U.S. government will be avoided. Most interest rests on the U.S. debt ceiling, which has to be raised early next year to avoid a debt default.

A week ahead of the next policy meeting of the Federal Reserve, investors appear to be holding back from making big trading decisions.

Following a run of solid economic data, particularly with regard to the labor market, there's a growing expectation in the markets that the Fed will decide to start reducing its $85 billion worth of financial asset purchases.

xchrom

(108,903 posts)***SNIP

Here are questions and answers about the Volcker Rule:

Q: What is it?

A: The Volcker Rule is a key plank of a financial regulation law enacted in 2010 to try to reduce the likelihood of another crisis and a resulting government bailout. The rule is intended to bar banks from trading for their own profit. This activity is known as proprietary trading. It's become a huge money-making machine for mega Wall Street banks, like Goldman Sachs, JPMorgan Chase and Morgan Stanley. Under the rule, the banks will be required to trade mainly on their clients' behalf.

Still, if it were that simple, the final draft would be a lot shorter than its roughly 920 pages - about as long as Dostoyevsky's "The Brothers Karamazov." The rule left to regulators the burden of finalizing the fine print.

Besides curbing proprietary trading, the Volcker Rule limits banks' investments in hedge funds and private equity funds, which are high-risk, lightly regulated investment pools.

The rule is named for Paul Volcker, a former Federal Reserve chairman who was an adviser to President Barack Obama during the financial crisis. Volcker urged a ban on high-risk trading by big banks to diminish the likelihood that taxpayers might have to rescue them, as they did after the financial crisis.

Q: Where are the complications?

A: The ban on proprietary trading isn't absolute. There are exemptions. One involves an important activity called market making. When big banks engage in market making, they use their own money to take the opposite side of a customer's trade: They buy or sell an investment to help execute the trade.

xchrom

(108,903 posts)Good news: A budget deal was reached last night!

Bad news: There's nothing in the agreement to further extend emergency unemployment benefits.

It's conceivable that a deal could still be reached on that before next year, but for now the long-term unemployed remain in the lurch.

These two charts show why it's a total scandal.

The first chart shows the number of unemployed workers divided by the number of available jobs. There's still nearly 3 unemployed workers for each available job, a level that's still worse than the WORST level of the last economic cycle.

Read more: http://www.businessinsider.com/why-unemployment-benefits-should-be-extended-2013-12#ixzz2nAfk4YCM

DemReadingDU

(16,000 posts)Who voted for these idiots

xchrom

(108,903 posts)Almost every major economy in the world is wrestling with surprisingly low inflation this year. Some argue this is the big economic story of 2013.

Societe Generale's Albert Edwards has been early on this story, warning of deflation as other market skeptics warned of Fed-induced hyperinflation.

In his new note to clients, Edwards points to an obscure inflation measure that reinforces his concerns.

"Staring catatonically at this month’s US Personal Income and Outlays press release I was struck by just how weak an alternative measure of the core PCE deflator it had become," wrote Edwards. "The report says “the market-based PCE is a supplemental measure that is based on household expenditures for which there are observable price measures. It excludes most imputed transactions (for example, financial services furnished without payment)”, i.e. it excludes prices which the statisticians have to invent!"

Read more: http://www.businessinsider.com/albert-edwards-market-based-pce-deflationary-2013-12#ixzz2nAgmuMfg

DemReadingDU