Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

Related: About this forumDr. Housing Bubble 10/01/2014

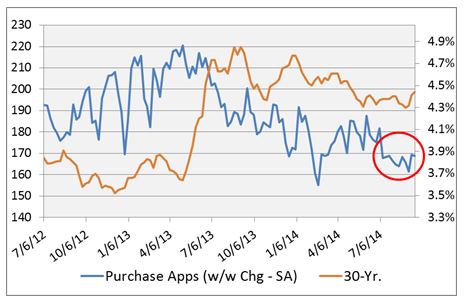

Who needs a mortgage? How the traditional mortgage market is stuck in low gear and reflects an underlying lack of demand for home buying.In ancient home buying times, the vast majority of home purchases came from regular families looking to buy a home. When I say buying, I mean committing to a 30 year mortgage financed by a bank. This was the traditional mechanism of keeping the real estate machinery moving. Since 2008, a large part of the buying power has come from “all cash” buyers that simply did not require a mortgage. This has been a dramatic shift in how home sales work. It is interesting to see real estate agents unhappy about this arrangement as well because volume has crumbled. Also, many of the early deals were done via REOs at banks and auctions which were largely off the market for most regular buyers unless you had the funds to purchase a large block of single family homes. So with big investors pulling back from the market, it is no surprise that regular American families simply cannot compete. One good indicator of this is to actually look at applications for mortgages. What we find is that demand for mortgages is simply not there.

Who needs a mortgage?

2013 saw a major jump in prices but not necessarily sales activity. Many real estate agents still remember the early 2000s and wish volume was once again, back to those levels. Alas, it is not. Many investors were “one and done” transactions. That is, they might have bought an REO, made it a rental, and are holding on. One sales transaction. While in the past, you would have two transactions because typically, the person would sell their home and move up the inevitable property ladder (i.e., Compton, Culver City, and then Pacific Palisades). Two commission checks are better than one.

Let us take a look at purchase applications then:

http://www.doctorhousingbubble.com/mortgage-application-demand-money-finance-home-buying-low-interest/

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

5 replies, 1191 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (1)

ReplyReply to this post

5 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

Dr. Housing Bubble 10/01/2014 (Original Post)

Crewleader

Oct 2014

OP

Warpy

(111,261 posts)1. Oh, there is plenty of pent up demand

but people crippled by huge debt and/or low wages are just not in a position to act upon that demand.

abelenkpe

(9,933 posts)3. Demand won't return until wages go up with secure jobs

Or prices come down to be affordable for workers struggling with insecure positions, few benefits and suppressed wages.

Crewleader

(17,005 posts)4. exactly abelenkpe

golfguru

(4,987 posts)5. Wages won't go up until

New Businesses can start, old businesses can expand.

Obviously conditions are not right for that to happen.